Professional Documents

Culture Documents

Activity 1 A. Initial Entry

Activity 1 A. Initial Entry

Uploaded by

MTECH ASIACopyright:

Available Formats

You might also like

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Trading Secrets UnleashedDocument61 pagesTrading Secrets UnleashedKen Ken75% (4)

- POV Test Bank 2011Document40 pagesPOV Test Bank 2011Thuy PhanNo ratings yet

- Mc28 Annex GDocument3 pagesMc28 Annex GMTECH ASIANo ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Not Profit Organisations - Additional Practice Que. Set - AnswersDocument13 pagesNot Profit Organisations - Additional Practice Que. Set - AnswersRushikesh100% (2)

- Sunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsDocument2 pagesSunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsAmit PandeyNo ratings yet

- FABM 1-Exam Fourth QuarterDocument3 pagesFABM 1-Exam Fourth QuarterRaul Cabanting100% (1)

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Financial Accounting and Reporting PDFDocument12 pagesFinancial Accounting and Reporting PDFanis athirahNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Tutorial 5 6 UECH1104Document3 pagesTutorial 5 6 UECH1104Putri Nurin Hasnida HassanNo ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- Week 4 Topic Tutorial Solutions CB2100 - 1920ADocument20 pagesWeek 4 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Chapter 5-Prob. 1Document7 pagesChapter 5-Prob. 1Rajah CalicaNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- MGT AC - Prob-NewDocument276 pagesMGT AC - Prob-Newrandom122No ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- CH3 Classwork E3 20 SolutionDocument7 pagesCH3 Classwork E3 20 SolutionSamuel TaylorNo ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Name: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoDocument2 pagesName: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoRowma Danielle LactaoNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Asistensi 9 - AnswerDocument17 pagesAsistensi 9 - AnswerannisaanoviandiniNo ratings yet

- Tutorial Test 2 AnswerDocument4 pagesTutorial Test 2 AnswerHoang Bich Kha NgoNo ratings yet

- AS Book 1Document12 pagesAS Book 1Vashu ShrivastavNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Worksheet ProblemDocument4 pagesWorksheet Problemusernames358No ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Answer MINMANDocument12 pagesAnswer MINMANumi kalsumNo ratings yet

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- Pembahasan LabAkun 16-17Document6 pagesPembahasan LabAkun 16-17sepuluh 10No ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Ap A2Document22 pagesAp A2damminhngoc228No ratings yet

- Nama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Document5 pagesNama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Putri NabilahNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsShovan KarmakarNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Red Flash PhotographyDocument18 pagesRed Flash Photographylaale dijaanNo ratings yet

- Session 4 - Adjusting The AccountsDocument18 pagesSession 4 - Adjusting The AccountsSILVINA SEPTIANINGSIHNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- Tugas Kelompok Ke-1 (Minggu 3) : Case 1Document10 pagesTugas Kelompok Ke-1 (Minggu 3) : Case 1Kenny BagusNo ratings yet

- Asset 2017 2018: Total 313.000 295.000Document1 pageAsset 2017 2018: Total 313.000 295.000Agung KartikasariNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Laporan Keuangan PT JayatamaDocument2 pagesLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Dian Andika - Praktikum 2 - Laporan Laba Rugi Single Dan MultipleDocument3 pagesDian Andika - Praktikum 2 - Laporan Laba Rugi Single Dan MultipleDian AndikaNo ratings yet

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Learning: Fundamentals of Accounting, Business and Management 1Document13 pagesLearning: Fundamentals of Accounting, Business and Management 1MTECH ASIANo ratings yet

- Nu-Nazareth School: Remote Learning Material Worksheet 1Document2 pagesNu-Nazareth School: Remote Learning Material Worksheet 1MTECH ASIANo ratings yet

- Educational Attainment College: Cagas, Rose TomasDocument4 pagesEducational Attainment College: Cagas, Rose TomasMTECH ASIANo ratings yet

- General Journal: Page Number GJDocument13 pagesGeneral Journal: Page Number GJMTECH ASIANo ratings yet

