Professional Documents

Culture Documents

Taxes 2016

Taxes 2016

Uploaded by

PhilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxes 2016

Taxes 2016

Uploaded by

PhilCopyright:

Available Formats

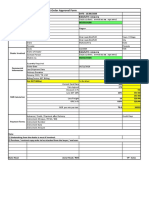

SCHEDULE C Profit or Loss From Business OMB No.

1545-0074

(Form 1040)

Department of the Treasury

a Information

(Sole Proprietorship)

about Schedule C and its separate instructions is at www.irs.gov/schedulec. 2016

Attachment

Internal Revenue Service (99) a Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09

Name of proprietor Social security number (SSN)

Erica M Knowler 033-68-1339

A Principal business or profession, including product or service (see instructions) B Enter code from instructions

Florist a 4 5 3 1 1 0

C Business name. If no separate business name, leave blank. D Employer ID number (EIN), (see instr.)

Orchids N Blooms LLC 4 7 2 6 3 3 7 0 4

E Business address (including suite or room no.) a 9 Bonazzoli Ave Suite 7

City, town or post office, state, and ZIP code Hudson, MA 01749

F Accounting method: (1) Cash (2) Accrual (3) Other (specify) a

G Did you “materially participate” in the operation of this business during 2016? If “No,” see instructions for limit on losses . Yes No

H If you started or acquired this business during 2016, check here . . . . . . . . . . . . . . . . . a

I Did you make any payments in 2016 that would require you to file Form(s) 1099? (see instructions) . . . . . . . . Yes No

J If "Yes," did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . . . . . Yes No

Part I Income

1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on

Form W-2 and the “Statutory employee” box on that form was checked . . . . . . . . . a 1 139,449.

2 Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . 3 139,449.

4 Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . . . . 4

5 Gross profit. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . 5 139,449.

6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . 6

7 Gross income. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . a 7 139,449.

Part II Expenses. Enter expenses for business use of your home only on line 30.

8 Advertising . . . . . 8 3,254. 18 Office expense (see instructions) 18 664.

9 Car and truck expenses (see 19 Pension and profit-sharing plans . 19

instructions) . . . . . 9 21,891. 20 Rent or lease (see instructions):

10 Commissions and fees . 10 a Vehicles, machinery, and equipment 20a

11 Contract labor (see instructions) 11 b Other business property . . . 20b 25,636.

12 Depletion . . . . . 12 21 Repairs and maintenance . . . 21

13 Depreciation and section 179 22 Supplies (not included in Part III) . 22 91,236.

expense deduction (not

included in Part III) (see 23 Taxes and licenses . . . . . 23 19,748.

instructions) . . . . . 13 24 Travel, meals, and entertainment:

14 Employee benefit programs a Travel . . . . . . . . . 24a 10,528.

(other than on line 19) . . 14 b Deductible meals and

15 Insurance (other than health) 15 8,788. entertainment (see instructions) . 24b

16 Interest: 25 Utilities . . . . . . . . 25 7,724.

a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) . 26 12,049.

b Other . . . . . . 16b 27a Other expenses (from line 48) . . 27a 2,728.

17 Legal and professional services 17 24,665. b Reserved for future use . . . 27b

28 Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . . . a 28 228,911.

29 Tentative profit or (loss). Subtract line 28 from line 7 . . . . . . . . . . . . . . . . . 29 -89,462.

30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829

unless using the simplified method (see instructions).

Simplified method filers only: enter the total square footage of: (a) your home:

and (b) the part of your home used for business: . Use the Simplified

Method Worksheet in the instructions to figure the amount to enter on line 30 . . . . . . . . . 30

31 Net profit or (loss). Subtract line 30 from line 29.

• If a profit, enter on both Form 1040, line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2.

(If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3.

• If a loss, you must go to line 32.

} 31 -89,462.

}

32 If you have a loss, check the box that describes your investment in this activity (see instructions).

• If you checked 32a, enter the loss on both Form 1040, line 12, (or Form 1040NR, line 13) and

on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and 32a All investment is at risk.

trusts, enter on Form 1041, line 3. 32b Some investment is not

at risk.

• If you checked 32b, you must attach Form 6198. Your loss may be limited.

For Paperwork Reduction Act Notice, see the separate instructions. BAA REV 01/25/17 TTMac Schedule C (Form 1040) 2016

You might also like

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- F 1040Document2 pagesF 1040Kevin RowanNo ratings yet

- Tax Sentry Organizer 2016 PDFDocument9 pagesTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20Y100% (1)

- Tax Invoice: Insulation SolutionsDocument1 pageTax Invoice: Insulation SolutionsganagarajkrNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- 1Document1 page1hansNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- Ahtasham Ahmed Case - CompressedDocument19 pagesAhtasham Ahmed Case - CompressedarsssyNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Document15 pagesZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusSammi Bowe100% (1)

- A082000109a0298508172c001c: Contact InformationDocument1 pageA082000109a0298508172c001c: Contact InformationYudo KunaNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Electronic Filing Instructions For Your 2016 Michigan Tax ReturnDocument4 pagesElectronic Filing Instructions For Your 2016 Michigan Tax Returngrace kruegerNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- 2021 TaxReturnDocument6 pages2021 TaxReturnAntonio BarrionueboNo ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsRony MartinezNo ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- LIBRO 9 Derecho RomanoDocument30 pagesLIBRO 9 Derecho RomanoDomingo VasquezNo ratings yet

