Professional Documents

Culture Documents

Answer: 5,280

Answer: 5,280

Uploaded by

Winoah HubaldeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer: 5,280

Answer: 5,280

Uploaded by

Winoah HubaldeCopyright:

Available Formats

1.

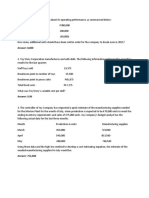

Charlie Corporation's records for the year 200B show the following data:

Net Sales (6,000 units) - P21,000

Cost of goods manufactured (7,000 units):

Variable - 9,450

Fixed - 4,725

Operating expenses

Variable - 1,470

Fixed - 2,100

There was no finished goods inventory at the beginning of the period. Neither was there any work-in-

process inventory at the beginning and end of the year.

Charlie Corporation's operating figures during the year under absorption costing were:

Answer: 5,280

2.The owners of Kelsey's Daily Mart have been looking for ways to improve sales at the store. One of the

proposals is to have a weekly raffle with a total prize of P10,000 per week. For every P50 worth of goods

purchased, the customer shall receive a numbered ticket for the raffle. The variable cost to print and

distribute the tickets has been estimated at five pesos (P5.00). Promotions and other fixed costs in

connection with the raffle, likewise, have been estimated at P15,000 per week. The current weekly

operating results of Kelsey are given below:

Sales - P1,000,000

Variable costs - 700,000

Fixed cost for the week - 120,000

Question: What is the sales revenue required to break-even with the raffle?

Answer: 725,000

3. Garcia Corporation has the following budget estimate for the year 2020:

Sales - P2,800,000

Income before tax - 10% of sales

Selling and administrative expenses - 25% of sales

Conversion cost - 70% of total manufacturing cost

Inventories are budgeted as follows:

Beginning Ending

Materials P176,000 P216,000

Work-in-process 200,000 240,000

Finished goods 280,000 336,000

The budgeted cost of goods sold is:

Answer: 1,820,000

4. The following is a summarized income statement of Carr Company's profit center No. 20 for March of

2019:

Contribution margin - P70,000

Period expenses:

Manager's salary - P20,000

Facility depreciation - 8,000

Corporate expense allocation - 5,000

Total period expenses - 33,000

Segment's profit - P37,000

What amount is most likely subject to the control of the profit of center's manager for the period?

Answer:70,000

5. The Sampaguita Steam Laundry bought a laundry truck that can be used for 5 years. The cost of the

truck is P225,000 with a salvage value of P35,000. Since the truck is not working efficiently,

management has thought of selling the truck immediately and buy a delivery wagon which will serve the

company’s purposes more properly. The estimated net returns of the truck for 5 years is P150,000. If

the truck is sold, management can only recover P175,000. (In all calculations, use the straight line

method of depreciation)

If the firm decides to keep the truck, the net gain (loss) over the 5-year period is: (If the your answer is a

loss, please put (-) before the numerical figure)

Answer: -40,000

6. Efren Corporation uses Part BIX in the assembly of a major product line. The cost to produce one BIX

is presented below:

Direct materials - P4,000

Material handling (20% of direct materials) - 800

Direct labor - 32,000

Overhead - 48,000

Total manufacturing costs - 84,800

Materials handling which is not included in manufacturing overhead represents the direct variable costs

of the receiving department that are applied to direct materials and purchased component on the basis

of their cost. The company's annual overhead budget is one-third variable and two-third fixed. Ten units

of BIX are expected to be required for one month. Zim Company offers to supply BIX at a unit prcie of

P60,000.

If product BIX is purchased from Zim, the released facilities would be used to product product CZX and

generate a profit of P208,000.

The net opportunity cost of the better alternative, make or buy is:

Answer: 16,000

7. The folk Company is planning to purchase a new machine, which it will depreciate on a straight-line

basis over a ten-year period with no salvage value and a full year's depreciation in the year of

acquisition. The new machine is expected to produce cash flow from operations, net of income taxes, of

P66,000 a year in each of the next ten years. The accounting (book value) rate of return on the initial

investment is expected to be at 12%. How much will the new machine cost?

Answer:300,000

8. Boy Casual Wear has P75,000 in a bank as of December 31, 2017. If the company plans on depositing

P4,000 in the account at the end of each of the next three years (2018, 2019 and 2020) and all amounts

in the account balance earn 8% per year, what will the account balance be at December 31, 2020?

Ignore the effect of income taxes.

