Professional Documents

Culture Documents

Advacc

Advacc

Uploaded by

Jyasmine Aura V. AgustinCopyright:

Available Formats

You might also like

- Full Download Financial Managerial Accounting 6th Edition Horngren Solutions ManualDocument35 pagesFull Download Financial Managerial Accounting 6th Edition Horngren Solutions Manualezranewood100% (31)

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Corporate LiquidationDocument1 pageCorporate Liquidationkat kaleNo ratings yet

- HHHHDocument2 pagesHHHHdean subbie0% (2)

- Transtutors005 ch11 QuestionsDocument25 pagesTranstutors005 ch11 QuestionsAstha GoplaniNo ratings yet

- Partnership Liquidation InstallmentDocument1 pagePartnership Liquidation InstallmentAkira Marantal ValdezNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- RFBT Final Preboard QuestionairesDocument18 pagesRFBT Final Preboard QuestionairesMABI ESPENIDONo ratings yet

- 02Document3 pages02Jodel Castro100% (1)

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- MASDocument2 pagesMASClarisse AlimotNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Problem: I - Statement of Affairs and Deficiency AccountDocument1 pageProblem: I - Statement of Affairs and Deficiency AccountAnn Marie GabayNo ratings yet

- Acc 310 - M004Document12 pagesAcc 310 - M004Edward Glenn BaguiNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- QZ CHPT 13 9 10 Answers OnlyDocument6 pagesQZ CHPT 13 9 10 Answers OnlyKim TranNo ratings yet

- ACCO 3026 Final ExamDocument11 pagesACCO 3026 Final ExamClarisseNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- Business Combination AssignmentDocument5 pagesBusiness Combination AssignmentBienvenido JmNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Special Transaction AssignmentDocument2 pagesSpecial Transaction Assignment수지No ratings yet

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuarteNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- Advanced Accounting Home Office, Branch and Agency TransactionsDocument7 pagesAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- Set DDocument6 pagesSet DJeremiah Navarro PilotonNo ratings yet

- Ac8dccd2 1613019594275Document7 pagesAc8dccd2 1613019594275Emey CalbayNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- 2014 3016 Midterm Departmental ExamDocument14 pages2014 3016 Midterm Departmental ExamPatrick ArazoNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- Ch19 Consolidated Fs With Minority InterestsDocument5 pagesCh19 Consolidated Fs With Minority InterestsralphalonzoNo ratings yet

- DocDocument12 pagesDocalmira garciaNo ratings yet

- Quiz 101Document1 pageQuiz 101Mohammad Lomondot AmpasoNo ratings yet

- Consignment Sales ProblemsDocument1 pageConsignment Sales ProblemsAkako MatsumotoNo ratings yet

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- Tina and KimDocument3 pagesTina and KimAngelli LamiqueNo ratings yet

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Activity 2Document3 pagesActivity 2LFGS Finals0% (1)

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaNo ratings yet

- Special Transact - Almario Quiz 1Document4 pagesSpecial Transact - Almario Quiz 1Es ToryahieeNo ratings yet

- Chapter 18 Updated SolutionDocument8 pagesChapter 18 Updated Solutionalmira garciaNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Document3 pagesYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Hartmann Annual Report 2018 PDFDocument88 pagesHartmann Annual Report 2018 PDFjuan pabloNo ratings yet

- Prosperity Weaving Mills LTDDocument3 pagesProsperity Weaving Mills LTDumer165No ratings yet

- Ifsa Chapter14Document34 pagesIfsa Chapter14Nageswara KorrakutiNo ratings yet

- BUSCOMBDocument3 pagesBUSCOMBCamila MayoNo ratings yet

- Week 3 - Principle of Accounting (LCMS)Document51 pagesWeek 3 - Principle of Accounting (LCMS)Mai NgocNo ratings yet

- White Swans - MontierDocument13 pagesWhite Swans - Montier;lkjfNo ratings yet

- MCQ - Pp&eDocument6 pagesMCQ - Pp&eEshaNo ratings yet

- 4 DP Business Combination - Acquisition DateDocument6 pages4 DP Business Combination - Acquisition DateYapi BallersNo ratings yet

- Admission of PartnersDocument30 pagesAdmission of Partnersvansh gandhiNo ratings yet

