Professional Documents

Culture Documents

Family Investment Companies: Structure and Tax Benefits

Family Investment Companies: Structure and Tax Benefits

Uploaded by

srowbothamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Family Investment Companies: Structure and Tax Benefits

Family Investment Companies: Structure and Tax Benefits

Uploaded by

srowbothamCopyright:

Available Formats

www.croweclarkwhitehill.co.

uk

Family investment companies

Structure and tax benefits

The UK currently has one of the lowest rates of corporation tax in any of the

G7 countries. With rates set to fall further to 18%, using a company as an

investment ‘wrapper’ is becoming a popular concept for investors.

A Family Investment Company (FIC) is a The founder shareholder generally maintains

company that invests rather than trades. control over the company (or is responsible

The investments are usually equity portfolios for appointing an advisor) and the payment of

or, in an increasing number of cases, dividends. The Articles of Association and the

property. There is in fact no restriction on shareholders agreement can be drafted to protect

the asset class that a FIC can invest in. the shares from sale outside of the family.

The FIC is funded by the founder transferring Tax drivers

cash or assets usually by way of a loan. Any Income tax

profits arising from the investments are taxed The FIC is usually funded by way of a loan and

at corporation tax rates rather than income can be repaid from profits tax-free. There can

or capital gains. This can create a tax saving be issues with settlements legislation where

of up to 25% for an individual paying tax at loans are involved, although assigning part

additional rates. Additionally, on an equity of the loan to the other shareholders should

portfolio, dividends can be received by a reduce any risk of challenge by HMRC.

limited company free from tax creating an

even larger tax saving. The FIC therefore The company shelters the investments from

offers a structure whereby the investments income tax until the funds are extracted from the

can grow in a low or zero tax environment. company. When profits are extracted, other than

by repayment of the loan, the shareholders will

The structure also offers Inheritance Tax (IHT) be liable to income tax on any amounts received.

advantages and is becoming an attractive and Payments are usually made by way of dividend

flexible alternative to a trust, particularly with and from April 2016 will be subject to rates in

entrepreneurial clients who are more familiar the hands of the recipient as outlined below.

and comfortable with a company structure.

Income band Tax rate

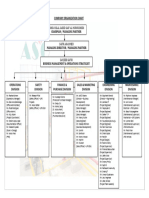

Structure

Usually a FIC is set up with a founder share 0-£5,000 (dividend income only) 0%

held by the individual providing the capital,

with other family members brought in as £5,001-£32,000 7.5%

shareholders. Different classes of share £32,001-£150,000 32.5%

are often issued to enable flexibility around

payment of dividends. It is also possible Over £150,001 38.1%

to create redeemable preference shares to

extract capital with minimal, if any, tax cost.

Crowe Clark Whitehill

The FIC is created to benefit the family and, Profits on gains arising would be extracted

as such, parents and children are generally in the same way as outlined above.

included as shareholders. It is also possible

and can be beneficial to include a trust as On the sale or liquidation of the company the

a shareholder to offer more flexibility. shareholders would be charged to CGT on the

proceeds received less any cost. As shares are

Dividends paid to minor children are taxed on likely to be subscribed for at par, CGT will be

the parents, where they are the source of the charged on the whole increase in value at 28%.

underlying capital. However, for children over

18, payment of a dividend up to the basic rate Inheritance tax

band can be a very efficient way of extracting One of the main advantages to an FIC are

funds to help with costs such as university fees. the IHT benefits. Not only is value passed

to the other shareholders on the creation

It is not generally beneficial to pay dividends of the company (subject to the seven year

to the founder shareholders as their income survivorship rule) but any increase in value of

levels are usually high. The combined tax rate the investments arises outside of the estate

of the company and the income tax would of the original founder. Additional shares can

be higher than if the asset was held directly. be transferred at a later date, possibly to a

The FIC structure is of most benefit where the trust structure. As the value of the founder’s

capital and income can be retained within the shareholding diminishes so the value of the

company for long periods, or indeed used as other shareholder’s portion increases, therefore

a structure to pass on to the next generation reducing the IHT exposure in the estate further.

in the same way one would use a trust.

