Professional Documents

Culture Documents

Down

Down

Uploaded by

Zarna Shingala SOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Down

Down

Uploaded by

Zarna Shingala SCopyright:

Available Formats

KNOW YOUR CLIENT (KYC)

In order to comply with regulatory provisions under the Prevention of Money Laundering Act 2002, Rules issued

thereunder and related guidelines/circulars issued by SEBI, KYC formalities are required to be completed for all Unit

Holders, including Guardians and Power of Attorney holders, for any investment (whether new or additional

purchase) of Rs. 50,000 or more in mutual funds. For the convenience of investors in mutual funds, all mutual funds

have made special arrangements with CDSL Ventures Ltd. (CVL), a wholly owned subsidiary of Central Depository

Services (India) Ltd. (CDSL)).

DOCUMENTS AND INFORMATION TO BE PROVIDED BY INVESTORS:

Investors in mutual fund schemes have to provide:

(1) Proof of Identity

(2) Proof of Address

(3) PAN Card

(4) Photograph

(Click here for List of documents)

The originals of these documents along with a copy each to be presented and the original will be returned after

verification. Alternatively, investors can also provide an attested true copy of the relevant documents. Attestation

could be done by Notary Public/ Gazetted Officer/ Manager of a Scheduled Commercial Bank.

Instead of providing the required documents again and again to different mutual funds in which one would like to

invest, CVL, on behalf of all mutual funds will carry out the process of KYC and issue an acknowledgement.

Investors have to provide the relevant documents and information ONLY ONCE for complying with KYC. After that

Investors could invest in the schemes of all mutual funds by merely attaching a copy of the KYC acknowledgement

slip with the application form / transaction slip when investing for the first time in every folio (Post KYC) in each

Mutual Fund house, without the necessity to submit the KYC documents again.

Any subsequent changes in address or other details could be intimated to any of the POS (with relevant documentary

evidence) (Click here for Change Form Individual) / (Click here for Change Form Non-Individual) and the same will

get updated in all the mutual funds where the investor has invested.

This facility is being provided absolutely FREE OF COST to the investors. To begin with, investors investing

Rs.50,000 or more will have to comply with KYC effective from 1st February, 2008.

WHERE TO COMPLETE THE FORMALITIES:

Investors could complete the formalities by submitting the KYC form (Click here for Individual KYC Form) / (Click here

for Non-Individual KYC Form) and relevant documents at the Points of Services (POS). (Click here for List of

POS) To start with, these POS will be the select branches / offices of mutual funds, registrars and select branches of

some distributors. The application form for complying with KYC will be available from these POS. The application

form could also be downloaded from CVL www.cvlindia.com. Investors could contact offices of mutual funds,

registrars and mutual fund distributors (ARN Holders) for further details and assistance.

You might also like

- Case 11 Horniman HorticultureDocument4 pagesCase 11 Horniman HorticultureFaza FadhilahNo ratings yet

- Reportorial Requirements For SEC Registered CorporationsDocument2 pagesReportorial Requirements For SEC Registered Corporationssirrhouge100% (1)

- Investment Memo For DeloitteDocument6 pagesInvestment Memo For Deloitteblackpearl192No ratings yet

- Project of Transfer of Property ACT On Fraudulent Transfer: Submitted ByDocument23 pagesProject of Transfer of Property ACT On Fraudulent Transfer: Submitted Byaatish babuNo ratings yet

- Know Your Client (Kyc)Document8 pagesKnow Your Client (Kyc)বলবো নাNo ratings yet

- Individual KYC PDFDocument2 pagesIndividual KYC PDFSivakumarNo ratings yet

- Presented To:-: Mr. Anil KothariDocument21 pagesPresented To:-: Mr. Anil KothariAniket JhaNo ratings yet

- Sebi Updates NovDocument7 pagesSebi Updates NovParidhi JainNo ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- Unit 4 Mutual Fund OperationDocument13 pagesUnit 4 Mutual Fund OperationSneha GahlyanNo ratings yet

- Chapter 09Document8 pagesChapter 09siddhant singhNo ratings yet

- FAQ DematDocument10 pagesFAQ DematPrashant SharmaNo ratings yet

- STFC NCD ProspectusOCT 13 NCDDocument47 pagesSTFC NCD ProspectusOCT 13 NCDPrakash JoshiNo ratings yet

- Instructions For Completing The Application FormDocument2 pagesInstructions For Completing The Application FormRanjan G HegdeNo ratings yet

- IDBI Distributor Empanelment FormDocument2 pagesIDBI Distributor Empanelment FormNataasha JumaniNo ratings yet

- M2 Account OpeningDocument58 pagesM2 Account OpeningGouri K MakatiNo ratings yet

