Professional Documents

Culture Documents

Fundamental of Partnership - MCQs

Fundamental of Partnership - MCQs

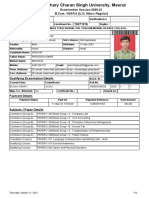

Uploaded by

Sanchit GargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental of Partnership - MCQs

Fundamental of Partnership - MCQs

Uploaded by

Sanchit GargCopyright:

Available Formats

COCEDUCATION.

COM MCQ Series CA/CMA Santosh kumar

Fundamental of Partnership

1. …………. is prepared by partnership firm to distribute profit among partners.

a. profit and loss account

b. trading account

c. profit and loss appropriation account

d. capital account

2. while preparing financial statement of partnership firm, ……….is prepared after preparing profit & loss

A/c.

a. profit and loss appropriation account

b. trading account

c. Balance sheet

d. capital account.

3. partnership is defined by ……………..

a. Indian partnership act 1932, section 2

b. Indian partnership act 1932, section 4

c. companies act 2013, section 4

d. Indian partnership act 1932, section 30

4. According to section 4 of Indian partnership Act 1932, "Partnership is the relation between persons who have

agreed to share the profits of a business carried on by all or ………………."

a. all of them acting for all.

b. any of them acting for all.

c. any one of them acting for all.

d. any of them acting for one.

5. ------- are shown in profit and loss appropriation account.

a. charge against profit.

b. appropriation of profit.

c. both

d. none of the above.

6. The written document known as ………….. details the terms and conditions of partnership.

a. partnership agreement.

b. partnership deed.

c. partnership act 1932

d. notary agreement

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

COCEDUCATION.COM MCQ Series CA/CMA Santosh kumar

7. Interest on drawing is -------- in profit and loss appropriation account.

a. debited

b. credited

c. no treatment

d. none of above

8. Partner’s drawing is -------- in profit and loss appropriation account

a. debited

b. credited

c. no treatment

d. none of above

9. Salary of manager is recorded in………..

(a) Trading A/c

(b) Profit & loss A/c

(c) Profit loss App A/c

(d) Balance sheet

10. Salary to partner is recorded in-------

(a) Trading A/c

(b) Profit & loss A/c

(c) Profit loss App A/c

(d) Balance sheet

11. Interest on loan to partner is debited to………..

(a) Trading A/c

(b) Profit & loss A/c

(c) Profit loss App A/c

(d) Balance sheet

12. Interest on capital is credited to ……

(a) Profit & loss A/c

(b) Profit loss App A/c

(C) Partners’ capital account.

(c) None of the above

13. Rent to partner for using his property in business is debited/transferred to ……..

(a) Trading A/c

(b) Profit & loss A/c

(c) Profit loss App A/c

(d) Balance sheet

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

COCEDUCATION.COM MCQ Series CA/CMA Santosh kumar

14. Transfer to General reserve is debited to…….

(a) Trading A/c

(b) Profit & loss A/c

(c) Profit loss App A/c

(d) Balance sheet.

15. Net profit before interest on loan and tax ₹ 4,00,000

Interest on partner’s loan ₹ 50,000

Tax rate 30%

Manager’s commission 10% of net profit.

Calculate manager’s commission.

a. ₹35,000

b. ₹24,500

c.. ₹40,000

d. ₹22,273

16. Net profit before interest on loan ₹ 4,00,000

Interest on partner’s loan ₹ 50,000

Manager’s commission 10% of net profit after charging such commission.

Calculate manager’s commission.

a. ₹35,000

b. ₹31818

c.. ₹40,000

d. ₹38,889

17. net profit before manager’s commission and interest on loan ₹6,00,000.

Manager’s commission ₹ 80,000

Interest on loan to partners ₹ 70,000

Interest on capital to partners ₹40,000.

Journal entry for transferring net profit to profit and loss appropriation account.

(a) profit and loss account Dr 6,00,000

To profit and loss appropriation A/c 6,00,000

(b) profit and loss account Dr 4,50,000

To profit and loss appropriation A/c 4,50,000

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

COCEDUCATION.COM MCQ Series CA/CMA Santosh kumar

(c) profit and loss account Dr 4,10,000

To profit and loss appropriation A/c 4,10,000

(d) profit and loss account Dr 5,20,000

To profit and loss appropriation A/c 5,20,000

18. Net profit before manager’s commission = ₹ 2,20000

Manager’ commission = 10% of net profit after such commission

Calculate commission.

