Professional Documents

Culture Documents

Lecture 9-9

Lecture 9-9

Uploaded by

rohab muhammad0 ratings0% found this document useful (0 votes)

9 views1 pageThis document provides an example of revaluation of property, plant, and equipment (PPE) with journal entries required for increases and decreases in value over multiple years. It includes two questions - one with an asset purchased in 2012 and revalued in subsequent years, and another with an asset purchased in 2008 and revalued in 2022. Journal entries are required to record the transactions from acquisition to the latest period provided.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an example of revaluation of property, plant, and equipment (PPE) with journal entries required for increases and decreases in value over multiple years. It includes two questions - one with an asset purchased in 2012 and revalued in subsequent years, and another with an asset purchased in 2008 and revalued in 2022. Journal entries are required to record the transactions from acquisition to the latest period provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageLecture 9-9

Lecture 9-9

Uploaded by

rohab muhammadThis document provides an example of revaluation of property, plant, and equipment (PPE) with journal entries required for increases and decreases in value over multiple years. It includes two questions - one with an asset purchased in 2012 and revalued in subsequent years, and another with an asset purchased in 2008 and revalued in 2022. Journal entries are required to record the transactions from acquisition to the latest period provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

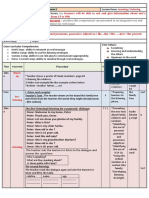

CAF-01 (FAR-1) Property, Plant and Equipment (IAS-16)

Lecture 9 (IAS-16) Lecture 9 (Overall)

Revaluation of PPE

Classwork

Q.1)

Asset purchased on 01-01-12

Cost of Asset 500

Useful life 20 Years

Revaluation Details:

01-01-14 800

01-01-16 250

01-01-18 600

Required: Prepare Journal entries from 2012 to 2018.

Q.2)

Asset Purchased on 1-07-08

Cost Rs.600

Useful Life 30 Years

It is revalued on 1.7.22 at Rs.800

Required: Prepare journal entries of 2023 (i.e. for the year ended 30.06.23)

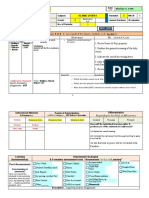

Homework:

Q.1) Shahzad Textile Mills Limited (STML) purchased a plant for Rs. 500 million on 1 July 2010. The plant has

an estimated useful life of 10 years and no residual value.

STML uses revaluation model for subsequent measurement of its property, plant and equipment and accounts

for revaluations on net replacement value method. The details of revaluations performed by an independent

firm of valuers are as follows:

Revaluation date Fair value

1 July 2011 Rs. 575 million

1 July 2012 Rs. 390 million

1 July 2013 Rs. 380 million

Required: Prepare journal entries to record the above transactions from the date of acquisition of the plant to the

year ended 30 June 2014. (Ignore tax implications) (15)

{Autumn 2014, Q# 4, CAF-05}

Umair Sheraz Utra, ACA Page |1

You might also like

- Chapter 1 Test BankDocument12 pagesChapter 1 Test BankRahul Bandari100% (3)

- Acft 6-Week Training PlanDocument28 pagesAcft 6-Week Training PlanAnthony Dinicolantonio75% (4)

- The Counting Crows Song Book 1.0Document73 pagesThe Counting Crows Song Book 1.0Frederic Paleizy100% (1)

- Lecture 13 14Document2 pagesLecture 13 14Ali Optimistic0% (1)

- Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountDocument2 pagesPrior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountBabar MalikNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- 1 III TERMS AFR June 2024 Exam Batch 80 12 27 Saugat G 77Document4 pages1 III TERMS AFR June 2024 Exam Batch 80 12 27 Saugat G 77y.yubaraj001No ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- Test Series: April, 2018 Mock Test Paper - 2 Final (Old) Course: Group - I Paper - 1: Financial ReportingDocument10 pagesTest Series: April, 2018 Mock Test Paper - 2 Final (Old) Course: Group - I Paper - 1: Financial ReportingBharathNo ratings yet

