Professional Documents

Culture Documents

Central Banks: Monthly Balance Sheets: Yardeni Research, Inc

Central Banks: Monthly Balance Sheets: Yardeni Research, Inc

Uploaded by

Doni EdwardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banks: Monthly Balance Sheets: Yardeni Research, Inc

Central Banks: Monthly Balance Sheets: Yardeni Research, Inc

Uploaded by

Doni EdwardCopyright:

Available Formats

Central Banks:

Monthly Balance Sheets

Yardeni Research, Inc.

March 8, 2021

Dr. Edward Yardeni

516-972-7683

eyardeni@yardeni.com

Mali Quintana

480-664-1333

aquintana@yardeni.com

Please visit our sites at

www.yardeni.com

blog.yardeni.com

thinking outside the box

Table Of Contents Table Of Contents

Total Assets of Major Central Banks 1-4

PBOC 5

Total Assets 6

March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

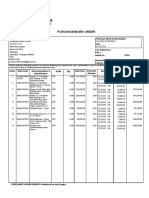

Total Assets of Major Central Banks

Figure 1.

9.0 9.0

MAJOR CENTRAL BANKS: TOTAL ASSETS

8.5 (trillion dollars, nsa) 8.5

8.0 8.0

7.5 7.5

7.0 Fed (Feb=7.6) 7.0

6.5 ECB (Feb=8.6) 6.5

BOJ (Feb=6.8)

6.0 6.0

PBOC (Jan=6.0)

5.5 5.5

5.0 5.0

4.5 4.5

4.0 4.0

3.5 3.5

3.0 3.0

2.5 2.5

2.0 2.0

1.5 1.5

1.0 1.0

yardeni.com

.5 .5

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: Haver Analytics.

Figure 2.

29 Jan 29

MAJOR CENTRAL BANKS: TOTAL ASSETS

27 (trillion dollars, nsa) 27

25 25

23 23

21 21

Total of

Fed, ECB, BOJ, & PBOC (28.8)

19 19

17 17

15 15

13 13

11 11

9 9

7 7

5 5

yardeni.com

3 3

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: Haver Analytics.

Page 1 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

Total Assets of Major Central Banks

Figure 3.

60 60

MAJOR CENTRAL BANKS: TOTAL ASSETS OF FED, ECB, BOJ, & PBOC

(yearly percent change)

50 50

Jan

40 40

30 Latest (44.0) 30

20 20

10 10

0 0

yardeni.com

-10 -10

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: Haver Analytics.

Figure 4.

80 80

MAJOR CENTRAL BANKS: TOTAL ASSETS OF FED, ECB, & BOJ

(yearly percent change)

60 Latest (57.5) 60

Feb

40 40

20 20

0 0

yardeni.com

-20 -20

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: Haver Analytics.

Page 2 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

Total Assets of Major Central Banks

Figure 5.

140 140

TOTAL ASSETS OF MAJOR CENTRAL BANKS

(as a percent of local currency nominal GDP)

120 120

Fed (Q4=33.4)

100 ECB (Q3=55.3) 100

BOJ (Q4=127.1)

PBOC (Q4=35.1)

80 80

60 60

40 40

20 20

yardeni.com

0 0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Source: Haver Analytics.

Figure 6.

4000 23

3800 S&P 500 & ASSETS OF MAJOR CENTRAL BANKS 3/8 22

21

3600

20

3400

QE1+ QE3+ QT RM 19

3200 18

3000 17

2800 16

2600 QE1 QE2 QE3 15

14

2400

13

2200

12

2000 11

1800 QE4 10

S&P 500 Index 9

1600

1400 8

Total Assets of 7

1200 Fed, ECB, BOJ

(in dollars) 6

1000

5

800 4

yardeni.com

600 3

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Note: QE1 (11/25/08-3/31/10) = $1.24tn in mortgage securities; expanded (3/16/09-3/31/10) = $300bn in Treasuries. QE2 (11/3/10-6/30/11) = $600bn

in Treasuries. QE3 (9/13/12-10/29/14) = $40bn/month in mortgage securities (open ended); expanded (12/12/12-10/1/14) = $45bn/month in Treasuries.

QT (10/1/17-7/31/19) = balance sheet pared by $675bn. RM (11/1/19-3/15/20) = reserve management, $60bn/month in Treasury bills. QE4 (3/16/20-infinity).

Source: Federal Reserve Board, Standard & Poor’s and Haver Analytics.

Page 3 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

Total Assets of Major Central Banks

Figure 7.

