Professional Documents

Culture Documents

National Foods LTD FY21 Earnings Update

National Foods LTD FY21 Earnings Update

Uploaded by

Malcolm ChitenderuCopyright:

Available Formats

You might also like

- Financial Analysis of - Toys "R" Us, Inc.Document30 pagesFinancial Analysis of - Toys "R" Us, Inc.Arabi AsadNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- Top Stories:: THU 11 APR 2024Document3 pagesTop Stories:: THU 11 APR 2024philnabank1217No ratings yet

- Ceylon Cold Stores PLC: Limited Disruptions To Support CCS's Growth AvenuesDocument3 pagesCeylon Cold Stores PLC: Limited Disruptions To Support CCS's Growth AvenuesantiqurrNo ratings yet

- 536248112021255dabur India Limited - 20210806Document5 pages536248112021255dabur India Limited - 20210806Michelle CastelinoNo ratings yet

- Earnings Update DANGCEM 2021FY 1Document6 pagesEarnings Update DANGCEM 2021FY 1kazeemsheriff8No ratings yet

- Stove Kraft-1QFY22 Result Update - 01 August 2021Document7 pagesStove Kraft-1QFY22 Result Update - 01 August 2021Raghu KuchiNo ratings yet

- Granules - India BP - Wealth 151121Document7 pagesGranules - India BP - Wealth 151121Lakshay SainiNo ratings yet

- JollibeeDocument4 pagesJollibeeJoyce C.No ratings yet

- VMART Q4FY22 ResultDocument6 pagesVMART Q4FY22 ResultKhush GosraniNo ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Padenga Holdings FY22 Earnings UpdateDocument3 pagesPadenga Holdings FY22 Earnings UpdateMichael MatambanadzoNo ratings yet

- Bayer Cropscience (BYRCS IN) : Q1FY21 Result UpdateDocument7 pagesBayer Cropscience (BYRCS IN) : Q1FY21 Result UpdateChockalingam SundharNo ratings yet

- Motilal Oswal On Devyani InternationalDocument10 pagesMotilal Oswal On Devyani InternationalbapianshumanNo ratings yet

- q2 2021 Results AnnouncementDocument71 pagesq2 2021 Results AnnouncementmarceloNo ratings yet

- Suryoday Small Finance Bank Q1FY24 Result Update Centrum 11082023Document13 pagesSuryoday Small Finance Bank Q1FY24 Result Update Centrum 11082023yoursaaryaNo ratings yet

- Cpin 130524 PtosDocument4 pagesCpin 130524 Ptosmaradona ligaNo ratings yet

- 1Q21 Profits Jump 23.5% Y/y, in Line With Estimates: Century Pacific Food, IncDocument7 pages1Q21 Profits Jump 23.5% Y/y, in Line With Estimates: Century Pacific Food, IncJajahinaNo ratings yet

- CNPF Sustains Growth Momentum in 3Q21: Century Pacific Food, IncDocument8 pagesCNPF Sustains Growth Momentum in 3Q21: Century Pacific Food, IncJajahinaNo ratings yet

- Hold Hindustan Unilever: Strong Performance Inflation Pressure Continues To PersistDocument13 pagesHold Hindustan Unilever: Strong Performance Inflation Pressure Continues To PersistAbhishek SaxenaNo ratings yet

- Fineorg 25 5 23 PLDocument8 pagesFineorg 25 5 23 PLSubhash MsNo ratings yet

- Indofood CBP: Navigating WellDocument11 pagesIndofood CBP: Navigating WellAbimanyu LearingNo ratings yet

- Weekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Document2 pagesWeekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Romel Alvendia ValenciaNo ratings yet

- HSIE Results Daily - 04 August 21-202108040822126132901Document9 pagesHSIE Results Daily - 04 August 21-202108040822126132901Michelle CastelinoNo ratings yet

- DNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncDocument9 pagesDNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncJajahinaNo ratings yet

- Financial AnalysisDocument14 pagesFinancial Analysismuzaffarovh271No ratings yet

- ICICI Securities REDUCE on Adani Wilmar With 6 DOWNSIDE ProfitabilityDocument8 pagesICICI Securities REDUCE on Adani Wilmar With 6 DOWNSIDE ProfitabilityPratham IngaleNo ratings yet

- Quarterly Update Q1FY22: Krishna Institute of Medical Sciences LTDDocument10 pagesQuarterly Update Q1FY22: Krishna Institute of Medical Sciences LTDhackmaverickNo ratings yet

