Professional Documents

Culture Documents

Ican Advance Taxation Week 10 Questions Topic: Petroleum Profit Tax

Ican Advance Taxation Week 10 Questions Topic: Petroleum Profit Tax

Uploaded by

Adebayo Yusuff AdesholaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ican Advance Taxation Week 10 Questions Topic: Petroleum Profit Tax

Ican Advance Taxation Week 10 Questions Topic: Petroleum Profit Tax

Uploaded by

Adebayo Yusuff AdesholaCopyright:

Available Formats

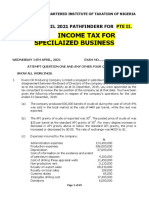

ICAN ADVANCE TAXATION

WEEK 10 QUESTIONS

TOPIC: PETROLEUM PROFIT TAX

Kindly go through chapter 14 in the video lecture before you attempt the questions

because the topic have been simplified and analyzed for easy understanding.

REVIEW QUESTIONS

QUESTION 1

a. Briefly discuss the following:

i. Exploration Well

ii. Appraisal Well

iii. Investment Tax Credit

iv. Petroleum Investment Allowance

b. Outline four legislations that regulate the activities in the Oil and Gas Industry in Nigeria.

QUESTION 2

In computing the adjusted profit of a business engaged in petroleum operation, depreciation is disallowed as a charge against

income. The second schedule of PPTAct sets out the classes of qualifying expenditure and rates of capital allowance.

(a) Explain the term “Qualifying Expenditure and list Five (5) types of qualifying expenditure specified in PPT Act.

(b) What are the conditions that must be met before capital allowances are granted for qualifying expenditure?

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 1

(c) Describe two types of capital allowances.

QUESTION 3

In relation to Petroleum Profit Tax, list:

(a) (i) Five (5) expenses allowable for the purpose of calculating Petroleum Profit Tax.

(ii) Five (5) expenses not allowable for the purpose of calculating Petroleum Profit Tax.

(b) Describe four (4) main activities carried out in the upstream sector of the Nigerian

Oil & Gas Industry.

QUESTION 4

Ado Petroleum Co. Ltd, a company in JV with NNPC since 2000 and operating offshore at water depth of 90m, incurred the

following qualifying capital expenditure for the year ended 31st December 2015:-

i. Plant Expenditure N10,500,000

ii. Pipeline and Storage N15,750,000

iii. Tangible Drilling Costs N27,450,000

Tax written down value of qualifying capital expenditure at 1st January, 2015 amounted to N6,800,000 for plant expenditure and

N10, 400,000 for Tangible drilling costs.

You are required to compute

i. Petroleum Investment Allowances

ii. Annual Allowances.

QUESTION 5

a. Distinguish between Estimates and Final Petroleum Tax Returns.

b. Molad Petroleum Development Co. Ltd submitted it 1st estimate to FIRS for 2008 on 27th February 2008 with tax

payable of N60m. In July 2008, it submitted its 2nd estimate with tax payable of N84m. In November 2008, it also

submitted a 3rd estimate with tax payable of N90m.

You are required to:

i. Indicate the due dates for payment of the monthly instalments payable.

ii. Compute the monthly instalments payable.

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 2

iii. If the final returns showed tax payable of N113.65m, Determine the 13th instalment payable.

QUESTION 6:

(a) Define the following terms in respect to petroleum operations.

(i) Fee

(ii) Rent

(iii) Royalty

(b) ABC Ltd is a Petroleum Company. During the year ended 31st December, 2010, the company produced 40million barrels of

crude oil out of which 12 million barrels were either cost or used or returned. The posted price of crude oil of gravity

320 was N51, and the agreed adjustment was N1.00 for every 10if the gravity at the point of production was 280 and

the rate of royalty is 20%.

Required:

Compute the amount of royalty payable by the company in that accounting period.

QUESTION 7

Oriade Petroleum Nigeria Ltd has the following information in its books as at 31st December 2013.

Quantity of crude oil exported is 5,000,000 barrels.

