Professional Documents

Culture Documents

Prof Abdurrahim-Paper Shariah Audit & Integrity

Prof Abdurrahim-Paper Shariah Audit & Integrity

Uploaded by

Dila Fadiya FarrasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prof Abdurrahim-Paper Shariah Audit & Integrity

Prof Abdurrahim-Paper Shariah Audit & Integrity

Uploaded by

Dila Fadiya FarrasCopyright:

Available Formats

ENHANCING THE INTEGRITY OF

ISLAMIC FINANCIAL INSTITUTIONS

IN MALAYSIA:

THE CASE FOR THE SHARÔÑAH AUDIT

FRAMEWORK

Abdul Rahim Abdul Rahman*

I. INTRODUCTION

Enhancing integrity is of prime importance for any business and it is

especially more pressing in the case of Islamic Financial Institutions

(IFIs). IFIs claim to practice ethical finance and thus must be in

compliance with the SharÊÑah in all their business activities and

operations. Their stability, financial performance and ability to provide

intermediate resources will depend on stakeholders’ confidence

in the integrity of the IFIs. A particular feature of confidence and

integrity in respect of Islamic financial services is the requirement of

conveying to stakeholders that their financial business is conducted

in conformity with their religious beliefs (Grais and Pallegrini, 2006).

Since the SharÊÑahis the cornerstone of Islamic financial products

and services, if the stakeholders are aware that the products that they

have in their portfolio are not SharÊÑah-compliant, this would seriously

undermine the integrity of and confidence in the Islamic financial

services industry as a whole (Bhambra, 2007). Some regulators have

sought to find a solution through the implementation of adequate

systems and controls that ensure compliance with the SharÊÑah. Such

SharÊÑah systems and controls should ensure that the rulings of the

SharÊÑah Committee are disseminated and implemented throughout

* Abdul Rahim Abdul Rahman is a Professor at the Kulliyyah of Economics and

Management Sciences, International Islamic University Malaysia (IIUM) and

Research Fellow at the International Shari’ah Research Academy on Islamic Finance

(ISRA). He can be contacted at abdulrahim@iium.edu.my

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 135

ISRA VOL3 IS 1.indd z135 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

the financial institutions. The SharÊÑah systems and controls need

to be supplemented with SharÊÑah audit requirements. These audit

requirements will provide mechanisms for a regulator to monitor,

control and take action against the financial institutions if they do not

meet the SharÊÑah requirements.

In broad terms, SharÊÑah audit is a process of accumulating

and evaluating evidence to determine and report on the degree of

correspondence between information and established criteria for

SharÊÑah compliance purposes (Abdul Rahman, 2008). Auditing is an

assurance process conducted by a competent and independent person.

To conduct an audit, there should be information in a verifiable form

and some standards (criteria) by which the auditor can evaluate the

information. Information can and does take many forms. SharÊÑah

auditors may perform audits on both objective (financial information,

e.g. profit distribution) and subjective information (SharÊÑah

information) to ensure SharÊÑah compliance of IFIs.

The objective of the paper is to provide an overview of a research

and development initiative initiated by the International SharÊÑah

Research Academy in Islamic Finance (ISRA) and Bank Negara

Malaysia (BNM) to produce the SharÊÑah Audit Framework. The

Framework aims to provide a guide for IFIs in Malaysia to conduct

SharÊÑah audit. The paper firstly explains the SharÊÑah Governance

Framework recently issued by BNM, which the SharÊÑah Audit

Framework will aim to complement. Secondly, the paper provides

a discussion on the need for the SharÊÑah Audit Framework. Thirdly,

the paper presents some of the institutional arrangements and

requirements that need to be considered to ensure that the IFIs will be

able to effectively undertake a SharÊÑah audit function.

II. THE SHARÔÑAH GOVERNANCE FRAMEWORK:

AN OVERVIEW

Bank Negara Malaysia (BNM) recently issued the SharÊÑah

Governance Framework that is effective from January 2011. The

SharÊÑah Governance Framework (hereinafter to be referred to as

the Framework) is a set of organisational arrangements through

136 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z136 6/3/11 5:44 PM

Abdul Rahim Abdul Rahman

which Islamic financial institutions (IFIs) ensure effective oversight,

responsibility and accountability of the board of directors, management

and SharÊÑah Committee. The Framework serves as a guide towards

ensuring an operating environment that is compliant with SharÊÑah

principles at all times. SharÊÑah principles provide the foundation for

the practice of Islamic finance through the observance of the tenets,

conditions and principles propagated by Islam. Comprehensive

compliance with SharÊÑah principles would bring confidence to the

general public and the financial markets in the credibility of Islamic

finance operations.

The Framework aims essentially to strengthen the SharÊÑah

governance process, decision making, accountability and

independence. The Framework reinforces the SharÊÑah compliance

functions, internal SharÊÑah review and audit requirements, and is

supported by an appropriate risk management process and research

capability. It is envisaged that the implementation of the Framework

will contribute towards more robust and sound SharÊÑah governance

within Islamic financial institutions which, in turn, will promote

SharÊÑah compliance throughout the organisation.

The Framework is divided into six sections as follows:

i. General requirements of the SharÊÑah governance framework

ii. Oversight, accountability and responsibility

iii. Independence

iv. Competency

v. Confidentiality and consistency

vi. SharÊÑah compliance and research functions.

The general requirements describe the essential key functional

areas or key organs of the Framework. The guidelines on oversight,

accountability and responsibility outline the levels of accountability

and responsibility of the directors, SharÊÑah Committee and

management of IFIs. The guidelines on independence are aimed at

safeguarding the independence of the SharÊÑah Committee in ensuring

sound SharÊÑah decisions, and emphasise the role of the board of

directors in recognising the independence of the SharÊÑah Committee.

The competency guidelines highlight the requirements and

expected competencies to ensure key functions are capable of

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 137

ISRA VOL3 IS 1.indd z137 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

implementing SharÊÑah governance. The confidentiality and

consistency guidelines provide a minimum set of rules that emphasise

the importance of observing and preserving confidentiality and

improving consistency by the SharÊÑah Committee. Finally, the

guidelines on SharÊÑah compliance prescribe the functions of the

internal SharÊÑah review, SharÊÑah audit, SharÊÑah risk management

process and the SharÊÑah research functions.

Islamic financial institutions are also expected to establish three

functions that provide a system of checks and balances within the

organisation, which include the following:

i. The SharÊÑah risk management control function that is able to

identify all possible risks of SharÊÑah non-compliance and, where

appropriate, remedial measures to manage this risk;

ii. The SharÊÑah review function that continuously assesses SharÊÑah

compliance of all activities and operations. Where instances of

non-compliances are identified, the institution is expected to

take prompt rectification measures and put in place the necessary

mechanisms to avoid such recurrences; and,

iii. The SharÊÑah audit function that performs annual audits to provide

an independent assessment of the adequacy and compliance of

the Islamic financial institution with established policies and

procedures, and the adequacy of the SharÊÑah governance process.

The Framework clearly delineates the SharÊÑah review function and

the SharÊÑah audit function. While the SharÊÑah review function is

the responsibility of the organs of the IFIs, namely the board, the

management and the SharÊÑah Committee, the SharÊÑah audit function

should be undertaken by an independent internal audit unit, or

externally by a qualified and competent third party. The word “audit”

entails an independent assurance process, while the review function

is performed by the management themselves. Hence, there is a clear

need for the SharÊÑah audit function, and more importantly, the

Islamic finance industry needs proper and comprehensive guidelines

to enable IFIs to undertake SharÊÑah audit.

138 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z138 6/3/11 5:44 PM

Abdul Rahim Abdul Rahman

III. DEVELOPING THE SHARÔÑAH AUDIT FRAMEWORK

In essence, there is a need for SharÊÑah audit to ensure that all

activities and operations carried out by the IFIs do not contravene

the SharÊÑah. The first scope of SharÊÑah audit is the audit of the

financial operations of the IFIs. The audit of the financial transactions

is needed to ensure that the transactions are recognised, measured and

reported accurately and reflect the rights and obligations arising from

the various SharÊÑah contracts. The adherence to best practices should

consider both the existing accounting standards, the existing BNM

rules and regulations, the SharÊÑah parameters, the resolutions of the

SharÊÑah Advisory Council (SAC), and the relevant international

standards, such as those provided by AAOIFI.

Secondly, SharÊÑah audit should undertake a systematic

examination of policies and procedures of the IFIs, such as product

manuals, operational processes, contracts, etc. Thirdly, SharÊÑah audit

needs to examine the organisational structure of the IFIs to ensure

their feasibility to undertake SharÊÑah-compliant activities. This will

include the availability of qualified staff with a sufficient knowledge

of SharÊÑah to support the operations of the IFIs.

For SharÊÑah audit to be effectively undertaken there is a need

for SharÊÑah auditors that understand the business of the IFIs,

including the nature of contracts used for different types of Islamic

financial services. An audit program will then need to be identified

and developed for the key auditing processes to be undertaken, the

objective of each activity and the techniques to be used (including

sampling techniques) in order to achieve each audit objective.

The Islamic financial industry does not currently fully and

systematically undertake SharÊÑah audit. Even though the products

and services are approved by BNM and the SharÊÑah Committee, no

systematic auditing has been comprehensively undertaken to ensure

proper SharÊÑah compliance. In the absence of proper guidelines to

undertake SharÊÑah audit, many IFIs have difficulties in properly

planning, executing and reporting SharÊÑah audit.

ISRA has recently initiated a study that aims to come up with

a policy guidance paper – the SharÊÑah Audit Framework – to be

considered by the Islamic finance industry and BNM. This policy

guidance paper will serve as the guidelines for the proper undertaking

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 139

ISRA VOL3 IS 1.indd z139 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

of SharÊÑah audit. These guidelines are expected to assist the IFIs by

facilitating the proper undertaking of SharÊÑah audit in their respective

institutions.

This study aims to achieve the following three objectives:

i. To review the current SharÊÑah supervisory and auditing practices

among the IFIs in Malaysia.

ii. To evaluate the present SharÊÑah Governance Framework of the

IFIs in Malaysia.

iii. To propose the SharÊÑah Audit Framework that will lay out policy

recommendations and guidelines in order for the IFIs to properly

conduct SharÊÑah audit.

The study adopts a number of approaches and techniques to achieve

the above objectives. In the first stage, the research will draft the

SharÊÑah Audit Framework based on inputs gathered in the focus

group (research cluster) meetings. The members of the focus group

comprise selected SharÊÑah scholars, academic experts, and industry

experts. Literature review is also conducted in parallel with the focus

group meetings to provide theoretical support for the research.

In the second stage, the draft of the SharÊÑah Audit Framework

is presented and discussed with the IFIs and the stakeholders. The

industry feedback is crucial to ensure the relevance of the draft and

effective implementation later. In the final stage, the final SharÊÑah

Audit Framework will be re-drafted and further consolidated before

submission to and consideration by the BNM.

IV. SHARÔÑAH AUDIT FRAMEWORK: INSTITUTIONAL

ARRANGEMENTS AND REQUIREMENTS

In the course of developing the SharÊÑah Audit Framework, the study

focuses its work on the internal SharÊÑah audit function. While the

external SharÊÑah audit is crucial, based on the initial feedback of the

industry players and BNM, the study found that the more immediate

need is to have an effective internal SharÊÑah audit function in place.

The internal SharÊÑah audit is concerned with sound and effective

140 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z140 6/3/11 5:44 PM

internal control systems for SharÊÑah compliance through continuous

periodical assessment. The SharÊÑah audit function is designed to

add value and improve IFI compliance by providing an independent

assessment and objective assurance. The paper will present necessary

institutional arrangements and requirements that will facilitate the

internal SharÊÑah audit function.

A. Objectives and Scope of SharÊÑah Audit

The primary objective of the internal SharÊÑah audit should be to

ensure that the management is discharging its responsibilities of

SharÊÑah compliance in all activities and operations of the IFI. In

addition, the purpose of internal SharÊÑah audit should also be to

ensure that the system of internal control for SharÊÑah compliance is

conceptually sound and effective in its implementation.

For the implementation of internal SharÊÑah audit, the IFI shall

need an internal SharÊÑah audit unit that is independent from the

management. The unit is accountable directly to the Board through

the Board Audit Committee. The head of the internal SharÊÑah audit

unit shall be appointed by the Board.

Prior to the implementation of a separate unit of the internal

SharÊÑah audit unit, the IFIs should consider their scale of operations,

capacity in terms of manpower or human resources and also the costs

associated in its implementation. Members of the internal SharÊÑah

audit unit should build and develop trust with other units in the

IFI in order to effectively and efficiently execute their tasks. They

should appear as business partners rather than auditors or corporate

watchdogs.

The Board should ensure that the internal SharÊÑah audit unit is

adequately resourced in terms of qualified and competent staff and

adequate funds to ensure the effective performance of its functions.

The internal SharÊÑah audit unit should have a SharÊÑah audit charter

that establishes the audit’s position within the organisation and

addresses the following issues:

i. The nature of internal SharÊÑah auditing;

ii. The SharÊÑah audit objectives;

iii. The scope of SharÊÑah audit work;

iv. SharÊÑah audit’s responsibilities;

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 141

ISRA VOL3 IS 1.indd z141 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

v. SharÊÑah audit’s authority;

vi. SharÊÑah audit’s independence.

The SharÊÑah audit charter should clearly specify the planning,

implementation and reporting of internal SharÊÑah audit. The internal

SharÊÑah audit unit should plan the SharÊÑah audit activities for the

year, which must be communicated to the SharÊÑah Committee and

their feedback should be considered. Once the SharÊÑah audit function

is performed by the auditors, it should then be reported directly to the

Board Audit Committee and the SharÊÑah Committee for deliberation.

The final report should then be tabled before the Board for their

attention and remedial action.

The internal SharÊÑah audit function should specify that the internal

SharÊÑah auditors must have direct and regular communications with

all levels of management and the SharÊÑah Committee. There should

not be any scope of limitation and restriction of access to documents,

reports, personnel, etc. placed on the internal SharÊÑah auditors. This

is to ensure the efficiency and effectiveness of the internal SharÊÑah

audit function.