- Nirmal Bang PDFDocument11 pagesNirmal Bang PDFBook MonkNo ratings yet

- Varun Beverages Q1CY22 Result UpdateDocument5 pagesVarun Beverages Q1CY22 Result UpdateBaria VirenNo ratings yet

- 2Q FY22 Financial Results Presentation: 22 October 2021Document58 pages2Q FY22 Financial Results Presentation: 22 October 2021chaitanya varma ChekuriNo ratings yet

- Burger King India (BURGERKI IN) : Q2FY22 Result UpdateDocument8 pagesBurger King India (BURGERKI IN) : Q2FY22 Result UpdatebradburywillsNo ratings yet

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Centrum Dabur India Company UpdateDocument7 pagesCentrum Dabur India Company UpdateprasaadrajputNo ratings yet

- SH Kelkar: All-Round Performance Outlook Remains StrongDocument8 pagesSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaNo ratings yet

- Butterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1Document12 pagesButterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1sundar iyerNo ratings yet

- V Guard Industries Q3 FY22 Results PresentationDocument17 pagesV Guard Industries Q3 FY22 Results PresentationRATHINo ratings yet

- Raymond-Q2FY22-RU LKPDocument9 pagesRaymond-Q2FY22-RU LKP56 AA Prathamesh WarangNo ratings yet

- 1Q FY 2021-22 Financial ResultsDocument54 pages1Q FY 2021-22 Financial Resultsaditya tripathiNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Edita 3Q2023 Earnings Release E v4Document10 pagesEdita 3Q2023 Earnings Release E v4Habiba HishamNo ratings yet

- 211428182023567dabur India Limited - 20230808Document5 pages211428182023567dabur India Limited - 20230808Jigar PitrodaNo ratings yet

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsDocument6 pagesIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiNo ratings yet

- RIL 3Q FY24 Analyst Presentation 19jan24Document55 pagesRIL 3Q FY24 Analyst Presentation 19jan24meetpanchal172006No ratings yet

- Earnings Release - 01.30.2023 FINALDocument20 pagesEarnings Release - 01.30.2023 FINALDuangjitr WongNo ratings yet

- Infosys (INFO IN) : Q1FY22 Result UpdateDocument13 pagesInfosys (INFO IN) : Q1FY22 Result UpdatePrahladNo ratings yet

- Mrs. Bectors Food Specialities 04062024 AcDocument6 pagesMrs. Bectors Food Specialities 04062024 AcgreyistariNo ratings yet

- Indofood CBP Sukses Makmur: Equity ResearchDocument5 pagesIndofood CBP Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Income Statement Analysis of Vitarich CorporationDocument11 pagesIncome Statement Analysis of Vitarich CorporationLynnie Jane JauculanNo ratings yet

- Infosys (INFO IN) : Q1FY21 Result UpdateDocument14 pagesInfosys (INFO IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- UNVR SekuritasDocument7 pagesUNVR Sekuritasfaizal ardiNo ratings yet

- Financial Highlights: Values in R$ ('000)Document33 pagesFinancial Highlights: Values in R$ ('000)renatoNo ratings yet

- Nestle India: Project RURBAN To Support Strong Growth Inflationary Clouds RemainDocument11 pagesNestle India: Project RURBAN To Support Strong Growth Inflationary Clouds Remainkrishna_buntyNo ratings yet

- Prabhudas Lilladher Apar Industries Q2FY24 Results ReviewDocument7 pagesPrabhudas Lilladher Apar Industries Q2FY24 Results ReviewyoursaaryaNo ratings yet

- CTEC 2021 4Q Press ReleaseDocument46 pagesCTEC 2021 4Q Press Releasefatso68No ratings yet

- BP Plastics Holding Berhad Outperform : 1HFY21 Above ExpectationDocument4 pagesBP Plastics Holding Berhad Outperform : 1HFY21 Above ExpectationZhi_Ming_Cheah_8136No ratings yet

- Burger King India (BURGERKI IN) : Q4FY21 Result UpdateDocument8 pagesBurger King India (BURGERKI IN) : Q4FY21 Result UpdateSushilNo ratings yet

- Nestle India Equity Research ReportDocument9 pagesNestle India Equity Research ReportDurgesh ShuklaNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions ManualDocument18 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions Manualdaviddulcieagt6100% (35)