- What Is A Depository?Document12 pagesWhat Is A Depository?Dinesh GodhaniNo ratings yet

- KotakDocument2 pagesKotakRandhir RanaNo ratings yet

- Canara DemateDocument6 pagesCanara DemateGagan PrasadNo ratings yet

- 107 ExtraDocument47 pages107 ExtraDhawan SandeepNo ratings yet

- FAQ On CKYC For ChannelsDocument5 pagesFAQ On CKYC For ChannelsYasahNo ratings yet

- Draftlistingforsecuritiseddebt InstrumentsDocument22 pagesDraftlistingforsecuritiseddebt InstrumentsRajalakshmi13No ratings yet

- Internal Audit of DPDocument9 pagesInternal Audit of DPAlpa ShahNo ratings yet

- Depository System: This System Came in To Force With Effect FromDocument38 pagesDepository System: This System Came in To Force With Effect Fromanilkanwar111No ratings yet

- AMFI ProjectDocument7 pagesAMFI ProjectSunny AroraNo ratings yet

- RemittancesDocument28 pagesRemittancesDeepthi RavichandhranNo ratings yet

- Faqs On Sebi Investment Advisor Regulation 2013Document10 pagesFaqs On Sebi Investment Advisor Regulation 2013maheshmuralinair6No ratings yet

- Page From SR 5 Infra Disclosure DocumentDocument1 pagePage From SR 5 Infra Disclosure DocumentkartiksharmainspireNo ratings yet

- KRA Validation ActivityDocument20 pagesKRA Validation ActivityPRIYANKA NITIN KAWALENo ratings yet

- JM Transaction Slip 31-03-10Document2 pagesJM Transaction Slip 31-03-10arshadjafri123No ratings yet

- FAQ-Dematerialisation: Bank DepositoryDocument9 pagesFAQ-Dematerialisation: Bank DepositoryRitika SharmaNo ratings yet

- Get Quote Get Quote: Alternative Investment Funds Alternative Investment FundsDocument6 pagesGet Quote Get Quote: Alternative Investment Funds Alternative Investment FundsVIESAKAN VSNo ratings yet

- Depository SystemDocument20 pagesDepository SystemSuhail AkhterNo ratings yet

- Sip & Micro Sip PDC Form - 29.04.2013Document4 pagesSip & Micro Sip PDC Form - 29.04.2013Aayush ShahNo ratings yet

- MD ImportsDocument14 pagesMD Importsshaunak goswamiNo ratings yet

- Mem Comp HandbookDocument35 pagesMem Comp HandbookKalpesh Rathi100% (1)

- Faqs Member ComplianceDocument33 pagesFaqs Member ComplianceSunny ChaturvediNo ratings yet

- FAQs KRA v1.3Document5 pagesFAQs KRA v1.3vbpscribdNo ratings yet

- LLLLLDocument21 pagesLLLLLLokesh ChelaniNo ratings yet

- Page 1 of 3Document3 pagesPage 1 of 3Shyam SunderNo ratings yet

- Connectors GuidelinesDocument2 pagesConnectors GuidelinesdelhilicofficeNo ratings yet

- Depository SystemDocument16 pagesDepository Systemreemasngh01No ratings yet

- Mannapuram Application Form DetailsTNCDocument47 pagesMannapuram Application Form DetailsTNCTejas Pradyuman JoshiNo ratings yet

- Overseas Direct Investment (ODI) by Resident Individuals Under Liberalized Remittance Scheme (LRS) (3)Document5 pagesOverseas Direct Investment (ODI) by Resident Individuals Under Liberalized Remittance Scheme (LRS) (3)notalwaysavailableNo ratings yet

- Lecture 04Document19 pagesLecture 04Syed NayemNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- KYC Requirements From Jan 1 2011Document1 pageKYC Requirements From Jan 1 2011praveen_vmNo ratings yet

- Financial Services Assignment 1: Submitted To: Ms Geetika ChawlaDocument7 pagesFinancial Services Assignment 1: Submitted To: Ms Geetika ChawlaSunny AroraNo ratings yet

- Sbi Funds Management Private LimtedDocument48 pagesSbi Funds Management Private LimtedAkash ParabNo ratings yet

- Risk ManagementDocument62 pagesRisk ManagementBhavik ShahNo ratings yet

- Sebi Master Circular DepositoriesDocument53 pagesSebi Master Circular DepositoriesPrasanna RathNo ratings yet

- ProfitMart CommoditiesDocument16 pagesProfitMart CommoditiesProfit CircleNo ratings yet

- Overview of Demat AccountDocument12 pagesOverview of Demat AccountNagireddy KalluriNo ratings yet

- Open-Ended FundDocument9 pagesOpen-Ended Fundzeratul9901No ratings yet

- RBI Master Circular AML and KYC 201507Document88 pagesRBI Master Circular AML and KYC 201507sgjNo ratings yet

- Depositories Act 1996: Depository SystemDocument5 pagesDepositories Act 1996: Depository SystemMukul Kr Singh ChauhanNo ratings yet

- Systematic Investment Plan S I P: SIP Enrolment FormDocument4 pagesSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghNo ratings yet

- Master Direction On Liberilised Remittance Scheme Jan 1, 2016Document20 pagesMaster Direction On Liberilised Remittance Scheme Jan 1, 2016patrodeskNo ratings yet

- FAQ On Revised KYC ProcessDocument6 pagesFAQ On Revised KYC ProcessashokanpoonamNo ratings yet

- Demat Account Project 12th StandardDocument5 pagesDemat Account Project 12th StandardZaid Khan100% (2)

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Factory OverheadDocument21 pagesFactory OverheadJuvi CruzNo ratings yet

- Latest Development of IFRS (and HKFRS) : Nelson Lam Nelson Lam 林智遠 林智遠Document32 pagesLatest Development of IFRS (and HKFRS) : Nelson Lam Nelson Lam 林智遠 林智遠ChanNo ratings yet

- Mis For HDFCDocument16 pagesMis For HDFCAlankrita Mayura MinzNo ratings yet

- Central Bank of Iraq: Press CommuniquéDocument9 pagesCentral Bank of Iraq: Press CommuniquéLawa samanNo ratings yet

- Pengaruh Stock Spilt Dan Kinerja Keuangan DLM Return SHMDocument11 pagesPengaruh Stock Spilt Dan Kinerja Keuangan DLM Return SHMKevinNo ratings yet

- 041&100-NTC vs. CA 311 SCRA 508, 514-515 (1999)Document4 pages041&100-NTC vs. CA 311 SCRA 508, 514-515 (1999)wewNo ratings yet

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Document94 pagesNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieNo ratings yet

- Project Planning and FinanceDocument79 pagesProject Planning and FinanceajayghangareNo ratings yet

- Tax Exemption Rules For Cooperatives ApprovedDocument2 pagesTax Exemption Rules For Cooperatives Approvedmrlee28No ratings yet

- Rekening Koran 3Document10 pagesRekening Koran 3Farahdilla LovianeNo ratings yet

- Amara Raja - Q1FY22 - MOStDocument10 pagesAmara Raja - Q1FY22 - MOStRahul JakhariaNo ratings yet

- Annual Report 2017 of BSRM Steels LimitedDocument177 pagesAnnual Report 2017 of BSRM Steels LimitedZakaria SakibNo ratings yet

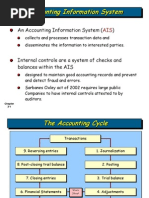

- Wiley - Chapter 3: The Accounting Information SystemDocument36 pagesWiley - Chapter 3: The Accounting Information SystemIvan BliminseNo ratings yet

- Act 2874Document23 pagesAct 2874givemeasign24No ratings yet

- Challenges & Opportunities For CILDocument30 pagesChallenges & Opportunities For CILKrishna Deo PrasadNo ratings yet

- Literature Review On Profit MaximizationDocument6 pagesLiterature Review On Profit Maximizationea4c954q100% (1)

- Basics of CandleStick - SreeDocument22 pagesBasics of CandleStick - SreeManikanta SatishNo ratings yet

- UPSC IAS Pre LAST 5 Year Papers General StudiesDocument96 pagesUPSC IAS Pre LAST 5 Year Papers General StudiesSundeep MalikNo ratings yet

- "Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NDocument20 pages"Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NShalini NagavarapuNo ratings yet

- Explain The Relationship Between Financial Management and Other Disciplines Finance and EconomicsDocument14 pagesExplain The Relationship Between Financial Management and Other Disciplines Finance and EconomicsajeshNo ratings yet

- 09 Hontiveros V TRBDocument45 pages09 Hontiveros V TRBMichael RentozaNo ratings yet

- US Internal Revenue Service: p4227Document2 pagesUS Internal Revenue Service: p4227IRSNo ratings yet

- Believe Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheDocument48 pagesBelieve Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheSofia SantosNo ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- Funding of AcquisitionsDocument41 pagesFunding of AcquisitionssandipNo ratings yet

- 091 - People's Bank & Trust Co. V Dahican LumberDocument2 pages091 - People's Bank & Trust Co. V Dahican LumberJaerelle HernandezNo ratings yet

- Master Budget Short ProblemsDocument3 pagesMaster Budget Short ProblemsMary Berly MagueflorNo ratings yet