Professional Documents

Culture Documents

Terminology and Concepts

Terminology and Concepts

Uploaded by

did0kuL0 ratings0% found this document useful (0 votes)

259 views5 pages1. The document defines key insurance concepts and terminology including risk management, insurable interest, risk pooling, policy provisions, and types of common insurance policies.

2. It explains the basic components of an insurance contract including the application, effective date, cancellation terms, duties of insured and insurer, and defenses against payment.

3. Examples of common insurance policies are provided, including property insurance, homeowners insurance, life insurance, and automobile insurance along with descriptions of typical coverage and liability.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document defines key insurance concepts and terminology including risk management, insurable interest, risk pooling, policy provisions, and types of common insurance policies.

2. It explains the basic components of an insurance contract including the application, effective date, cancellation terms, duties of insured and insurer, and defenses against payment.

3. Examples of common insurance policies are provided, including property insurance, homeowners insurance, life insurance, and automobile insurance along with descriptions of typical coverage and liability.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

259 views5 pagesTerminology and Concepts

Terminology and Concepts

Uploaded by

did0kuL1. The document defines key insurance concepts and terminology including risk management, insurable interest, risk pooling, policy provisions, and types of common insurance policies.

2. It explains the basic components of an insurance contract including the application, effective date, cancellation terms, duties of insured and insurer, and defenses against payment.

3. Examples of common insurance policies are provided, including property insurance, homeowners insurance, life insurance, and automobile insurance along with descriptions of typical coverage and liability.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

I. TERMINOLOGY AND CONCEPTS B.

EFFECTIVE DATE OF COVERAGE

A policy is effective when (1) a binder is

A. RISK MANAGEMENT written, (2) the policy is issued, or (3) a certain

Risk management consists of plans to protect time elapses.

personal and financial interests should an event

undermine their security. The most common 1. When a Policy Is Obtained from a Broker

method is to transfer risk from a business or A broker is the agent of the applicant. Until the

individual to an insurance company. broker obtains a policy, the applicant is

normally not insured.

B. INSURANCE TERMINOLOGY

An insurance company is an underwriter or 2. When a Policy Is Obtained from Agent

an insurer; the party covered by insurance is An agent is the agent of the insurer. One who

the insured; an insurance contract is a policy; consideration obtains a policy from an agent can be protected

paid to an insurer is a premium; from the moment the application is made

policies are obtained through an agent or (under a binder), or the parties may agree to

broker. delay coverage until a policy is issued or some

condition is met (such as a physical exam).

C. RISK POOLING

Insurance companies spread the risk among a C. PROVISIONS AND CLAUSES

large number of people—the pool—to make Some important clauses include—

the premiums small compared with the

coverage offered. 1. Provisions Mandated by Statute

A court will deem that a policy contains such a

D. CLASSIFICATIOINS OF INSURANCE clause even if it is not actually included in the

Insurance is classified according to the nature language of the contract.

of the risk involved.

2. Incontestability Clause

E. INSURABLE INTEREST After a life or health policy has been in force

To obtain insurance, one must have a for a certain time (two or three years), the

sufficient interest in what is insured. insurer cannot cancel the policy or avoid a

claim on the basis of statements made in the

1. Life Insurance application.

One must have a reasonable expectation of

benefit from the continued life of another. The 3. Coinsurance Clause

benefit may be related to money or may be A standard provision in fire insurance policies;

founded on a relationship (by blood or affinity). applies only in cases of partial loss. If an

owner insures property up to a specified

a. Key-person Insurance percentage (usually 80 percent) of its value, he

An organization (partnership, corporation) can or she will recover any loss up to the face

insure the life of a person who is important to amount of the policy. If the insurance is for

that organization (partner, officer). less than this percentage, the owner is

responsible for a proportionate share.

b. When the Insurable Interest Must Exist

An interest in someone’s life must exist when 4. Appraisal and Arbitration Clauses

the policy is obtained. If insurer and insured disagree about the value

of a loss, they can demand separate appraisals,

2. Property Insurance to be resolved by a third party (umpire).

One has an insurable interest in property when

one would sustain a pecuniary loss from its 5. Multiple Insurance Coverage

destruction. An insurable interest in property If policies with several companies cover the

must exist when the loss occurs. same risk and the amount of coverage exceeds

the loss, the insured collects from each insurer

II. THE INSURANCE CONTRACT its proportionate share of the liability to the total

Policies generally are standard; in some states, amount of insurance.

this is required.