a. 20,000

b. 22,000

c. 24,444

d. none of the above

19. Profit before rent to a partner = ₹ 5,00,000

Rent payable to partner = ₹ 40,000

Salary payable to partner = ₹ 60,000

10% of net profit is to be transferred to General reserve

A. ₹ 46000

B. ₹50,000

C. ₹40,000

D. 41,818

20. Profit before rent to a partner = ₹ 5,00,000

Rent payable to partner = ₹ 40,000

Salary payable to partner = ₹ 60,000

10% of distributable profit is to be transferred to General reserve

A. ₹ 46000

B. 50,000

C. ₹40,000

D. 41,818

21. Profit before rent to a partner = ₹ 5,00,000

Rent payable to partner = ₹ 40,000

Salary payable to partner = ₹ 60,000

10% of distributed profit is to be transferred to General reserve

A. ₹ 46000

B. 50,000

C. ₹40,000

D. 41,818

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

COCEDUCATION.COM MCQ Series CA/CMA Santosh kumar

22. A and B are partners sharing profit and losses as follow:

Salary to A ₹ 30,000

Provision of 5% of net profit to be made for commission to manager.

Net profit after A’s salary = ₹1,20,000

Calculate amount of profit to be transferred from profit & loss A/c profit & loss appropriation A/c.

A. ₹1,20,000

B. ₹1,50,000

C. ₹1,42,500

D. ₹1,14,000

23. Journal entry for transferring net loss from profit & loss A/c to profit & loss appropriation A/c.

A. Profit & loss A/c Dr.

To Profit & loss appropriation A/c.

B. Profit & loss Appropriation A/c Dr.

To Profit & loss A/c.

C. Profit & loss A/c Dr.

To Partner’s capital account.

D. none of the above

24. Appropriation of profit is debited to _________

A. profit and loss account

B. profit and loss appropriation account.

C. partner’s capital account

d. none of the above.

25. Change against profit are debited to __________.

A. profit and loss account

B. profit and loss appropriation account.

C. partner’s capital account

d. none of the above.

26. Partnership comes into existence by ------- .

(a) an Oral agreement

(b) a Written agreement

(c) an oral or a written agreement

(d) no idea

27. In the absence of partnership deed, interest on capital is allowed at the rate of :

(a) 6% p.a.

(b) 6%

(c) nill

(d) 12% p.a.

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

COCEDUCATION.COM MCQ Series CA/CMA Santosh kumar

28. In the absence of partnership deed, ---- interest on drawings will be charged @:

(a) 6% p.a.

(b) 6%

(c) nill

(d) 12% p.a.

29. In the absence of partnership deed, interest on loan will be allowed @

(a) 6% (b) 6% p.a. (c) 12% (d) Nill

30. On 1 July 2021, partner had given a loan of ₹ 2,00,000 to the firm. Calculate interest on loan @ 10% p.a.

for the year ended on 31.3.2022.

A. 20,000 B. 10,000 C. 15,000 D. 9,000

COCEDUCATION.COM For Purchase call 9999631597, 7303445575, 8448322142

www.coceducation.com

Download Free PDF E-books

(Full Course & Chapterwise)

coceducation.com/ebooks

For CA/CMA/CS/

B.com/B.com(Hons.)/ Class XI-XII

Contact us: /

8448322142,

9999631597,

7303445575.

Visit Website-

www.coceducation.com

You might also like

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- Sem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease AccountingDocument11 pagesSem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease Accountinglol50% (2)

- IT Decision Makers USA Mid Atlantic 1mto2 5MDocument168 pagesIT Decision Makers USA Mid Atlantic 1mto2 5MKunal SinghalNo ratings yet

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- Group 9 - ACCCOB3 - K39 Business CaseDocument4 pagesGroup 9 - ACCCOB3 - K39 Business CaseMelanie GraceNo ratings yet

- 1 ACF-Web Test 1 FinalDocument4 pages1 ACF-Web Test 1 FinalSathishkumar NatarajanNo ratings yet

- Reg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksDocument12 pagesReg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksMuhammad ThanveerNo ratings yet

- CPT Model Papers 1Document418 pagesCPT Model Papers 1Kalyan SagarNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.abiNo ratings yet

- 12 Accountancy Sp02Document15 pages12 Accountancy Sp02Rahul PareekNo ratings yet

- Fundamental of Partnership 120 McqsDocument158 pagesFundamental of Partnership 120 McqsAkshatNo ratings yet

- No.1 For CA/CWA & MEC/CEC: Master MindsDocument8 pagesNo.1 For CA/CWA & MEC/CEC: Master MindsBadri AthreyasNo ratings yet

- DPP - 1 Accounts Chapter - FundamentalsDocument29 pagesDPP - 1 Accounts Chapter - FundamentalsShubham GuptaNo ratings yet

- 502A - Corporate Accounting - IIDocument23 pages502A - Corporate Accounting - IIحسينبيسواسNo ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- Class Xii CH 1 MCQ AccountancyDocument27 pagesClass Xii CH 1 MCQ Accountancyscammer9901No ratings yet