How can we help?

Capital Gains Tax There is no ‘one size fits all’ to planning a FIC.

Any assets sold within the company would There are considerable savings to be made

be charged at corporation tax rates rather where the structure is appropriate, and we can

than Capital Gains Tax (CGT), 20% tax help develop the best plan for you and your

compared with 28% CGT. Companies family. As with any tax planning there are risks,

still have the benefit of indexation which for example HMRC could change the rate of

is no longer available to individuals. tax on investments. We recommend you seek

professional advice before any action is taken.

Start the conversation

London Kent London Mayfair Thames Valley

Tim Norkett Simon Warne Tom Elliott Mark Stemp

Head of Private Clients +44 (0)1622 767676 +44 (0)20 7842 7372 +44 (0)118 959 7222

+44 (0)20 7842 7151 simon.warne@crowecw.co.uk tom.elliott@crowecw.co.uk mark.stemp@crowecw.co.uk

tim.norkett@crowecw.co.uk

Manchester Midlands

Cheltenham Rebecca Durrant Joe Hancox

Sue Daye +44 (0)161 214 7500 +441 (0)121 543 1900

+44 (0)1242 234421 rebecca.durrant@crowecw.co.uk joe.hancox@crowecw.co.uk

sue.daye@crowecw.co.uk

Follow us on:

@crowecw

Find out more about us at

www.croweclarkwhitehill.co.uk

Crowe Clark Whitehill LLP is a member of Crowe Horwath International, a Swiss verein (Crowe Horwath). Each member firm of Crowe Horwath is a separate and independent legal entity. Crowe Clark

Whitehill LLP and its affiliates are not responsible or liable for any acts or omissions of Crowe Horwath or any other member of Crowe Horwath and specifically disclaim any and all responsibility or

liability for acts or omissions of Crowe Horwath or any other Crowe Horwath member. This material is for informational purposes only and should not be construed as financial or legal advice. Please

seek guidance specific to your organisation from qualified advisors in your jurisdiction.

© 2015 Crowe Clark Whitehill LLP | 0595

Crowe Clark Whitehill LLP is registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales and is authorised and regulated by the Financial Conduct Authority.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Black & DeckerDocument28 pagesBlack & DeckerSunny ShresthaNo ratings yet

- Lux Researh Sustainability in Architectural Coatings Ranade European Coatings Show Mar13Document21 pagesLux Researh Sustainability in Architectural Coatings Ranade European Coatings Show Mar13srowbothamNo ratings yet

- iSCAPE - D1.2 - Guidelines To Promote Passive Methods For Improving Urban Air Quality in Climate Change Scenarios - Feb17Document137 pagesiSCAPE - D1.2 - Guidelines To Promote Passive Methods For Improving Urban Air Quality in Climate Change Scenarios - Feb17srowbothamNo ratings yet

- Shineon Technical Description EnglishDocument19 pagesShineon Technical Description EnglishsrowbothamNo ratings yet

- Advisers Alpha - Vanguard 2017Document34 pagesAdvisers Alpha - Vanguard 2017srowbothamNo ratings yet

- Titanium Dioxide Based Nanomaterials For Photocatalytic Water Treatment - Aug16Document129 pagesTitanium Dioxide Based Nanomaterials For Photocatalytic Water Treatment - Aug16srowbothamNo ratings yet

- Effects of N Doping On Structure and Improvement Photocatalytic Properties of Anatase TiO2 - Winter2016Document6 pagesEffects of N Doping On Structure and Improvement Photocatalytic Properties of Anatase TiO2 - Winter2016srowbothamNo ratings yet

- Sol Gel NanoCoatings Global MKT Forecast 2010 24 - May2014Document159 pagesSol Gel NanoCoatings Global MKT Forecast 2010 24 - May2014srowbothamNo ratings yet

