Professional Documents

Culture Documents

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Uploaded by

Emar KimCopyright:

Available Formats

You might also like

- Performance Task No. 2 Preparation of BudgetDocument3 pagesPerformance Task No. 2 Preparation of BudgetChristine Nathalie Balmes100% (2)

- IBIG 04 03 Projecting 3 StatementsDocument75 pagesIBIG 04 03 Projecting 3 StatementsCarloNo ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Senior High School S.Y. 2019-2020Document4 pagesSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- CaseDocument6 pagesCaseGlaiza Dalayoan Flores67% (3)

- Fin Activity For Sales Budget EtcDocument3 pagesFin Activity For Sales Budget EtcMariz TimarioNo ratings yet

- Sales Cost of SalesDocument4 pagesSales Cost of SalesRio Awitin50% (2)

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- CHAPTER 2 Vertical-AnalysisDocument1 pageCHAPTER 2 Vertical-AnalysisAiron BendañaNo ratings yet

- Identify Which of The Following Transactions FallDocument1 pageIdentify Which of The Following Transactions FallAdoree Ramos75% (4)

- Case AnalysisDocument1 pageCase Analysismarissa casareno almuete0% (1)

- Mavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Document2 pagesMavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Alexidaniel Labasbas100% (2)

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Besr M7Document2 pagesBesr M7markjempalomaria100% (1)

- Cash BudgetDocument18 pagesCash BudgetMichelle Tabacoan100% (2)

- Business Ethics Third QTR Module Week6 (Autorecovered)Document10 pagesBusiness Ethics Third QTR Module Week6 (Autorecovered)trhgjrNo ratings yet

- Assets Would Have Increased P55,000Document4 pagesAssets Would Have Increased P55,000Louise100% (1)

- Change in Equity SCEDocument3 pagesChange in Equity SCEAizia Sarceda Guzman100% (2)

- ApliedEconomics Q3 M5 Activity 2Document1 pageApliedEconomics Q3 M5 Activity 2Gine Bert Fariñas PalabricaNo ratings yet

- Business Finance: Net Present Value MethodDocument12 pagesBusiness Finance: Net Present Value MethodAngelica ParasNo ratings yet

- Abm Act 3 FinalDocument6 pagesAbm Act 3 FinalJasper Briones IINo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- CHAPTER 3 Financial PlanningDocument7 pagesCHAPTER 3 Financial Planningflorabel parana0% (1)

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- SLM WK 1-2 Bus EthicsDocument22 pagesSLM WK 1-2 Bus Ethicsvincent viovicenteNo ratings yet

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- CSN 1Document5 pagesCSN 1Kent Anthony Gestopa100% (1)

- Activity 1 - Income and Business Tax (Finals)Document4 pagesActivity 1 - Income and Business Tax (Finals)Jam SurdivillaNo ratings yet

- Bamuya Fabm Act-3Document2 pagesBamuya Fabm Act-3Irish C. BamuyaNo ratings yet

- Financial Statement AnalysisDocument25 pagesFinancial Statement AnalysisAldrin CustodioNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- 4.1 Nature Financial Statement AnalysisDocument15 pages4.1 Nature Financial Statement AnalysisBOSS I4N TVNo ratings yet

- SFP 1 and 2 AccountingDocument13 pagesSFP 1 and 2 AccountingAlissa MayNo ratings yet

- AcadsDocument3 pagesAcadsReid PaladNo ratings yet

- POWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Document30 pagesPOWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Phaelyn YambaoNo ratings yet

- TG - FundaofABM-Lesson 2Document9 pagesTG - FundaofABM-Lesson 2HLeigh Nietes-Gabutan60% (5)

- Opportunities Atractiveness MatrixDocument9 pagesOpportunities Atractiveness MatrixEliNo ratings yet

- Simple InterestDocument3 pagesSimple Interestjohn gabriel bondoyNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- Application of Accounting Equation and Double Entry SystemDocument3 pagesApplication of Accounting Equation and Double Entry SystemMark Joseph CanoNo ratings yet

