Professional Documents

Culture Documents

Computation of Income Tax Liability

Computation of Income Tax Liability

Uploaded by

Abdullah QureshiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computation of Income Tax Liability

Computation of Income Tax Liability

Uploaded by

Abdullah QureshiCopyright:

Available Formats

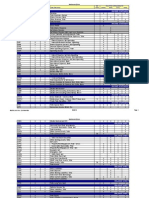

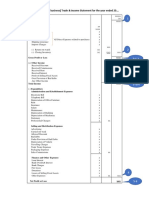

Computation of Taxable income of an individual

NAME OF TAXPAYER :

NTN TAXPAYER :

TAX YEAR :

RESIDENTIAL STATUS :

PERSON STATUS :

NOTES Total Exempted Rs. Taxable

Rs. Rs.

Income from salary:

Basic salary Xx - xx

Dearness allowance Xx - xx

Cost of living allowance Xx - Xx

Bonus Xx - xx

Commission/fee Xx - Xx

Leave encashment 1 Xx - xx

Overtime payment Xx - xx

Allowances:

Medical allowance Xx Exempt up to xx

10% basic

salary

House rent allowance Xx - xx

Entertainment allowance Xx - xx

Travelling allowance Xx - Xx

Utilities allowance Xx - xx

Overseas allowance Xx - xx

TA/DA or special allowance 2 Xx Xx -

Senior post allowance Xx - xx

Facilities:

Medical facility 3 Xx Xx -

Higher of

Rent free accommodation provided by Annual rental

4

employer value OR 45% of

basic salary

Car provided by the employer: 5

For office work only xx -

For private use only 10% of value of

car

For both use 5% of value of

car

Interest on loan provided by employer If loan is less Loan

than Rs. 1

million , no amount*(10%-

tax will be interest charged

charged

by employer)

Salary of domestic servant paid by xx

employer

Obligation of employee Xx - xx

waive/paid/reimbursed by employer

Reward/Asset paid/transferred by Fair market value

employer

Leave fare assistance Xx - xx

Entertainment facility Xx Xx -

(free/reimbursement/subsidized)

Provident fund:

Employee contribution - - -

Employer contribution 6 Xx Exempt up to xx

lessor of 10%

of salary or

Rs. 150,000

Interest credited 6 Xx Exempt xx

higher of 1/3rd

of salary or

amount

calculated at

16%

Accumulated balance - - -

Gratuity /accumulated pension:

Government Xx Fully exempt -

Approved under Income tax Xx Fully exempt -

ordinance, 2001, by the commissioner

Un-recognized fund but scheme is Xx Exempt up-to xx

approved by the board Rs. 300,000

Any other 7 Xx Lessor of xx

Rs.75,000 or

50% of

amount

Pension 8 Xx - xx

Any other benefit or allowances Xx - xx

Waiver of amount payable by Xx - xx

employee

Total taxable income from salary xx

Income from property: NOTES Total Exempted Taxable

(separate block of Rs. Rs. Rs.

income/Normal income)

Annual rent received Higher of actual rent or xx - xx

FMR is taxable

Un-adjustable advance Unadjustable advance

xx - xx

10 years

Liability of landlord paid by Xx - xx

tenant

Forfeited token money Xx - xx

received

Rent chargeable to tax (RCT) xxx

Deductions:

1. Repair and 1/5th Of RCT

maintenance

2. Insurance premium Annual

insurance

premium

3. Local /property tax Actual

amount paid

4. Ground rent related Actual

with that property amount paid

5. Profit on debt /Share Amount Interest on

of rent to HBFC borrowed for such amount

property paid

6. Rent collection Up-to 4% of

charges RCT

7. Legal expenses on Actual

suit against the amount paid

property

Rent chargeable to Tax

Income from Business: NOTES Total Exempted Rs Taxable

Rs Rs

Net profit/loss for the year

Add:

In admissible deduction

Accounting depreciation

Less:

Tax depreciation

Admissible deduction

Carry forward of business loss

Total taxable income from business xx

Income from capital gain: NOTES Total Exempted Rs Taxable

Rs Rs

Gain on assets disposed of within 7 xx - xx

one year from the date of

acquisition

Gain on assets disposed of after Xx 25% gain 75% of gain

year from the date of acquisition

Less: carry forward of capital (xx)

losses

Total taxable income from capital gain xx

Income from other sources: NOTES Total Exempted Rs Taxable

Rs Rs

All other incomes that are not 7 xx - xx

taxable under any above heads

will be taxable under income

from other sources

Total taxable income from other sources xx

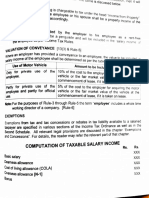

NOTES Total Exempted Rs Taxable

Rs Rs

Total taxable income from xx

Salary

Total taxable income from xx

Business

Total taxable income from xx

capital gain

Total taxable income from xx

other sources

Total income 3800

Deduction:

1. Zakat paid under xx

zakat and usher

ordinance

2. Contribution to xx

worker welfare

fund

3. Contribution to xx

worker

participation fund

4. Donation to xx

approved

institution

5. Profit on debt for Lessor of

house Actual profit on debt or

50% taxable income or

Rs.2000,000

6. Education 10 Lessor of

expenses of 5% of total tuition fee or

children 25% of total taxable income or

Rs. 60,000* nos of children

7. Donation to relief xx (xx)

fund established

by the government

Actual total taxable income xx

NOTES Total Exempted Rs Taxable

Rs Rs

Add: Income included for xx

rate purpose only

Share of profit from AOP xx

Taxable income for rate xx

purpose

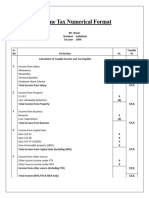

Computation of taxable

income:

Tax liability as per tax rate in first schedule of income tax ordinance, 2001 xxx

Less: Tax credits

Foreign tax Actual foreign tax paid OR (xx)

credit Tax ontaxable∗foreign source Income

Taxable Income

Investment in Amount eligible for Lessor of

shares tax credit Cost of acquisition of shares or

20% of taxable income or

Rs.2000,000

Investment in Xx

life insurance

Contribution to Lessor of total actual (Xx)

approved contribution or 20% taxable

pension fund income

Gross Tax liability xxx

Less: reduction in case of

full time teacher &

researcher (25%) (xx)

Total tax xx

Add: tax on income from property xx

Total tax liability under NTR: xx

Less: withholding taxes (xx)

Tax deducted at source (xx)

Net tax payables XX

Notes:

1. In case of government employees leave preparatory to retirement LPR will be exempted from tax.

2. Any allowance received for purpose of official duty is exempt from tax.

3. If both medical allowance and medical facility is provided, then medical allowance will fully taxable

4. If the house in provided in small cities, then 30% of basic salary is used instead of 45%.

5. Value of car;

Owned by employer: cost of car

Leased car: Market price

6. In case of government provident fund, employer contribution and interest credited are fully exempt. For

provident fund, salary means basic salary plus leave fare assistance

7. In case of government employee, gratuity received is fully exempt.

8. Only one pension with higher amount is exempt.

9. Capital gain on sale of immovable property with taxable under separate block of income

10. A deduction for education of children is only allowed if total taxable income of an individual is less than Rs

1500,000.

You might also like

- Task 1 - Questions: CHCCOM005 - AssignmentDocument4 pagesTask 1 - Questions: CHCCOM005 - AssignmentAbdullah QureshiNo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- 4995628Document5 pages4995628mohitgaba19100% (1)

- Format - SOPL N SOFPDocument2 pagesFormat - SOPL N SOFPA24 Izzah50% (2)

- Final Account Format - VerticalDocument2 pagesFinal Account Format - VerticalTan Shu Yuin100% (1)

- Lyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Document18 pagesLyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Abdullah QureshiNo ratings yet

