Professional Documents

Culture Documents

F005 Test 5 Students

F005 Test 5 Students

Uploaded by

bhumikaaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F005 Test 5 Students

F005 Test 5 Students

Uploaded by

bhumikaaCopyright:

Available Formats

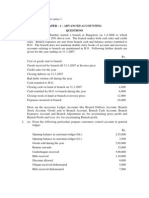

CA FOUNDATION ACCOUNTS TEST

TEST

CA Foundation Test 5

All Questions compulsory.

Working notes will be part of the answer.

MARKS 80

1. E Ltd. sends out its accounting machines costing ` 200 each to their customers on Sales

or Return basis. All such transactions are, however, treated like actual sales and are

passed through the Day Book. Just before the end of the financial year, i.e., on March

24, 2016, 300 such accounting machines were sent out at an invoice price of ` 280

each, out of which only 90 accounting machines are accepted by the customers ` 250

each and as to the rest no report is forthcoming. Show the Journal Entries in the books

of the company for the purpose of preparing Final Accounts for the year ended March

31, 2016.

(5 Marks)

2. S. Ltd. sends out its goods to dealers on Sale or Return basis. All such transactions are,

however, treated as actual sales and are passed through the Day Book. Just before the

end of the accounting year on 31.03.2016, 200 such goods have been sent to a dealer at

`250 each (cost ` 200 each) on sale or return basis and debited to his account. Of

these goods, on 31.03.2016, 50 were returned and 70 were sold while for the other goods,

date of return has not yet expired. Pass necessary adjustment entries on 31.03.2016.

(5 Marks)

3. Journalize the following in the books of Don:

a) Bob informs Don that Ray’s acceptance for ` 3,000 has been dishonoured and noting

charges are ` 40. Bob accepts ` 1,000 cash and the balance as bill at three months

at interest of 10%.Don accepts from Ray his acceptance at two months plus interest

@ 12% p.a.

b) James owes Don ` 3,200; he sends Don’s own acceptance in favour of Ralph for `

,160; in full settlement.

c) Don meets his acceptance in favour of Singh for ` 4,500 by endorsing John’s

acceptance for ` 4,450 in full settlement.

www.cavidya.com 1 CA Anand R Bhangariya

CA FOUNDATION ACCOUNTS TEST

d) Ray’s acceptance in favour of Don retired one month before due date, interest is

taken at the rate of 6% p.a.

(10 Marks)

4. (5 Marks)

i. On 1.1.2017, A draws a bill on B for `1,20,000 for 3 months’ maturity date of the bill

will be:

(a) 1.4.2017 (b) 3.4.2017 (c) 4.4.2017

ii. PQ draws a bill on XY for `130,000 on 1.1.2017. X accepts the same on 4.1.2017 for

period of 3 months after date. What will be the maturity date of the bill:

(a) 4.4.2017 (b) 3.4.2017 (c) 7.4.2017

iii. A draws a bill on B. A endorsed the bill to C. The payee of the bill will be

(a) A (b) B (c) C

iv. X sold goods to Y for ` 5,00,000. Y paid cash `4,30,000. X will grant 2% discount on

balance, and Y request X to draw a bill for balance, the amount of bill will be:

(a) ` 98,000 (b) ` 68,000 (c) ` 68,600

v. XZ draws a bill on YZ for ` 2,00,000 for 3 months on 1.1.2017. The bill is discounted

with banker at a charge of `1,000. At maturity the bill return dishonoured. In the

books of XZ, for dishonour, the bank account will be credited by:

(a) `199,000 (b) ` 200,000 (c) ` 201,000

5. Miss Rakhi consigned 1,000 radio sets costing `900 each to Miss Geeta, her agent on 1st

July,2016. Miss Rakhi incurred the following expenditure on sending the consignment.

Freight ` 7,650

Insurance ` 3,250

Miss Geeta received the delivery of 950 radio sets. An account sale dated 30th

November,2016 showed that 750 sets were sold for `9,00,000 and Miss Geeta incurred

`10,500 for carriage.

www.cavidya.com 2 CA Anand R Bhangariya

CA FOUNDATION ACCOUNTS TEST

Miss Geeta was entitled to commission 6% on the sales eVected by her. She incurred

expenses amounting to `2,500 for repairing the damaged radio sets remaining in the

inventories.

Miss Rakhi lodged a claim with the insurance company which was admitted at `35,000.

Show the Consignment Account and Miss Geeta’s Account in the books of Miss Rakhi.