N N

Selling Price 1,975

Adjusted Price Per Barrel 23.16

Administrative Expenses 6,100,000

Production Expenditure 2,300,000

Customs Duties:

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 3

- Company’s Assets 80,000

- Employee’s Goods 30,000 110,000

Royalties - Export 2,500,000

- Local 500,000 3,000,000

Intangible Dwelling Cost 10,000,000

Other Income Incidental to Petroleum Operation 151,500

Capital Allowances (Agreed) 24,000,000

Losses Brought Forward 8,000,000

Required:

(a) Compute the fiscal value of chargeable oil.

(b) Calculate the chargeable tax.

QUESTION 8

Tom Johnsons Petroleum Nig. Ltd. makes up its account to 31st December every year.

The following details were extracted from its records for the year ended 31December, 2011.

N’000

Cost of exploration and production 29,600

Cost of transportation 2,600

Cost of refined products 17,400

Sales of crude oil 62,400

Sales of DPK 6,200

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 4

Sales of AGO 5,800

Sales of PMS 12,400

Incidental income 3,400

Non-productive rent 1,400

Royalties 3,000

Customs duties 800

Management and admin expenses 12,000

Capital allowances 6,400

Petroleum investment allowance 3,600

MOU credit 3,000

You are required to ascertain the tax liability payable.

Note that 1/3 of the incidental income, management expenses and capital allowances is attributable to downstream operation.

QUESTION 9

(a) With respect to Petroleum Profits Tax Cap P13 LFN 2004, explain briefly:

(i) G-Factor

(ii) Chargeable oil

(iii) Chargeable Natural Gas

(iv) Posted Price

(b)Sadery Petroleum Limited presented the following report for the year ended 31 December 2007

N‟000 N‟000

Net fiscal value of sales 124,315

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 5

Sundry income 14,352 138,667

Less:

Operating expenses 52,305

Intangible drilling cost 44,765

Royalties 12,750

Custom duties 975

Rentals 1,352 (112,147)

Net profit 26,520

It is also given that:

(i) The Company is entitled to an Investment Tax Credit of N230,000.

(ii) Capital allowance for the year is N23,564,000.

(iii)Balancing charge available is N200,000.

(iv) Memorandum of Understanding credits is N1,000,000.

You are required to compute the Chargeable Tax.

QUESTION 10

Endurance Petroleum Nigeria Limited has been in the Oil business for several years. There was however, a dispute between the

Company’s Management and its External Auditors/ Tax Consultants on fees-related issues.

You have just received a letter from the Company Secretary of Endurance Petroleum Nigeria Limited, stating the Board’s resolution

appointing you as the Tax Consultant to the Company.

The following details were extracted from the Financial Records of the Company for the Accounting Year Ended 31 December,

2012.

N’000

Custom Duties on essentials 3,125

Capital allowances 30,000

Fines for contravening traffic rules 350

Unabsorbed concession rental (Non-Productive rent) 1,500

Royalties on sales in Nigeria for local refining purposes 300

OPL and OML Rents and Royalties on export 13,500

Surveys preparatory to drilling 2,500

Loan interest (Parent Company) 2,750

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 6

Depreciation 12,000

Intangible drilling expenditure 10,000

Production and administrative expenses 15,000

Miscellaneous Income 200

Sales of Crude Oil and Gas within Nigeria 5,000

Chargeable Oil exported 107,500

You are required to advise the Company on the Total Tax Liabilities for the relevant Year of Assessment.

QUESTION 11

The Independent Auditors to Jisosi Petroleum Limited submitted the draft Audited, Financial Statements for the year ended 31

December 2013 for management’s discussion. The executive summary revealed total revenue of N286,650,000 and Profit before

Taxation of N82,642,000.

In order to arrive at the proposed Dividend for the consideration of the Board, there is the need to determine the total tax liabilities

for the year. The draft Statement of Profit or Loss has the following items among others:

N

Royalty on Crude Oil sold 13,500,000

Cost of Well drilling 25,000,000

Custom duties 500,000

Clearing of oil spillage 7,500,000

Depreciation 32,000,000

Donations 4,500,000

Community relations expenses 10,000,000

Transportation expenses for 2012 8,500,000

The revenue for the Year Ended 31 December 2013, includes: N

Profit on Property, Plant and Equipment sold 48,000

Income from transportation of crude oil 16,894,000

The officials of Federal Inland Revenue Service and the Company agreed as follows:

N

Annual Allowances on exploration 25,500,000

Balancing Charge on exploration 242,000

Capital Allowances on exploration b/f 11,000,000

Petroleum Investment Allowance 18,500,000

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 7

Capitalised Intangible Drilling cost 14,000,000

Losses b/f 10,000,000

Capital Allowances on transportation 750,000

You are required to: Determine the Total Tax Liabilities of the Company for the consideration of the Directors, with a view to

taking a decision on the Proposed Dividend.

QUESTION 12

The Federal Government of Nigeria is encouraging Nigerians in diaspora to return home and invest in the economy in order to

create jobs.

In response to the patriotic call, NNEOCHI OK Ltd was incorporated to engage in Petroleum operations.

The company operates a joint venture with NNPC.

The Chief Executive of the company is uncertain as to which tax statute regulates companies engaged in Upstream Petroleum

Operations. He was also confused when the issue of Basis of Assessment and what constitutes the profit of an accounting period

including treatment of losses were raised at one of the heated Board meetings of the company. He is desirous of updating his

knowledge in these areas.

The Company commenced its operation immediately after incorporation, it bidded for and was granted Oil Mining Lease (OML) by

the Federal government. After some years of prospecting, the company successfully struck oil and its first year of production data

are given below:

The following information is provided for the year ended 31 December 2012

N’ 000

Direct lifting costs 70,000

Direct handling/transportation costs 40,000

Other direct production costs 20,000

Field overheads 30,000

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 8

Environmental protection 11,000

Safety 7,000

Personnel amenities 14,000

Materials handling and storage expenses 19,000

Other general and administrative expenses 9,000

Exploration costs 36,000

First two Appraisal Well costs 26,000

Intangible drilling and development costs 60,000

Capital allowances 98,000

Fees received for services ancillary to petroleum operations 22,000

Production of crude oil for the year - 44,000,000 barrels

You are required to:

As Tax Consultant, state briefly the points to be raised in a Tax Advisory Memorandum addressed to the Chief Executive of the

company by providing a clearer understanding of the issues raised above, using the following as a guide in analysing the data.

a. Computation of the Operating Cost per barrel (T1)

b. Computation of the Capital Investment Costs (T2)

c. The tax statutes regulating the Upstream and Downstream operations

d. The Basis Year applicable to the Upstream operations

e. The components of profit of an accounting period for Upstream operations

f. The treatment of losses in Upstream operations

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 9

QUESTION 13

From the audited data regarding period ending 31st December, 2010 below, you are required to prepare the tax liability of Muniru

Petroleum Limited, which also operates two oil tankers for transportation of crude oil from the Nigeria port of export.

Income :- N

Proceeds of Chargeable Oil: - 4.4 million barrels (Export) 237,600,000

- Local Sales 21,800,000

Freight for Transportation of Crude Oil 15,000,000

Value of natural Gas Sold 33,745,000

Other Oil related income 1,127,400

Expenses:- Salaries & Wages 12,496,020

Rent on Staff Accommodation 9,674,046

Compensation to host communities 920,500

Royalties on Export Crude 8,674,076

Royalties on Local Sale of Crude Oil 1,674,926

Royalties on Local Disposal of Natural Gas 4,375,000

Interest on loan from parent company 1,645,920

Bad debts written off 849,750

Depreciation 13,849, 200

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 10

Exploration & Drilling Costs:

1st Appraisal Well 3,749,250

2nd Appraisal Well 1,160,494

3rd Appraisal Well 3,849,250 8,758,994

Contribution to Pension Fund 3,074 920

Custom Duties on Essentials 1,579,250

Administration Expenses 13,949,920

The summary of qualifying expenditure incurred is as follows:

Location N Year

On shore operations 4,279,200 2003

Territorial waters within 100 meters of water depth 3,564,500 2005

Off shore between 100 & 200 meters depth 3,564,500 2005

Off shore beyond 200 meters water depth 4,928,750 2005

Assume that one quarter of administration expenses and qualifying expenditure for on shore operations relate to the transportation of

crude oil by Ocean – going Vessel and that the rate of Petroleum Profit Tax is 85% .

STARRY GOLD ACADEMY +2348023428420, +2347038174484, info@starrygoldacademy.com , www.starrygoldacademy.com Page 11

You might also like

- Consulting Math Drills Full Cases v6.2 PDFDocument111 pagesConsulting Math Drills Full Cases v6.2 PDFwind kkun100% (2)

- PRTC Practial Accounting 1Document56 pagesPRTC Practial Accounting 1Pam G.71% (21)

- Contracts and Consumer Law Assignment - 160207 1Document31 pagesContracts and Consumer Law Assignment - 160207 1kamranNo ratings yet

- Tax Question Bank 2020Document37 pagesTax Question Bank 2020Tawanda Tatenda HerbertNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Financial AccountingDocument6 pagesFinancial AccountingFernando Alcantara100% (1)

- Recto LawDocument23 pagesRecto Lawjelviee15No ratings yet

- Online Quiz 3 Duration Q&ADocument3 pagesOnline Quiz 3 Duration Q&AjonNo ratings yet

- This Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationDocument8 pagesThis Study Resource Was: Midterm-Final Exam Aec 215 - Business TaxationGray JavierNo ratings yet

- Caloocan City Citizens CharterDocument241 pagesCaloocan City Citizens CharterAngelito Dela CruzNo ratings yet

- April 2021 Pathfinder For PTE 2 LevelDocument65 pagesApril 2021 Pathfinder For PTE 2 LevelAdedotun OmonijoNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Question OnDocument3 pagesQuestion OndemolaojaomoNo ratings yet

- IT AY 2022-23 Probs On PGBPDocument15 pagesIT AY 2022-23 Probs On PGBPmojesnandas9935No ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Caribbean Holding LTD Is A Manufacturer of Cricket Balls CALCULATION QUESTIONDocument3 pagesCaribbean Holding LTD Is A Manufacturer of Cricket Balls CALCULATION QUESTIONJoiAntoineNo ratings yet

- Tax Sept2002Document10 pagesTax Sept2002Insan KerdilNo ratings yet

- Ch.6-Tutorial 1Document3 pagesCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)No ratings yet

- Hba 2302 Advanced TaxationDocument4 pagesHba 2302 Advanced TaxationprescoviaNo ratings yet

- April 2020 PTE 2 PathfinderDocument54 pagesApril 2020 PTE 2 PathfinderBadmus AyomideNo ratings yet

- c4 Grande Finale Solving 2023 Nov (Set 1)Document7 pagesc4 Grande Finale Solving 2023 Nov (Set 1)charlesmicky82No ratings yet

- This Question Paper Is Printed On BOTH SIDES. This Question Paper Contains 5 Questions and 9 PagesDocument9 pagesThis Question Paper Is Printed On BOTH SIDES. This Question Paper Contains 5 Questions and 9 PagesDjameel ZubairNo ratings yet

- CUAC 408 Group Assignment 1 2021Document6 pagesCUAC 408 Group Assignment 1 2021Blessed Nyama100% (1)

- Mid Term Examination Xii Eco 2022-23Document4 pagesMid Term Examination Xii Eco 2022-23sgouryaNo ratings yet

- Nov 2016 Ques & Answes Taxation-&-Fiscalpolicy-3.4 Nov 2016Document16 pagesNov 2016 Ques & Answes Taxation-&-Fiscalpolicy-3.4 Nov 2016Timore FrancisNo ratings yet

- Financial Accounting 19 PDF FreeDocument6 pagesFinancial Accounting 19 PDF FreeLyka Kristine Jane PacardoNo ratings yet

- Advanced Taxation Practice Question QuestionDocument8 pagesAdvanced Taxation Practice Question QuestionDanisa NdhlovuNo ratings yet

- Advanced Taxation QuestionsDocument7 pagesAdvanced Taxation QuestionsObeng CliffNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Taxation: Maicsa - Icsa International Qualifying Scheme (Iqs)Document25 pagesTaxation: Maicsa - Icsa International Qualifying Scheme (Iqs)diviananaslinNo ratings yet

- download (15)Document11 pagesdownload (15)John KitwikaNo ratings yet

- MABALAZADocument4 pagesMABALAZAMahasa R HajiiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- December 2010 TC10BQDocument11 pagesDecember 2010 TC10BQkalowekamoNo ratings yet

- BFC 3225 Intermediate Accounting I 2 - 2Document6 pagesBFC 3225 Intermediate Accounting I 2 - 2karashinokov siwoNo ratings yet

- PDFDocument6 pagesPDFjoshua yakubuNo ratings yet

- 2016, August QnsDocument5 pages2016, August QnsTimore FrancisNo ratings yet

- Maf5101 Fa CatDocument10 pagesMaf5101 Fa Catahimbisibwe lamedNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- First Semester M.B.A. Degree Examination, March 2020 Course - 3: Accounting For ManagersDocument7 pagesFirst Semester M.B.A. Degree Examination, March 2020 Course - 3: Accounting For ManagersChaithanya ChaithuNo ratings yet

- Befa Grand Test 2022Document2 pagesBefa Grand Test 2022cyberdrip1No ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Taxation - I: (Please Turn Over)Document3 pagesTaxation - I: (Please Turn Over)Laskar REAZ100% (1)

- ACC311 July 2017Document4 pagesACC311 July 2017Sunday NgbokiNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Natural Resource TaxationDocument14 pagesNatural Resource TaxationOWUSU BOATENGNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- New Business-Studies-Paper-2-Revision-BookletDocument108 pagesNew Business-Studies-Paper-2-Revision-BookletRogue12layeNo ratings yet

- Advanced Accounting 2eDocument3 pagesAdvanced Accounting 2eHarusiNo ratings yet

- Business Taxation Week 2 TutorialDocument6 pagesBusiness Taxation Week 2 Tutorialflipflip9000No ratings yet

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Document3 pages2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- CFAP 5 ATAX Winter 2021Document6 pagesCFAP 5 ATAX Winter 2021Mahendar BhojwaniNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesAllyzzaBuhain100% (1)

- M.B.A (2013 Pattern)Document110 pagesM.B.A (2013 Pattern)Niharika MehtreNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- 5010 Ohada Fin Reporting p2Document12 pages5010 Ohada Fin Reporting p2serge folegweNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Problems On Profits and Gains of Business and ProfessionDocument11 pagesProblems On Profits and Gains of Business and ProfessionNikithaNo ratings yet

- Synthesis - AudProb (Q)Document8 pagesSynthesis - AudProb (Q)Anna Gian SobrevillaNo ratings yet

- Case Study 2023 Set 2Document12 pagesCase Study 2023 Set 2Bosz icon DyliteNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- ABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiDocument12 pagesABRAHAM ADESANYA POLYTECHNI2 Mr. OlabamijiRasheed Onabanjo DamilolaNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Champion Breweries Plc. Financial Statements 2019Document56 pagesChampion Breweries Plc. Financial Statements 2019Adebayo Yusuff Adeshola100% (1)

- Chapter 4 Solutions: A) Explain The FollowingDocument23 pagesChapter 4 Solutions: A) Explain The FollowingAdebayo Yusuff AdesholaNo ratings yet

- GNS 312 Complete QuestionDocument164 pagesGNS 312 Complete QuestionAdebayo Yusuff AdesholaNo ratings yet

- Research Methods Nature of ResearchDocument4 pagesResearch Methods Nature of ResearchAdebayo Yusuff AdesholaNo ratings yet

- Finance Act 2020:: Key Changes and ImplicationsDocument5 pagesFinance Act 2020:: Key Changes and ImplicationsAdebayo Yusuff AdesholaNo ratings yet

- Power QuizDocument2 pagesPower QuizmonicajaymieNo ratings yet

- Barclays PDD Pinduoduo Inc. - Shedding Some Light On The Black BoxDocument11 pagesBarclays PDD Pinduoduo Inc. - Shedding Some Light On The Black Boxoldman lokNo ratings yet

- Implementing Corporate Strategy: Managing The Multi Business FirmDocument15 pagesImplementing Corporate Strategy: Managing The Multi Business FirmArjay MolinaNo ratings yet

- ) Under The Correct Heading To Show Whether The Item: For Examiner's UseDocument13 pages) Under The Correct Heading To Show Whether The Item: For Examiner's UseAung Zaw HtweNo ratings yet

- Unit 3 Company IntroductionDocument6 pagesUnit 3 Company IntroductionZaya SapkotaNo ratings yet

- Invoice 3066535 EYI1839894 qjl5xzDocument1 pageInvoice 3066535 EYI1839894 qjl5xzKARTHIKEYAN NATARAJANNo ratings yet

- LC Financial Report & Google Drive Link: Aiesec Delhi IitDocument6 pagesLC Financial Report & Google Drive Link: Aiesec Delhi IitCIM_DelhiIITNo ratings yet

- Production and Operations Management - Session 08-09Document56 pagesProduction and Operations Management - Session 08-09Manik KapoorNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- Construction Economics & Finance: B.E. (Civil Engineering) Eighth Semester (C.B.S.)Document2 pagesConstruction Economics & Finance: B.E. (Civil Engineering) Eighth Semester (C.B.S.)Adesh DeshbhratarNo ratings yet

- The Rationale of New Economic Policy 1991Document3 pagesThe Rationale of New Economic Policy 1991Neeraj Agarwal50% (2)

- ABM MODULE D OliveboardDocument114 pagesABM MODULE D OliveboardASHUTOSHNo ratings yet

- TESCO Share Fundamentals (TSCO) - London Stock ExchangeDocument5 pagesTESCO Share Fundamentals (TSCO) - London Stock ExchangeinuNo ratings yet

- Mas Notes Reviewer PDFDocument91 pagesMas Notes Reviewer PDFstudentoneNo ratings yet

- Radisson Hospitality Ab Annual Report 2019Document74 pagesRadisson Hospitality Ab Annual Report 2019Priya YadavNo ratings yet

- EGIS Retairment Slab PDFDocument32 pagesEGIS Retairment Slab PDFVISHALNo ratings yet

- Warren Buffet BiographyDocument8 pagesWarren Buffet BiographyMark allenNo ratings yet

- List OSS Notes For GST - V2 - 1 Mar17Document3 pagesList OSS Notes For GST - V2 - 1 Mar17Vishal YadavNo ratings yet

- Buy Back of SharesDocument17 pagesBuy Back of SharesTayyeb RangwalaNo ratings yet

- No - Claim - Indemnity - CSR - SBSVA - WFDocument1 pageNo - Claim - Indemnity - CSR - SBSVA - WFVenu Gopal Reddy GadeNo ratings yet

- Overview of Investment BankingDocument3 pagesOverview of Investment BankingSamin SakibNo ratings yet

- Becoming An AstrologerDocument8 pagesBecoming An AstrologerNill SalunkeNo ratings yet

- Baby PipsDocument109 pagesBaby PipsMonty001100% (2)

- Revolving Credit Facility AgreementDocument52 pagesRevolving Credit Facility AgreementKnowledge Guru100% (1)