- Infosys Annual Report 2018-19Document1 pageInfosys Annual Report 2018-19Prachi SharmaNo ratings yet

- Introduction To Accounting Practice Exercises: Exercise 1: The Accounting Equation Problem 1.1Document10 pagesIntroduction To Accounting Practice Exercises: Exercise 1: The Accounting Equation Problem 1.1Arbie Joy Olofernes SibilNo ratings yet

- Lecture 8 - Exercises - SolutionDocument8 pagesLecture 8 - Exercises - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- Chattanooga State AuditDocument78 pagesChattanooga State AuditDan LehrNo ratings yet

- Account AssignmentDocument10 pagesAccount AssignmentkanchanghengNo ratings yet

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Document4 pagesPage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- List of Sub-Object Code - 20160322Document135 pagesList of Sub-Object Code - 20160322Julius AlemanNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- Kelompok 10 - Kelas o - Week 9Document10 pagesKelompok 10 - Kelas o - Week 9willyNo ratings yet

- Decision MakingDocument28 pagesDecision MakingGelyn CruzNo ratings yet

- Chapter 2Document54 pagesChapter 2Léo AudibertNo ratings yet

- Bank Maybank Indonesia Bilingual 31des21 ReleasedDocument350 pagesBank Maybank Indonesia Bilingual 31des21 ReleasedNidaNo ratings yet

- Tata Consultancy ServicesDocument6 pagesTata Consultancy ServicesHarshad PawarNo ratings yet

- Quiz 1-EIB10403 - Oct 2023 ComfirmDocument6 pagesQuiz 1-EIB10403 - Oct 2023 ComfirmprfznvtczdNo ratings yet

- SPSPS DatabaseDocument226 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- Solutions To Solution E12-1: Chapler 12Document38 pagesSolutions To Solution E12-1: Chapler 12Carlo VillanNo ratings yet

- Tuprag - RTR - Explore Design Workshop Deck - Manage General LedgerDocument26 pagesTuprag - RTR - Explore Design Workshop Deck - Manage General LedgerANISHA ROYNo ratings yet

- Chapter 7 Investment PropertyDocument8 pagesChapter 7 Investment PropertyKrissa Mae Longos100% (2)

- Fabozzi BMAS7 CH04 Bond Price Volatility SolutionsDocument40 pagesFabozzi BMAS7 CH04 Bond Price Volatility Solutionsvishal kanekarNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- Capital BudgetingDocument44 pagesCapital Budgetingrisbd appliancesNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Chapter 1 - Introduction ToDocument30 pagesChapter 1 - Introduction ToCostAcct1No ratings yet

- Sbi q42019-2020Document66 pagesSbi q42019-2020Nihal YnNo ratings yet

- UBT - CBA - Final ProjectDocument24 pagesUBT - CBA - Final ProjectLUKE WHITENo ratings yet

- InternshipDocument30 pagesInternshipSumithra K - Kodaikanal centerNo ratings yet

National Foods LTD FY21 Earnings Update

National Foods LTD FY21 Earnings Update

Uploaded by

Malcolm ChitenderuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Foods LTD FY21 Earnings Update

National Foods LTD FY21 Earnings Update

Uploaded by

Malcolm ChitenderuCopyright:

Available Formats

National Foods Ltd

15 October 2021

FMCG – Equity Research

FY21: Improved market presence across product portfolio

Margins soften on account of expected cost-corrections Market Data

FY21 provided some respite for businesses as inflation moderated down to the double digits for the first time in

almost two years. The relatively stable operating environment allowed for increased focus on enhancing product Report Date 15-Oct-21

portfolio and optimising the business models in the respective units for National Foods rather than preserving Bloomberg Ticker NTFD: ZH

value on the Statement of Financial Position. Aggregate volumes for the group grew 15% y/y to 525,430 tonnes

Rating SELL

underpinned by recovering consumer spend on the back of a good harvest. Volumes in the flour division

increased by 43%, buoyed by a strong performance in the pre-pack segment. Maize meal volumes remained

depressed at a 32% decline relative to the prior period largely due to competition from an influx of cheap imports Current price $ 1,496.04

from neighbouring South Africa and market adjustments that took place following the conclusion of the subsidy Target price $ 479.92

program as well as intense competition from imported maize meal. In the stockfeeds segment, volumes were

