Professional Documents

Culture Documents

2013-14 - Multan 25112019

2013-14 - Multan 25112019

Uploaded by

Shahaan ZulfiqarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2013-14 - Multan 25112019

2013-14 - Multan 25112019

Uploaded by

Shahaan ZulfiqarCopyright:

Available Formats

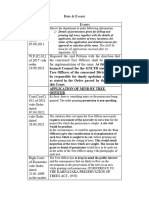

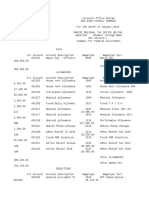

MINUTES OF DAC MEETING HELD ON 25.11.

2019 AT CRTO, LAHORE- AUDIT REPORT 2013-14

IN RESPECT OF RTO MULTAN

Irregular reduction and short payment of Income Tax Rs 248.899

S.# Para/DP Name of Tax Amount Compliance by the department Audit Remarks DAC Directives

No. taxpayer Year Involved

1 4.4.1 Marghoob 2012 0.820 13.02.2017 05.12.2016 DAC Directive dated 19.12.2016

14496/03 Ahmad C/o Order u/s 122 (5A) has been RTO has contested. DAC directed the RTO to get

Mn Zone Sunshine passed on 10.02.2017 minimum As per return for tax year its contention verified from audit and submit

Traders 2012 the taxpayer showing final compliance by 30.12.2016.

1938594-3 tax u/s 113 amounting to Rs.

trading business of petrol DAC Directives dated 14.02.2017

Availed facility 820150/- charged. products. No evidence of RTO informed that tax amounting to

of 80% tax deductions of

reduction in tax

Rs.820,150/- u/s 113 has been charged on

08.03.2017 petroleum commission by

rate any company was

10.02.2017. DAC directed the RTO to enforce

Demand notice served on

provided. The contention recovery and report compliance at earliest.

22.02.2017. Recovery proceeding DAC Directives dated 20.03.2017

of the department may

will be initiated after expiry of 30 RTO informed that recovery proceedings are

please be revisited.

days. 30.03.2017: in hand. DAC directed the RTO to enforce

Taxpayer in appeal recovery and submit final compliance by

27.03.2017 CIR(A).Recovery awaited. 27.03.2017 after verification from audit.

Taxpayer has filed appeal against

DAC Directive dated 25.11.2019

the order passed u/s 122 (5A) 06.11.2019 RTO informed that the case is subjudice before

before the CIR (A) Multan. SUBJUDICE ATIR since 31.07.2017. DAC directed the RTO to

18.04.2017

request for out of turn hearing and pursue the

CIR(A) Multan has annulled the

case for early disposal.

order on 07.04.2017.Demand of

Rs.820,150/- taken into minus

account.

20.02.2019

2ND appeal before ATIR has been

filed on 31.07.2017.

Still Subjudice.

05.11.2019

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 1

Still subjudice before ATIR

Letter for early hearing vide

No.4213 dated 15.11.2019 has

been written ( copy enclosed)

2 14091 RANAJAVAIDIQBA 2012 Rs 15.12.2016 05.12.2016 DAC Directive dated 19.12.2016

MN Zone L C/o 890,316 The commissioner has selected The department to provide RTO informed that case has been selected for

RanaJavaidIqbal the reason of revision of audit u/s 177 of the Income Tax Ordinance,

the case u/s 177 for audit.

Property Owner return. Outcome of action 2001 and final out-come shall be reported

Proceeding are underway. taken u/s 177 dated: after completion of proceedings under the law.

Khanewal

0119513-1 17.11.2016 may kindly be DAC Directives dated 14.02.2017

03.03.2017 intimated. RTO informed that case has been selected for audit u/s

Notice 177/214 C issued for 177/214C recently, and the proceedings are underway. DAC

compliance by 15.02.2017. On directed the RTO to finalize the proceedings under the law

06.11.2019

and intimate final compliance at the earliest.

14.02.2017 AR has moved an SUBJUDICE DAC Directive dated 20.03.2017

application seeking adjournment RTO informed that adjudication proceedings u/s

up-to 08.03.2017 177/214 C are still in hand. DAC directed the RTO

27.03.2017: to finalize the proceedings at earliest under the law

An opportunity was provided to and report final compliance by 27.03.2017.

the tax-payer to participate in DAC Directive dated 25.11.2019

proceedings. Response has RTO informed that the case is subjudice before

requested up-to 31.03.2017. ATIR since 31.07.2017. DAC directed the RTO to

request for out of turn hearing and pursue the case

20.02.2019 for early disposal.

Minimum tax u/s 113@1%

amounting to Rs. 902950 has been

charged. Net recoverable amount

comes to (Rs. 902950-12634) =

890316/-. 2ND appeal before ATIR

has been filed on 31.07.2017.

05.11.2019

Still subjudice before ATIR

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 2

Short levy of tax due to non-allocation of proportionate expenses

3 14417 Karmanwalay 2010 2.026 As proposed assessment was 17.11.2016 DAC Directive dated 19.12.2016

Multan Model amended u/s 122(5A) of the Pending with ATIR RTO informed that case is subjudice before ATIR

Zone Industries Income Tax Ordinance, 2010 for 06.11.2019 since 17.11.2016. DAC directed the RTO to

allocation of the tax year 2010. The taxpayer SUBJUDICE pursue the case for early hearing.

proportionate filed appeal before worthy

expenses Commissioner Income Tax DAC Directive dated 13.02.2017.

(Appeals) Multan who annulled the RTO informed that case is subjudice before ATIR

above said order vide Appeal since June, 2015. DAC directed the RTO to

No.675 dated 31.03.2015. Now the pursue the case for early hearing.

department has filed 2nd appeal DAC Directive dated 20.03.2017

vide CIR Multan Zone letter RTO informed that case is subjudice before ATIR since

No.13053 dated 09.06.2015. June, 2015. DAC directed the RTO to pursue the case for

early disposal.

20.02.2019 DAC Directive dated 25.11.2019

Request was made to the registrar RTO informed that the case is subjudice before ATIR

Income tax appellate tribunal since 09.06.2015. DAC directed the RTO to request

Lahore by the CIR Multan zone to for out of turn hearing and pursue the case for early

fix the appeals at an early date. disposal.

However, Taxpayer has deposited

tax amounting to Rs. 660,782/-

vide CPR IT-20150129-1839-

1190715 dated 29.01.2015.

05.11.2019

Still subjudice beforeATIR

Letter for early hearing vide

No.4215 dated 15.11.2019 has

been written ( copy enclosed)

4 14417 ABCO 2012 Rs 02.12.2016 05.12.2016 DAC Directive dated 19.12.2016

TECHNICAL PVT 494,561 Proceedings u/s 122(5A)have As per order u/s 122(5A) RTO informed that recovery proceedings are in

corporate been concluded and demand of dated: 24.11.2016 hand. DAC directed the RTO to enforce recovery and

LTD allocation

Rs. 494,561 has been created. demand of Rs. 494,561/- submit final compliance by 30.12.2016 after

of created. The recovery of verification from audit.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 3

proportionat the same may please be DAC Directive dated 14.02.2017.

e expenses 03.03.2017 expedited. RTO informed that recovery proceedings are in

CIR (A) vide order dated 08.03.2017: hand. DAC directed the RTO to enforce recovery and

Status of second appeal submit final compliance by 20.02.2017 after

16.02.2017 annulled the

may be intimated. verification from audit.

impugned amended order for DAC Directive dated 20.03.2017

the tax year 2012 with the RTO informed that original order was annulled

certain directions. by CIR(A) through order dated 16.02.2017. DAC

05.11.2019 directed the RTO to invoke further proceedings

2nd appeal not filed being under the law and report final compliance by

reassessment in hand of the 27.03.2017.

department. DAC Directive dated 25.11.2019

RTO informed that original order was annulled by

CIR(A) through order dated 16.02.2017. DAC

directed the RTO to intimate regarding 2 nd appeal

or any other proceedings initiated by RTO and

report final compliance by 06.12.2019.

Non levy of tax on unexplained income u/s 111

5 14418 SHEIKH 2009 10.967 02.02.2016 02.02.2016 DAC Directive dated 19.12.2016

NOMAN C/O to Tax year 2011 An amount of Rs. RTO informed that case is subjudice before

Amna Food 2012 Rs 853240 charged for the tax 853240/- charged for the President of Pakistan against the order of

year 2009 and taxpayer filed tax year 2009. Recovery Honorable FTO.

Industries complaint before FTO. FTO passed is awaited.

order with the recommendation that Assessment for the tax DAC Directives dated 14.02.2017

assessment finalized is barred by years 2010 to 2012 may

RTO informed that representation before

time.Department filed be expedited.

representation before President of Honorable President of Pakistan is still

Pakistan. subjudice. DAC directed the RTO to pursue the

Tax year 2012 case for early disposal.