6. Antilapse Clause

A. APPLICATION FOR INSURANCE Provides grace period for insured to pay an

The application is part of the contract. overdue premium.

Misstatements can void a policy, especially if

the insurer shows that it would not have issued D. INTERPRETING PROVISIONS

the policy if it had known the facts. Words in an insurance contract have their

ordinary meanings. If there is an ambiguity or

uncertainty, it is interpreted against the insurer.

E. CANCELLATION 1. Liability

A policy may be canceled for nonpayment of Usually, recovery is limited to losses resulting

premiums, fraud or misrepresentation, from hostile fires. In some cases, the insured

conviction for a crime that increases the hazard must file proof of a loss as a condition for

insured against, or gross negligence that recovery. In most cases, premises must be

increases the hazard insured against. An occupied at the time of loss, unless the parties

insurer may be required to give advance agree otherwise.

written notice.

2. Assignment

F. BASIC DUTIES AND RIGHTS Not assignable without the consent of the

Parties must act in good faith and disclose all insurer (because it would materially change the

material facts. If there is a claim, the insurer insurer’s risk).

must investigate. Insurer and insured must

fulfill the terms of the policy. C. HOMEOWNERS’ INSURANCE

G. DEFENSES AGAINST PAYMENT 1. Property Coverage

Fraud, misrepresentation, violation of The garage; the house; other private buildings;

warranties, and actions that are against public personal possessions at home, in travel, or at

policy or that are otherwise illegal. work. Includes expenses for living away from

home because of a fire or some other covered

III. TYPES OF INSURANCE peril.

A. LIFE INSURANCE 2. Liability Coverage

A fixed amount is paid to a beneficiary on an Injuries occurring on the insured’s property;

insured’s death. damage or injury by the insured to others or

their property. Excludes professional

1. Types of Life Insurance malpractice.

Basic types—whole life: has cash surrender

value that grows at a predetermined rate and D. AUTOMOBILE INSURANCE

can be used as collateral for a loan; term:

provides protection for a specified period; has no cash 1. Liability Insurance

surrender value. Covers bodily injury and property damage.

2. Liability 2. Collision Insurance

Unless excluded, any cause of death is the Covers damage to the insured’s car in any type

insurer’s risk. Typical exclusions: death by of collision. Most people agree to pay a

suicide, when the insured is a passenger in a deductible before the insurer becomes liable.

commercial vehicle, in military action in war, or

execution by the government. 3. Comprehensive Insurance

Covers loss, damage, and destruction by fire,

3. Misstatement of Age hurricane, hail, vandalism, and theft.

This does not void a policy, but premiums or

benefits are adjusted. 4. Uninsured Motorist Insurance

Covers the driver and passengers against injury

4. Assignment caused by any driver without insurance or by a

An insured can change beneficiaries, with hit-and-run driver. Some states require it of all

notice to the insurer. automobile policies sold to drivers.

5. Creditors’ Rights 5. Other-Driver Coverage

Generally, a judgment creditor can reach an Protects vehicle owner and anyone who drives

insured’s interest in life insurance. The the vehicle with owner’s permission.

creditor cannot compel the insured to obtain

cash surrender value or change the beneficiary 6. No-fault Insurance

to the creditor. Provides that claims arising from an accident

are made against the claimant’s own insurer,

6. Termination regardless of whose fault the accident was.

Usually occurs only on default in premium

payments (policy lapses), payment of benefits, E. MARINE INSURANCE

expiration of term, or cancellation by insured. Protects from the damage to or loss of a

seaworthy vessel or its cargo due to perils at

B. FIRE INSURANCE sea. (If the vessel is not seaworthy, the policy

Protects the homeowner against fire, lightning, is usually void.)

and damage from smoke and water caused by

the fire or the fire department. CLAIMS

iii. Pushpa A/P Rajoo v Msian Coop Insu Soc [1995] 2

• GENERAL RULE Right to make a claim exist MLJ 652

upon the occurrence of the insured event ie loss Issue: whether marriage automatically

• Who can make a claim? revoked earlier nomination

a. Life policy : Sec165 – 169 Insurance Act 1996 I , a bachelor took out a life insurance policy.

