Professional Documents

Culture Documents

PWA Sub Appl

PWA Sub Appl

Uploaded by

Jawad0 ratings0% found this document useful (0 votes)

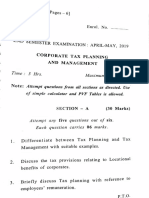

16 views1 pageThis document provides the syllabus and questions for a Pakistan public works accounts exam. It outlines 3 questions to be answered in 1 hour and 15 minutes. Question 1 asks about terms for secured advances during work execution. Question 2 describes instructions for maintaining a public works cash book. Question 3 requires preparing a running bill, making deductions for prior advances, security deposits, and taxes based on provided work quantities and rates. Books allowed include various public works, audit, and accounts codes.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides the syllabus and questions for a Pakistan public works accounts exam. It outlines 3 questions to be answered in 1 hour and 15 minutes. Question 1 asks about terms for secured advances during work execution. Question 2 describes instructions for maintaining a public works cash book. Question 3 requires preparing a running bill, making deductions for prior advances, security deposits, and taxes based on provided work quantities and rates. Books allowed include various public works, audit, and accounts codes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views1 pagePWA Sub Appl

PWA Sub Appl

Uploaded by

JawadThis document provides the syllabus and questions for a Pakistan public works accounts exam. It outlines 3 questions to be answered in 1 hour and 15 minutes. Question 1 asks about terms for secured advances during work execution. Question 2 describes instructions for maintaining a public works cash book. Question 3 requires preparing a running bill, making deductions for prior advances, security deposits, and taxes based on provided work quantities and rates. Books allowed include various public works, audit, and accounts codes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Pakistan Institute of Public Finance Accountants

Summer Exam-2019 Syllabus–2015

AGP/CGA/PG/PUBLIC SECTORS

Public Works Accounts Rules & Procedures (Practical)

[08.05.2019] [03:55 – 05:20 pm]

Marks-38 Duration:1 hr.15 Mins.

Subjective Additional time – 10 min for Paper Reading

[Instructions]

Ensure that the question paper delivered to you is the same, in which you intend to appear.

Read the instructions given on the title page of Answer Script.

Start each question from fresh page.

Books Allowed:

CPWA Code Books of Forms referred in CPWA code Audit Manual

CPWD Code Accounts Code Vol - III

Audit Code Chart of Accounts

Attempt all Questions

Q.1. What do you know about terms and conditions necessary for grant of secured 09

advance during execution of work?

Q.2. Describe the necessary instructions to be observed for maintenance of Cash Book 09

of Public Work Department.

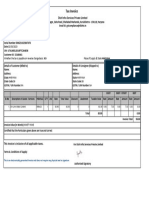

Q.3. Prepare 2nd Running Bill of M/s. Butt & Co. of the Work “Rehabilitation of Roads” 20

Paid vide Vr. No. 24 dated 22-3-2019 from the following data:-

Sr. Rate Up to date Quantities paid

Item of Work Unit

No. Rs. Quantity in last bill

1. Earth work embankment ‰ Cft. 8,000 70,000 23,500

2. Relaying of old material as Sub-base % Cft. 3,560 18,000 9,000

3. P/L sub base % Cft. 10,500 25,000 7,500

4. P/L brick edging P. Rft 30.30 21,000 10,000

5. P/L Base course % Cft. 11,500 50,000 15,000

P/L TST with 79 Lbs bitumen and

6. % Sft 6,000 30,000 -

9.75 cft bajri per % sft

7. Lane Marking with paint Per Rft 31.70 5,000 -

(i) Mobilization Advance of Rs. 15,000,000 was given in 1st Running Bill without

interest. Recovery of 1st installment @ 25% of the total Value of Work done upto 2 nd

running bill is to be made in this bill.

(ii) Secured Advance of 40,000 Cft crush was given in last bill at Market Rate of

Rs. 5,500 %Cft which is to be adjusted in this bill.

(iii) Secured Advance against 50,000 Cft crush is to be given in this bill on Market rate of

Rs. 6,500 % Cft

(iv) Deduct Security Deposit @ 5% and Income Tax @ 7%.

