Professional Documents

Culture Documents

Weekly Container Briefing: Market Comment Time Charter Rates

Weekly Container Briefing: Market Comment Time Charter Rates

Uploaded by

Quyên LýCopyright:

Available Formats

You might also like

- Recruitment &selectionDocument46 pagesRecruitment &selectionsejal200950% (2)

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Market Report - Week 4Document15 pagesMarket Report - Week 4gm9sfwdmfdNo ratings yet

- RCL Market Data: Tile Sector UpdateDocument8 pagesRCL Market Data: Tile Sector UpdatejdNo ratings yet

- ReportDocument18 pagesReportfclmlchNo ratings yet

- Market Report Week 31Document18 pagesMarket Report Week 31Mai PhamNo ratings yet

- Cool Company q1 2024 Earnings Press ReleaseDocument14 pagesCool Company q1 2024 Earnings Press ReleaseVojdan TrajkovskiNo ratings yet

- Container Weekly 4th February - 10th February PDFDocument3 pagesContainer Weekly 4th February - 10th February PDFvj_epistemeNo ratings yet

- News Highlights & Investor Watch 20-Sep-2023Document2 pagesNews Highlights & Investor Watch 20-Sep-2023WJAHAT HASSANNo ratings yet

- WEEK 10, 14 March 2021: CapesizeDocument13 pagesWEEK 10, 14 March 2021: CapesizeVGNo ratings yet

- PHPG KWZAYDocument5 pagesPHPG KWZAYfred607No ratings yet

- Intermodal Weekly 16-2013Document8 pagesIntermodal Weekly 16-2013Wisnu KertaningnagoroNo ratings yet

- Market Report Week 24Document19 pagesMarket Report Week 24ChetanNo ratings yet

- ABL Funds Manager Report - Conventional - August 2022Document14 pagesABL Funds Manager Report - Conventional - August 2022Aniqa AsgharNo ratings yet

- Report PDFDocument29 pagesReport PDFmuhammad sholehNo ratings yet

- Xclusiv Weekly 2022 07 18Document7 pagesXclusiv Weekly 2022 07 18Ekvazis TarsachNo ratings yet

- Valeura Energy Inc. TSXVLE ReportsDocument88 pagesValeura Energy Inc. TSXVLE Reportsxavier xaviNo ratings yet

- Shipbuilding Time To ChangeDocument36 pagesShipbuilding Time To ChangeAdlerNSNo ratings yet

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandNo ratings yet

- 12 02 21 221740 BanksDocument10 pages12 02 21 221740 BanksFaisal AzizNo ratings yet

- Martin Stopford How Will The Market Develop Sept 10 2010 (Paper)Document9 pagesMartin Stopford How Will The Market Develop Sept 10 2010 (Paper)Talha TurnaNo ratings yet

- Report On Petroleum Production and Revenues: January 2020Document8 pagesReport On Petroleum Production and Revenues: January 2020Rahul ChoudharyNo ratings yet

- GCC Energy Industry Mar 2011Document23 pagesGCC Energy Industry Mar 2011fati159No ratings yet

- Fund Manager Report - Conventional - Sept 2022Document14 pagesFund Manager Report - Conventional - Sept 2022Aniqa AsgharNo ratings yet

- ASX Announcement: First Quarter Report For Period Ended 31 March 2021Document18 pagesASX Announcement: First Quarter Report For Period Ended 31 March 2021Liam GallagherNo ratings yet

- Uranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?Document7 pagesUranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?ZerohedgeNo ratings yet

- Chapter 7Document18 pagesChapter 7noura alsubaieNo ratings yet

- Review of Pakistan's Balance of Payments July 2008 - June 2009Document8 pagesReview of Pakistan's Balance of Payments July 2008 - June 2009Nauman-ur-RasheedNo ratings yet

- BRS Review 2021 ShipbuildingDocument14 pagesBRS Review 2021 Shipbuildingpv cabaretNo ratings yet

- Fundamentals of Oil Gas Accounting 6th Edition by Charlotte J. Wright Z Lib - Org 236 248 PDFDocument13 pagesFundamentals of Oil Gas Accounting 6th Edition by Charlotte J. Wright Z Lib - Org 236 248 PDFnoura alsubaieNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDocument1 pageThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNo ratings yet

