Professional Documents

Culture Documents

Problem 4-9

Problem 4-9

Uploaded by

maryaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 4-9

Problem 4-9

Uploaded by

maryaniCopyright:

Available Formats

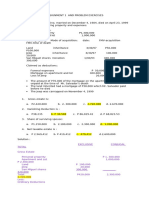

Problem 4-9 (IAA)

Baron Company is involved with several situations about contingencies. The fiscal year

ends December 31, 2020 and

financial statements are issued on March 1, 2021.

On March 1, 2021, the city government is in the process of investigating possible

chemical leaks at Baron s facilities but has not proposed a deficiency assessment.

Management feels an assessment is reasonably possible and if an assessment is made

an unfavorable settlement of up to P4,000,000 is reasonably possible.

Baron is the plaintiff in a P3,000,000 lawsuit filed against Faye Company for damages

due to lost profit from rejected contracts and for unpaid receivables.

The case is in final appeal and legal counsel advised that it is probable that Baron will

prevail and be awarded P2,500,000

In July 2020, the provincial government filed suit against Baron seeking civil penalties

and injunctive relief for violation of environmental law regulating hazardous waste. On

February 15, 2021, Baron reached a settlement with state authorities.

Based upon discussions with legal counsel, Baron feels it is probable that P2,000,000

will be required to cover the cost of violation.

Baron believed that the ultimate settlement of this claim will not have a material adverse

effect on the entity. Baron is involved in a lawsuit resulting from a dispute with a

customer. On January 5, 2021, judgment was rendered against Baron in the amount of

P1,500,000 plus interest of P300,000.

Baron plans to appeal the judgment and is unable to predict its outcome though it is not

expected to have a material adverse effect on the entity.

Required:

Prepare any necessary journal entries to recognize the situations involving

contingencies.

e on one of the facilities related to the division. It is estimated that it will have to or a

penalty of P4,000,000 to break the lease.

The entity estimates that the present value related to payment on the lease contract is

P6,500,000.

The entity's allocation of overhead costs to other divisions will increase by P15,000,000

due to the restructuring of the facilities.

Also, some employees will be shifted to other divisions within the entity and cost of

retraining the employees is estimated at P20,000,000

The entity has hired an outplacement firm to help in dealing with the number of

terminations related to the restructuring. It is estimated that the cost to the entity will be

P6,000,000.

Employee termination costs are estimated to be P30,000,000 and the entity believes

that moving usable assets from the toy division to other division within the entity will cost

P3,200,000.

Required:

Compute the total amount that should be included in restructuring provision.

Problem 4-8 (IAA) .

Western Company pro transactions related to contingencies

The fiscal year ends December 31, 2020: Financial Statement are issued on April 1,

2021.

No customer accounts have been shown + uncollectible as yet but Western

estimated that 304 credit sales will eventually prove uncollectible. Cre sales

amounted P30,000,000 for 2020.

Western offers a one-year warranty against manufacturer's defects for all its

products. Industries experience indicates that warranty costs will approximate 2%

of credit sales.

Actual warranty expenditures totaled P355,000 in 2020 and were recorded as

warranty expense when incurred.

In December 2020, Western became aware of an engineering flaw in a product

that poses a potential risk of injury. As a result, a product recall appears

inevitable. This move would likely cost the entity P1,500,000.

In November 2020, the City of Manila filed suit against Western asking civil

penalties and injunctive relief for violations of clean water laws.

Western reached a settlement with the city government authorities to pay

P4,200,000 in penalties on February 15, 2021.

Western is the plaintiff in a P4.000.000 lawsuit filed against a customer for costs

and lost profit from contracts rejected in 2020.

The lawsuit is in final appeal and attorneys advised that it is probable that

Western will be awarded P3,000,000

Required: Prepare the appropriate journal entries that should recorded as a result of

each of these contingencies. If no journal entry is indicated, state the reason why.

