Professional Documents

Culture Documents

Auditing Cash and Cash Equivalents

Auditing Cash and Cash Equivalents

Uploaded by

Lawrence YusiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing Cash and Cash Equivalents

Auditing Cash and Cash Equivalents

Uploaded by

Lawrence YusiCopyright:

Available Formats

lOMoARcPSD|8456182

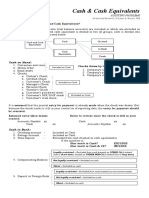

Auditing: CASH AND CASH Equivalents

Bachelor of Science in Accountancy (Polytechnic University of the Philippines)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Mark Lawrence Yusi (yusi.marklawrence@gmail.com)

lOMoARcPSD|8456182

SYNCHRONOUS 1 OCTOBER 14

Cash and Cash Equivalents

Cash

Financial asset 6. Company’s postdated checks, unreleased

Unrestricted checks, undelivered checks

Initial & Subsequent measurement @face Cash

value 7. Compensating balances

Composition Legally Restricted: current/noncurrent

1. Cash on Hand asset

Undeposited collections Not legally restricted: Cash

Working funds 8. Cash set aside for long term specific purpose

2. Cash in bank Noncurrent asset

Demand deposits

SA/CA unrestricted Petty Cash Fund

Cash Equivalent Accountability: should be balance of petty cash

3-month rule count

Notes 1. Imprest balance

1. Foreign currency 2. Collections (with or without official

Restricted: Other Asset receipt)

Unrestricted: Cash 3. Accommodation check

2. Cash in closed banks 4. Currency in envelope

Receivable (written in recoverable value) Accounted for: actual cash count

3. Customers Postdated, DAIF, DAUD, NSF checks 1. Bills and coins

and IOU notes 2. Checks collected

Receivable 3. Accommodation check

4. Postage stamps, Expense advances 4. Unreplenished vouchers

Prepaid expenses 5. Replenishment checks

5. Bank Overdraft 6. Actual currency inside envelope

Can be offset (if there is also another

positive account in same bank)

Cannot be offset (current liabilities)

Bank Reconciliation

NSF checks

Previou Receipts Disbursement Current

s

NSF check prev. month, redeposited current month (xxx) xxx (xxx) xxx

NSF check current month, redeposited current month xxx xxx

NSF check current month, redeposited next month xxx (xxx)

Bank Errors

Erroneous Previous Receipts Disbursement Current

deposit previous month, corrected current month (xxx) (xxx)

deposit current month, corrected current month (xxx) (xxx)

deposit current month, corrected next month (xxx) (xxx)

deposit previous month, corrected next month (xxx) (xxx)

Downloaded by Mark Lawrence Yusi (yusi.marklawrence@gmail.com)

lOMoARcPSD|8456182

Erroneous Previous Receipts Disbursement Current

Charges previous month, corrected current month xxx (xxx)

Charges current month, corrected current month (xxx) (xxx)

Charges current month, corrected next month (xxx) xxx

Charges previous month, corrected next month xxx xxx

CASES

CASE 5

Accountability Allocation of Shortage

Imprest balance 50,000 General Cash Fund

Official Receipts 198,500 Bills and Coins 24,230

Unofficial Receipt 56,000 OR 3052 (65,500)

Accommodation check 6,800 OR 3054 (25,000)

Envelope money 35,000 Deficiency in envelope (15,000)

Total 346,300 Cash shortage 81,270

Accounted for Petty Cash Fund

Bills and Coins 24,230 Imprest fund 50,000

Official check receipts 108,000 Unreplenished

Unofficial check receipt 56,000 vouchers (37,100)

Accommodation check 6,800 Accommodation check 6,800

Unreplenished Expenses 37,100 Should be balance 19,700

Replenishment 5,000 Replenishment 5,000

Cash in envelope 20,000 Accommodation check 6,800

Total 257,130 Actual balance 11,800

Shortage 89,170 PCF shortage 7,900

1. PAJE 3. 11,800

2. a. 7,900; b. 81,270 4. 330,030

CASE 7

June Receipts Disbursement July

Unadjusted balances per bank 86,295 375,840 451,695 10,440

Deposit in Transit, June 30 9000 (9,000)

Outstanding check, June 30 (26,130) (26,130)

Note e: Debit Error (5,940) 5,940

Outstanding checks, July 31 28,910 (28,910)

Deposit in Transit, July 31 15,000 15,000

.

