Professional Documents

Culture Documents

Derivatives & Risk Management Syllabus

Derivatives & Risk Management Syllabus

Uploaded by

DivyeshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives & Risk Management Syllabus

Derivatives & Risk Management Syllabus

Uploaded by

DivyeshCopyright:

Available Formats

Semester : III Core

Title of the Subject / : Derivatives and Risk Management

Course

Course Code :

Credits : 4 Duration in Hrs. : 40

Learning Objectives

1 To understand the concepts related to derivatives markets and gain in-depth

knowledge of functioning of derivatives markets.

2 To learn the derivatives pricing and application of strategies for financial risk

management.

3 To acquaint learners with the trading, clearing and settlement mechanism in

derivatives markets.

Prerequisites if any Financial management, mathematics and statistics.

Connection with subjects in SAPM, Corporate Valuation, Investment Banking,

the current or Future courses Commodity Markets and International Finance.

Sr. Content Activity Learning outcomes

No

1 Introduction to Derivatives Classroom Understanding the basics of

Economic functions of derivatives, discussion derivatives markets

application of derivatives – for risk

management and speculation (Leveraging),

basic terms and properties of options,

futures and forwards.

2 Forwards and Futures Classroom Understanding the process

Pricing and valuation - futures and discussion of pricing and valuation of

forwards, Risk management using futures, and forwards and futures

introduction to currencies, commodity and problem

interest rate futures. solving

3 Mechanics and Properties of Options Classroom Understanding mechanics of

Co-relation with underlying assets, discussion options and creating

boundary conditions for options, Put-call and synthetic options

parity and its interpretation, synthetic problem

options and risk free arbitrage. solving

4 Option Trading Strategies Classroom To understand pay off of

Directional strategies (Bull call spread, discussion/ each strategy

Bear put spread, Ladder, Ratio spreads), problem

Non-directional strategy (butterfly, solving/dra

condor), Volatility based strategies wing graph

(Straddle, Strangle, Calendar Spread), and live

Hedging strategies (Protective put, covered trading

call).

5 Introduction to Options Valuation Classroom Valuations of options and

Binominal Model for valuation, risk discussion creating scenario analysis

neutral probabilities and their and using Excel

interpretation, binomial model’s problem

application for American options where the solving

underlying pays the dividend, Black and

Scholes Model, log – normal distribution,

interpreting the B & S formula, seeing

options sensitivity to different variable.

6 Risk Management Classroom Understanding risk

Options sensitivity to the underlying, discussion assessment methods and

volatility, strike price, interest rate, time to Options Greeks

expiration. Scenario analysis. Risk

management using Greeks- Delta, Theta,

Vega and Gamma risks of options,

understanding options Greeks for various

trading strategies (volatility and directional

spreads), delta / dynamic hedging and

relating the cost of Delta.

9 Options Volatility Classroom Understanding volatility and

Historical and implied volatility, volatility discussion its relation to demand and

smile, term structure of volatility, some and supply of options

advance models of volatility estimation, problem

value at risk, historical simulation, model solving

building approach, stress testing and back

testing.

10 Trading, Clearing and Settlement in Classroom Understanding the process

Derivatives Markets discussion of trading, clearing and

Meaning and concept, SEBI guidelines, settlement

Trading mechanism, learning mechanism-

role of NSCCL, settlement mechanism,

types of settlement, accounting and

taxation aspect of derivatives trade.

Text Books

1 Redhead Keith, Financial Derivatives - An introduction to futures, forwards, options

and swaps

2 Yadav Surendra S, Jain PK, Foreign exchange markets: understanding derivatives

and other instruments

3 Hull John C. - Options, Futures and other derivatives

Reference Books

1 Bhaskar P Vijaya, Mahapatra B - Derivatives simplified: An introduction to risk

management

2 Bhalla V K - Financial derivatives (risk management)

Assessment

Internal 40%

Semester-end 60%

You might also like

- Shubhiksha Case Study 1Document12 pagesShubhiksha Case Study 1aemma100100% (1)

- Project Report On CSR of Tata SteelDocument43 pagesProject Report On CSR of Tata SteelDivyesh100% (3)

- Conceptualization: Project Report On Total Quality ManagementDocument38 pagesConceptualization: Project Report On Total Quality ManagementDivyeshNo ratings yet

- HDFC Bank ProjectDocument87 pagesHDFC Bank ProjectShweta Kanojia0% (1)

- Mba IV Rural Marketing (10mbamm415) NotesDocument101 pagesMba IV Rural Marketing (10mbamm415) NotesHemanth Kumar80% (5)

- Attitudes and Behavior of Rural ConsumerDocument25 pagesAttitudes and Behavior of Rural ConsumerAlisha Bajpai67% (3)

