Professional Documents

Culture Documents

Activity Number 2 (Mutual Funds)

Activity Number 2 (Mutual Funds)

Uploaded by

JINKY MARIELLA VERGARAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Number 2 (Mutual Funds)

Activity Number 2 (Mutual Funds)

Uploaded by

JINKY MARIELLA VERGARACopyright:

Available Formats

ACTIVITY NO.

A. Calculate the return on investment (ROI)

1. NAV = P171.60 on January 1; NAV = P720 on Dec 31;

Dividend Distributions = P31.

2. NAV = P408 on January 1; NAV = P400 on Dec 31;

Dividend Distributions = P 17.80.

3. Peso Bond Fund’ s net asset value on January 1was P160. During

the year, the fund distributed P20 per share to investors. At the end

of the year, the net asset value was P162.

4. Short-term Fund’s net asset value on January 1, was p315. During

the year, the fund distributed P60 per share to investors. At the end

of the year, the net asset value was P 320.

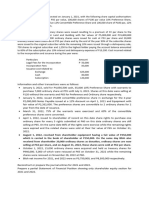

B. Compute Net Asset Value (NAV).

1. You have been provided with the following assets and liabilities

details of Mutual Fund X as on February 10, 2020. Calculate its net

asset value as on that date.

Particulars Amount

Investments in various securities 234,000

Cash and cash equivalents 4,000

Total Receivables 16,200

Short term liabilities 6,760

Long term liabilities 14,600

Accrued expenses 2,000

Particulars Amount

Number of outstanding shares 2,500

2)

Let's assume at the close of trading yesterday that a

particular mutual fund held P20,480,000 worth of securities,

$1,876,000 of cash, and $410,000 of liabilities. If the fund had

800,000 shares outstanding, then yesterday's NAV would be?

3)If at the close of trading, a mutual fund has $8,000,000 worth of

assets, $200,000 of cash, and $500,000 of liabilities. The fund has

350,000 shares outstanding. What is the mutual fund net asset

value calculation?

You might also like

- Homework ch2Document35 pagesHomework ch2KristineTwo CorporalNo ratings yet

- Midterm Exam in FMDocument10 pagesMidterm Exam in FMROB101512No ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Aklan DakDocument39 pagesAklan DakConi AyuNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- Arlene Joy S. Garcia BSA-4 Assignment 1 ACC 311 730-930 AM: RequiredDocument3 pagesArlene Joy S. Garcia BSA-4 Assignment 1 ACC 311 730-930 AM: RequiredARLENE GARCIANo ratings yet

- AccountingDocument3 pagesAccountingrenoNo ratings yet

- Audit of Stockholders Equity StudentsDocument5 pagesAudit of Stockholders Equity StudentsJames R JunioNo ratings yet

- Assets Notes: Total Current Assets 1 Total Noncurrent Assets 2 LiabilitiesDocument2 pagesAssets Notes: Total Current Assets 1 Total Noncurrent Assets 2 Liabilitiesjuan vicente gungonNo ratings yet

- Week 06 - 03 - Module 15 - Fund and Other Types of Investment & DerivativesDocument16 pagesWeek 06 - 03 - Module 15 - Fund and Other Types of Investment & Derivatives지마리No ratings yet

- Activity 1 Audit of Shareholders EquityDocument4 pagesActivity 1 Audit of Shareholders EquityAnna Carlaine PosadasNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- Financial Midterm ExaminationDocument3 pagesFinancial Midterm ExaminationHanabusa Kawaii IdouNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- SHE Comprehensive ProblemDocument4 pagesSHE Comprehensive Problemliezelkatemesina82No ratings yet

- 10 - ReviewDocument14 pages10 - ReviewNur Mohammad Yusuf Deljan EscanderNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- Advact PrelimDocument10 pagesAdvact PrelimSano ManjiroNo ratings yet

- SheDocument2 pagesSheRhozeiah LeiahNo ratings yet

- Activity 1.1 PDFDocument2 pagesActivity 1.1 PDFDe Nev OelNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument4 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Investments - Equity - Assignment - For Acc316Document3 pagesInvestments - Equity - Assignment - For Acc316beeeeeeNo ratings yet