Market Cap $mn 102,329.28

up 33% driven by uptick in the poultry feed. The groceries division reported a 74% positive shift in volumes,

whilst the snacks and treats category closed 57% higher from a mix of competitive pricing and marginal recovery

EV $m n 100,946.81

in consumer appetite. Complying with IAS 29, National Foods presented inflation adjusted results, however, for

the purpose of our analysis historical financials were considered for the period under review. Revenue grew by Market Weight 8.31%

343% to ZWL$28.07bn, whilst EBITDA slowed down in real terms on account of correction of the cost lag with Common Shares Outstanding mn 68.40

increases in key expenditure lines such as rates, fuel and staff costs. The group reported a 92% increase in

EBITDA from ZWL$1.72bn in FY20 to ZWL$3.30bn in the period under review, pressure from escalating cost Freefloat 14.88%

lines in nominal terms led to EBTIDA margins declining from 27% to 12% y/y. PAT grew 81% to ZWL$2.61bn

Average Daily Value Traded $000’s 666.03

from ZWL$1.44bn in the prior comparable period with the group’s headline earnings per share registering at

ZWLc3,659.10 from ZWLc2,112.36 in FY20. National Foods’s balance sheet remained healthy in the period Last Dividend declared FY21

under review with asset growth of 186% y/y to ZWL$ 11.17bn. Cash generated from operating activities grew Dividend Yield (+1) 1.05%

to ZWL$1.77bn, an above inflation improvement from $401.236mn in the prior comparable period. Resultantly,

cash and cash equivalents increased 204% to ZWL$1.12bn from ZWL$369.74mn in FY20 with an OCF/EBITDA PER (+1) 26.58

54%. National foods declared a final dividend of ZWLc296.49 translating to a dividend yield of 1.16% and EV/EBITDA (+1) 21.39

bringing total dividend for the year to ZWLc1,099.76. The dividend payable to shareholders registered at close

of business on the 15th of October 2021.

Share price performance YTD 2,389.25%

Marginal gains in volumes expected

Heading into 1H22, we foresee a maintained volumes recovery path for National Foods on account of a

relatively more enabling environment. We believe that increasing consumer liquidity combined with the festive

season demand and specialization of business units will positively impact volumes growth for the company’s

discretionary goods segments. Volumes sold in the maize segment are however likely to remain weak in the

12m share price performance (ZWL$) v. All Share

short term due to flooding of the product on the domestic market from the bumper harvest. Government has

since moved to ban imports of maize and products to support the local industry whilst management has since

remodelled the business model for the Maize unit to ensure that it continues to make a sustainable contribution.

The Board approved the purchase of a new state of the art Flour mill, which will be installed as a replacement

for the existing mill at the Bulawayo Basch Street site, at an estimated cost of US$ 5mn. Commissioning is

scheduled for late 2022 and is set to contribute to increased efficiencies in FY23 going forward. Lowered margins

for the Group at full year are still above historical averages so we anticipate further correction and normalisation

as we head to FY22. We have therefore forecasted EBITDA margin to ease from 11.7% in FY21 to circa 10%

in FY22. We however acknowledge that another run in inflation numbers will see margins surging again due to

the sizeable pre-payments made to secure a steady supply pipeline. The key focus highlighted by management

going forward are improving operational efficiencies, management of working capital and cash flow models and

ensuring interest costs are at kept at sustainable levels.

Update to SELL recommendation on demanding multiples.

We estimate that National Foods’s topline will grow 68% y/y to ZWL$47.20bn at FY22 versus ZWL$28.07bn at

FY21. We forecast EBITDA will close the year at ZWL$4.72bn up 43% from the previous comparable period.

We estimate National Foods is trading on a PER (+1) to FY22 of 26.6x versus its peers at 11.8x, and EV/EBITDA

(+1) to FY21 of 21.4x compared to peers at 8.16x. Using a blended DCF and multiples-based valuation method

we now arrive at a target price of ZWL$479.77 for National Foods. At current levels, we therefore update our

recommendation to a SELL rating.