– Policy owner : Sec 2 Father was nominated as sole Beneficiary in

– Beneficiaries/ nominees 1986. I married Pl 3 years later but did not

– Assignees, Personal representatives revoke the nomination. I died in 1992.

b. General insurance • K C Vohrah, J at p 660

- Insured ‘ … as the law stands, the spouse and the children …may be

- Third party claim ( motor policy) unjustly deprived…because …forgot to include, or

renominate or procrastinated in renominating…or…failed to

• Beneficiary’s right to sue Insurer revoke the nomination made before marriage. It is ,

B has no direct interest [ privity of contract] however, for Parliament to change the law if Parliament

a] Common law position deems the circumstances justify such change.’

Ins is entitled to make payment to a named Question: Position after 1996?

Beneficiary. Duty is discharged upon payment • INSURANCE ACT 1996

b] Malaysian position i. Sec 165 : where policy owner has made a nomination

B entitled to bring action against Ins to enforce >> Insurer shall pay the policy moneys of the deceased

the policy. policy owner according to the direction of the nomination

Reason: B was privy to the consideration. ii. Sec 169: where there is no nomination

Interest subsist at time of I’s death >> Insurer shall pay… to the applicant who produce Grant

• CLAIMANTS of Probate or Letters of Administration

i. Manomani v Gt Eastern Life Insurance [ 1991] 1 • Vaswani R. Anilkumar v Vaswani L. Challaram

CLJ 141 ( Mother as B) [2003] SLR CA

ii. Perumal A/L Manickam v Msian Coop Insu Soc • I bought 3 policies & named his parents as

[1995]2 MLJ 144 ( no named Beneficiary) Beneficiaries. Did not revoke nomination after

iii. Pushpa A/P Rajoo v Msian Coop Insu Soc [1995] 2 marriage to App.

MLJ 652 ( whether marriage automatically revoked • After his death, Insure willing to pay to

earlier nomination] Beneficiaries . Did not do so because of Widow’s

iv. Re Tan Hui Gan , dec ( Phang Siew Fa v Aw Kim claims. I died intestate & money formed as part of

Shiok)) [ 2006] 3 MLJ 663 the estate

v. Poominathan v Besprin Stationers Sdn Bhd [ 2003] • Appeal against District Courts order to pay to

3 MLJ 249 parents/ Beneficiary

vi. Wong Cheong Kong v Prudential Assurance[ 1998] • Held:

3 MLJ 72 1. No statutory trust created as named beneficiaries

• cases were parents, and not spouse or child.

i. Manohmani v Gt Eastern Life Insurance 2. By naming a beneficiary, Insured had

[ 1991] 1 CLJ 141 expressly authorised insurer to make payment to persons

Insured took life policy . Mother named as named

Beneficiary. I died. Def refused to release • NOTICE

the money 1. Was the loss covered by the risk insured?

• Perumal A/L Manickam v Msian 2. Notice of loss

Coop Insu Soc [1995] 2 MLJ 144 > by proper claimant.

Ratio: Where no named Beneficiary is > oral vs written?

named in the policy, Ins is entitled to make > given within time stipulated in the policy ie

payment to the proper claimant within reasonable time or as soon as possible

Facts: • Breach of duty to cooperate

Pl’s son took out life policy. No beneficiary • a. Duty to notify Insurer of the loss / claim. Effect

was named. He died & Pl made a claim of limitation period to make a claim?.

Held • Notice of loss by proper claimant.: when must

1. Proof of the correctness of Dec’s date of birth as per the notice be given?

proposal form was a condition precedent to payment of the – given within the time stipulated in the

policy money policy

• cont – within reasonable time or as soon as

2. Sec 44 Insurance Act 1963 gave Ins discharge when possible

payment was made to a proper claimant. Insurer is then • b. Waiver of notice

absolved from further liabilities. • NOTICE OF CLAIM

Sec 44(5) : ‘ proper claimant ‘ includes • Requirement:

• Executor of Deceased a] written / request /application for payment in accordance

• Widower /widow with Ins.’s promise to pay for loss incurred by the Insured

• Parents as provided in the policy.

