Professional Documents

Culture Documents

Lpgaswire: Market Commentary Asia LPG ($/MT)

Lpgaswire: Market Commentary Asia LPG ($/MT)

Uploaded by

Trần Đức DũngOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lpgaswire: Market Commentary Asia LPG ($/MT)

Lpgaswire: Market Commentary Asia LPG ($/MT)

Uploaded by

Trần Đức DũngCopyright:

Available Formats

]

www.platts.com

LPGASWIRE

[OIL ]

Volume 35 / Issue XXX / Month D, 2013

Asia LPG ($/mt) (PGL page 2780) Market Commentary

Code Mid Change Code Mid Change

CFR Refrigerated Diffs to Saudi CP strip Asia LPG (PGL page 2798)

11:11 Singapore-Japan (H1 Feb) AASGO00 989.000 -6.000

11:11 Singapore-Japan (H2 Feb) AASGP00 976.000 -6.000

11:11 Singapore-Japan (H1 Mar) AASGQ00 963.000 -6.000 Asian LPG prices made a strong rebound Thursday from

11:11 Singapore-Japan cargo* AASGN00 982.500 -6.000 recent weakness, with sentiment boosted by news of a

Propane Japan cargo (H1 Feb) AAVAK00 1004.00–1006.00 1005.000 -6.000 Propane Japan PMAAX00 16.00/17.00 16.500 +3.000

Propane Japan cargo (H2 Feb) AAVAL00 991.00–993.00 992.000 -6.000

delay in deliveries of term Aramco supplies to Asian lifters

Propane Japan cargo (H1 Mar) AAVAM00 978.00–980.00 979.000 -6.000 from H1 February to H2 February, as well as expectations

Propane Japan cargo* PMAAV00 998.00–999.00 998.500 -6.000 of overall lower exports from the Middle East, traders

Propane South China cargo AABAK00 998.00–1000.00 999.000 -6.000 Propane South China AABAI00 -12.00/-10.00 -11.000 -6.000

Propane Taiwan cargo AABAN00 999.00–1001.00 1000.000 -6.000 Propane Taiwan AABAO00 -11.00/-9.00 -10.000 -6.000 said. The LPG market bucked the $6/mt drop seen on

Propane North Asia Zone AAJTQ00 998.00–1000.00 999.000 -6.000 ICE Brent crude futures. Prices of propane for delivery

Propane Korea PMABK00 13.00/14.00 13.500 +3.000

along the Singapore-Japan route 30-45 days forward

Butane Japan cargo (H1 Feb) AAVAN00 944.00–946.00 945.000 -6.000 Butane Japan PMAAH00 16.00/17.00 16.500 +3.000

Butane Japan cargo (H2 Feb) AAVAO00 931.00–933.00 932.000 -6.000 jumped by $33/mt from the previous session to $908/mt

Butane Japan cargo (H1 Mar) AAVAP00 918.00–920.00 919.000 -6.000 Thursday. Butane rose by $38/mt to $908/mt. The front-

Butane Japan cargo* PMAAF00 938.00–939.00 938.500 -6.000

Butane South China cargo AABAU00 938.00–940.00 939.000 -6.000 Butane South China AABAT00 -12.00/-10.00 -11.000 -6.000

month propane Contract Price swap was heard traded

Butane Taiwan cargo AABBH00 939.00–941.00 940.000 -6.000 Butane Taiwan AABBI00 -11.00/-9.00 -10.000 -6.000 just after the Asian market close at $885/mt and $900/

Butane North Asia Zone AAJTT00 938.00–940.00 939.000 -6.000 mt. During the Asian trading session, the swap was

Butane Korea PMABL00 13.00/14.00 13.500 +3.000

discussed in a wide range, with a bid heard at $861/

CFR Pressurized Diffs to Saudi CP strip

LPG Vietnam AAWUV00 1063.00–1065.00 1064.000 -5.000 LPG Vietnam AAWUW00 84.00/86.00 85.000 +1.000 mt and an offer at $925/mt. On Wednesday, trades

LPG Philippines AAWUX00 1068.00–1070.00 1069.000 -5.000 LPG Philippines AAWUY00 89.00/91.00 90.000 +1.000 were heard between $853 and $854/mt. Traders said

FOB Pressurized Diffs to Saudi CP strip that while there were concerns of lower Middle Eastern

LPG East China AAWUZ00 976.00–978.00 977.000 -6.000 LPG East China AAWVA00 -3.00/-1.00 -2.000 +0.000

