Professional Documents

Culture Documents

Hubungan Etnik

Hubungan Etnik

Uploaded by

EmmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hubungan Etnik

Hubungan Etnik

Uploaded by

EmmaCopyright:

Available Formats

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

Question 1:

IFRS 8 Operating Segments focuses on the determination of a company’s operating segments

and how to apply certain principles to determine the reportable segments.

Required:

(a) Illustrate in detail the quantitative and qualitative thresholds for determining

reportable segments, as required by IFRS 8. (8 marks)

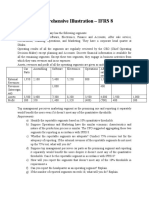

(b) The following information was extracted from Evergreen Bhd., an international

restaurant group and has five business segments in different region. The results of the

regional segment for the year ended 31 December 2019 are as follows:

Revenue

External Internal Profit /loss Assets

RM million RM million RM million RM million

European 650 180 (10) 900

South-east Asia 450 100 70 400

Africa 250 50 40 200

North America 150 50 15 300

South America 300 40 105 2000

There were no significant inter-company balances in the segment assets and liabilities.

Required:

Based on the quantitative thresholds mentioned in part (a) above, assess which are the

reportable segments of Evergreen Bhd.

By Michelle Tan (2019) 1

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

Question 2:

Jesmond, a retailer and leisure group, has three businesses operating in different part of the

world. Jesmond reports to management on the basis of region. The results of the regional

segments for the year ended 31 December 20X9 are as follows

Segment

Revenue Results Segment

Region External Internal Profit/ loss Assets

RM million RM million RM million RM million

Europe 140 5 (10) 300

North America 300 280 60 800

Asia 300 475 105 2000

There were insignificant intra-group balance in the segment assets and liabilities. Due to the

disappointing performance of Europe in the year, the management of Jesmond would prefer

not to include Europe as a reportable segment. They believe reporting North America and

other regions will provide the stakeholders with sufficiency information.

Required:

Advise the management of Jesmond on the principles for determining reportable segments

under IFRS 8 and comment on whether Europe can be omitted as a reportable segment.

Question 3:

Klanet is a public limited company operating in the pharmaceutical sector. The company

advice on the following financial reporting issue.

Klanet produces and sells its range of drugs through three separate divisions. In addition, it

has two laboratories which carry out research and development activities.

In the first laboratory, the research and development activity is funded internally and

centrally for each of the three divisions. It does not carry out research and development

activities for other entities. Each of the three divisions is given a budget allocation which it

uses to purchase research and development activities from the laboratory. The laboratory is

directly accountable to the division heads for this expenditure.

The second laboratory performs contract investigation activities for other laboratories and

pharmaceutical companies. This laboratory earns 75% of its revenue from external customers

and these external revenues represent 18% of the organisation’s total revenue.

The performance of the second laboratory’s activities and of the three separate divisions is

regularly reviewed by the chief operating decision maker (CODM). In addition to the heads

By Michelle Tan (2019) 2

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

of divisions, there is a head of the second laboratory. The head of second laboratory is

directly accountable to the CODM and they discuss the operating activities, allocation of

resources and financial results of the laboratory.

The managing director does not think IFRS 8 provides information that is useful to investors.

He feels it just add more pages to financial statements that are already very lengthy. The

finance director partially agrees with the managing director and believes that the IASB’s

practice statement on materiality confirms his opinion that not all the disclosure requirements

in IFRS 8 are necessary.

Required:

(i) Advise the managing director, with reference to IFRS 8 Operating Segments, whether

the research and development laboratories should be reported as two separate

segments.

(ii) Discuss the managing director’s view that IFRS 8 does not provide useful information

to investors.

(iii) Discuss whether the finance director is correct in his opinion about IFRS 8,

identifying any ethical concerns you may have. You should briefly refer to Practise

Statement 2 Making Materiality Judgement in your answer.

By Michelle Tan (2019) 3

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

Suggested Solution:

Question 1:

IFRS 8 states that in determining reportable segment, it should meet both qualitative and quantitative

characteristic.

QUALITATIVE CHARACTERISTICS

An operating segment is a component of an entity:

(a) That engages in business activities from which it may earn revenues and incur expenses

(including revenues and expenses relating to transactions with other components of the same

entity);

(b) Whose operating results are regularly reviewed by the entity’s chief operating decision maker

to make decisions about resources to be allocated to the segment and assess its performance;

and

(c) For which discrete financial information is available.

QUANTITATIVE THRESHOLD - 10% rule

An operating segment should pass at least one of the criteria below in order to be reportable:

The reported revenue (external and inter-segment) is 10% or more of the combined revenue of all

operating segments

The absolute amount of the segment’s reported profit or loss is 10% or more of the greater of

profit and loss making segments

The segment’s assets are 10% or more of the combined assets of all operating segments.

75% rules on external revenue

After determining the reportable segments, an entity must ensure that the total external

revenue attributable to those reportable segments is at least 75% of the entity’s total revenue.

If the total external revenue reported by the operating segment constitutes less than 75% of

the entity’s total revenue, then additional operating segments shall be identified as reportable

segment.

By Michelle Tan (2019) 4

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

(a) Show how these principles would be applied to Evergreen Bhd

Revenue test

North

Europea

South-east Ameri South

n

Asia Africa ca America total

RM’mi

RM’mil RM’mil RM’mil l RM’mil RM’mil

External revenue 650 450 250 150 300 1800

Internal 180 100 50 50 40 420

830 550 300 200 340 2220

10%

10% -revenue Yes Yes Yes No Yes 222

10% of the combined external (RM1,800 million) and internal revenue (RM420

million) totaling RM2,220 million amounts to RM222 million. Thus, the 10%

threshold would be RM222 million. As such, the segments that report a combined

(external and internal) revenue of RM222 million or more will pass the test.

Therefore, all other regions qualify as reportable segments, except the North

America region.

Profit or Loss Test:

Profit 70 40 15 105 230

Loss -10 -10

-10 70 40 15 105 220

No Yes Yes No Yes 10%

greater

10% - profit 23.0 amount

10% - loss -1

By Michelle Tan (2019) 5

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

The total profit reported by the profit-making segments (SEA, Africa, North and

South America) is RM230 million. The European region is the only loss-making

segment at RM10 million. Thus, 10% of the greater of these two amounts is RM23

million. A segment will qualify as a reportable segment as long as its reported profit

or loss is RM23 million and above. Thus, all regions except the European and North

America regions fail the test.

Assets test

Assets 900 400 200 300 2000 3800

10%

10% - assets Yes Yes No No Yes 380

10% of the combined assets of all segments is RM3,800 × 10% = RM380. Thus, all other

regions qualify as a reportable segment. The Africa and North America regions fail the test.

Conclusion

The European, SEA, Africa and South America regions are reportable segments. However,

the North America region fails all three tests and should be categorized as ‘other region’.

Question 2:

IFRS 8 requires a business to determine its operating segment on the basis of its internal

management reporting. As Jesmond reports to management on the basis of geographical

reasons, this is how Jesmond determines its segment.

IFRS 8 requires an entity to report separate information about each operating segment that:

(a) Has been identified as meeting the definition of an operating segment;

that engages in revenue earning or incurred expenses from business activities

whose operating results are regularly reviewed by the chief operating decision maker

(CODM).

for which discrete financial information is available.

By Michelle Tan (2019) 6

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

(b) Has a segment total that is 10% or more of total:

(i) Revenue (internal and external)

(ii) Profitability ( or all segment in loss if greater)

(iii) Assets

The 10% quantitative criteria have been applied in below tables

Revenue Test :

Region Europe N America Asia Total

$mil $mil $mil $mil

External revenue 140 300 300 740

Inter-segment rev 5 280 475 760

145 580 775 1500

√ √

10% -revenue 150

Segment revenue > 10% of total revenue = North America & Asia

Result Test:

Profit 60 105 165

Loss -10 -10

-10 60 105

√ √

10% - profit 16.5

10% - loss -1

Segment result > total profit =North America & Asia

Assets Test: 300 800 2000 3100

10% - assets √ √ 310

By Michelle Tan (2019) 7

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

Segment assets > 10% of total assets = North America & Asia

From the 10% quantitative test, Europe is not a reportable segment.

However, IRFS 8 also requires that at least 75% of total external revenue must be reportable

by operating segments. Reportable North America and Asia accounts for 81% of external

revenue ($600m/740m) and therefore the test is satisfied. There is no requirement for

Jesmond to include Europe as a reportable segment.

Nevertheless, it could be perceived as being unethical not to report Europe separately if the

sales motivation were to hide losses. Given that IFRS 8 allows management to choose to

report segment that do not meet any of the qualitative thresholds, Jesmond might like to

consider disclosing Europe as a separate reportable segment.

Question 3:

(i)

IFRS 8 Operating Segments states that an operating segment is a component of an entity

which engages in business activities from which it may earn revenues and incur cost. In

addition, discrete financial information should be available for the sgement and these result

should be regularly reviewed by the entity’s CODM when making decisions about allocation

to segment and assessing its performance.

Other factors should be taken into account, including the nature of the business activities of

each component, the existence of manager responsible for them, and information presented to

the board of directors.

According to IFRS 8, an operating segment is one which meets any of the following

quantitative thresholds:

(a) It reportable revenue 10% or more of the combined revenue of all operating segments.

(b) The absolute amount of its reportable profit or loss is 10% or more of the greater, in

absolute amount, of (1) the combined reported profit of all operating segments which did not

report to loss and (2) the combined reported loss of all operating segment which reported a

loss.

(c ) Its assets are 10% or more of the combined assets of all operating segments.

As a result of the application of the above criteria, the first laboratory will not be reported as

a separate operating segment. The division have heads directly accountable to, and

maintaining regular contact with, the CODM to discuss all aspect of their division’s

performance The division seem to be consistent with the core principle of IFRS 8 and

should be reported as separate segments. However, the laboratory does not have a separate

segment manager and the existence of a segment manager is normally an important factor in

By Michelle Tan (2019) 8

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

determining operating segments. Instead, the laboratory is responsible to the division by

themselves, which would seem to indicate that it is simply supporting the existing divisions

and not a separate segment. Additionally, there does not seem to be any discrete performance

information for the segment, which is reviewed by the CODM.

The second laboratory should be reported as a separate segment. It meets the quantitative

threshold for percentage of total revenues and it meets other criteria for an operating segment.

It engages in activities which earn revenue and incurs cost, its operating results are reviewed

by the CODM and discrete information is available for the laboratory’s activities. Finally, it

has a separate segment manager.

(ii) Contrary to the managing director’s view, IFRS 8 provides information that makes the

financial statements more relevant and more useful to investors. IFRS financial statements

are highly aggregated and may prevent investors from understanding the many different

business areas and activities that an activity is engaged in. IFRS 8 requires information to be

disclosed that is not readily available elsewhere in the financial statements, therefore it

provides additional information which aids an investor’s understanding of how the business

operates and is managed.

IFRS 8 uses a ‘management approach’ to report information on an entity’s segments and

results from the point of view of the decision makers of the entity. This allows investors to

examine an entity ‘through the eye of management’ - to see the business in the way in which

the manager who run the business segments allowing them to better assess the return being

earned from those business segments, the risks that are associated with those segments and

how those risk are manged. The more detailed information provides investors with more

insight into an entity’s longer term performance.

The requirement to disclose information that is actually used by internal decision makers is

an important feature in IFRS 8 but it also one of its main criticism. The fact that the reporting

does not need to be based on IFRS makes it difficult to make comparisons with information

that was reported in prior periods and with other companies in the sector. The flexibility in

reporting can make it used in conjunction with narrative disclosures prepared by the directors

of the company.

(iii)

The finance director’s opinion that ‘not all disclosure in IFRS 8 is necessary’ could be

interpreted to mean that he believes he can pick and choose which disclosure requirements he

feels are necessary and which he believes are not.

This is not correct. IAS 1 Presentation of Financial Statements requires all standards to be

applied if fair presentation is to be achieved. Directors cannot choose which parts of

standards they do or do not apply.

By Michelle Tan (2019) 9

Tunku Abdul Rahman University College

Faculty of Accountancy, Finance and Business

BBFA3034 Advance Accounting Practice

Tutorial 1: IFRS 8 Segmental reporting

However, as confirmed by Practice Statement 2, if the information provided by a disclosure is

immaterial and it therefore cannot reasonably be expected to influence the decision of

primary users of the financial statements, then that disclosure does not need to be made.

If the finance director is suggesting that the information provided about Klancet by some of

the disclosures required by IFRS 8 are not material, then assuming that the information is

indeed immaterial, he would be correct in stating that those disclosure s are not necessary.

The directors should apply the principles given in Practice Statement 2 to review how they

have made materiality judgement in their financial reporting. It may be that their current

financial report is very lengthy because they include information that is not material.

Both directors appear reluctant to give the disclosures required by IFRS 8. This raises

concern. If the finance director is not aware that he cannot pick and choose requirements

from IFRSs, then his professional competence may be called into question. If he is aware of

this, and an assessment of whether the disclosure s are material has not been done, or has

been done inappropriately, then it may be that the directors are trying to hide an issue. This

should be considered in more detail.

By Michelle Tan (2019) 10

You might also like

- How Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaDocument17 pagesHow Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaMeester KewpieNo ratings yet

- MODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodDocument16 pagesMODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodJohn Mark FernandoNo ratings yet

- Operating Segments QUIZ AnswerDocument6 pagesOperating Segments QUIZ AnswerLynssej Barbon100% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- T1. Operating Segment-Student Q & ADocument12 pagesT1. Operating Segment-Student Q & A嘉慧No ratings yet

- Tutorial 3 Answer SegmentalDocument6 pagesTutorial 3 Answer Segmental--bolabolaNo ratings yet

- UKAF4034 ACR Tutorial3 Q - OpSegmentsDocument7 pagesUKAF4034 ACR Tutorial3 Q - OpSegmentstan JiayeeNo ratings yet

- IFRS 8 Operating Segment-5-7Document3 pagesIFRS 8 Operating Segment-5-7vicent laurianNo ratings yet

- Chapter 8Document7 pagesChapter 8suleymantesfaye10No ratings yet

- Ifrs 8Document11 pagesIfrs 8Huzaifa WaseemNo ratings yet

- Chapter 35 Operating SegmentDocument4 pagesChapter 35 Operating SegmentEllen MaskariñoNo ratings yet

- Ifrs 8 Operating Segments: BackgroundDocument4 pagesIfrs 8 Operating Segments: Backgroundmusic niNo ratings yet

- Tutorial 3 MFRS8 Q PDFDocument3 pagesTutorial 3 MFRS8 Q PDFKelvin LeongNo ratings yet

- AS 17 Segment ReportingDocument11 pagesAS 17 Segment ReportingNishant Jha Mcom 2No ratings yet

- Adv - Chap 8Document7 pagesAdv - Chap 8Melody LisaNo ratings yet

- 07 Segment Reporting 1Document4 pages07 Segment Reporting 1Irtiza AbbasNo ratings yet

- 07 Segment ReportingDocument5 pages07 Segment ReportingHaris IshaqNo ratings yet

- IFRS 8 - Segmental ReportingDocument16 pagesIFRS 8 - Segmental ReportinglaaybaNo ratings yet

- Operating Segment StudentsDocument4 pagesOperating Segment StudentsAG VenturesNo ratings yet

- Module 33 Operating SegmentsDocument10 pagesModule 33 Operating SegmentsAngelica Sanchez de VeraNo ratings yet

- Operating SegmentDocument15 pagesOperating SegmentSrabon BaruaNo ratings yet

- Tutorial 1 QDocument3 pagesTutorial 1 QHemaram NaiduNo ratings yet

- Operating Segments Illustrative ExampleDocument1 pageOperating Segments Illustrative ExampleMahir RahmanNo ratings yet

- ACCA102 - 15 Operating SegmentsDocument24 pagesACCA102 - 15 Operating SegmentsMary Kate OrobiaNo ratings yet

- Chapter Five Segment ReportingDocument20 pagesChapter Five Segment Reportingworkiemelkamu400No ratings yet

- ACR Tutorial 3 (Group 3)Document3 pagesACR Tutorial 3 (Group 3)tan JiayeeNo ratings yet

- OPERATING SEGMENT With ANSWERSDocument8 pagesOPERATING SEGMENT With ANSWERSRaven Sia100% (1)

- Unit 1 Advanced AccountingDocument130 pagesUnit 1 Advanced AccountingNigussie BerhanuNo ratings yet

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Document9 pagesThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNo ratings yet

- MFRS 8 - Lecture Notes 2021 - UploadDocument16 pagesMFRS 8 - Lecture Notes 2021 - UploadZhaoYing TanNo ratings yet

- Segment ReportingDocument7 pagesSegment ReportingNamita GoburdhanNo ratings yet

- Segment and Interim Financial Reporting: Answers To QuestionsDocument25 pagesSegment and Interim Financial Reporting: Answers To QuestionsainopeNo ratings yet

- Module 6Document5 pagesModule 6Karen GarciaNo ratings yet

- QUESTION 1: IFRS 8 Operating SegmentsDocument2 pagesQUESTION 1: IFRS 8 Operating SegmentsduncanNo ratings yet

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Brines Christian Joseph C. Operating SegmentsDocument59 pagesBrines Christian Joseph C. Operating SegmentsAlexandra Nicole IsaacNo ratings yet

- Operating SegmentsDocument39 pagesOperating Segmentslascona.christinerheaNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- Acctg205 ResponsibilityCentersPerformanceMeasures-SampleQuestions PDFDocument2 pagesAcctg205 ResponsibilityCentersPerformanceMeasures-SampleQuestions PDFEliseNo ratings yet

- CH 14Document20 pagesCH 14M Rafi PriyambudiNo ratings yet

- Cost Accounting 2008wDocument7 pagesCost Accounting 2008wMustaqim QureshiNo ratings yet

- Brines Christian Joseph C. Operating SegmentsDocument58 pagesBrines Christian Joseph C. Operating SegmentsAllana MierNo ratings yet

- Tut 11Document4 pagesTut 11Tang TammyNo ratings yet

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- Chapter 14Document27 pagesChapter 14IstikharohNo ratings yet

- Strategic Corporate Finance AssignmentDocument6 pagesStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- L3 ACC 2008 S2 (M) (New)Document17 pagesL3 ACC 2008 S2 (M) (New)Fung Hui YingNo ratings yet

- Sample Test Paper 2015Document4 pagesSample Test Paper 2015jeankoplerNo ratings yet

- AcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andDocument42 pagesAcFN 3151 CH, 7 Segment Reporting and Interim Reporting IFRS 8 andbethelhemNo ratings yet

- Sime Darby AnswerDocument11 pagesSime Darby AnswerNurAshikinMohamad100% (4)

- Chapter 44 Operating SegmentsDocument17 pagesChapter 44 Operating SegmentsChinNo ratings yet

- Operating SegmentsDocument13 pagesOperating SegmentsCHANDANA THIMMAPURAM 2022146No ratings yet

- Operating Segments PDFDocument12 pagesOperating Segments PDFZahidNo ratings yet

- International Business Taxation August ResitDocument14 pagesInternational Business Taxation August ResitSuyash DixitNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankFrom EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PM Tutorial 1Document5 pagesPM Tutorial 1EmmaNo ratings yet

- Week 3 PM Tutorial - BudgetingDocument4 pagesWeek 3 PM Tutorial - BudgetingEmmaNo ratings yet

- Global Bike Group: Product Motivation NotesDocument11 pagesGlobal Bike Group: Product Motivation NotesEmmaNo ratings yet

- Fi ErpDocument26 pagesFi ErpEmmaNo ratings yet

- Factory Overhead PDFDocument18 pagesFactory Overhead PDFANDI TE'A MARI SIMBALANo ratings yet