You might also like

- Business Forum Project ProposalDocument9 pagesBusiness Forum Project ProposalReiou ManuelNo ratings yet

- Ia2 Prob 1-24 & 25Document2 pagesIa2 Prob 1-24 & 25maryaniNo ratings yet

- Textile Mill in Sambalpur: A Feasibility ReportDocument3 pagesTextile Mill in Sambalpur: A Feasibility ReportPatanjali NayakNo ratings yet

- Unit No: 5: Organizational Development and Intervention StrategiesDocument26 pagesUnit No: 5: Organizational Development and Intervention StrategiesBayu100% (2)

- Article 1525: Article 1527Document2 pagesArticle 1525: Article 1527elaine0% (1)

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Seatwork Module 10Document3 pagesSeatwork Module 10Marjorie PalmaNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Acc 224L 1st Laboratory ExamDocument13 pagesAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNo ratings yet

- Problem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallyDocument1 pageProblem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallymaryaniNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Lesson3 - Warranty LiabilityDocument15 pagesLesson3 - Warranty LiabilityCirelle Faye Silva0% (1)

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Sia 3.compound Financial InstrumentDocument11 pagesSia 3.compound Financial InstrumentleneNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- ACC 226 Week 4 To 5 SIMDocument33 pagesACC 226 Week 4 To 5 SIMMireya YueNo ratings yet

- IA2 Worksheet-BONDS PAYABLE - 101010Document11 pagesIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNo ratings yet

- LiabilitiesDocument8 pagesLiabilitiesGerald F. SalasNo ratings yet

- CAED101 - DE CASTRO - ACN1 - EOQ ActivityDocument1 pageCAED101 - DE CASTRO - ACN1 - EOQ ActivityIra Grace De CastroNo ratings yet

- Fair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final ExamDocument2 pagesFair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final Examkaeya alberichNo ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Financial Asset at Amortized CostDocument4 pagesFinancial Asset at Amortized CostXNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Answer Key For Strategic Cost Management - CompressDocument19 pagesAnswer Key For Strategic Cost Management - CompressMikee RizonNo ratings yet

- AC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDocument2 pagesAC13 Provisions, Contingencies and Other Liabilities Additional Guide ProblemsDianaNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Module 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPADocument3 pagesModule 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPABrein Symon DialaNo ratings yet

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- FAR04-08 - Government Grant & Borrowing CostsDocument7 pagesFAR04-08 - Government Grant & Borrowing CostsAi NatangcopNo ratings yet

- Act Day 1-3Document45 pagesAct Day 1-3Joyce Anne GarduqueNo ratings yet

- Act. 3-9Document4 pagesAct. 3-9Fernando III PerezNo ratings yet

- Pre2 Module-Intangible Assets: Learning ObjectivesDocument9 pagesPre2 Module-Intangible Assets: Learning ObjectivesCyrine Grace DucogNo ratings yet

- 21 Financial Assets at Fair Value: Solution 21-1 Answer CDocument30 pages21 Financial Assets at Fair Value: Solution 21-1 Answer CLayNo ratings yet

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- Lecture Notes On Borrowing Costs - 000Document3 pagesLecture Notes On Borrowing Costs - 000judel ArielNo ratings yet

- Sim Acc 325Document105 pagesSim Acc 325Ivan Pacificar BioreNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Test - Financial PlanningDocument3 pagesTest - Financial PlanningMasTer PanDaNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Problem 2 10Document9 pagesProblem 2 10Carl Jaime Dela CruzNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Practice Problem (Bonds Payable)Document4 pagesPractice Problem (Bonds Payable)Kristine Mae PresentacionNo ratings yet

- Accounting 4 Provisions and ContingenciesDocument4 pagesAccounting 4 Provisions and ContingenciesMicaela EncinasNo ratings yet

- FINACC 2 - Quiz 4Document9 pagesFINACC 2 - Quiz 4Kim Ruwen AblazaNo ratings yet