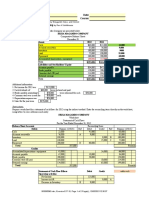

Revenue EBITDA Net EPS DPS EBITDA

EV Net Debt EV/Sales EV/EBITDA P/E P/Bk Div yield

($mn) ($mn) Income (cents) (cents) Margin

2021 28,074.4 3,296.9 2,612.4 3,819.3 1,099.8 11.7% 101,738.3 (590.9) 3.6 30.9 39.2 28.45 0.74%

2022E 47,199.3 4,719.9 3,850.4 5,629.2 1,576.2 10.0% 100,946.8 (1,382.5) 2.1 21.4 26.6 16.07 1.05%

2023E 69,105.0 4,837.4 4,238.7 6,196.9 2,168.9 7.0% 100,774.4 (1,554.9) 1.5 20.8 24.1 11.21 1.45%

2024E 75,651.0 4,917.3 4,368.2 6,386.3 2,235.2 6.5% 98,887.1 (3,442.2) 1.3 20.1 23.4 8.55 1.49%

2025E 82,824.2 5,383.6 4,797.9 7,014.4 2,805.8 6.5% 97,040.2 (5,289.0) 1.2 18.0 21.3 6.89 1.88%

2026E 90,685.2 5,894.5 5,270.4 7,705.3 3,082.1 6.5% 94,998.3 (7,330.9) 1.0 16.1 19.4 5.68 2.06%

Equity Research

Financials

15 October 2021

umm

National Foods Financial Summary 2021 2022E 2023E 2024E 2025E CAGR

Statement of Comprehensive Income

Revenue 28,074.42 47,199.33 69,105.04 75,651.03 82,824.18 31%

EBITDA (adjusted) 3,296.94 4,719.93 4,837.35 4,917.32 5,383.57 13%

Net financing charges (120.03) 31.08 237.64 290.60 349.83

Equity Accounted Earnings 261.05 438.88 642.57 703.44 770.13 31%

Net income 2,612.40 3,850.38 4,238.68 4,368.25 4,797.88 16%

Basic EPS 38.19 56.29 61.97 63.86 70.14 16%

Dividend per share 11.00 15.76 21.69 22.35 28.06 26%

Margins

EBITDA margin 11.7% 10.0% 7.0% 6.5% 6.5%

PBT margin 12.2% 10.8% 8.1% 7.6% 7.7%

Net margin 9.3% 8.2% 6.1% 5.8% 5.8%

Statement of Financial Position

Non current assets 1,409.18 1,555.13 1,797.24 2,049.90 2,315.29 13%

Inventories 4,365.97 6,336.35 9,277.12 10,155.89 11,118.86 26%

Trade and other receivables 4,270.40 6,465.66 9,466.44 10,363.15 11,345.78 28%

Bank balances and cash 1,122.72 3,146.13 3,368.55 5,305.81 7,202.70 59%

Current assets 9,759.09 15,948.14 22,112.11 25,824.86 29,667.34 32%

Total assets 11,168.27 17,503.27 23,909.35 27,874.76 31,982.64 30%

Shareholders' equity 3,596.98 6,369.25 9,124.39 11,963.75 14,842.48 43%

Non-current liabilities 56.23 56.85 56.85 56.85 56.85 0%

Short-term borrowings 1,713.66 1,763.66 1,813.66 1,863.66 1,913.66 3%

Current liabilities 7,515.07 11,077.17 14,728.11 15,854.16 17,083.31 23%

Total equity and liabilities 11,168.27 17,503.27 23,909.35 27,874.76 31,982.64 30%

Statement of Cash Flows

Operating cash flow 576.50 3,287.51 2,001.48 3,794.40 4,180.16

Investing cash flow (671.36) (236.00) (345.53) (378.26) (414.12) -11%

FCF (94.87) 3,051.52 1,655.96 3,416.15 3,766.04

Financing cash flow 864.61 (1,028.11) (1,433.54) (1,478.89) (1,869.15)

Change in cash 752.98 2,023.41 222.42 1,937.26 1,896.89 26%

Cash bop 369.74 1,122.72 3,146.13 3,368.55 5,305.81 95%

Cash eop 1,122.72 3,146.13 3,368.55 5,305.81 7,202.70 59%

Growth rates

Revenue 342.8% 68.1% 46.4% 9.5% 9.5%

EBITDA 91.5% 43.2% 2.5% 1.7% 9.5%

EBIT 77.6% 41.7% 2.2% 1.2% 9.2%

Net income 80.8% 47.4% 33.5% 13.4% 13.2%

RESEARCH TEAM

Lloyd Mlotshwa Tatenda Makoni Florence Takaendesa Vanessa Machingauta

lmlotshwa@ih-group.com tmakoni@ihsecurities.com ftakaendesa@ihsecurities.com vmachingauta@ihsecurities.com

Tel: +263 (242) 745 133/139, Email: research@ihsecurities.com

Website: www.ih-group.com

Equity Research

www.ihsecurities.com

Certification

The analyst(s) who prepared this research report hereby certifies(y) that: (i) all of the views and opinions expressed in this research

report accurately reflect the research analyst’s(s) personal views about the subject investment(s) and issuer(s) and (ii) no part of

the analyst’s(s) compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed

by the analyst(s) in this research report.

