Professional Documents

Culture Documents

Four Year Profit Projection: Enter Your Company Name Here

Four Year Profit Projection: Enter Your Company Name Here

Uploaded by

Misscreant EveOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Four Year Profit Projection: Enter Your Company Name Here

Four Year Profit Projection: Enter Your Company Name Here

Uploaded by

Misscreant EveCopyright:

Available Formats

Four Year Profit Projection

Enter your Company Name here

2003 % 2004 % 2005 % 2006 %

Sales $ - 100.00% $ - 100.00% $ - 100.00% $ - 100.00%

Cost/ Goods Sold (COGS) - - - - - - - -

Gross Profit $ - - $ - - $ - - $ - -

Operating Expenses

Notes on Preparation

Salary (Office & Overhead) $ - - $ - - $ - - $ - -

Payroll (taxes etc.) - - Note: You may want- to print this information

- to use as -reference later. To -delete these instructions,

- click the -

Outside Services - - border of this text- box and then press

- the DELETE key.- - - -

Supplies (off and operation) - - A long term forecast is not a necessary part of a basic business plan. However, it is an excellent tool to help you-

- - - - -

Repairs/ Maintenance - - open up your thinking

- about the company's

- future. Furthermore,

- venture capitalists

- will almost

- always want a -

long term forecast to get a feel for growth prospects.

Advertising - - - forecast, the less- accuracy you can- maintain, so use round

The further out you - - where you know

numbers, except -

Car, Delivery and Travel - - exact amounts; e.g.:

- rent expense if-you have a long term - lease. - - -

The most important part of the long term forecast is not the numbers themselves, but the assumptions underlying

Accounting and Legal - - the numbers. So make sure your assumptions are stated clearly and in detail in a narrative attachment. This will-

- - - - -

Rent - - communicate your - vision of the company's

- future and how

- you anticipate -realizing that vision. - -

You will note that there are some lines on the bottom of this spreadsheet which were not on the twelve-month P &

Telephone - - - -

L. This is to help you do some planning about funding growth:- - - -

Utilities - - - NET PROFIT BEFORE

- TAX is the-same as Net Profit- on the 12-month Profit - and Loss spreadsheet.

- -

- INCOME TAX allows you to estimate how much of your profit will have to go to the IRS.

Insurance - - - NET PROFIT AFTER- TAX is what -is left for you to use.

- - - -

Taxes (real estate etc.) - - - OWNER DRAW/ - DIVIDENDS is how - much the owners - plan to take out for

- themselves. - -

- ADJUSTMENT TO RETAINED EARNINGS is the amount of profit actually left in the business to increase

Interest - - -

Owners' Equity and fund growth. - - - - -

Depreciation - - - - - - - -

Other expense (specify) - - - - - - - -

Other expense (specify) - - - - - - - -

Total Expenses $ - - $ - - $ - - $ - -

Net Profit Before Tax - - - -

Income Taxes - - - -

Net Profit After Tax - - - -

Owner Draw/ Dividends - - - -

Adj. to Retained Earnings $ - $ - $ - $ -

You might also like

- FULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF EbookDocument41 pagesFULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF Ebookkathy.galayda516100% (40)

- Your CFO Guy - 7 Chart TemplatesDocument6 pagesYour CFO Guy - 7 Chart TemplatesOaga GutierrezNo ratings yet

- Case Study of HY DiariesDocument4 pagesCase Study of HY DiariesDba Dba100% (1)

- Footwear Wholesaling in Australia Industry ReportDocument31 pagesFootwear Wholesaling in Australia Industry ReportBakar ChNo ratings yet

- Clara's Hardware Store Sample Business PlanDocument22 pagesClara's Hardware Store Sample Business PlanPalo Alto Software84% (19)

- Four Year Profit ProjectionDocument1 pageFour Year Profit Projectiondamir101No ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit ProjectionDebbieNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit Projectionbaderf75No ratings yet

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereNadia.ishaqNo ratings yet

- Financial TemplateDocument6 pagesFinancial TemplateLiyin LeeNo ratings yet

- Dupoint AnalysisDocument14 pagesDupoint AnalysisRahul MalikNo ratings yet

- Financial History and RatiosDocument1 pageFinancial History and RatiosRosana Alves LaudelinoNo ratings yet