17.11.2016

Tax Rs 1,179,791/- charged for the DAC Directives dated 20.03.2017

Subjudice before

tax year 2012.Recovery Awaited. RTO informed that representation before

05.11.2019 FTO/President of Pakistan

Honorable President of Pakistan against the

Tax year 2011 is subjudice before order of Honorable FTO is still subjudice.

president and in tax year 2012 DAC directed the RTO to pursue the case for

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 4

recovery is awaited. early disposal.

DAC Directive dated 25.11.2019

RTO informed that reassessment proceedings are in hand.

DAC directed the RTO to provide tax year wise details of

proceedings and report final compliance by 06.12.2019.

6 14418 KHAWAJA 2007 Rs The taxpayer is a director in various corporate entities i.eKhawaja Bashir 27.12.2016 DAC Directive dated

Corporate Ahmad and Company, Khawaja Bashir and Sons Pvt Ltd, M/S Khawaja Reconciliation of 19.12.2016

MAHMOOD TO 73,324,26

income from different RTO has contested.

UR 2012 6 Feeds Pvt Ltd, M/S MahmoodMahboob Brothers Pvt Ltd, M/S Chamman

business as pointed DAC directed the

REHMAN- Sultana Fabric and M/S Ghareeb Nawaz Flour Mills. Detail of share

out by audit may be RTO to get its

capital invested as well as increase in share capital over the years is as contention verified

provided.

01011693 under: from audit and

30.03.2017:

2008 2009 2010 2011 2012 Tax Year 2009 report compliance

Share 230,451,05 362,390,55 402,206,07 481,297,08 481,297,08 Demand created by 30.12.2016.

Capital 6 6 0 3 3 u/s.122(5A)

invested amounting to DAC Directives dated

The

Accretio - 131,939,50 39,845,000 79,091,013 - Rs.32,153,590/- 13.02.2017

taxpayer which is recoverable. RTO informed that

declared n in 0 case is under process.

Tax Year 2010:

loss or capital Proceedings filed. DAC directed the RTO to

invested finalize proceedings by

marginal Contention of the

20.02.2017 and report

profit. On Less - 3,868,006 41,095,347 Proceeding - Department is final compliance

the other declared s u/s accepted. thereafter.

sources 122(5A) Tax Year 2011: DAC Directive dated

hand,the (Under

of are in 20.03.2017

capital Process)Proceeding

accretio process RTO has contested.

employed s are in hand. DAC directed the RTO to

has been n Department to get its stance verified

increased in expedite

from audit and

all tax years. Proceedings for the tax year 2009 have already been completed u/s proceedings and

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 5

122(5A) creating demand of Rs.32,153,590/-. Copy of order is enclosed. report compliance. report final

For the tax year 2010, the taxpayer was available with sufficient sources Tax Year 2012: compliance by

as indicated above. There is no increase in share capital for the tax year No increase. 27.03.2017.

2012. Proceedings u/s 122(5A) for the tax year 2011 are in process. Contention is DAC Directive dated

05.11.2019 accepted.

25.11.2019

Tax year 2009 and tax year 2011 order u/s 122(5A_ concluded .however, Tax year 2010 &

recovery is under process. 2012

Departmental

contention accepted

and verified by audit.

DAC recommended

the case for

settlement.

Tax Year 2009 &

2011

RTO informed that

statutory

proceedings are in

hand. DAC directed

the RTO to finalize

proceedings and

report final

compliance by

06.12.2019

7 14418 KHAWAJA 2007 Rs The taxpayer is a director in various corporate entities i.eKhawaja 27.12.2016 DAC Directive dated

Corporat Bashir Ahmad and Company, Khawaja Bashir and Sons Pvt Ltd, M/S Reconciliation of 19.12.2016

MAHBOOB TO 73,324,26

e income from different RTO has

UR 2012 6 Khawaja Feeds Pvt Ltd, M/S MahmoodMahboob Brothers Pvt Ltd, M/S

business as pointed contested. DAC

REHMAN- Chamman Sultana Fabric and M/S Ghareeb Nawaz Flour Mills. Detail

out by audit may be directed the RTO

of share capital invested as well as increase in share capital over the to get its

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 6

0101170 years is as under: provided. contention

2008 2009 2010 2011 2012 30.03.2017: verified from audit

Tax Year 2009 and report

Share 230,451,05 362,390,55 402,206,07 481,297,08 481,297,08

Demand of compliance by

The Capital 6 6 0 3 3 Rs.15,796,586/- 30.12.2016.

taxpayer investe u/s.122(5A) has been DAC Directives dated

declared d created.Recovery of 13.02.2017

loss or Acretio - 131,939,50 39,845,000 79,091,013 - the same is awaited. RTO informed that

marginal n in 0 Tax Year 2010: case is under process.

Contention of the DAC directed the RTO

profit. On capital to finalize proceedings

Department is

the other investe by 20.02.2017 and

accepted.

hand,the d report final compliance

Tax Year 2011:

thereafter.

capital Less - 69,869,365 41,368,646 Proceeding - Under Process to DAC Directive dated

employed declare s u/s expedite the 20.03.2017

has been d 122(5A) proceedings and RTO has contested.

increased in sources are in report compliance. DAC directed the RTO

Tax Year 2012: to get its stance

all tax years. of process

Contention is

acretio verified from audit

accepted.

n and report final

compliance by

Proceedings for the tax year 2009 have already been completed u/s 27.03.2017.

122(5A) creating demand of Rs.15,796,586/-. Copy of order is DAC Directive

enclosed. For the tax year 2010, the taxpayer was available with dated 25.11.2019

sufficient sources as indicated above. There is no increase in share Tax year 2010 &

capital for the tax year 2012. Proceedings u/s 122(5A) for the tax year 2012

2011 are in process. Departmental

05.11.2019 contention accepted

Tax year 2009 and tax year 2011 order u/s 122(5A_ concluded .however, and verified by

recovery is under process. audit. DAC

recommended the

case for settlement.

Tax Year 2009 &

2011

RTO informed that

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 7

statutory

proceedings are in

hand. DAC directed

the RTO to finalize

proceedings and

report final

compliance by

06.12.2019

8 14418 Ahmad Ind(pvt)Ltd. 2010 3,649,276 Contested: 27.12.2016 DAC Directive dated 19.12.2016

TAX YEAR 2009 Department to reconcile the RTO has contested. DAC directed the RTO to get its

3224780 2012 20,794,07

As per tax profile, the stance verified from audit and report compliance by

Sales declared in 7 sales of taxpayer as per 26.12.2016.

company was registered Income Tax and sales tax

sales tax and for Income Tax purposes

income tax did not returns for all years. Sales DAC Directives dated 14.02.2017

on 18-11-2008. The

tally. figures of sales mentioned

tax profile of Ahmad RTO has contested. Audit has already verified

in audit observation have Industries Pvt Ltd departmental contention for the tax year 2009 for amount of

reconsidered during Rs.27.051 million. DAC recommended the case for

been reflected in the settlement to this extent. For rest of the years, DAC

return of the company’s reconciliation. directed the RTO to get their stance verified from audit and

directorMr.MuhammadZak submit final compliance by 20.02.2017.

i who filed income tax 01.02.2017 (Tax Year

return for the tax year 2009) DAC Directive dated 20.03.2017

2009 under the name and RTO informed that for tax Departmental contention accepted and verified by audit for

style as M/S Ahmad tax year 2009 and 2011. DAC recommended the case to

year 2009 the taxpayer M/s this extent and directed the RTO to expedite finalization of

Traders and disclosed

sales at Rs.79,430,736/- Ahmad Traders got proceedings in tax years 2010 and 2012 and report final

registration as PVT LTD compliance by 27.03.2017.

whereas the company M/S

Ahmad Ind filed its return Company under the name DAC Directive dated 25.11.2019

for the year 2009 ahmad industries Pvt Ltd. The Tax year 2009 (27.051 million)& 2011 (Rs.13.027

disclosing sales at taxpayer has consolidated the million)

Rs.2,140,000/-. Therefore sales of both status i.e. Departmental contention accepted and verified by

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 8

the observation is individual and Pvt Ltd audit. DAC recommended the case for settlement.

incorrect and accordingly Company. Copies of Sales Tax Tax Year 2010 & 2012

contested. Copies of both Returns Provided to Audit. RTO informed that statutory proceedings are in hand.

returns are enclosed.

Hence contention for Tax Year DAC directed the RTO to finalize proceedings and

2009 involving an amount of report final compliance by 06.12.2019

Rs. 27.051 M is accepted.

