Professional Documents

Culture Documents

Polestar

Polestar

Uploaded by

HusseinCopyright:

Available Formats

You might also like

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- 3rd Examination FabmDocument19 pages3rd Examination FabmZein gomez50% (8)

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- No. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomDocument7 pagesNo. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomKimberlyNo ratings yet

- Valuing Financial Services FirmsDocument20 pagesValuing Financial Services Firmsgargrahul20004612No ratings yet

- Chapter 13-Equity Financing: Multiple ChoiceDocument43 pagesChapter 13-Equity Financing: Multiple ChoiceLouise100% (2)

- Consolidation Q71Document5 pagesConsolidation Q71IbraheemsadeekNo ratings yet

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- SW3 SCFDocument4 pagesSW3 SCFJhazzie DolorNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- Buttons ENGDocument2 pagesButtons ENGisabella.desa04No ratings yet

- Past Paper Question 1 With AnswerDocument6 pagesPast Paper Question 1 With AnswerChitradevi RamooNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- Horizontal Groups (2021)Document5 pagesHorizontal Groups (2021)Tawanda Tatenda HerbertNo ratings yet

- Lecture 3 Class ExampleDocument2 pagesLecture 3 Class ExamplesogutuNo ratings yet

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- Mutual OwingsDocument3 pagesMutual Owingsbriankuria21No ratings yet

- Question 85: Basic ConsolidationDocument5 pagesQuestion 85: Basic ConsolidationMoses SikaNo ratings yet

- AFU 08501 - Tutorial Set-2021 - DemosntrationDocument5 pagesAFU 08501 - Tutorial Set-2021 - DemosntrationCunningham LazzNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Assignment IV Advanced Financial Accounting Chapter 4&5Document6 pagesAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNo ratings yet

- PandarDocument2 pagesPandarAuthentic HNo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- Unit 5-Group Statements L Cons at Acquisition Date (2024)Document12 pagesUnit 5-Group Statements L Cons at Acquisition Date (2024)jamileethomNo ratings yet

- Consolidation BasicsDocument5 pagesConsolidation Basicspoonamemrith22No ratings yet

- Assignment - QuestionDocument3 pagesAssignment - QuestionWang Hon YuenNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Consolidated Statement of Financial PositionDocument2 pagesConsolidated Statement of Financial PositionEvita Ayne TapitNo ratings yet

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- FRFSA Previous Year Questions 2020-2023Document29 pagesFRFSA Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Chapter 1 Book Questions With AnswersDocument5 pagesChapter 1 Book Questions With AnswersZeinab MohamadNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Tutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)Document8 pagesTutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)cynthiama7777No ratings yet

- 371 PedanticDocument2 pages371 Pedanticabdirahman farah AbdiNo ratings yet

- Statutory Merger Problem 1Document2 pagesStatutory Merger Problem 1Meleen TadenaNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- SFP and SCIDocument6 pagesSFP and SCIJeffrey Paul Dorotheo100% (1)

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- Financial Reporting (Irish) : Wednesday 4 December 2013Document9 pagesFinancial Reporting (Irish) : Wednesday 4 December 2013Abdulahi farah AbdiNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Acct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsDocument5 pagesAcct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsGround ZeroNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocument5 pagesLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548No ratings yet

- AssetsDocument2 pagesAssetsShesha Nimna GamageNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Link Between Money Supply and Interest Rates NotesDocument5 pagesLink Between Money Supply and Interest Rates NotesHusseinNo ratings yet

- f1 Past Papers by AcuteDocument137 pagesf1 Past Papers by AcuteHusseinNo ratings yet

- Agenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsDocument16 pagesAgenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsHusseinNo ratings yet

- Dickens and JonesDocument2 pagesDickens and JonesHusseinNo ratings yet

- Dill ExcelDocument1 pageDill ExcelHusseinNo ratings yet

- AA Mock ExamDocument12 pagesAA Mock ExamHusseinNo ratings yet

- Blackberry CoDocument2 pagesBlackberry CoHusseinNo ratings yet

- Transcript Work With ComputersDocument25 pagesTranscript Work With ComputersHusseinNo ratings yet

- CGT OTQ2 - Day 2Document2 pagesCGT OTQ2 - Day 2HusseinNo ratings yet

- Sahabooleea Hussein 2Document3 pagesSahabooleea Hussein 2HusseinNo ratings yet

- Practice Tests: Section ADocument5 pagesPractice Tests: Section AHusseinNo ratings yet