- 2021-04-12 Market OverviewDocument12 pages2021-04-12 Market Overviewadelafuente2012No ratings yet

- Fund Managers Report - Conventional - Oct 2022Document15 pagesFund Managers Report - Conventional - Oct 2022Aniqa AsgharNo ratings yet

- Shipping EconomistDocument52 pagesShipping EconomistJames RobbinsNo ratings yet

- Single 9423457726580e5899c26aDocument6 pagesSingle 9423457726580e5899c26acarlNo ratings yet

- Vientam Container Shipping 2Document10 pagesVientam Container Shipping 2Tony ZhangNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- Weekly SP Market Report Week Ending February 26th 2021 Week 8 Report No 08.21Document8 pagesWeekly SP Market Report Week Ending February 26th 2021 Week 8 Report No 08.21Sandesh Tukaram GhandatNo ratings yet

- ECON306: Class Test 1, 16 March 2009 Solution Guide: Cultural AffinityDocument6 pagesECON306: Class Test 1, 16 March 2009 Solution Guide: Cultural AffinitySandile DayiNo ratings yet

- Weekly SP Market Report Week Ending August 27th 2021 Week 34 Report No 34.21Document7 pagesWeekly SP Market Report Week Ending August 27th 2021 Week 34 Report No 34.21Sandesh Tukaram GhandatNo ratings yet

- The Market For Ship DemolitionDocument9 pagesThe Market For Ship Demolitiony4x6kfzhc8No ratings yet

- 7 21 Impairment PDFDocument14 pages7 21 Impairment PDFRenart LdsNo ratings yet

- 21 02 08 DP More Margin More Upside Buy TP 38 From 32Document24 pages21 02 08 DP More Margin More Upside Buy TP 38 From 32tarun606No ratings yet

- Economics Training ManualDocument157 pagesEconomics Training ManualJesus Ponce GNo ratings yet

- Cement - Sector Update - 05 Apr 22Document17 pagesCement - Sector Update - 05 Apr 22shubh13septemberNo ratings yet

- IMP Market Outlook SRODocument22 pagesIMP Market Outlook SRObhavin183No ratings yet

- 2021 Cefor Half Year Hull TrendsDocument21 pages2021 Cefor Half Year Hull Trendsaa4e11No ratings yet

- Fund Manager Report - Shariah Compliant - Sept 2022Document13 pagesFund Manager Report - Shariah Compliant - Sept 2022Aniqa AsgharNo ratings yet

- Coursework 2Document29 pagesCoursework 2kapilNo ratings yet

- ALLIED-Weekly-Market-Report 23 08 2020Document12 pagesALLIED-Weekly-Market-Report 23 08 2020Supreme starNo ratings yet

- 26 02 21 213055 FertilizerDocument10 pages26 02 21 213055 FertilizerMuhammad IlyasNo ratings yet

- Weekly SP Market Report Week Ending January 15th 2021 Week 2 Report No 02.21Document8 pagesWeekly SP Market Report Week Ending January 15th 2021 Week 2 Report No 02.21Sandesh Tukaram GhandatNo ratings yet

- Leadway Bill of Lading - FRA240000059Document2 pagesLeadway Bill of Lading - FRA240000059Luis Osorio AlonsoNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- BRS Market Report: Week IVDocument7 pagesBRS Market Report: Week IVSudheera IndrajithNo ratings yet

- News Release: Lucara Announces Year End 2023 Results Continued Development of The Underground ProjectDocument10 pagesNews Release: Lucara Announces Year End 2023 Results Continued Development of The Underground ProjectShaneNo ratings yet

- Economic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesDocument3 pagesEconomic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesÁron KerékgyártóNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- Basic Accounting Final ExamDocument7 pagesBasic Accounting Final ExamCharmae Agan Caroro75% (4)

- Wall's Ice Cream Report 2015Document43 pagesWall's Ice Cream Report 2015Rabi Khan67% (3)

- Patagonia, Inc.:: A Company AnalysisDocument5 pagesPatagonia, Inc.:: A Company AnalysisRsn786No ratings yet

- BSBSTR601 Assessment Task 1 v1.0Document5 pagesBSBSTR601 Assessment Task 1 v1.0sherryy619No ratings yet

