Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 viewsPROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

PROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

Uploaded by

Jean Kathyrine Chiong1. Goodwill is calculated as the average excess earnings of $40,000 capitalized at 25%, resulting in goodwill of $160,000.

2. Goodwill is calculated by capitalizing the average earnings of $1,000,000 at 12%, resulting in an estimated purchase price of $8,333,333 and goodwill of $333,333.

3. Goodwill is calculated as the average excess earnings of $40,000 multiplied by the probable duration of excess earnings of 5 years, resulting in goodwill of $200,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- 18-3-SA-V1-S1 Solved Problems RaDocument34 pages18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiNo ratings yet

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- Chapter 11 CaseDocument4 pagesChapter 11 CaseTina CastilloNo ratings yet

- Valle Quiz AbcDocument6 pagesValle Quiz Abclorie anne valle100% (2)

- Financial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsDocument30 pagesFinancial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsanisaNo ratings yet

- Accounting For Business Combination Chapter 3 - Part 1Document1 pageAccounting For Business Combination Chapter 3 - Part 1Janella Umieh De UngriaNo ratings yet

- Method 1: Multiples of Average Excess EarningsDocument8 pagesMethod 1: Multiples of Average Excess EarningsDanielle JuntillaNo ratings yet

- Activity Chapter 3: (A) Average Annual Earnings 2,600,000Document2 pagesActivity Chapter 3: (A) Average Annual Earnings 2,600,000Randelle James FiestaNo ratings yet

- Goodwill P 200,000Document1 pageGoodwill P 200,000Jean Kathyrine ChiongNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeeNo ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- BUSCOM Illustration (Estimation of Goodwill)Document3 pagesBUSCOM Illustration (Estimation of Goodwill)Liberty NovaNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- 2008 Acct 212 Chapter 10 Resp Accg NotesDocument6 pages2008 Acct 212 Chapter 10 Resp Accg NotesBrandon HookerNo ratings yet

- 67229bos54127 Inter P8aDocument16 pages67229bos54127 Inter P8aSANDEEP MADANNo ratings yet

- BUSLYTCJDWILLIAMSCASEDocument20 pagesBUSLYTCJDWILLIAMSCASEchristinekehyengNo ratings yet

- Vian Faiq GBS Introduction To Financial Management - ReportDocument8 pagesVian Faiq GBS Introduction To Financial Management - Reportsabbirhtonmoy.1749No ratings yet

- Fiman. WC AssignmentDocument9 pagesFiman. WC AssignmentKii-anne Fernandez100% (1)

- HFMDocument1 pageHFMJPNo ratings yet

- Profe03 Act3Document1 pageProfe03 Act3Red MarieeNo ratings yet

- FMFTutorialDocument7 pagesFMFTutorialJane liewNo ratings yet

- Financial-Management Study NoteDocument1 pageFinancial-Management Study NotekhurramNo ratings yet

- Financial Management Alternative Assessment (DANISH ALI SCKD1800427)Document24 pagesFinancial Management Alternative Assessment (DANISH ALI SCKD1800427)Danish ALyNo ratings yet

- Ration AnalysisDocument35 pagesRation AnalysisMuhammad EjazNo ratings yet

- Week 7Document17 pagesWeek 7aminajubril8No ratings yet

- Akmen Chapter 12 (Putri Ramadhani)Document22 pagesAkmen Chapter 12 (Putri Ramadhani)Putri RamadhaniNo ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- DFM - AssignmentDocument9 pagesDFM - AssignmentHein Zaw Zaw NyiNo ratings yet

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressDocument5 pagesMill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressAubrey Shaiyne OfianaNo ratings yet

- Acc 501Document3 pagesAcc 501freebutterfly121No ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Chapter 33 Intangible Assets Intro and Goodwill - XLSM - Cap of AVE EXCESS EARNINGSDocument1 pageChapter 33 Intangible Assets Intro and Goodwill - XLSM - Cap of AVE EXCESS EARNINGSJaypee Verzo SaltaNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument9 pagesRatio Analysis: Liquidity RatiosNikhil GuptaNo ratings yet

- Distributions To Shareholders Dividends and Share Purchases (D. Bañas)Document8 pagesDistributions To Shareholders Dividends and Share Purchases (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- AccSoc ACCT102-23S1 Pre-Test 2 TutorialDocument38 pagesAccSoc ACCT102-23S1 Pre-Test 2 TutorialowmferrierNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Finman Activity1 SantosDocument9 pagesFinman Activity1 SantosJken OrtizNo ratings yet

- Performance Evaluation and Decentralization: Discussion QuestionsDocument20 pagesPerformance Evaluation and Decentralization: Discussion QuestionsMc Jedh CabarrubiasNo ratings yet

- 4e NBG CH12 SMDocument72 pages4e NBG CH12 SM胡振猷No ratings yet

- Performance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)Document37 pagesPerformance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)cindy chandraNo ratings yet

- CMA Assignment No - 3 (Problem)Document4 pagesCMA Assignment No - 3 (Problem)noob 2 proNo ratings yet

