Professional Documents

Culture Documents

Key Operating Financial Data

Key Operating Financial Data

Uploaded by

Shbxbs dbvdhsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Operating Financial Data

Key Operating Financial Data

Uploaded by

Shbxbs dbvdhsCopyright:

Available Formats

Key Operating and Financial Data

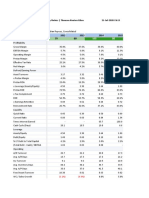

Six years summary 2020 2019 2018 2017 2016 2015

Financial Ratios

Profitability Ratios

Profit / (Loss) Before Tax / Gross Premium % 7.8% 7.4% 7.6% 8.5% 11% 7%

Profit / (Loss) Before Tax / Net Premium % 8.0% 7.6% 7.7% 8.7% 12% 7%

Profit / (Loss) After Tax / Gross Premium % 5.5% 4.9% 5.1% 5.8% 8% 5%

Profit / (Loss) After Tax / Net Premium % 5.6% 5.0% 5.2% 5.9% 8% 5%

Gross Yield on Earning Assets % 7.8% 9.8% 6.3% 6.3% 6% 7%

Net Claims / Net Premium % 56.4% 50.3% 43.4% 46.1% 74% 29%

Commission / Net premium % 18.0% 20.1% 14.3% 11.7% 12% 10%

Acquisition Cost / Net premium % 20.9% 23.5% 22.4% 17.7% 18% 14%

Administration Expenses / Net premium % 5.9% 5.7% 5.4% 5.3% 5% 3%

Change in PHL / Net Inflow % 74.6% 35.2% 21.7% 11.9% 35% 57%

Net investment income / Net Premium % 64.2% 21.8% 0.7% -11.7% 66% 29%

Return On Capital Employed % 16.9% 16.1% 17.7% 20.7% 23% 22%

Return on Equity % 28.9% 26.2% 26.2% 41.8% 45% 43%

Liquidity Ratio

Current Ratio 7.07 8.60 7.51 4.85 3.54 4.39

Quick Ration 7.07 8.60 7.51 4.85 3.54 4.39

Cash to Current Liability % 612% 728% 633% 397% 287% 358%

Investment / Market Ratio

Breakup Value Per Share Rupees 61.75 59.08 60.28 43.41 41.93 34.10

Earnings / (loss) per share (pre tax) Diluted Rupees 25.27 23.54 23.26 26.81 27.98 22.25

Earnings / (loss) per share (after tax) Diluted Rupees 17.84 15.49 15.81 18.12 18.73 14.75

Price Earning Ratio -PAT Times 12.16 14.95 14.41 13.99 11.50 13.49

Mkt price per share at end of the year Rupees 217.00 231.57 227.92 253.49 215.47 199

Mkt price per share - Highest during the year Rupees 228.00 244.4 311.48 329.95 247 260

Mkt price per share - Lowest during the year Rupees 181.05 223.5 195.66 209.00 162 140

Cash Dividend per Share Rupees 15 15 15 15 15 10

Price to book ratio 0.14 0.18 0.20 0.23 0.20 0.22

Cash Dividend % % 150% 150% 150% 150% 150% 100%

Dividend Yield % 7% 6% 7% 6% 7% 5%

Dividend Payout % 84.07% 96.82% 94.86% 82.76% 80.09% 67.78%

Dividend Cover Times 1.19 1.03 1.05 1.21 1.25 1.48

Stock Dividend per share Times – – – – –

Bonus % % – – – – –

Capital Structure Ratio

Return on Asset % 1.15% 1.20% 2.0% 2.4% 3% 2.4%

Earning Asset to total asset % 94.89% 91% 91% 92% 95% 94%

Total Liabilities / Equity Times 24.02 20.88 18.37 24.40 24.35 25.77

Paid-up Capital / Total Asset % 0.65% 0.77% 0.86% 0.91% 0.94% 1.10%

Equity/ total Asset % 4.00% 4.57% 5.2% 3.9% 4% 4%

Comments:

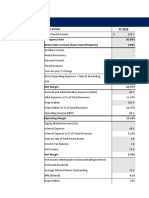

Profitability Ratios:

Net profit after tax have increased from 1.549 billion to 1.784 billion. The Company has managed to underwrite Rs. 32.876 billions of

business (new and subsequent) in 2020.

