Professional Documents

Culture Documents

Ty V Trampe Digest

Ty V Trampe Digest

Uploaded by

Jay GeeCopyright:

Available Formats

You might also like

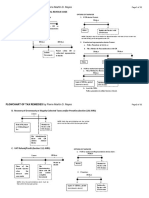

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Digest San Juan Vs CastroDocument2 pagesDigest San Juan Vs CastroRyan AcostaNo ratings yet

- RR 12-99 Full TextDocument5 pagesRR 12-99 Full TextErmawoo100% (2)

- Camp John Hay Development Corporation Vs Central Board of Assessment Appeals Etc Et Al DECISIONDocument3 pagesCamp John Hay Development Corporation Vs Central Board of Assessment Appeals Etc Et Al DECISIONKhian JamerNo ratings yet

- Shall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeDocument10 pagesShall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeSusannie AcainNo ratings yet

- The Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Document10 pagesThe Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Daryl DumayasNo ratings yet

- Ty vs. Trampe, GR No. 117577 Dated December 1, 1995Document5 pagesTy vs. Trampe, GR No. 117577 Dated December 1, 1995daybarbaNo ratings yet

- Assessment of Taxes NIRC SECTION 203 Period of Limitation Upon Assessment and Collection. - Except AsDocument29 pagesAssessment of Taxes NIRC SECTION 203 Period of Limitation Upon Assessment and Collection. - Except AsmarvinNo ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- PointersDocument10 pagesPointersJenaro CabornidaNo ratings yet

- 2020 Bar - Tax - Assessment Property - LGCDocument2 pages2020 Bar - Tax - Assessment Property - LGCNardz AndananNo ratings yet

- 15 27Document5 pages15 27aljazzerusadNo ratings yet

- SUMMARY: Pursuant To Section 219 of The LGC, The City of Manila (After 3 Years) Undertook To Revise Property ValuesDocument1 pageSUMMARY: Pursuant To Section 219 of The LGC, The City of Manila (After 3 Years) Undertook To Revise Property ValuesnikoNo ratings yet

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- City of Manila Vs Cosmos Bottling CorpDocument1 pageCity of Manila Vs Cosmos Bottling Corpmaria100% (3)

- GDocument20 pagesGCesNo ratings yet

- Cristina Olarita Tax Cases 105-113Document6 pagesCristina Olarita Tax Cases 105-113Maraipol Trading Corp.No ratings yet

- PROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-231Document3 pagesPROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-2312022107419No ratings yet

- Court of Tax Appeal: Chairperson, andDocument25 pagesCourt of Tax Appeal: Chairperson, andYna YnaNo ratings yet

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.Document13 pagesNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.red gynNo ratings yet

- Tax Case DigestDocument5 pagesTax Case DigestRay Marvin Anor Palma100% (1)

- CJHDC v. CbaaDocument3 pagesCJHDC v. CbaaLDNo ratings yet

- CASES On Real Property TaxDocument14 pagesCASES On Real Property TaxGlenda May100% (1)

- SEC. 252. Payment Under Protest.Document3 pagesSEC. 252. Payment Under Protest.Joesil DianneNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- Court of Tax Appeals: Third DivisionDocument9 pagesCourt of Tax Appeals: Third DivisionMosquite AquinoNo ratings yet

- Court of Tax Appeals: Third DivisionDocument9 pagesCourt of Tax Appeals: Third DivisionMosquite AquinoNo ratings yet

- AsssssssDocument2 pagesAsssssssCity Budget Office - Davao City PhilippinesNo ratings yet

- Tax 2 Finals (Remedies To Cta)Document27 pagesTax 2 Finals (Remedies To Cta)Athena Salas100% (1)

- CTA RulingsDocument4 pagesCTA Rulingsjb13ruizNo ratings yet

- CTA AC No. 68Document16 pagesCTA AC No. 68carinokatrinaNo ratings yet

- Week 10Document8 pagesWeek 10Victor LimNo ratings yet

- Assessment ProcedureDocument6 pagesAssessment ProcedureJezreel CastañagaNo ratings yet

- Transfer TaxDocument6 pagesTransfer TaxMark Rainer Yongis LozaresNo ratings yet

- Camp John Hay Development CorpDocument2 pagesCamp John Hay Development Corp6f5wvrg8whNo ratings yet

- Tax FinalDocument5 pagesTax FinalRJ DAWATONNo ratings yet

- BAR Qs Local and Real Property Taxes, Tariff and CustomsDocument11 pagesBAR Qs Local and Real Property Taxes, Tariff and CustomsBeverly Jane H. BulandayNo ratings yet

