Professional Documents

Culture Documents

Income Tax Reviewer

Income Tax Reviewer

Uploaded by

Krizah Marie CaballeroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Reviewer

Income Tax Reviewer

Uploaded by

Krizah Marie CaballeroCopyright:

Available Formats

INCOME TAX (part2) Taxation power can be used as an instrument of

police power. It can be used to discourage or

by: Sir Rene Jayme

prohibit undesirable activities or occupation.

General Principles of Individual Taxation

2. Holme's Doctrine

a. A citizen of the Philippines residing therein is

"Taxation power is not the power to destroy while

taxable on all income derived from sources within

the court sits."

and without the Philippines;

Taxation power may be used to build or encourage

b. A non-resident citizen is taxable only on income

beneficial activities or industries by the grant of tax

derived from sources within the Philippines

incentives.

c. An individual citizen who is working and deriving

3. Prospectivity of tax laws

income abroad as an OFW is taxable only on

Tax laws are generally prospective in operation. An

income from sources within the Philippines

ex post facto law or a law that retroacts is

provided, that the OFW, who is a citizen of the

prohibited by the Constitution.

Philippines and who receives compensation for

Exceptionally, income tax laws may operate

services rendered abroad as a member of the

retrospectively if intended by the Congress under

complement vessel engaged exclusively in

certain justifiable conditions.

international trade shall be treated as an OFW.

4. Non-compensation or set-off

d. An alien individual, whether a resident or not of

Taxes are not subject to automatic set-off or

the Philippines, is taxable only on income derived

compensation. The taxpayer cannot delay payment

from sources within the Philippines.

of tax to wait for the resolution of a lawsuit involving

his pending claim against the government.

Situs of Taxation

Tax is not a debt; hence, it is not subject to set-off.

Situs is the place of taxation. It is the tax jurisdiction

Exceptions:

that has the power to levy taxes upon the tax

a. Where the taxpayer's claim has already become

object. Situs rules serve as the frames of reference

due and demandable such as when the

in gauging whether the tax object is within or

government already recognized the same and an

outside the tax jurisdiction of the taxing authority.

appropriation for refund was made

Examples of Situs Rules

b. Cases of obvious overpayment of taxes

Business Tax Situs

c. Local taxes

Businesses are subject to tax in the place where

5. Non-assignment of taxes

the business is conducted.

Tax obligations cannot be assigned or transferred

Income Tax Situs on Services

to another entity by contract. Contracts executed by

Service fees are subject to tax where they are

the taxpayer to such effect shall not prejudice the

rendered.

right of the government to collect.

Income Tax Situs on Sale of Good

6. Imprescriptibility in Taxation

The gain of sale is subject to tax in the place of

Prescription is the lapsing of the right due to

sale.

passage of time. When one sleep on his right over

Property Tax Situs

an unreasonable period of time, he is presumed to

Properties are taxable in their location.

be waiving his right. The government's right to

Personal Tax Situs

collect taxes does not prescribe unless the law

Persons are taxable in their place of residence.

itself provides for such prescription.

7. Doctrine of Estoppel

Other Fundamental Doctrines in Taxation

Under the doctrine of estoppel, any

1. Marshall Doctrine

misrepresentation made by one party toward

"The power to tax involves the power to destroy"

another who relied therein in good faith will be held

true and binding against that person who made the foreign taxpayer also gives the same treatment to

misrepresentation. Filipino non-residents therein.

8. Judicial Non-interference d. Entering into treaties or bilateral agreements

Generally, courts are not allowed to issue injunction countries may stipulate for a lower tax-rates for

against the government's pursuit to collect tax as their residents if they engage in transactions that

this would unnecessarily defer tax collection. This are taxable by both of them

rule is anchored on the Lifeblood Doctrine. Escapes from Taxation

9. Strict Construction of Tax Laws Escapes from taxation are the means available to

When the law clearly provides for taxation, taxation the taxpayer to limit or even avoid the impact of

is the general rule unless there is a clear taxation.

exemption. Hence the maxim, "Taxation is the rule,

exemption is the exception." Categories of Escapes from Taxation

A. Those that result to loss of government revenue

Double Taxation -Tax Evasion, also known as tax dodging, refers to

Double taxation occurs when the same taxpayer is any act or trick that tends to illegally reduce or

taxed twice by the same tax jurisdiction for the avoid the payment of tax.

same thing. -Tax avoidance, also known as tax minimization,

Elements of Double Taxation refers to any act or trick that reduces or totally

Primary Element: Same object escapes taxes by any legally permissible means.