Total 69,165 381,840 440,535 10,470

June Receipts Disbursement July

Unadjusted balances per book 70,165 381,840 327,165 124,840

Note d: Unrecorded disbursement 15,900 (15,900)

Note g: DAUD check 4,665 (4,665)

Note paid by bank 91,500 (91,500)

Bank service charge, July 1,305 1,305

Total 70,165 381,840 440,535 11,470

Downloaded by Mark Lawrence Yusi (yusi.marklawrence@gmail.com)

lOMoARcPSD|8456182

Outstanding checks Deposit in transit, beginning 9,000

Outstanding check, beginning 26,130 Receipts per book 381,840

Disbursement per book 343,065 less: Receipts per bank 375,840

less: Disbursement per bank (348,285) Outstanding check, end 15,000

Outstanding check, end 28,910

Deposit in transit

1. 28,910 3. 1,000

2. 15,000 4. 11,470

CASE 10

Novembe Receipts Disbursement December

r

Unadjusted balances per bank 803,115 2,018,310 1,787,798 1,033,627

Deposit in transit 65,100 (65,100)

Outstanding check, Nov. 30 (72,400) (72,400)

Outstanding check, Dec. 31 66,320 (66,320)

Note e: Credit Error (45,000) (45,000)

Note e: Debit Error (22,000) 22,000

Deposit in transit, Dec. 31 125,050 125,050

.

Total 750,815 2,078,260 1,714,718 1,114,357

Novembe Receipts Disbursement December

r

Unadjusted balances per book 503,705 2,033,130 1,753,118 783,717

Bank Service Charge, Nov. 30 (700) (700)

Bank Service Charge, Dec. 31 300 (300)

ISF check, Nov. 30 (12,500) (12,500)

ISF check, Dec. 31 19,600 (19,600)

NR received by bank, Nov. 30 280,310 (280,310)

NR received by bank, Dec. 31 309,440 309,440

Note f: Debit Error (5,000) (5,000)

Note g: Debit Error (20,000) (20,000)

Note h: Credit Error 21,000 (20,100) 41,100

Total 750,815 2,078,260 1,714,718 1,114,357

Deposit in transit

Deposit in transit, beginning 65,100

Receipts per book 2,078,260

less: Receipts per bank (2,018,310

)

Deposit in transit, end 125,050

1. 125,050 4. 783,717

2. 783,717 5. 1,114,357

3. 1,753,780

Downloaded by Mark Lawrence Yusi (yusi.marklawrence@gmail.com)

lOMoARcPSD|8456182

Downloaded by Mark Lawrence Yusi (yusi.marklawrence@gmail.com)

You might also like

- Languagecert Test of English (Lte) : Practice BookDocument80 pagesLanguagecert Test of English (Lte) : Practice BookΚατερίνα Τσαλάνη50% (2)

- Global Business 4th Edition Ebook PDFDocument42 pagesGlobal Business 4th Edition Ebook PDFrobert.higa747100% (40)

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 1Document7 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 1Rodolfo Manalac100% (3)

- CCEDocument3 pagesCCESofia Nadine100% (1)

- FAR Lecture NotesDocument80 pagesFAR Lecture NotesJuan Miguel Suerte Felipe100% (2)

- Cash and Cash EquivalentsDocument14 pagesCash and Cash EquivalentsPatricia Guba100% (1)

- Share-Based Compensation-Share OptionsDocument16 pagesShare-Based Compensation-Share OptionsLawrence YusiNo ratings yet

- SUMMER PROJECT REPORT (Bajaj Capital0Document39 pagesSUMMER PROJECT REPORT (Bajaj Capital0Rishabh JainNo ratings yet

- Remedi TOEFLDocument15 pagesRemedi TOEFLMuhammad FadhilNo ratings yet

- 1 Cash and Cash Equivalents 3Document14 pages1 Cash and Cash Equivalents 3Abegail AdoraNo ratings yet

- Chapter 1 Cash and Cash EquivalentsDocument23 pagesChapter 1 Cash and Cash EquivalentsAngelica Joy ManaoisNo ratings yet