32 9.1

TOTAL ASSETS OF MAJOR CENTRAL BANKS Feb

30

(all in trillions of US dollars) Jan 8.2

28

26 7.3

24 Total ECB (8.6)

22 Assets* (28.8) 6.4

20

5.5

18

16 4.6

14

12 3.7

10

2.8

8

6 1.9

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

8.6 6.2

Jan

7.8

Feb 5.7

7.0 PBOC (6.0)

Fed (7.6) 5.2

6.2

4.7

5.4

4.6 4.2

3.8

3.7

3.0

3.2

2.2

2.7

1.4

yardeni.com

.6 2.2

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

7.2 25

6.8 Feb

Feb 23

6.4

6.0 21

5.6

19

5.2 BOJ (6.8) Total

4.8 Ex PBOC (22.9) 17

4.4 15

4.0

3.6 13

3.2 11

2.8

9

2.4

2.0 7

1.6

5

1.2

.8 3

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

*Includes Fed, ECB, Bank of Japan, and PBOC.

Source: Haver Analytics.

Page 4 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

PBOC

Figure 8.

6.1 Jan 6.1

5.6

5.1

PBOC ASSETS 5.6

5.1

4.6 (trillion dollars, nsa, ratio scale) 4.6

4.1 4.1

3.6 3.6

3.1 3.1

2.6 2.6

2.1 2.1

1.6 1.6

1.1 1.1

.6 .6

Total Assets (6.0)

Foreign Exchange Assets (3.3)

Nongold International Reserves

Held by China (IMF data) (3.2)

yardeni.com

.1 .1

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: People’s Bank of China and IMF.

Figure 9.

85 85

PBOC ASSETS

(percent)

80 80

75 Foreign Exchange Held/ 75

Total PBOC Assets

70 70

65 65

60 60

55 Jan 55

50 50

45 45

40 40

yardeni.com

35 35

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: People’s Bank of China and IMF.

Page 5 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

Total Assets

Figure 10.

7.8 7.8

TOTAL ASSETS Feb

7.0 7.0

6.2 6.2

5.4 Fed 5.4

4.6 (trillion dollars) (7.6) 4.6

3.8 3.8

3.0 3.0

2.2 2.2

1.4 1.4

.6 .6

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

8 8

7 Feb 7

6 6

ECB

5 (trillion euros) (7.1) 5

4 4

3 3

2 2

1 1

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

800 800

700 Feb 700

600 600

500 BOJ 500

(trillion yen) (712.6)

400 400

300 300

200 200

100 100

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

45 45

40 40

Jan

35 35

PBOC

30 (trillion yuan) (38.9) 30

25 25

20 20

yardeni.com

15 15

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Souce: Haver Analytics.

Page 6 / March 8, 2021 / Monthly Balance Sheets Yardeni Research, Inc.

www.yardeni.com

Copyright (c) Yardeni Research, Inc. 2021. All rights reserved. The information

contained herein has been obtained from sources believed to be reliable, but is not

necessarily complete and its accuracy cannot be guaranteed. No representation or

warranty, express or implied, is made as to the fairness, accuracy, completeness, or

correctness of the information and opinions contained herein. The views and the other

information provided are subject to change without notice. All reports and podcasts posted on

http://blog.yardeni.com

www.yardeni.com, blog.yardeni.com, and YRI’s Apps are issued

without regard to the specific investment objectives, financial situation, or particular needs

of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell

any securities or related financial instruments. Past performance is not necessarily a guide

to future results. Company fundamentals and earnings may be mentioned occasionally, but

should not be construed as a recommendation to buy, sell, or hold the company’s stock.

Predictions, forecasts, and estimates for any and all markets should not be construed as

recommendations to buy, sell, or hold any security--including mutual funds, futures

contracts, and exchange traded funds, or any similar instruments.

The text, images, and other materials contained or displayed on any Yardeni Research, Inc.

product, service, report, email or website are proprietary to Yardeni Research, Inc. and

constitute valuable intellectual property. No material from any part of www.yardeni.com,

http://blog.yardeni.com

blog.yardeni.com, and YRI’s Apps may be downloaded, transmitted,

broadcast, transferred, assigned, reproduced or in any other way used or otherwise

disseminated in any form to any person or entity, without the explicit written consent of

Yardeni Research, Inc. All unauthorized reproduction or other use of material from Yardeni

Research, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary

and intellectual property rights, including but not limited to, rights of privacy. Yardeni

Research, Inc. expressly reserves all rights in connection with its intellectual property,

including without limitation the right to block the transfer of its products and services and/or

to track usage thereof, through electronic tracking technology, and all other lawful means,

now known or hereafter devised. Yardeni Research, Inc. reserves the right, without further

notice, to pursue to the fullest extent allowed by the law any and all criminal and civil

remedies for the violation of its rights.