- Chapter 3statement of Changes in EquityDocument14 pagesChapter 3statement of Changes in EquityKyla DizonNo ratings yet

- Chapter 1 - Group 4 - CourtesyDocument13 pagesChapter 1 - Group 4 - CourtesyRhea Mae OmbajinNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- Lesson 7 - Activity FABMDocument2 pagesLesson 7 - Activity FABMZamantha MarquezNo ratings yet

- Review of Financial Statement PreparationDocument2 pagesReview of Financial Statement PreparationNiccaP100% (3)

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- FABM2 Week5Document14 pagesFABM2 Week5Hazel TolentinoNo ratings yet

- Abm 103Document3 pagesAbm 103MarieeeeeeeeeNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Loan AmortizationDocument50 pagesLoan AmortizationPhill Samonte67% (3)

- AppEco Lesson 2Document21 pagesAppEco Lesson 2wendell john medianaNo ratings yet

- Acctg 3b-3cDocument4 pagesAcctg 3b-3cRizelle Louisse Cantalejo33% (3)

- Statement of Changes in EquityDocument2 pagesStatement of Changes in EquityNicole Allyson AguantaNo ratings yet

- Rañeses, Raizen Kyle - Activity For BudgetDocument4 pagesRañeses, Raizen Kyle - Activity For BudgetRK RanesesNo ratings yet

- MODULE 2 Good Citizenship and ValuesDocument44 pagesMODULE 2 Good Citizenship and ValuesEmar KimNo ratings yet

- Assignment 2 (38 PTS)Document3 pagesAssignment 2 (38 PTS)Emar KimNo ratings yet

- Palacol - Charles M Assignment 1Document3 pagesPalacol - Charles M Assignment 1Emar KimNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- Application Permit: Waiver For CredentialDocument1 pageApplication Permit: Waiver For CredentialEmar KimNo ratings yet

- Current Assets:: What Is The Statement of Financial PositionDocument4 pagesCurrent Assets:: What Is The Statement of Financial PositionEmar KimNo ratings yet

- Pre Spanish SpanishPeriodDocument44 pagesPre Spanish SpanishPeriodEmar KimNo ratings yet

- Statement of Financial Position (S.F.P)Document3 pagesStatement of Financial Position (S.F.P)Emar KimNo ratings yet

- The Study of Literature As An ARTDocument15 pagesThe Study of Literature As An ARTEmar KimNo ratings yet

- Corporate-Finance MCQ'sDocument5 pagesCorporate-Finance MCQ'sAjish JoyNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- DCF Valuation Raimundo Valdés FresnoDocument3 pagesDCF Valuation Raimundo Valdés Fresnorvaldesf98No ratings yet

- Solution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194Document36 pagesSolution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194stephanievargasogimkdbxwn100% (30)

- Nov. 11, 21 - Tax Trans (Continuation On Gross Income)Document19 pagesNov. 11, 21 - Tax Trans (Continuation On Gross Income)law schoolNo ratings yet

- Cost of CapitalDocument16 pagesCost of Capitalsarvan kumarNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- RHM Accounting SOP AdminstrationDocument52 pagesRHM Accounting SOP AdminstrationGianna AngelaNo ratings yet

- Philippine Taxation and The History of The Bureau of Internal RevenueDocument8 pagesPhilippine Taxation and The History of The Bureau of Internal RevenuejohnNo ratings yet

- CBCTG Midterm ExamDocument13 pagesCBCTG Midterm ExamJuvy LagardeNo ratings yet

- XtolDocument2 pagesXtolsujal JainNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Randstad Solutions: 450 Capability Green Luton Bedfordshire Lu1 3luDocument1 pageRandstad Solutions: 450 Capability Green Luton Bedfordshire Lu1 3luAzza BeeNo ratings yet

- Analysis of Financial StatementsDocument16 pagesAnalysis of Financial StatementsAlok ThakurNo ratings yet

- Individual Assignment FIN533Document16 pagesIndividual Assignment FIN533SHAHRIZMAN INDRANo ratings yet

- PennsylvaniaREV 419Document1 pagePennsylvaniaREV 419Vikram rajputNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Erold John Salvador BuenaflorNo ratings yet

- Exercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioDocument6 pagesExercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioMaryane AngelaNo ratings yet

- Wey AP 13e SET Ch03Document13 pagesWey AP 13e SET Ch03CamilaNo ratings yet

- Illustrative Exercises On Cost Terms and Behavior-1Document7 pagesIllustrative Exercises On Cost Terms and Behavior-1nnnNo ratings yet

- Akilah 1:13Document1 pageAkilah 1:13Chris LeeNo ratings yet

- FARAP-4516Document10 pagesFARAP-4516Accounting StuffNo ratings yet

- Pfrs 8: Operating Segments Objective: Other Related Points With The DefinitionDocument4 pagesPfrs 8: Operating Segments Objective: Other Related Points With The DefinitionNhel AlvaroNo ratings yet

- Rosen SummaryDocument35 pagesRosen SummaryNurun Nabi MahmudNo ratings yet

- Assignno3 Incometax-LiwagjaicelberniceDocument3 pagesAssignno3 Incometax-LiwagjaicelberniceShane KimNo ratings yet

- Dividend PolicyDocument16 pagesDividend PolicyDương Thuỳ TrangNo ratings yet

- AC101 Quiz 1Document2 pagesAC101 Quiz 1irene TogaraNo ratings yet

- IAS 16 PPE - LectureDocument11 pagesIAS 16 PPE - LectureBeatrice Ella DomingoNo ratings yet

- Overview of Vietnam Tax SystemDocument13 pagesOverview of Vietnam Tax SystemNhung HồngNo ratings yet

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Uploaded by

Emar KimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Obien, Francine Denise Eleanor G. Abm 12 Y1-7

Uploaded by

Emar KimCopyright:

Available Formats

Obien, Francine Denise Eleanor G.

Abm 12 Y1-7

ACTIVITY

PRODUCTION BUDGET, SALES BUDGET AND PROJECTED FINANCIAL STATEMENTS

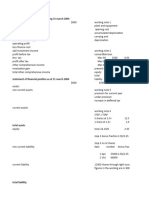

1. Determine the number of units to be produced in 2020 given the following information:

a. Inventories at the Beginning of the Year 250,000 units

b. Projected Sales in 2019 5,750,000 units

c. Target Level of Ending Inventories 400,000 units

Number of Units= Expected sales + Target level of ending inventory

Number of Units= 5,750,000 + 400,000 Units

= 6,150,000- Inventories at the beginning of the year

=6, 150,000- 250,000 Units

Number of Units= 5,900,000 Units

2. Given the following information, estimate the quarterly production in 2020

a. Inventories, December 31, 2019 2, 500 units

b. Projected Quarterly sales and target level of ending inventories in 2020:

Quarter Projected Sales Target Level of Ending

Inventories

Quarter 1 8,000 1,500

Quarter 2 6,000 3,000

Quarter 3 8,500 5,000

Quarter 4 12,500 3,000

Prepare a production budget schedule for 2020 showing the quarterly data.

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year

Expected Sales 8,000 6,000 8,500 12,500 35,000

in Units

Target Level of 1,500 3,000 5,000 3,000 3,000

Inventories

Total: 9,500 9,000 13,500 15,500 38,000

Less of 2,500 1,500 3,000 5,000 2,500

Beginning

Inventories

Required 7,000 7,500 10,500 10,500 35,500

production

Obien, Francine Denise Eleanor G.

