Professional Documents

Culture Documents

CVP

CVP

Uploaded by

Jessica EntacOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CVP

CVP

Uploaded by

Jessica EntacCopyright:

Available Formats

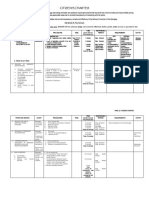

Problem No.

1

The K Corporation makes major household appliances such as refrigerators, stoves,

and dishwashers. Sales are heavily dependent on the number of housing starts and the

level of disposable income. Next year, the number of housing starts in the Central

region is expected to be the same as this year's; however, about two-thirds of these

starts will be for rental apartments as compared to an historical average of one-third.

The remaining housing starts will be for single-family homes and upscale

condominiums.

K generally makes two models of each product: Economy (fully functional, but with few

special features) and Prestige (with the most popular special features). BoSan

assumes a product mix of 40% Economy and 60% Prestige.

Required:

1. Explain how a cost-volume-profit (CVP) analysis may be used by management.

- Cost-volume-profit (CVP) analysis helps managers understand the

relationships among cost, volume, and profit. As it focuses on the following

factors; selling price, number of unit (sales volume), variable per unit, total fixed

cost, and product mix it enables them to make important decisions such as what

products and services to offer, what prices to charge, what marketing strategy to

use and what cost structure to maintain.

2. One of the assumptions that underlies CVP analysis is a constant sales mix over

the relevant range of activity. What are three other assumptions of CVP

analysis?

- The selling price per unit is constant.

- The cost behavior is linear over a relevant range.

- The number of units manufactured and sold is the same

3. Describe how the percentage change in rental units could create a problem with

BoSan's CVP analysis.

- With the change to less single-family homes and upscale condominiums

to more rental apartments this may result for demand on the economy models to

increase relative to the demand for Prestige models. This shift in the customer’s

buying behavior could create a problem since the Cost Value Profit model

assumes a constant sales mix. The change in the mix could invalidate previous

Cost Value Profit studies.

Problem No. 2

Low esteem Corporation reported sales revenues of $1,850,000 for the period just

ended. Cost of goods sold, selling expenses, and administrative expenses totaled

$1,200,000, $280,000, and $170,000, respectively. A detailed analysis of the latter

three amounts revealed respective fixed cost components of $780,000, $60,000, and

$130,000.

Required:

1. Determine the amounts that High Point would report on a traditional income

statement for (1) gross margin, (2) contribution margin, and (3) net income.

(1) Gross margin:

Sales revenue $1,850,000.00

Less: Cost of goods sold $1,200,000.00

Gross margin $ 650,000.00

(2) Contribution margin:

Contribution margin $0 (not disclosed on traditional IS)

(3) Net income:

Gross margin $650,000.00

Less: Selling expenses $280,000.00

Administrative expenses $170,000.00

Net income $200,000.00

2. Determine the amounts that High Point would report on a contribution income

statement for (1) gross margin, (2) contribution margin, and (3) net income.

(1) Gross margin:

Gross margin $0 (not disclosed on contribution IS)

(2) Contribution margin:

Total Fixed Variable

Expenses Expenses Expenses

Cost of goods sold $1,200,000 $780,000 $420,000

Selling expenses $280,000 $60,000 $220,000

Administrative expenses $170,000 $130,000 $40,000

Total $1,650,000 $970,000 $680,000

Sales revenue $1,850,000.00

Less: Variable expenses $680,000.00

Contribution margin $1,170,000.00

(3) Net income:

Contribution margin $1,170,000.00

Less: Fixed expenses $970,000.00

Net income $200,000.00

3. Which of the two income statements (traditional or contribution) is more useful for

studying a company's cost-volume-profit relationships.

- Contribution income statement would be more useful as it already

categorizes its costs into fixed and variable cost.

Problem No. 3

Absorption and variable costing are two different methods of measuring income and

costing inventory.

Required:

1. Product costs are defined as costs associated with the manufacturing process.

How does the operational definition of product cost differ between absorption

costing and variable costing?

- The operational definition of product cost differ between the two in a way

that the former costing defined fixed manufacturing overhead costs as product

cost while the latter costing view it as a period cost.

2. An absorption-costing income statement will report gross profit or gross margin

whereas a variable-costing income statement will report contribution margin.

What is the difference between these terms?

- Gross profit or gross margin is the difference between sales and cost of

goods sold. While, on the other hand, contribution margin is the difference

between sales and variable expenses only, as it ignores fixed costs/expenses

upon calculating the contribution margin.

