Professional Documents

Culture Documents

FMCG Sector Analysis

FMCG Sector Analysis

Uploaded by

Shivani BhardwajCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Applied Economics: Q2: Week 1-2: Module 1Document21 pagesApplied Economics: Q2: Week 1-2: Module 1Godwill Oliva88% (16)

- WOW English Grammar CBSE - CH 1-4 - Class 04Document22 pagesWOW English Grammar CBSE - CH 1-4 - Class 04Aleksandra Vu0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Luganda ProverbsDocument364 pagesLuganda ProverbsTrial Meister100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KFC Internationalization Process and StrategiesDocument7 pagesKFC Internationalization Process and StrategiesAnkita I S 2027743100% (2)

- 5 Questions - : Ben Sally Nick KimDocument7 pages5 Questions - : Ben Sally Nick KimDai PhanNo ratings yet

- Shake Shack Las Vegas MenuDocument1 pageShake Shack Las Vegas Menususan6215No ratings yet

- DPB2012 Business PlanDocument61 pagesDPB2012 Business Planafifroslan1507No ratings yet

- Commodity CodesDocument55 pagesCommodity CodesjesuswithusNo ratings yet

- 1st Grade Everyday AllDocument5 pages1st Grade Everyday AllClaudiaNo ratings yet

- Westinghouse Oven ManualDocument21 pagesWestinghouse Oven ManualKeith BourdonNo ratings yet

- Colegio San Marcos Inglés 4to Año EP: Extra Practice BookletDocument35 pagesColegio San Marcos Inglés 4to Año EP: Extra Practice BookletCeleste aldana Gómez torresNo ratings yet

- Guidelines For Crop Cutting ExperimentsDocument22 pagesGuidelines For Crop Cutting ExperimentsvenucoldNo ratings yet

- C&A Dec5 - Dec11Document1 pageC&A Dec5 - Dec11Sumit NegiNo ratings yet

- Balaw-Balaw Restaurant and Art Gallery: Task Performance in Tourism and Hospitality MarketingDocument9 pagesBalaw-Balaw Restaurant and Art Gallery: Task Performance in Tourism and Hospitality MarketingChristianallen DenoloNo ratings yet

- Periodical Test in Mathematics 5Document5 pagesPeriodical Test in Mathematics 5Nick Bantolo100% (1)

- Protestors Block The Delhi-Jaipur Highway: Fear of Illness Makes People Avoid Vegetables, Vendors HitDocument12 pagesProtestors Block The Delhi-Jaipur Highway: Fear of Illness Makes People Avoid Vegetables, Vendors Hitmohammad aliNo ratings yet

- English Assignment 1-2021Document4 pagesEnglish Assignment 1-2021Jennifer LydangNo ratings yet

- 80 A 85 HOWTHEDESERTTORTOISEGOTITSSHELLDocument6 pages80 A 85 HOWTHEDESERTTORTOISEGOTITSSHELLClaudiaLoredoNo ratings yet

- 10th Social Science Sankalya (EM) - 2023 (GSEBMaterial - Com)Document15 pages10th Social Science Sankalya (EM) - 2023 (GSEBMaterial - Com)nokhayaenrichNo ratings yet

- Ento - 354Document244 pagesEnto - 354Saurabh PatilNo ratings yet

- Price Monitoring April 20 2022Document5 pagesPrice Monitoring April 20 2022HannielAgbulosNo ratings yet

- Adjuncts and Coloured MaltsDocument33 pagesAdjuncts and Coloured MaltsEyoel AwokeNo ratings yet

- Tool Practice ExplanationDocument4 pagesTool Practice ExplanationAaron HuangNo ratings yet

- Metodos Simples de AcuiculturaDocument16 pagesMetodos Simples de AcuiculturaWilfrido Rosado0% (1)

- Albert Town High School C.X.C Agricultural Science Crop Production PortfolioDocument16 pagesAlbert Town High School C.X.C Agricultural Science Crop Production PortfolioNyomie CoxNo ratings yet

- Assignment 1 10 %Document9 pagesAssignment 1 10 %HaRry sanghaNo ratings yet

- Porter's 5 Forces Applied To Kellogg'sDocument13 pagesPorter's 5 Forces Applied To Kellogg'sraghavendramishraNo ratings yet

- Hubungan Perspektif Sosial Budaya Dengan Pemberian Asi EksklusifDocument8 pagesHubungan Perspektif Sosial Budaya Dengan Pemberian Asi EksklusifDita AulitaNo ratings yet

- Agroindustrial Technology Journal: Efektivitas Penambahan Ekstrak Kelopak Bunga Rosella (Hibiscus (Aloe Vera)Document14 pagesAgroindustrial Technology Journal: Efektivitas Penambahan Ekstrak Kelopak Bunga Rosella (Hibiscus (Aloe Vera)qorry ainaNo ratings yet

- FRUMECAR - EBA BrochureDocument2 pagesFRUMECAR - EBA BrochurealaouiNo ratings yet

FMCG Sector Analysis

FMCG Sector Analysis

Uploaded by

Shivani BhardwajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMCG Sector Analysis

FMCG Sector Analysis

Uploaded by

Shivani BhardwajCopyright:

Available Formats

FMCG SECTOR

FMCG- Fast Moving Consumer Goods, is the fourth largest sector in

Indian Economy. The market size of FMCG sector is estimated to be

around $1.1 trillion, which is likely to cross $2.2 trillion by 2025.

According to Neilson, the Indian FMCG industry grew at 9.4% in

January-March quarter of 2021, supported by consumption led growth

and value expansion from higher product prices.

Recently, FMCG has

Product-wise breakup witnessed rise of Direct

to Consumers (D2C)

Household & model and India is home

Healthcare Personal care to more than 800 D2C

Food & brands looking at

Beverages

19% 31% 50% around $100 billion

opportunity by 2025.

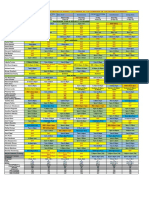

Top players

Mkt Cap - 5.71 tn 2.5 tn 1.7 tn

ROE - 16.77 % 21.8 % 105.76 % NIFTY P/E - 45.31

P/E - 71.45 20.42 78.18

NIFTY FMCG is designed to reflect the behavior and performance of

FMCG stocks. Unilever, ITC and Nestle are the top players in Indian

FMCG market having 29%, 25% and 8% in Nifty FMCG respectively.

PORTER's Five FORCES

Bargaining

Barriers to Power of

Entry Suppliers

Low Low

Competitive

Rivalry

High

Bargaining

Threat of

power of

Substitutes

consumers

High High

1. Barriers to entry are low in FMCG sector due to low customer

switching costs and relatively lower capital requirements.

2. Bargaining power of suppliers of raw material and intermediate

goods is low due to presence of ample number of substitute suppliers.

3. Threat of substitutes is high due to low switching costs on

consumer's side and easy availability of competitor's products.

4. Bargaining power of consumers is very high even due to the fact

that high brand loyalty discourages customers to switch but easy

availability of substitues and agressive market strategies entice them.

5. Competitive Rivalry competitive rivalry is very high due to

availability of local brands entering due to low barriers of entry.

KEY PERFORMANCE INDICATORS

1. Numeric Distribution Percentage - Indicates the percentage of

stores that sells an FMCG product in a given area.

2. Product Penetration rate - Shows the percentage of people buying

the product in a particular area.

3. Share of wallet - An Indicator that helps managers understand the

amount of business that they receive from certain customers.

4. Market Share Distribution - A contextual KPI that can be used to

gauge a product’s potential in the market.

5. Market Share to sell - It shows the company’s sales turnover with

respect to the overall turnover of the sector.

Recent Developments

The Union Government's Production-

Linked Incentive (PLI) scheme gives

companies a major opportunity to boost

exports and has expanded its purview to

food processing industry too.

GOI has approved 100% FDI in the cash and carry segment and

in single-brand retail along with 51% in multi-brand retail.

Rural consumption has increased, led by a combination of

increasing income and higher aspirations.

FMCG giants that have dominated Indian markets for years are

now facing competition from D2C focused companies like

Mamaearth, The Moms Co., Bey Bee.