*****************************

You might also like

- Project Report On E-Rickshaw AssemblyDocument18 pagesProject Report On E-Rickshaw Assemblymishasinha2323100% (1)

- Project Proposal Wooden Furniture & Fixture Manufacturing UnitDocument9 pagesProject Proposal Wooden Furniture & Fixture Manufacturing UnitCA Devangaraj Gogoi71% (7)

- Bab 3 Interim PaymentDocument23 pagesBab 3 Interim Paymentamyamirulali100% (2)

- Measuring Tape Manufacturing FeasibilityDocument6 pagesMeasuring Tape Manufacturing FeasibilityNauman TajNo ratings yet

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- PWA Sub Appl 2015Document1 pagePWA Sub Appl 2015JawadNo ratings yet

- Winter Exam-2019 Pakistan Institute of Public Finance AccountantsDocument3 pagesWinter Exam-2019 Pakistan Institute of Public Finance AccountantsJawadNo ratings yet

- Winter Exam-2019 Pakistan Institute of Public Finance AccountantsDocument3 pagesWinter Exam-2019 Pakistan Institute of Public Finance AccountantsJawadNo ratings yet

- Summer 10Document1 pageSummer 10Adnan SethiNo ratings yet

- Summer 12Document1 pageSummer 12Adnan SethiNo ratings yet

- Pwa Application Winter 2020Document3 pagesPwa Application Winter 2020ArifNo ratings yet

- Summer 11Document1 pageSummer 11Adnan SethiNo ratings yet

- Ae Sdo 2016 Under PWD Accounts Paper IDocument2 pagesAe Sdo 2016 Under PWD Accounts Paper ILalbiakkima RokhumNo ratings yet

- Uniform ManufacturingDocument6 pagesUniform ManufacturingcollinsongoriNo ratings yet

- 4GB-3GBPE Generic Building BOQDocument148 pages4GB-3GBPE Generic Building BOQforbeskaNo ratings yet

- Project Profile On G. P. Bucket: Dcdi-Mzfpur - Dcmsme@gov - in WWW - Msmedimzfpur.bih - Nic.inDocument8 pagesProject Profile On G. P. Bucket: Dcdi-Mzfpur - Dcmsme@gov - in WWW - Msmedimzfpur.bih - Nic.inAMIT PRAJAPATINo ratings yet

- Tutorial Sheet - 1 CEL 464 Q. 1: ND RDDocument2 pagesTutorial Sheet - 1 CEL 464 Q. 1: ND RDsachin.meenaNo ratings yet

- Cost Accounting 2 Question PaperDocument6 pagesCost Accounting 2 Question PaperSajitha100% (1)

- Assignment 30% Construction Economics and Finance COTM 6021Document6 pagesAssignment 30% Construction Economics and Finance COTM 6021Mengstagegnew0% (1)

- Modelling Test 02aDocument5 pagesModelling Test 02araajeshh.goelNo ratings yet

- 1 Bid Document Vol IDocument122 pages1 Bid Document Vol IDhabalia AshvinNo ratings yet

- Mech Bicycle RimsDocument8 pagesMech Bicycle Rimsharish rajputNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- Construction Project Management AssignmentDocument6 pagesConstruction Project Management AssignmentMilashu0% (1)

- Cma612s - Cost Management Accounting - 1st Opp - Nov 2019Document7 pagesCma612s - Cost Management Accounting - 1st Opp - Nov 2019Nolan TitusNo ratings yet

- Kalka The Pearl Price ListDocument1 pageKalka The Pearl Price ListSaptarshi ChatterjeeNo ratings yet

- Hiring of Concrete MixerDocument6 pagesHiring of Concrete Mixermr.xinbombayNo ratings yet

- Government of Andhra Pradesh: Municipal Administration & Urban Development (Crda.2) DepartmentDocument6 pagesGovernment of Andhra Pradesh: Municipal Administration & Urban Development (Crda.2) DepartmentBalu Mahendra SusarlaNo ratings yet

- Accounting For Managers MBA (1st Sem)Document1 pageAccounting For Managers MBA (1st Sem)Nikhil KumarNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- Project Profile: Manufacturing of Staple PinDocument8 pagesProject Profile: Manufacturing of Staple PinAbhijeet ChauhanNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Model Report Pmegp Solar Charkha New - 25Document10 pagesModel Report Pmegp Solar Charkha New - 25kiranNo ratings yet