(10 Marks)

6. From the following information (as on 31.3.2017), prepare a bank reconciliation statement

after making necessary amendments in the cash book:

Particulars

Bank balances as per the cash book (Dr.) 32,50,000

Cheques deposited, but not yet credited 44,75,000

Cheques issued but not yet presented for payment 35,62,000

Bank charges debited by bank but not recorded in the cash-book 12,500

Dividend directly collected by the bank 1,25,000

Insurance premium paid by bank as per standing instruction not 15,900

intimated

Cash sales wrongly recorded in the Bank column of the cash-book 2,55,000

Customer’s cheque dishonoured by bank not recorded in the cash-book 1,30,000

Wrong credit given by the bank 1,50,000

Also show the bank balance that will appear in the trial balance as on 31.3.2017.

( 10 Marks)

7. On 31st March 2017, the Bank Pass Book of Namrata showed a balance of ` 1,50,000 to

her credit while balance as per cash book was ` 1,12,050. On scrutiny of the two books,

she ascertained the following causes of dierence:

a) She has issued cheques amounting to ` 80,000 out of which only ` 32,000 were

presented for payment.

b) She received a cheque of ` 5,000 which she recorded in her cash book but forgot to

deposit in the bank.

c) A cheque of ` 22,000 deposited by her has not been cleared yet.

d) Mr. Gupta deposited an amount of ` 15,700 in her bank which has not been recorded

by her in Cash Book yet.

e) Bank has credit an interest of ` 1,500 while charging ` 250 as bank charges.

www.cavidya.com 3 CA Anand R Bhangariya

CA FOUNDATION ACCOUNTS TEST

Prepare a bank reconciliation statement.

(5 Marks)

8. The following errors were found in the book of Ram Prasad & Sons. Give the necessary

entries to correct them.

1. ` 500 paid for furniture purchased has been charged to ordinary Purchases Account.

2. Repairs made were debited to Building Account for ` 50.

3. An amount of `100 withdrawn by the proprietor for his personal use has been debited

to Trade Expenses Account.

4. `100 paid for rent debited to Landlord’s Account

5. Salary `125 paid to a clerk due to him has been debited to his personal account

6. `100 received from Shah & Co. has been wrongly entered as from Shaw & Co.

7. ` 700 paid in cash for a typewriter was charged to Office Expenses Account.

8. A purchase of goods from Ram amounting to `150 has been wrongly entered through

the Sales Book.

9. A Credit sale of goods amounting `120 to Ramesh has been wrongly passed through

the Purchase Book.

10. On 31st December, 2016 goods of the value of `300 were (10

Marks)

9. The following was the Receipts and Payments Account of Exe Club for the year ended

March. 31, 2016

Receipts ` Payments `

Cash in hand 100 Groundsman’s Fee 750

Balance at Bank as per Pass Moving Machine 1,500

Book:

Deposit Account 2,230 Rent of Ground 250

Current Account 600 Cost of Teas 250

Bank Interest 30 Fares 400

Donations and Subscriptions 2,600 Printing & Office Expenses 280

Receipts from teas 300 Repairs to Equipment 500

Contribution to fares 100 Honorarium to Secretary and

www.cavidya.com 4 CA Anand R Bhangariya

CA FOUNDATION ACCOUNTS TEST

Sale of Equipment 80 Treasurer of 2015 400

Net proceeds of Variety Balance at Bank as per Pass

Book:

Entertainment 780 Deposit Account 3,090

Donation for forth coming Current Account 150

Tournament 1,000 Cash in hand 250

7,820 7,820

You are given the following additional information:

Particulars April, 1, 2015 March, 31, 2016

` `

Subscription due 150 100

Amount due for printing etc. 100 80

Cheques unpresented being payment for repairs 300 260

Estimated value of machinery and equipment 800 1,750

Interest not yet entered in the Pass book 20

Bonus to Groundsman o/s. 300

For the year ended March. 31, 2016, the honorarium to the Secretary and Treasurer are to be increased

by a total of `200.

(10 Marks)

10. Mr. Vimal runs a factory which produces soaps. Following details were available in

respect of his manufacturing activities for the year ended on 31.3.2016:

Opening Work-in-Process (10,000 units) 16,000

Closing Work-in-Process (12,000 units) 20,000

Opening inventory of Raw Materials 1,70,000

Closing inventory of Raw Materials 1,90,000

Purchases 8,20,000

Hire charges of machine @ `0.60 per unit manufactured

Hire charges of factory 2,20,000

Direct wages-Contracted @ ` 0.80 per unit manufactured and @ ` 0.40 per

unit of

Closing W.I.P.

