Professional Documents

Culture Documents

Spi 3k

Spi 3k

Uploaded by

Tricolor C A0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

spi 3k

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageSpi 3k

Spi 3k

Uploaded by

Tricolor C ACopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

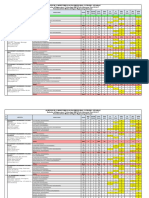

BEST ULIP INVESTMENT PLAN

Best Plan for Regular Investments

Monthly Insurance

Years (Term) Fund Value Description

Premium Cover

1 3,000 3,60,000 Regular Term Invesment Plan

2 3,000 3,60,000 Entry Age: 18 years to 45 years

3 3,000 3,60,000 Maximum Maturity Age: 65 years

4 3,000 3,60,000 Various Fund Options available in Smart Choice -

Pure Fund / Top300 Fund / Bond Optimiser Fund

5 3,000 3,60,000 / Balanced Fund / Bond Fund / Corporate Bond

Fund / Equity Optimiser Fund / Equity Fund /

6 3,000 3,60,000 3,10,807 Growth Fund / Money Market Fund

7 3,000 3,60,000 3,86,404

Yearly partial withdrawal facility available of 15%

of Fund value after 5th year onwards

8 3,000 3,60,000 4,71,072

9 3,000 3,60,000 5,65,900

Yearly two free fund switching and Yearly two free

premium redirection facilities

10 3,000 3,60,000 6,72,107

11 3,000 3,60,000 7,91,060 Tax Benefits available under Sec. 80C upto Rs.1.5

Lakhs per Annum & Sec. 10(10D) on maturity with

12 3,000 3,60,000 9,24,286 Zero Tax

13 3,000 3,60,000 10,73,500

Paying mode: Monthly [Rs.2000 & above]

Quarterly [Rs.5,500 & above]

14 3,000 3,60,000 12,40,620 Half-Yearly [Rs.9,500 & above]

Yearly [Rs.15,000 & above]

15 3,000 3,60,000 14,27,794

16 3,000 3,60,000 16,37,429 Cashless Transactions Only

17 3,000 3,60,000 18,72,219

Death Benefit: Either fund value or the

18 3,000 3,60,000 21,35,185

Insurance Cover value whichever is higher is

paid to the nominee in case of policyholder's

19 3,000 3,60,000 24,29,707 death occuring during the policy period

20 3,000 3,60,000 27,59,572

Note: Fund values are prepared on 12% CAGR, since inception returns are 18%

You might also like

- Ch14 P13 Build A ModelDocument6 pagesCh14 P13 Build A ModelRayudu Ramisetti0% (2)

- 2013 07-20-223905 Jones Family Minicase Analysis ModelDocument1 page2013 07-20-223905 Jones Family Minicase Analysis ModelkartikartikaaNo ratings yet

- Cover Letter Samples - Wharton MBADocument0 pagesCover Letter Samples - Wharton MBAJason Jee100% (4)

- Ebook Agency 2012 PDFDocument179 pagesEbook Agency 2012 PDFsks8253No ratings yet

- Finance MBA ProjectDocument86 pagesFinance MBA Projectanandingole100% (1)

- O2C Cycle With Accounting EntriesDocument3 pagesO2C Cycle With Accounting Entriessudharsan49100% (3)

- Stock Market Modeling and Forecasting, ChenDocument166 pagesStock Market Modeling and Forecasting, ChenIsmith Pokhrel100% (2)

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- Best Ulip Plan: SMART POWER (Sample Illustration)Document1 pageBest Ulip Plan: SMART POWER (Sample Illustration)Tricolor C ANo ratings yet

- Smart Scholar: Best Investment Plan For Children's FutureDocument1 pageSmart Scholar: Best Investment Plan For Children's FutureTricolor C ANo ratings yet

- Best Investment Plan For Children's Future: Sbi Life InsuranceDocument1 pageBest Investment Plan For Children's Future: Sbi Life InsuranceTricolor C A100% (1)