The recipient should check any email and any attachments for the presence of viruses.

Yardeni Research, Inc. accepts no liability for any damage caused by any virus transmitted

by this company’s emails, website, blog and Apps. Additional information available on

request.

requests@yardeni.com

You might also like

- Central Banks - Banlance Sheets - 10oct2022Document9 pagesCentral Banks - Banlance Sheets - 10oct2022scribbugNo ratings yet

- PeacockfedecbassetsDocument9 pagesPeacockfedecbassetsJeetguptaNo ratings yet

- Central Banks Balance SheetDocument13 pagesCentral Banks Balance SheetLiana AntonelaNo ratings yet

- UCO Bank v2 09022023Document12 pagesUCO Bank v2 09022023hritiks2801No ratings yet

- HDFC MF Yearbook2019Document44 pagesHDFC MF Yearbook2019Naveen NirajNo ratings yet

- Global Interest Rates - 10oct2022Document7 pagesGlobal Interest Rates - 10oct2022scribbugNo ratings yet

- Chinas Policy Banks Final Mar22Document10 pagesChinas Policy Banks Final Mar22LIBERTAD1978No ratings yet

- 2 SJ 520Document4 pages2 SJ 520ibnuzayn.7No ratings yet

- Macroeconomic Performance and Prospect: Global Growth, Price Situation and OutlookDocument22 pagesMacroeconomic Performance and Prospect: Global Growth, Price Situation and Outlookmr.kuddus789No ratings yet

- Outlook For Public and Private MarketsDocument40 pagesOutlook For Public and Private MarketsContra_hourNo ratings yet

- Bandhan Bank 14022023Document12 pagesBandhan Bank 14022023hritiks2801No ratings yet

- Iecmd - February 2023Document104 pagesIecmd - February 2023zak sutomoNo ratings yet

- IDFC Infrastructure A GR: Fund Sta S CsDocument1 pageIDFC Infrastructure A GR: Fund Sta S CsRachana MakhijaNo ratings yet

- CK Ee Ebook (Trend Trading Made Easy)Document58 pagesCK Ee Ebook (Trend Trading Made Easy)SBNo ratings yet

- Bank of Maharashtra 10022023Document12 pagesBank of Maharashtra 10022023hritiks2801No ratings yet

- Pearson Coefficient 0.992 Pearson Coefficient 0.974 Pearson Coefficient 0.978 Pearson Coefficient 0.992Document1 pagePearson Coefficient 0.992 Pearson Coefficient 0.974 Pearson Coefficient 0.978 Pearson Coefficient 0.992Geetesh Gupta (B17CS024)No ratings yet

- 05 Operating Highlights & Financial SummaryDocument1 page05 Operating Highlights & Financial SummaryHammad SarwarNo ratings yet

- Retail Sales Ina 2019Document7 pagesRetail Sales Ina 2019gege tantoroNo ratings yet

- Air Vent - 325 X 325mm - (SNAP FIT)Document1 pageAir Vent - 325 X 325mm - (SNAP FIT)Dilip MohantyNo ratings yet

- Industry Deck 07082023 - WIP - VpvtoldDocument14 pagesIndustry Deck 07082023 - WIP - Vpvtoldhritiks2801No ratings yet

- Indian Bank 10022023Document12 pagesIndian Bank 10022023hritiks2801No ratings yet

- Beyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveDocument20 pagesBeyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveAbhilash SharmaNo ratings yet

- Report 1277718Document81 pagesReport 1277718Ranjan KumarNo ratings yet

- UniCredit - Macro - Markets 2024-25 OutlookDocument16 pagesUniCredit - Macro - Markets 2024-25 OutlookKhang ĐặngNo ratings yet

- Power SpikeDocument130 pagesPower SpikeJagdish BhandariNo ratings yet

- Statistic - Id781456 - Commercial Kitchen Equipment Market Size in North America 2014 2025Document8 pagesStatistic - Id781456 - Commercial Kitchen Equipment Market Size in North America 2014 2025Diego Angeles BarcenesNo ratings yet

- Fund Report - Pure Stock Fund - Aug 2021Document3 pagesFund Report - Pure Stock Fund - Aug 2021faleela IsmailNo ratings yet

- 2024 January Monthly Chart PackDocument17 pages2024 January Monthly Chart PackChris StarcherNo ratings yet