Ratings Definition

Buy - Expected 1 year return is at least 20%

Hold - Expected 1 year return of between -10% and 20%

Sell - Expected 1 year return of -10% and below

Disclaimer

This document has been prepared by IH Securities to provide background information about the securities and (or) markets

mentioned herein, the forecasts, opinions and expectations are entirely those of IH Securities. This document was prepared with

the utmost due care and consideration for accuracy and factual information; the forecasts, opinions and expectations are deemed

to be fair and reasonable. However there can be no assurance that future results or events will be consistent with any such

forecasts, opinions and expectations. Therefore the authors will not incur any liability for any loss arising from any use of this

document or its contents or otherwise arising in connection therewith. Neither will the sources of information or any other related

parties be held responsible for any form of action that is taken as a result of the proliferation of this document.

RESEARCH TEAM

Lloyd Mlotshwa Tatenda Makoni Florence Takaendesa Vanessa Machingauta

lmlotshwa@ih-group.com tmakoni@ihsecurities.com ftakaendesa@ihsecurities.com vmachingauta@ihsecurities.com

Tel: +263 (242) 745 133/139, Email: research@ihsecurities.com

Website: www.ih-group.com

You might also like

- Financial Analysis of - Toys "R" Us, Inc.Document30 pagesFinancial Analysis of - Toys "R" Us, Inc.Arabi AsadNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- Top Stories:: THU 11 APR 2024Document3 pagesTop Stories:: THU 11 APR 2024philnabank1217No ratings yet

- Ceylon Cold Stores PLC: Limited Disruptions To Support CCS's Growth AvenuesDocument3 pagesCeylon Cold Stores PLC: Limited Disruptions To Support CCS's Growth AvenuesantiqurrNo ratings yet

- 536248112021255dabur India Limited - 20210806Document5 pages536248112021255dabur India Limited - 20210806Michelle CastelinoNo ratings yet

- Earnings Update DANGCEM 2021FY 1Document6 pagesEarnings Update DANGCEM 2021FY 1kazeemsheriff8No ratings yet

- Stove Kraft-1QFY22 Result Update - 01 August 2021Document7 pagesStove Kraft-1QFY22 Result Update - 01 August 2021Raghu KuchiNo ratings yet

- Granules - India BP - Wealth 151121Document7 pagesGranules - India BP - Wealth 151121Lakshay SainiNo ratings yet

- JollibeeDocument4 pagesJollibeeJoyce C.No ratings yet

- VMART Q4FY22 ResultDocument6 pagesVMART Q4FY22 ResultKhush GosraniNo ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Padenga Holdings FY22 Earnings UpdateDocument3 pagesPadenga Holdings FY22 Earnings UpdateMichael MatambanadzoNo ratings yet

- Bayer Cropscience (BYRCS IN) : Q1FY21 Result UpdateDocument7 pagesBayer Cropscience (BYRCS IN) : Q1FY21 Result UpdateChockalingam SundharNo ratings yet

- Motilal Oswal On Devyani InternationalDocument10 pagesMotilal Oswal On Devyani InternationalbapianshumanNo ratings yet

- q2 2021 Results AnnouncementDocument71 pagesq2 2021 Results AnnouncementmarceloNo ratings yet

- Suryoday Small Finance Bank Q1FY24 Result Update Centrum 11082023Document13 pagesSuryoday Small Finance Bank Q1FY24 Result Update Centrum 11082023yoursaaryaNo ratings yet

- Cpin 130524 PtosDocument4 pagesCpin 130524 Ptosmaradona ligaNo ratings yet

- 1Q21 Profits Jump 23.5% Y/y, in Line With Estimates: Century Pacific Food, IncDocument7 pages1Q21 Profits Jump 23.5% Y/y, in Line With Estimates: Century Pacific Food, IncJajahinaNo ratings yet

- CNPF Sustains Growth Momentum in 3Q21: Century Pacific Food, IncDocument8 pagesCNPF Sustains Growth Momentum in 3Q21: Century Pacific Food, IncJajahinaNo ratings yet