- MINERAL CompleteDocument3 pagesMINERAL CompleteAngela ArleneNo ratings yet

- Tax Recit With AnswersDocument8 pagesTax Recit With AnswersEnrique Legaspi IVNo ratings yet

- Local Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetDocument20 pagesLocal Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetcharmainejalaNo ratings yet

- Cta 3D CV 09965 R 2019jul30 RefDocument6 pagesCta 3D CV 09965 R 2019jul30 RefReina Noreen IgnacioNo ratings yet

- 8 Tax RemediesDocument98 pages8 Tax RemediesHaRry Peregrino100% (1)

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerHaze Q.No ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- REFUNDS SEC 229 and SEC 76Document12 pagesREFUNDS SEC 229 and SEC 76Kent DarantinaoNo ratings yet

- Taxpayer's RemediesDocument5 pagesTaxpayer's RemediesCel TanNo ratings yet

- Poli Rev Tax CasesDocument26 pagesPoli Rev Tax CasesBilton Cheng SyNo ratings yet

- UDocument53 pagesUvmanalo16No ratings yet

- Tax Remedies (1991-1999)Document18 pagesTax Remedies (1991-1999)HaRry Peregrino100% (1)

- 21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Document4 pages21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Sheena MarieNo ratings yet

- Camp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)Document3 pagesCamp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)lexxNo ratings yet

- Tax Law 1 DG3 NOTES Part 2Document28 pagesTax Law 1 DG3 NOTES Part 2Fayie De LunaNo ratings yet

- First, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction OverDocument2 pagesFirst, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction Overhigoremso giensdksNo ratings yet

- 9 12 SAT (Afternoon)Document8 pages9 12 SAT (Afternoon)Daryl Noel TejanoNo ratings yet

- Taxation Law Updates by Atty. OrtegaDocument21 pagesTaxation Law Updates by Atty. Ortegavillanueva9guapster9100% (1)

- Finals Personal Study Guide Tax2Document116 pagesFinals Personal Study Guide Tax2TeacherEliNo ratings yet

- Models of Incorporation Escr Vfinal Nov18Document70 pagesModels of Incorporation Escr Vfinal Nov18Jay GeeNo ratings yet

- N U S L: Ortheastern Niversity Chool of AWDocument44 pagesN U S L: Ortheastern Niversity Chool of AWJay GeeNo ratings yet

- People v. GeneblazoDocument8 pagesPeople v. GeneblazoJay GeeNo ratings yet

- Guelen, Jeanne ThereseDocument2 pagesGuelen, Jeanne ThereseJay GeeNo ratings yet

- People v. CA and TanganDocument13 pagesPeople v. CA and TanganJay GeeNo ratings yet

- What Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Document7 pagesWhat Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Jay GeeNo ratings yet

- Module 2 - First LawDocument25 pagesModule 2 - First LawJay GeeNo ratings yet

- Icescr MCQ QuestionsDocument2 pagesIcescr MCQ QuestionsJay GeeNo ratings yet

- Background Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsDocument16 pagesBackground Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsJay GeeNo ratings yet

- Activity No. 1.1: InstructionsDocument2 pagesActivity No. 1.1: InstructionsJay GeeNo ratings yet

- Renewable Energy Act ReportDocument16 pagesRenewable Energy Act ReportJay GeeNo ratings yet

- What Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Document7 pagesWhat Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Jay GeeNo ratings yet

- GAMIT Appellant's BriefDocument30 pagesGAMIT Appellant's BriefJay GeeNo ratings yet

- Background Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsDocument16 pagesBackground Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsJay GeeNo ratings yet

Ty V Trampe Digest

Ty V Trampe Digest

Uploaded by

Jay GeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ty V Trampe Digest

Ty V Trampe Digest

Uploaded by

Jay GeeCopyright:

Available Formats

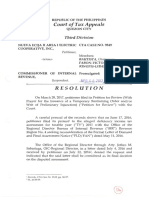

TY v.

TRAMPE

Assessor sent a notice of assessment for certain real properties of petitioners in Pasig. Not satisfied with

the assessment, petitioners filed within the RTC, presided over the respondent judge, to declare null and

void the new tax assessments and to enjoin the collection of real estate taxes based on said

assessments.

RTC Denied the petition for lack of merit.

Petitioners Motion of Reconsideration was subsequently denied.