- Valuation TechniquesDocument22 pagesValuation Techniquespoisonbox100% (1)

- CA IPCC Advance Accounts Paper May 2015Document11 pagesCA IPCC Advance Accounts Paper May 2015Abhay AnandNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/33Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/33gibbamanjexNo ratings yet

- Caie A2 Level Accounting 9706 Theory v1Document12 pagesCaie A2 Level Accounting 9706 Theory v1Juveria RazaNo ratings yet

- Financial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inDocument43 pagesFinancial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inUJJWALNo ratings yet

- Corporate Financing and Valuation-1Document14 pagesCorporate Financing and Valuation-1Ashish pariharNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- Intermediate Accounting I IntangiblesDocument7 pagesIntermediate Accounting I IntangiblesGiny BenavidezNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- 2022 Iktva Guideline - Final Version 7.30.23Document41 pages2022 Iktva Guideline - Final Version 7.30.23Hassan Al EidNo ratings yet

- Long-Lived Assets: 15.511 Corporate Accounting Summer 2004 Professor SP KothariDocument24 pagesLong-Lived Assets: 15.511 Corporate Accounting Summer 2004 Professor SP KothariLu CasNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraNo ratings yet

- Assets Company Pin Book Value Debit CreditDocument5 pagesAssets Company Pin Book Value Debit CreditABDUL KHALIQ BRUTUNo ratings yet

- Chapter 12 - Test BankDocument50 pagesChapter 12 - Test Bankjdiaz_64624792% (12)

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- Swap Ratio (Or Exchange Ratio)Document2 pagesSwap Ratio (Or Exchange Ratio)Jyoti YadavNo ratings yet

- Business CombinationsDocument164 pagesBusiness CombinationsTsania FerrariniNo ratings yet

- Valuation of Bonds and Stocks ExercisesDocument8 pagesValuation of Bonds and Stocks ExercisesRoderica RegorisNo ratings yet

Advacc

Advacc

Uploaded by

Jyasmine Aura V. AgustinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advacc

Advacc

Uploaded by

Jyasmine Aura V. AgustinCopyright:

Available Formats

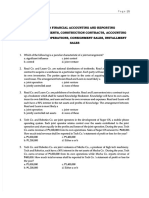

CONSOLIDATION AT THE DATE OF ACQUISITION PROBLEMS

PROBLEM I

Entity A acquired the net assets of Entity B by issuing 10,000 ordinary shares with par value of P10 and bonds payable with

face amount of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the

ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable classified as financial liability

at amortized cost are trading at 110.

Entity A paid P10,000 share issuance costs and P20.000 bond issue costs. Entity A also paid P40,000 acquisition related

costs and P30,000 indirect costs of business combination. Before the date of acquisition, Entity A and Entity B reported the

following data:

Entity A Entity B

Current assets 1,000,000 500,000

Noncurrent assets 2,000,000 1,000,000

Current liabilities 200,000 400,000

Noncurrent liabilities 300,000 500,000

Ordinary shares 500,000 200,000

Share premium 1,200,000 300,000

Retained earnings 800,000 100,000

At the time of acquisition, the current assets of Entity A have fair value of P1,200,000 while the noncurrent assets of Entity

B have fair value of P1,300,000. On the same date, the current liabilities of Entity B have fair value of P600,000 while the

noncurrent liabilities of Entity A have fair value of P500,000.

1. What is the goodwill or gain on bargain purchase arising from business combination?

2. What total amount should be expensed as incurred at the time of business combination?

3. What is Entity A's amount of total assets after the business combination?

4. What is Entity A's amount of total liabilities after the business combination?

PROBLEM II

On January 1, 2019, JANUS Company purchased the net assets of Francis Company (excluding cash) by paying P850,000

cash and issuing shares 180,000 shares with par of P16 of stocks at P3,110,000 fair market value. Book value and fair value

data on the Statement of Financial Position on January 1, 2019 are as follows:

JANUS Company Francis Company

Book Value Fair Value Book Value Fair Value

Cash 4,600,000 4,600,000 300,000 300,000

Accounts Rec. 1,000,000 1,000,000 980,000 980,000

Inventory 1,500,000 1,300,000 710,000 600,000

Building & Eqpt. 1,800,000 1,460,000 1,520,000 1,064,000

Goodwill 90,000 80,000

Total 8,900,000 8,360,000 3,600,000 3,024,000

Liabilities 1,000,000 1,000,000 570,000 570,000

Share Capital 1,600,000 600,000

Share Premium 900,000 960,000

Retained Earnings 5,400,000 1,470,000

Total 8,900,000 3,600,000

JANUS incurred and paid legal fees and brokerage fees of P25,600 for business combination; share issue costs of P23,000

and P12,000 indirect costs. It is determinable that contingency fee of P118,000 would be paid within the year. JANUS

Company is classified as SME.