Repairs and Maintenance 1,80,000

www.cavidya.com 5 CA Anand R Bhangariya

CA FOUNDATION ACCOUNTS TEST

Units produced – 5,00,000 units

Required

Prepare a Manufacturing Account of Mr. Vimal for the year ended 31.3.2016.

(5 Marks)

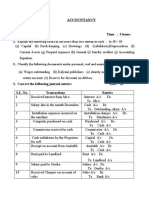

11. Mr. Mohan gives you the following trial balance and some other information:

Trial Balance as on 31st March, 2017

Particulars ` `

Capital 6,50,000

Sales 9,70,000

Purchases 4,30,000

Opening Inventory 1,10,000

Freights Inward 40,000

Salaries 2,10,000

Other Administration Expenses 1,50,000

Furniture 3,50,000

Trade receivables and Trade payables 2,10,000 1,90,000

Returns 20,000 12,000

Discounts 19,000 9,000

Bad Debts 5,000

Investments in Government Securities 1,00,000

Cash in Hand and Cash at Bank 1,87,000

18,31,000 18,31,000

Other Information:

(i) Closing Inventory was ` 1,80,000;

(ii) Depreciate Furniture @ 10% p.a.

Required

Prepare Trading and Profit and Loss Account for the year ended on 31.3.2017 and

Balance Sheet of Mr. Mohan as on that date.

(5 Marks)

www.cavidya.com 6 CA Anand R Bhangariya

You might also like

- Statement PDFDocument3 pagesStatement PDFRodney PattersonNo ratings yet

- Canadian Banking Industry Since 1970Document14 pagesCanadian Banking Industry Since 1970Shegan MartinsNo ratings yet

- Auditing and Assurance Principles Pre TestDocument9 pagesAuditing and Assurance Principles Pre TestKryzzel Anne JonNo ratings yet

- Account Closure FormDocument2 pagesAccount Closure Formrafeekmekgce75% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- Council For Legal EducationDocument4 pagesCouncil For Legal EducationConeliusNo ratings yet

- Accounting Test - IDocument3 pagesAccounting Test - IRahulNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- 5627Document8 pages5627MS 7No ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Account Past Questions Compilation (2009june - 2022 June)Document319 pagesAccount Past Questions Compilation (2009june - 2022 June)Arjun AdhikariNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- CBM 514-3 Question 3Document3 pagesCBM 514-3 Question 3hafsamohmd793No ratings yet

- Assignment For 2nd Yr Eco. StudentsDocument3 pagesAssignment For 2nd Yr Eco. StudentsMan SanchoNo ratings yet

- Financial Accounting and Reporting With AnswersDocument11 pagesFinancial Accounting and Reporting With AnswersHades MercadejasNo ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- CashDocument6 pagesCashrosemariesollegue888No ratings yet

- Cash AssignmentDocument2 pagesCash Assignmentyjkq4byrj6No ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Group 5 Cash and Cash Equivalents QuizbowlDocument6 pagesGroup 5 Cash and Cash Equivalents Quizbowlkorina velascoNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- 4.CA Foundation Test 4Document6 pages4.CA Foundation Test 4Nived Narayan PNo ratings yet

- Test Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingGayathiri RNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Bank Reconciliation Statement August 17Document10 pagesBank Reconciliation Statement August 17NO NAMENo ratings yet

- 500,000 Demand Deposit 4,000,000: Activity 2 - ProblemsDocument7 pages500,000 Demand Deposit 4,000,000: Activity 2 - ProblemsSaclao John Mark GalangNo ratings yet

- Long Quiz 1 Acc 205Document6 pagesLong Quiz 1 Acc 205Philip LarozaNo ratings yet

- Cac ElvnDocument4 pagesCac Elvnsamarthj.9390No ratings yet

- Cash and Cash Equivalent QuizDocument3 pagesCash and Cash Equivalent QuizApril Rose Sobrevilla DimpoNo ratings yet

- Exam 3Document5 pagesExam 3MahediNo ratings yet

- 03 - Accounts - Prelims 4Document6 pages03 - Accounts - Prelims 4Pawan TalrejaNo ratings yet

