Professional Documents

Culture Documents

104 E&c Tae 5

104 E&c Tae 5

Uploaded by

Kaustubh0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

104 E&C TAE 5-Converted

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 page104 E&c Tae 5

104 E&c Tae 5

Uploaded by

KaustubhCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

G.H.RAISONI COLLEGE OF ENGINEERING & MANAGEMENT , WAGHOLI (PUNE).

(An Autonomous Institute Affiliated to Savitribai Phule Pune University)

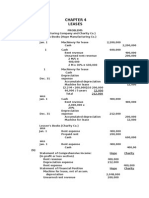

TOPIC :-Valuation

TAE :- 5

➢Factors Affecting Value of a ➢Method of Valuation

➢Terminology Building 1. Direct Comparisons of the capital value

Valuation is the technique of 11.3.1. Incomes: 2. Valuation based on the profit

1. Type of the building

determination of fair price of a property a) Gross income: Total income from all 3. Valuation based on the cost

2. Location

such as land, sources. 4. Development method of Valuation

3. Building structure and durability

building, factory or other structures. b) Outgoings: these are the expenses 5. Depreciation method of Valuation

4. The quality of materials used in the

Valuation determines present value of the which are required to be incurred to construction

property maintain the property. These includes: 5. Size of the building

for sale or renting purpose. Taxes, periodic repairs, management and

collection charges, sinking fund, and loss ➢Sinking fund

➢Purpose of the Valuation of rent (for the period when the property It is an amount which has to set aside at

The main purposes of valuation are as is not occupied). fixed intervals of time (say annually)

follows: c) Net income: The amount left after out of the gross income so that at the

• Sale or Purchase of a property deducting all outgoings from the gross end of the useful life of the building or

•To fix up the municipal taxes, wealth tax income. the property, the fund accumulated

and estate duty on a property d) Net income = gross income- should be equal to the initial cost of the

• To fix up the gift tax payable to the govt outgoings. property

when the property is gifted to somebody e) Perpetual income: It is the income .

else. receivable for indefinite period of time. ➢Depreciation

• To probate, i.e. to prove before a court f) Deferred Income: it is the income It is the loss in value of a building or

that the written paper purporting to be the receivable after a lapse of certain period. property due to structural deterioration,

will of a person who has died is indeed his

wear and

lawful act the official copy of a will is to ➢Valuation of Building: tear, decay and obsolescence. It depends

be presented along with court stamp fees. Valuation of a building depends on the on use, age, nature of maintenance etc.

The stamp fee depends on the value of a type of the building, its structure and A certain percentage (per annum) of the Name-Aditi Bari

property and for this valuation is durability, on the situation, size, shape, total cost may be allowed as Class- Btech.104

necessary. frontage, width of roadways, the quality of depreciation to determine its

•To divide the property among the materials used in the construction and Reg No.-2019DCIV1103156

present value. Faculty- Girish Joshi

shareholders in case of the partition. present day prices of materials.

•Assessment of income or stamp duty.

You might also like

- The Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFDocument62 pagesThe Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFalec.black13997% (38)

- Audit of Property, Plant, and EquipmentDocument15 pagesAudit of Property, Plant, and EquipmentLuna100% (1)

- Field Guide for Construction Management: Management by Walking AroundFrom EverandField Guide for Construction Management: Management by Walking AroundRating: 4.5 out of 5 stars4.5/5 (4)

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourNo ratings yet

- BlockchainDecryptedFor2018 PDFDocument46 pagesBlockchainDecryptedFor2018 PDFPunjena Paprika100% (1)

- Doing Business in IndiaDocument7 pagesDoing Business in IndiaBrian KuttikkatNo ratings yet

- 145 E&c Tae5Document1 page145 E&c Tae5KaustubhNo ratings yet

- 6904 PPT Materials For UploadDocument5 pages6904 PPT Materials For UploadAljur SalamedaNo ratings yet

- FINAC1 - Accounting For Property, Plant, and Equipment 1Document3 pagesFINAC1 - Accounting For Property, Plant, and Equipment 1Jerico DungcaNo ratings yet

- Tangible Non-Current Assets: Learning ObjectivesDocument26 pagesTangible Non-Current Assets: Learning Objectivesduong duongNo ratings yet

- ReviewerDocument5 pagesReviewercholestudyNo ratings yet

- Ia2 PrelimsDocument9 pagesIa2 PrelimsAngela GarciaNo ratings yet

- Handout AP 2306 FDocument14 pagesHandout AP 2306 FDyosa MeNo ratings yet

- Far: Property, Plant, and Equipment: I. Definition and NatureDocument13 pagesFar: Property, Plant, and Equipment: I. Definition and NatureAl ChuaNo ratings yet

- PPE Review For A PPE Review For A: Accounting (Far Eastern University) Accounting (Far Eastern University)Document6 pagesPPE Review For A PPE Review For A: Accounting (Far Eastern University) Accounting (Far Eastern University)JANISCHAJEAN RECTONo ratings yet

- 01 - Finacc - Property, Plant, and EquipmentDocument5 pages01 - Finacc - Property, Plant, and EquipmentAbigail PadillaNo ratings yet

- AC 2101 Chapter 23 NotesDocument4 pagesAC 2101 Chapter 23 NotesKemuel TantuanNo ratings yet

- FARAP 4404 Property Plant EquipmentDocument11 pagesFARAP 4404 Property Plant EquipmentJohn Ray RonaNo ratings yet

- PFC Appraisal PDFDocument2 pagesPFC Appraisal PDFChavilita VallesNo ratings yet

- PAS 38 Intangible Assets: Lecture AidDocument18 pagesPAS 38 Intangible Assets: Lecture Aidwendy alcosebaNo ratings yet

- To Recognize The Purchase of Investment PropertyDocument3 pagesTo Recognize The Purchase of Investment PropertyShantalNo ratings yet

- ACCA106 Reviewer TheoriesDocument5 pagesACCA106 Reviewer TheoriesFrankie AsidoNo ratings yet

- Cpa Far - Study Unit 8 Property, Plant, Equipment, and Depletable Resources Core ConceptsDocument3 pagesCpa Far - Study Unit 8 Property, Plant, Equipment, and Depletable Resources Core ConceptsGAANo ratings yet

- Property, Plant and Equipment: Initial RecognitionDocument6 pagesProperty, Plant and Equipment: Initial RecognitionMary Grace NaragNo ratings yet

- 1.2 Audit of PPE ValuationDocument3 pages1.2 Audit of PPE ValuationLayla SimNo ratings yet

- Ppe Ias 16Document37 pagesPpe Ias 16Yến Hoàng HảiNo ratings yet

- Material 3 PDF FreeDocument6 pagesMaterial 3 PDF FreeIshi Erika OrtizNo ratings yet

- Estimate Costing Handwriting PDFDocument162 pagesEstimate Costing Handwriting PDFAltamashNo ratings yet

- Unit 4: Indian Accounting Standard 23: Borrowing Costs: Learning OutcomesDocument29 pagesUnit 4: Indian Accounting Standard 23: Borrowing Costs: Learning OutcomesYashviNo ratings yet

- Accounting For Fixed Assets I. Property, Plant and EquipmentDocument45 pagesAccounting For Fixed Assets I. Property, Plant and EquipmentLayNo ratings yet

- CHAPTER 27, 28, and 29Document4 pagesCHAPTER 27, 28, and 29Aia SmithNo ratings yet

- Income Approach: VR - Poovannan.A IIV-RVF April-2021Document96 pagesIncome Approach: VR - Poovannan.A IIV-RVF April-2021Muruga DasNo ratings yet

- Pas 38 - Intangible AssetsDocument24 pagesPas 38 - Intangible Assetscaryljoyce.macedaNo ratings yet

- FA II Chapter OneDocument80 pagesFA II Chapter OneGirma NegashNo ratings yet

- Group 1 PPEDocument29 pagesGroup 1 PPEChiel Sea Erica CutchonNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- Farap 4504Document8 pagesFarap 4504Marya NvlzNo ratings yet

- CFAS 2020 Chapter 15 and MC ProblemsDocument7 pagesCFAS 2020 Chapter 15 and MC Problems4220019No ratings yet

- AC Chapter 9Document19 pagesAC Chapter 9Minh AnhNo ratings yet

- Long Term Capital AppreciationDocument18 pagesLong Term Capital AppreciationRAVEN REI GARCIANo ratings yet

- Pas 16Document5 pagesPas 16iyahvrezNo ratings yet

- Appraisal TermsDocument4 pagesAppraisal TermsPrince EG DltgNo ratings yet

- D14Document12 pagesD14YaniNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRazel Tercino100% (1)

- Property Plant and EquipmentDocument13 pagesProperty Plant and EquipmentWilsonNo ratings yet

- Substantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Document38 pagesSubstantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Mej AgaoNo ratings yet

- Notes On Property, Plant and EquipmentDocument49 pagesNotes On Property, Plant and Equipmentcriszel4sobejanaNo ratings yet

- Module 5 Property Plant EquipmentDocument15 pagesModule 5 Property Plant EquipmentThea Danica BrazaNo ratings yet

- Pas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition MeasurementDocument4 pagesPas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition Measurementmarilyn wallaceNo ratings yet

- CH 10Document56 pagesCH 10Tifany Natasia100% (1)

- Ppe Part 1 NotesDocument4 pagesPpe Part 1 NotesRyan Malanum AbrioNo ratings yet

- Unit 2 PpeDocument82 pagesUnit 2 PpeHirut GetachewNo ratings yet

- Module 5 Property Plant EquipmentDocument16 pagesModule 5 Property Plant EquipmentTrine De LeonNo ratings yet

- Lesson 1 PPEDocument17 pagesLesson 1 PPEBeatriz Jade TicobayNo ratings yet

- Tangible Asset - With A Useful Life of More Than One Year - Used in Business OperationsDocument4 pagesTangible Asset - With A Useful Life of More Than One Year - Used in Business OperationsJhonalyn ZonioNo ratings yet

- Chap 10-1 UpdateDocument45 pagesChap 10-1 Update110206004No ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument24 pagesAcquisition and Disposition of Property, Plant, and EquipmentFaishal Alghi FariNo ratings yet

- FAR 5.2MC1 Property Plant and Equipment Part 1Document6 pagesFAR 5.2MC1 Property Plant and Equipment Part 1Abegail AdoraNo ratings yet

- Financial Accounting and Reporting - Property, Plant and EquipmentDocument7 pagesFinancial Accounting and Reporting - Property, Plant and EquipmentLuisitoNo ratings yet

- Script Ending Pork EmpanadaDocument3 pagesScript Ending Pork EmpanadaRose MarieNo ratings yet

- Ch#8 ValuationDocument40 pagesCh#8 ValuationSudhan PaudelNo ratings yet

- Capitalized Expensed: Whether Taken or NotDocument3 pagesCapitalized Expensed: Whether Taken or NotKaryl FailmaNo ratings yet

- Learning Packet - Week 4Document14 pagesLearning Packet - Week 4Emmanuel ApuliNo ratings yet

- Audit 2 - Concept Map For InvestmentsDocument4 pagesAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)

- Quiz - QuestionsDocument20 pagesQuiz - QuestionsArturo ArbajeNo ratings yet

- Overview of Current Investment Scenario in IndiaDocument7 pagesOverview of Current Investment Scenario in IndiakarnvatsNo ratings yet

- Chapter 6 - Accounting For Production LossesDocument15 pagesChapter 6 - Accounting For Production LossesJoey LazarteNo ratings yet

- 0708 DisDocument17 pages0708 DisAlexShearNo ratings yet

- SPECIAL JOURNALS (Final)Document8 pagesSPECIAL JOURNALS (Final)NoroNo ratings yet

- Intrinsic Stock Value FCFF On JNJ StockDocument6 pagesIntrinsic Stock Value FCFF On JNJ Stockviettuan91No ratings yet

- A.H Wadia V. Income - Tax Commissioner (A.I.R 1949 F.C. 18 S.C.)Document12 pagesA.H Wadia V. Income - Tax Commissioner (A.I.R 1949 F.C. 18 S.C.)Swaraj Shukla100% (1)

- Gen Z - The Breakthrough Generation or The DisruptorsDocument1 pageGen Z - The Breakthrough Generation or The DisruptorslientranftuNo ratings yet

- Ebm 3Document38 pagesEbm 3Mehak AsimNo ratings yet

- YearBook2017 18 PDFDocument212 pagesYearBook2017 18 PDFMuhammad jamilNo ratings yet

- 10 Manufacturers Hanover Trust Vs GuerreroDocument157 pages10 Manufacturers Hanover Trust Vs GuerreroChara GalaNo ratings yet

- Purpose of The Countywide Transportation Plan: San Francisco County Transportation AuthorityDocument12 pagesPurpose of The Countywide Transportation Plan: San Francisco County Transportation AuthorityprowagNo ratings yet

- 2010 Economic Report On Indonesia: ISSN 0522-2572Document26 pages2010 Economic Report On Indonesia: ISSN 0522-2572tanjq87No ratings yet

- Answers To PreboardDocument7 pagesAnswers To PreboardCodeSeekerNo ratings yet

- Final Legal Term PaperDocument14 pagesFinal Legal Term PaperAfroza Khan100% (1)

- Europass CV 120602 QuintanillaClimentDocument3 pagesEuropass CV 120602 QuintanillaCliment1GSITursulaquintanillaNo ratings yet

- 20-30 MCQDocument3 pages20-30 MCQlorrynorry100% (1)

- Financial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementDocument3 pagesFinancial Management: Graduate School Master of Arts in Education Major: Educational Management Financial ManagementJoje Sadili CostañosNo ratings yet

- Junior Philippine Institute of AccountantsDocument4 pagesJunior Philippine Institute of AccountantsFrancis TumamaoNo ratings yet

- U-Bix Corporation vs. HolleroDocument19 pagesU-Bix Corporation vs. HolleroFelix TumbaliNo ratings yet

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- QOUTATION Rack Dismanting Fance Inside WHC 032.SMAR-P G.XII.2023Document2 pagesQOUTATION Rack Dismanting Fance Inside WHC 032.SMAR-P G.XII.2023Tabasa GroupNo ratings yet

- Chapter 1 BAC 100 PDFDocument32 pagesChapter 1 BAC 100 PDFacademianotes75% (4)

- BCG MatrixDocument8 pagesBCG MatrixAsh ZafarNo ratings yet

- Background Report: Pete SantilliDocument10 pagesBackground Report: Pete Santilliapi-139412189No ratings yet

- Importance of The Study of EconomicsDocument2 pagesImportance of The Study of EconomicsSyed Fawad Ali ShahNo ratings yet