- Tax AakashDocument6 pagesTax AakashAkash ChauhanNo ratings yet

- Cost Accounting 30 QuestionsDocument28 pagesCost Accounting 30 QuestionsDineshNo ratings yet

- Domestic LPG Stove (Project Report)Document6 pagesDomestic LPG Stove (Project Report)Prashant KhaireNo ratings yet

- Cyber Cafe Xerox LaminationDocument7 pagesCyber Cafe Xerox LaminationRatna KarNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- PROFORMA of SCHEDULES CPWD A Cement For Works With EstimatedDocument18 pagesPROFORMA of SCHEDULES CPWD A Cement For Works With EstimatedTarun ChopraNo ratings yet

- Water BOQDocument171 pagesWater BOQLeonard TonuiNo ratings yet

- Accounts Last Year PaperDocument2 pagesAccounts Last Year PaperShubham KumarNo ratings yet

- Worksmes (T&a)Document5 pagesWorksmes (T&a)BlueNo ratings yet

- Brief Note On Progress of NRW Reduction Work in 5 Divisional Headquarter Towns in The StateDocument3 pagesBrief Note On Progress of NRW Reduction Work in 5 Divisional Headquarter Towns in The StateRAJNo ratings yet

- Ca 1Document4 pagesCa 1VaibhavrvNo ratings yet

- Problems On PPEDocument8 pagesProblems On PPEDibyansu KumarNo ratings yet

- Decisions.: Examination Control Division M/IiDocument20 pagesDecisions.: Examination Control Division M/IiPrabin123No ratings yet

- Che - Corrugated Paper BoxDocument6 pagesChe - Corrugated Paper Boxanon_241349485100% (1)

- KotureshwaraDocument9 pagesKotureshwaraVeerabhadreshwar Online CenterNo ratings yet

- Review Class For Final Exam 2016, For Moodle, With SolutionDocument17 pagesReview Class For Final Exam 2016, For Moodle, With SolutionMaxNo ratings yet

- Project Report For Printing Press MsmeDocument8 pagesProject Report For Printing Press MsmekapilNo ratings yet

- Assignment 2 2015Document2 pagesAssignment 2 2015marryam nawazNo ratings yet

- Notice Inviting E-Tender: Shimla Jal Prabandhan Nigam Limited (SJPNL)Document12 pagesNotice Inviting E-Tender: Shimla Jal Prabandhan Nigam Limited (SJPNL)9novtarunNo ratings yet

- Chemical Plant Design and Economics - R2009 - 29!05!2014Document2 pagesChemical Plant Design and Economics - R2009 - 29!05!2014rahulNo ratings yet

- Tendernotice 1Document30 pagesTendernotice 1Arindam PaulNo ratings yet

- Chemical - PVC Self Adhesive Insulation Tape PDFDocument6 pagesChemical - PVC Self Adhesive Insulation Tape PDFVivaan RadheNo ratings yet

- Obsolescence 2. Book Value 3. Depreciation 4. Depletion EtcDocument9 pagesObsolescence 2. Book Value 3. Depreciation 4. Depletion EtcKHAN AQSANo ratings yet

- Techno Economic Feasibiliy CUM Project Profile ON Computer Assembling Unit Manufacturing Unit Under P.M.E.G.PDocument7 pagesTechno Economic Feasibiliy CUM Project Profile ON Computer Assembling Unit Manufacturing Unit Under P.M.E.G.PGlobal Law FirmNo ratings yet

- TDR MinibusDocument2 pagesTDR MinibusDaynie QVNo ratings yet

- Electronic & ElectricalDocument5 pagesElectronic & ElectricalArjun GhoshNo ratings yet

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportFrom EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportNo ratings yet

- Pakistan Institute of Public Finance Accountants Summer Exam 2019Document3 pagesPakistan Institute of Public Finance Accountants Summer Exam 2019JawadNo ratings yet