- Quiz 1 Stratcost F Edited 1Document4 pagesQuiz 1 Stratcost F Edited 1Aeron Arroyo IINo ratings yet

- BoeingDocument18 pagesBoeingGnesh WaraNo ratings yet

- CHAPTER 4 Caselette Audit of Receivables PDFDocument32 pagesCHAPTER 4 Caselette Audit of Receivables PDFDaniela BombezaNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Chapter 10 Discounted DividendDocument5 pagesChapter 10 Discounted Dividendmahnoor javaidNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Overview of Management AccountingDocument40 pagesOverview of Management AccountingNurul-Fawzia BalindongNo ratings yet

- Rubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyDocument5 pagesRubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyneilmacalamNo ratings yet

- Business Plan TemplateDocument15 pagesBusiness Plan TemplateShubham Devendra SinghNo ratings yet

- A Study On Customer Satisfaction With MahendraDocument85 pagesA Study On Customer Satisfaction With MahendraBHARATHNo ratings yet

- Organizational Behavior - Leadership in The Digital AgeDocument8 pagesOrganizational Behavior - Leadership in The Digital AgeVincent StuhlenNo ratings yet

- 3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HKDocument2 pages3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HKjed loverNo ratings yet

- FRC Ernst Young LLP Public Report - July 2022Document40 pagesFRC Ernst Young LLP Public Report - July 2022Miran RafekNo ratings yet

- Digests On PartnershipDocument4 pagesDigests On PartnershipNeapolle FleurNo ratings yet

- Measuring Financial LiteracyDocument21 pagesMeasuring Financial LiteracySaumya Jain Nigam100% (1)

- Introduction To The Industrial RevolutionDocument11 pagesIntroduction To The Industrial RevolutionMathusan LakshmanNo ratings yet

- Audit of Construction CompaniesDocument2 pagesAudit of Construction Companiesnicole bancoroNo ratings yet

- Salary Slip July'09Document1 pageSalary Slip July'09Erin HamiltonNo ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Practice Questions 308Document9 pagesPractice Questions 308Nidale ChehadeNo ratings yet

- Actividad D1. Final Term Paper Maria FigueroaDocument6 pagesActividad D1. Final Term Paper Maria FigueroaEdith MezaNo ratings yet

- Lesson 1Document8 pagesLesson 1Amangeldi SalimzhanovNo ratings yet

- AS-Solved Past Paper Business 9609 P1 2023-2022Document51 pagesAS-Solved Past Paper Business 9609 P1 2023-2022TheOfficialTitaniumNo ratings yet

- Basic Economic ProblemsDocument4 pagesBasic Economic ProblemsSarah Nicole BrionesNo ratings yet

- NWRB Tariff Users Manual - 2018-Oct-20Document65 pagesNWRB Tariff Users Manual - 2018-Oct-20Leo PastorNo ratings yet

Weekly Container Briefing: Market Comment Time Charter Rates

Weekly Container Briefing: Market Comment Time Charter Rates

Uploaded by

Quyên LýOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Container Briefing: Market Comment Time Charter Rates

Weekly Container Briefing: Market Comment Time Charter Rates

Uploaded by

Quyên LýCopyright:

Available Formats

Weekly Container Briefing 24 August 2021

Time Charter Rates Market comment

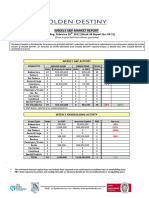

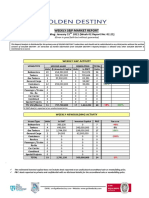

Vessel (TEU/HOM) 13-Aug 20-Aug Index +/- It has certainly not been a typical August in the container market, as we

continue to see more vessels being placed on the block for sale as Owners

1,100/715TEU (G) 19 k 35,000 35,000 48.61 ► 0.00 look to take advantage of the robust prices available today.