• Child b] within reasonable time from date of notice of loss

• Brother / sister/nephew /niece c] convey clear indication that a claim is being made under

• cases the policy

• Note

• Notice of the loss Case: i. Amanah Raya Bhd v Jerneh Insurance [ 2005] 4

> in writing if contract requires; otherwise oral MLJ 1

notice is sufficient Whether death was the direct result of the

i. Where the policy did not contain any provision on giving accident? Whether Insurer’s liability was

notice, Insured is required to give notice within reasonable excluded by the operation of exclusion

time [ ‘as soon as possible ‘] clause?

Case: Public Insurance v Lee Chau [1969] • NAZA MOTOR SB v. Msian Motor Insu Pool

Sa NR p127 [2011] 1 CLJ 332 CA

I gave notice 5 mths after the accident & 4 days • Loss of car - Car stolen while being test driven by

before trial potential buyer - Whether defendant could deny

Held: notice was not given ‘as soon as possible’ liability under the insurance policy

• NOTE • claim for RM263,779.34 on loss of vehicle, a

ii Where the policy impose a duty to give notice to Insurer Mercedez Benz E230 .

of any accident which may give rise to a claim, the duty • procured from the Resp/ Def Motor Trade Policy

arise when the accident is serious & sufficient to give rise to providing cover for, inter alia, loss of vehicle by

a claim [not any trivial accident] theft

• NOTE • Car was test-driven by a potential buyer, & stolen,

iii Where the policy imposes a duty to give written notice of presumably by the said potential buyer as he

loss, strict compliance is mandatory. vanished with the car on the day it was test-driven

Case : Lee Seng Heng v.Guardian Assurance (1932) on 20 November 1998.

• To whom must notice be given? • P's claim for the loss was rejected by the Insurer.

• Notice to insurance agent Repudiated liability solely on the exclusion cl. B of

Whether equivalent to notice to Insurer? the policy,

• Non-compliance where claimant gives oral notice ie the loss was due to cheating and not

or gives notice to the insurance agent. theft

– Authority of A to receive the notice? • DECISION Mohamed Apandi Ali JCA

Chong Kok Hwa v Taisho Marine & Fire Insu(1977) • Intention & purpose of policy was to provide

Held: Ordinary agent did not have authority coverage for loss of vehicle during test-driving by

Lee Seng Heng v Guardian Assu Co [1932] potential customers. No valid reason for the

Notice to A who issued the policy is notice to plaintiff's salesman to doubt or disbelief the

Insurer if notice was transmitted / communicated to intention of the potential customer to test drive and

Ins probably purchase the vehicle

See NR p131 • any such reasonable precaution should not be

• Effect of failure to comply with time repugnant to the commercial purpose of contract

Whether a claim is time-barred if not submitted between I & Insurer

within the stated period in the insurance contract? • There was not a single element to show that the

Validity of the clause? plaintiff's salesman was deliberately courting

Cases: danger. He also could not be said to have thrown

i. Chop Eng Thye v MNI [1977] : ratio caution to the winds. the circumstances leading to

the situation where the potential buyer of the test-

• Limitation Act : 6 years car had driven off with the car, was beyond any

• Application of Sec 29 Contract Act, 1950: restraint reasonable expectations. [ Note the rebuttal of

against legal proceeding is void negligence !!! ]

Note: • Deceit by the potential buyer was indicative of

Chop Eng Thye v MNI was overruled by dishonest intention to take the car out of the

Corporation Royal Exchange v Teck Guan ( 1921) possession of the salesman, without the latter's

was followed consent. This situation was similar, by analogy, to

• Ong Choo Lin v NZ Insu [1991] ; [1992] 1 SCR Illustration (b) of s. 378 of the Penal Code.

177 • was a theft per se of the Mercedes Benz, by the

• Cl 19.’ In no case …shall the company be liable for potential buyer. Under the insurance policy, Insurer

any loss / damage after the expiration of 12 months could not deny liability and were liable to the

from the happening of the loss or damage…’ insured App/ Pl.