LPG South China AAWVB00 976.00–978.00 977.000 -6.000 LPG South China AAWVC00 -3.00/-1.00 -2.000 +0.000 supplies to Asia, demand was not strengthening, with

LPG Singapore AAWVD00 981.00–983.00 982.000 -6.000 LPG Singapore AAWVE00 2.00/4.00 3.000 +0.000 Japanese buyers comfortable with their current stockpiles,

which they are expected to draw upon to meet winter

Middle East LPG (PGL page 2776)

demand. The current February/March backwardation of

Code Mid Change Code Mid Change $15/mt in the swaps market is also deterring Japanese

FOB Arab Gulf Diffs to Saudi CP

Propane cargo PMUDM00 832.00–834.00 833.000 +56.000 Propane vs CP PMABF00 -14.00/-12.00 -13.000 -7.000

traders from buying, sources said. “The Japanese are

Propane vs CP M1 (Jan) AAKZA00 -28.00/-26.00 -27.000 +10.000 waiting for March to buy,” one trader said. In the physical

Propane vs CP M2 (Feb) AALAM00 -1.00/1.00 0.000 +0.000 market, Vilma was heard to have bid for 22,000 mt of

Butane cargo PMUDR00 811.00–812.00 813.000 +56.000 Butane vs CP PMABG00 -28.00/-26.00 -27.000 -7.000

Butane vs CP M1 (Jan) AAKZB00 -38.00/-36.00 -37.000 +10.000 propane for second half-February at a premium of $15/mt

Butane vs CP M2 (Feb) AALAN00 -1.00/1.00 0.000 +0.000 to the February CP swap for half the cargo and at $900/

Propane CP strip (Japan-Korea)* AAKZC00 845.00–847.00 846.000 +56.000 mt for the other half. Cargill was heard to have bid for the

Butane CP strip (Japan-Korea)* AAKZD00 839.00–841.00 840.000 +56.000

Propane CP strip (China-Taiwan)** AAKZE00 981.00–983.00 982.000 +56.000 same volume, also for H2 February at parity to the Argus

Butane CP strip (China-Taiwan)** AAKZF00 930.00–932.00 931.000 +56.000 Far Eastern Index for February for half the cargo and at

*loading 20-40 days; **loading 5-15 days

$895/mt for the other half. No trades were seen.

The McGraw Hill Companies

LPGASWIRE MONTH D, 2013

European LPG ($/mt) (PGL page 1775) Middle East LPG (PGL page 2799)

Code Propane Mid Change Code Butane Mid Change

Northwest Europe Saudi Aramco has announced its acceptance of

FOB Seagoing PMABB00 945.00–950.00 947.500 +20.000 FOB Seagoing PMAAL00 835.00–840.00 837.500 +5.000 nominations for term LPG cargoes for February with no

FOB ARA PMAAS00 980.00–985.00 982.500 +5.000 FOB ARA PMAAC00 860.00–865.00 862.500 +10.000 cuts to supplies, but some loading delays, traders said

FCA ARA* PMABH00 1010.00–1015.00 1012.500 +15.000 FCA ARA* PMABI00 1870.00–1875.00 1872.500 +10.000

CIF 1-3k mt PMAAZ00 975.00–980.00 977.500 +20.000 CIF 1-3k mt PMAAJ00 875.00–880.00 877.500 +5.000 Thursday. The delays to some lifters are between one

CIF 7000+ mt PMABA00 965.00–970.00 967.500 +35.000 CIF 3000+ mt PMAAK00 880.00–885.00 882.500 +5.000 and two weeks, sources said. “There is no reduction

FOB 7000+ mt AAVKH00 940.00–945.00 942.500 +35.000 FOB 3000+ mt AAVKI00 843.00–848.00 845.500 +5.000

to nomination quantity,” one trader said. “On the other

Western Mediterranean

hand, because many FOB lifters nominated 1st February

FOB Ex-Refinery/Storage PMABC00 985.00–990.00 987.500 +35.000 FOB Ex-Ref/Storage PMAAM00 890.00–895.00 892.500 +5.000

FCA Ex-Refinery/Storage* PMABJ00 985.00–990.00 987.500 +35.000 as the lifting stem, most acceptance for them were

CIF 7000+ mt PMABE00 965.00–970.00 967.500 +35.000 delayed,” he said adding that it may not be due to any