Liquidity Ratio

EFU Life's liquidity position had always been very strong. Strong in liquidity ratios is mainly due to effective workig capital management.

Investment / Market Ratio

Despite Pandemic, the Company managed to underwrite a profitable business which resulted in around 15% increase in our EPS to

Rs. 17.84 from 15.49 . The Company’s good performance was supported by better performance of PSX. The company has announced

Rs. 10.50 final dividend in addition to Rs. 4.45 Interim dividend (which sums up to 150% total dividend), reflecting robust and strong foot

print in Industry.

Capital Structure Ratio

EFU Life's paid up capital is 1 Billion which is the largest in the life insurance industry in Pakistan. Total assets of the company has increased

from 129.289 Billion to 154.479 Billion making an increase of almost 19.48%.

In addition to this, company has maintained Rs. 2.65 billion in ledger account D, along with 3.2 billion in accumulated surplus and reserves.

104

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- ToolsCorp Corporation's Business PlanDocument7 pagesToolsCorp Corporation's Business PlanericNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Rural MarketingDocument13 pagesRural MarketingKareena ChaudharyNo ratings yet

- Economics Exam Technique GuideDocument21 pagesEconomics Exam Technique Guidemalcewan100% (5)

- Week 9 Individual AssignmentDocument2 pagesWeek 9 Individual AssignmentBryan Pongao100% (1)

- CTC Trade LoggerDocument921 pagesCTC Trade LoggersachinNo ratings yet

- Ice Fili Case AnalysisDocument11 pagesIce Fili Case AnalysisZahid KhanNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Finance Term PaperDocument23 pagesFinance Term PaperTawsiq Asef MahiNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Banks RatiosDocument4 pagesBanks RatiosYAKUBU ISSAHAKU SAIDNo ratings yet

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- Selected Financial Information (Consolidate ($ Millions) )Document2 pagesSelected Financial Information (Consolidate ($ Millions) )KshitishNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- CH 13 Mod 2 Common Size StatementsDocument2 pagesCH 13 Mod 2 Common Size StatementsAkshat JainNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Earnings Highlight - DANGSUGAR PLC 9M 2016Document1 pageEarnings Highlight - DANGSUGAR PLC 9M 2016LawNo ratings yet

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art Euphoria100% (1)

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- AlnassarDocument11 pagesAlnassarFaizanNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Samsung FY16 Q4 PresentationDocument8 pagesSamsung FY16 Q4 PresentationJeevan ParameswaranNo ratings yet

- AcovaDocument5 pagesAcovafutyNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- V F Corporation NYSE VFC FinancialsDocument9 pagesV F Corporation NYSE VFC FinancialsAmalia MegaNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument29 pagesExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- FM205 CaseDocument33 pagesFM205 CaseAastik RockzzNo ratings yet

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- Statement For AAPLDocument1 pageStatement For AAPLEzequiel FriossoNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- 2006 Annual ReportDocument196 pages2006 Annual Reportpcelica77No ratings yet

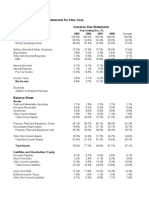

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Momo Operating Report 2022 Q4Document5 pagesMomo Operating Report 2022 Q4Harris ChengNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- KKCL - Investor Presentation Q2 & H1FY24Document45 pagesKKCL - Investor Presentation Q2 & H1FY24Variable SeperableNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Iblf Excel (Mehedi)Document12 pagesIblf Excel (Mehedi)Md. Mehedi HasanNo ratings yet

- Apple Inc., Dividends Per Share (DPS) Forecast: Calcualation of Terminal ValueDocument45 pagesApple Inc., Dividends Per Share (DPS) Forecast: Calcualation of Terminal ValueRadNo ratings yet