8% Interest Rate Factors

Period Future Value of P1 Future value of an annuity of P1

1 1.08 1.00

2 1.17 2.08

3 1.26 3.25

4 1.36 4.51

Answer: 107,500

You might also like

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- Budgeting ExercisesDocument3 pagesBudgeting ExercisesMaan Caboles100% (1)

- Exam 7Document15 pagesExam 7mohit verrmaNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- A7 Topic 10 - Gross Profit Variance AnalysisDocument1 pageA7 Topic 10 - Gross Profit Variance AnalysisAnna CharlotteNo ratings yet

- Quiz 18: Use The Following Information For Questions 3 To 5Document4 pagesQuiz 18: Use The Following Information For Questions 3 To 5CrisNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisJackielou BasaNo ratings yet

- Reviewer in CVP AnalysisDocument5 pagesReviewer in CVP AnalysisIts meh SushiNo ratings yet

- Shareholders' Equity - ExercisesDocument5 pagesShareholders' Equity - Exercisesjooo0% (1)

- The FIDIC 1999 Forms of ContractDocument5 pagesThe FIDIC 1999 Forms of ContractAZNo ratings yet

- Att 1 GHJDocument1 pageAtt 1 GHJ牟鲜旺100% (2)

- Star Rate Breakdown of Mep ItemsDocument2 pagesStar Rate Breakdown of Mep ItemsAbdul Rahman Sabra100% (2)

- Installment Sales OldDocument3 pagesInstallment Sales OldThea Grace Bianan0% (1)

- 06 Standard Costing KEYDocument13 pages06 Standard Costing KEYKlasz Klasz100% (1)

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Desired Income (Step Costs)Document2 pagesDesired Income (Step Costs)Ann louNo ratings yet

- First Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)Document18 pagesFirst Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)LJBernardoNo ratings yet

- Answer Selected Answer: Correct Answer: Response Feedback:: Second Quarter IsDocument11 pagesAnswer Selected Answer: Correct Answer: Response Feedback:: Second Quarter IsKim FloresNo ratings yet

- Exercises Calculating Present Values (Answers) - A2C Intacc2ADocument4 pagesExercises Calculating Present Values (Answers) - A2C Intacc2ACris Ann Marie ESPAnOLANo ratings yet

- 2009-09-06 125024 MmmmekaDocument24 pages2009-09-06 125024 MmmmekathenikkitrNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Solutions:: Problem 2Document2 pagesSolutions:: Problem 2AlexNo ratings yet

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesDocument2 pagesThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaNo ratings yet

- MAS 1 1st Long QuizDocument6 pagesMAS 1 1st Long QuizHanna Lyn BaliscoNo ratings yet

- 2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)Document2 pages2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)max pNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- BA 115 - Master Budgeting ExercisesDocument2 pagesBA 115 - Master Budgeting ExercisesLance EstopenNo ratings yet

- ULOd ANSWER KEYDocument2 pagesULOd ANSWER KEYzee abadillaNo ratings yet

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Intermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)Document5 pagesIntermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)happy240823100% (1)

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Week 6 Basic Earnings Per ShareDocument4 pagesWeek 6 Basic Earnings Per SharePearlle Ivana TavarroNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- StratCost CVP 1Document65 pagesStratCost CVP 1Vrix Ace MangilitNo ratings yet

- Answers - Chapter 5 Vol 2Document5 pagesAnswers - Chapter 5 Vol 2jamfloxNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- Advance Accounting - LUPISAN-CHAPTER 3 PDFDocument25 pagesAdvance Accounting - LUPISAN-CHAPTER 3 PDFATLASNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Document7 pagesRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNo ratings yet

- Answer - ELEC 001Document2 pagesAnswer - ELEC 001Kris Van HalenNo ratings yet

- SpoilageDocument17 pagesSpoilageBhawin DondaNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- Temporarily Shut Down Operations or ContinueDocument2 pagesTemporarily Shut Down Operations or ContinueAira Jaimee GonzalesNo ratings yet

- DeductionsDocument10 pagesDeductionsceline marasiganNo ratings yet

- Assignment - VAT and Exemptions From VAT - AnswersDocument3 pagesAssignment - VAT and Exemptions From VAT - AnswersMark Paul RamosNo ratings yet

- Ronquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodDocument9 pagesRonquillo, Ramainne Chalsea L. - Sec1 - Assignment-MethodRamainne RonquilloNo ratings yet

- Chapter 1: IntroductionDocument143 pagesChapter 1: IntroductionmarieieiemNo ratings yet

- Assignment 4 - CVPDocument12 pagesAssignment 4 - CVPAlyssa BasilioNo ratings yet

- ch3 PDFDocument49 pagesch3 PDFMekanchha Dhakal100% (2)

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- Chapter 11 - Fringe Benefits PDFDocument12 pagesChapter 11 - Fringe Benefits PDFJohn RavenNo ratings yet

- Answer: Difficulty: Objective: Terms To Learn: Internal Rate-Of-Return (IRR) Method, Required Rate of Return (RRR)Document7 pagesAnswer: Difficulty: Objective: Terms To Learn: Internal Rate-Of-Return (IRR) Method, Required Rate of Return (RRR)Maha HamdyNo ratings yet

- Business Finance Activity.: Problem 2: 1 3Document3 pagesBusiness Finance Activity.: Problem 2: 1 3André MendozaNo ratings yet