- TheChemistryofPaintsandPainting 10076550Document335 pagesTheChemistryofPaintsandPainting 10076550srowbothamNo ratings yet

- Chemours Tio2 June-2017 Investor-DeckDocument21 pagesChemours Tio2 June-2017 Investor-DecksrowbothamNo ratings yet

- Building Successful Fee Based Advice Practice - Vanguard - 2011Document36 pagesBuilding Successful Fee Based Advice Practice - Vanguard - 2011srowbothamNo ratings yet

- New Horizons in MPNs Treatment - A Review of Current and Future Therapeutic Options - 2021Document14 pagesNew Horizons in MPNs Treatment - A Review of Current and Future Therapeutic Options - 2021srowbothamNo ratings yet

- Nano Data Landscape-Construction - EU - Aug16Document197 pagesNano Data Landscape-Construction - EU - Aug16srowbothamNo ratings yet

- Modification of TiO2 With Graphic Carbon - Photocatalyst - 2016Document9 pagesModification of TiO2 With Graphic Carbon - Photocatalyst - 2016srowbothamNo ratings yet

- Lifetime Allowance and Benefit Crystallisation Events - Apr18Document4 pagesLifetime Allowance and Benefit Crystallisation Events - Apr18srowbothamNo ratings yet

- The Lifetime Allowance and The Retirement Account: CE6 CE1Document4 pagesThe Lifetime Allowance and The Retirement Account: CE6 CE1srowbothamNo ratings yet

- Bridging The Advice Gap: Delivering Investment Products in A post-RDR WorldDocument20 pagesBridging The Advice Gap: Delivering Investment Products in A post-RDR WorldsrowbothamNo ratings yet

- Base Financial Client and Fee AgreementDocument11 pagesBase Financial Client and Fee AgreementsrowbothamNo ratings yet

- Guaranteed Income - A License To Spend - Blanchett - June21Document19 pagesGuaranteed Income - A License To Spend - Blanchett - June21srowbothamNo ratings yet

- Brewin Dolphin - Our-Services-And-Charges-Sept18Document16 pagesBrewin Dolphin - Our-Services-And-Charges-Sept18srowbothamNo ratings yet

- The Pensions Lifetime Allowance: Adviser GuideDocument7 pagesThe Pensions Lifetime Allowance: Adviser GuidesrowbothamNo ratings yet

- Lifetime Allowance: What You Need To KnowDocument12 pagesLifetime Allowance: What You Need To KnowsrowbothamNo ratings yet

- Creating The Culture For Innovation Practical Guide For Leaders Dyson QuotesDocument149 pagesCreating The Culture For Innovation Practical Guide For Leaders Dyson QuotessrowbothamNo ratings yet

- Retirement Outcomes Review Interim Report FCA July17Document122 pagesRetirement Outcomes Review Interim Report FCA July17srowbothamNo ratings yet

- Drawdown The Mirror Image of Accumulation - EV-1 - Sept21Document32 pagesDrawdown The Mirror Image of Accumulation - EV-1 - Sept21srowbothamNo ratings yet

- Engineering at The Dyson InstituteDocument3 pagesEngineering at The Dyson InstitutesrowbothamNo ratings yet

- Study - Id128160 - Digital Economy Compass 2022Document246 pagesStudy - Id128160 - Digital Economy Compass 2022Georgiana OanaNo ratings yet

- LPG - Organization ChartDocument1 pageLPG - Organization Chartabdo emadNo ratings yet

- Topic: Cargo Surveying: Marine InsuranceDocument48 pagesTopic: Cargo Surveying: Marine InsuranceKaren DavilaNo ratings yet

- 100% Off & Free Udemy Coupons June 2024Document2 pages100% Off & Free Udemy Coupons June 2024Rashedul IslamNo ratings yet