Abm 12 Y1-7

3. An analyst wants to project the financial statements of a company in 2020. He has gathered the following

information for 2019:

Current Assets 70 000 000

Property, Plant and Equipment 110 000 000

Current Liabilities 50 000 000

Bank Debt 30 000 000

Common Stocks, P1 par 60 000 000

Retained Earnings 40 000 000

Sales 200 000 000

Net Income 10 000 000

Assumptions:

- Current Assets and current liabilities are expected to vary with sales

- The net profit margin in 2019 is expected to hold in 2020

- Projected sales in 2020 is P210 million

- The company plans to pay P0.05 cash dividends per share in 2020.

Compute the following for 2020:

a. Net income

Net profit margin in 2019 = (Net income in 2019/ Net sales in 2019) x100

Net profit margin in 2019=(10,000,000/200,000,000)x 100%

Net profit margin in 2019 = (0.05)(100%)

Net profit margin in percent= 0.05 or 5%

Projected net income in 2020= 0.05 x Sales in 2020

Projected net income in 2020= 0.05 x 210,000,000

Projected net income in 2020= 10,500,000

b. Current Assets

Current Assets in 2019= (Current Assets in 2019/ Net sales in 2019) x100%

Current Assets in 2019=(70,000,000/200,000,000)x100%

Current Assets in 2019=(0.35) or 35%

Projected Current Assets in 2020= 0.35 x Sales in 2020

Projected Current Assets in 2020= 0.35 x 210,000,000

Projected Current Assets in 2020= 73,500,000

c. Current Liabilities

Current Liabilities in 2019= (Current Liabilities in 2019/ Net sales in 2019) x100%

Current Assets in 2019=(50,000,000/200,000,000)x100%

Current Assets in 2019=(0.25) or 25%

Projected Current Assets in 2020= 0.25 x Sales in 2020

Projected Current Assets in 2020= 0.25 x 210,000,000

Projected Current Assets in 2020= 52,500,000

d. Cash Dividends

Cash Dividends in 2020= (Common stocks in 2019 x Cash dividends per share in 2020)

Cash Dividends in 2020= (60,000,000) (0.05)

Cash Dividends in 2020= 3,000,000

(Note: net profit margin is calculated by dividing net income by net sales)

You might also like

- Performance Task No. 2 Preparation of BudgetDocument3 pagesPerformance Task No. 2 Preparation of BudgetChristine Nathalie Balmes100% (2)

- IBIG 04 03 Projecting 3 StatementsDocument75 pagesIBIG 04 03 Projecting 3 StatementsCarloNo ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Senior High School S.Y. 2019-2020Document4 pagesSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- CaseDocument6 pagesCaseGlaiza Dalayoan Flores67% (3)

- Fin Activity For Sales Budget EtcDocument3 pagesFin Activity For Sales Budget EtcMariz TimarioNo ratings yet

- Sales Cost of SalesDocument4 pagesSales Cost of SalesRio Awitin50% (2)

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- CHAPTER 2 Vertical-AnalysisDocument1 pageCHAPTER 2 Vertical-AnalysisAiron BendañaNo ratings yet

- Identify Which of The Following Transactions FallDocument1 pageIdentify Which of The Following Transactions FallAdoree Ramos75% (4)

- Case AnalysisDocument1 pageCase Analysismarissa casareno almuete0% (1)

- Mavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Document2 pagesMavic Enterprises Post-Closing Trial Balance: December 31, 20X1 (In Philippine Peso)Alexidaniel Labasbas100% (2)

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Besr M7Document2 pagesBesr M7markjempalomaria100% (1)

- Cash BudgetDocument18 pagesCash BudgetMichelle Tabacoan100% (2)

- Business Ethics Third QTR Module Week6 (Autorecovered)Document10 pagesBusiness Ethics Third QTR Module Week6 (Autorecovered)trhgjrNo ratings yet

- Assets Would Have Increased P55,000Document4 pagesAssets Would Have Increased P55,000Louise100% (1)

- Change in Equity SCEDocument3 pagesChange in Equity SCEAizia Sarceda Guzman100% (2)

- ApliedEconomics Q3 M5 Activity 2Document1 pageApliedEconomics Q3 M5 Activity 2Gine Bert Fariñas PalabricaNo ratings yet

- Business Finance: Net Present Value MethodDocument12 pagesBusiness Finance: Net Present Value MethodAngelica ParasNo ratings yet

- Abm Act 3 FinalDocument6 pagesAbm Act 3 FinalJasper Briones IINo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- CHAPTER 3 Financial PlanningDocument7 pagesCHAPTER 3 Financial Planningflorabel parana0% (1)

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- SLM WK 1-2 Bus EthicsDocument22 pagesSLM WK 1-2 Bus Ethicsvincent viovicenteNo ratings yet

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- CSN 1Document5 pagesCSN 1Kent Anthony Gestopa100% (1)

- Activity 1 - Income and Business Tax (Finals)Document4 pagesActivity 1 - Income and Business Tax (Finals)Jam SurdivillaNo ratings yet

- Bamuya Fabm Act-3Document2 pagesBamuya Fabm Act-3Irish C. BamuyaNo ratings yet

- Financial Statement AnalysisDocument25 pagesFinancial Statement AnalysisAldrin CustodioNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- 4.1 Nature Financial Statement AnalysisDocument15 pages4.1 Nature Financial Statement AnalysisBOSS I4N TVNo ratings yet

- SFP 1 and 2 AccountingDocument13 pagesSFP 1 and 2 AccountingAlissa MayNo ratings yet

- AcadsDocument3 pagesAcadsReid PaladNo ratings yet

- POWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Document30 pagesPOWS02 - CelyKalaw (VCM, 2021, p58) Soln 1Phaelyn YambaoNo ratings yet

- TG - FundaofABM-Lesson 2Document9 pagesTG - FundaofABM-Lesson 2HLeigh Nietes-Gabutan60% (5)

- Opportunities Atractiveness MatrixDocument9 pagesOpportunities Atractiveness MatrixEliNo ratings yet

- Simple InterestDocument3 pagesSimple Interestjohn gabriel bondoyNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- Application of Accounting Equation and Double Entry SystemDocument3 pagesApplication of Accounting Equation and Double Entry SystemMark Joseph CanoNo ratings yet

- Chapter 3statement of Changes in EquityDocument14 pagesChapter 3statement of Changes in EquityKyla DizonNo ratings yet

- Chapter 1 - Group 4 - CourtesyDocument13 pagesChapter 1 - Group 4 - CourtesyRhea Mae OmbajinNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- Lesson 7 - Activity FABMDocument2 pagesLesson 7 - Activity FABMZamantha MarquezNo ratings yet

- Review of Financial Statement PreparationDocument2 pagesReview of Financial Statement PreparationNiccaP100% (3)

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- FABM2 Week5Document14 pagesFABM2 Week5Hazel TolentinoNo ratings yet

- Abm 103Document3 pagesAbm 103MarieeeeeeeeeNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Loan AmortizationDocument50 pagesLoan AmortizationPhill Samonte67% (3)

- AppEco Lesson 2Document21 pagesAppEco Lesson 2wendell john medianaNo ratings yet

- Acctg 3b-3cDocument4 pagesAcctg 3b-3cRizelle Louisse Cantalejo33% (3)

- Statement of Changes in EquityDocument2 pagesStatement of Changes in EquityNicole Allyson AguantaNo ratings yet

- Rañeses, Raizen Kyle - Activity For BudgetDocument4 pagesRañeses, Raizen Kyle - Activity For BudgetRK RanesesNo ratings yet

- MODULE 2 Good Citizenship and ValuesDocument44 pagesMODULE 2 Good Citizenship and ValuesEmar KimNo ratings yet

- Assignment 2 (38 PTS)Document3 pagesAssignment 2 (38 PTS)Emar KimNo ratings yet

- Palacol - Charles M Assignment 1Document3 pagesPalacol - Charles M Assignment 1Emar KimNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- Application Permit: Waiver For CredentialDocument1 pageApplication Permit: Waiver For CredentialEmar KimNo ratings yet

- Current Assets:: What Is The Statement of Financial PositionDocument4 pagesCurrent Assets:: What Is The Statement of Financial PositionEmar KimNo ratings yet

- Pre Spanish SpanishPeriodDocument44 pagesPre Spanish SpanishPeriodEmar KimNo ratings yet

- Statement of Financial Position (S.F.P)Document3 pagesStatement of Financial Position (S.F.P)Emar KimNo ratings yet

- The Study of Literature As An ARTDocument15 pagesThe Study of Literature As An ARTEmar KimNo ratings yet

- Corporate-Finance MCQ'sDocument5 pagesCorporate-Finance MCQ'sAjish JoyNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- DCF Valuation Raimundo Valdés FresnoDocument3 pagesDCF Valuation Raimundo Valdés Fresnorvaldesf98No ratings yet

- Solution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194Document36 pagesSolution Manual For Corporate Finance Foundations Global Edition 15th Edition by Block Hirt Danielsen ISBN 007716119X 9780077161194stephanievargasogimkdbxwn100% (30)

- Nov. 11, 21 - Tax Trans (Continuation On Gross Income)Document19 pagesNov. 11, 21 - Tax Trans (Continuation On Gross Income)law schoolNo ratings yet

- Cost of CapitalDocument16 pagesCost of Capitalsarvan kumarNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- RHM Accounting SOP AdminstrationDocument52 pagesRHM Accounting SOP AdminstrationGianna AngelaNo ratings yet

- Philippine Taxation and The History of The Bureau of Internal RevenueDocument8 pagesPhilippine Taxation and The History of The Bureau of Internal RevenuejohnNo ratings yet

- CBCTG Midterm ExamDocument13 pagesCBCTG Midterm ExamJuvy LagardeNo ratings yet

- XtolDocument2 pagesXtolsujal JainNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Randstad Solutions: 450 Capability Green Luton Bedfordshire Lu1 3luDocument1 pageRandstad Solutions: 450 Capability Green Luton Bedfordshire Lu1 3luAzza BeeNo ratings yet

- Analysis of Financial StatementsDocument16 pagesAnalysis of Financial StatementsAlok ThakurNo ratings yet

- Individual Assignment FIN533Document16 pagesIndividual Assignment FIN533SHAHRIZMAN INDRANo ratings yet

- PennsylvaniaREV 419Document1 pagePennsylvaniaREV 419Vikram rajputNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Erold John Salvador BuenaflorNo ratings yet

- Exercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioDocument6 pagesExercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioMaryane AngelaNo ratings yet

- Wey AP 13e SET Ch03Document13 pagesWey AP 13e SET Ch03CamilaNo ratings yet

- Illustrative Exercises On Cost Terms and Behavior-1Document7 pagesIllustrative Exercises On Cost Terms and Behavior-1nnnNo ratings yet

- Akilah 1:13Document1 pageAkilah 1:13Chris LeeNo ratings yet

- FARAP-4516Document10 pagesFARAP-4516Accounting StuffNo ratings yet

- Pfrs 8: Operating Segments Objective: Other Related Points With The DefinitionDocument4 pagesPfrs 8: Operating Segments Objective: Other Related Points With The DefinitionNhel AlvaroNo ratings yet

- Rosen SummaryDocument35 pagesRosen SummaryNurun Nabi MahmudNo ratings yet

- Assignno3 Incometax-LiwagjaicelberniceDocument3 pagesAssignno3 Incometax-LiwagjaicelberniceShane KimNo ratings yet

- Dividend PolicyDocument16 pagesDividend PolicyDương Thuỳ TrangNo ratings yet

- AC101 Quiz 1Document2 pagesAC101 Quiz 1irene TogaraNo ratings yet

- IAS 16 PPE - LectureDocument11 pagesIAS 16 PPE - LectureBeatrice Ella DomingoNo ratings yet

- Overview of Vietnam Tax SystemDocument13 pagesOverview of Vietnam Tax SystemNhung HồngNo ratings yet