3. Check Inc., has greatly modified its manufacturing process to reduce non-value-

added activities and has also adopted the just-in-time philosophy. As a result,

the average finished-goods inventory has dropped from six weeks' supply to

eight business days' supply. In view of these changes, will the difference in

operating income between variable costing and absorption costing be greater or

less than in the past? Explain.

- In view of those changes the difference in operating income between the

two costing will be reduced. As the inventories of work-in-process and finished

goods were previously smaller, changes in inventories will be less significant

which will result to a reduced difference in income.

Problem No. 4

B Company manufactures sleeping bags that sell for $30 each. The variable standard

costs of production are $19.50. Budgeted fixed manufacturing overhead is $100,000,

and budgeted production is 10,000 sleeping bags. The company actually manufactured

12,500 bags, of which 11,000 were sold. There were no variances during the year

except for the fixed-overhead volume variance. Variable selling and administrative

costs are $0.50 per sleeping bag sold; fixed selling and administrative costs are $5,000.

Required:

1. Calculate the standard product cost per sleeping bag under absorption costing

and variable costing.

Variable cost per unit:

Variable cost per unit (given) $19.50

Fixed cost per unit:

Fixed cost $100,000.00

Divide: No. of units 10,000 $10.00

Absorption cost per unit $29.50

2. Compute the fixed-overhead volume variance.

Budgeted fixed overhead $100,000.00

Actual fixed overhead:

No. of units sold 12,500

Multiply: Fixed cost per unit $10.00 $125,000.00

Fixed overhead variance ($25,000.00)

3. Prepare income statements for the year by using absorption costing and variable

costing.

- See next page for answers.

Absorption Costing Income Statement:

B Company

Absorption-Costing Income Statement

For the Year-Ended December 31, 20XX

Sales revenue (11,000 units x $30) $330,000

Less: Cost of goods sold (11,000 units x $29.50) $324,500

Gross margin (standard) $5,500

Fixed overhead variance $25,000

Gross margin (actual) $30,500

Less: Operating expenses [(11,000 units x $0.50) + 5,000] $10,500

Net income $20,000

Variable Costing Income Statement:

B Company

Variable-Costing Income Statement

For the Year-Ended December 31, 20XX

Sales revenue (11,000 units x $30) $330,000

Less: Variable cost of goods sold

(11,000 units x $19.50) $214,500

Variable operating expenses

(11,000 units x $0.50) $5,500 $220,000

Contribution margin $110,000

Less: Fixed costs ($100,000 + $5,000) $105,000

Net income $5,000

Problem No. 5

J Corporation, which uses throughput costing, began operations at the start of the

current year. Planned and actual production equaled 20,000 units, and sales totaled

17,500 units at $95 per unit. Cost data for the year were as follows:

Direct materials (per unit) $ 18

Conversion cost:

Direct labor 160,000

Variable manufacturing overhead 280,000

Fixed manufacturing overhead 340,000

Selling and administrative costs (total) 430,000

The company classifies direct materials as a throughput cost.

Required:

1. Compute the company's total cost for the year.

Direct materials (20,000 units x $18) $360,000.00

Direct labor $160,000.00

Variable manufacturing overhead $280,000.00

Fixed manufacturing overhead $340,000.00

Selling and administrative costs $430,000.00

Total cost $1,570,000.00

2. How much of this cost would be held in year-end inventory under (1) absorption

costing, (2) variable costing, and (3) throughput costing?

Absorption Variable Throughput

costing costing costing

Direct materials $360,000 $360,000 $360,000

Direct labor $160,000 $160,000

Variable manufacturing overhead $280,000 $280,000

Fixed manufacturing overhead $340,000

Total product cost (TPC) $1,140,000 $800,000 $360,000

Cost per unit (TPC/ 20,000 units) $57 $40 $18

Multiply: No. of units still in inventory* 2,500 2,500 2,500

Year-end inventory cost $142,500 $100,000 $45,000

(1) Absorption costing = $142,500

(2) Variable costing = $100,000

(3) Throughput costing = $45,000

3. How much of the company's total cost for the year would appear on the period's

income statement under (1) absorption costing, (2) variable costing, and (3)

throughput costing?

