Professional Documents

Culture Documents

Castillo - Income Statement and Cost Control

Castillo - Income Statement and Cost Control

Uploaded by

Andriel JophineOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Castillo - Income Statement and Cost Control

Castillo - Income Statement and Cost Control

Uploaded by

Andriel JophineCopyright:

Available Formats

Castillo, Adrian Joseph R.

BSA-A2A

Use of Income Statement to Control Costs

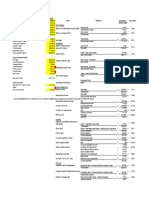

Jalapeno Company provided the following information for last year:

Sales in units 280,000

Selling price P 12

Direct materials 180,000

Direct labor 505,000

Manufacturing overhead 110,000

Selling expense 437,000

Administrative expense 854,000

Last year, beginning and ending inventories of work in process and finished goods equaled zero.

Required:

1. Prepare an income statement for Jalapeno for last year. (5 pts.)

Jalapeno Company

Statement of Financial Performance

For the year ended 20xx

3,360,00

Sales (280,000 units * P12) 0

Less: Cost of Goods Sold 795,000*

2,565,00

Gross Profit 0

Less: Selling Expense 437,000

Administrative Expense 854,000

1,291,00

0

1,274,00

Net Income 0

*= Direct Material + Direct Labor + MOH

= 180,000 + 505,000 + 110,000

= 795,000

Beginning and ending WIP and FG inventories equaled zero so it is assumed that the incurred product costs are all

part of COGS.

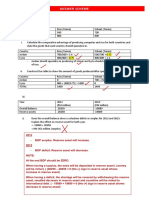

2. Briefly explain how a manager could use the income statement created in Requirement 1

to better control costs. (5 pts.)

In an income statement, all the costs that a company incurred in its business operations

are displayed according to their function or nature. A manager can determine a cost department

(e.g., COGS or selling expenses) that has the highest amount through an income statement.

Through this, a manager can formulate strategies to lower the costs in that specific cost

department.

Cost analysis using income statement can also be done using percentage of sales. A

company may set a specific standard for cost percentages to avoid incurring large amount of

costs. The percentage of each costs in relation to total sales can be generated to see if a specific

cost’s percentage is higher or lower than the standard.

You might also like

- Nism Xxi A - V Imp Case Studies and Short NotesDocument85 pagesNism Xxi A - V Imp Case Studies and Short NotesBharath Kumar100% (2)

- Loan Agreement - BaniDocument7 pagesLoan Agreement - BaniNonnatus P ChuaNo ratings yet

- Impact of GST On Society RedevelopmentDocument23 pagesImpact of GST On Society Redevelopmentraj pandey100% (2)

- BCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalDocument10 pagesBCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalAkshayBhutadaNo ratings yet

- Report 08 - 05 - 2020 10 - 49 - 33 CATDocument2 pagesReport 08 - 05 - 2020 10 - 49 - 33 CATManthan VananiNo ratings yet

- Assignment 3 - Conceptual ConnectionDocument2 pagesAssignment 3 - Conceptual Connectionjoint accountNo ratings yet

- FM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesDocument2 pagesFM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesJelly Ann AndresNo ratings yet

- Tugas Personal Pertama AKDocument7 pagesTugas Personal Pertama AKerni75% (4)

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Cost-Volume Profit AnalysisDocument3 pagesCost-Volume Profit AnalysisWycliffe Luther RosalesNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- Assignment CostramDocument2 pagesAssignment CostramAndree PereaNo ratings yet

- 1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument4 pages1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Chapter 5 - Dayag - MCS 81-88Document4 pagesChapter 5 - Dayag - MCS 81-88Mazikeen DeckerNo ratings yet

- Acc 2 Nov 2020 SolDocument3 pagesAcc 2 Nov 2020 SolKimberly GondoraNo ratings yet

- Mahusay-Bsa-315-Module 3-CaseletsDocument15 pagesMahusay-Bsa-315-Module 3-CaseletsJeth MahusayNo ratings yet

- Annotated-Combined Ratio Project Yash & WuDocument6 pagesAnnotated-Combined Ratio Project Yash & WuYashasvi RaghavendraNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- BLT FINAL Assignment (Feb - June 2020) FINALDocument16 pagesBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidNo ratings yet

- 05 Activity 1 Managerial Accounting PDFDocument2 pages05 Activity 1 Managerial Accounting PDFAngela Fye LlagasNo ratings yet

- PG 3Document6 pagesPG 3Prish AnandNo ratings yet

- SBA03 FSAnalysisPart32of3Document5 pagesSBA03 FSAnalysisPart32of3Jr PedidaNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Exercises On Projected Financial StatementsDocument4 pagesExercises On Projected Financial StatementsMicca DeynNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Cash and Receivable Management With SolutionsDocument3 pagesCash and Receivable Management With SolutionsRandy ManzanoNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument2 pages6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Financial Planning IllustrationDocument4 pagesFinancial Planning IllustrationJohn Sean CapsaNo ratings yet

- 07 Quiz 1 - SCMDocument1 page07 Quiz 1 - SCMJen DeloyNo ratings yet

- Activity 6: Paramount ServicesDocument5 pagesActivity 6: Paramount ServicesDJazel TolentinoNo ratings yet

- Chapter 5&6 Case 2Document3 pagesChapter 5&6 Case 2Erlangga DharmawangsaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- TAX 1 SampleDocument2 pagesTAX 1 SamplerhieelaaNo ratings yet

- Multiple StepDocument1 pageMultiple StepMerza DyanNo ratings yet

- REVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Document2 pagesREVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Saiyid Ali Haider RazaNo ratings yet