*FCA ARA refers to sales onto railcars and trucks in the Amsterdam-Rotterdam-Antwerp region supply issues. However, some market sources said the

term export volume to Asia for February this year may

be less than the 17-18 cargoes, or around 800,000

Naphtha ($/mt) LPG Postings ($/mt)

mt, supplied in February 2012. The actual volume this

$/mt Mid Change Saudi Contract Postings (PGL page 2790) time could not be immediately determined. Sources

Europe (PGA page 1310 & 1320) Saudi Propane CP (Jan) PTAAM10 975.00 said that Saudi Aramco may also have less or no spot

CIF ARA cargo PAAAL00 918.00–922.00 920.000 +34.000 Saudi Butane CP (Jan) PTAAF10 975.00

CIF Med cargo PAAAI00 867.00–871.00 869.000 +35.000

cargoes to export for February as it diverts supply to

Algerian Postings (PGL page 1790)

the domestic petrochemical sector. They said that

Propane FOB Bethouia CP (Jan) PTAAI10 975.00

Propane FOB Skikda CP (Jan) PTAAJ10 975.00 the Saudi Polymers’ production facility, which shut for

Month to Date Averages Butane FOB Algeria CP (Jan) PTAAC10 980.00 maintenance November 11, had resumed operations

$/mt Mid Change early January instead of late January, taking up LPG as

Europe Month to Date (PGL page 1775)

Propane swaps feedstock. The restart and other details could not be

FOB Seagoing PMUDI00 967.00–972.00 969.500 +1.500

CIF 7000+ mt PMUDK00 999.60–1004.60 1002.100 +1.500 Mid Change confirmed by the company. The market is also watching

Middle East Month to Date (PGL page 2776) Northwest Europe ($/mt) (PGL page 1775) the supply situation from the rest of the Middle East and

Propane cargo PMUDO00 943.10–944.80 943.950 +57.000 M1 (Feb) PMABU00 918.00–922.00 920.000 +34.000 West Africa into the Asian and European markets. Gas

Butane cargo PMUDQ00 899.10–900.80 899.950 +57.000 M2 (Mar) PMUDH00 867.00–871.00 869.000 +35.000 plant shutdowns were heard in the UAE in January and

M3 (Apr) AALQQ00 791.00–795.00 793.000 +22.000

February, and in Qatar next month, while the hostage

LPG Shipping ($/mt) Q1 (Q2 2013) PMUDE00 858.00–862.00 860.000 +30.000 crisis at Algeria’s In Amenas gas field, jointly operated

Q2 (Q3 2013) AAHIN00 730.00–734.00 732.000 +30.000

by British oil giant BP, Norway’s Statoil and state-run

From: To: Product Cargo size Code $/mt US Gulf Coast ($/barrel) (PGA page 780)

Algerian energy firm Sonatrach, could disrupt around

(PGL page 1786) M1 (Feb) AAHYX00 84.00–84.10 84.050 +3.000

Norway Netherlands Propane 20kt AAVKK00 41.00 M2 (Mar) AAHYY00 84.40–84.50 84.450 +5.000 80,000 mt of propane production, sources said. Even

Norway Netherlands Butane 10kt AAVKJ00 36.00 M3 (Apr) AAHYZ00 84.60–84.70 84.650 +2.000 though Algerian supplies mainly go to Europe, one trader

(PGL page 2786) said: “I guess all disruptions count to the market.”

Q1 (Q2 2013) PMABS00 85.50–85.60 85.550 +3.000

Persian Gulf Japan LPG 11-44kt AAPNI00 41.00

Q2 (Q3 2013) PMABT00 86.50–86.60 86.550 +3.000

Persian Gulf South China LPG 11-44kt AAPNG00 36.00

Persian Gulf East China LPG 11-44kt AAPNH00 39.00 Saudi CP ($/mt) (PPA page 2652) West Mediterranean LPG (PGL page 1797)

Thailand Guangzhou LPG 1-3kt AAPNJ00 123.00 M1 (Feb) AAHHG00 921.98–922.02 922.000 +3.000

Thailand Guangxi LPG 1-3kt AAPNK00 121.00 M2 (Mar) AAHHH00 888.98–889.02 889.000 +5.000

Propane exports from Lavera remained at low levels

Thailand Shantou LPG 1-3kt AAPNL00 124.00 M3 (Apr) AAHHI00 838.98–839.02 839.000 +2.000

Japan Shanghai LPG 1-3kt AAPNM00 73.00 Thursday with only a small 1,700 mt cargo for Spain

Korea Shanghai LPG 1-3kt AAPNN00 58.00 Q1 (Q2 2013) AAHHJ00 805.98–806.02 806.000 +3.000 currently nominated for loading. Following the deal

Copyright © 2013, The McGraw-Hill Companies 2

LPGASWIRE MONTH D, 2013

US LPG (PGA page 780) concluded Wednesday market activity was more

Code Mid Change Code Mid Change muted Thursday with no public bids or offers seen.