- Lecture 16Document2 pagesLecture 16Ali OptimisticNo ratings yet

- Lect 14TVDocument22 pagesLect 14TVsalman siddiquiNo ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Revision Questions 2020 Part IVDocument31 pagesRevision Questions 2020 Part IVJeffrey KamNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- AspDocument6 pagesAspCaramakr ManthaNo ratings yet

- 4 5807634410916285735Document5 pages4 5807634410916285735magwazagroup33No ratings yet

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- PP 58 TAX enDocument6 pagesPP 58 TAX enDEODATUSNo ratings yet

- Lecture # 22Document3 pagesLecture # 22HussainNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Ias 8Document9 pagesIas 8Syed Huzaifa SamiNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- CAF 07 Notes 2Document356 pagesCAF 07 Notes 2Scarlett IvyNo ratings yet

- Cfap 4 BFD Winter 2017Document4 pagesCfap 4 BFD Winter 2017Tanveer RazaNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of Indiakunal akhadeNo ratings yet

- FR (Old) MTP Compiler Past 8Document122 pagesFR (Old) MTP Compiler Past 8Pooja GuptaNo ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- Taxation Practice: Dunhinda (PVT) Ltd. Was Incorporated On 01Document8 pagesTaxation Practice: Dunhinda (PVT) Ltd. Was Incorporated On 01Muhazzam MaazNo ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- Inp 2111 - Accounts - Suggested AnswerDocument14 pagesInp 2111 - Accounts - Suggested AnswerSachin ChourasiyaNo ratings yet

- RTP May-2020Document29 pagesRTP May-2020mehtastha5454No ratings yet

- FR 1 Assignment 1 IAS 16 08112022 071429am 15102023 114037amDocument2 pagesFR 1 Assignment 1 IAS 16 08112022 071429am 15102023 114037amAnasNo ratings yet

- Assessment 1 SolutionDocument2 pagesAssessment 1 Solutionlalshahbaz57No ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- BSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester IiDocument8 pagesBSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester Iipriyadarshini212007No ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Cfap-1 AfrDocument5 pagesCfap-1 AfrsdfasNo ratings yet

- Maf5101 Financial Accounting I Eve SuppDocument6 pagesMaf5101 Financial Accounting I Eve Suppshobasabria187No ratings yet

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDocument123 pagesCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaNo ratings yet

- IAS 16 QuestionsDocument8 pagesIAS 16 QuestionsAhmad SaleemNo ratings yet

- Aff - Ol 2 May'18 (E)Document8 pagesAff - Ol 2 May'18 (E)Shahid MahmudNo ratings yet

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- Advanced Financial AccountingDocument7 pagesAdvanced Financial AccountingMuhazzam MaazNo ratings yet

- IDT Corrigendum For Nov 22 ExamsDocument8 pagesIDT Corrigendum For Nov 22 Examspreeti sinhaNo ratings yet

- Question 8: Ias 16 Property, Plant & EquipmentDocument2 pagesQuestion 8: Ias 16 Property, Plant & EquipmentBisma AmjaidNo ratings yet

- PAC All CAF Mocks With Solutions Compiled by Saboor AhmadDocument128 pagesPAC All CAF Mocks With Solutions Compiled by Saboor AhmadOmair HasanNo ratings yet

- RTP Cap III Gr-I Dec 2022Document105 pagesRTP Cap III Gr-I Dec 2022मदन कुमार बिस्टNo ratings yet

- (Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaDocument8 pages(Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaSujan SanjayNo ratings yet

- Q2Document2 pagesQ2Wathz NawarathnaNo ratings yet

- FINANCIAL ACCOUNTING Time Allowed  2 Hours Total ... - ICABDocument4 pagesFINANCIAL ACCOUNTING Time Allowed  2 Hours Total ... - ICABrumelrashid.66No ratings yet

- Intermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)Document5 pagesIntermediate Accounting 3 1. Chapter 4: Share-Based Payments (Part 2)happy240823100% (1)

- Paper - 1: Financial Reporting: (5 Marks)Document30 pagesPaper - 1: Financial Reporting: (5 Marks)priyanka khakharNo ratings yet

- Test 2 - Ind As 36 - 105 - QuesDocument4 pagesTest 2 - Ind As 36 - 105 - Quesbhallavishal.socialmediaNo ratings yet