• Held: • FRAUDULENT CLAIM

1. Chop Eng Thye was wrongly decided. Neither S29 • Application of doctrine “ utmost good faith”

Contracts Act nor Corporation Royal Exchange v Teck • Duty of utmost good faith in making a claim

Guan ( 1912) decision of Ct of App of FMS were taken into Case: Tuong Aik ( Sarawak) Sdn Bhd v Arab Msian Eagle

account. Assurance[1996]

2. A condition in a policy which had the effect of cutting • Conduct of Claimant

down the period which I might bring an action …to a period > Reasonable claimant is to ensure the claim is true &

less than that allowed by the law of limitation is void…’ honest ie no deception on Insurer

• Avoidance of the policy > Not to make profit from the loss ie to make an honest

• Construction of policy claim

• Fraudulent claim Claim must be real. …”wrong to overstate a

• Illegality & public policy claim..”

• Construction of policy Reason: I cannot hold Ins to a risk other than that accepted

• Exclusion clause & effect on claim by Insurer

• Proof of fraud? • ASEAN Securities Paper Mills v CGU Insu Bhd

• Tender of false information by claimant [ 2006] CA

> Overstated claim supported by false info / altered invoice, • Facts: Fire policy on paper stored in warehouse.

or claim for non existent goods, cost of new goods Claim for RM 16mInsurer denied the claim.

substituted for old goods Fraudulent claim. Reason: arson by persons acting

• Reckless disregard for honesty n truth of statements for Insured

• Issue: Cause of fire ?

Burden of proof • Accident > combustion of security papers or

• Beyond reasonable doubt • Arson by persons acting on I’s instruction

whether too high a burden? • ASEAN Securities Paper Mills

• Burden on party alleging fraud ie Insurer • Gopal Sri Ram overruled HC. Arson was cause of

> Has to prove that exaggeraton was made with a view to fire

defraud Insurer • Error of law. Misdirection of evidence of eye

• Intention to mislead witness as to time of the fire. Evidence of arsonist

Case: Ong Choo Lin v NZ Insu that they were directed to burn the papers by

I made police report 5 days after the fire . Balasundram

Estimated loss RM 300,000. Adjuster’s estimate : • Decision overruled by FC

RM 101,996.Ins alleged I made a fraudulent claim. >>>WHY?

• Ong Choo Lin v NZ Insu • Effect on the insurance contract

Decision • General rule: The whole policy is voidable

• Ins had not proven fraud beyond reasonable doubt • NOTE :

Court took into consideration the circumstances Growing view in UK that the claim is

under which the statements were made ie avoided, not the policy

> Making a guess with all the documents burnt Case

> Potential tendency of adjusters to play down the K/S Merc –Skandia v Lloyds Underwriters [2001]

value as he was retained by the Insurer Direct Line Insu v Khan [ 2002 ]

• Exaggerated claim here was not fraudulent • In a joint insurance taken by more than one insured,

• FRAUDULENT CLAIM the fraud of an insured does not prevent the other

• Elements of fraud? Is a false statement = a fraud? policyholder who was innocent from recovering

• Standard of proof? • Determine whether I’s fraudulent act is partly on

• Exaggerated claims? Whether exaggeration of a behalf of 2nd insured?

claim = fraud? • Defence against I is also available against TP

Note: question of fact including avoiding policy for nondisclosure or

• Commercial Union Assu v ng Chek Hung [ 1997] breach of warranty . Applied to liability

CA insurance ,excluding motor insurance

• Premises and goods insured with the App, under • Settlement agreement is not binding / null & void

two policies of insurance. • Claim made to I in ignorance of true facts

• On 11 October 1984, the amounts insured under > Ins is entitled to recover payment from I as payment made

both policies were increased. under a mistake of fact

• On 30 November a fire broke out as a result of • Disclosure of existing policies

which the premises and the goods were damaged. • Can failure to disclose other existing policies defeat

• Claims made to Insurer a claim?

• Rejection by insurer Case: Leong Kum Whay v QBE Insu [ 2006] 1 MLJ 710 CA

• Resp/ claimant had secreted away household and

other goods from the premises shortly before the

fire. Amount of loss claimed was fraudulent

• HC judge : Judgemt for claimant

> most of the material in proof of the alleged loss

had perished in the fire which took place close to the date

when the premises and contents were last inspected

• Held : Gopal Sri Ram JCA

• these appeals are without merit.