Mount Belvieu non-LST (¢/gal) Mount Belvieu LST (¢/gal) Nevertheless, trading sources said that prompt spot

Ethane/propane mix M1 PMUDA05 25.10–25.20 25.150 +5.000 butane availability at Lavera was still quite tight. Exports

Ethane/propane mix M2 AAWUB00 26.60–26.70 26.650 +5.000

Ethane purity M1 PMUDB05 28.35–28.45 28.400 +5.000

continued to move out of Lavera at a steady rate with a

Ethane purity M2 AAWUC00 29.10–29.20 29.150 +5.000 5 kt cargo reported to be loading in the next couple of

Propane M1 PMAAY00 79.60–79.70 79.650 +5.000 Propane M1 PMABQ00 81.35–81.45 81.400 +5.000 days and another 6 kt cargo loading shortly after wards.

Propane M2 AAWUD00 80.60–80.70 80.650 +5.000 Propane M2 AAWUE00 81.35–81.45 81.400 +5.000

Normal butane M1 PMAAI00 116.35–116.45 116.400 +5.000 Normal butane PMABR00 106.35–106.45 106.400 +5.000

Normal butane M2 AAWUF00 117.35–117.45 117.400 +5.000 Northwest Europe Propane (PGL page 1798)

Isobutane PMAAB00 133.60–133.70 133.650 +5.000 Isobutane AAIVD00 133.60–133.70 133.650 +5.000

Natural gasoline (non-Targa) M1 PMABY05 163.10–163.20 163.150 +5.000 Natural gasoline AAIVF00 175.10–175.20 175.150 +5.000

Natural gasoline (non-Targa) M2 AAWUG00 163.10–163.20 163.150 +5.000 Spot prices were slightly higher Thursday with several

Natural gasoline (Targa) PMABW05 175.10–175.20 175.150 +5.000 public bids but only one offer. Totsa was a buyer for 8 kt

($/mt) CIF Le Havre January 25-28 at $859/mt, and also 20.6

Propane AAXDD00 414.72–415.24 414.980 +5.000

Normal butane AAXDC00 527.07–527.52 527.295 +5.000

kt CIF January 30-February 2 at $850/mt and February

Conway, Kansas (¢/gal) Bushton, Kansas (¢/gal)

quotes plus $2/mt. Statoil was a buyer of 20.5 kt CIF

Ethane/propane mix PMAAO00 7.10–7.20 7.150 +1.500 January 24-26 at $851/mt and balance January quotes

Propane PMAAT00 52.35–52.45 52.400 +1.500 Propane AALBE00 52.35–52.45 52.400 +1.500 minus $1/mt. Gunvor was a seller of 20.6 kt January

Normal butane PMAAD00 86.10–86.20 86.150 -1.500

Isobutane PMAAA00 125.10–125.20 125.150 +1.500 27-February 6 at February quotes plus $15/mt. There

Natural gasoline PMAAQ00 172.45–172.55 172.500 +1.500 were no reported trades. According to trading sources

The River* (¢/gal) Hattiesburg pipeline (¢/gal) Thursday spot availability continued to be tight over the

Natural gasoline AALBG00 164.45–164.55 164.500 +1.500 Propane AALBC00 78.75–78.85 78.800 +1.500

rest of January with no refinery or Tees product currently

Note: Spot prices exclude terminalling; *The River means on barges in various points of Mississippi River in Louisiana.

on offer. SHV reported buying 2,000-2,400 mt FOB

Karlshamn January 21-25 at $819/mt. Industry sources

NYMEX Futures Thursday said there had still not been any significant

Platts Futures Assessments 3:15 pm ET* (PGA page 703) Futures Settlement (PGA page 702) increase in spot demand for ARA propane. “We need

$/barrel $/MMBtu more cold days,” said a German trader. On the FCA

Light sweet crude (Jan) NYCRM01 93.04 Natural gas (Feb) AACMZ00 3.02 market about 315 mt on rail was said done at $880/