1. The goodwill arising from business combination is

2. The total assets after the business combination is

3. The total shareholders’ equity after the business combination is

PROBLEM III

On January 2, 2020, the Balance Sheet of JAA Company and SG Company immediately before the combination are:

JAA SG

Cash 2,700,000 90,000

Inventories 1,800,000 180,000

Property & Equipment 4,500,000 630,000

Total Assets 9,000,000 900,000

Current Liabilities 540,000 90,000

Ordinary shares 900,000 90,000

Share premium 2,700,000 180,000

Retained Earnings 4,860,000 540,000

Total Liabilities & Equity 9,000,000 900,000

1. JAA acquired 80% of the outstanding shares of SG Company, how much is the consolidated shareholders’ equity?

PROBLEM IV

Lexi Company’s stockholders’ equity as of December 31, 2019 is P7,308,000. On January 1, 2020, Lexi acquires 30% of

Rome Company’s ordinary shares for P540,000 cash and by issuing its own shares with a fair value of P1,350,000. Clark

acquired significant influence over Rome as a result of stock acquisition. After four months, Lexi purchases another 60% of

Rome’s ordinary shares for a cash payment of P3,942,000. On this date, Rome reports identifiable net assets with carrying

value of P6,480,000 and fair value of P11,520,000 and it has liabilities with a book value and fair value of P3,240,000.

At the acquisition date, net loss reported by Rome for the four-month ended amounted to P900,000. The fair value of the

10% non-controlling interest is P1,296,000. Non-controlling interest is valued using the proportionate basis. Lexi also paid

the following: P90,000 for legal fees, P72,000 for finder’s fees, P77,400 for accountant’s fees, P64,800 for audit fee and

P19,800 for printing of stock certificates.

1. Immediately after the business combination, how much is the consolidated total equity?

You might also like

- Full Download Financial Managerial Accounting 6th Edition Horngren Solutions ManualDocument35 pagesFull Download Financial Managerial Accounting 6th Edition Horngren Solutions Manualezranewood100% (31)

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Corporate LiquidationDocument1 pageCorporate Liquidationkat kaleNo ratings yet

- HHHHDocument2 pagesHHHHdean subbie0% (2)

- Transtutors005 ch11 QuestionsDocument25 pagesTranstutors005 ch11 QuestionsAstha GoplaniNo ratings yet

- Partnership Liquidation InstallmentDocument1 pagePartnership Liquidation InstallmentAkira Marantal ValdezNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- RFBT Final Preboard QuestionairesDocument18 pagesRFBT Final Preboard QuestionairesMABI ESPENIDONo ratings yet

- 02Document3 pages02Jodel Castro100% (1)

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- MASDocument2 pagesMASClarisse AlimotNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Problem: I - Statement of Affairs and Deficiency AccountDocument1 pageProblem: I - Statement of Affairs and Deficiency AccountAnn Marie GabayNo ratings yet

- Acc 310 - M004Document12 pagesAcc 310 - M004Edward Glenn BaguiNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- QZ CHPT 13 9 10 Answers OnlyDocument6 pagesQZ CHPT 13 9 10 Answers OnlyKim TranNo ratings yet

- ACCO 3026 Final ExamDocument11 pagesACCO 3026 Final ExamClarisseNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- Business Combination AssignmentDocument5 pagesBusiness Combination AssignmentBienvenido JmNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Special Transaction AssignmentDocument2 pagesSpecial Transaction Assignment수지No ratings yet

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuarteNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- Advanced Accounting Home Office, Branch and Agency TransactionsDocument7 pagesAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- Set DDocument6 pagesSet DJeremiah Navarro PilotonNo ratings yet