TAX YEAR 2010

The audit authorities

pointed out the purchases 01.02.2017 (Tax Year

in the income side have 2010)

been disclosed at Tax year 2010 may be

Rs.113,155,619/- whereas

revisited as taxpayer has not

perusal of return for the

year under consideration claimed tax adjustments on

reveals that raw material electricity consumption. (AO

consumed stands No.52)

disclosed at

Rs.106,917,094/-. Similarly 01.02.2017 (Tax Year

purchases in the sales tax 2011)

side have been taken by

Documentary evidence for tax

the audit authorities at

Rs.102,729,116/- whereas year 2011(AO # 50 to be

these are at provide to audit.

Rs.90,870,530/- as per 08.03.2017”

sales tax returns filed for Department informed that

the period July, 2009 to taxpayer inadvertently taken

June, 2010. The figure of supplies at Rs.42,310,667/-

purchases as per sales tax

returns have therefore not instead of Rs.4,231,066/- due

been compared with the to which difference of

figure of purchase as per Rs.38,079,601/- arrived.

Income Tax returns. Department also passed

Copies of Income Tax and order In-O-No. dated

sales tax returns are 03.05.2013. Copy of 0rder In-

enclosed. The observation

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 9

is therefore incorrect and O-No. also provided.

accordingly contested. Contention of the department

may be accepted.

TAX YEAR 2011

Difference in sales in

income tax return and 01.02.2017 (Tax Year

sales tax returns has been 2012)

communicated at Tax year 2012 may be

Rs.38,079,601/-. . The revisited as taxpayer has not

taxpayer inadvertently in claimed tax adjustments on

the sales tax return for the

electricity consumption. (AO

month of April, 2011,

disclosed supplies at No.52)

Rs.42,310,667/- instead of

Rs.42,31,066/- as digit-7

was mistakenly added.

The Officer vide ONO

01/2013 dated 3.5.2013

accepted the contention of

the registered person.

Para may be considered

as settled.

Tax year 2012

1. The audit authorities

pointed out that

purchases in the income

side have been disclosed

at Rs.106,870,006/-

whereas perusal of return

for the year under

consideration reveals that

total raw material

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 10

consumed has been

disclosed at

Rs.98,575,901/-. Similarly

purchases in the sales tax

side have been taken by

the audit authorities at

Rs.47,458,358/- whereas

these are at

Rs.93,378,063/- as per

sales tax returns filed for

the period July, 2011 to

June, 2012. The figures of

purchases as per

Annexure H-1 of the

Income tax return was

accordingly not compared

with the figure of

purchases mentioned in

sales tax return. Copies of

Income tax and sales tax

returns are enclosed. The

observation is therefore

incorrect and accordingly

contested.

2. In an other observation it

has been observed by the

audit authorities that stock in

the Income Tax Side has

been disclosed at

Rs.28,733,113/- whereas its

stands disclosed at

Rs.100,153,756/-, in the sales

tax return for June, 2012.

Apparently the discrepancy

is in the sales tax side,

monthly sales tax returns

have been scrutinized which

reveals that impact of stock

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 11

consumed has not been

shown in sales tax return.

Proceedings under the Sales

Tax Act, 1990 have been

initiated,

accordingly.05.11.2019

Contested as narrated

above.

9 4.4.4 SahibzadaJavedIqb 2010 Rs 29,392,804

10.02.2017 DAC Directive dated 19.12.2016

14164 al C/o MULTAN TO Notice u/s 122 (9) read with RTO has contested. DAC directed the RTO to

Multan get its stance verified from audit and report

PAPER MILLS. 2012 section 122 (5A) for the tax

zone compliance by 30.12.2016.

Sales declared in year 2010 has been issued.

sales tax and (Copy enclosed) DAC Directives dated 14.02.2017

income tax did not 03.03.2017 RTO informed that case is under process. DAC directed the

tally. The AR of the taxpayer RTO to finalize proceedings by 20.02.2017 and report final

compliance thereafter.

0103523-1 moved an application

seeking adjournment for DAC Directive dated 20.03.2017

06.03.2017. (copy enclosed) RTO informed that proceedings u/s 122 5A

27.03.2017 are in hand. DAC directed the RTO to finalize

Hearing is now fixed for the proceedings and report final compliance by

31.03.2017. 27.03.2017.

04.04.2017 DAC Directive dated 25.11.2019

Final opportunity provided DAC observed with concern that despite lapse of time.

to the taxpayer for Statutory proceedings could not be finalized. DAC

compliance by 14.04.2017. directed the CCIR to personally intervene, get the

statutory proceedings finalized and report final compliance

05.11.2019 by 06.12.2019.

Under process

10 14164 ZAINAB GHEE 2012 Rs Latest Compliance 08.03.2017: DAC Directive dated 19.12.2016

corporate & GENERAL 1,553,988 03.03.2017: Show Cause Under process. case is under process. DAC directed

RTO informed that

notice u/s.122(9)read with 06.11.2019 the RTO to finalize the proceedings and report

MILLS. Pvt ltd

compliance after one month

3653261-4 section 111 of the Income 06.11.2019

Tax 0rdinance,2001 for the Department has passed

tax year 2012 has been order u/s 122(5A) & DAC Directives dated 14.02.2017

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 12

issued for compliance by discussed issue of local & RTO informed that case is under process. DAC directed the

13.03.2017. imported raw material & RTO to finalize proceedings by 20.02.2017 and report final

Declared local

dropped proceeding initiated compliance thereafter.

material as 05.11.2019 DAC Directive dated 20.03.2017

Sales declared in income tax u/s 122(5A) being

imported reconciled. RTO informed that proceedings u/s 122 5A are

material. The and sales tax stand Copy of order is provided by in hand. DAC directed the RTO to finalize the

excess reconciled. Therefore department However proceedings and report final compliance by

difference proceeding initiated u/s department to provide copy 27.03.2017.

remained 122(5A) dropped. Copy of of audited accounts for tax DAC Directive dated 25.11.2019

unexplained. order is enclosed. year 2012 RTO has contested during last verification. Audit has

Para may kindly be treated as required copy of audited accounts for tax year 2012. DAC

recommended the case for settlement subject to provision

settled. of audited accounts for tax year 2012 to audit for

verification and report final compliance by 06.12.2019.

11 14164 ZafarIqbal C/o 2010 Rs Oder u/s 122(5A) has been 05.12.2016 DAC Directive dated 19.12.2016

Zainab Ghee & 25,988,475 passed by creating a demand Charged. Recovery RTO informed that recovery proceedings are in

of Rs 43,080,689/- copy of awaited hand. DAC directed the RTO to enforce recovery and

General

order is enclosed. submit final compliance by 30.12.2016 after

MillsPvtltd 31.01.2017 verification from audit.

01.02.2017

Capital The taxpayer being aggrieved DAC Directives dated 14.02.2017

Now CIT(A) annulled the

employed preferred appeal before RTO informed that CIR(A) has annulled the

CIR(A) who annulled the assessment order. RTO is

remained original order, and proceedings under law are in

assessment vide order No. requested to file second hand. DAC directed the RTO to finalize the

unexplained.

375 dated 22.12.2016. appeal. proceedings under the law and report final

05.11.2019 06.11.2019 compliance thereafter.

subjudice SUBJUDICE DAC Directive dated 20.03.2017

RTO informed that 2nd appeal has been filed

before ATIR which is subjudice. DAC directed

the RTO to pursue the case for early disposal.

DAC Directive dated 25.11.2019

RTO informed that the case is subjudice before ATIR

since January, 2017. DAC directed the RTO to request

for out of turn hearing and pursue the case for early

disposal.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 13

12 4.4.4 M/s. Yousaf Oil 2012 41.699 02.12.2016 06.11.2019

13962 Mills (Pvt) Ltd Proceedings are in Subjudice DAC Directive dated 19.12.2016

Special Increase in process. Case has been RTO informed that taxpayer has filed complaint

paid up capital fixed for hearing on before FTO on initiation of audit proceedings.

from 100 Final compliance shall be reported after FTO’s

17.11.2016. The AR of the

million to 200 decision.

Million

taxpayer has intimated that

against the proceedings , a DAC Directives dated 14.02.2017

unexplained RTO informed that matter is still subjudice

complaint before the FTO

before FTO.

has been filed Proceedings DAC Directive dated 20.03.2017

have therefore been kept RTO informed that case is subjudice before

pending and would be HonourableFTO since Dec., 2016. DAC directed the RTO

finalized in the light of to pursue the case for early disposal.

FTO’s directions. DAC Directive dated 25.11.2019

05.11.2019 RTO informed that case is subjudice before CIR(A)

case is subjudice before since January, 2017. DAC directed the RTO to submit

Honorable FTO since Dec., 2016 updated status of the case and pursue the same for

early hearing.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 14

Para pertains to non recovery of Withholding Income Tax of Rs.64,575,325/-

13 13965/04 1.Directors of 2012 19.992 DAC Directive dated 19.12.2016

Yousaf Oil Mills Returns of total income for 06.11.2019

the tax year 2012 have not The audit observation Directors of Yousaf Oil Mills

been filed by the directors. was relate to increase in RTO informed that taxpayer has been issued notices u/s

Notices u/s 114(4) have been share capital of directors. 114(4). DAC directed the RTO to finalize the

issued. Necessary action proceedings under the law and report final compliance.

Department to investigate DAC Directives dated 14.02.2017

would be taken after

the source of investment RTO informed that notices u/s 114(4)have been

enforcement of return

issued to Directors and proceedings are in hand.

DAC directed the RTO to finalize proceedings by 20.02.2017

1. Mohammad Yousaf and report final compliance thereafter.

2. Mohammad Afzaal

3. Mohammad DAC Directive dated 06.10.2016.

Mushtaq RTO informed that no compliance could

4. RashidaBibi be made on notices u/s 114 (4) .DAC directed

29.03.2017 the RTO to expedite finalization of

Mr. Mohammad Yousaf proceedings under the law and report

D/o Yousaf oil Mills Pvt Ltd final compliance by 27.03.2017.

has filed income tax return DAC Directive dated 25.11.2019

for the tax year 2012. RTO informed that the case is subjudice before

Copy of the same is on LHC since April, 2017. DAC directed the RTO to

record. Show cause pursue the case for early hearing.

notices u/s 122C have

been issued on

28.03.2017 to the following

Directors :

1. Mohammad Afzaal

2. Mohammad

Mushtaq

3. RashidaBibi

Notices u/s 122C are

available on record.

05.11.2019

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 15

Order 122(1) passed creating

tax demand of Rs. 99.484

million. However taxpayer

company filed complaint

before the FTO as well as

filed writ petition before

Honorable High Court

Multan Bench. Case is

subjudice.

2 Mst.FouziiaNasir

Directors of Sujabad. Proceedings initiated u/s DAC Directive dated 14.02.2017.

122(5A) for the tax year 2011 RTO informed that recovery proceedings are in

05.12.2016

have been concluded and hand. DAC directed the RTO to enforce recovery

demand of Rs.2,500,000/- has (Mst.FouziiaNasir)

As per order u/s 122(5A) and submit final compliance by 20.02.2017

been created for the year under

consideration. Copy of order is addition u/s 111(1)(b) of Rs. after verification from audit.

enclosed. 10,000,000/- made and tax DAC Directives dated 20.03.2017

demand of 2,500,000/- RTO informed thatrecovery proceedings are

The jurisdiction over the case of in hand. DAC directed the RTO to enforce

Mr.UmarEjaz Malik lies with created. Recovery of the

recovery and submit final compliance by

RTO Islamabad, which has same is awaited.

been requested to be 27.03.2017 after verification from audit.

06.11.2019

transferred to RTO Multan.

As soon as the jurisdiction of

Department to expedite the

above noted director is recovery. In respect of 3rd director Mr. UmerEjaz Malik,

transferred to RTO Multan,

RTO has already communicated to RTO

notice would be issued

accordingly. Islamabad for transferred of record so that

05.11.2019 necessary legal action can be under taken.

05.11.2019 DAC Directives dated 14.02.2017

Recovery effort where demand DAC directed the RTO to provide incorporation

is recoverable is being made

certificate by 20.02.2017.

DAC Directive dated 25.11.2019

RTO informed that tax demand has been

raised which is under recovery. DAC directed

the RTO to enforce recovery and report final

compliance by 06.12.2019.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 16

DAC Directives dated 20.03.2017

06.11.2019 RTO informed thatrecovery proceedings are

4.Directors of 2012 1.250

MithaMadni Rice Department to provide in hand. DAC directed the RTO to enforce

Processing Mills supporting document for recovery and submit final compliance by

3374983-3 18.04.2017 reconciliation. 27.03.2017 after verification from audit.

Increase in paid up Contested: DAC Directive dated 25.11.2019

capital:- Profile of income tax returns RTO has contested. During the last verification dated

06.11.2019, audit has required year wise reconciliation.

of the partners proves that DAC directed the RTO to provide requisite documents

1.MohammadRamza they had sufficient funds for to audit for verification and get their stance verified by

n the increase in paid up 06.12.2019 and report final compliance.

0123958-9 capital/investment.

Rs. 1,000,000 05.11.2019

As narrated above

2. Sheikh

RustamRehman

1656101-5

Rs. 1,000,000

4.SheikhZafar Ahmad

1656104-0

Rs. 1,000,000

5.others

0000005-1

Rs. 2,000,000

TOTAL 5,000,000

Recoverable Income

Tax @25%=

1,250,000

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 17

13965 Malik Muhammad Akram 05.12.2016( Directors of Shujabad Oil Mills

3.Directors of 2012 35.000 Proceedings initiated u/s Malik Muhammad Akram RTO informed that as against amount pointed

Shujabad Oil Mills 122(5A) for the tax year 2012

) out by audit tax demand of more than Rs.6

have been concluded and

demand of Rs.5,545,000/- has Charged Rs. 5,554,000/-. million has been created, while the balance is

been created for the year under Recovery awaited. not leviable. DAC directed the RTO to get it

consideration. Copy of order is stance verified from audit and report final

enclosed. compliance by 30.12.2016.

01.02.2017

30.01.2017

Case is annulled by CIT(A)

CIR(A) annulled with certain DAC Directives dated 14.02.2017

with direction to finalize

directions. Assessment Muhammad Akram

the proceeding as per law

proceedings are in hand. RTO informed that CIR(A) has annulled the

vide order of CIT(A) dated

original order and proceedings are in hand.

Faisal Shabbir 25.01.2017

DAC directed the RTO to finalize the proceeding

Proceedings initiated u/s 122(5A) for the

tax year 2012 have been concluded and under the law and report compliance

demand of Rs.139,595/- has been (Faisal Shabbir) thereafter.

created for the year under consideration. 05.12.2016

Copy of order is enclosed.

Charged Rs. 139,595/-. Faisal Shabbir and Mst.Farah Wahid

Mst.Farah Wahid

Proceedings initiated u/s 122(5A) for the Recovery awaited. RTO informed that recovery proceedings are in

tax year 2012 have been concluded and hand. DAC directed the RTO to enforce recovery

demand of Rs.2,40,000/- has been

created for the year under consideration.

and submit final compliance by 20.02.2017

Copy of order is enclosed. after verification from audit.

The jurisdiction of the following directors

vest with other RTOs/LTUs : Mst.Farah Wahid

1. Muhammad Tariq DAC Directive dated 25.11.2019

2. QaiserShabbir 1. Malik Muhammad Akram

3. Mst.Gulzar Begum 05.12.2016

4. Mr.AbdulWahir Charged Rs. 240,000/-. 2. Faisal Shabbir

Request has been made to trransfer the 3. Mst.Farah Wahid

Recovery awaited.

jurisdiction of these directors to RTO RTO informed that tax demand has been

Multan

As soon as the jurisdiction of above raised in above cases which is under recovery.

noted directors is transferred to RTO 06.11.2019 DAC directed the RTO to enforce recovery and

Multan, notices would be issued Department to expedite the report final compliance by 06.12.2019.

accordingly.

05.11.2019 recovery.

Recovery effort where demand

is recoverable is being made

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 18

Non-realization of withholding tax u/s 161

14 4.4.9 Ch.M.Rafiq C/o 2011 24,47,159 03.03.2017 08.03.2017:

14498 SaleemSoapFa Orders u/s.161/205 for the tax Charged. Recovery DAC Directive dated 19.12.2016

WHT ctory 2012 2,449,337 years 2011,2012 and 2013 awaited. case is under process. DAC directed

RTO informed that

3004888-5 06.11.2019 the RTO to finalize the proceedings and report

Did not deduct 2013 have been passed on 28th compliance after one month

2,676,803 Department to expedite the

withholding February,2017 creating DAC Directives dated 14.02.2017

tax @3.5% demand of Rs.4,138,467/-, recovery. RTO informed that case is under process. DAC directed the

Total 7.373

from its Rs.4,143,406/- & RTO to finalize proceedings by 20.02.2017 and report final

suppliers on compliance thereafter.

Rs.4,416,652/- respectively.

amount of DAC Directives dated 20.03.2017

24.04.2017

Rs.210,665,694 RTO informed that recovery proceedings are in

resulted into

Tax year 2011

hand. DAC directed the RTO to enforce recovery and

loss of Notice u/s 138 (2) for payment

submit final compliance by 27.03.2017 after

Rs.7,373,299/-. of tax demand of Rs.

verification from audit.

2247159/- u/s 161 and Rs.