- Hold Hindustan Unilever: Strong Performance Inflation Pressure Continues To PersistDocument13 pagesHold Hindustan Unilever: Strong Performance Inflation Pressure Continues To PersistAbhishek SaxenaNo ratings yet

- Fineorg 25 5 23 PLDocument8 pagesFineorg 25 5 23 PLSubhash MsNo ratings yet

- Indofood CBP: Navigating WellDocument11 pagesIndofood CBP: Navigating WellAbimanyu LearingNo ratings yet

- Weekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Document2 pagesWeekly Wrap: Recovery Hopes Bolster PCOMP Above 6,600Romel Alvendia ValenciaNo ratings yet

- HSIE Results Daily - 04 August 21-202108040822126132901Document9 pagesHSIE Results Daily - 04 August 21-202108040822126132901Michelle CastelinoNo ratings yet

- DNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncDocument9 pagesDNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncJajahinaNo ratings yet

- Financial AnalysisDocument14 pagesFinancial Analysismuzaffarovh271No ratings yet

- ICICI Securities REDUCE on Adani Wilmar With 6 DOWNSIDE ProfitabilityDocument8 pagesICICI Securities REDUCE on Adani Wilmar With 6 DOWNSIDE ProfitabilityPratham IngaleNo ratings yet

- Quarterly Update Q1FY22: Krishna Institute of Medical Sciences LTDDocument10 pagesQuarterly Update Q1FY22: Krishna Institute of Medical Sciences LTDhackmaverickNo ratings yet

- Nirmal Bang PDFDocument11 pagesNirmal Bang PDFBook MonkNo ratings yet

- Varun Beverages Q1CY22 Result UpdateDocument5 pagesVarun Beverages Q1CY22 Result UpdateBaria VirenNo ratings yet

- 2Q FY22 Financial Results Presentation: 22 October 2021Document58 pages2Q FY22 Financial Results Presentation: 22 October 2021chaitanya varma ChekuriNo ratings yet

- Burger King India (BURGERKI IN) : Q2FY22 Result UpdateDocument8 pagesBurger King India (BURGERKI IN) : Q2FY22 Result UpdatebradburywillsNo ratings yet

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Centrum Dabur India Company UpdateDocument7 pagesCentrum Dabur India Company UpdateprasaadrajputNo ratings yet

- SH Kelkar: All-Round Performance Outlook Remains StrongDocument8 pagesSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaNo ratings yet

- Butterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1Document12 pagesButterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1sundar iyerNo ratings yet

- V Guard Industries Q3 FY22 Results PresentationDocument17 pagesV Guard Industries Q3 FY22 Results PresentationRATHINo ratings yet

- Raymond-Q2FY22-RU LKPDocument9 pagesRaymond-Q2FY22-RU LKP56 AA Prathamesh WarangNo ratings yet

- 1Q FY 2021-22 Financial ResultsDocument54 pages1Q FY 2021-22 Financial Resultsaditya tripathiNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Edita 3Q2023 Earnings Release E v4Document10 pagesEdita 3Q2023 Earnings Release E v4Habiba HishamNo ratings yet

- 211428182023567dabur India Limited - 20230808Document5 pages211428182023567dabur India Limited - 20230808Jigar PitrodaNo ratings yet

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsDocument6 pagesIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiNo ratings yet

- RIL 3Q FY24 Analyst Presentation 19jan24Document55 pagesRIL 3Q FY24 Analyst Presentation 19jan24meetpanchal172006No ratings yet

- Earnings Release - 01.30.2023 FINALDocument20 pagesEarnings Release - 01.30.2023 FINALDuangjitr WongNo ratings yet

- Infosys (INFO IN) : Q1FY22 Result UpdateDocument13 pagesInfosys (INFO IN) : Q1FY22 Result UpdatePrahladNo ratings yet

- Mrs. Bectors Food Specialities 04062024 AcDocument6 pagesMrs. Bectors Food Specialities 04062024 AcgreyistariNo ratings yet

- Indofood CBP Sukses Makmur: Equity ResearchDocument5 pagesIndofood CBP Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Income Statement Analysis of Vitarich CorporationDocument11 pagesIncome Statement Analysis of Vitarich CorporationLynnie Jane JauculanNo ratings yet