- Total Cash Receipt From Issuance of BondsDocument11 pagesTotal Cash Receipt From Issuance of Bondskrisha milloNo ratings yet

- Quotation For Fire ExtinguisherDocument2 pagesQuotation For Fire ExtinguisherRajiv Shrestha50% (2)

- Computation of Income Tax LiabilityDocument6 pagesComputation of Income Tax LiabilityMahnoor KamranNo ratings yet

- Computation of Assessable Income From Employment of .. For The Income Year 2077/78 Particulars AmountsDocument16 pagesComputation of Assessable Income From Employment of .. For The Income Year 2077/78 Particulars AmountsSophiya PrabinNo ratings yet

- Partnerships: Less Than or Equal To Php720,000 10%Document5 pagesPartnerships: Less Than or Equal To Php720,000 10%TurksNo ratings yet

- F5 POA TII - Co-Operatives Intro.Document4 pagesF5 POA TII - Co-Operatives Intro.Jada BrownNo ratings yet

- Tax3702 Exam Quick NotesDocument8 pagesTax3702 Exam Quick NotesnhlakaniphoNo ratings yet

- RPGT RatesDocument4 pagesRPGT RatesSarannRajSomasakaranNo ratings yet

- On Income From Salary - 20210202100403Document14 pagesOn Income From Salary - 20210202100403AJ WalkerNo ratings yet

- Prepared By: (Zeeshan Amjad Baig)Document20 pagesPrepared By: (Zeeshan Amjad Baig)zeeshan655No ratings yet

- Partnership LiquidationDocument4 pagesPartnership LiquidationMelanie RuizNo ratings yet

- Income From EmploymentFormatDocument3 pagesIncome From EmploymentFormatsatyaNo ratings yet

- Tax Credits - TY 2022 (Taweez)Document3 pagesTax Credits - TY 2022 (Taweez)Taaha JanNo ratings yet

- 3rd Sem AccountsDocument67 pages3rd Sem Accountsharamilanda2004No ratings yet

- InTax Formate 2021-22 Nuaman Khalid 03446046421 PDFDocument8 pagesInTax Formate 2021-22 Nuaman Khalid 03446046421 PDFMuhammad sheran sattiNo ratings yet

- Preparation of Financial Statements-PartnershipsDocument7 pagesPreparation of Financial Statements-PartnershipsHeavens MupedzisaNo ratings yet

- PerquisitiesDocument13 pagesPerquisitiesDeeksha KapoorNo ratings yet

- Summary Sheet Other SourceDocument2 pagesSummary Sheet Other SourceSamina HyderNo ratings yet

- Chapter 1 - PartnershipDocument12 pagesChapter 1 - PartnershipNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Share Based PaymentsDocument36 pagesShare Based PaymentsChristine Dawn LascoNo ratings yet

- Summary Sheet SalaryDocument5 pagesSummary Sheet SalaryWahab SheikhNo ratings yet

- ScreenDocument3 pagesScreenSmallCapAnalystNo ratings yet

- Shareholders' Equity (Share Capital Transactions, Dividends, Retained Earnings)Document5 pagesShareholders' Equity (Share Capital Transactions, Dividends, Retained Earnings)Richard Jr RjNo ratings yet

- The Trading and Profit and Loss Appropriation of A PartnershipDocument1 pageThe Trading and Profit and Loss Appropriation of A Partnershiphemchandradha13No ratings yet

- Valuation of SharesDocument11 pagesValuation of Shareslekha1997No ratings yet

- Calculation of Salary IncomeDocument3 pagesCalculation of Salary IncomeIqra HayatNo ratings yet

- Banking Company - Porfit and Loss Account FormatDocument8 pagesBanking Company - Porfit and Loss Account Formatgeetha sri100% (1)

- Form No. 22: Formtitle Statutory ReportDocument4 pagesForm No. 22: Formtitle Statutory Reportapi-26161273No ratings yet

- Share Based PaymentDocument55 pagesShare Based PaymentespinomarvyaNo ratings yet