1891308 u/s 205 has been DAC Directive dated 25.11.2019

issued to make payment by RTO informed that tax demand has been raised

26.04.2017 which is under recovery. DAC directed the RTO

Tax year 2012 to enforce recovery and report final compliance

Notice u/s 138 (2) for payment by 06.12.2019.

of tax demand of Rs.

2449337/- u/s 161 and

Rs.1694069 u/s 205 has been

issued to make payment by

26.04.2017

Tax year 2013

Notice u/s 138 (2) for payment

of tax demand of Rs. 2676803

/- u/s 161 and Rs.1739849 u/s

205 has been issued to make

payment by 26.04.2017

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 19

05.11.2019

Recovery effort are being

made for outstanding tax

demand.

15 14165/01 AL -HAMD 2009 to Rs Latest Compliance 03.03.2017: 08.0-3.2017:

Multan COTTON GINNERS 0rder u/s.1`22(5) for the tax year 2011 2009 & 2010 time barred.

2012 51,484,44 and 2012 has been passed vide DCR \2011:Charged Rs.14,157,610/-. DAC Directive dated 19.12.2016

Zone Chak No. 105- No.15/162 dated 02.03.2017 creating Recovery is awaited.

5 RTO has contested. DAC directed the RTO to provide

10-R khanewal demand of Rs.14,157,610/- and 2012: Charged Rs.11,357,139/-.

Incorrect payment Rs.11,357,139/-respectively. Recovery is awaited. copy of judgment reported as 212 PTD (Trib) 1444-

of refund. Tax year 2009 and 2010 are hit by M/s Quality Home Pvt Ltd Lahore and get its

The taxpayer deal limitation, hence, no further action can be contention verified from audit and furnish final report

in supply of cotton taken at this stage, 06.11.2019

lint and cotton

by 30.12.2016.

seed and taxed

08.03.2017 SUBJUDICE

was not paid on Order u/s 122 (5) has been passed.

Demand notice served on the

DAC Directives dated 14.02.2017

cotton seed.

taxpayer. Recovery proceeding will RTO informed that show cause notice has been

be initiated after expiry of 30 days. issued for 01.02.2017, and proceedings are in hand.

20.02.2019 DAC directed the RTO to finalize the proceedings and

Order was passed u/s 161/205 of the report compliance at earliest.

Income Tax Ordinance, 2001 for tax DAC Directive dated 20.03.2017

year 2009 & 2010 and order u/s Case discussed. RTO informed that tax

122(5) of the Income Tax Ordinance, amounting to Rs.14,157,610/- and

2001 for tax year 2011 & tax year Rs.11,357,139/- has been charged in tax year

2012 was passed. The taxpayer being

dissatisfied with the orders passed

2011 and 2012 respectively. DAC observed that

filed appeal before the Learned action u/s 161/205 is not barred by time. DAC

Commissioner-IR (A), Multan who therefore, directed the RTO to proceed under the

vide order No 93 & 94 dated law, enforce recovery and report final compliance

13.11.2017 annulled the assessment at earliest.

for tax years 2009 & 2010, and order

U/s 122(5) has also been annulled

vide A.O. No 1073 and 1074 DAC Directive dated 25.11.2019

dated 13.11.2017. the department RTO informed that the case is subjudice before ATIR

has filed 2nd appeal before ATIR since 28.02.2018. DAC directed the RTO to request

vide No 860 dated 28.02.2018 for for out of turn hearing and pursue the case for early

tax year 2009 and 2010. Second disposal.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 20

appeal for tax year 2011 and 2012

has also been filed. All the four

appeals are pending for

adjudication by the Honorable

ATIR. Copies of CIR(A) orders

are enclosed.

05.11.2019

Still subjudice before ATIR.

Letter for early hearing vide

No.4213 dated 15.11.2019 has

been written ( copy enclosed)

16 13959/07 M/s. 2012 21.972 Order u/s 161/205 has been 17.11.2016 DAC Directive dated 19.12.2016

Corporate Shujaabad passed vide DCR No. 2/61 Please expedite the Govt RTO informed that case is subjudice before ATIR

Zone Oil Mills dated: 15.11.2016 and created Dues under intimation to since June, 2016. Request for early hearing

(Pvt) Ltd a demand of Rs 21.972 M. audit. has already been made.

WHT copy of order is enclosed. DAC Directive dated 13.02.2017.

05.12.2016 RTO informed that case is

subjudice before

02.12.2016 The department charged Rs. ATIR since August, 2016. DAC directed the

Order and demand notice has 2,834,013/- which was RTO to pursue the case for early hearing.

been served upon the deleted in appeal CIR(A)

taxpayer. The taxpayer has dated: 17.06.2016. the DAC Directive dated 20.03.2017

filed application contending department has filed 2nd RTO informed that an amount of Rs.2,834,013/- was

that order u/s 161/205 has appeal before ATIR. charged as compared to amount pointed out by audit,

balance was not leviable. The original demand was

already been passed creating 06.11.2019 deleted by CIR(A) through its order dated 17.06.2016, the

a demand of Rs. 2,834,013/- . Subjudice case is subjudice before ATIR. DAC directed the RTO to

The said order has been pursue the case for early disposal.

deleted by worthyCIR(A) DAC Directive dated 25.11.2019

multan vide AO No. 770 dated:

RTO informed that the case is subjudice before ATIR

17.06.2016. The order u/s

161/205 dated: 15.11.2016 is since Jan., 2017. DAC directed the RTO to submit the

hereby rectified u/s 221 and updated status regarding case being subjudice /

demand of Rs. 21,971,544 is deletion of demand in this case and report final

hereby taken into minus compliance by 06.12.2019.

account.

05.11.2019

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 21

Subjudice

17 13959/07 M/s.AAADo 2010 0.740 Orders u/s 161/205 for the DAC Directive dated 19.12.2016

06.11.2019

RTO informed that recovery proceedings are in hand. DAC

Corporate ublers (Pvt) 2011 tax years 2010 and 2011 have Department to expedite the directed the RTO to enforce recovery and submit final

Zone Ltd been passed (copies recovery. compliance by 30.12.2016 after verification from audit.

enclosed). Para may be

treated as settled. DAC Directives dated 14.02.2017

RTO informed that reassessment has been finalized

30.01.2017 by raising tax demand of Rs.11538/- and Rs.2310

CIR(A) annulled the orders for the tax year 2010 and 2011 respectively as

for both the years with compared to amount pointed out by audit, balance

is not leviable. DAC directed the RTO to enforce

certain directions. Order u/s recovery and report final compliance by 20.02.2017

124/161/205 for the tax year after verification from audit.

2010 and 2011 was passed DAC Directives dated 20.03.2017

on 09.01.2017 creating tax RTO informed thatrecovery proceedings are in

payable u/s 205 at Rs. hand. DAC directed the RTO to enforce recovery

11538/- and Rs. 2310/- and submit final compliance by

respectively. 27.03.2017 after verification from audit.

11.04.2017

Tax payer company made

DAC Directive dated 25.11.2019

payment of (Rs. 11538 plus

2310/-)= 13848/- for the tax RTO informed that tax demand has been raised

year 2010 and 2011 which is under recovery. DAC directed the RTO

respectively on 04.04.2017 to enforce recovery and report final compliance

05.11.2019 by 06.12.2019.

Recovery effort are being

made.

18 14492/27 Multan Rice Mills 2011 0.818 09.02.2017 08.03.2017 DAC Directive dated 19.12.2016

MN Zone 2478053-7: Assessment Recovery may be RTO informed that case

is under process. DAC directed

u/s.122(5A)has been expedited. the RTO to finalize the proceedings and report

compliance by 30.12.2016.

Concealment of completed on 31/01/2017 06.11.2019

export creating tax demand of subjudice DAC Directives dated 14.02.2017

RTO informed that reassessment has been finalized

Rs.3.907(M).Copy of order by raising tax demand of Rs.3.907 million, as

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 22

passed is enclosed. compared to amount pointed out by audit, balance

17.04.2017 is not leviable. DAC directed the RTO to enforce

recovery and report final compliance by 20.02.2017

CIR (A) vide order dated after verification from audit.

29.03.2017 has annulled DAC Directives dated 20.03.2017

the impugned order dated

RTO informed thatrecovery proceedings are in

31.01.2017 for the tax year

hand. DAC directed the RTO to enforce recovery

2011.

and submit final compliance by

27.11.2017

The department filed 2nd 27.03.2017 after verification from audit.

appeal before the ATIR DAC Directive dated 25.11.2019

Lahore for the tax year RTO informed that the case is subjudice before ATIR

2011 by the CIR, Multan since 19.06.2017. DAC directed the RTO to request

Zone vide letter No.14950 for out of turn hearing and pursue the case for early

dated 19.6.2017. Copy disposal.

enclosed.