- Company Financial History and RatiosDocument1 pageCompany Financial History and Ratiospradhan13No ratings yet

- Investment Banking ExcelDocument28 pagesInvestment Banking ExcelJohn ChiwaiNo ratings yet

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereJeffrey BahnsenNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Mukhlish AkhatarNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Omotola Olukayode OsineyeNo ratings yet

- Azurea Spa - Bohol Yearly Budget TemplateDocument2 pagesAzurea Spa - Bohol Yearly Budget TemplateAzurea SpaNo ratings yet

- Balance Sheet (Projected) : Enter Your Company Name HereDocument1 pageBalance Sheet (Projected) : Enter Your Company Name Hereshahana salimNo ratings yet

- Data Analysis - ModellingDocument4 pagesData Analysis - ModellinganissamarissaaNo ratings yet

- (Lengkap) Templete Laporan Keuangan UMKMDocument59 pages(Lengkap) Templete Laporan Keuangan UMKMHardi alifinNo ratings yet

- Budgeting and Forecasting: and The Impact On ProfitabilityDocument33 pagesBudgeting and Forecasting: and The Impact On ProfitabilityHassan AzizNo ratings yet

- ME13Document4 pagesME13Joana Marie SajolNo ratings yet

- 1 Blank Model TemplateDocument28 pages1 Blank Model TemplateMasroor KhanNo ratings yet

- Template For Financial ProjectionDocument32 pagesTemplate For Financial ProjectionRussel Jess HeyranaNo ratings yet

- PT 1Document5 pagesPT 1Loraine SegumalianNo ratings yet

- 353147462-Ex Cel-Constr Uction-Pr Oject-Manag Ement-Tem Plates-Constr Uction-Bud Get-Temp LateDocument2 pages353147462-Ex Cel-Constr Uction-Pr Oject-Manag Ement-Tem Plates-Constr Uction-Bud Get-Temp LateBob RenauxNo ratings yet

- High Level Building Blocks - DrawioDocument1 pageHigh Level Building Blocks - DrawioSumanta DuttaNo ratings yet

- 1699611082master Web Ad - TV 14112023Document11 pages1699611082master Web Ad - TV 14112023javedNo ratings yet

- Profit and Loss ProjectionDocument3 pagesProfit and Loss ProjectionDokumen SayaNo ratings yet

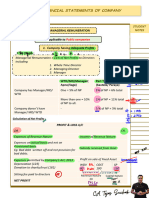

- Financial Statement of Company Plus Class NotesDocument10 pagesFinancial Statement of Company Plus Class NotesAlex FernandoNo ratings yet

- 3-Year Profit and Loss Projection: Merca OnlineDocument3 pages3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoNo ratings yet

- Calavie AnswerDocument3 pagesCalavie AnswerKunalNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Marco Antônio Rodrigues SilvaNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Fred CastroNo ratings yet

- Three-Year Profit ProjectionsDocument1 pageThree-Year Profit Projectionssurya277No ratings yet

- Rubric Sa Pag UulatDocument1 pageRubric Sa Pag UulatGabrielle AlonzoNo ratings yet

- IT Budget Template ExcelDocument6 pagesIT Budget Template ExcelJosé Manuel Montero OrtegaNo ratings yet

- Balance Sheet (Projected) : Enter Your Company Name HereDocument1 pageBalance Sheet (Projected) : Enter Your Company Name HereMUHAMMAD -No ratings yet

- Template Budget and Cash FlowDocument6 pagesTemplate Budget and Cash FlowlliombajnrNo ratings yet

- Igloa - Costs SpeasioDocument1 pageIgloa - Costs SpeasioSteve MedhurstNo ratings yet

- Full Case Study - WeWorkDocument16 pagesFull Case Study - WeWorkVanshika SharmaNo ratings yet

- Mandhana Industries LTD.: Sales & Distribution User ManualDocument9 pagesMandhana Industries LTD.: Sales & Distribution User ManualMukeshila2010No ratings yet

- Traf Presentation India WebcastDocument48 pagesTraf Presentation India WebcastSwastik GroverNo ratings yet

- Financial PlanningDocument27 pagesFinancial PlanningMani ManandharNo ratings yet

- Firms With Negative EarningsDocument10 pagesFirms With Negative Earningsakhil reddy kalvaNo ratings yet

- Basic Financial Package Template (With COGS)Document47 pagesBasic Financial Package Template (With COGS)Rukundo PatrickNo ratings yet

- Breakeven and Profit-Volume-Cost AnalysisDocument4 pagesBreakeven and Profit-Volume-Cost AnalysisNu SNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Carlos CoutoNo ratings yet

- NB Vendor Questionnaire v2.4Document10 pagesNB Vendor Questionnaire v2.4serpentor83No ratings yet

- Bombay Rayon Fashions Ltd. (BRFL) : Report Generated On: 6th September 2013 Score Card As of 6th September 2013Document1 pageBombay Rayon Fashions Ltd. (BRFL) : Report Generated On: 6th September 2013 Score Card As of 6th September 2013Vijayalaxmi GaddaleNo ratings yet

- WhizdmDocument99 pagesWhizdmVikas ShahNo ratings yet

- IC Project Management Project Charter 8556Document7 pagesIC Project Management Project Charter 8556Anh Thi Nguyễn ThịNo ratings yet

- First Accomplishment ProjectionsDocument26 pagesFirst Accomplishment Projectionsmoses kisakyeNo ratings yet

- Start Up Costs CalculatorDocument5 pagesStart Up Costs CalculatorSmita KumarNo ratings yet

- Sample Expense ReportDocument1 pageSample Expense Reportmharaynel.afableNo ratings yet

- Format Quotation ServiceDocument7 pagesFormat Quotation ServiceazizalloginNo ratings yet

- Six Sigma Project Charter TemplateDocument7 pagesSix Sigma Project Charter TemplateBhuvan B.SNo ratings yet

- SCORE Annual Marketing Budget TemplateDocument1 pageSCORE Annual Marketing Budget TemplateShrinesh PoudelNo ratings yet

- SCORE Annual Marketing Budget TemplateDocument1 pageSCORE Annual Marketing Budget TemplateFadiNo ratings yet

- SCORE Annual Marketing Budget TemplateDocument1 pageSCORE Annual Marketing Budget TemplatePrincess AarthiNo ratings yet

- SCORE Annual Marketing Budget TemplateDocument1 pageSCORE Annual Marketing Budget TemplateRobiul AlamNo ratings yet

- Uncover the Secrets of SAP Sales and DistributionFrom EverandUncover the Secrets of SAP Sales and DistributionRating: 4 out of 5 stars4/5 (1)

- #1 House Rules: Duck!Document3 pages#1 House Rules: Duck!Misscreant EveNo ratings yet

- Reef Octopus BH-100T Hangon Back SkimmerDocument3 pagesReef Octopus BH-100T Hangon Back SkimmerMisscreant EveNo ratings yet

- Liquid AssetsDocument46 pagesLiquid AssetsMisscreant EveNo ratings yet

- Income Statement (3/31/89) IncomeDocument8 pagesIncome Statement (3/31/89) IncomeMisscreant EveNo ratings yet

- Lineage Hunters Quest 004-1Document5 pagesLineage Hunters Quest 004-1Misscreant EveNo ratings yet

- Quests in Lineage 2 ClassicDocument22 pagesQuests in Lineage 2 ClassicMisscreant EveNo ratings yet

- Section 1: General Membership GuidelinesDocument4 pagesSection 1: General Membership GuidelinesMisscreant EveNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementMisscreant EveNo ratings yet

- Twelve Month Sales ForecastDocument1 pageTwelve Month Sales ForecastMisscreant EveNo ratings yet

- Business Plan Outline: I. Cover PageDocument3 pagesBusiness Plan Outline: I. Cover PageMisscreant EveNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereMisscreant EveNo ratings yet

- PRODUCT DEVELOPMENT (And Some Other Marketing Stuff... )Document3 pagesPRODUCT DEVELOPMENT (And Some Other Marketing Stuff... )Misscreant Eve100% (1)