- V3jan 2021 COVID19 Vaccines and Allergy FAQDocument5 pagesV3jan 2021 COVID19 Vaccines and Allergy FAQMTECH ASIANo ratings yet

- T3 Form No. 2c S. 2020 IPT Secretary CertificateDocument1 pageT3 Form No. 2c S. 2020 IPT Secretary CertificateMTECH ASIANo ratings yet

- 3693-87E GuideDocument20 pages3693-87E GuideNoor MalikNo ratings yet

- Palm OilDocument15 pagesPalm OilDon EmekaNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFsgirishri4044No ratings yet

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 07 ChapterDocument18 pagesTest Bank Advanced Accounting 3e by Jeter 07 ChapterNicolas ErnestoNo ratings yet

- NismDocument17 pagesNismRohit Shet50% (2)

- Export DataDocument156 pagesExport Databaskar05No ratings yet

- Plant, Assets, Natural Resources and Intangible AssetsDocument31 pagesPlant, Assets, Natural Resources and Intangible AssetsNatya Nindyagitaya100% (1)

- Tax2 Ch15 Estate Taxes ReviewerDocument7 pagesTax2 Ch15 Estate Taxes Reviewerlyle_roseNo ratings yet

- Residential Status Mock Test 1 IGP-CS CA Vivek GabaDocument11 pagesResidential Status Mock Test 1 IGP-CS CA Vivek GabaRahul R SinghNo ratings yet

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaNo ratings yet

- Sazgar Engineering Works Initiating CoverageDocument4 pagesSazgar Engineering Works Initiating CoverageMuhammad ZubairNo ratings yet

- CIR V Fortune Tobacco EscraDocument69 pagesCIR V Fortune Tobacco Escrasmtm06No ratings yet

- ACME - Ratio AnalysisDocument1 pageACME - Ratio AnalysistashnimNo ratings yet

- A Plea For FreedomDocument10 pagesA Plea For FreedomRich Fed Reserve AnatoneNo ratings yet

- Industrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksDocument3 pagesIndustrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksMohammed Shareef KoppilakkalNo ratings yet

- CH 06Document48 pagesCH 06Fenny MarietzaNo ratings yet

- Results Accountability - PPT NotesDocument72 pagesResults Accountability - PPT NotesEmma WongNo ratings yet

- Actual Receipt VS Constructive ReceiptDocument2 pagesActual Receipt VS Constructive ReceiptEduard RiparipNo ratings yet

- Income TaxDocument7 pagesIncome Tax20BCC64 Aruni JoneNo ratings yet

- Tax Co UntianDocument25 pagesTax Co UntianJanus Mari AbanNo ratings yet

- Assignment Budgeting 1 WorksheetDocument9 pagesAssignment Budgeting 1 WorksheetSultan Bin OboodNo ratings yet

- Cognizant Puts Up $30 Million For Employee RetentionDocument3 pagesCognizant Puts Up $30 Million For Employee RetentionAryan KapoorNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormMikky Garcia Dela CruzNo ratings yet

Activity 1 A. Initial Entry

Activity 1 A. Initial Entry

Uploaded by

MTECH ASIAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 1 A. Initial Entry

Activity 1 A. Initial Entry

Uploaded by

MTECH ASIACopyright:

Available Formats

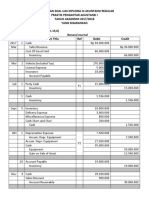

ACTIVITY 1

a. Initial Entry

Debit Credit

1 Printing Machine 78,000

Cash 78,000

2 Cash 90,000

Unearned Rental Income 90,000

3 Vehicle 340,000

Cash 340,000

ACTIVITY 2

JOURNAL ENTRIES

Debit

1 Cash 90,000

Unearned Rental Income

2 Accounts Receivable 12,000

Rental Income

3 Vehicle 500,000

Cash

4 Office Supplies 24,000

Cash

5 Office supplies 38,000

Accounts Payable

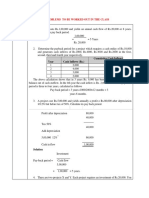

b. Annual Depreciation c. Adjusting Entries

Debit

Machine cost 78,000 Depreciation expense-machine 600

Salvage value (6,000) Acccumulated Depreciation-machine

72,000

divide by useful life 10 yrs 7,200/12= 600 monthly depreciation

Annual Dep. 7,200

none Unearned Rental Income 30,000

90,000/3 30,000 monthly rental income Rental Income

Vehicle cost 340,000 Depreciation expense-vehicle 7,875

Salvage value (25,000) Acccumulated Depreciation-vehicle

315,000

divide by useful life 10 yrs 31,500/4 7,875 quarterly depreciation

Annual Dep. 31,500

ADJUSTING ENTRIES

Credit Debit Credit

Unearned Rental Income 15,000

90,000 Rental Income 15,000

90,000/6=15,000 Rental income for 1 month

Cash 6,000

12,000 Accounts Receivable 6,000

12,000/2=6,000 1 half collection of services

Depreciation expense-vehicle 3,625

500,000 Acccumulated Depreciation-vehicle 3,625

Vehicle cost 500,000

Salvage value (65,000)

435,000 43,500/12=3,625 monthly dep.

divide by useful life 10 yrs

Annual Dep. 43,500

Office supplies expense 11,500

24,000 Office supplies 11,500

Office Supplies used 11,500

38,000 No adjusting entry

Credit

600

30,000

7,875

You might also like

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Trading Secrets UnleashedDocument61 pagesTrading Secrets UnleashedKen Ken75% (4)

- POV Test Bank 2011Document40 pagesPOV Test Bank 2011Thuy PhanNo ratings yet

- Mc28 Annex GDocument3 pagesMc28 Annex GMTECH ASIANo ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Not Profit Organisations - Additional Practice Que. Set - AnswersDocument13 pagesNot Profit Organisations - Additional Practice Que. Set - AnswersRushikesh100% (2)

- Sunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsDocument2 pagesSunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsAmit PandeyNo ratings yet

- FABM 1-Exam Fourth QuarterDocument3 pagesFABM 1-Exam Fourth QuarterRaul Cabanting100% (1)

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Financial Accounting and Reporting PDFDocument12 pagesFinancial Accounting and Reporting PDFanis athirahNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Tutorial 5 6 UECH1104Document3 pagesTutorial 5 6 UECH1104Putri Nurin Hasnida HassanNo ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- Week 4 Topic Tutorial Solutions CB2100 - 1920ADocument20 pagesWeek 4 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Chapter 5-Prob. 1Document7 pagesChapter 5-Prob. 1Rajah CalicaNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- MGT AC - Prob-NewDocument276 pagesMGT AC - Prob-Newrandom122No ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- CH3 Classwork E3 20 SolutionDocument7 pagesCH3 Classwork E3 20 SolutionSamuel TaylorNo ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Name: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoDocument2 pagesName: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoRowma Danielle LactaoNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Asistensi 9 - AnswerDocument17 pagesAsistensi 9 - AnswerannisaanoviandiniNo ratings yet

- Tutorial Test 2 AnswerDocument4 pagesTutorial Test 2 AnswerHoang Bich Kha NgoNo ratings yet

- AS Book 1Document12 pagesAS Book 1Vashu ShrivastavNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Worksheet ProblemDocument4 pagesWorksheet Problemusernames358No ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Answer MINMANDocument12 pagesAnswer MINMANumi kalsumNo ratings yet

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- Pembahasan LabAkun 16-17Document6 pagesPembahasan LabAkun 16-17sepuluh 10No ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Ap A2Document22 pagesAp A2damminhngoc228No ratings yet

- Nama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Document5 pagesNama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Putri NabilahNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsShovan KarmakarNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Red Flash PhotographyDocument18 pagesRed Flash Photographylaale dijaanNo ratings yet

- Session 4 - Adjusting The AccountsDocument18 pagesSession 4 - Adjusting The AccountsSILVINA SEPTIANINGSIHNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- Tugas Kelompok Ke-1 (Minggu 3) : Case 1Document10 pagesTugas Kelompok Ke-1 (Minggu 3) : Case 1Kenny BagusNo ratings yet

