Professional Documents

Culture Documents

Martinez, Althea E. Bsais 1-A (Far - Activity #4)

Martinez, Althea E. Bsais 1-A (Far - Activity #4)

Uploaded by

Althea Escarpe Martinez0 ratings0% found this document useful (0 votes)

67 views4 pagesSocorro Company provided its statement of financial position as of December 31, 2019. Key highlights include total assets of $8.7 million consisting of current assets of $3.1 million and non-current assets of $5.9 million. Total liabilities were $1.7 million comprising current liabilities of $1 million and non-current liabilities of $1 million. Total equity was $7 million with retained earnings of $1.5 million and share capital of $5 million.

Original Description:

Finance and Reporting

Original Title

MARTINEZ, ALTHEA E. BSAIS 1-A (FAR- ACTIVITY #4)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSocorro Company provided its statement of financial position as of December 31, 2019. Key highlights include total assets of $8.7 million consisting of current assets of $3.1 million and non-current assets of $5.9 million. Total liabilities were $1.7 million comprising current liabilities of $1 million and non-current liabilities of $1 million. Total equity was $7 million with retained earnings of $1.5 million and share capital of $5 million.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

67 views4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)

Martinez, Althea E. Bsais 1-A (Far - Activity #4)

Uploaded by

Althea Escarpe MartinezSocorro Company provided its statement of financial position as of December 31, 2019. Key highlights include total assets of $8.7 million consisting of current assets of $3.1 million and non-current assets of $5.9 million. Total liabilities were $1.7 million comprising current liabilities of $1 million and non-current liabilities of $1 million. Total equity was $7 million with retained earnings of $1.5 million and share capital of $5 million.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Martinez, Althea E.

September 22, 2021

BSAIS 1-A Activity #4

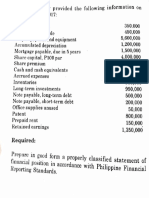

Socorro Company provided the following information on December 31, 2019:

Current assets 3,100,000 Current liabilities 1,000,000

Other assets 5,900,000 long term liabilities 1,000,000

Capital 7,000,000

Cash (including P200,000 invested in money market and

Restricted foreign deposit of P300,000) 1,000,000

Land held for undetermined use 500,000

Accounts receivable less allowance of P50,000 700,000

Inventories 600,000

Socorro Corporation share capital, at cost 300,000

Total current assets 3,100,000

Store supplies 50,000

Building less allowance of P500,000 3,000,000

Equipment less allowance of P250,000 750,000

Financial asset at amortized cost 1,000,000

Trademark 300,000

Advances to officers-indefinite repayment 150,000

Patent 250,000

Land 400,000

Total other assets 5,900,000

Accounts payable 500,000

Note payable, due December 31, 2020 100,000

Income tax payable 150,000

Share premium 250,000

Total current liabilities 1,000,000

Unearned leased hold income (five years starting 2020) 350,000

Stock dividend payable 150,000

Serial bonds payable (P100,000 maturing annually) 500,000

Total long-term liabilities 1,000,000

Retained earnings 1,500,000

Share capital,P100 par 5,000,000

Retained earnings appropriated for plant expansion 500,000

Total capital 7,000,000

Required:

Prepare statement of financial position with supporting notes and computations.

Socorro Company

Statement of Financial Position

December 31, 2019

ASSETS

Current Assets: Note

Cash and Cash Equivalents (1) 700, 000

Trade and other Receivable (2) 700, 000

Inventories 600, 000

Prepaid Expenses (3) 50, 000

Total Current Assets P2, 050, 000

Non-current Assets:

Property, plants and equipment (4) 4, 150, 000

Long-term Investment (5) 1, 000, 000

Investment Property (6) 500, 000

Intangible Assets (7) 550, 000

Other non-current assets (8) 450, 000

Total non-current assets P6, 650, 000

Total Assets P8, 700, 000

EQUITY AND LIABILITIES

Current Liabilities:

Trade and other payables (9) 820, 000

Serial bonds payable-current portion 100, 000

Total Current Liabilities P920, 000

Non-current Liabilities:

Serial bond payable- remaining portion 400, 000

Unearned leasehold income remaining portion 280, 000

Total Non-current Liabilities P680, 000

Equity

Share Capital (10) 5, 150, 000

Reserves (11) 1, 050, 000

Retained Earnings (12) 1, 200, 000

Treasury share at cost (300, 000)