- Cap 8 Performance CH09 SM 1Document61 pagesCap 8 Performance CH09 SM 1Lê Chấn PhongNo ratings yet

- Tutorial Chap 2Document10 pagesTutorial Chap 2Hafeszudeen Bin AnwarkhanNo ratings yet

- Valuation of SharesDocument15 pagesValuation of Sharesbharatipaul42No ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- Answer KeyDocument19 pagesAnswer KeyRenNo ratings yet

- Business Combination AssignmentDocument4 pagesBusiness Combination AssignmentRica Joy RuzgalNo ratings yet

- Business ApplicationsDocument14 pagesBusiness Applicationsrommel legaspi100% (2)

- Jones Corportion SoluationDocument14 pagesJones Corportion SoluationShakilNo ratings yet

- Case 5-32&33Document4 pagesCase 5-32&33Majde Qasem100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

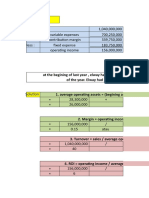

- Illustrative Problem On Cash Budget: ST ND RD THDocument3 pagesIllustrative Problem On Cash Budget: ST ND RD THJean Kathyrine ChiongNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Goodwill P 200,000Document1 pageGoodwill P 200,000Jean Kathyrine ChiongNo ratings yet

PROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

PROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

Uploaded by

Jean Kathyrine Chiong0 ratings0% found this document useful (0 votes)

25 views2 pages1. Goodwill is calculated as the average excess earnings of $40,000 capitalized at 25%, resulting in goodwill of $160,000.

2. Goodwill is calculated by capitalizing the average earnings of $1,000,000 at 12%, resulting in an estimated purchase price of $8,333,333 and goodwill of $333,333.

3. Goodwill is calculated as the average excess earnings of $40,000 multiplied by the probable duration of excess earnings of 5 years, resulting in goodwill of $200,000.

Original Description:

Original Title

PROBLEM 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Goodwill is calculated as the average excess earnings of $40,000 capitalized at 25%, resulting in goodwill of $160,000.

2. Goodwill is calculated by capitalizing the average earnings of $1,000,000 at 12%, resulting in an estimated purchase price of $8,333,333 and goodwill of $333,333.

3. Goodwill is calculated as the average excess earnings of $40,000 multiplied by the probable duration of excess earnings of 5 years, resulting in goodwill of $200,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesPROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

PROBLEM 1. (Estimating Goodwill - Direct Valuation) Required

Uploaded by

Jean Kathyrine Chiong1. Goodwill is calculated as the average excess earnings of $40,000 capitalized at 25%, resulting in goodwill of $160,000.

2. Goodwill is calculated by capitalizing the average earnings of $1,000,000 at 12%, resulting in an estimated purchase price of $8,333,333 and goodwill of $333,333.

3. Goodwill is calculated as the average excess earnings of $40,000 multiplied by the probable duration of excess earnings of 5 years, resulting in goodwill of $200,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

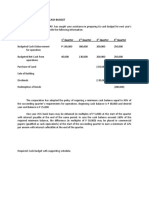

PROBLEM 1.

(Estimating Goodwill – Direct Valuation)

Required:

1. Goodwill is equal to the average excess earnings capitalized at 25%. How much is

the

goodwill?

Average annual earnings 1,000,000

Normal earnings (8M x 12%) (960,000)

Excess earnings 40,000

Divide by: Capitalization rate 25%

Goodwill 160,000

2. Goodwill is measured by capitalizing the average earnings at 12%. How much is

the Goodwill

Average earnings 1,000,000

Divide by: Capitalization rate 12%

Estimated purchase price 8,333,333

Fair value of Entity B’s net assets (8,000,000)

Goodwill 333,333

3. Goodwill is measured at the undiscounted amount of total excess earnings

expected to

be earned from the combination. How much is goodwill?

Average annual earnings 1,000,000

Normal earnings (8M x 12%) (960,000)

Excess earnings 40,000

Multiply by: Probable duration 5

Goodwill 200,000

4. Goodwill is measure by discounting the average excess earnings at 9%. How much

is the goodwill?

Average annual earnings 1,000,000

Normal earnings (8M x 12%) (960,000)

Excess earnings 40,000

Multiply by: PV of ordinary annuity of 1 at 9% 3.88965

Goodwill 155,586

You might also like

- 18-3-SA-V1-S1 Solved Problems RaDocument34 pages18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiNo ratings yet

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- Chapter 11 CaseDocument4 pagesChapter 11 CaseTina CastilloNo ratings yet

- Valle Quiz AbcDocument6 pagesValle Quiz Abclorie anne valle100% (2)

- Financial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsDocument30 pagesFinancial Analysis-Sizing Up Firm Performance: Income Statement 2016 % of Sales Example CalculationsanisaNo ratings yet

- Accounting For Business Combination Chapter 3 - Part 1Document1 pageAccounting For Business Combination Chapter 3 - Part 1Janella Umieh De UngriaNo ratings yet

- Method 1: Multiples of Average Excess EarningsDocument8 pagesMethod 1: Multiples of Average Excess EarningsDanielle JuntillaNo ratings yet