• Close proximity in time between the inspection by

the appellant's agent and the fire -- taken together

with the destruction of supportive documents --

well entitled the learned judge to conclude that the

loss as claimed had been established

• Effect on the insurance contract

• Effect of fraud on the claim

ASEAN Securities Paper Mills Sdn Bhd v CGU

Insu Bhd [ 2007] 2 MLJ 301 [FC], [2006] 3 MLJ 1 CA

[ allegation of arson ]

Question:

Do you agree with the FCt’s judgement or

the Ct of Appeal? Reason?

You might also like

- Outline of Philippine Insurance Code RA10607Document9 pagesOutline of Philippine Insurance Code RA10607James CorroNo ratings yet

- Revisiting Our Social GoalsDocument4 pagesRevisiting Our Social GoalsromyvilNo ratings yet

- IB History Guide: Causes of The Great DepressionDocument2 pagesIB History Guide: Causes of The Great DepressionKatelyn CooperNo ratings yet

- Ohsu, Sony EtcDocument7 pagesOhsu, Sony EtcCharm Ferrer100% (4)

- MercRev - InsuranceDocument18 pagesMercRev - InsuranceA GrafiloNo ratings yet

- Notes On INSURANCE LAWDocument5 pagesNotes On INSURANCE LAWAlthea QuijanoNo ratings yet

- M 1 Insurance 1Document9 pagesM 1 Insurance 1Trisha MoralesNo ratings yet

- Insurance First QuizDocument3 pagesInsurance First QuizronaldNo ratings yet

- Law 315 Reviewer by FJDocument41 pagesLaw 315 Reviewer by FJjerico lopezNo ratings yet

- Fire InsuranceDocument10 pagesFire Insurancetanjimalomturjo1No ratings yet

- 1 - General-Provisions1 (AQUINO INSURANCE SUMMARY)Document4 pages1 - General-Provisions1 (AQUINO INSURANCE SUMMARY)aifapnglnnNo ratings yet

- Principle of InsuranceDocument3 pagesPrinciple of InsuranceShweta AgrawalNo ratings yet

- Comm Law For EditingDocument16 pagesComm Law For EditingJerick Bambi SadernasNo ratings yet

- Subrogation-Substitution of OnceDocument4 pagesSubrogation-Substitution of OnceJoseph James JimenezNo ratings yet

- Insurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?Document46 pagesInsurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?anne valbuenaNo ratings yet

- Insurance Law Reviewer PRELIMSDocument5 pagesInsurance Law Reviewer PRELIMSKatrina San MiguelNo ratings yet

- Each Party Having in View TheDocument9 pagesEach Party Having in View TheMark MagnoNo ratings yet

- Fundamentals of Insurance - B. Com V - AS-2637Document10 pagesFundamentals of Insurance - B. Com V - AS-2637Sneha SNo ratings yet

- Insurance Law ReviewerDocument5 pagesInsurance Law ReviewerMarc GelacioNo ratings yet

- Insurance - 2013Document25 pagesInsurance - 2013Crazy KamaNo ratings yet

- Insurance CompaniesDocument11 pagesInsurance CompaniesPricia AbellaNo ratings yet

- Insurance LawDocument1 pageInsurance LawCinja ShidoujiNo ratings yet

- Resume Group 2 Insurance and TaxesDocument14 pagesResume Group 2 Insurance and Taxeshilwa asaNo ratings yet

- Unnati Khajanchi-Features of Insurance Contracts 1Document10 pagesUnnati Khajanchi-Features of Insurance Contracts 1SAURABH SINGHNo ratings yet

- Insurance First Exam de Leon ReviewerDocument8 pagesInsurance First Exam de Leon ReviewerCnfsr KayceNo ratings yet

- BBMF2083 - Chap 5 - 6.22Document26 pagesBBMF2083 - Chap 5 - 6.22ElizabethNo ratings yet

- Reviewer in InsuranceDocument17 pagesReviewer in InsuranceAnonymous BBs1xxk96VNo ratings yet