The scope of the SharÊÑah audit function shall cover all aspects of

the IFI’s business activities and operations, including:

i. SharÊÑah matters affecting the financial statements of the IFI

(e.g. profit distribution policy; penalty charge; basis of income

recognition; zakat computation, etc.)

ii. Compliance audit on organisational structure, human resource

and information technology application systems;

iii. SharÊÑah compliance of the products, services and marketing;

iv. Effectiveness of SharÊÑah internal control system;

v. SharÊÑah non-compliance risks management function;

vi. Special or ad-hoc SharÊÑah audit assignments as directed by the

Board or the SharÊÑah Committee; and

vii. Adequacy of SharÊÑah governance processes.

The function of the internal SharÊÑah audit unit shall include, but is

not limited to:

i. understanding the business activities to allow better audit

implementation, i.e. auditability and relevance of activities;

142 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z142 6/3/11 5:44 PM

Abdul Rahim Abdul Rahman

ii. developing a comprehensive internal SharÊÑah audit program

that shall include objectives, scope, procedures, personnel

assignment, sampling, control and duration;

iii. obtaining and making reference to relevant established SharÊÑah

criteria, including published SharÊÑah Committee rulings, BNM

guidelines and BNM SharÊÑah parameters and possibly the OIC

Fiqh Academy Rulings and AAOIFI SharÊÑah standards;

iv. conducting SharÊÑah audit on a periodical basis;

v. communicating results and findings to the Board Audit

Committee.

vi. providing regular formal internal SharÊÑah audit reports to the

Board Audit Committee as well as the SharÊÑah Committee; and

vii. providing recommendations as well as following up on

rectification measures taken by IFIs.

The report of internal SharÊÑah audit shall also contain the

observations and the assessment of systems, SharÊÑah non-compliance

risks and controls. The internal SharÊÑah audit report shall provide

recommendations for potential improvements and corrective actions

to be taken. If there are any disputes/differences of opinion between

the management and the internal SharÊÑah auditors on matters relating

to SharÊÑah, the interpretation and final decision shall be referred to

the SharÊÑah Committee of the IFI.

B. Independence and Reporting

To ensure independence, the internal SharÊÑah audit reports should

be presented, reviewed and endorsed by the Board Audit Committee.

In addition, the reports should also be escalated to the SharÊÑah

Committee of the IFI. The internal SharÊÑah auditors should have

an independent mental attitude. The competency of the individual

performing the audit is of little value if he or she is biased in the

accumulation and evaluation of evidence. Although absolute

independence is impossible, internal SharÊÑah auditors must strive

to maintain a high level of independence to retain the confidence of

users relying on their reports. Internal SharÊÑah auditors are required

to report directly to the Board Audit Committee.

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 143

ISRA VOL3 IS 1.indd z143 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

Internal SharÊÑah audit should be part of the regular internal audit

function. The internal SharÊÑah audit unit is a dedicated unit to conduct

SharÊÑah audit in the IFI. Proper implementation of the internal

SharÊÑah audit unit requires its members to always ask themselves

whether or not they will be able to provide assurance on what has

been audited.

The Board Audit Committee, upon consultation with the SharÊÑah

Committee, shall determine the deliverables of the internal SharÊÑah

audit. The Board Audit Committee is expected to review and endorse

the SharÊÑah audit plan. The reports of the SharÊÑah audit findings

should be submitted for the consideration and deliberation of the

Board Audit Committee.

Since the members of the Board Audit Committee may have

inadequate SharÊÑah knowledge to effectively execute their supervisory

function, it may be necessary that the representative of the SharÊÑah

Committee be invited to attend selected meetings according to needs.

In addition to the reports provided to the Board Audit Committee,

the internal SharÊÑah audit function should also provide reports of

their audit to the SharÊÑah Committee of the IFI for their attention,

deliberation and further action.

It is imperative that the internal SharÊÑah audit activity should

be free from interference in determining the scope of auditing,

performing work, accessing evidence and communicating results.

Internal SharÊÑah auditors should have an impartial, unbiased attitude

and avoid conflict of interest. If independence or objectivity is

impaired in fact or appearance, the details of the impairment should

be disclosed to the Board Audit Committee. The nature of disclosure

will depend upon the nature of the impairment.

C. Audit Criteria and Standards

The internal SharÊÑah auditing process should be undertaken with

reference to the established SharÊÑah criteria, which include but are

not limited to:

i. the written opinions of the SAC BNM;

ii. the SharÊÑah parameters established by the BNM;

iii. other relevant and applicable pronouncements issued by the

BNM;

144 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z144 6/3/11 5:44 PM

Abdul Rahim Abdul Rahman

iv. the written opinions of the SC of the IFIs;

v. the SharÊÑah standards and/or Fatwas issued by the OIC Fiqh

Academy, AAOIFI, IFSB and other established authorities; and

vi. the product manuals and the standard operating procedures of

the IFIs.

Audit evidence is the necessary information used by the auditor to

determine whether the information being audited is in accordance

with the established criteria. For the SharÊÑah auditing process,

evidence may take many forms, including:

i. product manuals, contracts, minutes and agreements;

ii. accounting transactions, books and documents;

iii. oral testimony of the auditee;

iv. written communication with outsiders;

v. observations by the auditor; and

vi. electronic data about transactions.

To satisfy the purpose of the audit, the auditors require reliable and

sufficient quality and quantity of evidence. Auditors must determine

the types and amount of evidence necessary and evaluate whether the

information corresponds to the established criteria. SharÊÑah auditors

need to determine the appropriate types and amount of evidence to

accumulate and to evaluate their sufficiency and reliability to be

satisfied with the existence of effective internal controls over SharÊÑah

matters. SharÊÑah audit also needs to review the organisational

structure to ensure it is conducive to undertake SharÊÑah compliance

activities and operations.

SharÊÑah audit needs to develop a systematic and thorough

SharÊÑah audit program. The list of audit procedures for an entire

SharÊÑah audit is termed as a SharÊÑah audit program. An audit program

is designed to audit a particular area of the overall scope of the audit

exercise. It is common to have several different audit programs for

the various departments and business activities. SharÊÑah auditors

should develop audit programs to cover a variety of Islamic financial

products and services.

In the case of SharÊÑah audit of the financial statements of

the IFIs, there is a need to review and to ensure that the financial

transactions are recognised, measured and reported accurately and

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 145

ISRA VOL3 IS 1.indd z145 6/3/11 5:44 PM

Enhancing the Integrity of Islamic Financial Institutions in Malaysia: The Case for the SharÊÑah Audit Framework

reflect the rights and obligations of affected parties arising from the

various SharÊÑah contracts. The adherence to best practices should

also consider the existing enforced accounting standards, BNM rules

and regulations, and the relevant international standards, such as

those provided by AAOIFI.

D. Competency

The internal SharÊÑah auditors should possess adequate auditing

knowledge, skills and competencies regarding the following:

i. proficiency in applying internal auditing standards and

procedures;

ii. proficiency in accounting principles and techniques;

iii. understanding of management principles;

iv. appreciation of accounting, economics, commercial law, taxation,

finance, quantitative methods and IT;

v. skills in dealing with people and communicating; and

vi. skills in oral and written communication.

The internal SharÊÑah auditors should have the ability to construct

relevant and appropriate audit tests in line with the audit objectives of

any particular area of the audit. The internal SharÊÑah auditors should

also have adequate knowledge of the SharÊÑah. The specialised

nature of their work requires knowledge of SharÊÑah, especially fiqh

muÑÉmalÉt, essential for them to carry out their work effectively.

The IFIs should encourage members of the internal SharÊÑah

audit unit to continuously participate in training on fiqh muÑÉmalÉt.

This is to keep them abreast with issues, development and practices

concerning fiqh muÑÉmalÉt. Consequently, the IFIs should create a

special position of internal SharÊÑah auditors that will function within

the internal SharÊÑah audit unit of the IFIs.

146 ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011

ISRA VOL3 IS 1.indd z146 6/3/11 5:44 PM

Abdul Rahim Abdul Rahman

V. CONCLUSION

Internationally, SharÊÑah audit regulation is yet to be fully enforced by

the respective central banks and monetary authorities (Abdul Rahman,

2009). SharÊÑah audit is essentially an assurance process and it should

be conducted by third party and independent auditors. The SharÊÑah

Committee of the IFIs only advises the institutions, and it is not in

the position to audit the processes and activities of the institutions

concerned. Hence, SharÊÑah audit is needed to fill the gap of SharÊÑah-

compliant activities and services (Abdul Rahman, 2009). The

stakeholders need to be assured that the institutions that offer Islamic

services have sufficient levels of SharÊÑah-compliant processes and

controls in place. The imperative next step for the development of

the Islamic financial industry is to meet the need for comprehensive

guidelines on the SharÊÑah audit function to complement the current

SharÊÑah governance mechanism. The initiative by BNM and ISRA to

develop the SharÊÑah Audit Framework is a timely and commendable

effort to further enhance the integrity of IFIs.

References

Abdul Rahman, A.R. (2008). Shari’ah Audit for Islamic Financial Services: Needs

and Challenges, ISRA Islamic Finance Seminar, Kuala Lumpur.

Abdul Rahman, A.R. (2009). Gathering Evidence: Creating Shari’ah Audit

Framework, Business Islamica Magazine, Dubai.

Bank Negara Malaysia (2010). Shari’ah Governance Framework.

Bhambra, H. (2007). Supervisory Implications of Islamic Finance in the Current

Regulatory Environment, in Archer, S. and Abdel Karim, R.A., Islamic Finance:

The Regulatory Challenge, John Wiley, pp.198 – 212.

Grais, W. and Pellegrini, M. (2006). Corporate Governance and Shari’ah Compliance

in Institutions Offering Islamic Financial Services, World Bank Policy Research

Working Paper, November, New York.

ISRA International Journal of Islamic Finance • Vol. 3 • Issue 1 • 2011 147

ISRA VOL3 IS 1.indd z147 6/3/11 5:44 PM

ISRA VOL3 IS 1.indd z148 6/3/11 5:44 PM

You might also like

- Comparative Analysis of Shariah Review and AuditDocument14 pagesComparative Analysis of Shariah Review and AuditNurazalia Zakaria100% (3)

- Shariah Non Compliance Through Auditing and Risk ManagementDocument22 pagesShariah Non Compliance Through Auditing and Risk ManagementAzah Atikah Anwar BatchaNo ratings yet

- The Foundations of Islamic Economics and BankingFrom EverandThe Foundations of Islamic Economics and BankingNo ratings yet

- Their Eyes Were Watching GodDocument13 pagesTheir Eyes Were Watching Godapi-316773627100% (1)

- Shahzad Asgharet Al Shariah Governance of IBIs in Pakistan An Empirical InvestigationDocument14 pagesShahzad Asgharet Al Shariah Governance of IBIs in Pakistan An Empirical InvestigationMuhammad Asghar ShahzadNo ratings yet

- Assessing The Effectiveness of Internal Sharī Ah Audit Structure and Its Practices in Islamic Financial InstitutionsDocument21 pagesAssessing The Effectiveness of Internal Sharī Ah Audit Structure and Its Practices in Islamic Financial InstitutionsUswah HanifNo ratings yet

- 2013 4thAsiaIslamicBankingConference CRMDocument25 pages2013 4thAsiaIslamicBankingConference CRMabdullaahjalilNo ratings yet

- Line of Reporting and CommunicationDocument18 pagesLine of Reporting and CommunicationSolomon TekalignNo ratings yet

- Shariah Governance Framework-MergedDocument125 pagesShariah Governance Framework-MergedThineshNo ratings yet

- Factors Affecting Sharı Ah AuditDocument17 pagesFactors Affecting Sharı Ah AuditYougie PoerbaNo ratings yet

- Shariah Supervisory BoardDocument31 pagesShariah Supervisory BoardMaas Riyaz MalikNo ratings yet

- Shariah Audit by Nabila and AthiqahDocument25 pagesShariah Audit by Nabila and AthiqahNurathiqah FadzilNo ratings yet

- Chapter 7 - Regulation NewDocument35 pagesChapter 7 - Regulation Newamirul hakimNo ratings yet

- Shariah Governance Practices in Malaysian Islamic Financial InstitutionsDocument16 pagesShariah Governance Practices in Malaysian Islamic Financial Institutionszabardast099No ratings yet

- Issues in Corporate and Shari'ah Governance Practices in Islamic Financial Institutions What Went WrongDocument14 pagesIssues in Corporate and Shari'ah Governance Practices in Islamic Financial Institutions What Went WrongWarriorNo ratings yet

- AC 5033: Shariah Audit: Assignment 1 GroupDocument14 pagesAC 5033: Shariah Audit: Assignment 1 GroupJubair Al AmeenNo ratings yet

- Proposal On Sharia ScholarDocument14 pagesProposal On Sharia ScholarSolomon TekalignNo ratings yet

- 10 1108 - Imefm 02 2013 0021Document12 pages10 1108 - Imefm 02 2013 0021alfauziyasserNo ratings yet

- ISRA, (2011) - International Shari' Ah Research Academy For Islamic Finance, MalaysiaDocument24 pagesISRA, (2011) - International Shari' Ah Research Academy For Islamic Finance, MalaysiaMohamed AlgzereyNo ratings yet

- Admin,+13 CIMAE Rifqi EndDocument13 pagesAdmin,+13 CIMAE Rifqi EndHafiz RezaNo ratings yet

- Islamic FinaceDocument4 pagesIslamic FinaceMohsin NoorNo ratings yet

- Islamic Finance - Audit Issues in Islamic Finance PDFDocument51 pagesIslamic Finance - Audit Issues in Islamic Finance PDFJIREN SHIS HAMUNo ratings yet

- 9-Article Text-15-1-10-20200814Document16 pages9-Article Text-15-1-10-20200814Daria PearNo ratings yet

- Shariah Governance System in Islamic Financial InsDocument17 pagesShariah Governance System in Islamic Financial InsWan RuschdeyNo ratings yet

- Shariah Governance Framework For Islamic Insurance or TakafulDocument19 pagesShariah Governance Framework For Islamic Insurance or TakafulRayhanNo ratings yet

- Materi Kelompok 1Document25 pagesMateri Kelompok 12 Ashlih Al TsabatNo ratings yet

- ISRA Research Paper Shariah Governance Accross JurisdictionDocument63 pagesISRA Research Paper Shariah Governance Accross JurisdictionRaudhatun NisaNo ratings yet

- Shari'ah Risk Management Framework For Islamic Financial InstitutionsDocument22 pagesShari'ah Risk Management Framework For Islamic Financial InstitutionsjawadNo ratings yet

- Islamic Financial System Principles and Operations PDF 701 800Document100 pagesIslamic Financial System Principles and Operations PDF 701 800Asdelina R100% (1)

- The Effects of Shariah Board Composition On Islamic Equity Indices ' PerformanceDocument12 pagesThe Effects of Shariah Board Composition On Islamic Equity Indices ' PerformanceGhulam NabiNo ratings yet

- Issues of Shariah AuditDocument12 pagesIssues of Shariah AuditFATIN 'AISYAH MASLAN ABDUL HAFIZNo ratings yet

- Special Feature Islamic Finance at The Current Sta PDFDocument14 pagesSpecial Feature Islamic Finance at The Current Sta PDFCode PutraNo ratings yet

- Shariah Audit Certification Contents: Views of Regulators, Shariah Committee, Shariah Reviewers and Undergraduat..Document19 pagesShariah Audit Certification Contents: Views of Regulators, Shariah Committee, Shariah Reviewers and Undergraduat..baehaqi17No ratings yet

- 335 1 1312 1 10 20130909 PDFDocument16 pages335 1 1312 1 10 20130909 PDFkristin_kim_13No ratings yet

- Constructs of Shariah Audit Effectiveness in IFIsDocument16 pagesConstructs of Shariah Audit Effectiveness in IFIsNurazalia Zakaria100% (1)

- 374-Article Text-866-1-10-20190925 PDFDocument37 pages374-Article Text-866-1-10-20190925 PDFVita Citra MulyandiniNo ratings yet

- Islamic Finance AsiaDocument2 pagesIslamic Finance AsiaAhmad FaresNo ratings yet

- The Development of Shariah Audit Scope in Malaysian Takaful Industry: A Preliminary AnalysisDocument22 pagesThe Development of Shariah Audit Scope in Malaysian Takaful Industry: A Preliminary AnalysisnsNo ratings yet

- External Shariah Audit: Current Development, Issues and Implementation ChallengesDocument23 pagesExternal Shariah Audit: Current Development, Issues and Implementation ChallengesHalimah Bibi Zurina ShafiiNo ratings yet

- Guiding Principles For Shariah Governance SystemDocument7 pagesGuiding Principles For Shariah Governance SystemHamad AbdulazizNo ratings yet

- Governance, Religious Assurance and Islamic Banks: Do Shariah Boards Effectively Serve?Document29 pagesGovernance, Religious Assurance and Islamic Banks: Do Shariah Boards Effectively Serve?Farid ZafarNo ratings yet

- Emifvoice Saunit10Document26 pagesEmifvoice Saunit10MANU OKAYNo ratings yet

- Gorvernance 2Document26 pagesGorvernance 2nurul nadzirahNo ratings yet

- Ife761 Final AssessmentDocument12 pagesIfe761 Final AssessmentElySya SyaNo ratings yet

- Shariah Audit, Shariah Certification & Shariah ReviewDocument11 pagesShariah Audit, Shariah Certification & Shariah ReviewAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Haridan2018 Article GovernanceReligiousAssuranceAnDocument32 pagesHaridan2018 Article GovernanceReligiousAssuranceAnRaffi RamliNo ratings yet

- Lec 7 Shariah GovernanceDocument20 pagesLec 7 Shariah GovernanceAina KhairunnisaNo ratings yet

- Summary Ifsb Puteri F1025Document5 pagesSummary Ifsb Puteri F1025Siti Nur QamarinaNo ratings yet

- Accounting and Auditing Standards For Islamic Banks1Document71 pagesAccounting and Auditing Standards For Islamic Banks1Amine ElghaziNo ratings yet

- WP-05 - En-Shariah NOn Compliance RiskDocument116 pagesWP-05 - En-Shariah NOn Compliance RiskDila Fadiya FarrasNo ratings yet

- Islamic Financial Service Board (Ifsb)Document5 pagesIslamic Financial Service Board (Ifsb)Siti Nur QamarinaNo ratings yet

- Irma Kasri Dan N. LukviarmanDocument29 pagesIrma Kasri Dan N. Lukviarmanjaharuddin.hannoverNo ratings yet

- Talent Management 2019 IJof Fin ResearchDocument16 pagesTalent Management 2019 IJof Fin ResearchnsNo ratings yet

- Overview of Financial Services Act 2013Document11 pagesOverview of Financial Services Act 2013FatehahNo ratings yet

- IE2001Document8 pagesIE2001eyaacobNo ratings yet

- Alternative Financial SystemDocument11 pagesAlternative Financial SystemMohammed SaifulNo ratings yet

- The Development in Shariah Auditing in MalaysiaDocument20 pagesThe Development in Shariah Auditing in MalaysiaAshween Raj яMc100% (1)

- Weathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?From EverandWeathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?No ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- 3 2 1 Code It 6th Edition Green Solutions Manual DOWNLOAD YOUR FILES DownloadDocument131 pages3 2 1 Code It 6th Edition Green Solutions Manual DOWNLOAD YOUR FILES DownloadelizabethNo ratings yet

- Philippine National Police, Police Regional Office 10 Camiguin Provincial Mobile Force PlatoonDocument3 pagesPhilippine National Police, Police Regional Office 10 Camiguin Provincial Mobile Force PlatoonIan Vic S. DalisNo ratings yet

- Gemba Walk Checklist QuestionsDocument2 pagesGemba Walk Checklist QuestionsDhurga SivanathanNo ratings yet

- Chapter 1 Project Management The Key To Achieving ResultsDocument40 pagesChapter 1 Project Management The Key To Achieving Resultslyster badenasNo ratings yet

- Applications of Rational ExpressionsDocument3 pagesApplications of Rational ExpressionslzttimNo ratings yet

- Washing Machine: Service ManualDocument59 pagesWashing Machine: Service ManualHama AieaNo ratings yet

- History of Western Society Since 1300 12Th Edition Mckay Test Bank Full Chapter PDFDocument35 pagesHistory of Western Society Since 1300 12Th Edition Mckay Test Bank Full Chapter PDFJakeOwensbnpm100% (12)

- EprDocument8 pagesEprcyrimathewNo ratings yet

- mth202 Solved Subjectives Final Term PDFDocument14 pagesmth202 Solved Subjectives Final Term PDFHumayunKhalid50% (2)

- ISKCON GBC Role and ResponsibilityDocument11 pagesISKCON GBC Role and ResponsibilityDeenanathaNo ratings yet

- 03-04-17 EditionDocument32 pages03-04-17 EditionSan Mateo Daily JournalNo ratings yet

- 123Document10 pages123Aryan SanezNo ratings yet

- FACTURADocument1 pageFACTURAAnny CañasNo ratings yet

- The Geology of The Panama-Chocó Arc: Stewart D. RedwoodDocument32 pagesThe Geology of The Panama-Chocó Arc: Stewart D. RedwoodFelipe ArrublaNo ratings yet

- Necromancer Bone Spear Build With Masquerade (Patch 2.6.10 Season 22) - Diablo 3 - Icy Veins 3Document1 pageNecromancer Bone Spear Build With Masquerade (Patch 2.6.10 Season 22) - Diablo 3 - Icy Veins 3filipNo ratings yet

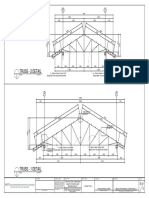

- Truss - 2 Detail: Scale 1: 50 MTRSDocument1 pageTruss - 2 Detail: Scale 1: 50 MTRSGerald MasangayNo ratings yet

- SBL BPP Kit-2019 Copy 457Document1 pageSBL BPP Kit-2019 Copy 457Reever RiverNo ratings yet

- Refrigeration and Air Conditioning Mechanic Harmonized Record Book June 2020Document36 pagesRefrigeration and Air Conditioning Mechanic Harmonized Record Book June 2020Certified Rabbits LoverNo ratings yet

- 3.2.4 - Design Info-Water SupplyDocument5 pages3.2.4 - Design Info-Water SupplyNyu123456No ratings yet

- Adverb Clauses With TimeDocument3 pagesAdverb Clauses With TimeDeni KurniawanNo ratings yet

- WWW Echalone COM: Techalon EDocument26 pagesWWW Echalone COM: Techalon EVara Prasad VemulaNo ratings yet

- Annex 1 - Preparation of GMP Report - ASPECT FinalDocument4 pagesAnnex 1 - Preparation of GMP Report - ASPECT FinalVõ Phi TrúcNo ratings yet

- Internet Programming With Delphi (Marco Cantu)Document14 pagesInternet Programming With Delphi (Marco Cantu)nadutNo ratings yet

- Astm C 750 - 03 Qzc1maDocument4 pagesAstm C 750 - 03 Qzc1mamario neriNo ratings yet

- General Bearing Requirements and Design CriteriaDocument6 pagesGeneral Bearing Requirements and Design Criteriaapi-3701567100% (2)

- Session #9 SAS - Nutrition (Lecture)Document9 pagesSession #9 SAS - Nutrition (Lecture)Mariel Gwen RetorcaNo ratings yet

- Non-Circumvention, Non-Disclosure Agreement (Ncnda)Document5 pagesNon-Circumvention, Non-Disclosure Agreement (Ncnda)fabrizio ballesiNo ratings yet

- Experiment 2 - Classes and Changes in MatterDocument4 pagesExperiment 2 - Classes and Changes in MatterLaurrence CapindianNo ratings yet

- Deployment Guide Series IBM Total Storage Productivity Center For Data Sg247140Document602 pagesDeployment Guide Series IBM Total Storage Productivity Center For Data Sg247140bupbechanhNo ratings yet