- 2012 ECON1003y-1-2012Document10 pages2012 ECON1003y-1-2012HusseinNo ratings yet

- Effects of Global Financial CrisisDocument10 pagesEffects of Global Financial CrisisHusseinNo ratings yet

- Realized Yield To Maturity On BondsDocument2 pagesRealized Yield To Maturity On BondscharymvnNo ratings yet

- Different Types of DividendDocument7 pagesDifferent Types of DividendAnshul Mehrotra100% (1)

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- 128-Equity Valuation - Models From Leading Investment Banks (The Wiley Finance Series) - Jan ViebigDocument62 pages128-Equity Valuation - Models From Leading Investment Banks (The Wiley Finance Series) - Jan ViebigveryhmanNo ratings yet

- Which of The Following Is The Most Likely Item To Result in A Deferred Tax AssetDocument2 pagesWhich of The Following Is The Most Likely Item To Result in A Deferred Tax AssetAllen KateNo ratings yet

- Bulgaro Angliiski Schet - RechnikDocument131 pagesBulgaro Angliiski Schet - RechnikbabinetiNo ratings yet

- Generally Accepted Accounting Principles and Accounting StandardsDocument32 pagesGenerally Accepted Accounting Principles and Accounting StandardsDileepkumar K DiliNo ratings yet

- IAS 32, IFRS7,9 Financial InstrumentsDocument6 pagesIAS 32, IFRS7,9 Financial InstrumentsMazni Hanisah100% (2)

- Chapter 3 AMA StudentDocument28 pagesChapter 3 AMA StudentjessicaNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Notes 2020 Cash Flows From Operating ActivitiesDocument5 pagesNotes 2020 Cash Flows From Operating ActivitiesKei SenpaiNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Prob Set 1Document6 pagesProb Set 1Nikki BulanteNo ratings yet

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Fin Ia TrungDocument15 pagesFin Ia Trungtrungptbcs150588No ratings yet

- ASE20093 Resource BookDocument8 pagesASE20093 Resource BookAung Zaw Htwe0% (1)

- 10-K Navigation GuideDocument203 pages10-K Navigation GuidejshethNo ratings yet

- 02.damodaran - Corporate FinanceDocument239 pages02.damodaran - Corporate Financessj9No ratings yet

- FA FOR BADM Course OutlineDocument3 pagesFA FOR BADM Course OutlineGUDATA ABARANo ratings yet

- FAR Final Preboard QuestionaireDocument18 pagesFAR Final Preboard Questionaireyzhlansang.studentNo ratings yet

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Pnoc Renewables Corporation Notes To Financial Statements: A. Geothermal ProjectsDocument23 pagesPnoc Renewables Corporation Notes To Financial Statements: A. Geothermal ProjectsLolita CalaycayNo ratings yet

- Accounts Coursework.Document2 pagesAccounts Coursework.hassan KyendoNo ratings yet

Polestar

Polestar

Uploaded by

HusseinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Polestar

Polestar

Uploaded by

HusseinCopyright:

Available Formats

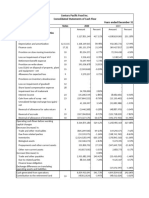

POLESTAR

On 1 April 2013, Polestar acquired 75% of Southstar. Southstar had been experiencing

difficult trading conditions and making significant losses. In allowing for Southstar's

difficulties, Polestar made an immediate cash payment of only $1.50 per share. In addition,

Polestar will pay a further amount in cash on 30 September 2014 if Southstar returns to

profitability by that date. The fair value ofthis contingent consideration at the date of

acquisition was estimated to be $1.8 million, but at 30 September 2013 in the light of

continuing losses, its value was estimated at only $1.5 million. The contingent consideration

has not been recorded by Polestar. Overall, the directors of Polestar expect the acquisition

to be a bargain purchase leading to negative goodwill.

Below are the summarised draft financial statements of both companies.