1,740/1,300TEU (G) 20.5 k 57,500 60,000 60.00 ▲ 2.50

Feeders have shown the largest rises in pricing although mostly due to a

1,714/1,250TEU (G) 19k Bkk Max 67,500 70,000 29.17 ▲ 1.04 lack of larger vessels coming open in the near future. At the time of writing

it is reported a 2021 built scrubber fitted SDARI 1800 has achieved a price

2,500/1,900TEU (G) 22 k 72,500 75,000 72.12 ▲ 2.40

of $38m basis delivery March 2022 - substantially over current newbuilding

2,500ECO/2,100TEU (G) 18.5 k 80,000 82,000 24.12 ▲ 0.59 price but equally a price that could look very ordinary should the market

continue at today’s levels.

2,800/2,000TEU (GL) 22 k 85,000 85,000 51.94 ► 0.00

3,500/2,500TEU (GL) 23 k 93,000 93,000 37.20 ► 0.00 Otherwise a 2010 built Wenchong 1700 with charter free delivery in

October – November invites offers later this week with a large number of

4,250/2,800TEU (GL) 24 k 120,000 120,000 96.00 ► 0.00 Buyers preparing to bid, it will be very interesting to see quite how much

6,500/4,900TEU (GL) 24 k 135,000 135,000 48.00 ► 0.00 she is able to achieve.

8,500/6,600 (GL) 25 k 160,000 160,000 51.20 ► 0.00

9,000WB/7,100TEU (GL) 25 k 180,000 180,000 30.00 ► 0.00

10,000/8,000 (GL) 25 k 180,000 180,000 30.00 ► 0.00

BOXi Total * $/day $/day 578.36 ▲ 6.53

52 Week High 578.36

52 Week Low 76.78

* Benchmark TC rates assessed on the basis of a 12-month time charter period

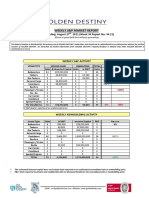

Braemar ACM’s Demometer - Container Ship Deliveries

Demolition Sales Last 30 days Total ACTUAL Demolished Total in Same Period 2020 Total Demolished 2020 Total NBs Delivered 2021

2021

1,800 TEU (2 Vessels) 13,000 TEU (16 Vessels) 167,000 TEU (67 Vessels) 199,000 TEU (89 Vessels) 663,000 TEU (92 Vessels)

Vessel Deliveries Wk33/21 TEU Shipyard Ow ner Deployment Series No + Comment

NIL NIL - - - -

Total TEU 0

Macroeconomics Liner and Trade

Japan’s economy rebounded more than expected in the second quar- The blocked Meishan terminal in the port of Ningbo appears to have part-

ter after slumping in the first three months of this year, data showed, a ly been reinstated, with new arrivals of containerships. Nevertheless, no

sign consumption and capital expenditure were recovering from the official announcement has yet to be made as to when the terminal will

coronavirus pandemic’s initial hit. The world’s third-largest economy reopen, although talks have been circulated in the market that local au-

grew an annualised 1.3% in April-June after a revised 3.7% slump in thorities plan to fully restore its operations, including the container gate-in

the first quarter. and gate-out, on September 1. (Source : Lloyd’s List)

The IHS Markit Eurozone Manufacturing PMI edged down to 61.5 in Orient Overseas International Ltd (OOIL) has reported its best six-month

August of 2021 from 62.8 in July, and compared to market forecasts of results in the company's history and maintained a bullish outlook for the

62, preliminary estimates showed. The reading pointed to the slowest coming months. The Hong Kong-listed parent of Orient Overseas Con-

growth in factory activity in 6 months, although it remained a robust tainer Line recorded a first-half profit of $2.81bn, up from just $102m for

one. Manufacturing output also continued to grow at a pace rarely the same period of 2020. Revenue jumped to $6.99bn from $3.42bn

exceeded in the survey history as a result of the ongoing recovery of on higher freight rates and transport volumes. (Source : Tradewinds)

demand from the depths of the pandemic, though the rate of expansion

moderated for a second month to the weakest since February. The top ten major Chinese container ports handled 18.1mTEU in July

2021, down 1% m-o-m, down 1% y-o-y For the seven months to July

United States jobless claims for the week ended Aug. 14 totalled 2021, the tally has reached 123.9m TEU up 11% y-o-y. On an annualised

348,000, the Labour Department. First-time filings for unemployment basis, the top Chinese box ports handled 214.5m TEU in the August 2020

insurance hit a pandemic-era low last week, a sign that the jobs market to July 2021 period, up 9% y-o-y. (Source : Port Container)

is improving heading into the autumn despite worries over the delta

Covid variant.