- Infosys (INFO IN) : Q1FY21 Result UpdateDocument14 pagesInfosys (INFO IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- UNVR SekuritasDocument7 pagesUNVR Sekuritasfaizal ardiNo ratings yet

- Financial Highlights: Values in R$ ('000)Document33 pagesFinancial Highlights: Values in R$ ('000)renatoNo ratings yet

- Nestle India: Project RURBAN To Support Strong Growth Inflationary Clouds RemainDocument11 pagesNestle India: Project RURBAN To Support Strong Growth Inflationary Clouds Remainkrishna_buntyNo ratings yet

- Prabhudas Lilladher Apar Industries Q2FY24 Results ReviewDocument7 pagesPrabhudas Lilladher Apar Industries Q2FY24 Results ReviewyoursaaryaNo ratings yet

- CTEC 2021 4Q Press ReleaseDocument46 pagesCTEC 2021 4Q Press Releasefatso68No ratings yet

- BP Plastics Holding Berhad Outperform : 1HFY21 Above ExpectationDocument4 pagesBP Plastics Holding Berhad Outperform : 1HFY21 Above ExpectationZhi_Ming_Cheah_8136No ratings yet

- Burger King India (BURGERKI IN) : Q4FY21 Result UpdateDocument8 pagesBurger King India (BURGERKI IN) : Q4FY21 Result UpdateSushilNo ratings yet

- Nestle India Equity Research ReportDocument9 pagesNestle India Equity Research ReportDurgesh ShuklaNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions ManualDocument18 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions Manualdaviddulcieagt6100% (35)

- Infosys Annual Report 2018-19Document1 pageInfosys Annual Report 2018-19Prachi SharmaNo ratings yet

- Introduction To Accounting Practice Exercises: Exercise 1: The Accounting Equation Problem 1.1Document10 pagesIntroduction To Accounting Practice Exercises: Exercise 1: The Accounting Equation Problem 1.1Arbie Joy Olofernes SibilNo ratings yet

- Lecture 8 - Exercises - SolutionDocument8 pagesLecture 8 - Exercises - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- Chattanooga State AuditDocument78 pagesChattanooga State AuditDan LehrNo ratings yet

- Account AssignmentDocument10 pagesAccount AssignmentkanchanghengNo ratings yet

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Document4 pagesPage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- List of Sub-Object Code - 20160322Document135 pagesList of Sub-Object Code - 20160322Julius AlemanNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- Kelompok 10 - Kelas o - Week 9Document10 pagesKelompok 10 - Kelas o - Week 9willyNo ratings yet

- Decision MakingDocument28 pagesDecision MakingGelyn CruzNo ratings yet

- Chapter 2Document54 pagesChapter 2Léo AudibertNo ratings yet

- Bank Maybank Indonesia Bilingual 31des21 ReleasedDocument350 pagesBank Maybank Indonesia Bilingual 31des21 ReleasedNidaNo ratings yet

- Tata Consultancy ServicesDocument6 pagesTata Consultancy ServicesHarshad PawarNo ratings yet

- Quiz 1-EIB10403 - Oct 2023 ComfirmDocument6 pagesQuiz 1-EIB10403 - Oct 2023 ComfirmprfznvtczdNo ratings yet

- SPSPS DatabaseDocument226 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- Solutions To Solution E12-1: Chapler 12Document38 pagesSolutions To Solution E12-1: Chapler 12Carlo VillanNo ratings yet

- Tuprag - RTR - Explore Design Workshop Deck - Manage General LedgerDocument26 pagesTuprag - RTR - Explore Design Workshop Deck - Manage General LedgerANISHA ROYNo ratings yet

- Chapter 7 Investment PropertyDocument8 pagesChapter 7 Investment PropertyKrissa Mae Longos100% (2)

- Fabozzi BMAS7 CH04 Bond Price Volatility SolutionsDocument40 pagesFabozzi BMAS7 CH04 Bond Price Volatility Solutionsvishal kanekarNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- Capital BudgetingDocument44 pagesCapital Budgetingrisbd appliancesNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Chapter 1 - Introduction ToDocument30 pagesChapter 1 - Introduction ToCostAcct1No ratings yet

- Sbi q42019-2020Document66 pagesSbi q42019-2020Nihal YnNo ratings yet

- UBT - CBA - Final ProjectDocument24 pagesUBT - CBA - Final ProjectLUKE WHITENo ratings yet

- InternshipDocument30 pagesInternshipSumithra K - Kodaikanal centerNo ratings yet