- Sukanya Samriddhi Yojana CalculatorDocument6 pagesSukanya Samriddhi Yojana CalculatorSelvan KstNo ratings yet

- VishalDocument0 pagesVishalVishal AggawalNo ratings yet

- Bharti Axa JobDocument4 pagesBharti Axa JobRakeshRkoNo ratings yet

- Samruddha Vilas Ghodake - Offer - SalesDocument2 pagesSamruddha Vilas Ghodake - Offer - SalesSam GNo ratings yet

- Aditya Jain NotesDocument55 pagesAditya Jain NotesVijayaNo ratings yet

- FM09-CH 24Document16 pagesFM09-CH 24namitabijweNo ratings yet

- Gunjan Maheshwari Offer LetterDocument3 pagesGunjan Maheshwari Offer LetterGunjan MaheshwariNo ratings yet

- POS Goal Suraksha - Detailed BrouchreDocument2 pagesPOS Goal Suraksha - Detailed BrouchreSuraj Shenoy NagarNo ratings yet

- Quant Checklist 463 by Aashish Arora For Bank Exams 2024Document102 pagesQuant Checklist 463 by Aashish Arora For Bank Exams 2024sharpleakey100% (1)

- TVM Practice Sums & SolutionsDocument15 pagesTVM Practice Sums & SolutionsRashi Mehta100% (1)

- New Incentive PLI RPLI Structure 07.04.23Document7 pagesNew Incentive PLI RPLI Structure 07.04.23duvaNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- BM Question Paper 2023 ADocument18 pagesBM Question Paper 2023 AKhushi kapasiyaNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Capital Budgeting - NotesDocument171 pagesCapital Budgeting - NotesSiddharth mehtaNo ratings yet

- Udaan Proposal FormatDocument14 pagesUdaan Proposal FormatAviral GanjooNo ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelsambhavjoshi100% (1)

- As10-Ca CS Hub PDFDocument6 pagesAs10-Ca CS Hub PDFULTIMATE FACTS HINDINo ratings yet

- TVM Assignment MBA 2013 - 27 ..... NagendraDocument74 pagesTVM Assignment MBA 2013 - 27 ..... NagendraNaga NagendraNo ratings yet

- Lic Pension Policy - Retire & Enjoy PresentationDocument57 pagesLic Pension Policy - Retire & Enjoy PresentationK.N. BabujeeNo ratings yet

- Bharti-Axa FinalDocument29 pagesBharti-Axa FinalAmit Bharti100% (1)

- Youtag Bussiness Plan - 230205 - 195219Document29 pagesYoutag Bussiness Plan - 230205 - 195219Mohammadismaiel ShaikNo ratings yet

- ST Clement'S School Case Study: YearsDocument8 pagesST Clement'S School Case Study: YearsTin Bernadette DominicoNo ratings yet

- Offer LetterDocument3 pagesOffer LetterKaran RanjanNo ratings yet

- ( (Sig1 Es :signer1:signature) )Document7 pages( (Sig1 Es :signer1:signature) )Vinayak M HNo ratings yet

- Braindumpsit: Braindumpsit - It Certification Company Provides Braindumps PDF!Document19 pagesBraindumpsit: Braindumpsit - It Certification Company Provides Braindumps PDF!Ramkrishana PathakNo ratings yet

- Acpc Seat Matrix PDFDocument25 pagesAcpc Seat Matrix PDFshlokshah2006No ratings yet

- Risk Assesment of Products of BkashDocument49 pagesRisk Assesment of Products of BkashRashed Hossain SonnetNo ratings yet

- LIC All Plans AvailableDocument40 pagesLIC All Plans AvailableAjit SinhaNo ratings yet

- Dear Niharika,: Bebo Technologies Private LimitedDocument11 pagesDear Niharika,: Bebo Technologies Private LimitedEr Niharika KhuranaNo ratings yet

- BUSLYTCJDWILLIAMSCASEDocument20 pagesBUSLYTCJDWILLIAMSCASEchristinekehyengNo ratings yet

- Nature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsDocument49 pagesNature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsRam Krishna Krish100% (2)