Total Equity P7, 100, 000

Total Liabilities and Equity P8, 700, 000

Note 1 – Cash and Cash Equivalent

Cash 500, 000

Money Market Placement 200, 000

Total P700, 000

Note 2 – Trade and other receivable

Accounts Receivable 750, 000

Allowance for doubtful accounts (50, 000)

Total Trade and other receivable P700, 000

Note 3 – Prepaid Expenses

Store Supplies P50, 000

Note 4 – Property, plant and equipment

Cost Accum.depr. Book Value

Land 400,000 - 400, 000

Building 3, 500, 000 500, 000 3, 000, 000

Equipment 1, 000, 000 250, 000 750, 000

Total P4, 900, 000 P750, 000 P4, 150, 000

Note 5 – Long Term Investment

Investment P1, 000, 000

Note 6 – Investment Property

Land for undetermined use P500, 000

Note 7 – Intangible Assets

Trademark 300, 000

Patent 250, 000

Total P550, 000

Note 8 – Other Non-current Assets

Advances to officers 150, 000

Restricted foreign deposit 300, 000

Total P450, 000

Note 9 – Trade and other Payables

Accounts Payable 500, 000

Notes Payable 100, 000

Income Tax Payable 150, 000

Unearned leasehold income current portion 70, 000

Total P820, 000

Note 10 – Common Stock

Stare Capital Issued 5, 000, 000

Stock dividend Payable 150, 000

Total P5, 150, 000

Note 11 – Reserves

Share Premium 250, 000

Retained earnings appropriate for plant expansion 500, 000

Retained earnings appropriate for treasury share 300, 000

Total Reserves P1, 050, 000

Note 12 – Retained Earnings

Retained Earnings Unappropriated 1, 500, 000

Appropration for treasury share (300, 000)

Adjusted Balance P1, 200, 000

You might also like

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Intermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionDocument19 pagesIntermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionJoyce Anne Garduque100% (1)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Relax Company: Statement of Financial PositionDocument4 pagesRelax Company: Statement of Financial PositionKenneth Ediza100% (3)

- Intacc SolmanDocument104 pagesIntacc Solmanpam92% (36)

- Boracay CompanyyDocument4 pagesBoracay Companyymarie aniceteNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionElaine Fiona Villafuerte100% (2)

- Frias Activity 1Document6 pagesFrias Activity 1Lars FriasNo ratings yet

- Group 2 Ia3Document5 pagesGroup 2 Ia3Abe Mayores CañasNo ratings yet

- Picarra, Sherilyn - PROBLEM 8-4Document2 pagesPicarra, Sherilyn - PROBLEM 8-4Sherilyn PicarraNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezNo ratings yet

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter 2 - Ia3Document11 pagesChapter 2 - Ia3Xynith Nicole RamosNo ratings yet

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Problem 2 Exemplar Company Statement of Financial Position December 31, 2020Document3 pagesProblem 2 Exemplar Company Statement of Financial Position December 31, 2020JonaNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Problem 8-2: Exemplar Company Statement of Financial Position December 31, 2019 AssetsDocument3 pagesProblem 8-2: Exemplar Company Statement of Financial Position December 31, 2019 AssetsChincel G. ANI100% (1)

- Activity 2 - Alaska Company - ADEVA, MKADocument3 pagesActivity 2 - Alaska Company - ADEVA, MKAMaria Kathreena Andrea AdevaNo ratings yet

- Report Form Exemplar Company Statement of Financial Position December 31, 2020Document4 pagesReport Form Exemplar Company Statement of Financial Position December 31, 2020Azuh ShiNo ratings yet

- Group 5 Prob-2-10Document2 pagesGroup 5 Prob-2-10Abe Mayores CañasNo ratings yet

- Ia3 Solman Solution Manual For Intermediate Accounting 3 by Valix CompressDocument104 pagesIa3 Solman Solution Manual For Intermediate Accounting 3 by Valix CompressRayzie MatulinNo ratings yet

- Ia 3 Answer KeyDocument104 pagesIa 3 Answer KeyAdrienne TarrayoNo ratings yet

- ABE Company Provided The Following Account Balances On December 31Document4 pagesABE Company Provided The Following Account Balances On December 31angeline bulacanNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Statement of Financial Position: Learning CompetenciesDocument9 pagesStatement of Financial Position: Learning CompetenciesJmaseNo ratings yet

- De Los Santos - Problems 1-7Document9 pagesDe Los Santos - Problems 1-7Kyla De los SantosNo ratings yet