- Balance SheetDocument1 pageBalance Sheetabo776No ratings yet

- Note 1-Estate Under AdministrationDocument8 pagesNote 1-Estate Under AdministrationNur Dina AbsbNo ratings yet

- Reits - NavDocument2 pagesReits - NavSneha PoddarNo ratings yet

- Partnership Final Accounts PDFDocument97 pagesPartnership Final Accounts PDFKaushik Patel75% (4)

- Share Based Payments Share OptionsDocument4 pagesShare Based Payments Share OptionsChristine AltamarinoNo ratings yet

- Computation of Income Tax Due and PayableDocument14 pagesComputation of Income Tax Due and Payablealia fauniNo ratings yet

- Income From Employment FormatDocument3 pagesIncome From Employment FormatsatyaNo ratings yet

- Salary Material Py 2017-18Document16 pagesSalary Material Py 2017-18MS editzzNo ratings yet

- Business CombinationDocument2 pagesBusiness CombinationMarie GonzalesNo ratings yet

- An Income Statement and A Statement of Financial Position For LawyersDocument5 pagesAn Income Statement and A Statement of Financial Position For Lawyerstapiwa mafunduNo ratings yet

- A1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyDocument3 pagesA1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyAvi MaheshwariNo ratings yet

- Tax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in LndiDocument5 pagesTax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in Lndirahulmehta1578No ratings yet

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- FormulasDocument5 pagesFormulasKezNo ratings yet

- Bos 50392 CP 4 U 1Document116 pagesBos 50392 CP 4 U 1Gokul AkrishnanNo ratings yet

- Note 2 - Trusts (Excluding Unit Trusts)Document7 pagesNote 2 - Trusts (Excluding Unit Trusts)Nur Dina AbsbNo ratings yet

- Partner FORMATDocument2 pagesPartner FORMATRownak SahaNo ratings yet

- ACC 1112 Format Sole TraderDocument3 pagesACC 1112 Format Sole TraderTran Tan Trong HieuNo ratings yet

- Income StatementDocument4 pagesIncome StatementBurhan AzharNo ratings yet

- Income From SalaryDocument15 pagesIncome From Salarysrisaidegree collegeNo ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Income From SalaryDocument35 pagesIncome From SalaryNistha RayNo ratings yet

- Less Return Inwards: Less Cost of Goods SoldDocument2 pagesLess Return Inwards: Less Cost of Goods SoldThooijooNo ratings yet

- 04 SalariesDocument28 pages04 SalariesKN KolkataNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- Format of The BalancesheetDocument2 pagesFormat of The BalancesheetRanu Games100% (1)

- Pert 3 (Laporan Keuangan 2)Document7 pagesPert 3 (Laporan Keuangan 2)Yani SupriyaniNo ratings yet

- A Large Refinery and Petrochemical Complex Is Plan...Document4 pagesA Large Refinery and Petrochemical Complex Is Plan...Abdullah QureshiNo ratings yet

- Question - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Document3 pagesQuestion - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Abdullah QureshiNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- North West Company: Analyzing Financial Performance: SolvencyDocument5 pagesNorth West Company: Analyzing Financial Performance: SolvencyAbdullah QureshiNo ratings yet

- EthicsDocument10 pagesEthicsAbdullah QureshiNo ratings yet

- Case Study 2 On-Time Delivery: 2. What Does Business Ethics Say?Document1 pageCase Study 2 On-Time Delivery: 2. What Does Business Ethics Say?Abdullah QureshiNo ratings yet

- Caf 6 Tax Spring 2019 2Document5 pagesCaf 6 Tax Spring 2019 2Abdullah QureshiNo ratings yet

- Class Project Topic: Women HarassmentDocument10 pagesClass Project Topic: Women HarassmentAbdullah QureshiNo ratings yet

- It Tell Us How Much Cash Is Generated From The Business Operation. It Is Increasing So We Add Them in The Cash Flow StatementsDocument4 pagesIt Tell Us How Much Cash Is Generated From The Business Operation. It Is Increasing So We Add Them in The Cash Flow StatementsAbdullah QureshiNo ratings yet

- Engineering Economics Assignment BETE 54D Present WorthDocument1 pageEngineering Economics Assignment BETE 54D Present WorthAbdullah QureshiNo ratings yet

- Input Tax Credit Under GST by CA. Nagesh Jadhav PDFDocument22 pagesInput Tax Credit Under GST by CA. Nagesh Jadhav PDFLumita SinghNo ratings yet

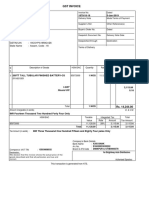

- Part Quotation GST-savari 2000Document2 pagesPart Quotation GST-savari 2000Kowsik KowsiNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Business Taxation Set 4Document6 pagesBusiness Taxation Set 4NITESH GondNo ratings yet

- Answer: ADocument3 pagesAnswer: ARosemarie CruzNo ratings yet

- Shunzeric Farm LLCDocument2 pagesShunzeric Farm LLCtcamon26No ratings yet

- Fundamentals of TaxationDocument6 pagesFundamentals of TaxationVince Josue LopezNo ratings yet

- A Review of Roy Rohatgis Basic International TaxaDocument7 pagesA Review of Roy Rohatgis Basic International TaxaAto SumartoNo ratings yet

- Marcus AgDocument4 pagesMarcus AgMosesNo ratings yet

- Financial Management - Exercise 2Document5 pagesFinancial Management - Exercise 2jhun ecleoNo ratings yet

- Taxation - DPP 9.1 - (CDS - 2 Viraat 2023)Document4 pagesTaxation - DPP 9.1 - (CDS - 2 Viraat 2023)tanwar9780No ratings yet

- Invoice: Please DO NOT PAY. You Will Be Charged The Amount Due Through Your Selected Method of PaymentDocument2 pagesInvoice: Please DO NOT PAY. You Will Be Charged The Amount Due Through Your Selected Method of PaymentStav KamilNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- Value Added Tax NotesDocument13 pagesValue Added Tax Noteswuxiaoji100% (1)

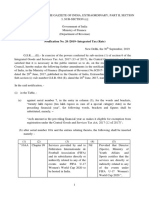

- Notfctn 20 2019 Igst Rate EnglishDocument4 pagesNotfctn 20 2019 Igst Rate EnglishDr M R aggarwaalNo ratings yet

- ACCOUNTING EQUATION, JOURNAL LEDGER - SolutionDocument4 pagesACCOUNTING EQUATION, JOURNAL LEDGER - SolutionRitika Das100% (1)

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet

- Financial Accounting Volume ThreeDocument32 pagesFinancial Accounting Volume ThreeJennybabe PetaNo ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- RMC 72-04Document9 pagesRMC 72-04ai0412No ratings yet

- Application For Property Tax Reduction For 2017: L L L L L LDocument1 pageApplication For Property Tax Reduction For 2017: L L L L L LO'Connor AssociateNo ratings yet

- Concerns Regarding Pakistan's Fiscal DeficitDocument21 pagesConcerns Regarding Pakistan's Fiscal DeficitumairzafarNo ratings yet

- Sample QP 2 Jan2020Document23 pagesSample QP 2 Jan2020M Rafeeq100% (1)

- Tax Invoice-Cum-Receipt: Railtel Corporation of India Limited. Gstin PanDocument1 pageTax Invoice-Cum-Receipt: Railtel Corporation of India Limited. Gstin PanADEN SPN MBNo ratings yet

- Commissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Document11 pagesCommissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Dino Bernard LapitanNo ratings yet

- PWC Worldwide Tax Summaries Corporate Taxes 2018 19 Europe 2Document860 pagesPWC Worldwide Tax Summaries Corporate Taxes 2018 19 Europe 2Dwi WahyuniNo ratings yet

- Summary of Collections and Remittances - BTDocument18 pagesSummary of Collections and Remittances - BTSt. Veronica Learning CenterNo ratings yet