Professional Documents

Culture Documents

Daily Equity Market Report 12.10.2021 2021-10-12

Daily Equity Market Report 12.10.2021 2021-10-12

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report 12.10.2021 2021-10-12

Daily Equity Market Report 12.10.2021 2021-10-12

Uploaded by

Fuaad DodooCopyright:

Available Formats

12TH OCTOBER 2021

DAILY EQUITY MARKET REPORT

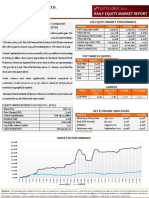

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: The Ghana Stock Market

slips, loses 17.47 points to return 47.03% YTD. Indicator Current Previous Change

GSE-Composite Index 2,854.74 2,872.21 -17.47pts

The Accra Bourse slipped as the benchmark GSE Composite index (GSE-CI) YTD (GSE-CI) 47.03% 47.93% -1.88%

lost 17.47 points to close trading at 2,854.74, translating into a YTD return of GSE-Financial index 2,062.36 2,058.22 4.14pts

YTD (GSE-FSI) 15.68% 15.45% 1.49%

47.03%. The GSE Financial Stock Index (GSE-FSI) however closed higher as it Market Cap. (GH¢ MN) 64,169.24 64,352.04 -182.80

gained 4.14 points to close the trading day at 2,062.36 points, also translating Volume Traded 321,059 677,184 -52.59%

Value Traded (GH¢) 894,420.54 858,982.46 4.13%

into a YTD return of 15.68%.

TOP TRADED EQUITIES

Three (3) equities; Total Petroleum Ghana (TOTAL), Republic Bank Ghana Ticker Volume Value (GH¢)

PLC. (RBGH) and Enterprise Group PLC. (EGL) recorded gains to close at FML 117,396 586,980.00

GH¢5.00, GH¢0.50 and GH¢2.40 respectively as against two decliners CAL 110,200 81,650.00

MTNGH 53,367 64,459.67

Scancom PLC. (MTNGH) and Cal Bank PLC. (CAL)

TOTAL 19,092 95,460.00

65.6% of value traded

RBGH 5,000 2,500.00

Market Capitalization decreased by GH¢182.80 million to close trading at

GH¢64.17 billion representing a YTD growth of 18.01% in 2021. GAINERS & DECLINERS

Ticker Close Price Open Price Change YTD Change

A total of 321,059 shares valued at GH¢894,420.54 exchanged hands in (GH¢) (GH¢)

TOTAL 5.00 4.65 7.53% 76.68%

thirteen (13) equities as FanMilk PLC. (FML) recorded the most trades,

RBGH 0.50 0.47 6.38% 25.00%

accounting for 65.62% of the total value traded. EGL 2.40 2.30 4.35% 71.43%

MTNGH 1.21 1.23 -1.63% 89.06%

EQUITY UNDER REVIEW: FAN MILK PLC. (FML) CAL 0.74 0.77 -3.90% 7.25%

Share Price GH¢ 5.00

Price Change (YtD) 362.96% KEY ECONOMIC INDICATORS

Market Capitalization GH¢581.04 million Indicator Current Previous

Dividend Yield 0.00% Monetary Policy Rate September 2021 13.50% 13.50%

Earnings Per Share GH¢0.1188 Real GDP Growth Q2 2021 3.90% 3.10%

Avg. Daily Volume Traded 7,599 Inflation August 2021 9.70% 9.00%

Value Traded (YtD) GH¢5,233,457.00 Reference rate September 2021 13.46% 13.51%

Source: GSS, BOG, GBA

INDEX YTD PERFORMANCE

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

23-Feb

27-Aug

25-Mar

30-Mar

22-Apr

17-May

25-May

15-Jan

25-Jan

17-Mar

9-Apr

27-Apr

28-Jan

6-Apr

7-Jun

22-Mar

19-Apr

20-May

10-Jun

23-Jun

23-Jul

23-Sep

20-Jan

24-Aug

15-Jun

17-Sep

28-Sep

1-Oct

DATE

3-Mar

12-Mar

6-Jan

12-Jan

5-Feb

10-Feb

6-Aug

11-Aug

9-Mar

6-May

11-May

2-Jun

28-Jun

19-Jul

28-Jul

15-Feb

19-Aug

28-May

18-Jun

1-Jul

1-Sep

26-Feb

2-Aug

16-Aug

6-Oct

11-Oct

2-Feb

18-Feb

14-Apr

30-Apr

6-Jul

9-Jul

14-Jul

6-Sep

9-Sep

14-Sep

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Foundations of Strategy 2nd Edition Grant Test Bank DownloadDocument11 pagesFoundations of Strategy 2nd Edition Grant Test Bank Downloadallisonpalmergxkyjcbirw100% (23)