SECTION 252. Payment Under Protest. - (a) No protest shall be entertained unless the taxpayer first pays

the tax. There shall be annotated on the tax receipts the words "paid under protest". The protest in

writing must be filed within thirty (30) days from payment of the tax to the provincial, city treasurer or

municipal treasurer, in the case of a municipality within Metropolitan Manila Area, who shall decide the

protest within sixty (60) days from receipt. (b) The tax or a portion thereof paid under protest, shall be

held in trust by the treasurer concerned. (c) In the event that the protest is finally decided in favor of the

taxpayer, the amount or portion of the tax protested shall be refunded to the protestant, or applied as

tax credit against his existing or future tax liability. (d) In the event that the protest is denied or upon the

lapse of the sixty day period prescribed in subparagraph (a), the taxpayer may avail of the remedies as

provided for in Chapter 3, Title II, Book II of this Code.

You might also like

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Digest San Juan Vs CastroDocument2 pagesDigest San Juan Vs CastroRyan AcostaNo ratings yet

- RR 12-99 Full TextDocument5 pagesRR 12-99 Full TextErmawoo100% (2)

- Camp John Hay Development Corporation Vs Central Board of Assessment Appeals Etc Et Al DECISIONDocument3 pagesCamp John Hay Development Corporation Vs Central Board of Assessment Appeals Etc Et Al DECISIONKhian JamerNo ratings yet

- Shall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeDocument10 pagesShall Have The Authority To Grant An Injunction To Restrain The Collection of Any National Internal Revenue Tax, Fee or Charge Imposed by This CodeSusannie AcainNo ratings yet

- The Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Document10 pagesThe Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Daryl DumayasNo ratings yet

- Ty vs. Trampe, GR No. 117577 Dated December 1, 1995Document5 pagesTy vs. Trampe, GR No. 117577 Dated December 1, 1995daybarbaNo ratings yet

- Assessment of Taxes NIRC SECTION 203 Period of Limitation Upon Assessment and Collection. - Except AsDocument29 pagesAssessment of Taxes NIRC SECTION 203 Period of Limitation Upon Assessment and Collection. - Except AsmarvinNo ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- PointersDocument10 pagesPointersJenaro CabornidaNo ratings yet

- 2020 Bar - Tax - Assessment Property - LGCDocument2 pages2020 Bar - Tax - Assessment Property - LGCNardz AndananNo ratings yet

- 15 27Document5 pages15 27aljazzerusadNo ratings yet

- SUMMARY: Pursuant To Section 219 of The LGC, The City of Manila (After 3 Years) Undertook To Revise Property ValuesDocument1 pageSUMMARY: Pursuant To Section 219 of The LGC, The City of Manila (After 3 Years) Undertook To Revise Property ValuesnikoNo ratings yet

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- City of Manila Vs Cosmos Bottling CorpDocument1 pageCity of Manila Vs Cosmos Bottling Corpmaria100% (3)

- GDocument20 pagesGCesNo ratings yet

- Cristina Olarita Tax Cases 105-113Document6 pagesCristina Olarita Tax Cases 105-113Maraipol Trading Corp.No ratings yet

- PROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-231Document3 pagesPROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-2312022107419No ratings yet

- Court of Tax Appeal: Chairperson, andDocument25 pagesCourt of Tax Appeal: Chairperson, andYna YnaNo ratings yet

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.Document13 pagesNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al.red gynNo ratings yet

- Tax Case DigestDocument5 pagesTax Case DigestRay Marvin Anor Palma100% (1)

- CJHDC v. CbaaDocument3 pagesCJHDC v. CbaaLDNo ratings yet

- CASES On Real Property TaxDocument14 pagesCASES On Real Property TaxGlenda May100% (1)

- SEC. 252. Payment Under Protest.Document3 pagesSEC. 252. Payment Under Protest.Joesil DianneNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- Court of Tax Appeals: Third DivisionDocument9 pagesCourt of Tax Appeals: Third DivisionMosquite AquinoNo ratings yet

- Court of Tax Appeals: Third DivisionDocument9 pagesCourt of Tax Appeals: Third DivisionMosquite AquinoNo ratings yet

- AsssssssDocument2 pagesAsssssssCity Budget Office - Davao City PhilippinesNo ratings yet

- Tax 2 Finals (Remedies To Cta)Document27 pagesTax 2 Finals (Remedies To Cta)Athena Salas100% (1)

- CTA RulingsDocument4 pagesCTA Rulingsjb13ruizNo ratings yet

- CTA AC No. 68Document16 pagesCTA AC No. 68carinokatrinaNo ratings yet

- Week 10Document8 pagesWeek 10Victor LimNo ratings yet

- Assessment ProcedureDocument6 pagesAssessment ProcedureJezreel CastañagaNo ratings yet