05.11.2019

Subjudice before ATIR

Request for early hearing

has been made vide

no.4214 dated

15.11.2019( copy

enclosed_)

Loss of revenue for non-treating the tax collected or deducted as final tax u/s 169

19 4.4.10 M/s. Qadir Ghee 2010 5.078 Cases have been fixed for 17.11.2016 DAC Directive dated 19.12.2016

14497 Industries 2011 hearing for 17-11-2016. Demand for tax year 2011 has RTO informed that recovery proceedings are in hand.

Corporate 2012 Proceedings for the tax year been created but remaining DAC directed the RTO to enforce recovery and submit

2011 has been finalized creating two tax years 2010 & 2012 still final compliance by 30.12.2016 after verification

demand of Rs.3,028,381/-.. pending. Expedite the from audit.

Proceedings initiated u/s recovery. DAC Directives dated 14.02.2017

122(5A) for the tax years 2010 Tax Year 2011

and 2012 have been concluded 05.12.2016 RTO informed that case is under process after the

creating demand of Charged. Recovery is awaited. original order was annulled by CIR(A).

Rs.1,305,272/- and Rs.134,722/- Tax Year 2010 and 2012

respectively. 01.02.2017 RTO informed that recovery proceedings are in hand.

T.Y. 2011 DAC directed the RTO to enforce recovery and submit

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 23

30.01.2017 RTO is requested to finalized the final compliance by 20.02.2017 after verification

CIR(A) annulled the order u/s 122 assessment proceedings as per from audit.

(5A) for the tax year 2011with CIT(A) directions dated: 31.12.2015. DAC Directives dated 20.03.2017

certain directions. Demand of Rs. For tax year 2010 and 2012 RTO informed thatrecovery proceedings are in hand.

3.028 M taken into minus account. recovery is awaited. DAC directed the RTO to enforce recovery and submit

Assessment proceedings are in 06.11.2019 final compliance by 27.03.2017 after verification

hand. Department to expedite the from audit.

05.11.2019 proceedings DAC Directive dated 25.11.2019

Under process RTO informed that statutory proceedings are in

hand after CIR(A) annulled the original assessment

with specific directions. DAC directed the RTO to

finalize proceedings and report final compliance by

06.12.2019

Incorrect grant of exemptions

20 4.4.13 M/s. Multan 2012 3.178 Proceedings initiated u/s 122(5A) for 05.12.2016 DAC Directive dated 19.12.2016

13960/11/1 Educational the tax year 2012 have been Charged and recovery awaited. RTO informed that recovery proceedings are in hand. DAC

concluded and demand of directed the RTO to enforce recovery and submit final

3 Trust 2898158-8 Rs.5,181,193/- has been created for 01.02.2017 compliance by 30.12.2016 after verification from audit.

Corporate the year under consideration. Copy RTO is requested to finalized the DAC Directives dated 14.02.2017

Zone of order is enclosed. assessment proceedings as per CIT(A) RTO informed that proceedings are in hand after CIR(A)

30.01.2017 order dated 11.01.2017 through his order dated 11.01.2017 annulled the original

CIR(A) vide order dated: 11.01.2017 has 06.11.2019 assessment. DAC directed the RTO to finalize the

annulled the assessment with the

Department to expedite the proceedings and report final compliance at the earliest.

directions to allow the appellant DAC Directive dated 20.03.2017

proceedings

reasonable opportunity of being heard. RTO informed that original demand was annulled by

Demand taken into minus account. CIR(a) through order dated 11.01.2017, and denovo

Assessment proceedings are in hand. proceedings are in hand. DAC directed the RTO to finalize

05.11.2019 the proceedings under the law and report final

Under process compliance by 27.03.2017.

DAC Directive dated 25.11.2019

RTO informed that statutory proceedings are in

hand after CIR(A) annulled the original assessment

with specific directions. DAC directed the RTO to

finalize proceedings and report final compliance by

06.12.2019

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 24

21 14092 M/s MunirArshad 2008 Contested 06.11.2019 DAC Directive dated 19.12.2016

Corporate Memorial Trust to Case discussed. DAC directed the RTO to provide

The taxpayer is a non Department to provide the copies of return alongwith all annexure and financial

NTN – 1050725 2012

profitable organization duly supporting documents in accounts filed by the taxpayer, to audit by 30.12.2016.

approved u/s 2(36) of the support of contention. Compliance report should be submitted thereafter.

Income Tax Ordinance, 2001 DAC Directives dated 14.02.2017

by the Commissioner. The RTO informed that case is under process. DAC directed the

approval granted exists till RTO to finalize proceedings by 20.02.2017 and report final

revoked by the compliance thereafter.

Commissioner. The income DAC Directive dated 20.03.2017

of the non profitable RTO informed that case is being examined. DAC

directed the RTO to get the same verified from audit and

organization is otherwise

submit final compliance by 27.03.2017

exempt under clause (11A)

((IX) of Part IV of 2nd

DAC Directive dated 25.11.2019

schedule to the Income Tax RTO has contested. DAC directed the RTO to get it stance

Ordinance, 2001.copy of verified from audit and report final compliance by 06.12.2019

audited accounts as well as

income tax return provided.

05.11.2019

Contested as narrated above.

22 14501 CENTRE DEGREE 2012 Rs Show cause notice has DAC Directive dated 19.12.2016

COLLEGE 1,017,094 been issued for compliance 06.11.2019 RTO informed thatcase is under process. DAC

2574568-9 by 22.12.2016. Expedite the proceedings directed the RTO to finalize the proceedings and

report compliance by 30.12.2016.

03.03.2017

DAC Directives dated 14.02.2017

The taxpayer has moved RTO informed that case is under process. DAC directed

an application seeking the RTO to finalize proceedings by 20.02.2017 and report

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 25

adjournment up to 1st week final compliance thereafter.

of March,2017. (copy DAC Directive dated 20.03.2017

enclosed) RTO informed that case is under process.

DAC directed the RTO to expedite

13.04.2017 proceedings, recover the amount, get the

Final opportunity was same verified from audit and report final

provided to the taxpayer to compliance by 27.03.2017.

furnish the required DAC Directive dated 25.11.2019

documents by 18.04.2017 RTO has contested. DAC directed the RTO to get it stance

verified from audit and report final compliance by

05.11.2019 06.12.2019

As above

23 13980 A & Z OILS 2010 Rs Contested: 27.12.2016 DAC Directive dated 19.12.2016

3283968-5 38,898,92 the taxpayer is Department replied that RTO has contested. DAC directed the RTO to get

manufacturer therefore taxpayer is a manufacturer its contention verified from audit by

5

but reply of the department 30.12.2016 and report compliance.

Unlawful Refund for the tax year

issuance of 2011 amounting to is not tenable as there is

Rs.38.898 was issued in no local purchase declared DAC Directives dated 14.02.2017

refund. RTO contested that refund of adjustable

Taxpayer was to accordance with relevant by the taxpayer. There is

provisions of law after import of Rs. 1,399.343 taxes deducted u/s 148 (taxpayer being

be assessed manufacturer) and u/s 235 was rightly

proper verification of the Million for the tax year

under PTR issued. DAC directed the RTO to get their

tax deduction/payments 2010. Further cost of

because the electricity as worked out by stance verified from audit by 20.02.2017

under various heads.

taxpayer were 05.11.2019 audit was Rs. 1,028,750 and report final compliance.

not engaged in Taxpayer company is and monthly bill comes to DAC Directive dated 20.03.2017

any manufacturing concern and Rs 85,729 which could not RTO has contested that refund was

manufacturer running a solvent plant. justified to run a solvent lawfully issued, as tax deducted u/s 148

activities. Copy of audited accounts, plant. Department to revisit was adjustable because the taxpayer is a

income tax return is the case and reply to audit. manufacturer. DAC directed the RTO to

enclosed for want of 06.11.2019 provide all documents including returns,

verification Department to provide the exemption certificates and other

ofmanufacturring activity. supporting document in evidences which established that

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 26

support of contention taxpayer was a manufacturer, provide to

audit for verification by 27.03.2017 and

report final compliance.

DAC Directive dated 25.11.2019

RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

24 13980 2010 27.12.2016 DAC Directive dated 19.12.2016

MAQBOOL Rs Contested

RTO has contested. DAC directed the RTO to get its

SOLVENT PVT 2,249,942 the taxpayer is Department to revisit the contention verified from audit by 30.12.2016 and

LTD manufacturer therefore case on the ground that report compliance.