Secondary Elements: -Tax exemption, also known as tax holiday, refers

Same type of tax to the immunity, privilege or freedom from being

Same purpose of tax subject to a-tax which others are subject to. Tax

Same taxing jurisdiction exemptions may be granted by the Constitution,

Same tax period law, or contract.

Types of Double Taxation B. Those that do not result to loss of government

1. Direct Double Taxation. This occurs when all the revenue

elements of double taxation exist for both SHIFTING. This is the process of transferring tax

impositions. burden to other taxpayers.

2. Indirect Double Taxation. This occurs when at FORMS OF SHIFTING

least one of the secondary elements of double Forward Shifting. This is the shifting of tax which

taxation is not common for both impositions. follows the normal flow of distribution. It is common

How can double taxation be minimized? with essential commodities and services such as

a. Provision of tax exemption food and fuel.

only one tax law is allowed to be applied to the tax Backward Shifting. This is common with non-

object while the other tax law exempts the same tax essential commodities where buyers have

object considerable market power and commodities with

b. Allowing foreign tax credit numerous substitute products.

both tax laws of the domestic country and a foreign Onward Shifting. Refers to any tax shifting in the

country tax the tax object, but the tax payments distribution channel that exhibits forward or

made in the foreign tax law are deductible against backward shifting.

the tax due of the domestic tax law.

c. Allowing reciprocal tax treatment

provisions in tax laws imposing a reduced tax rates

or even tax or even exemption if the country of the

CAPITALIZATION. This pertains to the adjustment

of the value of an asset caused by changes in tax

rates.

TRANSFORMATION - This pertains to the

elimination of wastes or losses by the taxpayer to

form savings to compensate for the tax imposition

or increase in taxes.

Tax Amnesty

• Amnesty is a general pardon granted by the

government for erring taxpayers to give

them a chance to reform and enable them

to have a fresh start to be part of a society

with a clean slate.

Tax Condonation

• Tax condonation is forgiveness of the tax

obligation of a certain taxpayer under

certain justifiable grounds. This is also

referred to as tax remission.

Tax Amnesty vs. Tax Condonation

• Amnesty covers both civil and criminal

liabilities, but condonation covers only civil

liabilities of the taxpayer.

• Amnesty operates retrospectively by

forgiving past violations. Condonation

applies prospectively to any unpaid balance

of the tax; hence, the portion already paid

by the taxpayer will not be refunded.

• Amnesty is also conditional upon the

taxpayer paying the government a portion of

the tax whereas condonation requires no

payment.

• Amnesty covers both civil and criminal

liabilities, but condonation covers only civil

liabilities of the taxpayer.

• Amnesty operates retrospectively by

forgiving past violations. Condonation

applies prospectively to any unpaid balance

of the tax; hence, the portion already paid

by the taxpayer will not be refunded.

• Amnesty is also conditional upon the

taxpayer paying the government a portion of

the tax whereas condonation requires no

payment.