Light sweet crude (Feb) NYCRM02 93.45 $/barrel

Light sweet crude (Mar) NYCRM03 93.85 Light sweet crude (Feb) AASCS00 93.05 mt with 40 mt on truck reported concluded at $876/

* These assessments reflect prevailing futures value exactly at 3:15 pm ET. However, on the business day preceding the following holidays these assessments reflect the mt. Another 315 mt FCA was said done at $895/mt. On

value of futures at precisely 1:30 pm ET: Christmas Day, New Years Day, Fourth of July, and Thanksgiving Day.

the barge market Gunvor reported selling to Petredec

450 mt FOB ARA January 25-27 at 50% $875/mt and

]

50% Platts FOB quotes related/mt. Another 500 mt FOB

LPGASWIRE Volume 35 / Issue xxx / Month d, 2013 loading January 25-26 was reported done at $878/mt.

Editorial: Esa Ramasamy, Editorial Director, Americas Oil: +1-713-658-3292, Matt Cook, Senior Managing Editor, Americas Clean Products +1-713-658-3208,

Sharmilpal Kaur, Associate Editorial Director, Americas PFC, Crude and Residual Fuel +1-713-655-2270 Northwest Europe Butane (PGL page 1799)

Client services information: North America: +1 800-PLATTS8 (+1-800-752-8878); direct: +1-212-904-3070 Europe & Middle East: +44-20-7176-6111

Asian Pacific: +65-6530-6430 Latin America: +54-11-4121-4810, E-mail: support@platts.com

Copyright © 2013 The McGraw-Hill Companies. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer Spot prices for mixed butane were slightly stronger

system or otherwise redistributed without prior written authorization from Platts. Platts is a trademark of The McGraw-Hill Companies Inc.Information has been obtained

from sources believed reliable. However, because of the possibility of human or mechanical error by sources, McGraw-Hill or others, McGraw-Hill does not guarantee the Thursday. There were no fundamental changes to

accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained from use of such information.

See back of publication invoice for complete terms and conditions.

the market as players waited for February trading to

commence. “It is pretty well done for January,” said one

Copyright © 2013, The McGraw-Hill Companies 3

LPGASWIRE MONTH D, 2013

industry source. Although good quality product remained strength in gasoline and crude. Non-LST normal butane News (PGA page 100)

tight Thursday market sentiment was seen to be a touch was assessed up 3.2 cents to $1.6275/gal and 2.75

more bearish. According to sources there would probably cents backwardated to February. Conway butane was Spot ARA propane prices up only

be several of the more olefinic cargoes available CIF assessed up 10 cents to $1.66/gal. Non-LST propane

modestly despite colder weather

over the balance of January which might be absorbed was assessed higher with crude, up 1.35 cents to

into the gasoline blending sector. Market activity was 80.35 cents/gal for non-LST product. Spot propane prices in the Amsterdam-Rotterdam-

at a low ebb Thursday. Industry sources said that there Antwerp region have failed respond to below-average

was not too much refinery product on offer, but gasoline temperatures in Europe, industry sources said. Propane

blending demand appeared to be sparse. “The blenders Tender Data is exported from refineries and terminals in ARA to meet

have come and gone,” one trader said. “It is a bit quiet heating and cooking demand in Germany, the Benelux

today,” added another source. Taiwan CPC sells up to 15,000 mt Feb region and North France. These exports can be moved

FCA on trucks and railcars or transported on barges.

pressurized LPG-

US Gulf Coast (PGA page 799) Despite the recent spell of cold weather in Northwest

Seller: CPC, Taiwan Buyers: Up to three Asian Europe, spot demand for propane from ARA has not

The NGL market recovered Thursday, backed by a trading firms Specs & quantity: Product A: Three increased significantly. Industry sources said a longer

stronger energy complex. Non-Targa natural gasoline cargoes of pressurized LPG of 1,800-2,500 mt each, period of low temperatures would be required to have a

was assessed at $2.1175/gal, up 2.75 cents from comprising 20-30% propane and the rest butane major impact on export requirements from ARA. “There

Wednesday, as February NYMEX RBOB gained 4.38 Product B: Three cargoes of mixed butane which also are no signs of increasing demand,” said one German

cents on the back of crude to an assessment of comprises isobutylene, of 1,800-2,500 mt each trader. Based on Platts data spot ARA prices for FCA

$2.7714/gal. February NYMEX crude was assessed at Port: Loading FOB Kaohsiung When: Loading over propane were just over $860/mt at the end of last

3:15 p.m. EST at $95.37/barrel on positive US growth February 1-10, 11-20 and 21-28 Price: Premium of week. Since then prices have increased by only $10

data. The front-month crude assessment was the around $20/mt to Saudi Aramco February Contract Price reaching a last published level Wednesday of $872.5/

highest since September 18, according to Platts data. Data from: Market sources Notes: Government-run CPC mt. FOB prices have followed a similar trend over the

In morning trading natural gasoline was heard trading also sold via its last tender up to 15,000 mt for loading same period rising by only a modest $15 from $937.5/

at $2.0950/gal but moved higher during the day and in January to two to three buyers, at a premium of $20- mt to a last published level Wednesday of $852.5/mt,

was heard trading at $2.1150/gal prior to the Platts 30/mt to the January Saudi Contract Prices for propane according to Platts data.

Market on Close assessment process. During the MOC and butane, FOB Kaohsiung. This is the same volume

process Shell sold 50,000 barrels to Koch at $2.1150/ as in December, after it sold a maximum of 8,000 mt

gal. Koch then purchased a Vitol offer for 25,000 for end-November loading. CPC has increased its exports

barrels at $2.1225/gal. However, all trades during the of pressurized LPG since November after the start of

MOC process were considered distressed and were commercial production at its new 80,000 b/d residue

disregarded for the assessment. Butane also found fluid catalytic cracker at the 300,000 b/d Talin refinery.

Copyright © 2013, The McGraw-Hill Companies 4

LPGASWIRE MONTH D, 2013

Trader note European LPG Weekly Averages, Date ($/mt) (PGL page 1776)

--- Code Propane Mid Change Code Butane Mid change

Northwest Europe

FOB Seagoing AABEU00 945.000–950.000 947.500 +20.000 FOB Seagoing AABEO00 835.000–840.000 837.500 +5.000

Corrections FOB ARA AABEV00 980.0000–985.000 982.500 +5.000 FOB ARA AABEP00 860.000–865.000 862.500 +10.000

FCA ARA* AABEW00 1010.000–1015.000 1012.500 +15.000 FCA ARA* AABEQ00 1870.000–1875.000 1872.500 +10.000

--- CIF 1-3k mt AABEX00 975.000–980.000 977.500 +20.000 CIF 1-3k mt AABER00 875.000–880.000 877.500 +5.000

CIF 7000+ mt AABEY00 965.000–970.000 967.500 +35.000 CIF 3000+ mt AABES00 880.000–885.000 882.500 +5.000

Subscriber notes (PGA page 1500) FOB 7000+ mt AAVKH04 940.000–945.000 942.500 +35.000 FOB 3000+ mt AAVKI04 843.000–848.000 845.500 +5.000

Western Mediterranean

Effective April 1, and in response to market conditions

FOB Ex-Refinery/Storage AABEZ00 985.000–990.000 987.500 +35.000 FOB Ex-Ref/Storage AABET00 890.000–895.000 892.500 +5.000

and to align with practices in other European refined FCA Ex-Refinery/Storage* AABFA00 985.000–990.000 987.500 +35.000

product assessments, Platts proposes to assess all CIF 7000+ mt AABFB00 965.000–970.000 967.500 +35.000

Liquefied Petroleum Gases with a typical maximum *FCA ARA refers to sales onto railcars and trucks in the Amsterdam-Rotterdam-Antwerp region

high-low range of $0.50/mt. Currently Platts European

LPG assessments are assessed with a typical maximum

high-low range of $5/mt. Platts European LPG, refined

product and crude oil assessments reflect the value of the LPG Monthly Averages, Month Year ($/mt) (PGL page 1777)

prevailing market at 16:30 London time. The high and Code Propane Mid Change Code Butane Mid change

low of each assessment are built around the specific value Northwest Europe

FOB Seagoing AABEU00 945.000–950.000 947.500 +20.000 FOB Seagoing AABEO00 835.000–840.000 837.500 +5.000

that is assessed each day. Comments please to europe_

FOB Seagoing PMUEA03 945.000–950.000 947.500 +20.000 FOB Seagoing PMUDU03 835.000–840.000 837.500 +5.000

products@platts.com with a cc to pricegroup@platts.com FOB ARA PMUEB03 980.000–985.000 982.500 +5.000 FOB ARA PMUDV03 860.000–865.000 862.500 +10.000

FCA ARA* PMUEC03 1010.000–1015.000 1012.500 +15.000 FCA ARA* PMUDW03 1870.000–1875.000 1872.500 +10.000

CIF 1-3k mt PMUED03 975.000–980.000 977.500 +20.000 CIF 1-3k mt PMUDX03 875.000–880.000 877.500 +5.000

CIF 7000+ mt PMUEE03 965.000–970.000 967.500 +35.000 CIF 3000+ mt PMUDY03 880.000–885.000 882.500 +5.000

FOB 7000+ mt AAVKH03 940.000–945.000 942.500 +35.000 FOB 3000+ mt AAVKI03 843.000–848.000 845.500 +5.000

Western Mediterranean

FOB Ex-Refinery/Storage PMUEF03 985.000–990.000 987.500 +35.000 FOB Ex-Ref/Storage PMUDZ03 890.000–895.000 892.500 +5.000

FCA Ex-Refinery/Storage* PMUEG03 985.000–990.000 987.500 +35.000

CIF 7000+ mt PMUEH03 965.000–970.000 967.500 +35.000

*FCA ARA refers to sales onto railcars and trucks in the Amsterdam-Rotterdam-Antwerp region

EIA Propane stocks (PGL page 777)

million barrels PADD 27-Jan-12 11-Jan-13 18-Jan-13 25-Jan-13

East Coast EIANR00 1 5.023 5.023 5.023 5.023

Midwest EIANV00 2 21.555 21.555 21.555 21.555

Gulf Coast EIANW00 3 36.679 36.679 36.679 36.679

Total 1-3 63.257 63.257 63.257 63.257

US Total EIABM00 65.572 65.572 65.572 65.572

Copyright © 2013, The McGraw-Hill Companies 5

LPGASWIRE MONTH D, 2013

API monthly LPG inventories – Month Year

Ethane Propane Normal Butane Iso Butane Pentane Plus Total

Stocks Include Underground Inventories

East Coast 0 3290 964 136 32 4422

IND,ILL,KY,etc 95 4317 2065 649 525 7651

Mid Continent 2893 11273 2778 1287 1762 19993

E.Texas,Ark,etc 362 6371 892 564 38 8227

Gulf Coast 12351 9437 8313* 4050 6753 40904

West.Tex,N.Mex 1151 1090 909 507 555 4195

Rocky Mountains 321 383 371 178 172 1425

West Coast 0 475 2006 563 1124 4168

*The Normal Butane volume includes 3,812 thousand barrels of refinery grade butane for April.

Stocks Include Underground Inventories

Apr 2006 17156 36636 18298 7934 10961 90985

Mar 2006 19549 31140 15737 8259 9834 84519

Apr 2006 23725 29682 16152 6197 8403 84159

Source: API. All data are estimates made by the API based on reporting companies at plants, terminals, underground and refineries.

Copyright © 2013, The McGraw-Hill Companies 6

LPGASWIRE MONTH D, 2013

Subscriber notes (PGA page 1500)

Copyright © 2013, The McGraw-Hill Companies 7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Gas Technician 2 WorkbookDocument262 pagesGas Technician 2 WorkbookHelly100% (6)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Practical Column Design GuideDocument404 pagesPractical Column Design Guidelaminars100% (4)

- 2022-02-03 Adidas Global Supplier ListDocument179 pages2022-02-03 Adidas Global Supplier ListTrần Đức Dũng100% (1)

- Solar Electricity Handbook 2021 EditionDocument273 pagesSolar Electricity Handbook 2021 EditionTrần Đức Dũng100% (12)

- ExportDocument135 pagesExportTrần Đức DũngNo ratings yet

- PUMA Global Core FTY List 2020Document14 pagesPUMA Global Core FTY List 2020Trần Đức Dũng100% (1)

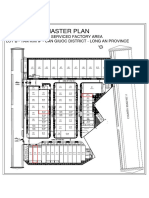

- Master Plan: Kizuna 2 Serviced Factory Area Lot B - Tan Kim Ip - Can Giuoc District - Long An ProvinceDocument1 pageMaster Plan: Kizuna 2 Serviced Factory Area Lot B - Tan Kim Ip - Can Giuoc District - Long An ProvinceTrần Đức DũngNo ratings yet

- TCVN 7568.2015 - 14 - HỆ THỐNG BÁO CHÁY - THIẾT KẾ, LẮP ĐẶT VẬN HÀNH VÀ BÃO DƯỠNG HỆ THỐNG BÁO CHÁYDocument51 pagesTCVN 7568.2015 - 14 - HỆ THỐNG BÁO CHÁY - THIẾT KẾ, LẮP ĐẶT VẬN HÀNH VÀ BÃO DƯỠNG HỆ THỐNG BÁO CHÁYTrần Đức DũngNo ratings yet

- Unit 6 Properties of Moist Air: StructureDocument15 pagesUnit 6 Properties of Moist Air: StructurearjunmechsterNo ratings yet

- 65631102162011KCB 2cy YcbDocument10 pages65631102162011KCB 2cy YcbGBHJRNo ratings yet

- Selection GuideDocument12 pagesSelection GuideMiguel Angel VasquezNo ratings yet

- Types of DistillationDocument6 pagesTypes of Distillationravi2007No ratings yet

- Water DemandDocument3 pagesWater DemandRaxKitNo ratings yet

- 1 Respiration Practical TestsDocument2 pages1 Respiration Practical TestsJean AlmiraNo ratings yet

- STATES OF MATTER WORK SHEET-ZayaDocument4 pagesSTATES OF MATTER WORK SHEET-Zayakzy1234No ratings yet

- Chapter 2 Pressure Distribution in A FluidDocument4 pagesChapter 2 Pressure Distribution in A FluidAlvaro CujiNo ratings yet

- Me GeDocument36 pagesMe Gepavlo_790317697No ratings yet

- Unit I - Properties of FluidsDocument12 pagesUnit I - Properties of FluidsTed Anthony100% (1)

- Latihan Soal Bab 1 Viskositas Dan Mekanisme Perpindahan Momentum 1. Calculation of Viscosities of Gas Mixtures at Low DensityDocument27 pagesLatihan Soal Bab 1 Viskositas Dan Mekanisme Perpindahan Momentum 1. Calculation of Viscosities of Gas Mixtures at Low DensityFettyNo ratings yet

- Process Design and Operating Philosophies ON Fired Process FurnaceDocument21 pagesProcess Design and Operating Philosophies ON Fired Process Furnacemanuppm100% (1)

- Directional Valves: Characteristic Value / Characteristic / InformationDocument1 pageDirectional Valves: Characteristic Value / Characteristic / InformationcontrolorNo ratings yet

- Design and Analysis of Gear PumpDocument7 pagesDesign and Analysis of Gear PumpMahesh KudtarkarNo ratings yet

- Technical Data: Pump NameDocument4 pagesTechnical Data: Pump NameMoniru islamNo ratings yet

- Product Brochure MGXG en 2018Document4 pagesProduct Brochure MGXG en 2018Carlos Toledo100% (1)

- Unit 4 Atmosphere Weather and ClimateDocument31 pagesUnit 4 Atmosphere Weather and Climateapi-22459801350% (2)

- Chemetron Novec Sell SheetDocument2 pagesChemetron Novec Sell Sheetjubert raymundoNo ratings yet

- CMEM01060FUDocument12 pagesCMEM01060FUAbeje AlemnewNo ratings yet

- Code of Guidance For Storage of Cylinders PDFDocument19 pagesCode of Guidance For Storage of Cylinders PDFAnonymous dSFbLxc9No ratings yet

- Seat TightnessDocument7 pagesSeat TightnessDiki PrayogoNo ratings yet

- GROTH Product Selection GuideDocument12 pagesGROTH Product Selection GuideJeniferth GaitanNo ratings yet

- Kualitas Air Tawar Yang Dihasilkan Dengan Menggunakan Energi MatahariDocument6 pagesKualitas Air Tawar Yang Dihasilkan Dengan Menggunakan Energi MataharifarahsadaNo ratings yet

- Air Pump2Document44 pagesAir Pump2abduallah muhammadNo ratings yet

- Simulations of The Kettle Reboiler Shell Side Thermal-Hydraulics With Different Two-Phase Flow ModelsDocument14 pagesSimulations of The Kettle Reboiler Shell Side Thermal-Hydraulics With Different Two-Phase Flow ModelsSaidFerdjallahNo ratings yet

- Demystifying ESPs - A Technique To Make Your ESP Talk To You PDFDocument19 pagesDemystifying ESPs - A Technique To Make Your ESP Talk To You PDFazareiforoushNo ratings yet

- Chapter 1-Introduction and Basic ConceptsDocument43 pagesChapter 1-Introduction and Basic ConceptsHarneysia JaneNo ratings yet

- PMT Am Solstice Ze DatasheetDocument8 pagesPMT Am Solstice Ze Datasheetdanari25No ratings yet