- Test Code - ACC-01: Time Allowed: 3 HoursDocument8 pagesTest Code - ACC-01: Time Allowed: 3 Hoursaniket chouhanNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationsDocument4 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationsSkans R&DNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- F003 NPO Exam TeachersDocument7 pagesF003 NPO Exam TeachersbhumikaaNo ratings yet

- Test 1 Rectification and Subsidiary Books 21.05.2019Document2 pagesTest 1 Rectification and Subsidiary Books 21.05.2019bhumikaaNo ratings yet

- F004 Bills of Exchange, Sale or Return and ADD Teachers Test 4Document11 pagesF004 Bills of Exchange, Sale or Return and ADD Teachers Test 4bhumikaaNo ratings yet

- Heart Touching QuotesDocument3 pagesHeart Touching QuotesbhumikaaNo ratings yet

- OTv 7 HG 5 YAf TV RJJaDocument8 pagesOTv 7 HG 5 YAf TV RJJaKuldeep JatNo ratings yet

- Application Form b2b Msme July19Document7 pagesApplication Form b2b Msme July19Vishal Kumar SoniNo ratings yet

- HaseenaDocument4 pagesHaseenaRema RajagopalNo ratings yet

- T Arivandandam vs. T.V. Satyapal and Anr. 1977 Air SC 2421Document30 pagesT Arivandandam vs. T.V. Satyapal and Anr. 1977 Air SC 2421AADITYA POPATNo ratings yet

- MSME by Dr. Jaime AlipDocument21 pagesMSME by Dr. Jaime AlipHenock GetachewNo ratings yet

- Chapter 6 2Document7 pagesChapter 6 2ArkokhanNo ratings yet

- Faya PDF 2 PDFDocument43 pagesFaya PDF 2 PDFRameNo ratings yet

- Dhanmondi Branch Account StatementDocument3 pagesDhanmondi Branch Account StatementKazi AsaduzzmanNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- FRM Learning Objectives 2023Document58 pagesFRM Learning Objectives 2023Tejas JoshiNo ratings yet

- Chime Bank Statement 2020.Document4 pagesChime Bank Statement 2020.kutner8181No ratings yet

- FIA Intro To Finance CH 10Document9 pagesFIA Intro To Finance CH 10Jagdish SinghNo ratings yet

- Inclusive BankingDocument13 pagesInclusive BankingMukeshKataraNo ratings yet

- Credit CollectionDocument15 pagesCredit CollectionMarie Frances SaysonNo ratings yet

- Sample Mock Call SimulationDocument3 pagesSample Mock Call SimulationEchoNo ratings yet

- Chapter 10 NOTES 2021Document8 pagesChapter 10 NOTES 2021giannimizrahi5No ratings yet

- ICICI Marketing ReportDocument75 pagesICICI Marketing ReportMansi MeenaNo ratings yet

- Standard Chartered Bank Nepal Limited 15th May 2020 Schedule of Charges Pertaining To Retail Clients 1 Client Services ChargesDocument3 pagesStandard Chartered Bank Nepal Limited 15th May 2020 Schedule of Charges Pertaining To Retail Clients 1 Client Services ChargesnepaliscribduserNo ratings yet

- Ac - Enyichukwu Precious Miracle - December, 2020 - 502578300 - FullstmtDocument9 pagesAc - Enyichukwu Precious Miracle - December, 2020 - 502578300 - FullstmtPreciousMimiNo ratings yet

- FSR Guide 2021Document166 pagesFSR Guide 2021OlegNo ratings yet

- Oromia International BankDocument1 pageOromia International Bankest89% (19)

- Win23 Pill1B Banking NPA BadloansDocument15 pagesWin23 Pill1B Banking NPA BadloansSumit PandaNo ratings yet

- Assessment 3 of International Marketing UnitDocument4 pagesAssessment 3 of International Marketing UnitDat Nhan TienNo ratings yet

- Applicability of Caro, 2020Document19 pagesApplicability of Caro, 2020hrudaya boysNo ratings yet

- Ravindra BhaiDocument45 pagesRavindra BhaiRavindra PatelNo ratings yet

- 0 Apr Credit Card Coping With Your FinancesDocument2 pages0 Apr Credit Card Coping With Your FinancesAhmed BelalNo ratings yet

- Braun & Koddenbrock (Eds.) - Capital Claims. Power and Global Finance (2023)Document283 pagesBraun & Koddenbrock (Eds.) - Capital Claims. Power and Global Finance (2023)mrdesignNo ratings yet