- Ia 1Document14 pagesIa 1redolvrs.28No ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsJohn Michael SorianoNo ratings yet

- 01 - Cash and Cash Equivalents (P1 - 13)Document9 pages01 - Cash and Cash Equivalents (P1 - 13)Earl ENo ratings yet

- Cash and Cash Equivalents 1Document22 pagesCash and Cash Equivalents 1Mark GilNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsAngelo Christian B. OreñadaNo ratings yet

- Acct 312 Chapter 6Document32 pagesAcct 312 Chapter 6jantriciadNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsDaniellaNo ratings yet

- Ama AccountingDocument3 pagesAma AccountingGabriel JacaNo ratings yet

- Cash and Cash EquivalentDocument2 pagesCash and Cash EquivalentLorence Patrick LapidezNo ratings yet

- Cash and Cash Equivalents - REVIEWERDocument15 pagesCash and Cash Equivalents - REVIEWERLark Kent TagleNo ratings yet

- Icpa - Ia1Document26 pagesIcpa - Ia1john paulNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Drill Corporate LiquidationDocument3 pagesDrill Corporate LiquidationElizabeth DumawalNo ratings yet

- Cash and Cash EquivalentsDocument51 pagesCash and Cash EquivalentsigayakirstenNo ratings yet

- Trisa Grace T. Cawaling (Bsba 2-A)Document3 pagesTrisa Grace T. Cawaling (Bsba 2-A)Sofia NadineNo ratings yet

- 2 - Review Materials - Cash and Cash EquivalentsDocument3 pages2 - Review Materials - Cash and Cash EquivalentsHyunjin MinotozakiNo ratings yet

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsAngel RosalesNo ratings yet

- Module 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPADocument24 pagesModule 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPALucas BantilingNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Topic - Cash & Cash EquivalentsDocument3 pagesTopic - Cash & Cash EquivalentsMhae DuranNo ratings yet

- ARMADA IC, 2BSACCTY B - ACC212 Act1Document9 pagesARMADA IC, 2BSACCTY B - ACC212 Act1Ian Cleo Caballero ArmadaNo ratings yet

- PDF Chapter 4 Cash Amp Cash Equivalent - CompressDocument1 pagePDF Chapter 4 Cash Amp Cash Equivalent - CompressAndrea IgnacioNo ratings yet

- Secret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Document99 pagesSecret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Erika Faith HalladorNo ratings yet

- Cash and Cash EquivalentDocument11 pagesCash and Cash EquivalentWilsonNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument4 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- LECT22s BANK RECONCILIATION StudentDocument10 pagesLECT22s BANK RECONCILIATION StudentLalaland Acads100% (1)

- Yusingco, Rhealene A. ABM 12 - St. Paul: Fundamentals of Accounting 2 Unit Test For Statement of Financial PositionDocument13 pagesYusingco, Rhealene A. ABM 12 - St. Paul: Fundamentals of Accounting 2 Unit Test For Statement of Financial PositionRaymond Roco100% (1)

- Cash and Receivable - Pre Rev - Questions ONLY PDFDocument9 pagesCash and Receivable - Pre Rev - Questions ONLY PDFNove Joy Majadas PatacNo ratings yet

- Cfas Pre FinalDocument10 pagesCfas Pre Finalreagan blaireNo ratings yet

- Assignment 1Document3 pagesAssignment 1Bernadeth Adelaine DomingoNo ratings yet

- John Bo FAR Lecture NotesDocument80 pagesJohn Bo FAR Lecture NotesAlvaro JheyNo ratings yet

- Intacc Actvity 1Document3 pagesIntacc Actvity 1KRISTINE RIO BACSALNo ratings yet

- POCDocument4 pagesPOCAlvin John San Juan100% (1)

- Cash and Cash Equivalent NotesDocument16 pagesCash and Cash Equivalent NotesJanelle Lyn MalapitanNo ratings yet

- CPALE REVIEWER by RDEDocument6 pagesCPALE REVIEWER by RDERachelle Dane EspañolaNo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- CCEDocument15 pagesCCEKianJohnCentenoTuricoNo ratings yet

- Basic Finance Exercice 2Document3 pagesBasic Finance Exercice 2Kazia PerinoNo ratings yet