- Asset 2017 2018: Total 313.000 295.000Document1 pageAsset 2017 2018: Total 313.000 295.000Agung KartikasariNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- Laporan Keuangan PT JayatamaDocument2 pagesLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Dian Andika - Praktikum 2 - Laporan Laba Rugi Single Dan MultipleDocument3 pagesDian Andika - Praktikum 2 - Laporan Laba Rugi Single Dan MultipleDian AndikaNo ratings yet

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Learning: Fundamentals of Accounting, Business and Management 1Document13 pagesLearning: Fundamentals of Accounting, Business and Management 1MTECH ASIANo ratings yet

- Nu-Nazareth School: Remote Learning Material Worksheet 1Document2 pagesNu-Nazareth School: Remote Learning Material Worksheet 1MTECH ASIANo ratings yet

- Educational Attainment College: Cagas, Rose TomasDocument4 pagesEducational Attainment College: Cagas, Rose TomasMTECH ASIANo ratings yet

- General Journal: Page Number GJDocument13 pagesGeneral Journal: Page Number GJMTECH ASIANo ratings yet

- V3jan 2021 COVID19 Vaccines and Allergy FAQDocument5 pagesV3jan 2021 COVID19 Vaccines and Allergy FAQMTECH ASIANo ratings yet

- T3 Form No. 2c S. 2020 IPT Secretary CertificateDocument1 pageT3 Form No. 2c S. 2020 IPT Secretary CertificateMTECH ASIANo ratings yet

- 3693-87E GuideDocument20 pages3693-87E GuideNoor MalikNo ratings yet

- Palm OilDocument15 pagesPalm OilDon EmekaNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFsgirishri4044No ratings yet

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 07 ChapterDocument18 pagesTest Bank Advanced Accounting 3e by Jeter 07 ChapterNicolas ErnestoNo ratings yet

- NismDocument17 pagesNismRohit Shet50% (2)

- Export DataDocument156 pagesExport Databaskar05No ratings yet

- Plant, Assets, Natural Resources and Intangible AssetsDocument31 pagesPlant, Assets, Natural Resources and Intangible AssetsNatya Nindyagitaya100% (1)

- Tax2 Ch15 Estate Taxes ReviewerDocument7 pagesTax2 Ch15 Estate Taxes Reviewerlyle_roseNo ratings yet

- Residential Status Mock Test 1 IGP-CS CA Vivek GabaDocument11 pagesResidential Status Mock Test 1 IGP-CS CA Vivek GabaRahul R SinghNo ratings yet

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaNo ratings yet

- Sazgar Engineering Works Initiating CoverageDocument4 pagesSazgar Engineering Works Initiating CoverageMuhammad ZubairNo ratings yet

- CIR V Fortune Tobacco EscraDocument69 pagesCIR V Fortune Tobacco Escrasmtm06No ratings yet

- ACME - Ratio AnalysisDocument1 pageACME - Ratio AnalysistashnimNo ratings yet

- A Plea For FreedomDocument10 pagesA Plea For FreedomRich Fed Reserve AnatoneNo ratings yet

- Industrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksDocument3 pagesIndustrial Engineering Objective Type Questions - Set 04 - ObjectiveBooksMohammed Shareef KoppilakkalNo ratings yet

- CH 06Document48 pagesCH 06Fenny MarietzaNo ratings yet

- Results Accountability - PPT NotesDocument72 pagesResults Accountability - PPT NotesEmma WongNo ratings yet

- Actual Receipt VS Constructive ReceiptDocument2 pagesActual Receipt VS Constructive ReceiptEduard RiparipNo ratings yet

- Income TaxDocument7 pagesIncome Tax20BCC64 Aruni JoneNo ratings yet

- Tax Co UntianDocument25 pagesTax Co UntianJanus Mari AbanNo ratings yet

- Assignment Budgeting 1 WorksheetDocument9 pagesAssignment Budgeting 1 WorksheetSultan Bin OboodNo ratings yet

- Cognizant Puts Up $30 Million For Employee RetentionDocument3 pagesCognizant Puts Up $30 Million For Employee RetentionAryan KapoorNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormMikky Garcia Dela CruzNo ratings yet