- Transfer TaxDocument6 pagesTransfer TaxMark Rainer Yongis LozaresNo ratings yet

- Camp John Hay Development CorpDocument2 pagesCamp John Hay Development Corp6f5wvrg8whNo ratings yet

- Tax FinalDocument5 pagesTax FinalRJ DAWATONNo ratings yet

- BAR Qs Local and Real Property Taxes, Tariff and CustomsDocument11 pagesBAR Qs Local and Real Property Taxes, Tariff and CustomsBeverly Jane H. BulandayNo ratings yet

- MINERAL CompleteDocument3 pagesMINERAL CompleteAngela ArleneNo ratings yet

- Tax Recit With AnswersDocument8 pagesTax Recit With AnswersEnrique Legaspi IVNo ratings yet

- Local Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetDocument20 pagesLocal Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetcharmainejalaNo ratings yet

- Cta 3D CV 09965 R 2019jul30 RefDocument6 pagesCta 3D CV 09965 R 2019jul30 RefReina Noreen IgnacioNo ratings yet

- 8 Tax RemediesDocument98 pages8 Tax RemediesHaRry Peregrino100% (1)

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerHaze Q.No ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- REFUNDS SEC 229 and SEC 76Document12 pagesREFUNDS SEC 229 and SEC 76Kent DarantinaoNo ratings yet

- Taxpayer's RemediesDocument5 pagesTaxpayer's RemediesCel TanNo ratings yet

- Poli Rev Tax CasesDocument26 pagesPoli Rev Tax CasesBilton Cheng SyNo ratings yet

- UDocument53 pagesUvmanalo16No ratings yet

- Tax Remedies (1991-1999)Document18 pagesTax Remedies (1991-1999)HaRry Peregrino100% (1)

- 21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Document4 pages21 Allied Banking Corp. v. Quezon City20180322-1159-1qhqio3Sheena MarieNo ratings yet

- Camp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)Document3 pagesCamp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)lexxNo ratings yet

- Tax Law 1 DG3 NOTES Part 2Document28 pagesTax Law 1 DG3 NOTES Part 2Fayie De LunaNo ratings yet

- First, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction OverDocument2 pagesFirst, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction Overhigoremso giensdksNo ratings yet

- 9 12 SAT (Afternoon)Document8 pages9 12 SAT (Afternoon)Daryl Noel TejanoNo ratings yet

- Taxation Law Updates by Atty. OrtegaDocument21 pagesTaxation Law Updates by Atty. Ortegavillanueva9guapster9100% (1)

- Finals Personal Study Guide Tax2Document116 pagesFinals Personal Study Guide Tax2TeacherEliNo ratings yet

- Models of Incorporation Escr Vfinal Nov18Document70 pagesModels of Incorporation Escr Vfinal Nov18Jay GeeNo ratings yet

- N U S L: Ortheastern Niversity Chool of AWDocument44 pagesN U S L: Ortheastern Niversity Chool of AWJay GeeNo ratings yet

- People v. GeneblazoDocument8 pagesPeople v. GeneblazoJay GeeNo ratings yet

- Guelen, Jeanne ThereseDocument2 pagesGuelen, Jeanne ThereseJay GeeNo ratings yet

- People v. CA and TanganDocument13 pagesPeople v. CA and TanganJay GeeNo ratings yet

- What Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Document7 pagesWhat Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Jay GeeNo ratings yet

- Module 2 - First LawDocument25 pagesModule 2 - First LawJay GeeNo ratings yet

- Icescr MCQ QuestionsDocument2 pagesIcescr MCQ QuestionsJay GeeNo ratings yet

- Background Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsDocument16 pagesBackground Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsJay GeeNo ratings yet

- Activity No. 1.1: InstructionsDocument2 pagesActivity No. 1.1: InstructionsJay GeeNo ratings yet

- Renewable Energy Act ReportDocument16 pagesRenewable Energy Act ReportJay GeeNo ratings yet

- What Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Document7 pagesWhat Are The Two Types of Ejectment Suits? Forcible Entry: Mangaser Vs - Ugay G.R. No. 204926, December 3, 2014Jay GeeNo ratings yet

- GAMIT Appellant's BriefDocument30 pagesGAMIT Appellant's BriefJay GeeNo ratings yet

- Background Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsDocument16 pagesBackground Conference Document Prepared by The Office of The United Nations High Commissioner For Human RightsJay GeeNo ratings yet