- Fabm2 Learning-Activity-2Document5 pagesFabm2 Learning-Activity-2Cha Eun WooNo ratings yet

- Buscom 4-1Document6 pagesBuscom 4-1dmangiginNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- You Must Use Excel Formulas and Cell References To Receive Full CreditDocument4 pagesYou Must Use Excel Formulas and Cell References To Receive Full CreditFaheem ManzoorNo ratings yet

- That Has Been Realized in Transactions With Third PartiesDocument4 pagesThat Has Been Realized in Transactions With Third PartiesMark CalapatanNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- Ratios QDocument1 pageRatios Qkashif.ali60001No ratings yet

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomePushTheStart GamingNo ratings yet

- LEARNING KIT Accounting2 Week 3Document4 pagesLEARNING KIT Accounting2 Week 3Asahi HamadaNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Spring Day Company Statement of Financial Position For 20x1 and 20x2Document2 pagesSpring Day Company Statement of Financial Position For 20x1 and 20x2Printing PandaNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Tugas CashFlow - Aura Anggun Permatasari - 21812141027 - A'21Document4 pagesTugas CashFlow - Aura Anggun Permatasari - 21812141027 - A'21Aura Anggun Permatasari auraanggun.2021No ratings yet

- Apple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesDocument3 pagesApple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesJaime Alexander PENA VILLABONANo ratings yet

- Chapter 7-MarginalDocument2 pagesChapter 7-Marginalhusse fokNo ratings yet

- Session 5Document14 pagesSession 5Mohit aswalNo ratings yet

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- Balucan InAcc 3 Week2 Part 2Document2 pagesBalucan InAcc 3 Week2 Part 2Luigi Enderez BalucanNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Apple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesDocument4 pagesApple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating Activitiesluisa Fernanda PeñaNo ratings yet

- Exercise 1: Solution: Dewitt's Budgeted Operating Income StatementDocument6 pagesExercise 1: Solution: Dewitt's Budgeted Operating Income StatementShawn MendezNo ratings yet

- The Statement of Comprehensive Income: Profit For The YearDocument4 pagesThe Statement of Comprehensive Income: Profit For The YearPlawan GhimireNo ratings yet

- Book 11Document4 pagesBook 11Actg SolmanNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- Fundamentals of Corporate Finance, SlideDocument250 pagesFundamentals of Corporate Finance, SlideYIN SOKHENG100% (4)

- Ud Wirastri Worksheet Desember 2015Document2 pagesUd Wirastri Worksheet Desember 2015YOHANA100% (1)

- Responsible InvestmentDocument6 pagesResponsible InvestmentBaargavi NagarajNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- Beams11 - Ppt16-Partnership Formation Cyber PDFDocument25 pagesBeams11 - Ppt16-Partnership Formation Cyber PDFCYNTHIA ARYA PRANATANo ratings yet

- Lesson 3 and 4 Cost Accounting Cycle and Job Order CostingDocument20 pagesLesson 3 and 4 Cost Accounting Cycle and Job Order CostingAlysa JaneNo ratings yet

- Associate Information: Ayansys Solutions Private Limited (Payslip)Document1 pageAssociate Information: Ayansys Solutions Private Limited (Payslip)B BhaskarNo ratings yet

- Grade 12 Economics - Economic Turmoil AssignmentDocument3 pagesGrade 12 Economics - Economic Turmoil AssignmentDom DesmaraisNo ratings yet

- Effect of Financial Performance On Stock PriceDocument14 pagesEffect of Financial Performance On Stock PriceMuhammad Yasir YaqoobNo ratings yet

- SOC FlyerDocument2 pagesSOC Flyersammer1985No ratings yet

- Finance For Managers NotesDocument114 pagesFinance For Managers NotesDavid Luko Chifwalo100% (1)

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- Affordable Housing BookletDocument38 pagesAffordable Housing BookletMatumbi NaitoNo ratings yet

- V - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2Document8 pagesV - 62 Caroni, Trinidad, Thursday 5th January, 2023-Price $1.00 N - 2ERSKINE LONEYNo ratings yet

- Statement of Account: From 01-APR-2020 To 31-MAR-2021Document2 pagesStatement of Account: From 01-APR-2020 To 31-MAR-2021debanwitaNo ratings yet

- Project On Online e PayDocument49 pagesProject On Online e PayAmaan RazviNo ratings yet

- Merchant Bank, Credit Rating, Debentures, SEBIDocument9 pagesMerchant Bank, Credit Rating, Debentures, SEBIClinton FernandesNo ratings yet

- Departmental Interpretation and Practice Notes No. 16 (Revised)Document12 pagesDepartmental Interpretation and Practice Notes No. 16 (Revised)Difanny KooNo ratings yet

- Write-Up Sample (Financial Analysis)Document18 pagesWrite-Up Sample (Financial Analysis)chialunNo ratings yet

- Matteo Gerardo PALUMBO: Personal InfoDocument2 pagesMatteo Gerardo PALUMBO: Personal InfoMatteo Gerardo PalumboNo ratings yet

- Reyes vs. Cordova G.R. No. 146555Document7 pagesReyes vs. Cordova G.R. No. 146555jackNo ratings yet

- Nassim Taleb On The Anti-Fragile PortfolioDocument4 pagesNassim Taleb On The Anti-Fragile Portfolioplato363100% (4)

- T7 - Answer Scheme BopDocument5 pagesT7 - Answer Scheme BopAkai GunnerNo ratings yet

- Zakon o Potvrdjivanju ZajmaDocument46 pagesZakon o Potvrdjivanju ZajmaSlavoljub AleksicNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet