Professional Documents

Culture Documents

Psa 320

Psa 320

Uploaded by

kris m0 ratings0% found this document useful (0 votes)

27 views2 pagesThe document discusses performance materiality and the revision of materiality during an audit. It states that performance materiality is set at an amount lower than materiality for the financial statements to reduce the risk that aggregate uncorrected misstatements exceed materiality. It also notes that materiality may need to be revised during the audit if circumstances change or if the auditor gains a better understanding of the entity through further audit procedures. For example, materiality may be revised if anticipated financial results used initially are likely to be substantially different than actual results.

Original Description:

Original Title

psa 320

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses performance materiality and the revision of materiality during an audit. It states that performance materiality is set at an amount lower than materiality for the financial statements to reduce the risk that aggregate uncorrected misstatements exceed materiality. It also notes that materiality may need to be revised during the audit if circumstances change or if the auditor gains a better understanding of the entity through further audit procedures. For example, materiality may be revised if anticipated financial results used initially are likely to be substantially different than actual results.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views2 pagesPsa 320

Psa 320

Uploaded by

kris mThe document discusses performance materiality and the revision of materiality during an audit. It states that performance materiality is set at an amount lower than materiality for the financial statements to reduce the risk that aggregate uncorrected misstatements exceed materiality. It also notes that materiality may need to be revised during the audit if circumstances change or if the auditor gains a better understanding of the entity through further audit procedures. For example, materiality may be revised if anticipated financial results used initially are likely to be substantially different than actual results.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

A11.

In considering whether, in the specific circumstances of the entity, such classes of

transactions, account balances or disclosures exist, the auditor may find it useful

to obtain an understanding of the views and expectations of those charged with

governance and management.

10

PSA 320 (Revised and Redrafted)

Performance Materiality (Ref: Para. 11)

A12. Planning the audit solely to detect individually material misstatements overlooks

the fact that the aggregate of individually immaterial misstatements may cause the

financial statements to be materially misstated, and leaves no margin for possible

undetected misstatements. Performance materiality (which, as defined, is one or

more amounts) is set to reduce to an appropriately low level the probability that

the aggregate of uncorrected and undetected misstatements in the financial

statements exceeds materiality for the financial statements as a whole. Similarly,

performance materiality relating to a materiality level determined for a particular

class of transactions, account balance or disclosure is set to reduce to an

appropriately low level the probability that the aggregate of uncorrected and

undetected misstatements in that particular class of transactions, account balance

or disclosure exceeds the materiality level for that particular class of transactions,

account balance or disclosure. The determination of performance materiality is not

a simple mechanical calculation and involves the exercise of professional

judgment. It is affected by the auditor’s understanding of the entity, updated

during the performance of the risk assessment procedures; and the nature and

extent of misstatements identified in previous audits and thereby the auditor’s

expectations in relation to misstatements in the current period.

Revision as the Audit Progresses (Ref: Para. 12)

A13. Materiality for the financial statements as a whole (and, if applicable, the

materiality level or levels for particular classes of transactions, account balances

or disclosures) may need to be revised as a result of a change in circumstances

that occurred during the audit (for example, a decision to dispose of a major part

of the entity’s business), new information, or a change in the auditor’s

understanding of the entity and its operations as a result of performing further

audit procedures. For example, if during the audit it appears as though actual

financial results are likely to be substantially different from the anticipated period

end financial results that were used initially to determine materiality for the

financial statements as a whole, the auditor revises that materiality.

Acknowledgment

This PSA is based on International Standard on Auditing 320 (Revised and Redrafted),

“Materiality in Planning and Performing an Audit,” issued by the International Auditing

and Assurance Standards Board.

There are no significant differences between this PSA 320 (Revised and Redrafted) and

ISA 320 (Revised and Redrafted).

11

PSA 320 (Revised and Redrafted)

This PSA 320 (Revised and Redrafted), “Materiality in Planning and Performing an

Audit,” was unanimously approved for adoption on October 27, 2008 by the members of

the Auditing and Assurance Standards Council.

Benjamin R. Punongbayan, Chairman

Felicidad A. Abad Antonio P. Acyatan

Erwin Vincent G. Alcala Froilan G. Ampil

David L. Balangue Ma. Gracia F. Casals-Diaz

Eliseo A. Fernandez Jaime P. Naranjo

Ma. Cecilia F. Ortiz Nestorio C. Roraldo

Joaquin P. Tolentino Editha O. Tuason

Jaime E. Ysmael

You might also like

- DocxDocument14 pagesDocxJh Junior100% (1)

- Full Business PlanDocument93 pagesFull Business PlanAkmal BasyirNo ratings yet

- Oracle EPBCS CapEx Input FormsDocument16 pagesOracle EPBCS CapEx Input FormsAmit SharmaNo ratings yet

- Sampa Video, Inc Case StudyDocument26 pagesSampa Video, Inc Case StudyFaradilla Karnesia100% (2)

- CommsDocument3 pagesCommskris mNo ratings yet

- Evaluation of Misstatements Identified During The Audit: Risk Management & Audit-ICMAP 1Document18 pagesEvaluation of Misstatements Identified During The Audit: Risk Management & Audit-ICMAP 1mrizwan84No ratings yet

- M P P A: Ateriality in Lanning and Erforming An UditDocument13 pagesM P P A: Ateriality in Lanning and Erforming An UditLaura D'souzaNo ratings yet

- Isa 320Document8 pagesIsa 320baabasaamNo ratings yet

- Lecture 5-Audit MaterialityDocument3 pagesLecture 5-Audit Materialityakii ramNo ratings yet

- Isa 450Document12 pagesIsa 450Drikita PinhelNo ratings yet

- ISA 320 Audit MaterialityDocument2 pagesISA 320 Audit MaterialityCasper ChahandaNo ratings yet

- ISA 320 AuditDocument9 pagesISA 320 Auditpitot cuteNo ratings yet

- ShakespeareDocument4 pagesShakespeareniroba7307No ratings yet

- Philippine Financial Reporting StandardsDocument9 pagesPhilippine Financial Reporting StandardsKristan John ZernaNo ratings yet

- Profit, Loss and Other Comprehensive IncomeDocument5 pagesProfit, Loss and Other Comprehensive IncomeSahin AydinNo ratings yet

- Audit 03Document9 pagesAudit 03lady gwaeyngNo ratings yet

- Psa 320Document8 pagesPsa 320Ysa PinedaNo ratings yet

- Going ConcernDocument10 pagesGoing Concerntimothy454No ratings yet

- What Differentiates Profit or Loss From Other Comprehensive IncomeDocument3 pagesWhat Differentiates Profit or Loss From Other Comprehensive IncomeWei MaoNo ratings yet

- What Is Audit MaterialityDocument5 pagesWhat Is Audit MaterialityK.QNo ratings yet

- ISA 320 Materiality in Planning and Performing An AuditDocument8 pagesISA 320 Materiality in Planning and Performing An AuditDarren LowNo ratings yet

- Interpretations of (SAS No. 47) - AU Section 312, Audit Risk and Materiality in Conducting An AuditDocument7 pagesInterpretations of (SAS No. 47) - AU Section 312, Audit Risk and Materiality in Conducting An AuditHarumNo ratings yet

- Expo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsDocument26 pagesExpo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsratiNo ratings yet

- Philippine Standard On Auditing 450 Evaluation of Misstatements Identified During The AuditDocument11 pagesPhilippine Standard On Auditing 450 Evaluation of Misstatements Identified During The AuditSebastian GarciaNo ratings yet

- ..CASH Flow@Union Bank of IndiaDocument83 pages..CASH Flow@Union Bank of Indiamoula nawazNo ratings yet

- Audit MaterialityDocument4 pagesAudit MaterialityJohn diggleNo ratings yet

- Deegan5e SM Ch20Document23 pagesDeegan5e SM Ch20Rachel TannerNo ratings yet

- Guidelines: Determining and Using Materiality Thresholds in Financial AuditDocument20 pagesGuidelines: Determining and Using Materiality Thresholds in Financial AuditMarisa Mae AngsiocoNo ratings yet

- Isa 200 Updated July 2022Document33 pagesIsa 200 Updated July 2022tinesa ambikapathyNo ratings yet

- SEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio AnalysisDocument20 pagesSEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio Analysismrinal kumarNo ratings yet

- Ac Standard - AS05Document6 pagesAc Standard - AS05api-3705877No ratings yet

- Auditing Practices and Procedures Lecture-05Document7 pagesAuditing Practices and Procedures Lecture-05humaNo ratings yet

- Compilation of Specified Elements, Accounts, or Items of A Financial StatementDocument10 pagesCompilation of Specified Elements, Accounts, or Items of A Financial StatementJhan AbanesNo ratings yet

- Part F - Evaluation of Financial Statements (Financial Statements Discussion and Analysis)Document11 pagesPart F - Evaluation of Financial Statements (Financial Statements Discussion and Analysis)Desmond Grasie ZumankyereNo ratings yet

- Financial AnalysisDocument22 pagesFinancial Analysisnomaan khanNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisShruti JainNo ratings yet

- Sa450 PDFDocument13 pagesSa450 PDFLaura D'souzaNo ratings yet

- GTHW 2010 Chapter 7 MaterialityDocument9 pagesGTHW 2010 Chapter 7 MaterialityasaNo ratings yet

- What Are Financial StatementsDocument4 pagesWhat Are Financial StatementsJustin Era ApeloNo ratings yet

- PSA-260 Communication With Those Charged With GovernanceDocument26 pagesPSA-260 Communication With Those Charged With GovernancecolleenyuNo ratings yet

- Auditor Reporting: Frequently Asked QuestionsDocument12 pagesAuditor Reporting: Frequently Asked QuestionsGuillermo LyNo ratings yet

- 9 ReportingDocument12 pages9 ReportingHussain MustunNo ratings yet

- Isa 805Document13 pagesIsa 805baabasaamNo ratings yet

- CAS 805 Single Financial StatementsDocument17 pagesCAS 805 Single Financial StatementszelcomeiaukNo ratings yet

- Definition of The 'Going Concern' Concept: AccountingDocument4 pagesDefinition of The 'Going Concern' Concept: Accountingmhrscribd014No ratings yet

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- PSA 805 Revised and RedraftedDocument21 pagesPSA 805 Revised and RedraftedShairamae CerdeñaNo ratings yet

- Lecture 15 - Procedures and Reports On SPEDocument6 pagesLecture 15 - Procedures and Reports On SPERachel LeachonNo ratings yet

- CH 11 PDFDocument33 pagesCH 11 PDFRizal SyaifuddinNo ratings yet

- Summary 1 60Document73 pagesSummary 1 60Karen Joy Jacinto Ello100% (1)

- Sri Lanka Accounting Standard SLAS 10Document27 pagesSri Lanka Accounting Standard SLAS 10Don Sudheera Dulan AbeysekaraNo ratings yet

- Audit Report: Learning OutcomesDocument63 pagesAudit Report: Learning OutcomesChahil BapnaNo ratings yet

- Sa 450Document13 pagesSa 450johnsondevasia80No ratings yet

- INTACC 3.1LN Presentation of Financial StatementsDocument9 pagesINTACC 3.1LN Presentation of Financial StatementsAlvin BaternaNo ratings yet

- Psa 805Document19 pagesPsa 805JecNo ratings yet

- Assign 1 Audit AssuranceDocument5 pagesAssign 1 Audit AssuranceAyesha HamidNo ratings yet

- Audit ResponsibilitiesDocument3 pagesAudit ResponsibilitiesAlberes GiliNo ratings yet

- Sa 320 (R)Document8 pagesSa 320 (R)Pankaj RungtaNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- AdequancyDocument3 pagesAdequancykris mNo ratings yet

- Chap 1 TAX TheoriesDocument16 pagesChap 1 TAX Theorieskris mNo ratings yet

- Home Office and Branch Accounting Testbankpdf PDF FreeDocument18 pagesHome Office and Branch Accounting Testbankpdf PDF Freekris mNo ratings yet

- Dokumen - Tips - Branch Accounting TestbankDocument6 pagesDokumen - Tips - Branch Accounting Testbankkris mNo ratings yet

- Taxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's ObjectiveDocument3 pagesTaxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's Objectivekris mNo ratings yet

- Construction Contract Notes (Ast)Document1 pageConstruction Contract Notes (Ast)kris mNo ratings yet

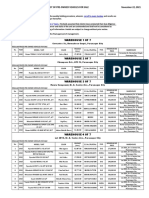

- November 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every SundayDocument3 pagesNovember 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every Sundaykris mNo ratings yet

- MCQDocument6 pagesMCQkris mNo ratings yet

- 12 Capital Budgeting v2Document3 pages12 Capital Budgeting v2kris mNo ratings yet

- Psa 315 RedraftedDocument4 pagesPsa 315 Redraftedkris mNo ratings yet

- Psa 315Document5 pagesPsa 315kris mNo ratings yet

- (H) Revenue Cycle - SAP Business One (H) Revenue Cycle - SAP Business OneDocument9 pages(H) Revenue Cycle - SAP Business One (H) Revenue Cycle - SAP Business Onekris mNo ratings yet

- Cost DivisionDocument4 pagesCost Divisionkris mNo ratings yet

- Responsibility Acctg 2Document5 pagesResponsibility Acctg 2kris mNo ratings yet

- Controls AuditingDocument4 pagesControls Auditingkris mNo ratings yet

- All About DataDocument2 pagesAll About Datakris mNo ratings yet

- CommsDocument3 pagesCommskris mNo ratings yet

- Shareholder's EquityDocument3 pagesShareholder's Equitykris mNo ratings yet

- Chapter 8Document7 pagesChapter 8BobNo ratings yet

- Definitions Flashcards - Microeconomics Topic 1 Introduction To Microeconomics - OCR Economics A-Level PDFDocument51 pagesDefinitions Flashcards - Microeconomics Topic 1 Introduction To Microeconomics - OCR Economics A-Level PDFNaomi IvoNo ratings yet

- Shobha Talent Acquisition Project Report PDFDocument77 pagesShobha Talent Acquisition Project Report PDFSiddhi kumariNo ratings yet

- 2C. NPO HospitalsDocument6 pages2C. NPO HospitalsJSNo ratings yet

- F3 (Fa) BPP ST 2021-22Document666 pagesF3 (Fa) BPP ST 2021-22Jeyhun0% (1)

- Performance Analysis of Hul - v1 27112020Document56 pagesPerformance Analysis of Hul - v1 27112020ippiligourisankar5442No ratings yet

- Marketing Mix 4psDocument7 pagesMarketing Mix 4psMir FaisalNo ratings yet

- Budgeting Q and ADocument26 pagesBudgeting Q and AAnonymous WoG0AmvPb100% (2)

- (Trott & Simms, 2017) An Examination of Product Innovation in Low - and Medium-Technology Industries Cases From The UK Packaged Food SectorDocument19 pages(Trott & Simms, 2017) An Examination of Product Innovation in Low - and Medium-Technology Industries Cases From The UK Packaged Food SectorYounes El ManzNo ratings yet

- Business Model Canvas: Customer SegmentsDocument6 pagesBusiness Model Canvas: Customer SegmentsValentino LunardiNo ratings yet

- Alphabet StructureDocument7 pagesAlphabet StructureConstance de Saint-pierreNo ratings yet

- TufDocument14 pagesTufHoàng VũNo ratings yet

- Ampliz 3 Year Sales Forecast TemplateDocument25 pagesAmpliz 3 Year Sales Forecast TemplateRABIATUL ADAWIYAHNo ratings yet

- Marico Ltd.Document16 pagesMarico Ltd.Mitali ParekhNo ratings yet

- Topacio Rizza C. Activity 6-1Document12 pagesTopacio Rizza C. Activity 6-1santosashleymay7No ratings yet

- Ifrs15 Are You Good To Go ConstructionDocument19 pagesIfrs15 Are You Good To Go ConstructionbatuchemNo ratings yet

- Mutual Fund ScriptDocument12 pagesMutual Fund ScriptSudheesh Murali NambiarNo ratings yet

- Fixed Asset Accounting and Management Procedures ManualDocument16 pagesFixed Asset Accounting and Management Procedures ManualSrini VasanNo ratings yet

- KPMG Private Equity Survey 2013Document64 pagesKPMG Private Equity Survey 2013bobbyr01norNo ratings yet

- Flipkart DessertationDocument32 pagesFlipkart DessertationshubhNo ratings yet

- Raj Singh Be Mba CaseDocument8 pagesRaj Singh Be Mba CaseAJAY KUMAR THAKURNo ratings yet

- Meredith Company Case StudyDocument4 pagesMeredith Company Case StudyZubaidahNo ratings yet

- NCI Balance, December 31, 2013 P114,000: Multiple Choices - ComputationalDocument43 pagesNCI Balance, December 31, 2013 P114,000: Multiple Choices - ComputationalLove FreddyNo ratings yet

- Principles of Marketing: Fifth Canadian Edition Philip Kotler, Gary Armstrong, Peggy H. CunninghamDocument10 pagesPrinciples of Marketing: Fifth Canadian Edition Philip Kotler, Gary Armstrong, Peggy H. CunninghamMohe EsteNo ratings yet

- SearchFundPrimer August2010Document94 pagesSearchFundPrimer August2010Hao ShiNo ratings yet

- Additional DM ProblemsDocument3 pagesAdditional DM ProblemsKaranSinghNo ratings yet