- Accounting 106: Quiz On Forwards, Futures, Options, and Foreign CurrencyDocument5 pagesAccounting 106: Quiz On Forwards, Futures, Options, and Foreign CurrencyLee SuarezNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Employee Benefit Expense 1,650,000Document14 pagesEmployee Benefit Expense 1,650,000Jud Rossette ArcebesNo ratings yet

- I Need A Step-By-Step Explanation For The FollowingDocument2 pagesI Need A Step-By-Step Explanation For The Followingnicolearetano417No ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Learning Resource 1 Lesson 4 PDFDocument14 pagesLearning Resource 1 Lesson 4 PDFJerald Jay Capistrano Catacutan100% (1)

- Ia 2Document23 pagesIa 2Gelo OwssNo ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- 221 PrintDocument23 pages221 PrintChara etangNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Prob Chap 4-18 To 19Document1 pageProb Chap 4-18 To 19maryaniNo ratings yet

- Chapter 1-4 QuizDocument11 pagesChapter 1-4 Quizspur iousNo ratings yet

- Polytechnic University of The Philippines Sta. Maria, Bulacan CampusDocument3 pagesPolytechnic University of The Philippines Sta. Maria, Bulacan CampusClarisse PelayoNo ratings yet

- Ia 3 Problem 4-36 Multiple Choice (IAA)Document2 pagesIa 3 Problem 4-36 Multiple Choice (IAA)maryaniNo ratings yet

- Problem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallyDocument1 pageProblem 1-22 (AICPA Adapted) : Hart Company Sells Subscriptions To A Specialized Directory That Is Published Semi-AnnuallymaryaniNo ratings yet

- Other Steps For Managing Foreign Exchange RiskDocument2 pagesOther Steps For Managing Foreign Exchange RiskmaryaniNo ratings yet

- Ia2 Prob 1-16 & 17Document1 pageIa2 Prob 1-16 & 17maryaniNo ratings yet

- Ia2 Prob 1-20 & 21Document2 pagesIa2 Prob 1-20 & 21maryaniNo ratings yet

- Ia2 Prob 1-32 & 33Document1 pageIa2 Prob 1-32 & 33maryaniNo ratings yet

- Non-Written Sources of HistoryDocument2 pagesNon-Written Sources of HistorymaryaniNo ratings yet

- Lesson 2: Historiography: Internal and External Criticism: What Is Historical Criticism?Document3 pagesLesson 2: Historiography: Internal and External Criticism: What Is Historical Criticism?maryaniNo ratings yet

- Money Market Financial InstrumentsDocument5 pagesMoney Market Financial InstrumentsmaryaniNo ratings yet

- Market and The Primary MarketDocument2 pagesMarket and The Primary MarketmaryaniNo ratings yet

- Primary Versus Secondary SourcesDocument1 pagePrimary Versus Secondary SourcesmaryaniNo ratings yet

- Problem 4-16 (IFRS) : 1. What Is The Amount of Undiscounted Cash Flows For The Provision?Document2 pagesProblem 4-16 (IFRS) : 1. What Is The Amount of Undiscounted Cash Flows For The Provision?maryaniNo ratings yet

- Prob 4-10 To 12Document2 pagesProb 4-10 To 12maryaniNo ratings yet

- Problem 4-33 Multiple ChoiceDocument2 pagesProblem 4-33 Multiple ChoicemaryaniNo ratings yet

- Prob Chap 4-18 To 19Document1 pageProb Chap 4-18 To 19maryaniNo ratings yet

- Prob Chap 4Document2 pagesProb Chap 4maryaniNo ratings yet

- Problem 1 With SolutionDocument3 pagesProblem 1 With SolutionmaryaniNo ratings yet

- Problem 4-26 To 28Document1 pageProblem 4-26 To 28maryaniNo ratings yet

- Problem 4-29 To 31Document1 pageProblem 4-29 To 31maryaniNo ratings yet

- SchemesTap Old - February 2023 Lyst3129Document60 pagesSchemesTap Old - February 2023 Lyst3129Bhanu RaghavNo ratings yet