Absorption Variable Throughput

costing costing costing

Total costs for the year (as computed in

letter A) $1,570,000 $1,570,000 $1,570,000

Year-end inventory cost (as computed in

letter B) $142,500 $100,000 $45,000

Total costs appearing in the income

statement $1,427,500 $1,470,000 $1,525,000

(1) Absorption costing = $1,427,500

(2) Variable costing = $1,470,000

(3) Throughput costing = $1,525,000

4. Compute the year's throughput-costing net income.

Sales revenue (17,500 units x $95) $1,662,500.00

Less: Throughput costing (as computed in letter C) $1,525,000.00

Throughput income $137,500.00

You might also like

- CH 8 Practice HomeworkDocument11 pagesCH 8 Practice HomeworkNCT100% (1)

- Chapter 4Document8 pagesChapter 4Châu Ánh ViNo ratings yet

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocument9 pagesFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- 29 Problems and Solution CostingDocument70 pages29 Problems and Solution CostingNavin Joshi73% (11)

- ACLS Study Guide NewDocument35 pagesACLS Study Guide NewNIRANJANA SHALINI100% (1)

- Managerial Accounting - WS4 Connect Homework GradedDocument9 pagesManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNo ratings yet

- E8-29 Segmented Income Statement: Conceptual ConnectionDocument5 pagesE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- Tugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)Document5 pagesTugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)irga ayudiasNo ratings yet

- CribMaster 11 Features - User GuideDocument22 pagesCribMaster 11 Features - User GuidesalurkarNo ratings yet

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- Maruti Suzuki Final ProjectDocument63 pagesMaruti Suzuki Final ProjectMilind Singanjude75% (4)

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Session 5 Variabel Costing - Example CaseDocument5 pagesSession 5 Variabel Costing - Example Casenatasya angelNo ratings yet

- Contribution Approach To Decision Making: Learning ObjectivesDocument21 pagesContribution Approach To Decision Making: Learning ObjectivesmoonbohoraNo ratings yet

- Cost-Volume-Profit Analysis (Week 7)Document8 pagesCost-Volume-Profit Analysis (Week 7)Ihuoma Onwubu ChikaNo ratings yet

- Variances MCQsDocument8 pagesVariances MCQsdanksaimNo ratings yet

- Product Production Units Sales Units: Selling Price Per UnitDocument3 pagesProduct Production Units Sales Units: Selling Price Per UnitKamisiro RizeNo ratings yet

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- MA 13.2 (No Solutions)Document2 pagesMA 13.2 (No Solutions)Michael ComunelloNo ratings yet

- Variable CostingDocument34 pagesVariable CostingAra Marie MagnayeNo ratings yet

- Final CH 5Document5 pagesFinal CH 5worknehNo ratings yet

- CVP AnalysisDocument24 pagesCVP AnalysisAshima shafiqNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- Acst6003 Week11 Tutorial SolutionsDocument5 pagesAcst6003 Week11 Tutorial Solutionsyida chenNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- FinanceDocument14 pagesFinanceJarvis Gych'No ratings yet

- 3420 - Midterm Review QuestionsDocument11 pages3420 - Midterm Review QuestionsANKIT SHARMANo ratings yet

- MBA 504 Ch5 SolutionsDocument12 pagesMBA 504 Ch5 SolutionspheeyonaNo ratings yet

- Full Book Test 5Document12 pagesFull Book Test 5alihanaveed9No ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- Cost AccountingDocument15 pagesCost AccountingmeskiNo ratings yet

- Variable Costing-A Tool For ManagementDocument32 pagesVariable Costing-A Tool For ManagementSederiku KabaruzaNo ratings yet

- Short-Term Business DecisionsDocument15 pagesShort-Term Business DecisionsZiad NehadNo ratings yet

- Metrillo - Comprehensive ProbDocument12 pagesMetrillo - Comprehensive ProbLordCelene C MagyayaNo ratings yet

- Chapter 7Document10 pagesChapter 7Eki OmallaoNo ratings yet

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- Chapter 7 Extra Questions & SolutionsDocument8 pagesChapter 7 Extra Questions & Solutionsandrew.yerokhin1No ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- Joint Product (Rayburn)Document21 pagesJoint Product (Rayburn)ramolananduangkuNo ratings yet

- Module 3 - CVP Operating and Financial Leverage 1Document3 pagesModule 3 - CVP Operating and Financial Leverage 1Leora CameroNo ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- Past Year QuestionsDocument11 pagesPast Year QuestionsHuế ThùyNo ratings yet

- Solutions To Week 3 Practice Text ExercisesDocument6 pagesSolutions To Week 3 Practice Text Exercisespinkgold48No ratings yet

- Bill French, Accountant - Case Study Analysis 1Document8 pagesBill French, Accountant - Case Study Analysis 1Shagnik RoyNo ratings yet

- Cost II Individual Assignment On CH 1 CVP Analysis-5Document3 pagesCost II Individual Assignment On CH 1 CVP Analysis-5kalina.sintayehuNo ratings yet