- M2019HRM046 - Cipla - Performance Management AssignementDocument11 pagesM2019HRM046 - Cipla - Performance Management AssignementpritamavhadNo ratings yet

- Question Bank Sub-Service Marketing (Marketing) Symms Semester 3 2020Document19 pagesQuestion Bank Sub-Service Marketing (Marketing) Symms Semester 3 2020Divyesh100% (1)

- Columbus - Hero or VillainDocument4 pagesColumbus - Hero or Villainapi-264258719No ratings yet

- Complete Question Bank - Entrepreneurship DevelopmentDocument3 pagesComplete Question Bank - Entrepreneurship DevelopmentUday Gowda100% (1)

- Ba 5005 Retail MarketingDocument5 pagesBa 5005 Retail MarketingHarihara PuthiranNo ratings yet

- Syllabus of Shivaji University MBADocument24 pagesSyllabus of Shivaji University MBAmaheshlakade755No ratings yet

- aPPLICATION OF Operation ResearchDocument3 pagesaPPLICATION OF Operation ResearchBrylle James BigorniaNo ratings yet

- Graphic Era Deemed To Be University MBA 1st SemDocument10 pagesGraphic Era Deemed To Be University MBA 1st SemArpit Jain0% (1)

- International Business Dynamics by Prof Balakrishnachar M S PDFDocument56 pagesInternational Business Dynamics by Prof Balakrishnachar M S PDFLathaNo ratings yet

- "A Study On Fundamental Analysis of Indian Infrastructure IndustryDocument18 pages"A Study On Fundamental Analysis of Indian Infrastructure IndustrySaadgi AgarwalNo ratings yet

- Presentation On OCP and SAP by Ritul TripathiDocument30 pagesPresentation On OCP and SAP by Ritul TripathiritulNo ratings yet

- Financial Analysis of Wipro LTD (2) (Repaired)Document80 pagesFinancial Analysis of Wipro LTD (2) (Repaired)Sanchit KalraNo ratings yet

- Objectives of SebiDocument5 pagesObjectives of Sebicherry0% (1)

- Small Industries Development Organisation:, Mahesh.PDocument12 pagesSmall Industries Development Organisation:, Mahesh.Pharidinesh100% (1)

- HRD Strategies For Long Term Planning & Growth: Unit-9Document28 pagesHRD Strategies For Long Term Planning & Growth: Unit-9rdeepak99No ratings yet

- Project TopicsDocument2 pagesProject TopicsAkhil SaiNo ratings yet

- Presentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDDocument12 pagesPresentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDEra ChaudharyNo ratings yet

- Syllabus: COURSE - 401 Service Marketing Unit - IDocument2 pagesSyllabus: COURSE - 401 Service Marketing Unit - IAnees AhmadNo ratings yet

- Unit 12 Sick Industrial UnitDocument17 pagesUnit 12 Sick Industrial UnitGinu George VargheseNo ratings yet

- Manish Sharma: Winter Internship Opportunity by Agile Capital ServicesDocument1 pageManish Sharma: Winter Internship Opportunity by Agile Capital ServicesUtkarsh Tripathi720% (1)

- Job SpecificationDocument9 pagesJob SpecificationMohnish Alka ThakkarNo ratings yet

- LinkedIn PIYUSHDocument10 pagesLinkedIn PIYUSHpiyush rawatNo ratings yet

- Business Statistics I BBA 1303: Muktasha Deena Chowdhury Assistant Professor, Statistics, AUBDocument54 pagesBusiness Statistics I BBA 1303: Muktasha Deena Chowdhury Assistant Professor, Statistics, AUBKhairul Hasan100% (1)

- UNIT-4 Mergers, Diversification and Performance EvaluationDocument13 pagesUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiNo ratings yet

- Human Resource Planning and Application of Technology in HRDocument3 pagesHuman Resource Planning and Application of Technology in HRDivyeshNo ratings yet

- Strategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.Document4 pagesStrategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.DivyaDesai100% (1)

- International BusinessDocument2 pagesInternational BusinessPrateek Sinha0% (2)

- Eic FrameworkDocument37 pagesEic FrameworkABSDJIGY0% (1)

- STRATEGIC MANAGEMENT - Question Papers 5 Sets - Sandeep KhedkarDocument5 pagesSTRATEGIC MANAGEMENT - Question Papers 5 Sets - Sandeep Khedkarkalpitgupta786100% (1)

- MBA Question PaperDocument3 pagesMBA Question Paperhks100% (2)

- EADR SyllabusDocument2 pagesEADR SyllabussanzitNo ratings yet

- Ba5302 Strategic Management PDFDocument1 pageBa5302 Strategic Management PDFAbhinayaa SNo ratings yet

- Swot Analysis TATA MotarDocument20 pagesSwot Analysis TATA Motarkalpesh1956No ratings yet

- Security Analysis & Portfolio ManagementDocument45 pagesSecurity Analysis & Portfolio ManagementVignesh PrabhuNo ratings yet

- 202 FMDocument34 pages202 FMshubhamatilkar04No ratings yet

- Mba 4th Sem Syllabus....Document5 pagesMba 4th Sem Syllabus....MOHAMMED SHEBEER A50% (2)

- Cusat Mba Second Semester SyllabusDocument12 pagesCusat Mba Second Semester SyllabusGabriel Belmonte100% (1)

- Difference Between GDR and IDRDocument18 pagesDifference Between GDR and IDRpriyanka chawlaNo ratings yet

- ETOPDocument11 pagesETOPVandana SharmaNo ratings yet

- Strategic Management SyllabusDocument2 pagesStrategic Management SyllabuspearlinwhiteNo ratings yet

- Mkt-Lab Assignment Book ReviewDocument11 pagesMkt-Lab Assignment Book ReviewRishabh Khichi100% (2)

- Unit - V: Conflict Management and Ethics in International Business ManagementDocument28 pagesUnit - V: Conflict Management and Ethics in International Business ManagementKarthikeyan RNo ratings yet

- Lecture 2 Forwards&FuturesPricing NewDocument48 pagesLecture 2 Forwards&FuturesPricing NewAniruddha DeyNo ratings yet

- CRVDocument5 pagesCRVjitendra patoliya0% (1)

- Line and Aspects of HRMDocument2 pagesLine and Aspects of HRMSe Sathya100% (2)

- Erp Mba NotesDocument96 pagesErp Mba NotesAbhishek MishraNo ratings yet

- BRM Study MaterialDocument21 pagesBRM Study MaterialLalithya Sannitha Meesala100% (1)

- Dissertation On Risk Management in Banking SectorDocument9 pagesDissertation On Risk Management in Banking SectorWhereCanIBuyResumePaperAkronNo ratings yet

- EDDocument8 pagesEDNaganandaKu67% (3)

- Corporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleDocument22 pagesCorporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleRashmi Ranjan Panigrahi100% (3)

- Procedures To Obtain Export FinanceDocument3 pagesProcedures To Obtain Export FinanceVajju ThoutiNo ratings yet

- BBA-Business Research MethodsDocument38 pagesBBA-Business Research MethodsMohammed Abu ShaibuNo ratings yet

- LearningDocument4 pagesLearningTusshar R Gadhiya New0% (1)

- Case Study KesuDocument12 pagesCase Study Kesusharath harady0% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Hrd Practices in Apsrtc: A Case Study with Special Reference to Vizianagaram ZoneFrom EverandHrd Practices in Apsrtc: A Case Study with Special Reference to Vizianagaram ZoneNo ratings yet

- PPM123Document4 pagesPPM123sneha bhongadeNo ratings yet

- First Semester 2021-22Document5 pagesFirst Semester 2021-22Anish ChettlaNo ratings yet

- Credits Faculty Name Program Academic Year and Term Option, Futures and Swaps 1. Course DescriptionDocument3 pagesCredits Faculty Name Program Academic Year and Term Option, Futures and Swaps 1. Course DescriptionAyushi GautamNo ratings yet

- Strategic HRM Que Bank (30 Que)Document4 pagesStrategic HRM Que Bank (30 Que)DivyeshNo ratings yet

- SHRM NotesDocument83 pagesSHRM NotesDivyeshNo ratings yet

- Operation Management Specialization SyllabusDocument18 pagesOperation Management Specialization SyllabusDivyeshNo ratings yet

- LL & Ir MCQDocument14 pagesLL & Ir MCQDivyeshNo ratings yet

- HR Planning & Applications of Technology in HRDocument20 pagesHR Planning & Applications of Technology in HRDivyesh100% (1)

- Paper Setter Faculties From Cluster 09Document2 pagesPaper Setter Faculties From Cluster 09DivyeshNo ratings yet

- Human Resources - VIA-VO INTERNAL MARKSDocument1 pageHuman Resources - VIA-VO INTERNAL MARKSDivyeshNo ratings yet

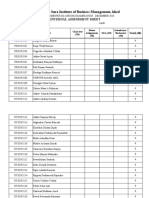

- Common - Internal Assessment SheetDocument3 pagesCommon - Internal Assessment SheetDivyeshNo ratings yet

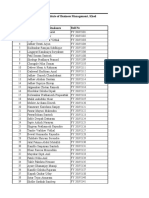

- Marketing - VIA-VO INTERNAL MARKSDocument12 pagesMarketing - VIA-VO INTERNAL MARKSDivyeshNo ratings yet