0101116-2 Refund for the tax year taxpayer did not have any DAC Directives dated 14.02.2017

2010 amounting to plant and machinery for RTO contested that refund of adjustable

Rs.22.49 was issued in processing the imported taxes deducted u/s 148 (taxpayer being

Unlawful manufacturer) and u/s 235 was rightly

issuance of accordance with relevant raw material.

issued. DAC directed the RTO to get their stance

provisions of law after 06.11.2019

refund. verified from audit by 20.02.2017 and report

proper verification of the Department to provide the

Taxpayer was to final compliance.

tax deduction/payments supporting document in DAC Directive dated 20.03.2017

be assessed support of contention

under various heads. RTO has contested that refund was lawfully

under PTR 05.11.2019 issued, as tax deducted u/s 148 was

because the 05.11.2019 adjustable because the taxpayer is a

taxpayer were Taxpayer company is manufacturer. DAC directed the RTO to

not engaged in manufacturing concern and provide all documents including returns,

any running a solvent plant. exemption certificates and other evidences

manufacturer Copy of audited accounts, which established that taxpayer was a

activities. income tax return is manufacturer, provide to audit for

verification by 27.03.2017 and report final

enclosed for want of

compliance.

verification of

DAC Directive dated 25.11.2019

manufacturing activity RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 27

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

25 13980 KONYA 2008 Rs Contested 27.12.2016 DAC Directive dated 19.12.2016

INDUSTRIES PVT 1,704,692 the taxpayer is Department to revisit the RTO has contested. DAC directed the RTO to get

manufacturer therefore case as taxpayer did not its contention verified from audit by

LTD

claim any depreciation on 30.12.2016 and report compliance.

2210411 Refund for the tax year

2008amounting to Rs17.04 plant and machinery. DAC Directives dated 14.02.2017

was issued in accordance Taxpayer is not a RTO contested that refund of adjustable

Unlawful taxes deducted u/s 148 (taxpayer being

issuance of with relevant provisions of manufacturer.

law after proper verification 06.11.2019 manufacturer) and u/s 235 was rightly

refund. issued. DAC directed the RTO to get their

of the tax Department to provide the

Taxpayer was to stance verified from audit by 20.02.2017

deduction/payments under supporting document in

be assessed support of contention and report final compliance.

various heads.

under PTR 05.11.2019 DAC Directive dated 20.03.2017

because the Taxpayer company is RTO has contested that refund was

taxpayer were manufacturing concern and lawfully issued, as tax deducted u/s 148

not engaged in running a solvent plant. was adjustable because the taxpayer is a

any Copy of audited accounts, manufacturer. DAC directed the RTO to

manufacturer income tax return is provide all documents including returns,

activities. enclosed for want of exemption certificates and other

verification of evidences which established that

manufacturing activity taxpayer was a manufacturer, provide to

audit for verification by 27.03.2017 and

report final compliance.

DAC Directive dated 25.11.2019

RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

26 13980 RAB NAWAZ 2008 Rs Contested 27.12.2016 DAC Directive dated 19.12.2016

RTO has contested. DAC directed the RTO to get its

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 28

IND. 1,663,059 the taxpayer is Department to revisit the contention verified from audit by 30.12.2016 and

manufacturer therefore case as taxpayer did not report compliance.

1313713-5

DAC Directives dated 14.02.2017

Unlawful Refund for the tax year claim any depreciation on RTO contested that refund of adjustable taxes

issuance of 2008 amounting to plant and machinery. deducted u/s 148 (taxpayer being manufacturer)

refund. Rs16.63 was issued in Taxpayer is not a and u/s 235 was rightly issued. DAC directed the RTO

Taxpayer was to accordance with relevant manufacturer. to get their stance verified from audit by

provisions of law after 06.11.2019 20.02.2017 and report final compliance.

be assessed DAC Directive dated 20.03.2017

proper verification of the Department to provide the

under PTR

tax deduction/payments supporting document in RTO has contested that refund was

because the

under various heads support of contention lawfully issued, as tax deducted u/s 148

taxpayer were . 05.11.2019 was adjustable because the taxpayer is a

not engaged in Taxpayer company is manufacturer. DAC directed the RTO to

any manufacturing concern and provide all documents including returns,

manufacturer running a solvent plant. exemption certificates and other

activities. Copy of audited accounts, evidences which established that

income tax return is taxpayer was a manufacturer, provide to

enclosed for want of audit for verification by 27.03.2017 and

verification of report final compliance.

manufacturing activity DAC Directive dated 25.11.2019

RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

27 13980 DECENT PAPER 2009 Rs 629,635 Contested 27.12.2016

MILLSPVt Ltd the taxpayer is Department to revisit the DAC Directives dated 14.02.2017

Corporate 3097943 manufacturer therefore case on the ground that RTO contested that refund of adjustable

Unlawful Refund for the tax year taxpayer did not conduct taxes deducted u/s 148 (taxpayer being

issuance of 2009 amounting to Rs..629 any activity in tax year manufacturer) and u/s 235 was rightly

refund. was issued in accordance 2009 than how tax issued. DAC directed the RTO to get their

Taxpayer was to with relevant provisions of deducted u/s 235 was stance verified from audit by 20.02.2017

law after proper verification claimed. and report final compliance.

be assessed

of the tax 06.11.2019 DAC Directive dated 20.03.2017

under PTR

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 29

because the deduction/payments under Department to provide the RTO has contested that refund was

taxpayer were various heads. supporting document in lawfully issued, as tax deducted u/s 148

not engaged in 05.11.2019 support of contention was adjustable because the taxpayer is a

any Taxpayer company is manufacturer. DAC directed the RTO to

manufacturer manufacturing concern and provide all documents including returns,

activities. running a solvent plant. exemption certificates and other

Copy of audited accounts, evidences which established that

income tax return is taxpayer was a manufacturer, provide to

enclosed for want of audit for verification by 27.03.2017 and

verification of report final compliance.

manufacturing activity DAC Directive dated 25.11.2019

RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

28 13980 KHAWAJA BASHIR & 2010 Rs Contested: 27.12.2016 DAC Directive dated 19.12.2016

Corporate CO 5,834,083 the taxpayer is Department to revisit the RTO has contested. DAC directed the RTO to get

3179817-7 manufacturer therefore case on the ground that its contention verified from audit by

Unlawful issuance tax deducted by cotton 30.12.2016 and report compliance.

Refund for the tax year

of refund. Taxpayer

2010 amounting to ginners u/s 153 was final DAC Directives dated 14.02.2017

was to be assessed

Rs.5.834 was issued in discharge and could not be RTO contested that refund of adjustable

under PTR because taxes deducted u/s 148 (taxpayer being

the taxpayer were accordance with relevant refunded.

not engaged in any provisions of law after 06.11.2019 manufacturer) and u/s 235 was rightly

manufacturer proper verification of the Department to provide the issued. DAC directed the RTO to get their

activities. tax deduction/payments supporting document in stance verified from audit by 20.02.2017

under various heads. support of contention and report final compliance.

DAC Directive dated 20.03.2017

05.11.2019

Taxpayer company is RTO has contested that refund was

manufacturing concern and lawfully issued, as tax deducted u/s 148

running a solvent plant. was adjustable because the taxpayer is a

Copy of audited accounts, manufacturer. DAC directed the RTO to

income tax return is provide all documents including returns,

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 30

enclosed for want of exemption certificates and other

verification of evidences which established that

manufacturing activity taxpayer was a manufacturer, provide to

audit for verification by 27.03.2017 and

report final compliance.

DAC Directive dated 25.11.2019

RTO informed that the taxpayer is a manufacturing

concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

29 13980 MAHMOODA 2009 Rs Contested 27.12.2016 DAC Directives dated 14.02.2017

MAQBOOL MILLS

6,354,516 the taxpayer is Department to revisit the RTO contested that refund of adjustable

0133347 taxes deducted u/s 148 (taxpayer being

Unlawful issuance of manufacturer therefore case on the ground that

Refund for the tax year tax deducted u/s 148 was manufacturer) and u/s 235 was rightly

refund. Taxpayer was

final as taxpayer is not a issued. DAC directed the RTO to get their stance

to be assessed under 2009amounting to

PTR because the verified from audit by 20.02.2017 and report

Rs.63.54 was issued in manufacturer.

taxpayer were not final compliance.

engaged in any accordance with relevant 06.11.2019 DAC Directive dated 20.03.2017

manufacturer provisions of law after Department to provide the RTO has contested that refund was

activities. proper verification of the supporting document in lawfully issued, as tax deducted u/s 148

tax deduction/payments support of contention was adjustable because the taxpayer is a

under various heads. manufacturer. DAC directed the RTO to

05.11.2019 provide all documents including returns,

Taxpayer company is exemption certificates and other

manufacturing concern and evidences which established that

running a solvent plant. taxpayer was a manufacturer, provide to

Copy of audited accounts,

audit for verification by 27.03.2017 and

income tax return is

report final compliance.

enclosed for want of

DAC Directive dated 25.11.2019

verification of RTO informed that the taxpayer is a manufacturing

manufacturering activity concern, hence refund was issued as per law. DAC

recommended the case for settlement subject to

provision of ITMS profile and inspection / local inquiry

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 31

report / audited accounts in case of Company case

and report final compliance by 06.12.2019.

30 13983 AL HILAL 2011 Rs Proceedings u/s 122(5A) for Charged but recovery is DAC Directive dated 19.12.2016

INDUSTRIES PVT 49,863,20 the tax year 2011 have been awaited. RTO informed that case is subjudice before

Corporate 06.11.2019 ATIR since 30.06.2016 after CIR(A) has

LTD 7 concluded creating tax

Request for early hearing annulled the tax demand. DAC directed the

demand at Rs.96,575,096/-. may be made to ATIR. RTO to pursue the case for early disposal.

DAC Directive dated 14.02.2017.

The taxpayer preferred RTO informed that case is subjudice before

appeal before learned CIR(A) ATIR since 30.06.2016. DAC directed the

who annulled the order RTO to pursue the case for early hearing.

passed u/s 122(5A) and DAC Directive dated 20.03.2017

RTO informed that case is subjudice before ATIR since

department filed 2nd appeal 30.06.2016. DAC directed the RTO to pursue the case

before ATIR on 30.06.2016. for early disposal.

05.11.2019 DAC Directive dated 25.11.2019

still subjudice before ATIR RTO informed that the case is subjudice before

22.11.2019 ATIR since 30.06.2016. DAC directed the RTO to

Letter for early hearing to request for out of turn hearing and pursue the

assistant Registrar ATIR vide case for early disposal.

No.1993 dated 20.11.2019

has been send.

31 13983 THAL 2008 Rs Contested: 01.02.2017 DAC Directive dated 19.12.2016

Corporate Tax liability u/s 113 was at Rs RTO is requested to provide RTO has contested. DAC directed the RTO to get

INDUSTRIES 6,329,396

8,618,453/- for the tax year challans of payments u/s 137, 147 its stance verified from audit and report

Minimum tax 2008. Thereafter order u/s 221 and 148 compliance by 30.12.2016.

u/s 113 was passed giving effect of

payment of Rs. 14,947,849/-.

Which resulted into balance DAC Directives dated 14.02.2017

refund of Rs. 6,329,396/-..The RTO informed that tax was charged and recovered

refund of Rs. 6,329,396/- has through adjustment of refund. DAC directed the

rightly been adjusted u/s 147 for RTO to get their stance verified from audit by

the tax year 2011. 20.02.2017.

DAC Directive dated 20.03.2017

30.01.2017 RTO has contested. DAC recommended the case

Copy of order u/s221 (10 of the for settlement subject to verification of

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 32

income tax ordinance, 2001 departmental stance by audit and report final

creating refund of Rs. 6,329,396/- is compliance by 27.03.2017.

enclosed. DAC Directive dated 25.11.2019

RTO has contested. DAC recommended the case

for settlement subject to verification of

departmental stance by audit and report final

compliance by 06.12.2019

32 13981 STANDARD 2006 Rs 2,475,408 Issue Involved 08.03.2017 DAC Directive dated 19.12.2016

Corporate EDIBLE OIL Refund issued but refund had Department to revisit the RTO informed thatcase is under process. DAC

Zone already been adjusted directed the RTO to finalize the proceedings and

case as there is no refund

against the other tax liability report compliance by 30.12.2016.

available for tax year 2005. DAC Directives dated 14.02.2017

of the taxpayer

RTO Lahore RTO informed that case is under process. DAC directed the

RTO to finalize proceedings by 20.02.2017 and report final

compliance thereafter.

03.03.2017 DAC Directive dated 20.03.2017

Contested DAC directed the RTO to revisit the case in view of their

Refund of Rs. 1,601,091/- for departmental explanation, get the same verified from

the tax year 2006 was audit and report final compliance by 27.03.2017.

created vide order u/s 170(3) DAC Directive dated 25.11.2019

dated: 20.04.2011. An RTO informed that demand has been adjusted against

amount of Rs. 1,407,757/- refund. DAC directed the RTO to provide proof of tax

was adjusted out of created payment to audit for verification and report final

refund leaving balance refund compliance by 06.12.2019.

of Rs. 193,334/-. Nofurther

refund was issued.

33 13981 AL HALAL 2003 Rs4,166,167 Issue Involved 06.11.2019 DAC Directive dated 19.12.2016

Corporate VEGETABLE Refund issued but refund had Department to provide the RTO informed thatcase is under process. DAC

Zone already been adjusted directed the RTO to finalize the proceedings and

GHEE MILLSPvt supporting documents

against the other tax liability report compliance by 30.12.2016.

Ltd DAC Directives dated 14.02.2017

of the taxpayer

RTO informed that case is under process. DAC directed the

RTO to finalize proceedings by 20.02.2017 and report final

05.11.2019 compliance thereafter.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 33

The matter has been DAC Directive dated 20.03.2017

referred to add.CIR for DAC directed the RTO to revisit the case in view of their

departmental explanation, get the same verified from

examination of the record audit and report final compliance by 27.03.2017.

DAC Directive dated 25.11.2019

RTO informed that demand has been adjusted against

refund. DAC directed the RTO to provide proof of tax

payment to audit for verification and report final

compliance by 06.12.2019.

34 13982 ROOMI FABRICS 2010 Rs30,168,035 Order u/s 122 (5A) passed 27.12.2016 DAC Directive dated 19.12.2016

PVT LTD and minimum tax of Rs Department has charged tax RTO has contested. DAC directed the RTO to

5,468,283/-.charged as under u/s 113 for the tax year 2010 get its stance verified from audit and report

Total sales declared at Rs. 5,468,283. Recovery is compliance by 30.12.2016.

4,268,686,883/- awaited. Moreover,

Less export sales department not provide the DAC Directives dated 14.02.2017

3,175,030,309/- proof of tax deductions RTO informed that leviable tax amount to

Local turnover from all claimed u/s 154 (on export). Rs.5,468,283/- has been charged and balance

sources 1,093,656,574/- 30.03.2017 was not leviable. DAC directed the RTO to

Tax leviable u/s 113@ .5% Proofs of tax deductions u/s recover tax demand and provide evidence of

Rs.5,468,283/- have been provided. tax deduction u/s 154 to Audit for verification

Balance Rs. 23,699,752/- is by 20.02.2017 and report final compliance.

not leviable being export Recovery of Rs. 5,468,283/- is

still awaited. Since DAC Directives dated 20.03.2017

sales and cover under FTR.

05.11.2019 29.06.2015 order u/s 122 RTO informed that tax has been recovered. DAC

Recovery of minimum tax u/s (5A). directed the RTO to provide proof of recovery to

113 is under process. 06.11.2019 audit by 27.03.2017 and report final compliance

Proof of tax payments may be DAC Directive dated 25.11.2019

DAC reiterated its earlier directive dated 14.02.2017 and

provided. 20.03.2017 and observed with concern that despite lapse

of more than two years time, RTO could not provide

documentary evidence regarding tax payment. DAC

directed the CCIR to provide tax payment for verification

to Audit and report final compliance by 06.12.2019.

RTO Multan AR 2013-14 DAC Meeting dated 25-11-2019 34

35 13982 2010 Rs Tax Year 2010 27.12.2016 DAC Directive dated 19.12.2016

RELIANCE Order u/s 122 (5A) passed and minimum

2011 130,148,689 Tax year 2010 RTO has contested. DAC directed the RTO to get its

WEAVING MILLS tax of Rs 5,468,283/-.charged as under

Total sales declared Department has charged tax stance verified from audit and report compliance by

6,773,391,678/- u/s 113 on local sales on 30.12.2016.

Less export sales

4,490,958,500/- which tax u/s 113 comes to

Local turnover from all sources Rs. 11,412,166. Recovery is DAC Directives dated 14.02.2017

2,282,433,178/-

awaited. RTO informed that leviable tax amount to

Tax leviable u/s 113@ .5%

11,412,166/- Balance Rs. 20,074,437 is Rs.11,412,166/- has been charged and

Balance Rs. 20,074,437/- is not not leviable. However balance was not leviable. DAC directed the RTO

leviable.

department to provide the to recover tax demand and provide evidence of

Tax Year 2011

Order u/s 122 (5A) passed and proof of tax deductions tax deduction u/s 154 to Audit for verification

minimum tax @ of 1% charged at claimed u/s 154. by 20.02.2017 and report final compliance.

Rs41,734,098/-. Which was arrived Tax year 2011 DAC Directives dated 20.03.2017

as under

Total sales declared Pending. RTO informed that tax has been recovered. DAC

9,973,989,378/- directed the RTO to provide proof of recovery to

Less export sales 08.03.2017

5,800,579,600/-