Companies with dedicated websites recorded an 88% YoY rise in

consumer demand due to adoption of D2C model.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Applied Economics: Q2: Week 1-2: Module 1Document21 pagesApplied Economics: Q2: Week 1-2: Module 1Godwill Oliva88% (16)

- WOW English Grammar CBSE - CH 1-4 - Class 04Document22 pagesWOW English Grammar CBSE - CH 1-4 - Class 04Aleksandra Vu0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Luganda ProverbsDocument364 pagesLuganda ProverbsTrial Meister100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KFC Internationalization Process and StrategiesDocument7 pagesKFC Internationalization Process and StrategiesAnkita I S 2027743100% (2)

- 5 Questions - : Ben Sally Nick KimDocument7 pages5 Questions - : Ben Sally Nick KimDai PhanNo ratings yet

- Shake Shack Las Vegas MenuDocument1 pageShake Shack Las Vegas Menususan6215No ratings yet

- DPB2012 Business PlanDocument61 pagesDPB2012 Business Planafifroslan1507No ratings yet

- Commodity CodesDocument55 pagesCommodity CodesjesuswithusNo ratings yet

- 1st Grade Everyday AllDocument5 pages1st Grade Everyday AllClaudiaNo ratings yet

- Westinghouse Oven ManualDocument21 pagesWestinghouse Oven ManualKeith BourdonNo ratings yet

- Colegio San Marcos Inglés 4to Año EP: Extra Practice BookletDocument35 pagesColegio San Marcos Inglés 4to Año EP: Extra Practice BookletCeleste aldana Gómez torresNo ratings yet

- Guidelines For Crop Cutting ExperimentsDocument22 pagesGuidelines For Crop Cutting ExperimentsvenucoldNo ratings yet

- C&A Dec5 - Dec11Document1 pageC&A Dec5 - Dec11Sumit NegiNo ratings yet

- Balaw-Balaw Restaurant and Art Gallery: Task Performance in Tourism and Hospitality MarketingDocument9 pagesBalaw-Balaw Restaurant and Art Gallery: Task Performance in Tourism and Hospitality MarketingChristianallen DenoloNo ratings yet

- Periodical Test in Mathematics 5Document5 pagesPeriodical Test in Mathematics 5Nick Bantolo100% (1)

- Protestors Block The Delhi-Jaipur Highway: Fear of Illness Makes People Avoid Vegetables, Vendors HitDocument12 pagesProtestors Block The Delhi-Jaipur Highway: Fear of Illness Makes People Avoid Vegetables, Vendors Hitmohammad aliNo ratings yet

- English Assignment 1-2021Document4 pagesEnglish Assignment 1-2021Jennifer LydangNo ratings yet

- 80 A 85 HOWTHEDESERTTORTOISEGOTITSSHELLDocument6 pages80 A 85 HOWTHEDESERTTORTOISEGOTITSSHELLClaudiaLoredoNo ratings yet

- 10th Social Science Sankalya (EM) - 2023 (GSEBMaterial - Com)Document15 pages10th Social Science Sankalya (EM) - 2023 (GSEBMaterial - Com)nokhayaenrichNo ratings yet

- Ento - 354Document244 pagesEnto - 354Saurabh PatilNo ratings yet

- Price Monitoring April 20 2022Document5 pagesPrice Monitoring April 20 2022HannielAgbulosNo ratings yet

- Adjuncts and Coloured MaltsDocument33 pagesAdjuncts and Coloured MaltsEyoel AwokeNo ratings yet

- Tool Practice ExplanationDocument4 pagesTool Practice ExplanationAaron HuangNo ratings yet

- Metodos Simples de AcuiculturaDocument16 pagesMetodos Simples de AcuiculturaWilfrido Rosado0% (1)

- Albert Town High School C.X.C Agricultural Science Crop Production PortfolioDocument16 pagesAlbert Town High School C.X.C Agricultural Science Crop Production PortfolioNyomie CoxNo ratings yet

- Assignment 1 10 %Document9 pagesAssignment 1 10 %HaRry sanghaNo ratings yet

- Porter's 5 Forces Applied To Kellogg'sDocument13 pagesPorter's 5 Forces Applied To Kellogg'sraghavendramishraNo ratings yet

- Hubungan Perspektif Sosial Budaya Dengan Pemberian Asi EksklusifDocument8 pagesHubungan Perspektif Sosial Budaya Dengan Pemberian Asi EksklusifDita AulitaNo ratings yet

- Agroindustrial Technology Journal: Efektivitas Penambahan Ekstrak Kelopak Bunga Rosella (Hibiscus (Aloe Vera)Document14 pagesAgroindustrial Technology Journal: Efektivitas Penambahan Ekstrak Kelopak Bunga Rosella (Hibiscus (Aloe Vera)qorry ainaNo ratings yet

- FRUMECAR - EBA BrochureDocument2 pagesFRUMECAR - EBA BrochurealaouiNo ratings yet