- Email Conversion Analysis of Feel Like Home CompanyDocument10 pagesEmail Conversion Analysis of Feel Like Home CompanyPhương DungNo ratings yet

- Prestige Trade Centre - Aerocity - March 2023Document58 pagesPrestige Trade Centre - Aerocity - March 2023gargipurigosaiiNo ratings yet

- Characteristics and Causes of GlobalisationDocument10 pagesCharacteristics and Causes of GlobalisationDunith HANo ratings yet

- Invt Chapter 2Document29 pagesInvt Chapter 2Khadar MaxamedNo ratings yet

- Public: Standard Chartered Bank (Vietnam) LimitedDocument22 pagesPublic: Standard Chartered Bank (Vietnam) Limitedvince dommNo ratings yet

- Chapter One An Introduction To Human Capital ManagementDocument13 pagesChapter One An Introduction To Human Capital Managementnosheen_noshNo ratings yet

- Class 4: Ideation Phase: Prototyping Overview of Ideation Phase: PrototypingDocument15 pagesClass 4: Ideation Phase: Prototyping Overview of Ideation Phase: Prototypingdreamer4077No ratings yet

- Pabahay Bonanza: Philippine National Bank As of September 30, 2009Document80 pagesPabahay Bonanza: Philippine National Bank As of September 30, 2009ramonlucas700No ratings yet

- Money and Banking Week 1 CH 5Document5 pagesMoney and Banking Week 1 CH 5Pradipta NarendraNo ratings yet

- Providerpay® and Mckesson Reimbursement Advantage (Mra) : Special Offer!Document2 pagesProviderpay® and Mckesson Reimbursement Advantage (Mra) : Special Offer!larryrph78No ratings yet

- Manajemen Dasar PLN - Pengembangan Manajemen TalentaDocument21 pagesManajemen Dasar PLN - Pengembangan Manajemen TalentarifkiriguuulNo ratings yet

- GermanyDocument6 pagesGermanySiti MaimunahNo ratings yet

- Blades Plc. Case I: Decision To Expand InternationallyDocument4 pagesBlades Plc. Case I: Decision To Expand InternationallyАлинаNo ratings yet

- Holiday Homework XI B St.Document5 pagesHoliday Homework XI B St.yashikagupta10a.doonNo ratings yet

- Ending Corruption Towards A Collaborative StrategyDocument2 pagesEnding Corruption Towards A Collaborative StrategyDr.Touhid Muhammed Faisal kamal100% (1)

- Notification OFK Danger Building Worker PostsDocument11 pagesNotification OFK Danger Building Worker Postssipuns827No ratings yet

- Menna's ResumeDocument1 pageMenna's Resumemohamed mustafaNo ratings yet

- Financial MGT New Module 4Document17 pagesFinancial MGT New Module 4Anjelika ViescaNo ratings yet

- Most Profitable Mayonnaise & Salad Dressings Manufacturing Business-104583Document64 pagesMost Profitable Mayonnaise & Salad Dressings Manufacturing Business-104583Jahangir MiltonNo ratings yet

- Variance ANALYSISDocument10 pagesVariance ANALYSISWaseim khan Barik zaiNo ratings yet

- CA Inter Law Q MTP 2 May 2024 Castudynotes ComDocument11 pagesCA Inter Law Q MTP 2 May 2024 Castudynotes ComthegodslayyerNo ratings yet

- What Is Plot Ratio in MalaysiaDocument5 pagesWhat Is Plot Ratio in Malaysiavin237becNo ratings yet

- MGT603 Solved MCQs From Book by Fred (Chap 7)Document4 pagesMGT603 Solved MCQs From Book by Fred (Chap 7)Fan CageNo ratings yet

- Risks and Mitigations For Losing EMS Functions Reference Document WebinarDocument11 pagesRisks and Mitigations For Losing EMS Functions Reference Document WebinarJeans GonzalezNo ratings yet

- Management Discussion and Analysis: Business OverviewDocument35 pagesManagement Discussion and Analysis: Business OverviewShashank PalNo ratings yet