- The Khus Project Case StudyDocument7 pagesThe Khus Project Case StudyUdit GourNo ratings yet

- Shrudi Nadar BlackbookDocument35 pagesShrudi Nadar Blackbookravina bhuvadNo ratings yet

- Transaction Cum Unit Statement Date: 30/03/2022: Investment Value in Rs. NAV Units %Document1 pageTransaction Cum Unit Statement Date: 30/03/2022: Investment Value in Rs. NAV Units %AlexanderNo ratings yet

- Walpole Massachusetts Realtor Local StatsDocument1 pageWalpole Massachusetts Realtor Local StatsMichael MahoneyNo ratings yet

- Unit 3. Accounting For Merchandising BusinessesDocument33 pagesUnit 3. Accounting For Merchandising BusinessesYonas100% (1)

- Iso 3019-1 2001Document9 pagesIso 3019-1 2001v38619951No ratings yet

- Info General of Moldova CorectDocument9 pagesInfo General of Moldova CorectJeka MkNo ratings yet

- DHL Express Packing Guide en PDFDocument13 pagesDHL Express Packing Guide en PDFshrikantmsdNo ratings yet

- Nation State System State and Non State Actors Lecture 3Document2 pagesNation State System State and Non State Actors Lecture 3muhammad junaidNo ratings yet

- 3 The Balance of Payments: Chapter ObjectivesDocument12 pages3 The Balance of Payments: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- Construction Management Chapter 3Document113 pagesConstruction Management Chapter 3thapitcherNo ratings yet

- Volume IDocument64 pagesVolume IVansh PandyaNo ratings yet

- Distributed Leadership and Adaptive Leadership Are Two Theories That Provide Different Perspectives On Leadership and Its Implementation Within OrganizationsDocument3 pagesDistributed Leadership and Adaptive Leadership Are Two Theories That Provide Different Perspectives On Leadership and Its Implementation Within OrganizationsDTYT GamnGNo ratings yet

- Thesis Statement For Life InsuranceDocument8 pagesThesis Statement For Life Insurancednnsgccc100% (2)

- Blue Ocean Stretegy AssignmentDocument4 pagesBlue Ocean Stretegy AssignmentMBA 8th Batch At MUSOMNo ratings yet

- Dr. K. Rajeswara Rao, IAS: Government of India Ministry of Mines Indian Bureau of MinesDocument20 pagesDr. K. Rajeswara Rao, IAS: Government of India Ministry of Mines Indian Bureau of MinesmitheleshpurohitNo ratings yet

- The History of EFT PaymentsDocument9 pagesThe History of EFT PaymentsDerick du ToitNo ratings yet

- BEL Project Engineer Trainee Officer NotificationDocument5 pagesBEL Project Engineer Trainee Officer NotificationrithinNo ratings yet

- MME 321 PRACTICAL-EXERCISES-1 (Summer 2021)Document1 pageMME 321 PRACTICAL-EXERCISES-1 (Summer 2021)Laurence Rue AudineNo ratings yet

- Tsla q4 and Fy 2021 UpdateDocument37 pagesTsla q4 and Fy 2021 UpdateFred Lamert100% (2)

- Knowledge and Human Capital As Sustainable Competitive Advantage in Human Resource Management2019Sustainability SwitzerlandDocument18 pagesKnowledge and Human Capital As Sustainable Competitive Advantage in Human Resource Management2019Sustainability SwitzerlandMary RodchenkoNo ratings yet

- ProofDocument8 pagesProofGlizette SamaniegoNo ratings yet

- Adjective Plus Preposition WorksheetDocument4 pagesAdjective Plus Preposition WorksheetRUTH MARIBEL MAMANI MAMANINo ratings yet

- DNV GL ETO 2018 Main Report Sept 1Document324 pagesDNV GL ETO 2018 Main Report Sept 1Sergio AymiNo ratings yet

- ĐHTMDocument3 pagesĐHTMNgọc MaiNo ratings yet