- Exemplar Company Statement of Financial Position As of December 31, 2017Document3 pagesExemplar Company Statement of Financial Position As of December 31, 2017Rey Joyce AbuelNo ratings yet

- Current AssetsDocument7 pagesCurrent AssetssyraNo ratings yet

- 8 1-8 3Document2 pages8 1-8 3syraNo ratings yet

- Premium Co. Statement of Financial Position DECEMBER 30, 2020 Assets NoteDocument3 pagesPremium Co. Statement of Financial Position DECEMBER 30, 2020 Assets NoteJessica EntacNo ratings yet

- Finance1 Problem1 121013094019 Phpapp01 PDFDocument13 pagesFinance1 Problem1 121013094019 Phpapp01 PDFMauro SacamayNo ratings yet

- Chapter 2 ProblemDocument18 pagesChapter 2 ProblemJudielyn M GonzalesNo ratings yet

- SNGL Company NotesDocument3 pagesSNGL Company NotesMan LeyNo ratings yet

- INTACC Valix Chap3 QuestionsDocument10 pagesINTACC Valix Chap3 Questionsclary frayNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Financial PositionDocument2 pagesFinancial PositionLeomar CabandayNo ratings yet

- Note 5: PPE: Acc. Dep. Book Value Acquisition CostDocument5 pagesNote 5: PPE: Acc. Dep. Book Value Acquisition CostSabel LagoNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Chapter 1Document7 pagesChapter 1natalie clyde matesNo ratings yet

- Buttons ENGDocument2 pagesButtons ENGisabella.desa04No ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Ia Assignment 3Document3 pagesIa Assignment 3Resty VillaroelNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Gabriela Ysabelle P. Tangso St. Benedict of NursiaDocument2 pagesGabriela Ysabelle P. Tangso St. Benedict of NursiaGabriela Ysabelle TangsoNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Statement of Financial Position ActivityDocument3 pagesStatement of Financial Position ActivityHannah Mae JaguinesNo ratings yet

- ABC FinancialPosition1Document4 pagesABC FinancialPosition1paulineNo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- The Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyFrom EverandThe Hunt for Unicorns: How Sovereign Funds Are Reshaping Investment in the Digital EconomyNo ratings yet

- Management Science (Lesson 1)Document10 pagesManagement Science (Lesson 1)Althea Escarpe MartinezNo ratings yet

- Acctg Module 1 QuarterDocument22 pagesAcctg Module 1 QuarterAlthea Escarpe MartinezNo ratings yet

- Cipres Erika T. 2ndquarter Activity EappDocument9 pagesCipres Erika T. 2ndquarter Activity EappAlthea Escarpe MartinezNo ratings yet

- MARTINEZ, ALTHEA E. BSAIS 1-A (LESSON 2 - Activity # 3)Document3 pagesMARTINEZ, ALTHEA E. BSAIS 1-A (LESSON 2 - Activity # 3)Althea Escarpe MartinezNo ratings yet

- Martinez, Althea E. Bsais 1-A (Sta - Activity)Document5 pagesMartinez, Althea E. Bsais 1-A (Sta - Activity)Althea Escarpe MartinezNo ratings yet

- MARTINEZ, ALTHEA E. BSAIS 1-A (LESSON 2 - Activity # 4)Document1 pageMARTINEZ, ALTHEA E. BSAIS 1-A (LESSON 2 - Activity # 4)Althea Escarpe MartinezNo ratings yet

- Martinez, Althea E. BSAIS 1-A (Activity # 2 Marginal Analysis)Document2 pagesMartinez, Althea E. BSAIS 1-A (Activity # 2 Marginal Analysis)Althea Escarpe MartinezNo ratings yet

- Martinez, Althea E. Bsais 1-A (Math)Document1 pageMartinez, Althea E. Bsais 1-A (Math)Althea Escarpe MartinezNo ratings yet

- Martine, Althea E. Bsais 1-A (Activity 2)Document5 pagesMartine, Althea E. Bsais 1-A (Activity 2)Althea Escarpe Martinez100% (1)

- Martinez, Althea E. Bsais 1-A (Lesson 3 Actvity 6)Document3 pagesMartinez, Althea E. Bsais 1-A (Lesson 3 Actvity 6)Althea Escarpe MartinezNo ratings yet