- BT02Document10 pagesBT02Trang Phạm ThịNo ratings yet

- CSB Bank 13022023Document12 pagesCSB Bank 13022023hritiks2801No ratings yet

- 5 Charts For 2015: Down Under Daily, 22 December 2014Document3 pages5 Charts For 2015: Down Under Daily, 22 December 2014freemind3682No ratings yet

- GDPBD00000130219Document35 pagesGDPBD00000130219api-15059803100% (2)

- 4597 AAB SC 07 Addendum 2 R0v0 49Document1 page4597 AAB SC 07 Addendum 2 R0v0 49danieldumapitNo ratings yet

- Hesperidin 1H NMRDocument1 pageHesperidin 1H NMRDuc Anh NguyenNo ratings yet

- Maintaining A Solid Position: Corporate PresentationDocument37 pagesMaintaining A Solid Position: Corporate Presentationtim horeNo ratings yet

- Aecom 23-Nov-23 Ccs123 DraftDocument33 pagesAecom 23-Nov-23 Ccs123 DraftakshayNo ratings yet

- Red Digsilent VPPDocument1 pageRed Digsilent VPPSANTIAGO ANDRES OSORIO HUERTASNo ratings yet

- CPT 205488 Rep01Document2 pagesCPT 205488 Rep01rupalss1235No ratings yet

- 01 VillaDocument16 pages01 VillaFabio OliveiraNo ratings yet

- IndianOil AR 2022-23 - 1Document9 pagesIndianOil AR 2022-23 - 1pgpm2024.asafNo ratings yet

- CPT Static Liquefaction Analysis PlotsDocument1 pageCPT Static Liquefaction Analysis PlotsmyplaxisNo ratings yet

- Lac - OutlookDocument55 pagesLac - OutlookDanny Jose Torres JoaquinNo ratings yet

- Resort Site B&WDocument1 pageResort Site B&WAkshay NandhuNo ratings yet

- Thematic Report - Rockstars of 2QFY24 ResultDocument46 pagesThematic Report - Rockstars of 2QFY24 ResultdeepaksinghbishtNo ratings yet

- Integrated Report en 2022Document166 pagesIntegrated Report en 2022Omar BenaichaNo ratings yet

- Spending On Private Health insurance-OECD-2022Document6 pagesSpending On Private Health insurance-OECD-2022Swapna NixonNo ratings yet

- Monthly Economic Review - Feb 2024Document31 pagesMonthly Economic Review - Feb 2024Denis EliasNo ratings yet

- SBI Securities Diwali Picks 2023Document22 pagesSBI Securities Diwali Picks 2023satish shenoyNo ratings yet

- Ratio AnalysisDocument25 pagesRatio AnalysisKolaNo ratings yet

- FDI & Economics Growth of PakistanDocument15 pagesFDI & Economics Growth of PakistanMuhammad Usman AkramNo ratings yet

- 2020-01-22-064434 NCPI December 2019 PDFDocument22 pages2020-01-22-064434 NCPI December 2019 PDFMathiasNo ratings yet

- Apollo - 2023 Economic and Capital Markets OutlookDocument24 pagesApollo - 2023 Economic and Capital Markets OutlookReza Aditya HermawanNo ratings yet

- Datasheet c5707Document5 pagesDatasheet c5707amernasserNo ratings yet

- February 2024: Bank of TanzaniaDocument32 pagesFebruary 2024: Bank of TanzaniaAnonymous FnM14a0No ratings yet

- HDO Balanced Water BottleDocument2 pagesHDO Balanced Water BottleAgung SetiawanNo ratings yet

- 2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFODocument55 pages2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFOFrédéric GuillemetNo ratings yet

- A Desktop Guide for Nonprofit Directors, Officers, and Advisors: Avoiding Trouble While Doing GoodFrom EverandA Desktop Guide for Nonprofit Directors, Officers, and Advisors: Avoiding Trouble While Doing GoodRating: 5 out of 5 stars5/5 (1)

- PNC Account Agreement For Personal AccountsDocument30 pagesPNC Account Agreement For Personal AccountsAnthony Allen AndersonNo ratings yet

- Deutsche Bank Outlines New Payment System Going Around The US DollarDocument28 pagesDeutsche Bank Outlines New Payment System Going Around The US DollarAnthony Allen Anderson100% (4)

- Wells Fargo Warns The Fed Could Be Insolvent SoonDocument7 pagesWells Fargo Warns The Fed Could Be Insolvent SoonAnthony Allen AndersonNo ratings yet

- FDIC Bank Fail PlanDocument19 pagesFDIC Bank Fail PlanAnthony Allen AndersonNo ratings yet

- U.S. v. Smith - IndictmentDocument45 pagesU.S. v. Smith - IndictmentZerohedgeNo ratings yet

- Can UK Banks Pass The COVID-19 Stress Test 6 May 2020Document150 pagesCan UK Banks Pass The COVID-19 Stress Test 6 May 2020Anthony Allen AndersonNo ratings yet

- Production Costs - ReadingDocument1 pageProduction Costs - ReadingalcheccaNo ratings yet

- Managerial Economics & Business Strategy: The Theory of Individual BehaviorDocument15 pagesManagerial Economics & Business Strategy: The Theory of Individual BehaviorMalat DiemNo ratings yet

- Islamic Fintech AssignmentDocument16 pagesIslamic Fintech AssignmentSaherNo ratings yet

- Consumer Satisfactionp CksvimDocument92 pagesConsumer Satisfactionp CksvimSal OppulenceNo ratings yet

- Motivation Letter For PHDDocument2 pagesMotivation Letter For PHDlivealone boyNo ratings yet

- Cognizant Putting The Experience in Digital Customer Experience Codex1180 141217233002 Conversion Gate01Document30 pagesCognizant Putting The Experience in Digital Customer Experience Codex1180 141217233002 Conversion Gate01Guillaume TdlcNo ratings yet

- Youth in The Green EconomyDocument43 pagesYouth in The Green EconomyduycksNo ratings yet

- Morgan Witt - ResumeDocument3 pagesMorgan Witt - Resumemwitt13100% (1)

- Measuring Inflation in India Limitations of WPIDocument3 pagesMeasuring Inflation in India Limitations of WPIlenishmnNo ratings yet

- Oliver Wyman Insurance Insights Edition 15 EnglishDocument7 pagesOliver Wyman Insurance Insights Edition 15 EnglishChiara CambriaNo ratings yet

- Revised NRI-Account-Opening-Form-editable PDFDocument6 pagesRevised NRI-Account-Opening-Form-editable PDFSuprodip DasNo ratings yet

- E Types StrategyImplementation GL v0.3Document8 pagesE Types StrategyImplementation GL v0.3GiorgiLobjanidze100% (4)

- Chapter 2 - Test BankDocument25 pagesChapter 2 - Test Bankapi-253108236100% (5)

- SOIC-Result Update Q1FY22 VideoDocument32 pagesSOIC-Result Update Q1FY22 VideoSubham JainNo ratings yet

- Midterm Exam Service Marketing 40 50Document9 pagesMidterm Exam Service Marketing 40 50Bryan CarloNo ratings yet

- Engineering and Capital Goods: March 2020Document44 pagesEngineering and Capital Goods: March 2020lakshvamNo ratings yet

- Travancore - Revised - PO-1Document2 pagesTravancore - Revised - PO-1V.Sampath RaoNo ratings yet

- Module 2 Quiz Section A Chapter 1 - SolutionDocument29 pagesModule 2 Quiz Section A Chapter 1 - SolutionSaad RashidNo ratings yet

- Cambridge International AS & A Level: Business For Examination From 2023Document22 pagesCambridge International AS & A Level: Business For Examination From 2023khalid malikNo ratings yet

- Sales Letter Agora FinancialDocument10 pagesSales Letter Agora FinancialJapa Tamashiro JrNo ratings yet

- Tata MotorsDocument11 pagesTata MotorsashilNo ratings yet

- Concept+Tree Market+Research KochiDocument4 pagesConcept+Tree Market+Research KochisheizidireesNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Capstone II Final PaperDocument13 pagesCapstone II Final Paperapi-632420513No ratings yet

- NAVFAC Economic Analysis Handbook p442 PDFDocument240 pagesNAVFAC Economic Analysis Handbook p442 PDFartemiogenioNo ratings yet

- Chapter 21Document16 pagesChapter 21Tin ManNo ratings yet

- Globe&Mail ArticleDocument18 pagesGlobe&Mail Article7mhszy5xgfNo ratings yet

- Analysis of Annual Report of Godrej IndustriesDocument41 pagesAnalysis of Annual Report of Godrej IndustriesmadhuraNo ratings yet

- EXAM MAC 3rd Module PDFDocument2 pagesEXAM MAC 3rd Module PDFPaul De PedroNo ratings yet

- CorporationsDocument26 pagesCorporationsArielle D.No ratings yet