“

The International Monetary Fund (IMF) has said Afghanistan will no

longer be able to access the lender's resources. The move follows the

Taliban's takeover of the country last weekend. An IMF spokesperson

said it was due to "lack of clarity within the international community"

over recognising a government in Afghanistan. Resources of over

$370m (£268m) from the IMF had been set to arrive on 23 August. Indicators 23-Aug-21 Last w eek 12 months ago

These funds were part of a global IMF response to the economic crisis. Shanghai Containerised Freight Index 4340 ▲ 4,282 1,184

FTSE 100 Index 7,115 ▼ 7,154 6,002

US$ LIBOR 12 month 0.24% ► 0.24% 0.44%

Brent Crude Oil Price $/bbl 67.0 ▼ 69.0 44.0

Singapore Bunker 0.5% VLSFO $/t 494▼ 524 347

Braemar ACM Shipbroking - London - Singapore - Shanghai

Email: teu.snp@braemar.com

London Office: Tel: + (0) 203 142 4250 Singapore Office: Tel: + 65 65 169588

Every effort as been made to ensure the information contained within this report is accurate, Braemar ACM Shipbroking cannot accept responsibility for error, omission or consequence therefrom

You might also like

- Recruitment &selectionDocument46 pagesRecruitment &selectionsejal200950% (2)

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Market Report - Week 4Document15 pagesMarket Report - Week 4gm9sfwdmfdNo ratings yet

- RCL Market Data: Tile Sector UpdateDocument8 pagesRCL Market Data: Tile Sector UpdatejdNo ratings yet

- ReportDocument18 pagesReportfclmlchNo ratings yet

- Market Report Week 31Document18 pagesMarket Report Week 31Mai PhamNo ratings yet

- Cool Company q1 2024 Earnings Press ReleaseDocument14 pagesCool Company q1 2024 Earnings Press ReleaseVojdan TrajkovskiNo ratings yet

- Container Weekly 4th February - 10th February PDFDocument3 pagesContainer Weekly 4th February - 10th February PDFvj_epistemeNo ratings yet

- News Highlights & Investor Watch 20-Sep-2023Document2 pagesNews Highlights & Investor Watch 20-Sep-2023WJAHAT HASSANNo ratings yet

- WEEK 10, 14 March 2021: CapesizeDocument13 pagesWEEK 10, 14 March 2021: CapesizeVGNo ratings yet

- PHPG KWZAYDocument5 pagesPHPG KWZAYfred607No ratings yet

- Intermodal Weekly 16-2013Document8 pagesIntermodal Weekly 16-2013Wisnu KertaningnagoroNo ratings yet

- Market Report Week 24Document19 pagesMarket Report Week 24ChetanNo ratings yet

- ABL Funds Manager Report - Conventional - August 2022Document14 pagesABL Funds Manager Report - Conventional - August 2022Aniqa AsgharNo ratings yet

- Report PDFDocument29 pagesReport PDFmuhammad sholehNo ratings yet

- Xclusiv Weekly 2022 07 18Document7 pagesXclusiv Weekly 2022 07 18Ekvazis TarsachNo ratings yet

- Valeura Energy Inc. TSXVLE ReportsDocument88 pagesValeura Energy Inc. TSXVLE Reportsxavier xaviNo ratings yet

- Shipbuilding Time To ChangeDocument36 pagesShipbuilding Time To ChangeAdlerNSNo ratings yet

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandNo ratings yet

- 12 02 21 221740 BanksDocument10 pages12 02 21 221740 BanksFaisal AzizNo ratings yet

- Martin Stopford How Will The Market Develop Sept 10 2010 (Paper)Document9 pagesMartin Stopford How Will The Market Develop Sept 10 2010 (Paper)Talha TurnaNo ratings yet

- Report On Petroleum Production and Revenues: January 2020Document8 pagesReport On Petroleum Production and Revenues: January 2020Rahul ChoudharyNo ratings yet

- GCC Energy Industry Mar 2011Document23 pagesGCC Energy Industry Mar 2011fati159No ratings yet

- Fund Manager Report - Conventional - Sept 2022Document14 pagesFund Manager Report - Conventional - Sept 2022Aniqa AsgharNo ratings yet