- Absorption and Variable Costing Reviewer EphDocument4 pagesAbsorption and Variable Costing Reviewer Ephephraim100% (1)

- ACCT3104 - Lecture 5 - Lecture Exercise 2 & Solution RFDocument7 pagesACCT3104 - Lecture 5 - Lecture Exercise 2 & Solution RFnikkiNo ratings yet

- Portfolio Problem 5 - P1Document7 pagesPortfolio Problem 5 - P1Dwight Gabriel C. GarciaNo ratings yet

- Contribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is ADocument7 pagesContribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is AEVELYN ROSE MOGAONo ratings yet

- Extra MTQ Acca f2Document6 pagesExtra MTQ Acca f2siksha100% (1)

- Cost Volume Profit ERDocument17 pagesCost Volume Profit ERIris BalucanNo ratings yet

- Absorption and Variable CostingDocument6 pagesAbsorption and Variable CostingEvangelista, Trisha Gael V.100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Dicionário Assírio SDocument452 pagesDicionário Assírio SAlexandre Luis Dos Santos100% (1)

- Master Service Manual Product Family OLDocument478 pagesMaster Service Manual Product Family OLfernando schumacherNo ratings yet

- Xii Cbse Informatics Practices Sample Paper Solution Set3Document7 pagesXii Cbse Informatics Practices Sample Paper Solution Set3Vinit AgrawalNo ratings yet

- Minerals Potential - Minerals Law of Lao PDRDocument44 pagesMinerals Potential - Minerals Law of Lao PDRkhamsone pengmanivongNo ratings yet

- Bunker Fuel AnalysisDocument18 pagesBunker Fuel AnalysisMedha Jog Katdare100% (1)

- Digital Electronics MCQDocument10 pagesDigital Electronics MCQDr.D.PradeepkannanNo ratings yet

- Investment Property - DQDocument3 pagesInvestment Property - DQKryztal TalaveraNo ratings yet

- Lownds CFPB 2 of 3Document1,098 pagesLownds CFPB 2 of 3Judicial Watch, Inc.No ratings yet

- ATS Broussard User ManualDocument33 pagesATS Broussard User ManualMarv d'ar saoutNo ratings yet

- Schedule of FinishesDocument7 pagesSchedule of FinishesĐức ToànNo ratings yet

- EE211 Exam S1-09Document8 pagesEE211 Exam S1-09abadialshry_53No ratings yet

- Solvay India IntroductionDocument10 pagesSolvay India IntroductionRitesh KumarNo ratings yet

- CA ProjectDocument21 pagesCA Projectkalaswami100% (1)

- Pdms List Error CaptureDocument4 pagesPdms List Error Capturehnguyen_698971No ratings yet

- Sagarika Sinha: Senior Systems Engineer - Infosys, PuneDocument1 pageSagarika Sinha: Senior Systems Engineer - Infosys, PunePari RastogiNo ratings yet

- MatchmakerDocument43 pagesMatchmakerMatthew MckayNo ratings yet

- Pumba Cap 3 2022Document15 pagesPumba Cap 3 2022adityakamble070103No ratings yet

- CV Examples Uk StudentDocument8 pagesCV Examples Uk Studente7648d37100% (1)

- Customer Perception Towards Bharti Axa Life Insurance Co. Ltd. atDocument94 pagesCustomer Perception Towards Bharti Axa Life Insurance Co. Ltd. atShubham MishraNo ratings yet

- NJM072B/082B/072/082: Dual J-Fet Input Operational AmplifierDocument5 pagesNJM072B/082B/072/082: Dual J-Fet Input Operational Amplifieryuni supriatinNo ratings yet

- David M. Kroenke's: Database ProcessingDocument25 pagesDavid M. Kroenke's: Database ProcessingasalajalagiNo ratings yet

- Definition, Nature & Development of Tort Law-1Document40 pagesDefinition, Nature & Development of Tort Law-1Dhinesh Vijayaraj100% (1)

- Global Warming Holiday HomeworkDocument25 pagesGlobal Warming Holiday HomeworkAnanyaNo ratings yet

- International StandardDocument24 pagesInternational Standardalvaro cardenas100% (1)

- DS - 20201123 - MVS3150-LV Datasheet - V1.2.2 - ENDocument2 pagesDS - 20201123 - MVS3150-LV Datasheet - V1.2.2 - ENGabooNo ratings yet

- Dwnload Full Organization Development The Process of Leading Organizational Change 4th Edition Anderson Test Bank PDFDocument35 pagesDwnload Full Organization Development The Process of Leading Organizational Change 4th Edition Anderson Test Bank PDFliamhe2qr8100% (15)