Professional Documents

Culture Documents

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Uploaded by

Emiliano Mancilla SilvaCopyright:

Available Formats

You might also like

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Building and Construction General On Site Award Ma000020 Pay GuideDocument130 pagesBuilding and Construction General On Site Award Ma000020 Pay Guidesudip sharmaNo ratings yet

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- GDP, GNP, Balance of Payments and Trade ReportDocument52 pagesGDP, GNP, Balance of Payments and Trade ReportJeno GonoNo ratings yet

- The Bag Making BibleDocument166 pagesThe Bag Making Biblenicole Menes100% (2)

- Questions and SolutionsDocument12 pagesQuestions and SolutionsCris Joy Balandra BiabasNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- MasterThesisBusinessCoaching PDFDocument22 pagesMasterThesisBusinessCoaching PDFDavid Sanchez AriasNo ratings yet

- Bec Final 1Document16 pagesBec Final 1yang1987No ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsWindie SisodNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Module 7 QuizDocument6 pagesModule 7 QuizArif RahmanNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- EP60010 - Financing New Ventures PDFDocument2 pagesEP60010 - Financing New Ventures PDFRajat AgrawalNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document5 pagesAssignemnt Analysis of FS 03.22.2021lynnrodrigo16No ratings yet

- Credit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000Document11 pagesCredit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000rahul ambatiNo ratings yet

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- Deferred Income TaxesDocument3 pagesDeferred Income TaxesFEBRI IRAWANNo ratings yet

- Sample Question MCom 2019 PatternDocument6 pagesSample Question MCom 2019 PatternPRATIKSHA CHAUDHARINo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Business FinanceDocument4 pagesBusiness Financeseol :DNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Solutions On Capital BudgetingDocument25 pagesSolutions On Capital BudgetingASH GAMING GamesNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Hong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Document17 pagesHong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Sin TungNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Quiz On Sce and SFPDocument2 pagesQuiz On Sce and SFPMounicha AmbayecNo ratings yet

- Questions Related To Project Segment ReportDocument14 pagesQuestions Related To Project Segment ReportOm Prakash Sharma100% (1)

- FA & FFA Mock Exam Questions Set 1Document15 pagesFA & FFA Mock Exam Questions Set 1miss ainaNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- 69 Elective1 Advance Financial Managemen Repeaters 2014 15 OnwardsDocument3 pages69 Elective1 Advance Financial Managemen Repeaters 2014 15 Onwardspremium info2222No ratings yet

- Accounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Document3 pagesAccounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Mandeep KaurNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Total Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityDocument29 pagesTotal Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityshabNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- FI 3300 Midterm I Practice Test SolutionsDocument3 pagesFI 3300 Midterm I Practice Test SolutionsSerin SiluéNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- CBCS Accounting For Managers (2019)Document4 pagesCBCS Accounting For Managers (2019)ROYAL COLLEGENo ratings yet

- Llrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersDocument4 pagesLlrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersKavithri ponnappaNo ratings yet

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Mid-Term Test Preparation QuestionsDocument5 pagesMid-Term Test Preparation QuestionsDurjoy SharmaNo ratings yet

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietNo ratings yet

- IBS Lecture Week 4 Chapter 3Document33 pagesIBS Lecture Week 4 Chapter 3Tran LouisNo ratings yet

- Trần Thị Duy - 2000003658 - 20DTA3A - TATM Tiền Trung CấpDocument6 pagesTrần Thị Duy - 2000003658 - 20DTA3A - TATM Tiền Trung CấpTường DuyNo ratings yet

- Quality Earnings:: Growing Profit MarginDocument2 pagesQuality Earnings:: Growing Profit MarginShyamanth R KavimaneNo ratings yet

- FIN435 Asgmnt UpdatedDocument10 pagesFIN435 Asgmnt UpdatedNazirah Mohamed KauziNo ratings yet

- Fish Farming ProjectDocument6 pagesFish Farming ProjectElizabeth Zoe OgutuNo ratings yet

- SL TL InvestigationDocument6 pagesSL TL InvestigationanubrataNo ratings yet

- Chapter 1 Resource Utilization and EconomicsDocument51 pagesChapter 1 Resource Utilization and EconomicsNica Jane Macapinig100% (2)

- 49304752.xls / Sheet1 1Document3 pages49304752.xls / Sheet1 1LaSassyMeliNo ratings yet

- CMAI Association of India: Cmai International Mou Partners THDocument2 pagesCMAI Association of India: Cmai International Mou Partners THpooja sharmaNo ratings yet

- Training Proposal For Q-C-D Methodology Workshop-Revised 281108Document9 pagesTraining Proposal For Q-C-D Methodology Workshop-Revised 281108Ramli Abu Hassan100% (1)

- Copia de Puerto RicoDocument12 pagesCopia de Puerto Riconicole.marchant.tsengNo ratings yet

- List of ReferenceDocument6 pagesList of ReferenceHammad SaeedNo ratings yet

- Script - US Real Estate, Housing CrashDocument5 pagesScript - US Real Estate, Housing CrashMayumi AmponNo ratings yet

- Class Feb 2024 S4hanaDocument15 pagesClass Feb 2024 S4hanaSalauddin Kader ACCANo ratings yet

- Chapter 9 - Multifactor Models of Risk & ReturnDocument10 pagesChapter 9 - Multifactor Models of Risk & ReturnImejah FaviNo ratings yet

- Definition of International BusinessDocument15 pagesDefinition of International BusinessMonasque PamelaNo ratings yet

- What Is A Glossary?Document9 pagesWhat Is A Glossary?Carlos Alberto Canales MedranoNo ratings yet

- Balance Sheet 18-19Document4 pagesBalance Sheet 18-19Mohammad IrfanNo ratings yet

- EQUIPMENT SUMMERY For SurplusDocument17 pagesEQUIPMENT SUMMERY For SurplusEr Akshay ParmarNo ratings yet

- Advanced Financial Accounting and ReportingDocument18 pagesAdvanced Financial Accounting and Reportingedrick LouiseNo ratings yet

- Hotel Voucher 1Document2 pagesHotel Voucher 1MOHAMED MILADNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

- FIDP Applied EconomicsDocument6 pagesFIDP Applied EconomicsFAITH JOANGELICA EVANGELISTANo ratings yet

- 149 - Aerial Concepts 22 Nov 2023 RETAILDocument5 pages149 - Aerial Concepts 22 Nov 2023 RETAILMandy McInnesNo ratings yet

- The Anti-Politics Machine: "Development" and Bureaucratic Power in LesothoDocument6 pagesThe Anti-Politics Machine: "Development" and Bureaucratic Power in Lesotholili gaoNo ratings yet

- Abl Model Work - MemoDocument4 pagesAbl Model Work - MemokartikNo ratings yet

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Uploaded by

Emiliano Mancilla SilvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Name: E-Mail: Cell Phone Number:: Balance Sheet Initial 1st Month

Uploaded by

Emiliano Mancilla SilvaCopyright:

Available Formats

Emiliano Mancilla

Name:

E-mail: cemilianoms@gmail.com

7221318009

Cell phone number:

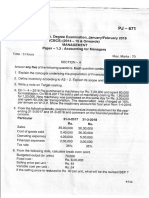

I. You’ve created a shoe company. The total investment to develop this enterprise was US$200 million, 75% was a capital contribution and

the balance came from a 5-year bank loan (which is amortized at maturity). US$150 million were required to build the shoe factory and

show room, and US$40 million were invested on the shoe inventory.

1) Build the initial balance sheet of the company (Initial balance column)

On your first month of operations you sell US$10 million, 50% to individual clients, who paid in cash, and 50% to a large department store

that agreed to pay you 3 months from now.

2) Consider a gross margin of 25%, no additional expenses, no tax payment, a 12% annual interest rate (paid monthly) for the 5-year

bank loan, and no interest gains on cash equivalents. Report the company’s first month P&L statement and balance sheet.

Balance Sheet

Initial 1st Month

Cash 10,000,000 7,000,000

Inventory 40,000,000 40,000,000

Account receivables 0 5,000,000

Current Assets 50,000,000 52,000,000

Fixed Assets 150,000,000 150,000,000

Total Assets 200,000,000 202,000,000

Cost Bearing Liabilities 0 0

Accounts Payables 0 0

Long -term cost bearing debt 50,000,000 50,000,000

Total Liabilities 50,000,000 50,000,000

Equity

Profit and Losses Statment

First Month

Revenues 10,000,000

Cost of Sales 7,500,000

Gross Profit 2,500,000

Expenses 0

Operating Profit 2,500,000

Interest payment 500,000

Net Profit 2,000,000

Comments (optional)

Equity Initial = 150,000,000. 1st month = 152,000,000

Assumption that inventory must prevail on $40,000,000

II. In US dollars, estimate the market size for electric vehicles in Mexico by 2030.

Elaborate on your answer.

The global electric car sales has been increasing in a probable exponential way (few years as sample) since 2010.

The simplest function I could find that most relates to this growth would be.

f(x)= x exp(0.3850*p). p= year. x= cars

According to statista there where 305 electric cars sold in 2019 in mexico, and 2030 - 2019=11

So 305 exp(0.3850*11) = 21,082 cars I Average cost electric car = $55,600 assuming no change in 11 years due technolgy/

innovation price decrement and inflation cancel each other (What increases by inflation, decreases by price of old tech)

USD Market size = $1,172,201,795 USD

Of course the estimation is sensitive to goverment policies and transcendece of electric energy trend.

III. You’ve been commissioned to appraise a property.

The property is one of four identical houses located in downtown Huston.

After interviewing the residents of the other 3 properties you have the following information:

1) The resident of the first house says she built the house 5 years ago and invested a total of US$1 million.

2) The resident of the second house says he pays a US$5,500 monthly rent.

3) The resident of the third house says she acquired the house two years ago for US$1.1 million.

Considering this information, what would be the fair value you estimate for the property?

Elaborate on your answer.

CAP rate

Description. CAP Rate Huston Rent

New luxury. 4.6 Monthly 5,500

Class A. 4.87 Annual. 66,000. CAP rate Value: $1,273,516.64

Class B 5.24

Class C 6.02

Average 5.1825%

House Growth rate 3.228% Growth rate Value $$1,172,162.43

t-5. 1,000,000.00

t-2. 1,100,000.00

t. 1,172,162.43 Answer, somewhere between this margin

IV. You received US$1 million to secure your retirement; how would you allocate this capital?

Elaborate on your answer.

I have 40 years left to allocate the capital

Decade Risk free assets. Risky and speculative investments

1 25% 75%

2 41% 59%

3 57% 43%

4 75% 25%

V.Based on the following information, which sector of the FMSE do you think it’s more likely that the company “NTTRO” belongs to? Rank

you answer from 1 to 4 from most likely to least likely and justify your answer.

Within the FMSE there are 100 listed companies, segmented in 4 different sectors:

• 50 in Construction.

• 10 in Technology

• 25 in Food and Beverage

• 15 in Financials

Amin Toufanie

@FMSEBl0gK1nG

The young management team @NTTRO once again delivers to shareholders through innovation and creativity! Buy NTTRO before

it’s to late! #Investing #NTTRO #IVF #FMSE

Elaborate on your answer.

Sheet Data:

1. Construction

2. F&B

3. Financials

4. Technology

Gathered data from web ————>. IVF= invitro fecundation Amin Toufanie = TLabs CEO (Tech)

Noises/signals— Innovation and Creativity, “Buy NTTRO before its to late” , “young management”

1. Technology

2. Financials

3. F&B

4. Construction

VI. It is estimated that Mexico’s GDP fell by roughly 9% in 2020; however, the Mexican Stock Index or IPC, remained virtually flat when

compared to 2019 numbers. How would you explain this?

Elaborate on your answer.

Because markets and economy are not the same, even though markets could be clearly influenced by world/country’s economy,

they are free and independent from it. Where subjectivity plays a big part to make participants negotiate and value individual

companies at the price they see most beneficial for their porpuses.

You might also like

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Building and Construction General On Site Award Ma000020 Pay GuideDocument130 pagesBuilding and Construction General On Site Award Ma000020 Pay Guidesudip sharmaNo ratings yet

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- GDP, GNP, Balance of Payments and Trade ReportDocument52 pagesGDP, GNP, Balance of Payments and Trade ReportJeno GonoNo ratings yet

- The Bag Making BibleDocument166 pagesThe Bag Making Biblenicole Menes100% (2)

- Questions and SolutionsDocument12 pagesQuestions and SolutionsCris Joy Balandra BiabasNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- MasterThesisBusinessCoaching PDFDocument22 pagesMasterThesisBusinessCoaching PDFDavid Sanchez AriasNo ratings yet

- Bec Final 1Document16 pagesBec Final 1yang1987No ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsWindie SisodNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Module 7 QuizDocument6 pagesModule 7 QuizArif RahmanNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- EP60010 - Financing New Ventures PDFDocument2 pagesEP60010 - Financing New Ventures PDFRajat AgrawalNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document5 pagesAssignemnt Analysis of FS 03.22.2021lynnrodrigo16No ratings yet

- Credit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000Document11 pagesCredit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000rahul ambatiNo ratings yet

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- Deferred Income TaxesDocument3 pagesDeferred Income TaxesFEBRI IRAWANNo ratings yet

- Sample Question MCom 2019 PatternDocument6 pagesSample Question MCom 2019 PatternPRATIKSHA CHAUDHARINo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Business FinanceDocument4 pagesBusiness Financeseol :DNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Solutions On Capital BudgetingDocument25 pagesSolutions On Capital BudgetingASH GAMING GamesNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Hong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Document17 pagesHong Kong University of Science and Technology FINA2303 Financial Management Final Mock Examination Spring 2015Sin TungNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Quiz On Sce and SFPDocument2 pagesQuiz On Sce and SFPMounicha AmbayecNo ratings yet

- Questions Related To Project Segment ReportDocument14 pagesQuestions Related To Project Segment ReportOm Prakash Sharma100% (1)

- FA & FFA Mock Exam Questions Set 1Document15 pagesFA & FFA Mock Exam Questions Set 1miss ainaNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- 69 Elective1 Advance Financial Managemen Repeaters 2014 15 OnwardsDocument3 pages69 Elective1 Advance Financial Managemen Repeaters 2014 15 Onwardspremium info2222No ratings yet

- Accounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Document3 pagesAccounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Mandeep KaurNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Total Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityDocument29 pagesTotal Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityshabNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- FI 3300 Midterm I Practice Test SolutionsDocument3 pagesFI 3300 Midterm I Practice Test SolutionsSerin SiluéNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- CBCS Accounting For Managers (2019)Document4 pagesCBCS Accounting For Managers (2019)ROYAL COLLEGENo ratings yet

- Llrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersDocument4 pagesLlrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersKavithri ponnappaNo ratings yet

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Mid-Term Test Preparation QuestionsDocument5 pagesMid-Term Test Preparation QuestionsDurjoy SharmaNo ratings yet

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietNo ratings yet

- IBS Lecture Week 4 Chapter 3Document33 pagesIBS Lecture Week 4 Chapter 3Tran LouisNo ratings yet

- Trần Thị Duy - 2000003658 - 20DTA3A - TATM Tiền Trung CấpDocument6 pagesTrần Thị Duy - 2000003658 - 20DTA3A - TATM Tiền Trung CấpTường DuyNo ratings yet

- Quality Earnings:: Growing Profit MarginDocument2 pagesQuality Earnings:: Growing Profit MarginShyamanth R KavimaneNo ratings yet

- FIN435 Asgmnt UpdatedDocument10 pagesFIN435 Asgmnt UpdatedNazirah Mohamed KauziNo ratings yet

- Fish Farming ProjectDocument6 pagesFish Farming ProjectElizabeth Zoe OgutuNo ratings yet

- SL TL InvestigationDocument6 pagesSL TL InvestigationanubrataNo ratings yet

- Chapter 1 Resource Utilization and EconomicsDocument51 pagesChapter 1 Resource Utilization and EconomicsNica Jane Macapinig100% (2)

- 49304752.xls / Sheet1 1Document3 pages49304752.xls / Sheet1 1LaSassyMeliNo ratings yet

- CMAI Association of India: Cmai International Mou Partners THDocument2 pagesCMAI Association of India: Cmai International Mou Partners THpooja sharmaNo ratings yet

- Training Proposal For Q-C-D Methodology Workshop-Revised 281108Document9 pagesTraining Proposal For Q-C-D Methodology Workshop-Revised 281108Ramli Abu Hassan100% (1)

- Copia de Puerto RicoDocument12 pagesCopia de Puerto Riconicole.marchant.tsengNo ratings yet

- List of ReferenceDocument6 pagesList of ReferenceHammad SaeedNo ratings yet

- Script - US Real Estate, Housing CrashDocument5 pagesScript - US Real Estate, Housing CrashMayumi AmponNo ratings yet

- Class Feb 2024 S4hanaDocument15 pagesClass Feb 2024 S4hanaSalauddin Kader ACCANo ratings yet

- Chapter 9 - Multifactor Models of Risk & ReturnDocument10 pagesChapter 9 - Multifactor Models of Risk & ReturnImejah FaviNo ratings yet

- Definition of International BusinessDocument15 pagesDefinition of International BusinessMonasque PamelaNo ratings yet

- What Is A Glossary?Document9 pagesWhat Is A Glossary?Carlos Alberto Canales MedranoNo ratings yet

- Balance Sheet 18-19Document4 pagesBalance Sheet 18-19Mohammad IrfanNo ratings yet

- EQUIPMENT SUMMERY For SurplusDocument17 pagesEQUIPMENT SUMMERY For SurplusEr Akshay ParmarNo ratings yet

- Advanced Financial Accounting and ReportingDocument18 pagesAdvanced Financial Accounting and Reportingedrick LouiseNo ratings yet

- Hotel Voucher 1Document2 pagesHotel Voucher 1MOHAMED MILADNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

- FIDP Applied EconomicsDocument6 pagesFIDP Applied EconomicsFAITH JOANGELICA EVANGELISTANo ratings yet

- 149 - Aerial Concepts 22 Nov 2023 RETAILDocument5 pages149 - Aerial Concepts 22 Nov 2023 RETAILMandy McInnesNo ratings yet

- The Anti-Politics Machine: "Development" and Bureaucratic Power in LesothoDocument6 pagesThe Anti-Politics Machine: "Development" and Bureaucratic Power in Lesotholili gaoNo ratings yet

- Abl Model Work - MemoDocument4 pagesAbl Model Work - MemokartikNo ratings yet