- ASX Announcement: First Quarter Report For Period Ended 31 March 2021Document18 pagesASX Announcement: First Quarter Report For Period Ended 31 March 2021Liam GallagherNo ratings yet

- Uranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?Document7 pagesUranium Sector Gets Four Catalysts Are "ESG" Investors Gaining Interest, and Is It Time To Buy?ZerohedgeNo ratings yet

- Chapter 7Document18 pagesChapter 7noura alsubaieNo ratings yet

- Review of Pakistan's Balance of Payments July 2008 - June 2009Document8 pagesReview of Pakistan's Balance of Payments July 2008 - June 2009Nauman-ur-RasheedNo ratings yet

- BRS Review 2021 ShipbuildingDocument14 pagesBRS Review 2021 Shipbuildingpv cabaretNo ratings yet

- Fundamentals of Oil Gas Accounting 6th Edition by Charlotte J. Wright Z Lib - Org 236 248 PDFDocument13 pagesFundamentals of Oil Gas Accounting 6th Edition by Charlotte J. Wright Z Lib - Org 236 248 PDFnoura alsubaieNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDocument1 pageThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNo ratings yet

- 2021-04-12 Market OverviewDocument12 pages2021-04-12 Market Overviewadelafuente2012No ratings yet

- Fund Managers Report - Conventional - Oct 2022Document15 pagesFund Managers Report - Conventional - Oct 2022Aniqa AsgharNo ratings yet

- Shipping EconomistDocument52 pagesShipping EconomistJames RobbinsNo ratings yet

- Single 9423457726580e5899c26aDocument6 pagesSingle 9423457726580e5899c26acarlNo ratings yet

- Vientam Container Shipping 2Document10 pagesVientam Container Shipping 2Tony ZhangNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- Weekly SP Market Report Week Ending February 26th 2021 Week 8 Report No 08.21Document8 pagesWeekly SP Market Report Week Ending February 26th 2021 Week 8 Report No 08.21Sandesh Tukaram GhandatNo ratings yet

- ECON306: Class Test 1, 16 March 2009 Solution Guide: Cultural AffinityDocument6 pagesECON306: Class Test 1, 16 March 2009 Solution Guide: Cultural AffinitySandile DayiNo ratings yet

- Weekly SP Market Report Week Ending August 27th 2021 Week 34 Report No 34.21Document7 pagesWeekly SP Market Report Week Ending August 27th 2021 Week 34 Report No 34.21Sandesh Tukaram GhandatNo ratings yet

- The Market For Ship DemolitionDocument9 pagesThe Market For Ship Demolitiony4x6kfzhc8No ratings yet

- 7 21 Impairment PDFDocument14 pages7 21 Impairment PDFRenart LdsNo ratings yet

- 21 02 08 DP More Margin More Upside Buy TP 38 From 32Document24 pages21 02 08 DP More Margin More Upside Buy TP 38 From 32tarun606No ratings yet

- Economics Training ManualDocument157 pagesEconomics Training ManualJesus Ponce GNo ratings yet

- Cement - Sector Update - 05 Apr 22Document17 pagesCement - Sector Update - 05 Apr 22shubh13septemberNo ratings yet

- IMP Market Outlook SRODocument22 pagesIMP Market Outlook SRObhavin183No ratings yet

- 2021 Cefor Half Year Hull TrendsDocument21 pages2021 Cefor Half Year Hull Trendsaa4e11No ratings yet

- Fund Manager Report - Shariah Compliant - Sept 2022Document13 pagesFund Manager Report - Shariah Compliant - Sept 2022Aniqa AsgharNo ratings yet

- Coursework 2Document29 pagesCoursework 2kapilNo ratings yet

- ALLIED-Weekly-Market-Report 23 08 2020Document12 pagesALLIED-Weekly-Market-Report 23 08 2020Supreme starNo ratings yet

- 26 02 21 213055 FertilizerDocument10 pages26 02 21 213055 FertilizerMuhammad IlyasNo ratings yet

- Weekly SP Market Report Week Ending January 15th 2021 Week 2 Report No 02.21Document8 pagesWeekly SP Market Report Week Ending January 15th 2021 Week 2 Report No 02.21Sandesh Tukaram GhandatNo ratings yet