- IAS 36 Practice Questions Solutions 08122022 104310amDocument4 pagesIAS 36 Practice Questions Solutions 08122022 104310amAdnan MaqboolNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Case Financial Performance - PT TimahDocument14 pagesCase Financial Performance - PT TimahIto PuruhitoNo ratings yet

- Stone Cladding Fixation 1Document3 pagesStone Cladding Fixation 1wadyspring100% (2)

- WerpapointDocument14 pagesWerpapointPaula Mae RubialesNo ratings yet

- Antilock Braking SystemDocument20 pagesAntilock Braking SystemRohit Kharote100% (1)

- Biology Infographics: Here Is Where This Template BeginsDocument34 pagesBiology Infographics: Here Is Where This Template BeginsYusfida Mariatul HusnaNo ratings yet

- 1701722483.roksim Alone in Space and No Suits at AllDocument28 pages1701722483.roksim Alone in Space and No Suits at AlllolyeetwutNo ratings yet

- Lesson 3 The Learner-Centered Psychological PrinciplesDocument21 pagesLesson 3 The Learner-Centered Psychological PrinciplesPurity MataNo ratings yet

- Declared Performance/sDocument1 pageDeclared Performance/sLjiljana MiskovicNo ratings yet

- Technical Elements: Curb AppealDocument1 pageTechnical Elements: Curb AppealerkkreNo ratings yet

- Articulated Boom Risk and Hazard AssessmentDocument7 pagesArticulated Boom Risk and Hazard Assessmentjcs223No ratings yet

- The Art of Safety Auditing A Tutorial For Regulators (Sasho Andonov (Author) )Document213 pagesThe Art of Safety Auditing A Tutorial For Regulators (Sasho Andonov (Author) )Ximena Manchego RosadoNo ratings yet

- Kenwood KDC-X396 ManualDocument24 pagesKenwood KDC-X396 Manualpurple_onionNo ratings yet

- ABB TPL 65 Turbochargers - Torsional Vibration of RotorDocument4 pagesABB TPL 65 Turbochargers - Torsional Vibration of Rotorartemio CardosoNo ratings yet

- Renal Failure Practice QuestionsDocument3 pagesRenal Failure Practice QuestionsJoslyn Gross100% (3)

- Sequence 02 All LessonsDocument14 pagesSequence 02 All Lessonstutor16100% (1)

- 1884 Unit - I Lecturer NotesDocument51 pages1884 Unit - I Lecturer NotesSelvan Dinesh Kumar100% (1)

- 03 Basic EngineeringDocument42 pages03 Basic EngineeringJJ Welding100% (5)

- STARBOOKS Named As Priority Program For 2018: Press ReleaseDocument2 pagesSTARBOOKS Named As Priority Program For 2018: Press ReleaseArnoNo ratings yet

- Specific Heat Relations of Ideal GasesDocument8 pagesSpecific Heat Relations of Ideal GasesNicole Anne BorromeoNo ratings yet

- Caltech - PG Program in Cloud ComputingDocument22 pagesCaltech - PG Program in Cloud ComputingkaperumaNo ratings yet

- Date Sunday, April 14, 2019 Date: Sha'ban 9, 1440Document7 pagesDate Sunday, April 14, 2019 Date: Sha'ban 9, 1440Ahmad SaadNo ratings yet

- Association of Indian Universities: Competitions On Four Zone Basis (Women)Document10 pagesAssociation of Indian Universities: Competitions On Four Zone Basis (Women)Aseem Singh SodhiNo ratings yet

- Pe BLSDocument4 pagesPe BLSchn pastranaNo ratings yet

- Sub Plan For Monday March 25Document2 pagesSub Plan For Monday March 25Mark EdwardsNo ratings yet

- Compliance CalendarDocument12 pagesCompliance CalendarAshish MallickNo ratings yet

- Free February Activities From Teaching ResourcesDocument26 pagesFree February Activities From Teaching ResourcesGabriela D Costescu100% (1)

- Arenco Fish ProcessingDocument12 pagesArenco Fish ProcessingGestora2015No ratings yet