- Kotak League Platinum Credit CardDocument2 pagesKotak League Platinum Credit Cardoh hoNo ratings yet

- Archwell Operations India Private LimitedDocument4 pagesArchwell Operations India Private LimitedBalaji SNo ratings yet

- All LIC PlansDocument4 pagesAll LIC Planslicvivek100% (1)

- Nic Asia Annual Report 2078 - 79 FyDocument232 pagesNic Asia Annual Report 2078 - 79 FyApil BhattaraiNo ratings yet

- IIM Nagpur Fees StructureDocument2 pagesIIM Nagpur Fees StructureVineed BijuNo ratings yet

- Proposal Form For Health Insurance PolicyDocument13 pagesProposal Form For Health Insurance PolicyAgniPat PatNo ratings yet

- Kotak MahindraDocument43 pagesKotak MahindraSatish RajNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterKushal SenNo ratings yet

- Chapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument18 pagesChapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsOyeleye TofunmiNo ratings yet

- Advanced AccountingDocument33 pagesAdvanced AccountingvijaykumartaxNo ratings yet

- AIA SmartRewards Saver (II) 55345 20140824113002 CR25RBR9Document11 pagesAIA SmartRewards Saver (II) 55345 20140824113002 CR25RBR9Lim Zer YeeNo ratings yet

- Computing The Present ValueDocument35 pagesComputing The Present ValueSana Naveed FawadNo ratings yet

- Profitability & Ratios: Exercise Book On Accounts and StatisticsDocument9 pagesProfitability & Ratios: Exercise Book On Accounts and Statisticsaryan singh100% (1)

- Gate Pass Print PDFDocument2 pagesGate Pass Print PDFrsp varunNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Request For Proposal NSDC StarDocument30 pagesRequest For Proposal NSDC StarakumaraoNo ratings yet

- Are Mergers The Only Solution To Revive Debt Driven BanksDocument3 pagesAre Mergers The Only Solution To Revive Debt Driven BanksKIPKOSKEI MARKNo ratings yet

- Non Medical ChartsDocument1 pageNon Medical ChartsAyush BhardwajNo ratings yet

- Income Tax Chapter-10 NoteDocument6 pagesIncome Tax Chapter-10 NoteRAGIB SHAHRIAR RAFINo ratings yet

- Product Review Flexible Endowment Plan (FEP)Document12 pagesProduct Review Flexible Endowment Plan (FEP)kayode AdebayoNo ratings yet

- Sales Illustrator ReportDocument3 pagesSales Illustrator ReportcakotyNo ratings yet

- E3 Epoxy Mastic Polyurethane Top Coat On Steel or Cast IronDocument5 pagesE3 Epoxy Mastic Polyurethane Top Coat On Steel or Cast IronTricolor C ANo ratings yet

- Wire Rope Sling 2Document1 pageWire Rope Sling 2Tricolor C ANo ratings yet

- District No AC Name Part NameDocument28 pagesDistrict No AC Name Part NameTricolor C A100% (2)

- District No AC Name Part NameDocument32 pagesDistrict No AC Name Part NameTricolor C A100% (1)

- District No AC NameDocument32 pagesDistrict No AC NameTricolor C A100% (1)

- District No AC Name Part NameDocument30 pagesDistrict No AC Name Part NameTricolor C ANo ratings yet

- District No AC Name Part Name BLO NameDocument28 pagesDistrict No AC Name Part Name BLO NameTricolor C ANo ratings yet

- Best Investment Plan For Children's Future: Sbi Life InsuranceDocument1 pageBest Investment Plan For Children's Future: Sbi Life InsuranceTricolor C A100% (1)

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- Best Ulip Plan: SMART POWER (Sample Illustration)Document1 pageBest Ulip Plan: SMART POWER (Sample Illustration)Tricolor C ANo ratings yet

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- Smart Scholar: Best Investment Plan For Children's FutureDocument1 pageSmart Scholar: Best Investment Plan For Children's FutureTricolor C ANo ratings yet