- Leadway Bill of Lading - FRA240000059Document2 pagesLeadway Bill of Lading - FRA240000059Luis Osorio AlonsoNo ratings yet

- FearnleysDocument7 pagesFearnleysSANDESH GHANDATNo ratings yet

- BRS Market Report: Week IVDocument7 pagesBRS Market Report: Week IVSudheera IndrajithNo ratings yet

- News Release: Lucara Announces Year End 2023 Results Continued Development of The Underground ProjectDocument10 pagesNews Release: Lucara Announces Year End 2023 Results Continued Development of The Underground ProjectShaneNo ratings yet

- Economic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesDocument3 pagesEconomic Update: Current Account Surplus Highest in Three Years Thanks To Stronger Oil PricesÁron KerékgyártóNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- Basic Accounting Final ExamDocument7 pagesBasic Accounting Final ExamCharmae Agan Caroro75% (4)

- Wall's Ice Cream Report 2015Document43 pagesWall's Ice Cream Report 2015Rabi Khan67% (3)

- Patagonia, Inc.:: A Company AnalysisDocument5 pagesPatagonia, Inc.:: A Company AnalysisRsn786No ratings yet

- BSBSTR601 Assessment Task 1 v1.0Document5 pagesBSBSTR601 Assessment Task 1 v1.0sherryy619No ratings yet

- Quiz 1 Stratcost F Edited 1Document4 pagesQuiz 1 Stratcost F Edited 1Aeron Arroyo IINo ratings yet

- BoeingDocument18 pagesBoeingGnesh WaraNo ratings yet

- CHAPTER 4 Caselette Audit of Receivables PDFDocument32 pagesCHAPTER 4 Caselette Audit of Receivables PDFDaniela BombezaNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Chapter 10 Discounted DividendDocument5 pagesChapter 10 Discounted Dividendmahnoor javaidNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Overview of Management AccountingDocument40 pagesOverview of Management AccountingNurul-Fawzia BalindongNo ratings yet

- Rubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyDocument5 pagesRubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyneilmacalamNo ratings yet

- Business Plan TemplateDocument15 pagesBusiness Plan TemplateShubham Devendra SinghNo ratings yet

- A Study On Customer Satisfaction With MahendraDocument85 pagesA Study On Customer Satisfaction With MahendraBHARATHNo ratings yet

- Organizational Behavior - Leadership in The Digital AgeDocument8 pagesOrganizational Behavior - Leadership in The Digital AgeVincent StuhlenNo ratings yet

- 3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HKDocument2 pages3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HKjed loverNo ratings yet

- FRC Ernst Young LLP Public Report - July 2022Document40 pagesFRC Ernst Young LLP Public Report - July 2022Miran RafekNo ratings yet

- Digests On PartnershipDocument4 pagesDigests On PartnershipNeapolle FleurNo ratings yet

- Measuring Financial LiteracyDocument21 pagesMeasuring Financial LiteracySaumya Jain Nigam100% (1)

- Introduction To The Industrial RevolutionDocument11 pagesIntroduction To The Industrial RevolutionMathusan LakshmanNo ratings yet

- Audit of Construction CompaniesDocument2 pagesAudit of Construction Companiesnicole bancoroNo ratings yet

- Salary Slip July'09Document1 pageSalary Slip July'09Erin HamiltonNo ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Practice Questions 308Document9 pagesPractice Questions 308Nidale ChehadeNo ratings yet

- Actividad D1. Final Term Paper Maria FigueroaDocument6 pagesActividad D1. Final Term Paper Maria FigueroaEdith MezaNo ratings yet

- Lesson 1Document8 pagesLesson 1Amangeldi SalimzhanovNo ratings yet

- AS-Solved Past Paper Business 9609 P1 2023-2022Document51 pagesAS-Solved Past Paper Business 9609 P1 2023-2022TheOfficialTitaniumNo ratings yet

- Basic Economic ProblemsDocument4 pagesBasic Economic ProblemsSarah Nicole BrionesNo ratings yet

- NWRB Tariff Users Manual - 2018-Oct-20Document65 pagesNWRB Tariff Users Manual - 2018-Oct-20Leo PastorNo ratings yet