Professional Documents

Culture Documents

Documentary Stamp Tax BIR Form 200-OT

Documentary Stamp Tax BIR Form 200-OT

Uploaded by

NGITPACopyright:

Available Formats

You might also like

- Acceptance Payment Form Estate Tax AmnestyDocument1 pageAcceptance Payment Form Estate Tax AmnestyAlvin III SiapianNo ratings yet

- Model Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)Document10 pagesModel Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)vidya adsule100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- Tax Amnesty Return On DelinquenciesDocument3 pagesTax Amnesty Return On DelinquenciesIML2016No ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- 0619-E Jan 2018 Rev Final-1Document6 pages0619-E Jan 2018 Rev Final-1cahiligjoyceNo ratings yet

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- Documentary Stamp Tax Declaration/ReturnDocument4 pagesDocumentary Stamp Tax Declaration/ReturnPajarillo Kathy AnnNo ratings yet

- 1702-RT Jan 2018 ENCS Final v3 PDFDocument4 pages1702-RT Jan 2018 ENCS Final v3 PDFR A GelilangNo ratings yet

- 1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pages1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Ivan ChuaNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoRichelle Ann RodriguezNo ratings yet

- BIR Form 0605Document4 pagesBIR Form 0605Rudy Bangaan63% (8)

- 0619-E Jan 2018 Rev Final-1-1Document8 pages0619-E Jan 2018 Rev Final-1-1cahiligjoyceNo ratings yet

- Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 pageMonthly Remittance Return: of Income Taxes Withheld On CompensationSafferon SaffronNo ratings yet

- 0619-EDocument9 pages0619-EMarylinNo ratings yet

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- BIR Form No. 0901-S1Document2 pagesBIR Form No. 0901-S1Aldrinn BenamirNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- 1701 Mixed TemplateDocument11 pages1701 Mixed TemplateDaniel B. MalillinNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Mavi Manalo-NarvaezNo ratings yet

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document4 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)docdocdeeNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008Jaime II LustadoNo ratings yet

- Bir Form 1701Document4 pagesBir Form 1701Ajoi SevillaNo ratings yet

- 82310BIR Form 1700Document4 pages82310BIR Form 1700TenNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Alexa Reyes de GuzmanNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- 0619-fDocument8 pages0619-fMarylinNo ratings yet

- 1600Document9 pages1600jbabellarNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- BIR Form No. 2119 - Rev - Guidelines2Document3 pagesBIR Form No. 2119 - Rev - Guidelines2rhea CabillanNo ratings yet

- 1701 June 2013 Pages 1 To 4Document4 pages1701 June 2013 Pages 1 To 4Stephen Paul EscañoNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- Bir Form 1600Document9 pagesBir Form 1600Vincent De GuzmanNo ratings yet

- Annex A - 1701A Jan 2018481Document3 pagesAnnex A - 1701A Jan 2018481Rhon MarlNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- RMC No. 108-2020 Annex BDocument2 pagesRMC No. 108-2020 Annex BJoel SyNo ratings yet

- 0901-PR Final 03.2021 2Document2 pages0901-PR Final 03.2021 2Yuri LopezNo ratings yet

- BIR Form No. 0622 - Rev - Guidelines2correctedDocument2 pagesBIR Form No. 0622 - Rev - Guidelines2correctedjomarNo ratings yet

- Tarelco IIDocument1 pageTarelco IIJessica CrisostomoNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Bir05 PDFDocument3 pagesBir05 PDFBarangay LumbangNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- 2551Q Miflores 1st QuarterDocument3 pages2551Q Miflores 1st Quartercatherine aleluyaNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument14 pagesAnnual Income Tax Return: Yes No Yes NoJoyce Ann CortezNo ratings yet

- PH Bir 0605Document2 pagesPH Bir 0605Anonymous onBMYp9YNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Danel Dave BarbucoNo ratings yet

- BIR Form 0616 Amnesty Tax Payment Form PDFDocument1 pageBIR Form 0616 Amnesty Tax Payment Form PDFLeichelle BautistaNo ratings yet

- Amnesty Tax Payment Form: Kawanihan NG Rentas InternasDocument1 pageAmnesty Tax Payment Form: Kawanihan NG Rentas InternasAtty Rester John NonatoNo ratings yet

- FBT Form 1603Document2 pagesFBT Form 1603Cb SingsonNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Lisondra, Kathleen Shayne A. Bsed - Math 1ADocument4 pagesLisondra, Kathleen Shayne A. Bsed - Math 1ANGITPANo ratings yet