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- MAS 2nd Summative TestDocument16 pagesMAS 2nd Summative TestNovie Abel BolivarNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- MODULE 5 To Module 6Document10 pagesMODULE 5 To Module 6Winoah HubaldeNo ratings yet

- Strategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionDocument9 pagesStrategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionWinoah HubaldeNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Answer: 215,000Document2 pagesAnswer: 215,000Winoah HubaldeNo ratings yet

- Break-Even Is The Point Where Total Sales Equal To Total CostsDocument5 pagesBreak-Even Is The Point Where Total Sales Equal To Total CostsWinoah HubaldeNo ratings yet

- Quiz 6.1 Capital BudgetingDocument1 pageQuiz 6.1 Capital BudgetingWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Answer: 8,000Document2 pagesAnswer: 8,000Winoah HubaldeNo ratings yet

- Segment MarginDocument1 pageSegment MarginWinoah HubaldeNo ratings yet

- HW5 1Document4 pagesHW5 1Winoah HubaldeNo ratings yet

- Lesson 1Document30 pagesLesson 1Winoah HubaldeNo ratings yet

- Lesson 2Document10 pagesLesson 2Winoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Data of Barbados Company:: Variable Cost Per UnitDocument2 pagesData of Barbados Company:: Variable Cost Per UnitWinoah HubaldeNo ratings yet

- 5 Questions InventoryDocument15 pages5 Questions Inventoryyousef0% (1)

- ECON2001 Intermediate Microeconomics II: DescriptionDocument4 pagesECON2001 Intermediate Microeconomics II: DescriptionShamar MundellNo ratings yet

- Skid Steer CaseDocument2 pagesSkid Steer CaseDANICA DIVINANo ratings yet

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDocument1 pageAccount Number Customer Id Account Currency Opening Balance Closing Balancemohammad1jamalNo ratings yet

- Lista de Sears y Kmart A La VentaDocument46 pagesLista de Sears y Kmart A La VentaEl Nuevo Día100% (1)

- L4 International Arbitrage and IRPDocument25 pagesL4 International Arbitrage and IRPKent ChinNo ratings yet

- Compesation ManagementDocument36 pagesCompesation ManagementAmitNo ratings yet

- The Untold Story of Gautam Adani's Dharavi Tryst - The Morning ContextDocument1 pageThe Untold Story of Gautam Adani's Dharavi Tryst - The Morning Contextashu19No ratings yet

- IEBDocument25 pagesIEBAnkit Kumar SinhaNo ratings yet

- Quality Related QuestionsDocument22 pagesQuality Related QuestionsHotPriyu OnlyforgalsNo ratings yet

- Ayala CorporationDocument2 pagesAyala CorporationYesi GuabNo ratings yet

- View Invoice - ReceiptDocument1 pageView Invoice - Receiptspeak2ebiniNo ratings yet

- Digital Ready Workshop ProposalDocument14 pagesDigital Ready Workshop ProposalnandukyNo ratings yet

- Suggested Readings For The Assignment TopicsDocument4 pagesSuggested Readings For The Assignment TopicsVidit GuptaNo ratings yet

- Uap Document 301Document14 pagesUap Document 301MaRio100% (1)

- Instant Download Ebook PDF Financial Accounting Tools For Business Decision Making 7th Canadian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting Tools For Business Decision Making 7th Canadian Edition PDF Scribdmarilyn.blake250100% (52)

- ICC Austria Case Studies On Bank Guarantees and Letters of CreditDocument6 pagesICC Austria Case Studies On Bank Guarantees and Letters of Creditmohamed salahNo ratings yet

- Strategic TrainingDocument10 pagesStrategic Trainingemily2408No ratings yet

- Shoppers Stop ErpDocument4 pagesShoppers Stop Erpabhay_155841071No ratings yet

- 10 1108 - JMH 11 2018 0060Document24 pages10 1108 - JMH 11 2018 0060Jorge Vélez DíazNo ratings yet

- 2023 Lazard Secondary MarketDocument26 pages2023 Lazard Secondary MarketAlexandre Da costaNo ratings yet

- BCG The Build or Buy Dilemma in AI Jan 2018Document6 pagesBCG The Build or Buy Dilemma in AI Jan 2018ah_tahaNo ratings yet

- 512 Case 1Document5 pages512 Case 1vikas singhNo ratings yet

- Agrolot: WhitepaperDocument25 pagesAgrolot: WhitepaperВиталий МельникNo ratings yet

- Final Exam, s2, 2018-FINALDocument11 pagesFinal Exam, s2, 2018-FINALShivneel Naidu0% (1)

- Chapter 3, Process CostingDocument10 pagesChapter 3, Process CostingArianne Marie OmoNo ratings yet

- TYBFM A 36 Vignesh Khandelwal Black BookDocument74 pagesTYBFM A 36 Vignesh Khandelwal Black Bookpreet doshiNo ratings yet