- Iifl Wealth & Asset Management: Q4 and Full Year FY21 Performance UpdateDocument21 pagesIifl Wealth & Asset Management: Q4 and Full Year FY21 Performance UpdateRohan RautelaNo ratings yet

- Keppel Pacific Oak US REIT Financial StatementsDocument155 pagesKeppel Pacific Oak US REIT Financial StatementsAakashNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Nestle Pakistan: Resource Person Sir Abdul Kareem Presented byDocument30 pagesNestle Pakistan: Resource Person Sir Abdul Kareem Presented byShbxbs dbvdhsNo ratings yet

- DPTX 2011 2 11230 0 365193 0 125299Document73 pagesDPTX 2011 2 11230 0 365193 0 125299Shbxbs dbvdhsNo ratings yet

- 140899SSCGAZSPEC2020Document96 pages140899SSCGAZSPEC2020Shbxbs dbvdhsNo ratings yet

- Sir FarzanDocument28 pagesSir FarzanShbxbs dbvdhsNo ratings yet

- Topic 3 Mas 2Document12 pagesTopic 3 Mas 2Jamaica DavidNo ratings yet

- Case StudyDocument3 pagesCase Studynazia malikNo ratings yet

- Competitors AnalysisDocument4 pagesCompetitors AnalysistrimyneNo ratings yet

- Marketing Mix of CarlsbergDocument9 pagesMarketing Mix of CarlsbergPraveen MechNo ratings yet

- Sample 2012 Practice L1.T1 - 57-61 - v3 - 0119Document5 pagesSample 2012 Practice L1.T1 - 57-61 - v3 - 0119Doc MashalNo ratings yet

- SendoutCards - Compensation - Plan - DetailsDocument11 pagesSendoutCards - Compensation - Plan - DetailsDonquotiNo ratings yet

- Territory Account Manager in San Francisco Bay CA Resume Linda DartDocument2 pagesTerritory Account Manager in San Francisco Bay CA Resume Linda DartlindadartNo ratings yet

- CHAPTER 12 Stock ValuationDocument36 pagesCHAPTER 12 Stock ValuationVivi CheyNo ratings yet

- Chapters 1 and 2 EconomicsDocument18 pagesChapters 1 and 2 Economicsmazinkaiser2174No ratings yet

- Butchery Business Plan-1Document12 pagesButchery Business Plan-1Andrew LukupwaNo ratings yet

- Puma PresentationDocument31 pagesPuma PresentationSami Zama100% (1)

- Frederick Jackson Turner and His Frontier ThesisDocument7 pagesFrederick Jackson Turner and His Frontier ThesisAbhinava Goswami100% (1)

- Basic of Technical AnalysisDocument44 pagesBasic of Technical Analysissameer jadhavNo ratings yet

- Sap MM Im WM Slides Class FourDocument31 pagesSap MM Im WM Slides Class FourMd Saif100% (1)

- Investigating The Impact and Effectiveness of DigiDocument7 pagesInvestigating The Impact and Effectiveness of Digivythao.ng212No ratings yet

- Managing Capability Nandos Executive Summary Marketing EssayDocument7 pagesManaging Capability Nandos Executive Summary Marketing Essaypitoro2006No ratings yet

- 597 PDFsam 290120 CUDocument197 pages597 PDFsam 290120 CUSomenath PaulNo ratings yet

- KSE RuleBook PDFDocument208 pagesKSE RuleBook PDFMuhammad HasnainNo ratings yet

- Fa3 ExcelDocument6 pagesFa3 ExcelGretchen MontoyaNo ratings yet

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Document106 pagesSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- 1.1 Definition of Price Action TradingDocument4 pages1.1 Definition of Price Action TradingBv Rao100% (1)

- Knowledge Management in The Intelligent EnterpriseDocument374 pagesKnowledge Management in The Intelligent EnterpriseeduardomoresiNo ratings yet

- Presentation Script For RecommendationsDocument8 pagesPresentation Script For RecommendationsDon FabloNo ratings yet

- InvoiceDocument1 pageInvoiceKaran RamchandaniNo ratings yet