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- Martinez, Althea E. BSAIS 1-A (MS - Activity Linear Programming)Document1 pageMartinez, Althea E. BSAIS 1-A (MS - Activity Linear Programming)Althea Escarpe MartinezNo ratings yet

- Quiñonez Marielle Denise G. - ABM12 1 - Philosophy..Document5 pagesQuiñonez Marielle Denise G. - ABM12 1 - Philosophy..Althea Escarpe MartinezNo ratings yet

- Analysis of Financial Performance Based On Liquidity and Profitability Ratio (Case Study On PT Unilever in Period 2013-2017)Document4 pagesAnalysis of Financial Performance Based On Liquidity and Profitability Ratio (Case Study On PT Unilever in Period 2013-2017)Nyobi May Yuson GalindezNo ratings yet

- Ratio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilityDocument6 pagesRatio Analysis. A) Liquidity Ratio - 1) Current Ratio Current Asset Current LiabilitysolomonNo ratings yet

- Hebron Arts - BSDocument9 pagesHebron Arts - BSMangsuan mungcheshamNo ratings yet

- Financial Proposal of UNITED CONSTRUCTION COMPANYDocument5 pagesFinancial Proposal of UNITED CONSTRUCTION COMPANYfayoNo ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: FinalDocument8 pagesFundamentals of Accountancy, Business and Management 2: FinalBryanNo ratings yet

- A. Journal Entries Accounts Debit CreditDocument3 pagesA. Journal Entries Accounts Debit CreditAnne AlagNo ratings yet

- FINMAN Financial-Statement-Analysis PDFDocument66 pagesFINMAN Financial-Statement-Analysis PDFstel mariNo ratings yet

- Afreximbank Accounts 170818Document1 pageAfreximbank Accounts 170818ankc92No ratings yet

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- Profe03 - Chapter 1 Business Combinations Recognition and MeasurementDocument19 pagesProfe03 - Chapter 1 Business Combinations Recognition and MeasurementSteffany Roque100% (1)

- Abm Business Finance 12 q1 w4 Mod5Document21 pagesAbm Business Finance 12 q1 w4 Mod5Edmon Jr Udarbe69% (13)

- Chapter 16 - Discontinued Operation: QUESTION 16-6 Multiple Choice (AICPA Adapted)Document2 pagesChapter 16 - Discontinued Operation: QUESTION 16-6 Multiple Choice (AICPA Adapted)Asi Cas JavNo ratings yet

- Dell's Working Capital CaseDocument3 pagesDell's Working Capital CaseRonak KamdarNo ratings yet

- Chapter 9 Cost Analysis and Estimation Questions AnswersDocument30 pagesChapter 9 Cost Analysis and Estimation Questions AnswersRobotic HumanNo ratings yet

- CH 1 - TemplatesDocument7 pagesCH 1 - TemplatesadibbahNo ratings yet

- Accounting Principles ةبساحمل ا ئدابم: Thirteenth EditionDocument70 pagesAccounting Principles ةبساحمل ا ئدابم: Thirteenth EditionKhaled Abu ShaweshNo ratings yet

- QB 2015 CH 4 LectureDocument99 pagesQB 2015 CH 4 LectureFadi Alshiyab100% (1)

- Watson Accounting ProceduresDocument3 pagesWatson Accounting ProceduresLevi Lazareno EugenioNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Audit 2 - Topic5Document9 pagesAudit 2 - Topic5YUSUFNo ratings yet

- Accounting Principles #038 Procedures MCQs (Set-I) For FPSC Senior AuditoDocument10 pagesAccounting Principles #038 Procedures MCQs (Set-I) For FPSC Senior AuditoAdiBalochNo ratings yet

- MM Theory: MM Proposition 1 Without TAXDocument2 pagesMM Theory: MM Proposition 1 Without TAXNasirNo ratings yet

- Recourse Obligation.: RequiredDocument55 pagesRecourse Obligation.: RequiredJude SantosNo ratings yet

- Vikran FICO KDS V3Document26 pagesVikran FICO KDS V3Abhishek AserkarNo ratings yet

- BMA21 Tut-4 Group-3Document29 pagesBMA21 Tut-4 Group-3Ninh Thị Ánh NgọcNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument34 pagesFinancial Statement Analysis: K R Subramanyam John J WildAgus Tina100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Annexure-V-Cover Page For Academic TasksDocument18 pagesAnnexure-V-Cover Page For Academic TasksNaeem AthafeefNo ratings yet

- QuizzerDocument30 pagesQuizzerMaeNo ratings yet