- Cfas CashDocument5 pagesCfas CashGeelyka MarquezNo ratings yet

- Cash Balance Per Bank Versus Per BookDocument6 pagesCash Balance Per Bank Versus Per BookSyrill CayetanoNo ratings yet

- Cash Cash Equivalent HandoutDocument18 pagesCash Cash Equivalent HandoutAdamNo ratings yet

- Int. Acc 1 Chap 1Document6 pagesInt. Acc 1 Chap 1Nicole Anne Santiago SibuloNo ratings yet

- Session 14-15 Preparation and Analysis of Cash Flow StatementDocument2 pagesSession 14-15 Preparation and Analysis of Cash Flow StatementYamu HiadeenNo ratings yet

- Financial StatementDocument197 pagesFinancial StatementShouvik NagNo ratings yet

- ProblemsDocument13 pagesProblemsEl AgricheNo ratings yet

- Audit CASHDocument43 pagesAudit CASHKirstine DelegenciaNo ratings yet

- INTACCDocument4 pagesINTACCmrgrthflxsubNo ratings yet

- Intacc 1a Reviewer Conceptual Framework and Accounting StandardsDocument32 pagesIntacc 1a Reviewer Conceptual Framework and Accounting StandardsKrizahMarieCaballeroNo ratings yet

- A09 Chapter 6 Notes 1232Document15 pagesA09 Chapter 6 Notes 1232raylannister14No ratings yet

- If Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashDocument3 pagesIf Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashKent Raysil PamaongNo ratings yet

- Current Assets and Current Liabilities 3Document4 pagesCurrent Assets and Current Liabilities 3Jasmine Ahmed Joty (161011023)No ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- AFAR 2 Quiz 1 Solution (BSA)Document11 pagesAFAR 2 Quiz 1 Solution (BSA)Lawrence YusiNo ratings yet

- AFAR 2 Quiz 1 Solution (BSA)Document11 pagesAFAR 2 Quiz 1 Solution (BSA)Lawrence YusiNo ratings yet

- 1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsDocument181 pages1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsLawrence YusiNo ratings yet

- 1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsDocument5 pages1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsLawrence YusiNo ratings yet

- Torrent Downloaded From Glodls - ToDocument1 pageTorrent Downloaded From Glodls - ToLawrence YusiNo ratings yet

- Auditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsDocument3 pagesAuditing Quiz - Cash and Cash Equivalents Auditing Quiz - Cash and Cash EquivalentsLawrence YusiNo ratings yet

- AFAR 2 SyllabusDocument11 pagesAFAR 2 SyllabusLawrence YusiNo ratings yet

- (2 Points) : Hi, Mark Lawrence. When You Submit This Form, The Owner Will See Your Name and Email Address. RequiredDocument5 pages(2 Points) : Hi, Mark Lawrence. When You Submit This Form, The Owner Will See Your Name and Email Address. RequiredLawrence YusiNo ratings yet

- Lease/Rental ContractDocument2 pagesLease/Rental ContractLawrence YusiNo ratings yet

- STS1Document3 pagesSTS1Lawrence YusiNo ratings yet

- Science, Technology and SocietyDocument2 pagesScience, Technology and SocietyLawrence YusiNo ratings yet

- (1/1 Point) : Correct Answers: FALSEDocument20 pages(1/1 Point) : Correct Answers: FALSELawrence YusiNo ratings yet

- STS Week 4 S&T and Nation-Building Part 2 PDFDocument40 pagesSTS Week 4 S&T and Nation-Building Part 2 PDFLawrence YusiNo ratings yet

- STS Week 5-6 Human Person Flourishing in Terms of S&T PDFDocument24 pagesSTS Week 5-6 Human Person Flourishing in Terms of S&T PDFLawrence YusiNo ratings yet

- Documentary Requirements Per Government Agency in Organizing A BusinessDocument2 pagesDocumentary Requirements Per Government Agency in Organizing A BusinessLawrence YusiNo ratings yet

- STS Instructional Modules - Week 4 EvaluationDocument1 pageSTS Instructional Modules - Week 4 EvaluationLawrence YusiNo ratings yet

- STS Instructional Modules - Week 5-6 EvaluationDocument1 pageSTS Instructional Modules - Week 5-6 EvaluationLawrence YusiNo ratings yet

- 4.4 BOND Analysis: (Inverse Floaters and Floating Rates Notes) (Callable Bonds) (Convertible Bonds)Document9 pages4.4 BOND Analysis: (Inverse Floaters and Floating Rates Notes) (Callable Bonds) (Convertible Bonds)Lawrence YusiNo ratings yet

- Written Report EthicsDocument1 pageWritten Report EthicsLawrence YusiNo ratings yet

- Rain Water Harvesting!Document17 pagesRain Water Harvesting!SaadNo ratings yet

- Resume For Teachers in KeralaDocument6 pagesResume For Teachers in Keralaitvgpljbf100% (2)

- Opt 101Document31 pagesOpt 101Diego AraújoNo ratings yet

- Task 1-Critical AnalysisDocument5 pagesTask 1-Critical AnalysisShashni RaiNo ratings yet

- Himachal Pradesh Public Service CommissionDocument4 pagesHimachal Pradesh Public Service CommissionHangrang Valley Kinnaur HPNo ratings yet

- Memorandum To Governor - Assam Mojuri Srameek UnionDocument4 pagesMemorandum To Governor - Assam Mojuri Srameek UnionArup BaisyaNo ratings yet

- SBB501S InternationalRectifierDocument12 pagesSBB501S InternationalRectifierruslan futkaradzeNo ratings yet

- Design PatternsDocument65 pagesDesign PatternsAshleyAndrianNo ratings yet

- Anshul UpadhyayDocument1 pageAnshul UpadhyayAnshul UpadhyayNo ratings yet

- Elecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)Document124 pagesElecciones Injustas, Una Cronología de Incidentes No Democráticos Desde 1999. Por Vladimir Chelminski (No Publicado)AgusGulman100% (1)

- Shakespeare in Love ScriptDocument134 pagesShakespeare in Love ScriptbelleNo ratings yet

- MSDS CavitonDocument9 pagesMSDS CavitonIka KusumawatiNo ratings yet

- People v. Sy Pio, G.R. No. L-5848. April 30, 1954Document3 pagesPeople v. Sy Pio, G.R. No. L-5848. April 30, 1954Anna BarbadilloNo ratings yet

- Maur MeyerDocument488 pagesMaur MeyerItachi KunNo ratings yet

- BTEC Assignment Brief: (For NQF Only)Document2 pagesBTEC Assignment Brief: (For NQF Only)mlmihjazNo ratings yet

- Outcome-Focused Management and BudgetingDocument30 pagesOutcome-Focused Management and BudgetingSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Revision - ADULTS BEGINNERDocument3 pagesRevision - ADULTS BEGINNERbrendakriNo ratings yet

- Anna Hazare Brother HazareDocument15 pagesAnna Hazare Brother HazareH Janardan PrabhuNo ratings yet

- Edward B. Hager v. United States, 993 F.2d 4, 1st Cir. (1993)Document3 pagesEdward B. Hager v. United States, 993 F.2d 4, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- Treatment Plan Assignment Lauren Farmer Kylie Hill Mackenzie Digmann Callie Verschoore Kirkwood Community CollegeDocument5 pagesTreatment Plan Assignment Lauren Farmer Kylie Hill Mackenzie Digmann Callie Verschoore Kirkwood Community Collegeapi-510470035No ratings yet

- Jakub Józef Orliński: Il Pomo D'Oro Maxim EmelyanychevDocument26 pagesJakub Józef Orliński: Il Pomo D'Oro Maxim EmelyanychevMarco Antônio RibasNo ratings yet

- YOUTH AbbreviationDocument23 pagesYOUTH AbbreviationKen ElectronNo ratings yet

- LASALA Partnership Formation SWDocument2 pagesLASALA Partnership Formation SWLizzeille Anne Amor MacalintalNo ratings yet

- NCERT Class 7 English Part 1Document157 pagesNCERT Class 7 English Part 1Kiran KumarNo ratings yet

- Discussion QuestionsDocument6 pagesDiscussion Questionselisha emilianNo ratings yet

- Characterization and Modeling of Oriented Strand CompositesDocument208 pagesCharacterization and Modeling of Oriented Strand CompositesBeatriz SilvaNo ratings yet