- Activity Chapter 3: (A) Average Annual Earnings 2,600,000Document2 pagesActivity Chapter 3: (A) Average Annual Earnings 2,600,000Randelle James FiestaNo ratings yet

- Goodwill P 200,000Document1 pageGoodwill P 200,000Jean Kathyrine ChiongNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeeNo ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- BUSCOM Illustration (Estimation of Goodwill)Document3 pagesBUSCOM Illustration (Estimation of Goodwill)Liberty NovaNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- 2008 Acct 212 Chapter 10 Resp Accg NotesDocument6 pages2008 Acct 212 Chapter 10 Resp Accg NotesBrandon HookerNo ratings yet

- 67229bos54127 Inter P8aDocument16 pages67229bos54127 Inter P8aSANDEEP MADANNo ratings yet

- BUSLYTCJDWILLIAMSCASEDocument20 pagesBUSLYTCJDWILLIAMSCASEchristinekehyengNo ratings yet

- Vian Faiq GBS Introduction To Financial Management - ReportDocument8 pagesVian Faiq GBS Introduction To Financial Management - Reportsabbirhtonmoy.1749No ratings yet

- Fiman. WC AssignmentDocument9 pagesFiman. WC AssignmentKii-anne Fernandez100% (1)

- HFMDocument1 pageHFMJPNo ratings yet

- Profe03 Act3Document1 pageProfe03 Act3Red MarieeNo ratings yet

- FMFTutorialDocument7 pagesFMFTutorialJane liewNo ratings yet

- Financial-Management Study NoteDocument1 pageFinancial-Management Study NotekhurramNo ratings yet

- Financial Management Alternative Assessment (DANISH ALI SCKD1800427)Document24 pagesFinancial Management Alternative Assessment (DANISH ALI SCKD1800427)Danish ALyNo ratings yet

- Ration AnalysisDocument35 pagesRation AnalysisMuhammad EjazNo ratings yet

- Week 7Document17 pagesWeek 7aminajubril8No ratings yet

- Akmen Chapter 12 (Putri Ramadhani)Document22 pagesAkmen Chapter 12 (Putri Ramadhani)Putri RamadhaniNo ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- DFM - AssignmentDocument9 pagesDFM - AssignmentHein Zaw Zaw NyiNo ratings yet

- Mill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressDocument5 pagesMill A N CH A Pter 1 Business Combin A Tion P A RT 3 CompressAubrey Shaiyne OfianaNo ratings yet

- Acc 501Document3 pagesAcc 501freebutterfly121No ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Chapter 33 Intangible Assets Intro and Goodwill - XLSM - Cap of AVE EXCESS EARNINGSDocument1 pageChapter 33 Intangible Assets Intro and Goodwill - XLSM - Cap of AVE EXCESS EARNINGSJaypee Verzo SaltaNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument9 pagesRatio Analysis: Liquidity RatiosNikhil GuptaNo ratings yet

- Distributions To Shareholders Dividends and Share Purchases (D. Bañas)Document8 pagesDistributions To Shareholders Dividends and Share Purchases (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- AccSoc ACCT102-23S1 Pre-Test 2 TutorialDocument38 pagesAccSoc ACCT102-23S1 Pre-Test 2 TutorialowmferrierNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Finman Activity1 SantosDocument9 pagesFinman Activity1 SantosJken OrtizNo ratings yet

- Performance Evaluation and Decentralization: Discussion QuestionsDocument20 pagesPerformance Evaluation and Decentralization: Discussion QuestionsMc Jedh CabarrubiasNo ratings yet

- 4e NBG CH12 SMDocument72 pages4e NBG CH12 SM胡振猷No ratings yet

- Performance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)Document37 pagesPerformance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)cindy chandraNo ratings yet

- CMA Assignment No - 3 (Problem)Document4 pagesCMA Assignment No - 3 (Problem)noob 2 proNo ratings yet

- Cap 8 Performance CH09 SM 1Document61 pagesCap 8 Performance CH09 SM 1Lê Chấn PhongNo ratings yet

- Tutorial Chap 2Document10 pagesTutorial Chap 2Hafeszudeen Bin AnwarkhanNo ratings yet

- Valuation of SharesDocument15 pagesValuation of Sharesbharatipaul42No ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Assignment FM I (2020)Document11 pagesAssignment FM I (2020)ShaggYNo ratings yet

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- Answer KeyDocument19 pagesAnswer KeyRenNo ratings yet

- Business Combination AssignmentDocument4 pagesBusiness Combination AssignmentRica Joy RuzgalNo ratings yet

- Business ApplicationsDocument14 pagesBusiness Applicationsrommel legaspi100% (2)

- Jones Corportion SoluationDocument14 pagesJones Corportion SoluationShakilNo ratings yet

- Case 5-32&33Document4 pagesCase 5-32&33Majde Qasem100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Illustrative Problem On Cash Budget: ST ND RD THDocument3 pagesIllustrative Problem On Cash Budget: ST ND RD THJean Kathyrine ChiongNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Goodwill P 200,000Document1 pageGoodwill P 200,000Jean Kathyrine ChiongNo ratings yet