- Explain The Hydraulic Cycle in NatureDocument3 pagesExplain The Hydraulic Cycle in NatureNGITPANo ratings yet

- Lesson Plan in Grade 9-Science: I. ObjectivesDocument1 pageLesson Plan in Grade 9-Science: I. ObjectivesNGITPANo ratings yet

- Individualism vs. CollectivismDocument4 pagesIndividualism vs. CollectivismNGITPANo ratings yet

- Continually Improving Products, People, and Services. So,: Twice by An Average of 20% ImprovementDocument4 pagesContinually Improving Products, People, and Services. So,: Twice by An Average of 20% ImprovementNGITPANo ratings yet

- Learnin G Curve Theory: Presenters: Freya Rica N. Martin Kessa Thea G. Lucero BSA-3Document6 pagesLearnin G Curve Theory: Presenters: Freya Rica N. Martin Kessa Thea G. Lucero BSA-3NGITPANo ratings yet

- Capital Gains Tax Return BIR Form No 1706Document1 pageCapital Gains Tax Return BIR Form No 1706NGITPANo ratings yet

- Lincoln Vs CA DigestDocument2 pagesLincoln Vs CA DigestNeNe Dela LLana100% (1)

- Vikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaDocument9 pagesVikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaVikki AmorioNo ratings yet

- International Tax: Bangladesh Highlights 2020Document8 pagesInternational Tax: Bangladesh Highlights 2020Mehadi HasanNo ratings yet

- 4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActDocument8 pages4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActSantosh SinghNo ratings yet

- Unit-2 Fake Currency and StampDocument32 pagesUnit-2 Fake Currency and StampABHINAV DEWALIYANo ratings yet

- S I P Project Report On Real EstateDocument65 pagesS I P Project Report On Real EstateCricket KheloNo ratings yet

- B'suraj Lamp & Industries (P) ... Vs State of Haryana & Anr On 11 October, 2011'Document10 pagesB'suraj Lamp & Industries (P) ... Vs State of Haryana & Anr On 11 October, 2011'samiaNo ratings yet

- Poornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651Document21 pagesPoornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651sumeet_jayNo ratings yet

- How To Perform Khata TransferDocument2 pagesHow To Perform Khata Transfermasta kalandarNo ratings yet

- Og Tra ReportDocument14 pagesOg Tra ReportMahasa R HajiiNo ratings yet

- Procedure of Transfer of Immovable PropertyDocument6 pagesProcedure of Transfer of Immovable PropertyAmit BidwaiNo ratings yet

- 116.CIR Vs Fireman's Fund InsuranceDocument6 pages116.CIR Vs Fireman's Fund InsuranceClyde KitongNo ratings yet

- Calculate Tax Fees and Charge PDFDocument30 pagesCalculate Tax Fees and Charge PDFJamal86% (7)

- Deed of Grant of Security Rights (Apht)Document15 pagesDeed of Grant of Security Rights (Apht)putri rejeki kasadNo ratings yet

- VAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxDocument5 pagesVAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxJune Romeo ObiasNo ratings yet

- Memorandum of UnderstandingDocument2 pagesMemorandum of UnderstandingPratik PatelNo ratings yet

- Stamp Paper TypesDocument16 pagesStamp Paper TypesMuhammad Ehsan QadirNo ratings yet

- 16 Transfer Deed For Flat or UnitDocument14 pages16 Transfer Deed For Flat or UnitSanjay KumarNo ratings yet

- Bombay Stamp ActDocument69 pagesBombay Stamp ActAjit BijlaneyNo ratings yet

- Taxability of GiftDocument9 pagesTaxability of GiftGaurav BeniwalNo ratings yet

- Deloitte - A Pocket Guide To Singapore Tax 2014 PDFDocument20 pagesDeloitte - A Pocket Guide To Singapore Tax 2014 PDFAlison YangNo ratings yet

- SPICe+ HelpDocument30 pagesSPICe+ HelpmohanngpNo ratings yet

- Operative Guidelines For DIC KARNATAKA INDUSTRIAL POLICY 2014-19 PDFDocument173 pagesOperative Guidelines For DIC KARNATAKA INDUSTRIAL POLICY 2014-19 PDFAzhar ChakoliNo ratings yet

- Steps in Transfer of TCTDocument2 pagesSteps in Transfer of TCTPogi akoNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Asia United Leasing Finance Corp. v.20220215-11-CrbnjjDocument35 pagesAsia United Leasing Finance Corp. v.20220215-11-CrbnjjRheneir MoraNo ratings yet