Statements of profit or loss for the year ended 30 September 2013

Polestar Southstar

$000 $000

Revenue 110000 66000

Cost of sales (88000) (67200)

Gross profit (loss) 22000 (1200)

Operating expenses (8500) (4400)

Profit (loss) before tax 13500 (5600.00)

Income tax (expense)/relief (3500) 1000

Profit (loss) for the year 10000 (4600)

Statements of financial position as at 30 September 2013

Polestar Southstar

Assets $000 $000

Non-current assets

Property, plant and equipment 41000 21000

Investments 13500

Current assets 19000 4800

Total assets 73500 25800

Equity and liabilities

Equity shares of 50 cents each 30000 6000

Retained earnings 28500 12000

58500 18000

Current liabilities 15000 7800

Total equity and liabilities 73500 25800

The following information is relevent:

i) At the date of acquisition, the fair values of Southstar's assets were equal to their

carrying amounts with the exception of a property. This had a fair value of $2 million

above its carrying amount and a remaining useful life of 10 years at that date. All

depreciation is included in cost of sales.

ii) Polestar transferred raw materials at their cost of $4 million to Southstar in June

2013. Southstar processed all of these materials incurring additional direct costs of

$1.4 million and sold them back to Polestar in August 2013 for $9 million. At

30 September 2013 Polestar had $1.5 million of these goods still in inventory. There

were no other intra-group sales.

iii) Polestar's policy is to value the non-controlling interest at fair value at the date of

acquisition. This was deemed to be $3.6 million.

iv) All items in the above statements of profit or loss are deemed to accrue evenly over

the year unless otherwise indicated.

Required:

a) Prepare the consolidated statement of profit or loss for Polestar for the year ended

30 September 2013. (11 marks)

b) Prepare the consolidated statement of financial position for Polestar as at

30 September 2013. (9 marks)

(Total: 20 marks)

You might also like

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- 3rd Examination FabmDocument19 pages3rd Examination FabmZein gomez50% (8)

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- No. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomDocument7 pagesNo. of Rooms Ave, Monthly Rent Per Room Annual Rent Per RoomKimberlyNo ratings yet

- Valuing Financial Services FirmsDocument20 pagesValuing Financial Services Firmsgargrahul20004612No ratings yet

- Chapter 13-Equity Financing: Multiple ChoiceDocument43 pagesChapter 13-Equity Financing: Multiple ChoiceLouise100% (2)

- Consolidation Q71Document5 pagesConsolidation Q71IbraheemsadeekNo ratings yet

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- SW3 SCFDocument4 pagesSW3 SCFJhazzie DolorNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- Buttons ENGDocument2 pagesButtons ENGisabella.desa04No ratings yet

- Past Paper Question 1 With AnswerDocument6 pagesPast Paper Question 1 With AnswerChitradevi RamooNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- Horizontal Groups (2021)Document5 pagesHorizontal Groups (2021)Tawanda Tatenda HerbertNo ratings yet

- Lecture 3 Class ExampleDocument2 pagesLecture 3 Class ExamplesogutuNo ratings yet

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- Mutual OwingsDocument3 pagesMutual Owingsbriankuria21No ratings yet

- Question 85: Basic ConsolidationDocument5 pagesQuestion 85: Basic ConsolidationMoses SikaNo ratings yet

- AFU 08501 - Tutorial Set-2021 - DemosntrationDocument5 pagesAFU 08501 - Tutorial Set-2021 - DemosntrationCunningham LazzNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Assignment IV Advanced Financial Accounting Chapter 4&5Document6 pagesAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNo ratings yet

- PandarDocument2 pagesPandarAuthentic HNo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- Unit 5-Group Statements L Cons at Acquisition Date (2024)Document12 pagesUnit 5-Group Statements L Cons at Acquisition Date (2024)jamileethomNo ratings yet

- Consolidation BasicsDocument5 pagesConsolidation Basicspoonamemrith22No ratings yet

- Assignment - QuestionDocument3 pagesAssignment - QuestionWang Hon YuenNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Consolidated Statement of Financial PositionDocument2 pagesConsolidated Statement of Financial PositionEvita Ayne TapitNo ratings yet

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- FRFSA Previous Year Questions 2020-2023Document29 pagesFRFSA Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Chapter 1 Book Questions With AnswersDocument5 pagesChapter 1 Book Questions With AnswersZeinab MohamadNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Tutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)Document8 pagesTutorial 6 Consolidated Statement of Financial Position (Csofp) - Part 2 - Question 1 (Q10.11)cynthiama7777No ratings yet

- 371 PedanticDocument2 pages371 Pedanticabdirahman farah AbdiNo ratings yet

- Statutory Merger Problem 1Document2 pagesStatutory Merger Problem 1Meleen TadenaNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- SFP and SCIDocument6 pagesSFP and SCIJeffrey Paul Dorotheo100% (1)