You might also like

- Offer LetterDocument3 pagesOffer LetterAditya GadgilNo ratings yet

- ReceiptDocument27 pagesReceiptnowana.0077100% (1)

- Sunway T1 (TX4014) - Business IncomeDocument4 pagesSunway T1 (TX4014) - Business IncomeEe LynnNo ratings yet

- Situs of TaxationDocument18 pagesSitus of Taxationgerlyn montilla50% (2)

- The Equity Implications of Taxation: Tax IncidenceDocument36 pagesThe Equity Implications of Taxation: Tax IncidenceSatria Hadi LubisNo ratings yet

- Self-Employment Information Sheet: State of Utah Department of Workforce ServicesDocument3 pagesSelf-Employment Information Sheet: State of Utah Department of Workforce ServicesJon SmithNo ratings yet

- Income TaxationDocument12 pagesIncome TaxationPeralta Renn JethroNo ratings yet

- 2019 Taxation Law Last Minute Tips PDFDocument11 pages2019 Taxation Law Last Minute Tips PDFz v100% (1)

- Chapter 1 NotesDocument12 pagesChapter 1 NotesGerald Nitz PonceNo ratings yet

- Reviewer TaxationDocument8 pagesReviewer TaxationJeffReyesAgasNo ratings yet

- Econ Jahsmen FinalDocument4 pagesEcon Jahsmen FinalJahsmen NavarroNo ratings yet

- Tax DoctrinesDocument8 pagesTax DoctrinesLouNo ratings yet

- Untitled Document-1Document3 pagesUntitled Document-1Shan Sai BuladoNo ratings yet

- M2 - Taxes, Tax Laws and Tax AdministrationDocument31 pagesM2 - Taxes, Tax Laws and Tax AdministrationTERRIUS AceNo ratings yet

- Penalty TAX: Ax Distinguished From Other ChargesDocument4 pagesPenalty TAX: Ax Distinguished From Other Chargesmaria cruzNo ratings yet

- Taxation ReviewerDocument8 pagesTaxation ReviewerDaphne FerciaNo ratings yet

- Chapter 1 - Income TaxationDocument7 pagesChapter 1 - Income Taxation21-51354No ratings yet

- BSA Assignment AnswerDocument7 pagesBSA Assignment AnswerjayNo ratings yet

- Income Taxation PrelimDocument7 pagesIncome Taxation PrelimJanella KeizyNo ratings yet

- Juicy Notes (2011)Document89 pagesJuicy Notes (2011)Edmart VicedoNo ratings yet

- PLS TAX Review Midterm ExamDocument72 pagesPLS TAX Review Midterm ExamKim OngNo ratings yet

- Taxation Chap 1Document16 pagesTaxation Chap 1Merylle Shayne GustiloNo ratings yet

- Taxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDocument2 pagesTaxation - Defined As A State Power, Legislative: Theory of Taxation - The GovernmentsDeyNo ratings yet

- Income Taxation Chapter 1 3Document65 pagesIncome Taxation Chapter 1 3Abegail Joy CabalfinNo ratings yet

- 6 TaxationDocument10 pages6 TaxationrecordedvideolecturesforacadsNo ratings yet

- FYCE BM1804 - Income Taxation HandoutDocument17 pagesFYCE BM1804 - Income Taxation HandoutLisanna DragneelNo ratings yet

- Taxation I Atty. Francisco Gonzalez General Principles of TaxationDocument45 pagesTaxation I Atty. Francisco Gonzalez General Principles of TaxationBea Czarina NavarroNo ratings yet

- Tax 003 - Module 1 - 4Document28 pagesTax 003 - Module 1 - 4Lian MaragayNo ratings yet

- Tax Law LMT Aquila Legis FraternityDocument17 pagesTax Law LMT Aquila Legis FraternityWilbert ChongNo ratings yet

- 2 General Principles of Income TaxationDocument9 pages2 General Principles of Income TaxationDenise ZurbanoNo ratings yet

- Tax 1 PDFDocument12 pagesTax 1 PDFhotgirlsummerNo ratings yet

- Taxation Law Reviewer - SyllabusDocument15 pagesTaxation Law Reviewer - Syllabusadonismiller03No ratings yet

- TAXATIONDocument5 pagesTAXATIONChristel EstabayaNo ratings yet

- AMBOL-TR Assignment 1Document8 pagesAMBOL-TR Assignment 1Cetacean HumpbackNo ratings yet

- Tax Cases FinalDocument10 pagesTax Cases FinalBINAYAO NAIZA MAENo ratings yet

- Bar Q&A Taxation-Volume 1: General Principles of Taxation Abelardo T. DomondonDocument17 pagesBar Q&A Taxation-Volume 1: General Principles of Taxation Abelardo T. DomondonFrance SanchezNo ratings yet

- Notes1 - Basic Concepts and Principles in TaxationDocument3 pagesNotes1 - Basic Concepts and Principles in TaxationCenelyn PajarillaNo ratings yet

- Feb 17, 2024 - Notes of BepitelDocument11 pagesFeb 17, 2024 - Notes of BepitelbepitelbreylleNo ratings yet

- Taxation Law Pages 1-3Document3 pagesTaxation Law Pages 1-3Tey TorrenteNo ratings yet

- Principles of TaxDocument46 pagesPrinciples of TaxPASCUA, ROWENA V.No ratings yet

- Income Taxation Quick NotesDocument3 pagesIncome Taxation Quick NotesKathNo ratings yet

- Tax Research Basic NotesDocument8 pagesTax Research Basic NotesMark EdisonNo ratings yet

- TaxDocument4 pagesTaxKatrina PaquizNo ratings yet

- O Taxation: The Power by Which The Sovereign Raises Revenue To Defray The Necessary Expenses of TheDocument19 pagesO Taxation: The Power by Which The Sovereign Raises Revenue To Defray The Necessary Expenses of Theniani marieNo ratings yet

- Module 5 TaxationDocument3 pagesModule 5 Taxationking diyawNo ratings yet

- TaxationDocument2 pagesTaxationRina Bico AdvinculaNo ratings yet

- Tax 1Document4 pagesTax 1Nicole Anne M. ManansalaNo ratings yet

- Power of TaxationDocument7 pagesPower of Taxationlei ann venturaNo ratings yet

- EcoTax Finals ReportingDocument6 pagesEcoTax Finals Reportingmau mauNo ratings yet

- Chapter 2 Taxes, Tax Laws and Tax AdministrationDocument7 pagesChapter 2 Taxes, Tax Laws and Tax AdministrationElisa Jane AbellaNo ratings yet

- Taxation+I+General+Principles+Reviewer+for+Atty +monteroDocument27 pagesTaxation+I+General+Principles+Reviewer+for+Atty +monteroMars SacdalanNo ratings yet

- Tax 3 Midterm ReviewerDocument6 pagesTax 3 Midterm ReviewerLustrous VisionsNo ratings yet

- 2 - Limitations of Taxing PowerDocument7 pages2 - Limitations of Taxing PowerAllan SantosNo ratings yet

- DraftDocument6 pagesDraftJudy Ann AdanteNo ratings yet

- General Principles of TaxationDocument59 pagesGeneral Principles of TaxationKing Nufayl SendadNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesMa. Valerie LabareñoNo ratings yet

- Income TaxDocument9 pagesIncome TaxRhea MendozaNo ratings yet

- Fundamental Principles OF Taxation: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantDocument19 pagesFundamental Principles OF Taxation: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantKristine Aubrey AlvarezNo ratings yet

- Module-02-Taxes, Laws, Systems and AdministrationDocument8 pagesModule-02-Taxes, Laws, Systems and AdministrationElle LegaspiNo ratings yet

- Taxes Are Enforced Proportional Contributions From Persons andDocument5 pagesTaxes Are Enforced Proportional Contributions From Persons andNate AlfaroNo ratings yet

- Inctax NoteDocument10 pagesInctax NoteJOVIE KATE MARIE MOLINANo ratings yet

- Exercises On General Principles of TaxationDocument9 pagesExercises On General Principles of TaxationMicah Amethyst TaguibaoNo ratings yet

- Limitations On The Exercise of Taxing PowerDocument63 pagesLimitations On The Exercise of Taxing PowerAngeliqueGiselleCNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Quiz 6Document3 pagesQuiz 6Krizah Marie CaballeroNo ratings yet

- Group 1 Create LawDocument38 pagesGroup 1 Create LawKrizah Marie CaballeroNo ratings yet