- Sale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered UnderDocument26 pagesSale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered Undernaveen KumarNo ratings yet

- Factors Affecting Foreign Direct InvestmentDocument17 pagesFactors Affecting Foreign Direct Investmentbenki megeriNo ratings yet

- Kashish Developers Limited: Housing Residential Complex at Sector-111, Gurgaon, HaryanaDocument22 pagesKashish Developers Limited: Housing Residential Complex at Sector-111, Gurgaon, HaryanaAnadi GuptaNo ratings yet

Documentary Stamp Tax BIR Form 200-OT

Documentary Stamp Tax BIR Form 200-OT

Uploaded by

NGITPAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Documentary Stamp Tax BIR Form 200-OT

Documentary Stamp Tax BIR Form 200-OT

Uploaded by

NGITPACopyright:

Available Formats

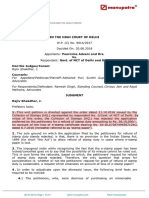

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Documentary Stamp Tax Declaration/

2000-OT Return (One-Time Transactions)

January 2018 (ENCS) Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all applicable

Page 1 boxes with an “X”. Two copies MUST be filed with the BIR and one to be held by the Taxpayer. 2000-OT 01/18ENCS P1

1 Date of Transaction (MM/DD/YYYY) 2 Amended Return? 3 Alphanumeric Tax Code (ATC) 4 Number of Sheet/s Attached

DO 102 DO 122 DO 125 3

Part I – Background Information

6 RDO Code of Location of the

5 Taxpayer Identification Number (TIN) 0 0 0 0 0 Property 107

7 Taxpayer’s Name (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals)

8 Registered Address (Indicate complete address. If branch, indicated the branch address. If registered address is different from the current address, go to the RDP to update registered address by using BIR Form No. 1905)

8A ZIP Code

9 Contact Number 10 Email Address

11 Other Party to the transaction Seller/Transferor/Donor Buyer/Transferee/Donee

11A Name (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals)

11B TIN 0 0 0 0 0

12 Nature of Transaction

Transfer of Shares of Stock Not Traded Through the Local Stock Exchange

(Does not include original issue of shares of stock by the issuing corporation)

Transfer of Real Property Classified as Capital Asset Transfer of Real Property Other Than Capital Asset

13 Location of Real Property (if sale/transfer/donation of real property)

Part II – Computation of Tax

14 Taxable Base - Shares of Stock [From Part IV Schedule 1.B column (d) or (e), whichever is applicable]

15 Taxable Base - Real Property (From Part IV Schedule 2 Item 2)

16 Tax Rate

17 Tax Due (Item 14 or 15 x Item 16)

18 Less: Tax Paid in Return previously filed, if this is an amended return

19 Tax Still Due/(Overpayment) (Item 17 less Item 18)

20 Add: Penalties

20A Surcharge

20B Interest

20C Compromise

20D Total Penalties (Sum of items 20A to 20C)

21 Total Amount Payable/Overpayment (Sum of Items 19 and 20D)

In case of overpayment, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds)

I/We declare under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to the

provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as

contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.(If signed by an Authorized Representative, attach Special Power of Attorney)

For Individual: For Non-Individual:

JUANA DELA CRUZ

Signature Over Printed Name of Taxpayer/Authorized Representative/Tax Agent Signature Over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent

(Indicate title/designation and TIN) (Indicate title/designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

PART III – DETAILS OF PAYMENT

Particulars Drawee Bank/Agency Number Date (MM/DD/YYYY) Amount

22 Cash/Bank Debit Memo / / .

23 Check / / .

24 Tax Debit Memo / / .

25 Others (specify)

/ /

Stamp of Authorized Agent Bank and Date of Receipt

.

Machine Validation

(Bank Teller's Initial)

*NOTE: Please read the BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

You might also like

- Acceptance Payment Form Estate Tax AmnestyDocument1 pageAcceptance Payment Form Estate Tax AmnestyAlvin III SiapianNo ratings yet

- Model Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)Document10 pagesModel Agreement Provided Under The Maharashtra Ownership of Flats Act (Mofa)vidya adsule100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- Tax Amnesty Return On DelinquenciesDocument3 pagesTax Amnesty Return On DelinquenciesIML2016No ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- 0619-E Jan 2018 Rev Final-1Document6 pages0619-E Jan 2018 Rev Final-1cahiligjoyceNo ratings yet