- Name of Students: Madanbhai Sura Institute of Business Management, KhedDocument4 pagesName of Students: Madanbhai Sura Institute of Business Management, KhedDivyeshNo ratings yet

- Common - Via-Vo Internal MarksDocument16 pagesCommon - Via-Vo Internal MarksDivyeshNo ratings yet

- TQM MCQDocument11 pagesTQM MCQDivyesh100% (1)

- Class: Sem: Subject: Cost Accounting Subject Code: Q.NoDocument6 pagesClass: Sem: Subject: Cost Accounting Subject Code: Q.NoDivyeshNo ratings yet

- Greene, Big - Data - in - Medicine PDFDocument6 pagesGreene, Big - Data - in - Medicine PDFglitterglyptodonNo ratings yet

- L.chandra Vs Union of IndiaDocument15 pagesL.chandra Vs Union of IndiaKashish GaurNo ratings yet

- Bandarban at A GlanceDocument29 pagesBandarban at A GlanceShahriazAlamNo ratings yet

- Eating Disorder PPT by Shreyasi MittalDocument35 pagesEating Disorder PPT by Shreyasi MittalPrachi gattaniNo ratings yet

- Electrospinning - A Fascinating Method For The Preparation of Ultrathin Fibers - GreinerDocument34 pagesElectrospinning - A Fascinating Method For The Preparation of Ultrathin Fibers - GreinerViviane QueirozNo ratings yet

- Case Study RubricDocument2 pagesCase Study RubricShainaNo ratings yet

- Files-2-Lectures CH 05 Problem Definition and The Research ProposalDocument18 pagesFiles-2-Lectures CH 05 Problem Definition and The Research ProposalAl Hafiz Ibn HamzahNo ratings yet

- Day 1 NotesDocument4 pagesDay 1 NotesPawan KumarNo ratings yet

- CRIM. CASE NO. 20001-18-C FOR: Violation of Section 5 of R.A. 9165Document5 pagesCRIM. CASE NO. 20001-18-C FOR: Violation of Section 5 of R.A. 9165RojbNo ratings yet

- SNAKE PLANT (Sansevieria Trifasciata) FIBER AS A POTENTIAL SOURCE OF PAPERDocument38 pagesSNAKE PLANT (Sansevieria Trifasciata) FIBER AS A POTENTIAL SOURCE OF PAPERandrei100% (1)

- Virology The Study of VirusesDocument45 pagesVirology The Study of Virusesdawoodabdullah56100% (2)

- (123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Document14 pages(123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Đình HảiNo ratings yet

- AN5993 Polution Degree and ClassDocument7 pagesAN5993 Polution Degree and Classmaniking11111No ratings yet

- WLC UpgradeDocument13 pagesWLC Upgradeapi-3703368No ratings yet

- 3.1.3.2 Batu Saluran KemihDocument64 pages3.1.3.2 Batu Saluran Kemihwinda musliraNo ratings yet

- Content and Contextual Analysis of The Parisian LifeDocument7 pagesContent and Contextual Analysis of The Parisian LifeSowla sidoNo ratings yet

- Sarah GarzaDocument1 pageSarah Garzasarah_garza67424No ratings yet

- The Passion of Jesus Christ: BY Saint Alphonsus de LiguoriDocument67 pagesThe Passion of Jesus Christ: BY Saint Alphonsus de Liguorisatya0988No ratings yet

- C1 - U5 - Grammar - Revision (1) - CONDITIONALSDocument2 pagesC1 - U5 - Grammar - Revision (1) - CONDITIONALSAdriana Merlos CasadoNo ratings yet

- Practice Test Cao Hoc 2012Document9 pagesPractice Test Cao Hoc 2012SeaBlueNo ratings yet

- Chemistry in Pictures - Turn Your Pennies Into "Gold" Rosemarie Pittenger,.Document3 pagesChemistry in Pictures - Turn Your Pennies Into "Gold" Rosemarie Pittenger,.Igor LukacevicNo ratings yet

- English4am Revision DechichaDocument6 pagesEnglish4am Revision Dechichaligue d'Alger de basket ballNo ratings yet

- Cookery 4th Week - Sept 18-21, 2023Document3 pagesCookery 4th Week - Sept 18-21, 2023Venus NgujoNo ratings yet

- (Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdDocument5 pages(Lesson2) Cultural, Social, and Political Institutions: Kinship, Marriage, and The HouseholdPlat JusticeNo ratings yet

- First Trimester TranslateDocument51 pagesFirst Trimester TranslateMuhammad Zakki Al FajriNo ratings yet

- JAM2015 MA SyllabusDocument1 pageJAM2015 MA Syllabusrcpuram01No ratings yet

- IntrotovedicmathDocument3 pagesIntrotovedicmathmathandmultimediaNo ratings yet