- Ac8dccd2 1613019594275Document7 pagesAc8dccd2 1613019594275Emey CalbayNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- 2014 3016 Midterm Departmental ExamDocument14 pages2014 3016 Midterm Departmental ExamPatrick ArazoNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- Ch19 Consolidated Fs With Minority InterestsDocument5 pagesCh19 Consolidated Fs With Minority InterestsralphalonzoNo ratings yet

- DocDocument12 pagesDocalmira garciaNo ratings yet

- Quiz 101Document1 pageQuiz 101Mohammad Lomondot AmpasoNo ratings yet

- Consignment Sales ProblemsDocument1 pageConsignment Sales ProblemsAkako MatsumotoNo ratings yet

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- Tina and KimDocument3 pagesTina and KimAngelli LamiqueNo ratings yet

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Activity 2Document3 pagesActivity 2LFGS Finals0% (1)

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Quiz Recl FinancingDocument1 pageQuiz Recl FinancingLou Brad IgnacioNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2Steph BorinagaNo ratings yet

- Special Transact - Almario Quiz 1Document4 pagesSpecial Transact - Almario Quiz 1Es ToryahieeNo ratings yet

- Chapter 18 Updated SolutionDocument8 pagesChapter 18 Updated Solutionalmira garciaNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Document3 pagesYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Hartmann Annual Report 2018 PDFDocument88 pagesHartmann Annual Report 2018 PDFjuan pabloNo ratings yet

- Prosperity Weaving Mills LTDDocument3 pagesProsperity Weaving Mills LTDumer165No ratings yet

- Ifsa Chapter14Document34 pagesIfsa Chapter14Nageswara KorrakutiNo ratings yet

- BUSCOMBDocument3 pagesBUSCOMBCamila MayoNo ratings yet

- Week 3 - Principle of Accounting (LCMS)Document51 pagesWeek 3 - Principle of Accounting (LCMS)Mai NgocNo ratings yet

- White Swans - MontierDocument13 pagesWhite Swans - Montier;lkjfNo ratings yet

- MCQ - Pp&eDocument6 pagesMCQ - Pp&eEshaNo ratings yet

- 4 DP Business Combination - Acquisition DateDocument6 pages4 DP Business Combination - Acquisition DateYapi BallersNo ratings yet

- Admission of PartnersDocument30 pagesAdmission of Partnersvansh gandhiNo ratings yet

- Valuation TechniquesDocument22 pagesValuation Techniquespoisonbox100% (1)

- CA IPCC Advance Accounts Paper May 2015Document11 pagesCA IPCC Advance Accounts Paper May 2015Abhay AnandNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/33Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/33gibbamanjexNo ratings yet

- Caie A2 Level Accounting 9706 Theory v1Document12 pagesCaie A2 Level Accounting 9706 Theory v1Juveria RazaNo ratings yet

- Financial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inDocument43 pagesFinancial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inUJJWALNo ratings yet

- Corporate Financing and Valuation-1Document14 pagesCorporate Financing and Valuation-1Ashish pariharNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- Intermediate Accounting I IntangiblesDocument7 pagesIntermediate Accounting I IntangiblesGiny BenavidezNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- 2022 Iktva Guideline - Final Version 7.30.23Document41 pages2022 Iktva Guideline - Final Version 7.30.23Hassan Al EidNo ratings yet

- Long-Lived Assets: 15.511 Corporate Accounting Summer 2004 Professor SP KothariDocument24 pagesLong-Lived Assets: 15.511 Corporate Accounting Summer 2004 Professor SP KothariLu CasNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraNo ratings yet

- Assets Company Pin Book Value Debit CreditDocument5 pagesAssets Company Pin Book Value Debit CreditABDUL KHALIQ BRUTUNo ratings yet

- Chapter 12 - Test BankDocument50 pagesChapter 12 - Test Bankjdiaz_64624792% (12)

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- Swap Ratio (Or Exchange Ratio)Document2 pagesSwap Ratio (Or Exchange Ratio)Jyoti YadavNo ratings yet

- Business CombinationsDocument164 pagesBusiness CombinationsTsania FerrariniNo ratings yet

- Valuation of Bonds and Stocks ExercisesDocument8 pagesValuation of Bonds and Stocks ExercisesRoderica RegorisNo ratings yet