- Model Supply Chain Management Pada Produk Industri Agraris Dan TurunanDocument10 pagesModel Supply Chain Management Pada Produk Industri Agraris Dan TurunanMUHAMMAD HAFIDZ MUNAWARNo ratings yet

- OGL 481 Pro-Seminar I: PCA-Human Resource Frame WorksheetDocument4 pagesOGL 481 Pro-Seminar I: PCA-Human Resource Frame Worksheetapi-561686395No ratings yet

- HiiiDocument2 pagesHiiiathirah jamaludinNo ratings yet

- Effect of Price Perception and Service Quality On On Purchase DecisionsDocument13 pagesEffect of Price Perception and Service Quality On On Purchase DecisionsAshutosh KNo ratings yet

- VISTA - Company ProfileDocument2 pagesVISTA - Company Profileinfo vegamatrixNo ratings yet

- Security Database Overview 11gr2 100419083446 Phpapp02 PDFDocument34 pagesSecurity Database Overview 11gr2 100419083446 Phpapp02 PDFĐỗ Văn TuyênNo ratings yet

- Account For MaterialDocument25 pagesAccount For Materialshrestha.aryxnNo ratings yet

- Global E-Business and CollaborationDocument8 pagesGlobal E-Business and CollaborationkapilNo ratings yet

- Sandra Sabu Updated CVDocument2 pagesSandra Sabu Updated CVAditi SinghNo ratings yet

- Acctg43 A 0 RSR A v1Document4 pagesAcctg43 A 0 RSR A v1Siarimae RecierdoNo ratings yet

- Legal Rules of AcceptanceDocument2 pagesLegal Rules of Acceptanceabhirathi92No ratings yet

- Contract To Sell With Extrajudicial Settlement Paid by BuyerDocument2 pagesContract To Sell With Extrajudicial Settlement Paid by BuyerLIZETTE REYES100% (1)

- SumTotal 360 Degree Feedback SoftwareDocument2 pagesSumTotal 360 Degree Feedback SoftwareSumTotal Talent ManagementNo ratings yet

- Agilysys - Competitive Pricing and Positioning - Final ReportDocument109 pagesAgilysys - Competitive Pricing and Positioning - Final ReportBayCreativeNo ratings yet

- Empanada Express Food Cart Is A Manufacturing Business of A Tasteful andDocument10 pagesEmpanada Express Food Cart Is A Manufacturing Business of A Tasteful andJenika AtanacioNo ratings yet

- Why You Need A Data WarehouseDocument8 pagesWhy You Need A Data WarehouseNarendra ReddyNo ratings yet

- Kenanga Growth Fund Dec 14Document30 pagesKenanga Growth Fund Dec 14Leonard YangNo ratings yet

- Question Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesDocument3 pagesQuestion Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesAshish GangwalNo ratings yet

- Letter of Introduction For A New Employee 2Document2 pagesLetter of Introduction For A New Employee 2mohd faris irfan Muhammad izzwanNo ratings yet

- Chapter 1 Fair FinancersDocument71 pagesChapter 1 Fair FinancersArfan AhmedNo ratings yet

- F1 - MCQ by Sir Fawad Mujahid, ACCADocument5 pagesF1 - MCQ by Sir Fawad Mujahid, ACCAMuhammad IdreesNo ratings yet

- Anthony M Barrios-57ebb22419449d2Document5 pagesAnthony M Barrios-57ebb22419449d2Diana JohnsonNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsEstera ShawnNo ratings yet

- List of Banks in DumagueteDocument3 pagesList of Banks in DumagueteZacOonnee100% (1)

- Basic Accounting Tutorial P3 ESSDocument36 pagesBasic Accounting Tutorial P3 ESSFrances Mikayla EnriquezNo ratings yet

- 2 - BSPDocument15 pages2 - BSPPatrick Lance EstremeraNo ratings yet

- AcknowledgementDocument4 pagesAcknowledgementSumit PatelNo ratings yet

- ) ) @Ç!!4Bg!!!lJ6.qD : TotalDocument5 pages) ) @Ç!!4Bg!!!lJ6.qD : Totalchris johnsonNo ratings yet