- Pension OrderDocument1 pagePension OrderJawadNo ratings yet

- Winter Exam-2019 Pakistan Institute of Public Finance AccountantsDocument3 pagesWinter Exam-2019 Pakistan Institute of Public Finance AccountantsJawadNo ratings yet

- PWA Sub Appl 2015Document1 pagePWA Sub Appl 2015JawadNo ratings yet

- Winter Exam-2019 Pakistan Institute of Public Finance AccountantsDocument3 pagesWinter Exam-2019 Pakistan Institute of Public Finance AccountantsJawadNo ratings yet

- Dinner For Billy LongDocument3 pagesDinner For Billy LongSunlight FoundationNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument1 pageCertificate of Creditable Tax Withheld at SourceLolo LolaNo ratings yet

- Sample - Chapter 5 - Problem 51 (Due 10.11.20)Document2 pagesSample - Chapter 5 - Problem 51 (Due 10.11.20)Tenaj KramNo ratings yet

- serviceCustomerInvoice 1 PDFDocument1 pageserviceCustomerInvoice 1 PDFK D Sri Ram 184951No ratings yet

- Swiggy 4Document1 pageSwiggy 4Mitesh GuptaNo ratings yet

- Salary Slip ReportDocument5 pagesSalary Slip ReportAlexis DavidNo ratings yet

- ACC 317 Homework CH 21Document1 pageACC 317 Homework CH 21leelee0302No ratings yet

- RS Components PDFDocument1 pageRS Components PDFHriEngNo ratings yet

- An Overview of Financial Management Forms of Business Organization PDFDocument2 pagesAn Overview of Financial Management Forms of Business Organization PDFPhil SingletonNo ratings yet

- Subramani PayslipDocument2 pagesSubramani PayslipMr. HarshaNo ratings yet

- Deepak-Law of TaxationDocument17 pagesDeepak-Law of Taxationdeepak singhNo ratings yet

- Watcho Masti - Mar 02, 2023 - 1678783224Document1 pageWatcho Masti - Mar 02, 2023 - 1678783224Rajesh KumarNo ratings yet

- ESS WalkthroughDocument25 pagesESS WalkthroughMani Shankar RajanNo ratings yet

- Earnings Statement: Earnings Other Benefits and Information DepositsDocument1 pageEarnings Statement: Earnings Other Benefits and Information Depositshitta100% (1)

- MEPCO Online Consumer BillDocument2 pagesMEPCO Online Consumer BillDanielNo ratings yet

- PDF Test Bank For South Western Federal Taxation 2015 Individual Income Taxes 38Th Edition Online Ebook Full ChapterDocument78 pagesPDF Test Bank For South Western Federal Taxation 2015 Individual Income Taxes 38Th Edition Online Ebook Full Chapterjoseph.martinez645100% (2)

- Form No. 35 (See Rule 45)Document3 pagesForm No. 35 (See Rule 45)Savoir PenNo ratings yet

- Interest 234 ABCDocument5 pagesInterest 234 ABCJitendra VernekarNo ratings yet

- Print - H NIZAMUDDIN (NZM) - MIRAJ JN (MRJ) - 2452618700Document1 pagePrint - H NIZAMUDDIN (NZM) - MIRAJ JN (MRJ) - 2452618700Rahul BudhawaleNo ratings yet

- Income Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Document8 pagesIncome Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Jnv MANACAMP RAIPURNo ratings yet

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- Income Tax Fundamentals 2015 33rd Edition Whittenburg Test BankDocument31 pagesIncome Tax Fundamentals 2015 33rd Edition Whittenburg Test Bankrefineternpho4100% (27)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jaideep SinghNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- GST NotesDocument22 pagesGST NotesSARATH BABU.YNo ratings yet

- Wa0094 PDFDocument1 pageWa0094 PDFBalraj BawaNo ratings yet

- Pascual v. CIR, 166 SCRA 560 (1988)Document2 pagesPascual v. CIR, 166 SCRA 560 (1988)DAblue ReyNo ratings yet

- Foreign Retirement Plans Forms 3520 Forms 3520-A and Rev. Proc. 2020-17Document14 pagesForeign Retirement Plans Forms 3520 Forms 3520-A and Rev. Proc. 2020-17e1chin0No ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet