Professional Documents

Culture Documents

Truth and Lending Act

Truth and Lending Act

Uploaded by

markCopyright:

Available Formats

You might also like

- COINBASE - 2023 Crypto Market OutlookDocument57 pagesCOINBASE - 2023 Crypto Market OutlookSubhan ArifinNo ratings yet

- Truth in Lending ActDocument12 pagesTruth in Lending ActCoreine Imee ValledorNo ratings yet

- Truth in Lending Act ChenezDocument20 pagesTruth in Lending Act ChenezErika Potian100% (1)

- Credit and Collection PrelimsDocument7 pagesCredit and Collection PrelimsMeloy ApiladoNo ratings yet

- Truth in Lending Act Republic Act No. 3765: - Credit GrabbersDocument3 pagesTruth in Lending Act Republic Act No. 3765: - Credit GrabbersJessa MaeNo ratings yet

- Truth-In-Lending-Act-HandoutDocument6 pagesTruth-In-Lending-Act-HandoutHazel Anne QuilosNo ratings yet

- 3 FxPro Education - Introduction To FX PDFDocument5 pages3 FxPro Education - Introduction To FX PDFalexphuong87No ratings yet

- Sol Ex Rate ExerciceDocument5 pagesSol Ex Rate ExerciceleahbngNo ratings yet

- 306 "Truth in Lending Act" Disclosure Requirement: - PersonDocument3 pages306 "Truth in Lending Act" Disclosure Requirement: - PersonJennifer MoscareNo ratings yet

- Truth Lending and Data PrivacyDocument14 pagesTruth Lending and Data PrivacyRyan MiguelNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- Truth in Lending Act ReviewerDocument1 pageTruth in Lending Act ReviewerJoanna Paula CañaresNo ratings yet

- Republic Act No. 3765 Truth in Lending ActDocument6 pagesRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNo ratings yet

- Special Comml Laws - Tila and AmlaDocument20 pagesSpecial Comml Laws - Tila and AmlaJoseph John Santos RonquilloNo ratings yet

- Credit TransactionsDocument31 pagesCredit TransactionsSarah May Tigue Talagtag100% (1)

- RFBT - Chapter 4 - Truth in Lending ActDocument3 pagesRFBT - Chapter 4 - Truth in Lending Actlaythejoylunas21No ratings yet

- UntitledDocument2 pagesUntitledGabieNo ratings yet

- AE128 - VI.c. Truth in Lending ActDocument2 pagesAE128 - VI.c. Truth in Lending Act마마무AyaNo ratings yet

- Truth in Lending Act (Notes)Document2 pagesTruth in Lending Act (Notes)Vernie Anne100% (2)

- TILA ACA Palma, JDADocument2 pagesTILA ACA Palma, JDAJames Daniel PalmaNo ratings yet

- CREDIT AND COLLECTION Module 6.docx 1 PDFDocument22 pagesCREDIT AND COLLECTION Module 6.docx 1 PDFRosemarie ArtigasNo ratings yet

- (Notes) RFBTDocument15 pages(Notes) RFBTkodzuken.teyNo ratings yet

- Truth in Lending NotesDocument2 pagesTruth in Lending NotesRyDNo ratings yet

- The Truth in Lending ActDocument3 pagesThe Truth in Lending ActBOEN YATORNo ratings yet

- Truth Lending Act - AmlaDocument10 pagesTruth Lending Act - AmlapendonNo ratings yet

- Consumer Act Q and ADocument4 pagesConsumer Act Q and ATine TineNo ratings yet

- TILADocument1 pageTILACJ IbaleNo ratings yet

- NOTES ON TILA - Truth in Lending Act (RA 3765)Document8 pagesNOTES ON TILA - Truth in Lending Act (RA 3765)edrianclydeNo ratings yet

- Republic Act No. 3765: Declaration of PolicyDocument3 pagesRepublic Act No. 3765: Declaration of Policyjeffprox69No ratings yet

- June 22, 1963: Prima Facie Evidence Against Such Defendant in An Action or ProceedingDocument40 pagesJune 22, 1963: Prima Facie Evidence Against Such Defendant in An Action or ProceedingIraMarieCalapardoCamoconNo ratings yet

- Truth in Lending Act SlidesDocument6 pagesTruth in Lending Act SlidesSherine Vizconde100% (1)

- Truth in Lending ActDocument5 pagesTruth in Lending Actadulusman501No ratings yet

- The Truth in Lending ActDocument10 pagesThe Truth in Lending ActMarem RiegoNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActGabieNo ratings yet

- RA 3765 Truth in Lending ActDocument2 pagesRA 3765 Truth in Lending ActGabieNo ratings yet

- R.A. 3765 Truth in Lending Act PDFDocument5 pagesR.A. 3765 Truth in Lending Act PDFsunthatburns00No ratings yet

- Lend Him Money That He CanDocument2 pagesLend Him Money That He CanJade RarioNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActKriztel CuñadoNo ratings yet

- The Truth in Lending Act ExplainedDocument24 pagesThe Truth in Lending Act ExplainedGrace Angelie C. Asio-Salih100% (3)

- Glossary of Financial Banking TermsDocument3 pagesGlossary of Financial Banking TermsbitocasNo ratings yet

- Truth in Lending Act - Data BankDocument2 pagesTruth in Lending Act - Data Bankjeongchaeng no jam brotherNo ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- 35471-2014-Clarifying The Taxability of Financial Lease20211001-11-11qkhmbDocument3 pages35471-2014-Clarifying The Taxability of Financial Lease20211001-11-11qkhmbyakyakxxNo ratings yet

- Credit Facility Sanction LetterDocument19 pagesCredit Facility Sanction LetterJyoti SukhdeveNo ratings yet

- TILA - Usec YebraDocument2 pagesTILA - Usec YebraGieeNo ratings yet

- Republic Act No. 3765Document4 pagesRepublic Act No. 3765Turtlegirl HannaNo ratings yet

- Republic Act 3765Document2 pagesRepublic Act 3765Dianne YcoNo ratings yet

- Mortgage+Facility+Agreement - Ver2 - 01122022 4 3Document40 pagesMortgage+Facility+Agreement - Ver2 - 01122022 4 3finserv2998No ratings yet

- Module 2 Tila & AmlaDocument23 pagesModule 2 Tila & AmlaRoylyn Joy CarlosNo ratings yet

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActArjay MolinaNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActMarien MontecalvoNo ratings yet

- Line of Credit NoteDocument5 pagesLine of Credit Noterhett.emmanuel.serfinoNo ratings yet

- MHA - HAMP Supplemental Directive 09-01Document38 pagesMHA - HAMP Supplemental Directive 09-01SoCal ForeclosuresNo ratings yet

- Truth in Lending ActDocument31 pagesTruth in Lending ActArann Pilande100% (1)

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActJuliana ChengNo ratings yet

- Truth in Lending Act (RA 3765)Document3 pagesTruth in Lending Act (RA 3765)Joanna MNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActPatricia ReyesNo ratings yet

- 9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasDocument5 pages9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasSarah WilliamsNo ratings yet

- Amended Rules and Regulations To Implement The Provisions of Republic Act No. 8556 The Financing Company Act of 1998Document4 pagesAmended Rules and Regulations To Implement The Provisions of Republic Act No. 8556 The Financing Company Act of 1998Ronalie MallariNo ratings yet

- REPUBLIC ACT No 3765 - Truth and Lending ActDocument2 pagesREPUBLIC ACT No 3765 - Truth and Lending ActJoey Ann Tutor KholipzNo ratings yet

- MBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Document15 pagesMBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Cairo AnubissNo ratings yet

- Bank Loan AgreementDocument8 pagesBank Loan AgreementSiddhi LikhmaniNo ratings yet

- MGT1107 Management Science Chapter 1Document20 pagesMGT1107 Management Science Chapter 1mark100% (1)

- Received 1028986051587098Document1 pageReceived 1028986051587098markNo ratings yet

- Received 699254285006944Document1 pageReceived 699254285006944markNo ratings yet

- Module 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesDocument3 pagesModule 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesmarkNo ratings yet

- MGT1107 Management Science Case 2Document22 pagesMGT1107 Management Science Case 2markNo ratings yet

- MGT1107 Management Science Case 3Document19 pagesMGT1107 Management Science Case 3markNo ratings yet

- MGT1107 Management Science Chapter 2Document23 pagesMGT1107 Management Science Chapter 2markNo ratings yet

- Module 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesDocument3 pagesModule 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesmarkNo ratings yet

- Jobli Group ResearchDocument22 pagesJobli Group ResearchmarkNo ratings yet

- R.A 11032 - Ease of Doing Business and Efficient Government Service Delivey ActDocument17 pagesR.A 11032 - Ease of Doing Business and Efficient Government Service Delivey ActmarkNo ratings yet

- Solution To AP05 - InvestmentsDocument17 pagesSolution To AP05 - InvestmentsmarkNo ratings yet

- Dishonour of ChequesDocument22 pagesDishonour of ChequesKrishnakant JainNo ratings yet

- Adjusting Entries FarDocument2 pagesAdjusting Entries FarKylha BalmoriNo ratings yet

- 3013734Document2 pages3013734GauriGanNo ratings yet

- Accounting NotesDocument106 pagesAccounting NotesjayedosNo ratings yet

- Accounts Payable Turnover Ratio Definition - InvestopediaDocument4 pagesAccounts Payable Turnover Ratio Definition - InvestopediaBob KaneNo ratings yet

- Islamic Banking FunctionDocument24 pagesIslamic Banking FunctionSalman RahiNo ratings yet

- The Block Chain EcosystemDocument1 pageThe Block Chain EcosystemLuis Alvarado100% (3)

- EMBA - T4 - SAPM-Assignment-3 - Rahul MJDocument7 pagesEMBA - T4 - SAPM-Assignment-3 - Rahul MJMujeeb Ur RahmanNo ratings yet

- Ust 2014 Bar Q Suggested Answers Civil LawDocument15 pagesUst 2014 Bar Q Suggested Answers Civil LawKevin AmanteNo ratings yet

- The Role of SEBI in Protecting The Interests of Investors and Regulation of Financial IntermediariesDocument10 pagesThe Role of SEBI in Protecting The Interests of Investors and Regulation of Financial IntermediariesSaurabh sarojNo ratings yet

- FIM Old Syllabus Questions - OcredDocument75 pagesFIM Old Syllabus Questions - OcredPavel DhakaNo ratings yet

- U.S.basel .III .Final .Rule .Visual - MemoDocument79 pagesU.S.basel .III .Final .Rule .Visual - Memoswapnit9995No ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Financial ManagementDocument171 pagesFinancial ManagementNasr MohammedNo ratings yet

- Accounts Receivable ManagementDocument14 pagesAccounts Receivable ManagementJay-ar Castillo Watin Jr.No ratings yet

- Dokumen - Tips Nism Eqty DerivativesDocument162 pagesDokumen - Tips Nism Eqty Derivativesharshijain2222No ratings yet

- April 2019 - May 2019Document3 pagesApril 2019 - May 2019Kalyan Reddy AnuguNo ratings yet

- Function Tcode ReferenceDocument90 pagesFunction Tcode ReferencePrashant KoshtaNo ratings yet

- Samuelson, Economics, 17 Ed.: by RetnoDocument18 pagesSamuelson, Economics, 17 Ed.: by RetnoWilda Rahayu HamzahNo ratings yet

- Islamic Capital Markets and Issues in Sukuk Documentation: TrainingDocument4 pagesIslamic Capital Markets and Issues in Sukuk Documentation: TrainingYasir Aftab BachaniNo ratings yet

- Impact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa JindappaDocument3 pagesImpact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa Jindappajasleen kaurNo ratings yet

- Briefing On - Bonus 3392-181Document6 pagesBriefing On - Bonus 3392-181Mike OwensNo ratings yet

- Receipt From STC Pay: Transaction ID: 90886855 Amount 26166.58 INR MTCN 2673573231Document1 pageReceipt From STC Pay: Transaction ID: 90886855 Amount 26166.58 INR MTCN 2673573231Asim AlamNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- Economic Value AddedDocument4 pagesEconomic Value AddedsinghdamanNo ratings yet

- 2nd Exam FinmanDocument17 pages2nd Exam FinmanKate AngNo ratings yet

- Addition by PurchaseDocument4 pagesAddition by PurchasesunshineNo ratings yet

Truth and Lending Act

Truth and Lending Act

Uploaded by

markOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Truth and Lending Act

Truth and Lending Act

Uploaded by

markCopyright:

Available Formats

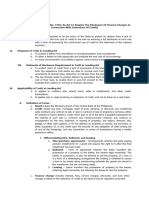

Regulatory Framework for Business Transactions ATTY. JOHNSON A.H.

ONG, CPA, MBA

RFBT Truth and Lending Act SUMMER 2021

STUDENT HANDOUTS

Truth in Lending Act bank and debtor, given at the time of the transaction in

R.A. 3765 partial payment for the property or service purchased.

Approved: June 22, 1963 (3) the difference between the amounts set forth under

clauses (1) and (2);

AN ACT TO REQUIRE THE DISCLOSURE OF FINANCE (4) the charges, individually itemized, which are paid or to

CHARGES IN CONNECTION WITH EXTENSIONS OF CREDIT be paid by such person in connection with the

transaction but which are not incident to the extension

Declaration of Policy of credit;

It is hereby declared to be the policy of the State to protect its (5) the total amount to be financed;

citizens from a lack of awareness of the true cost of credit to the Amounts to be financed consist of the cash price plus

user by assuring a full disclosure of such cost with a view of non-finance charges less the amount of the down

preventing the uninformed use of credit to the detriment of the payment and value of the trade-in.

national economy. • Non-finance charges correspond to the amounts

advanced by the bank for items normally

Requirement under R.A. 3765 associated with the ownership of the property or

1. Any creditor shall furnish to each person to whom credit is of the availment of the service purchased which

extended. are not incident to the extension of credit. For

• "Creditor" means any person engaged in the business example, in the case of the purchase of an

of extending credit (including any person who as a automobile on credit, the creditor may advance

regular business practice make loans or sells or rents the insurance premium as well as the registration

property or services on a time, credit, or installment fee for the account of the debtor

basis, either as principal or as agent) who requires as (6) the finance charge expressed in terms of pesos and

an incident to the extension of credit, the payment of a centavos; and

finance charge. (Sec 3 (4)) • "Finance charge" includes interest, fees, service

• “Credit" means any loan, mortgage, deed of trust, charges, discounts, and such other charges incident to

advance, or discount; any conditional sales contract; the extension of credit.(Sec 3)

any contract to sell, or sale or contract of sale of (7) the percentage that the finance bears to the total

property or services, either for present or future amount to be financed expressed as a simple annual

delivery, under which part or all of the price is payable rate on the outstanding unpaid balance of the

subsequent to the making of such sale or contract; any obligation. (Sec 4)

rental-purchase contract; any contract or arrangement • Simple annual rate is the uniform percentage

for the hire, bailment, or leasing of property; any which represents the ratio between the finance

option, demand, lien, pledge, or other claim against, or charge and the amount to be financed under the

for the delivery of, property or money; any purchase, or assumption that the loan is payable in one (1) year

other acquisition of, or any credit upon the security of, with single payment upon maturity and there are

any obligation of claim arising out of any of the no upfront deductions to principal.

foregoing; and any transaction or series of transactions For loans with terms different from the above

having a similar purpose or effect. (Sec 3(2)) assumptions, the EIR shall be calculated and disclosed

• Person" means any individual, corporation, to the borrower as the relevant true cost of the loan

partnership, association, or other organized group of comparable to the concept of simple annual rate. For

persons, or the legal successor or representative of the loans with contractual interest rates stated on monthly

foregoing, and includes the Philippine Government or basis, the effective interest rate may be expressed as a

any agency thereof, or any other government, or of any monthly rate. In accordance with the Philippine

of its political subdivisions, or any agency of the Accounting Standards (PAS) definition, EIR is the rate

foregoing. (Sec 3(5)) that exactly discounts estimated future cash flows

2. It must be made prior to the consummation of the through the life of the loan to the net amount of the loan

transaction proceeds. For consistency, methodology and standards

3. There must be a clear statement in writing the following for discounted cash flow models shall be prescribed to

information: be used for the purpose.

(1) the cash price or delivered price of the property or

service to be acquired; Information to be disclosed

Cash price or delivered price, in case of trade As a general rule, loan terms shall be disclosed to all types of

transactions, is the amount of money which would borrower.

constitute full payment upon delivery of property For small business/retail/consumer credit, the following are

(except money) or service purchased at the bank’s the minimum information to be disclosed

place of business. In the case of financial transactions, a. The total amount to be financed;

cash price represents the amount of money received by b. The finance charges expressed in terms of pesos and

the debtor upon consummation of the credit centavos;

transaction, net of finance charges collected at the time c. The net proceeds of the loan; and

the credit is extended (if any). (306, MORB 2018) d. The percentage that the finance charge bears to the total

(2) the amounts, if any, to be credited as down payment amount to be financed expressed as a simple annual rate or

and/or trade-in; an EIR. EIR may also be quoted as a monthly rate in parallel

Down Payment represents the amount paid by the with the quotation of the contractual rate. Banks are

debtor at the time of the transaction in partial payment required to furnish each borrower a copy of the disclosure

for the property or service purchased. Trade-in statement, prior to the consummation of the transaction.

represents the value of an asset agreed upon by the (306, MORB 2018)

0998-539-40-22; Jong@feu.edu.ph Page 1 of 2

ATTY. JOHNSON A.H. ONG, CPA, MBA

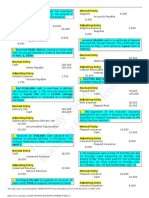

Scope of MORB 2018 • No punishment or penalty provided by this Act shall

The following regulations shall apply to all banks engaged in the apply to the Philippine Government or any agency or

following types of credit transactions: any political subdivision thereof.

a. Any loan, mortgage, deed of trust, advance and discount; • A final judgment hereafter rendered in any criminal

b. Any conditional sales contract, any contract to sell, or sale proceeding under this Act to the effect that a defendant

or contract of sale of property or services, either for present has willfully violated this Act shall be prima facie

or future delivery, under which part or all of the price is evidence against such defendant in an action or

payable subsequent to the making of such sale or contract; proceeding brought by any other party against such

c. Any rental-purchase contract; defendant under this Act as to all matters respecting

d. Any contract or arrangement for the hire, bailment, or which said judgment would be an estoppel as between

leasing of property; the parties thereto.

e. Any option, demand, lien, pledge, or other claim against, or

for delivery of, property or money; In addition to the sanction under R.A 3765

f. Any purchase, or other acquisition of, or any credit upon 1. Bank may also subject to appropriate monetary penalties

security of any obligation or claim arising out of any of the under Sec. 1102, depending on the severity of non-

foregoing; and disclosure, number of loans and amount involved in the

g. Any transaction or series of transactions having a similar violation.

purpose or effect. 2. The following sanctions may be imposed under MORB:

The following categories of credit transactions are outside the a. First offense. Reprimand on the erring officer/s;

scope of these regulations: b. Second offense. Reprimand on the entire board of

(1) Credit transactions which do not involve the payment of directors; and

any finance charge by the debtor; and c. Subsequent offense/s:

(2) Credit transactions in which the debtor is the one specifying (1) Suspension of the erring officer/s and/ or entire

a definite and fixed set of credit terms such as bank board of directors; and

deposits, insurance contracts, sale of bonds, etc. (2) Restriction on lending activities.

3. This is also without prejudice to other penalties and

Inspection of contracts covering credit transactions sanctions provided under Sections 36 and 37 of R.A. No.

Banks shall keep in their offices or places of business copies of 7653. (New Central Bank Act)

contracts which involve the extension of credit by the bank and

the payment of finance charges therefor. Such copies shall be

available for inspection or examination by the appropriate

supervising department of the Bangko Sentral. (306, MORB

2018)

Posters

Banks shall post in conspicuous places in their principal place

of business and branches, the information as contained in the

revised format of disclosure statement in Appendix 16. The

posters shall include an explicit notification that the disclosure

statement is a required attachment to the loan contract and the

customer has a right to demand a copy of such disclosure. (306,

MORB 2018)

Penalty under the Truth and Lending Act

1. Any creditor who in connection with any credit transaction

fails to disclose to any person any information required

under the Truth and Lending Act.

• Liable to such person P100 or in an amount equal to

twice the finance charged required by such creditor in

connection with such transaction, whichever is higher,

except that such liability shall not exceed P2,000 on any

credit transaction.

• Prescriptive period

o Action to recover such penalty may be brought by

such person within one year from the date of the

occurrence of the violation, in any court of

competent jurisdiction.

• In any action under this subsection in which any person

is entitled to a recovery, the creditor shall be liable for

reasonable attorney's fees and court costs as

determined by the court.

• This shall not affect the validity or enforceability of any

contract or transactions.

2. Criminal penalty

Fined by not less than P1,00 or more than P5,000 or

imprisonment for not less than 6 months, nor more than

one year or both.

0998-539-40-22; Jong@feu.edu.ph Page 2 of 2

You might also like

- COINBASE - 2023 Crypto Market OutlookDocument57 pagesCOINBASE - 2023 Crypto Market OutlookSubhan ArifinNo ratings yet

- Truth in Lending ActDocument12 pagesTruth in Lending ActCoreine Imee ValledorNo ratings yet

- Truth in Lending Act ChenezDocument20 pagesTruth in Lending Act ChenezErika Potian100% (1)

- Credit and Collection PrelimsDocument7 pagesCredit and Collection PrelimsMeloy ApiladoNo ratings yet

- Truth in Lending Act Republic Act No. 3765: - Credit GrabbersDocument3 pagesTruth in Lending Act Republic Act No. 3765: - Credit GrabbersJessa MaeNo ratings yet

- Truth-In-Lending-Act-HandoutDocument6 pagesTruth-In-Lending-Act-HandoutHazel Anne QuilosNo ratings yet

- 3 FxPro Education - Introduction To FX PDFDocument5 pages3 FxPro Education - Introduction To FX PDFalexphuong87No ratings yet

- Sol Ex Rate ExerciceDocument5 pagesSol Ex Rate ExerciceleahbngNo ratings yet

- 306 "Truth in Lending Act" Disclosure Requirement: - PersonDocument3 pages306 "Truth in Lending Act" Disclosure Requirement: - PersonJennifer MoscareNo ratings yet

- Truth Lending and Data PrivacyDocument14 pagesTruth Lending and Data PrivacyRyan MiguelNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- Truth in Lending Act ReviewerDocument1 pageTruth in Lending Act ReviewerJoanna Paula CañaresNo ratings yet

- Republic Act No. 3765 Truth in Lending ActDocument6 pagesRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNo ratings yet

- Special Comml Laws - Tila and AmlaDocument20 pagesSpecial Comml Laws - Tila and AmlaJoseph John Santos RonquilloNo ratings yet

- Credit TransactionsDocument31 pagesCredit TransactionsSarah May Tigue Talagtag100% (1)

- RFBT - Chapter 4 - Truth in Lending ActDocument3 pagesRFBT - Chapter 4 - Truth in Lending Actlaythejoylunas21No ratings yet

- UntitledDocument2 pagesUntitledGabieNo ratings yet

- AE128 - VI.c. Truth in Lending ActDocument2 pagesAE128 - VI.c. Truth in Lending Act마마무AyaNo ratings yet

- Truth in Lending Act (Notes)Document2 pagesTruth in Lending Act (Notes)Vernie Anne100% (2)

- TILA ACA Palma, JDADocument2 pagesTILA ACA Palma, JDAJames Daniel PalmaNo ratings yet

- CREDIT AND COLLECTION Module 6.docx 1 PDFDocument22 pagesCREDIT AND COLLECTION Module 6.docx 1 PDFRosemarie ArtigasNo ratings yet

- (Notes) RFBTDocument15 pages(Notes) RFBTkodzuken.teyNo ratings yet

- Truth in Lending NotesDocument2 pagesTruth in Lending NotesRyDNo ratings yet

- The Truth in Lending ActDocument3 pagesThe Truth in Lending ActBOEN YATORNo ratings yet

- Truth Lending Act - AmlaDocument10 pagesTruth Lending Act - AmlapendonNo ratings yet

- Consumer Act Q and ADocument4 pagesConsumer Act Q and ATine TineNo ratings yet

- TILADocument1 pageTILACJ IbaleNo ratings yet

- NOTES ON TILA - Truth in Lending Act (RA 3765)Document8 pagesNOTES ON TILA - Truth in Lending Act (RA 3765)edrianclydeNo ratings yet

- Republic Act No. 3765: Declaration of PolicyDocument3 pagesRepublic Act No. 3765: Declaration of Policyjeffprox69No ratings yet

- June 22, 1963: Prima Facie Evidence Against Such Defendant in An Action or ProceedingDocument40 pagesJune 22, 1963: Prima Facie Evidence Against Such Defendant in An Action or ProceedingIraMarieCalapardoCamoconNo ratings yet