- 44 Manufacturers Life Insurance V MeerDocument7 pages44 Manufacturers Life Insurance V Meerkarl doceoNo ratings yet

- Insurance Code: 7. Personal - Each Party Having in ViewDocument24 pagesInsurance Code: 7. Personal - Each Party Having in ViewEhem DrpNo ratings yet

- 9252 - Insurance Law - R.A. No. 2427Document4 pages9252 - Insurance Law - R.A. No. 2427dahpne saquianNo ratings yet

- Insurance - DoctrineDocument12 pagesInsurance - DoctrineJanelle TabuzoNo ratings yet

- Insight Into Basics of General InsuranceDocument50 pagesInsight Into Basics of General Insurancepiyushkumarjha12No ratings yet

- Insurance ContractDocument32 pagesInsurance ContractMa. Lou Erika BALITENo ratings yet

- United India Insurance Co REPORT 22.07.19Document53 pagesUnited India Insurance Co REPORT 22.07.19Trilok SamtaniNo ratings yet

- Report 22.07.19Document53 pagesReport 22.07.19Trilok SamtaniNo ratings yet

- Commercial Law Notes - Jurist Lecture (Reduced)Document17 pagesCommercial Law Notes - Jurist Lecture (Reduced)Rio AborkaNo ratings yet

- Module - Ch-9Document25 pagesModule - Ch-9Gedion MelkamuNo ratings yet

- InsuranceDocument45 pagesInsuranceAlex HaymeNo ratings yet

- Insurance Contracts General Introduction On Insurance Contracts Definition of InsuranceDocument30 pagesInsurance Contracts General Introduction On Insurance Contracts Definition of InsuranceEunice NandyNo ratings yet

- Commercial Law Review NotesDocument7 pagesCommercial Law Review NotesClio PantaleonNo ratings yet

- Insurance Midterm ReviewerDocument13 pagesInsurance Midterm ReviewerDaphnie CuasayNo ratings yet

- Subrogation: The Insurance Involved Is Property Insurance 1Document3 pagesSubrogation: The Insurance Involved Is Property Insurance 1Esto, Cassandra Jill SumalbagNo ratings yet

- Insight Into Basics of General InsuranceDocument30 pagesInsight Into Basics of General Insurancepiyushkumarjha12No ratings yet

- Pert. 2. - Insurance Risk-1Document25 pagesPert. 2. - Insurance Risk-1WidhaardianiNo ratings yet

- Insurance Code: 7. Personal - Each Party Having in ViewDocument24 pagesInsurance Code: 7. Personal - Each Party Having in Viewjolly faith pariñasNo ratings yet

- Insurance-Law CompressDocument4 pagesInsurance-Law Compressrieann leonNo ratings yet

- InsurancesDocument7 pagesInsuranceskidvictor16No ratings yet

- Insurance PlanningDocument18 pagesInsurance PlanningNeha SharmaNo ratings yet

- 5 Risk Managemennt Chapter 5 NGUC - 2020Document38 pages5 Risk Managemennt Chapter 5 NGUC - 2020HailemariamNo ratings yet

- Q & A Insurance LawDocument37 pagesQ & A Insurance LawChevy MacalmaNo ratings yet

- Insurance 1Document42 pagesInsurance 1markbulloNo ratings yet

- Insurance Law of The PhilippinesDocument24 pagesInsurance Law of The PhilippinesTherese Diane SudarioNo ratings yet

- InsuranceDocument20 pagesInsuranceYvonne BarrackNo ratings yet

- Insurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilsDocument12 pagesInsurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilskrstnkyslNo ratings yet

- 2018 Insurance Law Notes (Rondez)Document48 pages2018 Insurance Law Notes (Rondez)Troy GonzalesNo ratings yet

- Insurance Contracts: Insured Event OccursDocument7 pagesInsurance Contracts: Insured Event OccursDanielle MarundanNo ratings yet

- Essentials of Valid Insurance ContractDocument8 pagesEssentials of Valid Insurance ContractHarsh SharmaNo ratings yet

- InsuranceDocument45 pagesInsurancegech95465195No ratings yet

- Insurance SummarizedDocument9 pagesInsurance SummarizedMondrich GabrienteNo ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Artikel TriveliaDocument18 pagesArtikel TriveliaEzra SilalahiNo ratings yet

- 3 Gimp Size Color Contrast Crop RedeyeDocument2 pages3 Gimp Size Color Contrast Crop Redeyeapi-370628488No ratings yet

- Air Handling UnitDocument6 pagesAir Handling UnitAgung SetiajiNo ratings yet

- Mcdonald'S History ListingDocument9 pagesMcdonald'S History Listinghimanshu-guntewar-4431No ratings yet

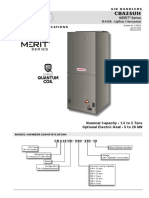

- Manejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxDocument16 pagesManejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxWalter BernalNo ratings yet

- LPG Profile 1.4.2021: As OnDocument14 pagesLPG Profile 1.4.2021: As OnSushobhan DasNo ratings yet

- Management - Organization Structures and Change - Narrative ReportDocument10 pagesManagement - Organization Structures and Change - Narrative ReportRino SangariosNo ratings yet

- Permit-To-Work - General Electrical (Under 1000 Volts) : ANNEX 16.1.6Document3 pagesPermit-To-Work - General Electrical (Under 1000 Volts) : ANNEX 16.1.6RihardsNo ratings yet

- WB 36Document21 pagesWB 36Nitin BajpaiNo ratings yet

- Duo Check Valve MaintenanceDocument2 pagesDuo Check Valve Maintenanceddoyle1351100% (1)

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDocument8 pagesMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamNo ratings yet

- Name Email Phone Hometown: Authorized To Work in The US For Any EmployerDocument3 pagesName Email Phone Hometown: Authorized To Work in The US For Any EmployerR.T. CoffmanNo ratings yet

- SOGA CH 2 - Transfer of Ownership Notes by Gyaani AcademyDocument5 pagesSOGA CH 2 - Transfer of Ownership Notes by Gyaani Academykjkapiljain510No ratings yet

- Agenda NetzeroDocument2 pagesAgenda NetzeroAbhimanyu GuptaNo ratings yet

- Random-Access Memory - WikipediaDocument14 pagesRandom-Access Memory - WikipediaHeera SinghNo ratings yet

- Formal-Relational Query Languages: Practice ExercisesDocument4 pagesFormal-Relational Query Languages: Practice ExercisesDivyanshu BoseNo ratings yet

- (LF303W) Pf-Em#53hd-303w Rev.a IvDocument4 pages(LF303W) Pf-Em#53hd-303w Rev.a IvPhung Cam VanNo ratings yet

- Trans World Airlines vs. CA G.R. No. 78656Document2 pagesTrans World Airlines vs. CA G.R. No. 78656Rhea CalabinesNo ratings yet

- NCKH ĐỊNH TÍNHDocument75 pagesNCKH ĐỊNH TÍNHnguyennguyen.31221022808No ratings yet

- Nato Joint DoctrineDocument121 pagesNato Joint DoctrineEdwin Sen100% (1)

- 1,000 Indie Posters PDFDocument325 pages1,000 Indie Posters PDFMauricio Mesa JaramilloNo ratings yet

- Rule 11 Gregslangmalakas Copy 2Document12 pagesRule 11 Gregslangmalakas Copy 2Gregorio AchanzarNo ratings yet

- AAMA STANDARDS Comparisons ChartDocument1 pageAAMA STANDARDS Comparisons ChartrayNo ratings yet

- WRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyDocument45 pagesWRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyHACHALU FAYENo ratings yet

- 7 Steps To Take Before Choosing A CareerDocument8 pages7 Steps To Take Before Choosing A CareerJade LegaspiNo ratings yet

- Novel Zero-Current-Switching (ZCS) PWM Switch Cell Minimizing Additional Conduction LossDocument6 pagesNovel Zero-Current-Switching (ZCS) PWM Switch Cell Minimizing Additional Conduction Lossashish88bhardwaj_314No ratings yet

- 0213 - Chinese (Mandarin) Exam InstructionsDocument13 pages0213 - Chinese (Mandarin) Exam InstructionsИрина БедрикNo ratings yet