- Sl. No. Name and Designation Office (Direct Line Number) P&T Phone NoDocument4 pagesSl. No. Name and Designation Office (Direct Line Number) P&T Phone NoTricolor C ANo ratings yet

- Form For Nomination of Data ContributorDocument1 pageForm For Nomination of Data ContributorTricolor C ANo ratings yet

- Contact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentDocument9 pagesContact Number of Relief Commissioner Office Chennai and Government Revenue DepartmentTricolor C ANo ratings yet

- Public Health and Family WelfareDocument7 pagesPublic Health and Family WelfareTricolor C ANo ratings yet

- N 20052443Document3 pagesN 20052443Tricolor C A100% (1)

- Sl. No. Name and Designation Details Office PH - No. Contact PH - NoDocument4 pagesSl. No. Name and Designation Details Office PH - No. Contact PH - NoTricolor C A100% (1)

- Fs FinalDocument39 pagesFs FinalJahara Obedencio CalaycaNo ratings yet

- Statistical Appendix in English PDFDocument175 pagesStatistical Appendix in English PDFMADHAVNo ratings yet

- DR, Reddy - BetapharmDocument53 pagesDR, Reddy - BetapharmSwathi Velisetty100% (5)

- India Story - Prof. KV SubramanianDocument55 pagesIndia Story - Prof. KV SubramanianKrishna KokulNo ratings yet

- SIX Swiss Exchange Swiss Leader Index (SLI) FactsheetDocument4 pagesSIX Swiss Exchange Swiss Leader Index (SLI) FactsheetjennabushNo ratings yet

- Final Summer Training ReportDocument76 pagesFinal Summer Training Reportjavedaliamu100% (1)

- Jet AirwaysDocument4 pagesJet Airwayssmith dabreoNo ratings yet

- Cost and MGMT Accti Chapter 1 Introduction and Cost ClassificationDocument17 pagesCost and MGMT Accti Chapter 1 Introduction and Cost ClassificationMahlet AbrahaNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Bri JunioDocument7 pagesBri JunioSinung Eko RaharjoNo ratings yet

- BJs Wholesale Club - Account InformationDocument3 pagesBJs Wholesale Club - Account InformationShehroz JamshedNo ratings yet

- 10 - Financing of Railway Projects - IRADocument34 pages10 - Financing of Railway Projects - IRAsakethmekalaNo ratings yet

- Handelsblatt VWL Ranking 2013Document47 pagesHandelsblatt VWL Ranking 2013johnalis22No ratings yet

- Audit Case of Silverbird Company PDFDocument2 pagesAudit Case of Silverbird Company PDFAzriSafarNo ratings yet

- Corporate Accounting I I FinalDocument82 pagesCorporate Accounting I I Finalthangarajbala123No ratings yet

- DU M.com SyllabusDocument67 pagesDU M.com SyllabusRajni Sinha VermaNo ratings yet

- Accounts Payable (J60) - Process DiagramsDocument16 pagesAccounts Payable (J60) - Process Diagramsgobasha100% (2)

- Construction of Portfolio Management For Selected Companies in The IndustriesDocument21 pagesConstruction of Portfolio Management For Selected Companies in The Industriesmaniapjc1No ratings yet

- Proabg Project Financial FreedomDocument32 pagesProabg Project Financial FreedomUttam Manas100% (1)

- Select State For Stamp PaperDocument4 pagesSelect State For Stamp PaperATSI InstituteNo ratings yet

- Sample Exam of Business Law 2021Document13 pagesSample Exam of Business Law 2021hermelaNo ratings yet

- Hotel Franchising in Europe The Push Continues For New Ways To Expand 9Document1 pageHotel Franchising in Europe The Push Continues For New Ways To Expand 9wloghuntNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- 애널리스트 이익예측의 정확성과 추천종목의 수익성 PDFDocument40 pages애널리스트 이익예측의 정확성과 추천종목의 수익성 PDFnho moo hyunNo ratings yet

- Globalization, Urban Form and GovernanceDocument231 pagesGlobalization, Urban Form and GovernanceDelftdigitalpressNo ratings yet