- Health Insurance 2018 - 4Document1 pageHealth Insurance 2018 - 4Mark ClayborneNo ratings yet

- Textile Business PlanDocument3 pagesTextile Business PlanJoshua Anim100% (2)

- Cost of CapitalDocument3 pagesCost of CapitalJohn Marthin ReformaNo ratings yet

- News Release 2 Araw NG KasambahayDocument1 pageNews Release 2 Araw NG KasambahayjulyenfortunatoNo ratings yet

- Unit 2 - Economic EnvironmentDocument50 pagesUnit 2 - Economic EnvironmentVaibhav AggarwalNo ratings yet

- Brand Trust, Customer SatisfacDocument21 pagesBrand Trust, Customer SatisfacJar JarNo ratings yet

- 10 Chapter 2Document46 pages10 Chapter 2Prasanth TPNo ratings yet

- Assessing Impact of Performance Determinants in Complex MTOETO Supply Chains - Barbosa Et Al 2019Document22 pagesAssessing Impact of Performance Determinants in Complex MTOETO Supply Chains - Barbosa Et Al 2019NINAN THERADAPUZHA MATHEWNo ratings yet

- Country NotebookDocument21 pagesCountry NotebookNicolás VilladiegoNo ratings yet

- Rithanya-Consumer Awareness-ProjectDocument19 pagesRithanya-Consumer Awareness-ProjecthfjnffefeNo ratings yet

- BDO International Tax Webinar Slides BEPSDocument42 pagesBDO International Tax Webinar Slides BEPSSergio VinsennauNo ratings yet

- Geico Corp 1995 Annual Report 10-KDocument85 pagesGeico Corp 1995 Annual Report 10-KansssNo ratings yet

- 5Document2 pages5noneofyourbusinessNo ratings yet

- 365 CFA Level 1: Formula SheetDocument25 pages365 CFA Level 1: Formula SheetsudhiNo ratings yet

- UPSC Mains Syllabus NewDocument4 pagesUPSC Mains Syllabus NewBunny SreevaramNo ratings yet

- MBA Notes On Brand Management, Moving The Brand DownDocument6 pagesMBA Notes On Brand Management, Moving The Brand DownCatherine MalenyaNo ratings yet

- 2023 Accounting Learners Notes Session 1-8Document215 pages2023 Accounting Learners Notes Session 1-8Nomfundo ShabalalaNo ratings yet

- Lesson 1Document33 pagesLesson 1Cher NaNo ratings yet

- Chapter 1 (Basic Economic Ideas and Resource Allocation)Document14 pagesChapter 1 (Basic Economic Ideas and Resource Allocation)ShaharyarNo ratings yet

- 06 - ASM Shodh Chintan 2015Document234 pages06 - ASM Shodh Chintan 2015Dr. Rajeev Kr. SinghNo ratings yet

- Quotation For NCL VEKA On 19.11.2020 - ALICIADocument3 pagesQuotation For NCL VEKA On 19.11.2020 - ALICIAsathishNo ratings yet

- Dayalbagh Educational Institute: Lecture 12:unit 3 Career Planning and Employee Retention StrategiesDocument38 pagesDayalbagh Educational Institute: Lecture 12:unit 3 Career Planning and Employee Retention StrategiesnancyagarwalNo ratings yet

- Financial Management in MSMEs in IndiaDocument15 pagesFinancial Management in MSMEs in IndiaSürÿã PrakashNo ratings yet

- Ch07 ShowDocument57 pagesCh07 ShowBagus ZijlstraNo ratings yet

- Antibiotic Resistance Is A Tragedy of CommonsDocument5 pagesAntibiotic Resistance Is A Tragedy of CommonsLeonardo SimonciniNo ratings yet

- Pfin5 5th Edition Billingsley Solutions ManualDocument25 pagesPfin5 5th Edition Billingsley Solutions ManualSarahSweeneyjpox100% (54)

- Blue Ocean Strategy at HenkelDocument20 pagesBlue Ocean Strategy at HenkelGinanjarSaputraNo ratings yet