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- Financial Reporting (Irish) : Wednesday 4 December 2013Document9 pagesFinancial Reporting (Irish) : Wednesday 4 December 2013Abdulahi farah AbdiNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Acct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsDocument5 pagesAcct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsGround ZeroNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocument5 pagesLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548No ratings yet

- AssetsDocument2 pagesAssetsShesha Nimna GamageNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Link Between Money Supply and Interest Rates NotesDocument5 pagesLink Between Money Supply and Interest Rates NotesHusseinNo ratings yet

- f1 Past Papers by AcuteDocument137 pagesf1 Past Papers by AcuteHusseinNo ratings yet

- Agenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsDocument16 pagesAgenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsHusseinNo ratings yet

- Dickens and JonesDocument2 pagesDickens and JonesHusseinNo ratings yet

- Dill ExcelDocument1 pageDill ExcelHusseinNo ratings yet

- AA Mock ExamDocument12 pagesAA Mock ExamHusseinNo ratings yet

- Blackberry CoDocument2 pagesBlackberry CoHusseinNo ratings yet

- Transcript Work With ComputersDocument25 pagesTranscript Work With ComputersHusseinNo ratings yet

- CGT OTQ2 - Day 2Document2 pagesCGT OTQ2 - Day 2HusseinNo ratings yet

- Sahabooleea Hussein 2Document3 pagesSahabooleea Hussein 2HusseinNo ratings yet

- Practice Tests: Section ADocument5 pagesPractice Tests: Section AHusseinNo ratings yet

- 2012 ECON1003y-1-2012Document10 pages2012 ECON1003y-1-2012HusseinNo ratings yet

- Effects of Global Financial CrisisDocument10 pagesEffects of Global Financial CrisisHusseinNo ratings yet

- Realized Yield To Maturity On BondsDocument2 pagesRealized Yield To Maturity On BondscharymvnNo ratings yet

- Different Types of DividendDocument7 pagesDifferent Types of DividendAnshul Mehrotra100% (1)

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- 128-Equity Valuation - Models From Leading Investment Banks (The Wiley Finance Series) - Jan ViebigDocument62 pages128-Equity Valuation - Models From Leading Investment Banks (The Wiley Finance Series) - Jan ViebigveryhmanNo ratings yet

- Which of The Following Is The Most Likely Item To Result in A Deferred Tax AssetDocument2 pagesWhich of The Following Is The Most Likely Item To Result in A Deferred Tax AssetAllen KateNo ratings yet

- Bulgaro Angliiski Schet - RechnikDocument131 pagesBulgaro Angliiski Schet - RechnikbabinetiNo ratings yet

- Generally Accepted Accounting Principles and Accounting StandardsDocument32 pagesGenerally Accepted Accounting Principles and Accounting StandardsDileepkumar K DiliNo ratings yet

- IAS 32, IFRS7,9 Financial InstrumentsDocument6 pagesIAS 32, IFRS7,9 Financial InstrumentsMazni Hanisah100% (2)

- Chapter 3 AMA StudentDocument28 pagesChapter 3 AMA StudentjessicaNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Notes 2020 Cash Flows From Operating ActivitiesDocument5 pagesNotes 2020 Cash Flows From Operating ActivitiesKei SenpaiNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Prob Set 1Document6 pagesProb Set 1Nikki BulanteNo ratings yet

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Fin Ia TrungDocument15 pagesFin Ia Trungtrungptbcs150588No ratings yet

- ASE20093 Resource BookDocument8 pagesASE20093 Resource BookAung Zaw Htwe0% (1)

- 10-K Navigation GuideDocument203 pages10-K Navigation GuidejshethNo ratings yet

- 02.damodaran - Corporate FinanceDocument239 pages02.damodaran - Corporate Financessj9No ratings yet

- FA FOR BADM Course OutlineDocument3 pagesFA FOR BADM Course OutlineGUDATA ABARANo ratings yet

- FAR Final Preboard QuestionaireDocument18 pagesFAR Final Preboard Questionaireyzhlansang.studentNo ratings yet

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Pnoc Renewables Corporation Notes To Financial Statements: A. Geothermal ProjectsDocument23 pagesPnoc Renewables Corporation Notes To Financial Statements: A. Geothermal ProjectsLolita CalaycayNo ratings yet

- Accounts Coursework.Document2 pagesAccounts Coursework.hassan KyendoNo ratings yet