- Bars & Nightclubs in The US Industry ReportDocument30 pagesBars & Nightclubs in The US Industry ReportAubrey BaileyNo ratings yet

- Tower Crane Market and OpportunitiesDocument65 pagesTower Crane Market and OpportunitiesSrini Parthasarathy100% (1)

- 8th and Walton Retail Math Cheat SheetDocument1 page8th and Walton Retail Math Cheat SheetSurabhi RajeyNo ratings yet

- LHBPDocument26 pagesLHBPandras88No ratings yet

- KFCDocument15 pagesKFCRajen DhariniNo ratings yet

- Daily Equity Market Report 25.10.2021 2021-10-25Document1 pageDaily Equity Market Report 25.10.2021 2021-10-25Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 31.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 31.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.04.2022Document1 pageDaily Equity Market Report - 07.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 16.12.2021 2021-12-16Document1 pageDaily Equity Market Report 16.12.2021 2021-12-16Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 17.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 17.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.04.2022Document1 pageDaily Equity Market Report - 06.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.04.2022 2022-04-04Document1 pageDaily Equity Market Report 04.04.2022 2022-04-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.08.2021Document1 pageDaily Equity Market Report - 26.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.04.2022Document1 pageDaily Equity Market Report - 05.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 02.12.2021 2021-12-02Document2 pagesWeekly Capital Market Report Week Ending 02.12.2021 2021-12-02Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.12.2021Document2 pagesWeekly Capital Market Report - Week Ending 10.12.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.10.2021Document2 pagesWeekly Capital Market Report - Week Ending 29.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2021Document1 pageDaily Equity Market Report - 08.09.2021Fuaad DodooNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- 2557 - OnDate - 4-3-2021weekly Market Update 040321Document3 pages2557 - OnDate - 4-3-2021weekly Market Update 040321অপুর্ব ভৌমিকNo ratings yet

- Daily Equity Market Report - 24.08.2021Document1 pageDaily Equity Market Report - 24.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.11.2021Document1 pageDaily Equity Market Report - 30.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.08.2022Document1 pageDaily Equity Market Report - 25.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.09.2021Document1 pageDaily Equity Market Report - 09.09.2021Fuaad DodooNo ratings yet

- Organisational Structure of Ministry of Environment, Forest & Climate Change (Divisions Under Forestry & Wildlife Sector)Document1 pageOrganisational Structure of Ministry of Environment, Forest & Climate Change (Divisions Under Forestry & Wildlife Sector)OkponkuNo ratings yet

- Fertilizer - Sector Update - GlobalDocument1 pageFertilizer - Sector Update - Globalmuddasir1980No ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- KML BSC Monthly Template EN v3Document3 pagesKML BSC Monthly Template EN v3Rinny Heryadi HadjohNo ratings yet

- October AccomplishmentDocument17 pagesOctober AccomplishmentReyma GalingganaNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Wo 17 Februari 2024Document1 pageDaily Wo 17 Februari 2024agusNo ratings yet

- Daily Equity Market Report - 01.09.2021Document1 pageDaily Equity Market Report - 01.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.03.2022Document1 pageDaily Equity Market Report - 15.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- (Invoice) Polygon-Support-AprilDocument2 pages(Invoice) Polygon-Support-AprilSourajyoti GuptaNo ratings yet

- Dixon 1QFY22 Result Update - OthersDocument14 pagesDixon 1QFY22 Result Update - OthersjoycoolNo ratings yet

- Daily Equity Market Report - 01.12.2021Document1 pageDaily Equity Market Report - 01.12.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- LEMBAR KERJA Laporan Keuangan 1thnDocument19 pagesLEMBAR KERJA Laporan Keuangan 1thnCool ThryNo ratings yet

- Daily Equity Market Report 29.11.2021 2021-11-29Document1 pageDaily Equity Market Report 29.11.2021 2021-11-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Sales Progress 181021Document1 pageDaily Sales Progress 181021Sarohman RohmanNo ratings yet

- Nigerian Stock Recommendation For August 7th 2023Document4 pagesNigerian Stock Recommendation For August 7th 2023DMAN1982No ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- IPC Register - 01-09-2022Document8 pagesIPC Register - 01-09-2022shakibNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Valuation MatrixDocument34 pagesValuation MatrixHaseebPirachaNo ratings yet