- CFA 2 - FRA - Multinationals (Preguntas FQ18)Document3 pagesCFA 2 - FRA - Multinationals (Preguntas FQ18)RuthNo ratings yet

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDocument11 pagesPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Simple Company SFP With NotesDocument5 pagesSimple Company SFP With Notesjudithtiempo03No ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- LiquidationDocument1 pageLiquidationChris Phil DeeNo ratings yet

- 9418 - Financial Statements TranslationDocument3 pages9418 - Financial Statements Translationjsmozol3434qcNo ratings yet

- HW On Equity SecuritiesDocument3 pagesHW On Equity Securitiesjjk firstloveNo ratings yet

- PARTNERSHIP1Document27 pagesPARTNERSHIP1Christine Mae Mata100% (3)

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Advac 103 Partnership and Corporate LiquidationDocument3 pagesAdvac 103 Partnership and Corporate Liquidationellie MateoNo ratings yet

- 6971 - Investment AssociateDocument2 pages6971 - Investment AssociateMarjhon TubillaNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Problem 2 8 IAADocument5 pagesProblem 2 8 IAAAbe Mayores CañasNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Activity 1 Business CombinationDocument4 pagesActivity 1 Business Combinationnglc srzNo ratings yet

- Comprehensive Problems:: 1. in Connection With Your Audit of The Financial Statements CHARLES Corporation, You WereDocument20 pagesComprehensive Problems:: 1. in Connection With Your Audit of The Financial Statements CHARLES Corporation, You WereMa. Hazel Donita DiazNo ratings yet

- Quiz 1 Partnership 09 10Document3 pagesQuiz 1 Partnership 09 10Aldyn Jade GuabnaNo ratings yet

- Thi Hong Loan Phan - s5191658 - 1202AFE - Part ADocument2 pagesThi Hong Loan Phan - s5191658 - 1202AFE - Part Aphan loanNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument8 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- The Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsDocument4 pagesThe Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsAnn louNo ratings yet

- 11.2. Investment in AssociateDocument3 pages11.2. Investment in AssociatePrincess Angela GelliaparangNo ratings yet

- ForexDocument2 pagesForexJeciel Mae M. CalubaNo ratings yet

- Partnership Formation NotesDocument4 pagesPartnership Formation NotesMary Rica DublonNo ratings yet

- Pert 1 - AKL - CH 3 - 2019-2020Document2 pagesPert 1 - AKL - CH 3 - 2019-2020Nova Yuliani0% (1)

- Afar Corporate Liquidation: Problem 1: The Statement of AffairsDocument5 pagesAfar Corporate Liquidation: Problem 1: The Statement of AffairsCha EsguerraNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionKAYLA SHANE GONZALESNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- MOD 4 Partnership LiquidationDocument3 pagesMOD 4 Partnership LiquidationCharles GainNo ratings yet

- Partnership - ExercisesDocument6 pagesPartnership - ExercisesCARPIO, JIANE KYLE M.No ratings yet

- You Have Been Engaged To Examine The Financial Statements of NashockDocument1 pageYou Have Been Engaged To Examine The Financial Statements of NashockSherlock Holmes0% (1)

- Requirements:: Intermediate Accounting 3Document7 pagesRequirements:: Intermediate Accounting 3happy240823No ratings yet

- Lesson 1 (Mutual Funds)Document14 pagesLesson 1 (Mutual Funds)JINKY MARIELLA VERGARANo ratings yet

- PURPOSIVE COMMUNICATION by Maudrino and MartinDocument82 pagesPURPOSIVE COMMUNICATION by Maudrino and MartinJINKY MARIELLA VERGARA100% (2)

- Activity No.2 Personal Finance Name: - Date: - TimeDocument4 pagesActivity No.2 Personal Finance Name: - Date: - TimeJINKY MARIELLA VERGARANo ratings yet

- Accounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500Document6 pagesAccounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500JINKY MARIELLA VERGARA100% (1)