Professional Documents

Culture Documents

Application Form For BCs

Application Form For BCs

Uploaded by

Abhijit SingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form For BCs

Application Form For BCs

Uploaded by

Abhijit SingCopyright:

Available Formats

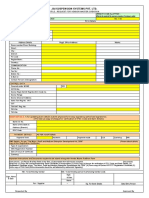

India Post Payments Bank Limited AFFIX RECENT PASSPORT

SIZE PHOTOGRAPH OF THE

APPLICANT

BUSINESS CORRESPONDENT APPLICATION FORM Please

across,

sign

sign

Corp. Office: 2nd Floor, Bhai Veer Singh Marg, Gole Market, New Delhi – 110001 should overlap on

Tel: +91-11-23362148 Website: www.ippbonline.com l Email: contact@ippbonline.in photo & APEF

Please fill the form in English with black ink and use BLOCK New Existing

LETTERS

* Mandatory to be filled

1. BUSINESS CORRESPONDENT DETAILS

* Name

*Contact Number

*Address Line 1

*City/District Line 2

*State

*Pin Code

*Alternate No.

*PAN (Please fill Form 60 if you do not have PAN)

Email ID

*Latitude *Longitude

*Father’s

Name First Name Middle Name Last Name

*Mother’s Maiden Name

*Date of Birth: (DD-MM-YYYY) *Gender Male Female Transgender

*Nationality

*Proof of ID (POI) Passport Driving Election Commission Income Tax Aadhaar Job card issued by NREGA duly signed by

License Voter ID Card Pan Card Identity Card an officer of the state government

*Proof of Address (POA) Passport Driving Election Commission Aadhaar Job card issued by NREGA duly signed

License Voter ID Card Identity Card by an officer of the state government

2. BANK DETAILS

*Branch Name *IFSC

*Account Name (As per bank record)

*Account Type Saving a/c Current a/c

*Account Number

3. BUSINESS CORRESPONDENT DECLARATION*

I have read and understood the terms & conditions provided in agreement and unconditionally accept them as binding on me. I hereby declare that the particulars given

herein are true, correct and complete in all respects and the documents submitted along with this ‘Business Correspondent Enr ollment form’ are genuine. I hereby

undertake to inform India Post Payments Bank Limited of any change in the information provided herein above.

Date :

Place :

Business Correspondent signature and stamp

FORM NO. 60 [See second proviso to rule 114B]

Form for declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account number and who enters into any transaction specified in rule 114B

Name D.O.B

Father’s Name

Address

Pin Code Telephone Number with STD Code Mobile Number

Amount of Transaction (First Cash in amt) Date of Transaction

In case of transaction in joint names member number of person involved in the transaction

Mode of Transaction: Cash Cheque Card Draft/ Bankers’ Cheque Online transfer other

Aadhar Number issue by UIIDAI (If available)

If applied for Pan and it is not yet generated enter date of application & Acknowledgement No

If pan not applied fill the estimate total income (Including spouse, Minor, Child etc. as per the section 64 of income tax act 1961for the financial year which the above transaction held

(a) Agriculture income (Rs.) (b)Other than Agriculture income (Rs.)

Detail of the document being produced support of identity Proof

(Doccode) (Doc identification number) (Doc issued authority Name & Address)

Detail of the document being produced support of address Proof

(Doccode) (Doc identification number) (Doc issued authority Name & Address)

Verification: I, do hereby declare that what is stated above is true to the best of my knowledge and belief. I further declare that I do not have a Permanent

Account Number and my/ our estimated total income (including income of spouse, minor child etc. as per section 64 of Income-tax Act, 1961) computed in accordance with the provisions of Income-tax Act,

1961 for the financial year in which the above transaction is held will be less than maximum amount not chargeable to tax.

Verified today, the DD day of MM 20 YY Place:

(Signature of declarant)

Note: For List of Documents, Please see overleaf.

List of Documents

Individual Identity d. Certificate/ registration document issued by sales tax/ services tax/

professional tax authorities

e. License issued by the registering authority like Certificate of Practice issued

i. Proof of identity (Any of the below)

by institute of Chartered Accountants of India, Institute of Cost Accountants

a. Passport,

of India, Institute of Company Secretaries of India, Indian Medical Council,

b. Driving license, food and Drug Control Authorities, importer / exporter, registration /

c. Voter Id Card, licensing document issued in the name of the proprietary concern by the

d. Pan card, Central Government or state Government /Authority / Department.

e. Aadhaar identity card, f. The complete Income Tax Return (Not Just the acknowledgement) in

f. Job card issued by NREGA duly signed by an officer of the the name of the sole proprietor where the firm’s income is reflected duly

state government authenticated /acknowledged by the Income Tax Authorities.

g. Utility bills such as electricity, water and landline telephone bill in the name

ii. Proof of address (Any one of the below) of proprietary (Not more than 2 months old).

a. Certificate/License issued by the Municipal authorities under the shops & h. Certificate under Shop & Establishment Act.

establishment act

b. Sales and income tax return

c. CST/VAT certificate

You might also like

- MACK Truck Electrical Wiring and Connections Manual CHU, CXU, GU, TD, MRU, LR SeriesDocument94 pagesMACK Truck Electrical Wiring and Connections Manual CHU, CXU, GU, TD, MRU, LR SeriesAlex Renne Chambi100% (9)

- Chat GPTDocument13 pagesChat GPTsuly maniyahNo ratings yet

- RBL App Form 18 01 2019 PDFDocument1 pageRBL App Form 18 01 2019 PDFAnmolNo ratings yet

- RBL App Form 18 01 2019Document1 pageRBL App Form 18 01 2019Yasar AliNo ratings yet

- AP Individual Proprietor MSOSWALDocument21 pagesAP Individual Proprietor MSOSWALAshish AgarwalNo ratings yet

- AP Individual Proprietor SHIVDocument21 pagesAP Individual Proprietor SHIVAshish AgarwalNo ratings yet

- 664899da0b80be2296d85f65 All SignDocument26 pages664899da0b80be2296d85f65 All SignrajindermechNo ratings yet

- Vendor - Form CopDocument1 pageVendor - Form CopMaaz KhanNo ratings yet

- 6599921eabd5914c3b626b01 All SignDocument42 pages6599921eabd5914c3b626b01 All SignSarthak MishraNo ratings yet

- Sbi Corporate Credit CardDocument9 pagesSbi Corporate Credit CardArvindNo ratings yet

- Ams - e Upstox SignedDocument6 pagesAms - e Upstox Signedavantikaa.baidNo ratings yet

- CarProposal QVPN107614961Document6 pagesCarProposal QVPN107614961sajithmon785No ratings yet

- ETRADE Bank ApplicationDocument7 pagesETRADE Bank ApplicationSeasoned_SolNo ratings yet

- Individual Sole ProprietorDocument9 pagesIndividual Sole ProprietorAiyyamperumalNo ratings yet

- forex-card-change-request-formDocument1 pageforex-card-change-request-formakrshivamNo ratings yet

- 65a682ab85147e055a4cdc78 All UPSTOX SIGNEDDocument41 pages65a682ab85147e055a4cdc78 All UPSTOX SIGNEDprajapatomprakash533No ratings yet

- CVL and Ind Stocks Indmoney EsignDocument34 pagesCVL and Ind Stocks Indmoney EsignmowseensadiqNo ratings yet

- Ific Rtgs FormDocument1 pageIfic Rtgs FormBissmillah auto Rice mill100% (1)

- KYC and Account Opening Form: Stamp of Agent/CSP For Official Purpose Customer DeclarationDocument1 pageKYC and Account Opening Form: Stamp of Agent/CSP For Official Purpose Customer DeclarationMirang ShahNo ratings yet

- 639246f6355ce33026e2ba42 All SignDocument39 pages639246f6355ce33026e2ba42 All SignShaikh Muhammad Zuber SaifiNo ratings yet

- Change in Client Information: (For Individual Clients)Document2 pagesChange in Client Information: (For Individual Clients)shwetawattal90No ratings yet

- Form GST REG-07: Government of India / State Government Department ofDocument4 pagesForm GST REG-07: Government of India / State Government Department ofthecoltNo ratings yet

- D D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration FormDocument7 pagesD D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration Formdharam singhNo ratings yet

- 661048e44e0f2116c41f9b54 All UPSTOX SIGNEDDocument24 pages661048e44e0f2116c41f9b54 All UPSTOX SIGNEDNikhil TutejaNo ratings yet

- PSB OnlineDocument3 pagesPSB Onlinesubhi deNo ratings yet

- Account Opening Application Form Non-Resident Individuals: (Non Face To Face)Document10 pagesAccount Opening Application Form Non-Resident Individuals: (Non Face To Face)RISHIKESH KUMARNo ratings yet

- 60d836af99ddde402e4e0fad_all_SignDocument27 pages60d836af99ddde402e4e0fad_all_Signdevanshtripathi485No ratings yet

- Account Opening FormDocument39 pagesAccount Opening FormArif ShaikhNo ratings yet

- Client Masters Form (Download)Document2 pagesClient Masters Form (Download)rmalhotraNo ratings yet

- Form Change of Address July 2015 YesbDocument2 pagesForm Change of Address July 2015 YesbHmavaiyaNo ratings yet

- Under The PPF Scheme 1968Document2 pagesUnder The PPF Scheme 1968Shalin JoshiNo ratings yet

- Contact Person For EnquiriesDocument23 pagesContact Person For EnquiriesNuRul HuDaNo ratings yet

- AP Individual Proprietor SHIV K CHANDAKDocument17 pagesAP Individual Proprietor SHIV K CHANDAKAshish AgarwalNo ratings yet

- 6359ffff372adf5a4b95c8e3 Ao PreviewDocument42 pages6359ffff372adf5a4b95c8e3 Ao PreviewPriyansh SinghNo ratings yet

- SRF CRP Huawei Nova 5T-PRP PDFDocument5 pagesSRF CRP Huawei Nova 5T-PRP PDFMin FoziNo ratings yet

- Merchant Processing Agreement - Merchant ApplicationDocument3 pagesMerchant Processing Agreement - Merchant ApplicationtonerangerNo ratings yet

- Reactivation+KYC 230328 184201Document4 pagesReactivation+KYC 230328 184201Vivek NesaNo ratings yet

- Application Form: Provide The Details As Per Pan (Block Letters)Document1 pageApplication Form: Provide The Details As Per Pan (Block Letters)ASHUTOSH BALNo ratings yet

- 65cded59733c265636436cdf All SignDocument37 pages65cded59733c265636436cdf All SignAkshayNo ratings yet

- Vendor Registration Form-RbsDocument1 pageVendor Registration Form-Rbstabish khanNo ratings yet

- Resident Individual Account Opening Form For Trading and Demat AccountDocument16 pagesResident Individual Account Opening Form For Trading and Demat AccountCHITA RANJAN GHADAINo ratings yet

- 6391640d355ce33026e2ac0a Ao PreviewDocument25 pages6391640d355ce33026e2ac0a Ao PreviewbalrajnaikgmhalliNo ratings yet

- 63c84971b766257eb6fda14f All SignDocument39 pages63c84971b766257eb6fda14f All SignMd Ulfath AliNo ratings yet

- Nri Customer Updation Form For KycDocument1 pageNri Customer Updation Form For KycBubulNo ratings yet

- 64100aa0c8337446d22cd95d All SignDocument42 pages64100aa0c8337446d22cd95d All SignANKIT KUMAR SINGHNo ratings yet

- 6612782be60ec11e13a5bc00 All SignDocument37 pages6612782be60ec11e13a5bc00 All SignHARISH KUMARNo ratings yet

- 1 USA Product Order Form & DISTRIBUTOR APPLICATIONDocument1 page1 USA Product Order Form & DISTRIBUTOR APPLICATIONmetwar ankitNo ratings yet

- Online Application: Version 1.36 E Promo Team/BR Code Lg/Dse LC2 Code Token No Source LD NoDocument4 pagesOnline Application: Version 1.36 E Promo Team/BR Code Lg/Dse LC2 Code Token No Source LD NoKrishna Kiran VyasNo ratings yet

- Business Partner Empanelment Form - 05102020Document6 pagesBusiness Partner Empanelment Form - 05102020Gaurav SonawaneNo ratings yet

- Investment Purchase ApplicationDocument2 pagesInvestment Purchase ApplicationMelchor BercasioNo ratings yet

- AooofDocument3 pagesAooofDartk DNo ratings yet

- Customer Credit Application 02 18 19 PDFDocument2 pagesCustomer Credit Application 02 18 19 PDFeduargaona97No ratings yet

- Account Opening FormDocument14 pagesAccount Opening FormAbdirahman mohamed100% (1)

- 653fc5fa6aaaaf24a0487644 All SignDocument42 pages653fc5fa6aaaaf24a0487644 All Signankkumar0355No ratings yet

- Commercial Card Applica On Form For CorporateDocument2 pagesCommercial Card Applica On Form For CorporateSubash K ENo ratings yet

- 661e0fd314111732ae256fa6 All SignDocument25 pages661e0fd314111732ae256fa6 All Signvrayak55No ratings yet

- Property Associate Partner Program (PAPP) Registration Form: 1 X 1 Photo IDDocument1 pageProperty Associate Partner Program (PAPP) Registration Form: 1 X 1 Photo IDJin KangNo ratings yet

- NSRPDFDocument1 pageNSRPDFroshanNo ratings yet

- ProgrammingDocument1 pageProgrammingsamreenimran1702No ratings yet

- DHL Strategy ModelDocument59 pagesDHL Strategy Modelfssankar100% (12)

- Licom AlphaCamDocument27 pagesLicom AlphaCamdrx11100% (1)

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- Sinumerik - 828D - Machine Commissioning - 2009 PDFDocument476 pagesSinumerik - 828D - Machine Commissioning - 2009 PDFpavlestepanic9932No ratings yet

- ToyotaDocument4 pagesToyotasunny837No ratings yet

- MPBPL00213180000011849 NewDocument4 pagesMPBPL00213180000011849 NewWorld WebNo ratings yet

- Collect and Analyze Troubleshooting DataDocument26 pagesCollect and Analyze Troubleshooting DataNixon MuluhNo ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet

- Turbine Blade Shop-Block 3 BhelDocument40 pagesTurbine Blade Shop-Block 3 Bheldeepak GuptaNo ratings yet

- Design and BuildDocument16 pagesDesign and BuildBernard DavidNo ratings yet

- Accounting ResearchDocument6 pagesAccounting ResearchAnne PanghulanNo ratings yet

- Company Profile - V2Document4 pagesCompany Profile - V2bhuvaneshelango2209No ratings yet

- Digitales: ArchivDocument9 pagesDigitales: ArchivbanbanNo ratings yet

- Justification For Base Resistance FormulaDocument110 pagesJustification For Base Resistance FormulaKS ChongNo ratings yet

- Satellite Communications Chapter 3:satellite Link DesignDocument38 pagesSatellite Communications Chapter 3:satellite Link Designfadzlihashim87100% (5)

- MatchmakerDocument43 pagesMatchmakerMatthew MckayNo ratings yet

- Mazlan's Lecture MNE - Fire Fighting SystemDocument34 pagesMazlan's Lecture MNE - Fire Fighting SystemTuan JalaiNo ratings yet

- Code of Practice For Power System ProtectionDocument3 pagesCode of Practice For Power System ProtectionVinit JhingronNo ratings yet

- Franchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Document2 pagesFranchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Nha Nguyen HoangNo ratings yet

- Chapter 13 - Basic DerivativesDocument59 pagesChapter 13 - Basic Derivativesjelyn bermudezNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- Draft Resolution No. 58-2020 - Authorizing Mayor To Sign Deed of Donation With PCSO For Patient Transport VehicleDocument2 pagesDraft Resolution No. 58-2020 - Authorizing Mayor To Sign Deed of Donation With PCSO For Patient Transport VehicleRica Carmel Lanzaderas100% (3)

- Ruwanpura Expressway Design ProjectDocument5 pagesRuwanpura Expressway Design ProjectMuhammadh MANo ratings yet

- Südmo: Leakage Butterfly Valves Hygienic Shut-Off ValvesDocument2 pagesSüdmo: Leakage Butterfly Valves Hygienic Shut-Off ValvesBob DylanNo ratings yet

- CV (2) - 2Document3 pagesCV (2) - 2abhishek.berkmanNo ratings yet

- Gender Informality and PovertyDocument15 pagesGender Informality and Povertygauravparmar1No ratings yet

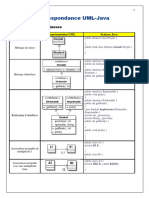

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Adaptive Multi RateDocument16 pagesAdaptive Multi RateRogelio HernandezNo ratings yet