- Truth in Lending Act SlidesDocument6 pagesTruth in Lending Act SlidesSherine Vizconde100% (1)

- Truth in Lending ActDocument5 pagesTruth in Lending Actadulusman501No ratings yet

- The Truth in Lending ActDocument10 pagesThe Truth in Lending ActMarem RiegoNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActGabieNo ratings yet

- RA 3765 Truth in Lending ActDocument2 pagesRA 3765 Truth in Lending ActGabieNo ratings yet

- R.A. 3765 Truth in Lending Act PDFDocument5 pagesR.A. 3765 Truth in Lending Act PDFsunthatburns00No ratings yet

- Lend Him Money That He CanDocument2 pagesLend Him Money That He CanJade RarioNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActKriztel CuñadoNo ratings yet

- The Truth in Lending Act ExplainedDocument24 pagesThe Truth in Lending Act ExplainedGrace Angelie C. Asio-Salih100% (3)

- Glossary of Financial Banking TermsDocument3 pagesGlossary of Financial Banking TermsbitocasNo ratings yet

- Truth in Lending Act - Data BankDocument2 pagesTruth in Lending Act - Data Bankjeongchaeng no jam brotherNo ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- 35471-2014-Clarifying The Taxability of Financial Lease20211001-11-11qkhmbDocument3 pages35471-2014-Clarifying The Taxability of Financial Lease20211001-11-11qkhmbyakyakxxNo ratings yet

- Credit Facility Sanction LetterDocument19 pagesCredit Facility Sanction LetterJyoti SukhdeveNo ratings yet

- TILA - Usec YebraDocument2 pagesTILA - Usec YebraGieeNo ratings yet

- Republic Act No. 3765Document4 pagesRepublic Act No. 3765Turtlegirl HannaNo ratings yet

- Republic Act 3765Document2 pagesRepublic Act 3765Dianne YcoNo ratings yet

- Mortgage+Facility+Agreement - Ver2 - 01122022 4 3Document40 pagesMortgage+Facility+Agreement - Ver2 - 01122022 4 3finserv2998No ratings yet

- Module 2 Tila & AmlaDocument23 pagesModule 2 Tila & AmlaRoylyn Joy CarlosNo ratings yet

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActArjay MolinaNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActMarien MontecalvoNo ratings yet

- Line of Credit NoteDocument5 pagesLine of Credit Noterhett.emmanuel.serfinoNo ratings yet

- MHA - HAMP Supplemental Directive 09-01Document38 pagesMHA - HAMP Supplemental Directive 09-01SoCal ForeclosuresNo ratings yet

- Truth in Lending ActDocument31 pagesTruth in Lending ActArann Pilande100% (1)

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActJuliana ChengNo ratings yet

- Truth in Lending Act (RA 3765)Document3 pagesTruth in Lending Act (RA 3765)Joanna MNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActPatricia ReyesNo ratings yet

- 9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasDocument5 pages9 Concepts Every Filipino Property Buyer Should Know: Buyers Rodel AmbasSarah WilliamsNo ratings yet

- Amended Rules and Regulations To Implement The Provisions of Republic Act No. 8556 The Financing Company Act of 1998Document4 pagesAmended Rules and Regulations To Implement The Provisions of Republic Act No. 8556 The Financing Company Act of 1998Ronalie MallariNo ratings yet

- REPUBLIC ACT No 3765 - Truth and Lending ActDocument2 pagesREPUBLIC ACT No 3765 - Truth and Lending ActJoey Ann Tutor KholipzNo ratings yet

- MBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Document15 pagesMBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Cairo AnubissNo ratings yet

- Bank Loan AgreementDocument8 pagesBank Loan AgreementSiddhi LikhmaniNo ratings yet

- MGT1107 Management Science Chapter 1Document20 pagesMGT1107 Management Science Chapter 1mark100% (1)

- Received 1028986051587098Document1 pageReceived 1028986051587098markNo ratings yet

- Received 699254285006944Document1 pageReceived 699254285006944markNo ratings yet

- Module 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesDocument3 pagesModule 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesmarkNo ratings yet

- MGT1107 Management Science Case 2Document22 pagesMGT1107 Management Science Case 2markNo ratings yet

- MGT1107 Management Science Case 3Document19 pagesMGT1107 Management Science Case 3markNo ratings yet