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDocument4 pagesChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNo ratings yet

- 12 Accountancy QP Prep T1 21Document9 pages12 Accountancy QP Prep T1 21mitaliNo ratings yet

- Question Bank - XII Accounts MCQDocument192 pagesQuestion Bank - XII Accounts MCQHarshal KaramchandaniNo ratings yet

- December 2011, CA-CPT Question Paper (Based On Memory) : No.1 For CA/CWA & MEC/CECDocument16 pagesDecember 2011, CA-CPT Question Paper (Based On Memory) : No.1 For CA/CWA & MEC/CECSanjeev SharmaNo ratings yet

- 23 Economic Evaluation of Capital ExpenditureDocument14 pages23 Economic Evaluation of Capital ExpenditureRicky Sibal MacalanNo ratings yet

- STO - Model Question-I - 05082023Document26 pagesSTO - Model Question-I - 05082023Mumthaz MohammedNo ratings yet

- Corp AccDocument19 pagesCorp Acckamala_kannan_22No ratings yet

- Accounting & Auditing Mcqs From Past PapersDocument16 pagesAccounting & Auditing Mcqs From Past PapersArslan Shakir88% (8)

- Accountancy Question BankDocument146 pagesAccountancy Question BankSiddhi Jain100% (1)

- Economic Evaluation of Capital Expenditures: Multiple ChoiceDocument14 pagesEconomic Evaluation of Capital Expenditures: Multiple ChoiceGweeenchanaNo ratings yet

- Accountancy Online Test Answer KeyDocument5 pagesAccountancy Online Test Answer KeyAppan HaNo ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- FDocument12 pagesFohhiitsmenasNo ratings yet

- The Accounting Education EPFO Accounting MCQ QUIZDocument20 pagesThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNo ratings yet

- DPP - 4 Accounts Chapter - Dissolution of A PartnershipDocument28 pagesDPP - 4 Accounts Chapter - Dissolution of A PartnershipShubham GuptaNo ratings yet

- CPT Mock Test Paper Dec 2014 Part A English 28-11-2014Document13 pagesCPT Mock Test Paper Dec 2014 Part A English 28-11-2014DIPNo ratings yet

- Multiple Choice Question: A/c-Part-1Document4 pagesMultiple Choice Question: A/c-Part-1ckvirtualizeNo ratings yet

- Class-TYBAF Semester - V Subject: Financial Accounting Sem - I (Atkt)Document37 pagesClass-TYBAF Semester - V Subject: Financial Accounting Sem - I (Atkt)Durvank PatilNo ratings yet

- Unit 4 With SolutionDocument18 pagesUnit 4 With Solutionnt2011633No ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 07Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 07sneha muralidharanNo ratings yet

- Test ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Document21 pagesTest ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Icaii InfotechNo ratings yet

- Disclaimer: Vidya Sagar InstituteDocument38 pagesDisclaimer: Vidya Sagar InstituteAkashdeep MukherjeeNo ratings yet

- Accountancy XIIDocument6 pagesAccountancy XIIGurmehar KaurNo ratings yet

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaeNo ratings yet

- CH 18 Revenue Recognition Self-Study: C H 1 8, P A G EDocument6 pagesCH 18 Revenue Recognition Self-Study: C H 1 8, P A G ENikhil JoyNo ratings yet

- Accounting MCQsDocument12 pagesAccounting MCQsLaraib AliNo ratings yet

- Dysas Center For Cpa ReviewDocument12 pagesDysas Center For Cpa ReviewAngela Luz de LimaNo ratings yet

- FXM Advac 2017 401aDocument10 pagesFXM Advac 2017 401acharlene mae100% (1)

- 120 General Accounting Principles MCQs - WatermarkedDocument25 pages120 General Accounting Principles MCQs - WatermarkedNamrata SrivastavaNo ratings yet

- Tax1 Final Exam 2022 ADocument7 pagesTax1 Final Exam 2022 AEjie MarabeNo ratings yet

- +2 Accountancy One MarkDocument8 pages+2 Accountancy One Marksaravanan.ma0611No ratings yet

- CPT June 2010Document15 pagesCPT June 2010poiooio101No ratings yet

- Barrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Document4 pagesBarrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Alishba KhanNo ratings yet

- MidTermEval S201901-2Document5 pagesMidTermEval S201901-2Victoria TavarezNo ratings yet

- Accounts Half Yearly 2022Document10 pagesAccounts Half Yearly 2022suryatutor48No ratings yet

- M.SC Finance: University of LagosDocument16 pagesM.SC Finance: University of LagosAguda Henry OluwasegunNo ratings yet

- 504A Direct TaxDocument38 pages504A Direct TaxOwais ZamanNo ratings yet

- Accounting 02 Financial Statements Quiz 20201218 ParabDocument21 pagesAccounting 02 Financial Statements Quiz 20201218 ParabSourabh ChavanNo ratings yet