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- Documentary Stamp Tax Declaration/ReturnDocument4 pagesDocumentary Stamp Tax Declaration/ReturnPajarillo Kathy AnnNo ratings yet

- 1702-RT Jan 2018 ENCS Final v3 PDFDocument4 pages1702-RT Jan 2018 ENCS Final v3 PDFR A GelilangNo ratings yet

- 1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pages1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Ivan ChuaNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoRichelle Ann RodriguezNo ratings yet

- BIR Form 0605Document4 pagesBIR Form 0605Rudy Bangaan63% (8)

- 0619-E Jan 2018 Rev Final-1-1Document8 pages0619-E Jan 2018 Rev Final-1-1cahiligjoyceNo ratings yet

- Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 pageMonthly Remittance Return: of Income Taxes Withheld On CompensationSafferon SaffronNo ratings yet

- 0619-EDocument9 pages0619-EMarylinNo ratings yet

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- BIR Form No. 0901-S1Document2 pagesBIR Form No. 0901-S1Aldrinn BenamirNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- 1701 Mixed TemplateDocument11 pages1701 Mixed TemplateDaniel B. MalillinNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Mavi Manalo-NarvaezNo ratings yet

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document4 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)docdocdeeNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008Jaime II LustadoNo ratings yet

- Bir Form 1701Document4 pagesBir Form 1701Ajoi SevillaNo ratings yet

- 82310BIR Form 1700Document4 pages82310BIR Form 1700TenNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Alexa Reyes de GuzmanNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- 0619-fDocument8 pages0619-fMarylinNo ratings yet

- 1600Document9 pages1600jbabellarNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- BIR Form No. 2119 - Rev - Guidelines2Document3 pagesBIR Form No. 2119 - Rev - Guidelines2rhea CabillanNo ratings yet

- 1701 June 2013 Pages 1 To 4Document4 pages1701 June 2013 Pages 1 To 4Stephen Paul EscañoNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- Bir Form 1600Document9 pagesBir Form 1600Vincent De GuzmanNo ratings yet

- Annex A - 1701A Jan 2018481Document3 pagesAnnex A - 1701A Jan 2018481Rhon MarlNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- RMC No. 108-2020 Annex BDocument2 pagesRMC No. 108-2020 Annex BJoel SyNo ratings yet

- 0901-PR Final 03.2021 2Document2 pages0901-PR Final 03.2021 2Yuri LopezNo ratings yet

- BIR Form No. 0622 - Rev - Guidelines2correctedDocument2 pagesBIR Form No. 0622 - Rev - Guidelines2correctedjomarNo ratings yet

- Tarelco IIDocument1 pageTarelco IIJessica CrisostomoNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Bir05 PDFDocument3 pagesBir05 PDFBarangay LumbangNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- 2551Q Miflores 1st QuarterDocument3 pages2551Q Miflores 1st Quartercatherine aleluyaNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument14 pagesAnnual Income Tax Return: Yes No Yes NoJoyce Ann CortezNo ratings yet

- PH Bir 0605Document2 pagesPH Bir 0605Anonymous onBMYp9YNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Danel Dave BarbucoNo ratings yet

- BIR Form 0616 Amnesty Tax Payment Form PDFDocument1 pageBIR Form 0616 Amnesty Tax Payment Form PDFLeichelle BautistaNo ratings yet

- Amnesty Tax Payment Form: Kawanihan NG Rentas InternasDocument1 pageAmnesty Tax Payment Form: Kawanihan NG Rentas InternasAtty Rester John NonatoNo ratings yet

- FBT Form 1603Document2 pagesFBT Form 1603Cb SingsonNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Lisondra, Kathleen Shayne A. Bsed - Math 1ADocument4 pagesLisondra, Kathleen Shayne A. Bsed - Math 1ANGITPANo ratings yet

- Explain The Hydraulic Cycle in NatureDocument3 pagesExplain The Hydraulic Cycle in NatureNGITPANo ratings yet

- Lesson Plan in Grade 9-Science: I. ObjectivesDocument1 pageLesson Plan in Grade 9-Science: I. ObjectivesNGITPANo ratings yet

- Individualism vs. CollectivismDocument4 pagesIndividualism vs. CollectivismNGITPANo ratings yet

- Continually Improving Products, People, and Services. So,: Twice by An Average of 20% ImprovementDocument4 pagesContinually Improving Products, People, and Services. So,: Twice by An Average of 20% ImprovementNGITPANo ratings yet

- Learnin G Curve Theory: Presenters: Freya Rica N. Martin Kessa Thea G. Lucero BSA-3Document6 pagesLearnin G Curve Theory: Presenters: Freya Rica N. Martin Kessa Thea G. Lucero BSA-3NGITPANo ratings yet

- Capital Gains Tax Return BIR Form No 1706Document1 pageCapital Gains Tax Return BIR Form No 1706NGITPANo ratings yet

- Lincoln Vs CA DigestDocument2 pagesLincoln Vs CA DigestNeNe Dela LLana100% (1)

- Vikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaDocument9 pagesVikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaVikki AmorioNo ratings yet

- International Tax: Bangladesh Highlights 2020Document8 pagesInternational Tax: Bangladesh Highlights 2020Mehadi HasanNo ratings yet

- 4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActDocument8 pages4 4 Conversion of A Partnership Firm Into A Company Under Part Ix of The Companies ActSantosh SinghNo ratings yet

- Unit-2 Fake Currency and StampDocument32 pagesUnit-2 Fake Currency and StampABHINAV DEWALIYANo ratings yet

- S I P Project Report On Real EstateDocument65 pagesS I P Project Report On Real EstateCricket KheloNo ratings yet

- B'suraj Lamp & Industries (P) ... Vs State of Haryana & Anr On 11 October, 2011'Document10 pagesB'suraj Lamp & Industries (P) ... Vs State of Haryana & Anr On 11 October, 2011'samiaNo ratings yet

- Poornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651Document21 pagesPoornima Advani and Ors Vs Govt of NCT of Delhi AnDE201827081816354128COM236651sumeet_jayNo ratings yet

- How To Perform Khata TransferDocument2 pagesHow To Perform Khata Transfermasta kalandarNo ratings yet

- Og Tra ReportDocument14 pagesOg Tra ReportMahasa R HajiiNo ratings yet

- Procedure of Transfer of Immovable PropertyDocument6 pagesProcedure of Transfer of Immovable PropertyAmit BidwaiNo ratings yet

- 116.CIR Vs Fireman's Fund InsuranceDocument6 pages116.CIR Vs Fireman's Fund InsuranceClyde KitongNo ratings yet

- Calculate Tax Fees and Charge PDFDocument30 pagesCalculate Tax Fees and Charge PDFJamal86% (7)

- Deed of Grant of Security Rights (Apht)Document15 pagesDeed of Grant of Security Rights (Apht)putri rejeki kasadNo ratings yet

- VAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxDocument5 pagesVAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxJune Romeo ObiasNo ratings yet

- Memorandum of UnderstandingDocument2 pagesMemorandum of UnderstandingPratik PatelNo ratings yet

- Stamp Paper TypesDocument16 pagesStamp Paper TypesMuhammad Ehsan QadirNo ratings yet

- 16 Transfer Deed For Flat or UnitDocument14 pages16 Transfer Deed For Flat or UnitSanjay KumarNo ratings yet

- Bombay Stamp ActDocument69 pagesBombay Stamp ActAjit BijlaneyNo ratings yet

- Taxability of GiftDocument9 pagesTaxability of GiftGaurav BeniwalNo ratings yet

- Deloitte - A Pocket Guide To Singapore Tax 2014 PDFDocument20 pagesDeloitte - A Pocket Guide To Singapore Tax 2014 PDFAlison YangNo ratings yet

- SPICe+ HelpDocument30 pagesSPICe+ HelpmohanngpNo ratings yet

- Operative Guidelines For DIC KARNATAKA INDUSTRIAL POLICY 2014-19 PDFDocument173 pagesOperative Guidelines For DIC KARNATAKA INDUSTRIAL POLICY 2014-19 PDFAzhar ChakoliNo ratings yet

- Steps in Transfer of TCTDocument2 pagesSteps in Transfer of TCTPogi akoNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Asia United Leasing Finance Corp. v.20220215-11-CrbnjjDocument35 pagesAsia United Leasing Finance Corp. v.20220215-11-CrbnjjRheneir MoraNo ratings yet

- Sale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered UnderDocument26 pagesSale Deed: ORGANISATION (AWHO), (PAN No. AABTA4251G) A Society Registered Undernaveen KumarNo ratings yet

- Factors Affecting Foreign Direct InvestmentDocument17 pagesFactors Affecting Foreign Direct Investmentbenki megeriNo ratings yet

- Kashish Developers Limited: Housing Residential Complex at Sector-111, Gurgaon, HaryanaDocument22 pagesKashish Developers Limited: Housing Residential Complex at Sector-111, Gurgaon, HaryanaAnadi GuptaNo ratings yet