- MGT1107 Management Science Chapter 2Document23 pagesMGT1107 Management Science Chapter 2markNo ratings yet

- Module 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesDocument3 pagesModule 3 of Week 6-7 Topic: Philippine Architecture Expected Learning OutcomesmarkNo ratings yet

- Jobli Group ResearchDocument22 pagesJobli Group ResearchmarkNo ratings yet

- R.A 11032 - Ease of Doing Business and Efficient Government Service Delivey ActDocument17 pagesR.A 11032 - Ease of Doing Business and Efficient Government Service Delivey ActmarkNo ratings yet

- Solution To AP05 - InvestmentsDocument17 pagesSolution To AP05 - InvestmentsmarkNo ratings yet

- Dishonour of ChequesDocument22 pagesDishonour of ChequesKrishnakant JainNo ratings yet

- Adjusting Entries FarDocument2 pagesAdjusting Entries FarKylha BalmoriNo ratings yet

- 3013734Document2 pages3013734GauriGanNo ratings yet

- Accounting NotesDocument106 pagesAccounting NotesjayedosNo ratings yet

- Accounts Payable Turnover Ratio Definition - InvestopediaDocument4 pagesAccounts Payable Turnover Ratio Definition - InvestopediaBob KaneNo ratings yet

- Islamic Banking FunctionDocument24 pagesIslamic Banking FunctionSalman RahiNo ratings yet

- The Block Chain EcosystemDocument1 pageThe Block Chain EcosystemLuis Alvarado100% (3)

- EMBA - T4 - SAPM-Assignment-3 - Rahul MJDocument7 pagesEMBA - T4 - SAPM-Assignment-3 - Rahul MJMujeeb Ur RahmanNo ratings yet

- Ust 2014 Bar Q Suggested Answers Civil LawDocument15 pagesUst 2014 Bar Q Suggested Answers Civil LawKevin AmanteNo ratings yet

- The Role of SEBI in Protecting The Interests of Investors and Regulation of Financial IntermediariesDocument10 pagesThe Role of SEBI in Protecting The Interests of Investors and Regulation of Financial IntermediariesSaurabh sarojNo ratings yet

- FIM Old Syllabus Questions - OcredDocument75 pagesFIM Old Syllabus Questions - OcredPavel DhakaNo ratings yet

- U.S.basel .III .Final .Rule .Visual - MemoDocument79 pagesU.S.basel .III .Final .Rule .Visual - Memoswapnit9995No ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Financial ManagementDocument171 pagesFinancial ManagementNasr MohammedNo ratings yet

- Accounts Receivable ManagementDocument14 pagesAccounts Receivable ManagementJay-ar Castillo Watin Jr.No ratings yet

- Dokumen - Tips Nism Eqty DerivativesDocument162 pagesDokumen - Tips Nism Eqty Derivativesharshijain2222No ratings yet

- April 2019 - May 2019Document3 pagesApril 2019 - May 2019Kalyan Reddy AnuguNo ratings yet

- Function Tcode ReferenceDocument90 pagesFunction Tcode ReferencePrashant KoshtaNo ratings yet

- Samuelson, Economics, 17 Ed.: by RetnoDocument18 pagesSamuelson, Economics, 17 Ed.: by RetnoWilda Rahayu HamzahNo ratings yet

- Islamic Capital Markets and Issues in Sukuk Documentation: TrainingDocument4 pagesIslamic Capital Markets and Issues in Sukuk Documentation: TrainingYasir Aftab BachaniNo ratings yet

- Impact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa JindappaDocument3 pagesImpact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa Jindappajasleen kaurNo ratings yet

- Briefing On - Bonus 3392-181Document6 pagesBriefing On - Bonus 3392-181Mike OwensNo ratings yet

- Receipt From STC Pay: Transaction ID: 90886855 Amount 26166.58 INR MTCN 2673573231Document1 pageReceipt From STC Pay: Transaction ID: 90886855 Amount 26166.58 INR MTCN 2673573231Asim AlamNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- Economic Value AddedDocument4 pagesEconomic Value AddedsinghdamanNo ratings yet

- 2nd Exam FinmanDocument17 pages2nd Exam FinmanKate AngNo ratings yet

- Addition by PurchaseDocument4 pagesAddition by PurchasesunshineNo ratings yet