- Wk14 Summary Quizzer 2 - Set ADocument5 pagesWk14 Summary Quizzer 2 - Set Amariesteinsher0No ratings yet

- CPT Sample Question PaperDocument41 pagesCPT Sample Question PaperAshraf ValappilNo ratings yet

- Accounting McqsDocument16 pagesAccounting McqsAsad RehmanNo ratings yet

- SP 7Document8 pagesSP 7Amit ChaudhryNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Adobe Scan 10 Nov 2021Document12 pagesAdobe Scan 10 Nov 2021Sanchit GargNo ratings yet

- Examination Session 2020-21: Exam Form # Verification #Document3 pagesExamination Session 2020-21: Exam Form # Verification #Sanchit GargNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument32 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of IndiaSanchit GargNo ratings yet

- Mcq-Fundamental of Partnership (Part 6)Document12 pagesMcq-Fundamental of Partnership (Part 6)Sanchit GargNo ratings yet

- Fundamental of Partnership (Part 4)Document11 pagesFundamental of Partnership (Part 4)Sanchit GargNo ratings yet

- Insolvency Introduction 2022Document2 pagesInsolvency Introduction 2022Roberto GuiseppiNo ratings yet

- Single To DoubleDocument4 pagesSingle To DoubleGarima GarimaNo ratings yet

- Setoff & Carry Forward of LossDocument3 pagesSetoff & Carry Forward of LossDr. Mustafa KozhikkalNo ratings yet

- RH PetrogasDocument4 pagesRH PetrogasInvest StockNo ratings yet

- Response To SGX Queries and Letter To The Editor of Business TimesDocument5 pagesResponse To SGX Queries and Letter To The Editor of Business TimesWeR1 Consultants Pte LtdNo ratings yet

- Shareholders EquityDocument51 pagesShareholders EquityIsmail Hossain100% (2)

- Memoire Finance Julien BOUSQUET Synergie Valuation in M ADocument77 pagesMemoire Finance Julien BOUSQUET Synergie Valuation in M AManal DassallemNo ratings yet

- IAS 16-Property, Plant and Equipment (PPE) : Nguyễn Đình Hoàng UyênDocument47 pagesIAS 16-Property, Plant and Equipment (PPE) : Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- University of Mumbai Karmaveer Bhaurao Patil College: Submitted by Shivprasad.B.PoojariDocument73 pagesUniversity of Mumbai Karmaveer Bhaurao Patil College: Submitted by Shivprasad.B.PoojariShiv GowdaNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationAngel PadillaNo ratings yet

- 6 PracticeProblems-IntercompanyExDocument6 pages6 PracticeProblems-IntercompanyExtheheckwithitNo ratings yet

- Ifrs 3Document14 pagesIfrs 3Ngọc LêNo ratings yet

- MBA-622 - Financial ManagementDocument11 pagesMBA-622 - Financial Managementovina peirisNo ratings yet

- TLV 20221111164418 2022-Q3-ReportDocument84 pagesTLV 20221111164418 2022-Q3-Reportafrodita99977No ratings yet

- Walter SchlossDocument40 pagesWalter SchlossZo Ki100% (1)

- Chapter 3: Liquidation Based Valuation Liquidation Based ValuationDocument7 pagesChapter 3: Liquidation Based Valuation Liquidation Based ValuationJoyce Dela CruzNo ratings yet

- 2020 Equity Incentive Plan ProspectusDocument42 pages2020 Equity Incentive Plan Prospectuschandra bhumiNo ratings yet

- Solutions Chapter 24Document5 pagesSolutions Chapter 24Avi SeligNo ratings yet

- AST Midterms PDFDocument36 pagesAST Midterms PDFMidas Troy VictorNo ratings yet

- CFAS SemiFinalDocument4 pagesCFAS SemiFinalJoy CastillonNo ratings yet

- ACCT. Cycle Reviewer 2Document7 pagesACCT. Cycle Reviewer 2Rosemarie GoNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisMohamed HussienNo ratings yet

- ACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Document6 pagesACCTG131-CourseGuide First Semester Ay2022-2023 Version 1Klarissemay MontallanaNo ratings yet

- Learning Activity Sheet Business Finance Introduction To Financial Management Quarter 1 - Week 1Document16 pagesLearning Activity Sheet Business Finance Introduction To Financial Management Quarter 1 - Week 1Dhee SulvitechNo ratings yet

- Chapter 5.doc Revision2022Document7 pagesChapter 5.doc Revision2022Rabie HarounNo ratings yet

- Prequalifying Exam Level 1 Set B AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 1 Set B AK FSUU AccountingRobert CastilloNo ratings yet