- 03 Cost BehaviorDocument71 pages03 Cost BehaviorKrizah Marie CaballeroNo ratings yet

- Actgia3 Course-OutlineDocument2 pagesActgia3 Course-OutlineKrizah Marie CaballeroNo ratings yet

- Actgia3 Ch02 Statement of Financial PositionDocument68 pagesActgia3 Ch02 Statement of Financial PositionKrizah Marie CaballeroNo ratings yet

- Actgnp Rev.Document11 pagesActgnp Rev.Krizah Marie CaballeroNo ratings yet

- Cost Accounting CHP 2 5Document30 pagesCost Accounting CHP 2 5Krizah Marie CaballeroNo ratings yet

- Students Carousel 2nd Sem 2021 2022Document20 pagesStudents Carousel 2nd Sem 2021 2022Krizah Marie CaballeroNo ratings yet

- Review Question 1Document8 pagesReview Question 1Krizah Marie CaballeroNo ratings yet

- Problem 3 6Document6 pagesProblem 3 6Krizah Marie CaballeroNo ratings yet

- Balongis Taxable de Minimis BenefitsDocument3 pagesBalongis Taxable de Minimis BenefitsKrizah Marie CaballeroNo ratings yet

- Tax Declaration RPT PDFDocument1 pageTax Declaration RPT PDFEder Epi100% (1)

- China Banking Corporation Vs Commissioner of Internal RevenueDocument6 pagesChina Banking Corporation Vs Commissioner of Internal Revenuemarc bantugNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- TDON1Document2 pagesTDON1Fevzi OzdemirNo ratings yet

- Commissioner of Internal Revenue v. Dash Engineering Philippines, Inc.Document3 pagesCommissioner of Internal Revenue v. Dash Engineering Philippines, Inc.Rap PatajoNo ratings yet

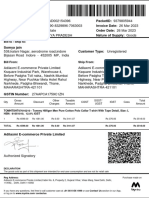

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hemant SahuNo ratings yet

- VAT Booklet F.Y.2012-13Document20 pagesVAT Booklet F.Y.2012-13ankur2706No ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- 1416191299950-01 1709962772 Mjoyo4oy6pDocument1 page1416191299950-01 1709962772 Mjoyo4oy6pchoudharyibrazNo ratings yet

- AC 3101 CHAPTER 10 NotesDocument2 pagesAC 3101 CHAPTER 10 NotesKemuel TantuanNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRitik MaheshwariNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raghu1234No ratings yet

- Payment Registration SlipDocument1 pagePayment Registration SlipFabol ZahirNo ratings yet

- Marvelous Music Provides Music Lessons To Student Musicians Some StudentsDocument2 pagesMarvelous Music Provides Music Lessons To Student Musicians Some Studentstrilocksp Singh0% (2)

- FA3Document13 pagesFA3JH Hương TrangNo ratings yet

- 2017 Budget CritiqueDocument3 pages2017 Budget CritiqueCouncilman Judd KrasherNo ratings yet

- Introduction To GSTDocument22 pagesIntroduction To GSTSowmya KRNo ratings yet

- 2020 2307Document15 pages2020 2307Pajarillo Kathy AnnNo ratings yet

- Atal Pension Yojana Subscriber FormDocument1 pageAtal Pension Yojana Subscriber FormTarsem SoniNo ratings yet

- 305 FinalDocument33 pages305 FinalsmithteeNo ratings yet

- Specimen of Indemnity BondDocument3 pagesSpecimen of Indemnity BondRahul Kumar100% (1)

- Value Added Tax FvatDocument10 pagesValue Added Tax FvatwellawalalasithNo ratings yet

- Tax Planning.: Dhruv Desai. Shriyans JainDocument13 pagesTax Planning.: Dhruv Desai. Shriyans JainShreyans JainNo ratings yet

- Onex I 230956Document2 pagesOnex I 230956chunduharikrishnaNo ratings yet

- 5 CIR Vs GoodyearDocument2 pages5 CIR Vs GoodyearNaomiJean InotNo ratings yet