- Tma July 2023Document124 pagesTma July 2023ravikumarjaladiNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- State Bank of India Management Meet NoteDocument9 pagesState Bank of India Management Meet Notevajiravel407No ratings yet

- Trading Journal Template 24Document84 pagesTrading Journal Template 24Dery AnggaraNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Weekly Mutual Fund Update 9th June 2019Document5 pagesWeekly Mutual Fund Update 9th June 2019Aslam HossainNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Electrical Schematic E185 355 Fixed Speed Star DeltaDocument5 pagesElectrical Schematic E185 355 Fixed Speed Star DeltaRudy LashleyNo ratings yet

- Lembar Kerja Jurnal-1Document7 pagesLembar Kerja Jurnal-1Cool ThryNo ratings yet

- Onshore Operation Daily Maintenance Report: H2S Support EngineerDocument1 pageOnshore Operation Daily Maintenance Report: H2S Support Engineershahzad sultanNo ratings yet

- IRN90-160k-Of AC-WC Electric SchematicDocument3 pagesIRN90-160k-Of AC-WC Electric Schematicsachin JoshiNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Irctc IpoDocument8 pagesIrctc IpoAbhishek PadhyeNo ratings yet

- Business Model Canvas Explained HandoutDocument10 pagesBusiness Model Canvas Explained HandoutAung Than OoNo ratings yet

- Economics SyllabusDocument16 pagesEconomics SyllabusRajiv VyasNo ratings yet

- Standing OrderDocument28 pagesStanding Orderf999khanNo ratings yet

- Industrial and Investment Analysis As A Tool For The Regulation of Public ServicesDocument46 pagesIndustrial and Investment Analysis As A Tool For The Regulation of Public ServicesMagdalena StankovskaNo ratings yet

- Business Plan: Omega Designs 1Document18 pagesBusiness Plan: Omega Designs 1api-335664543No ratings yet

- Lipton Yellow LabelDocument6 pagesLipton Yellow LabelFaHEEM DILAWAR100% (1)

- 7th Methanol Markets & Tech - About Event - About ConferenceDocument3 pages7th Methanol Markets & Tech - About Event - About ConferenceidownloadbooksforstuNo ratings yet

- BIF ChecklistDocument7 pagesBIF ChecklistMayank UpadhyayNo ratings yet

- TAM Analysis of Business ProblemsDocument2 pagesTAM Analysis of Business Problemsgeraldine sandovalNo ratings yet

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Final EconomyDocument6 pagesFinal EconomyA.Rahman Salah100% (1)

- Australia ReportDocument73 pagesAustralia ReportzeynologyNo ratings yet

- Lecture 3 - Part 2 - LC - Quick Check QuestionsDocument14 pagesLecture 3 - Part 2 - LC - Quick Check QuestionsDaisy LeungNo ratings yet

- Name of Business Projected Income Statement For The Years Ended December 31,2017-2021Document10 pagesName of Business Projected Income Statement For The Years Ended December 31,2017-2021Aries Gonzales CaraganNo ratings yet

- Abbott LaboratoriesDocument3 pagesAbbott LaboratoriessubhasisuwNo ratings yet

- Yemen, Rep. at A Glance: (Average Annual Growth)Document2 pagesYemen, Rep. at A Glance: (Average Annual Growth)tahaalkibsiNo ratings yet

- Poverty and Inequality in India - M.phil ThesisDocument77 pagesPoverty and Inequality in India - M.phil Thesissukumarnandi@hotmail.comNo ratings yet

- (SCM301m) Group 1 Chap 4.1 Supplier ManagementDocument40 pages(SCM301m) Group 1 Chap 4.1 Supplier ManagementVũ Cẩm Tú K16No ratings yet

- Level III Essay Questions 2011Document37 pagesLevel III Essay Questions 2011shikhagupta3288No ratings yet

- Macro AauDocument49 pagesMacro AauMohammed AdemNo ratings yet

- Information Economics From Jehle and RenyDocument10 pagesInformation Economics From Jehle and RenyAbby PeraltaNo ratings yet

- Forecast and Plan Your SalesDocument8 pagesForecast and Plan Your SalesMeenakshi AnandNo ratings yet

- 2010-10-22 003512 Yan 8Document19 pages2010-10-22 003512 Yan 8Natsu DragneelNo ratings yet

- Pricing and Promotions: The Analytics OpportunityDocument6 pagesPricing and Promotions: The Analytics OpportunityEduardo TeixeiraNo ratings yet