- 70 Kevin Lin PDFDocument8 pages70 Kevin Lin PDFKenneth LinNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Hall Tax Services Hall Tax Professionals Chicago Heights Il 60411Document34 pagesHall Tax Services Hall Tax Professionals Chicago Heights Il 60411Rendy MomoNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Amara Enyia's 2017 Tax ReturnDocument4 pagesAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- FTF - David George 2021 PRRRRRDocument7 pagesFTF - David George 2021 PRRRRRkramergeorgec397No ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Make Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"Document36 pagesMake Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"xakilNo ratings yet

- Rooksana Tax Return Form 2020-2021Document19 pagesRooksana Tax Return Form 2020-2021MITON CHOWDHURYNo ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina Reyes100% (1)

- W4 Miguel MarcanoDocument4 pagesW4 Miguel MarcanoNatasha GuzmanNo ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- 2019 W-2 Gregorio MartinezDocument2 pages2019 W-2 Gregorio Martinezporhj perraNo ratings yet

- Individual Tax ReturnDocument6 pagesIndividual Tax Returnaklank_218105No ratings yet

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Amara Enyia's 2016 Tax ReturnDocument4 pagesAmara Enyia's 2016 Tax ReturnMark KonkolNo ratings yet

- Real 1040 1Document2 pagesReal 1040 1paul100% (1)

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- 2019 Leon California FilingDocument18 pages2019 Leon California FilingPolo PoloNo ratings yet

- Edgar JDocument2 pagesEdgar Japi-585014034No ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- 2018 FederalDocument19 pages2018 Federalnischal.khatri07No ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Lejean Tax 2019Document1 pageLejean Tax 2019joseph GRAND-PIERRENo ratings yet

- Profit or Loss From Business: Linda Gercken 156-56-8670Document2 pagesProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERRENo ratings yet

- BOTEXDocument1 pageBOTEXjoseph GRAND-PIERRENo ratings yet

- Mini CooperDocument5 pagesMini CooperzavrisNo ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- Bir Ruling (Da-056-05) Nraetb 180 DaysDocument2 pagesBir Ruling (Da-056-05) Nraetb 180 DaysAloy DulayNo ratings yet

- Ec 210 Sample ExamDocument6 pagesEc 210 Sample ExamTylerTangTengYangNo ratings yet

- PLDT B. City of Davao (GR 143867)Document6 pagesPLDT B. City of Davao (GR 143867)minesmdvlNo ratings yet

- Tile WorkDocument10 pagesTile WorkKarunyanivas ThonichalNo ratings yet

- Online MutationDocument2 pagesOnline MutationBHAVANA SHARMA VELLIKANTINo ratings yet

- HIL Limited - Project Order Approval Form: Babulal & CompanyDocument2 pagesHIL Limited - Project Order Approval Form: Babulal & CompanyRavinandan KumarNo ratings yet

- The Land Development Tax Ordinance, 1976Document6 pagesThe Land Development Tax Ordinance, 1976alameenameen950No ratings yet

- Reviewer Legal Profession CosicoDocument8 pagesReviewer Legal Profession Cosicokrystlelim100% (1)

- Contract Laws and Regulations Ques BankDocument9 pagesContract Laws and Regulations Ques BankpoovizhiNo ratings yet

- OD113605157419684318Document1 pageOD113605157419684318Anoop JangraNo ratings yet

- CIR Vs Metro Star SuperamaDocument18 pagesCIR Vs Metro Star SuperamaPia Christine BungubungNo ratings yet

- Confiscation of Jewish Property in EuropeDocument156 pagesConfiscation of Jewish Property in EuropeRadu Simandan100% (2)

- Prozone by StockupdatesDocument181 pagesProzone by Stockupdatesstockupdates2012No ratings yet

- IA Econ Micro.Document6 pagesIA Econ Micro.nc23sbudNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Syllabus For Bachelors in Architecture: College of Architecture, Faculty of Engineering and TechnologyDocument2 pagesSyllabus For Bachelors in Architecture: College of Architecture, Faculty of Engineering and TechnologyAbhishek PanchalNo ratings yet

- IDM-33 Joint Ventures and Privatization in Infrastructure ProjectsDocument23 pagesIDM-33 Joint Ventures and Privatization in Infrastructure ProjectsSam RogerNo ratings yet

- Assignment 1Document17 pagesAssignment 1aromalNo ratings yet

- FanatecDocument2 pagesFanatecZack GouldNo ratings yet

- Maintain New Tax Codes and Tax Boxing - LegacyDocument5 pagesMaintain New Tax Codes and Tax Boxing - LegacymmtNo ratings yet

- Case ProblemDocument45 pagesCase ProblemJonath M GelomioNo ratings yet

- Del Mar Vs PagcorDocument20 pagesDel Mar Vs PagcorRhea Lyn MalapadNo ratings yet

- Wasteland Entertainment Pvt. LTD.: Transaction Number Receipt DateDocument1 pageWasteland Entertainment Pvt. LTD.: Transaction Number Receipt DateRaghu RamanNo ratings yet

- A Toolkit of Policies To Promote InnovationDocument22 pagesA Toolkit of Policies To Promote InnovationYgro4wiNNo ratings yet

- Final ReportDocument47 pagesFinal ReportchriisngoNo ratings yet

- Vanishing Deductions X Estate Tax ComputationDocument2 pagesVanishing Deductions X Estate Tax ComputationShiela Mae OblanNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet