Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

22 viewsAccounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Accounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Uploaded by

Rafael BarbinMamshie Corporation acquired 70% of the outstanding shares of Anakiz Company for P4,200,000 cash on January 2, 2019. The financial statements of both companies on the acquisition date are provided, including book and fair values of assets and liabilities. The problem requires calculating consolidated financial statement amounts from the business combination, and performing the same calculations for various acquisition prices, ownership percentages acquired, and fair values of the non-controlling interest.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Intermediate Accounting 2 AnswersDocument18 pagesIntermediate Accounting 2 AnswersFery AnnNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Week 1 - Partnership Formation and Partnership OperationDocument10 pagesWeek 1 - Partnership Formation and Partnership OperationJanna Mari Frias100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDocument3 pagesAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionClaire CadornaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- EquityDocument4 pagesEquityZairah FranciscoNo ratings yet

- FEU Quiz 2 Conso SY DocxDocument6 pagesFEU Quiz 2 Conso SY DocxBryle EscosaNo ratings yet

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Financial Accounting Q&aDocument4 pagesFinancial Accounting Q&aGlen JavellanaNo ratings yet

- Discussion 1 Second Sem PDFDocument11 pagesDiscussion 1 Second Sem PDFRNo ratings yet

- Quizzer - Buscom 01Document7 pagesQuizzer - Buscom 01khyla Marie NooraNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Acctg 10 - Final ExamDocument6 pagesAcctg 10 - Final ExamNANNo ratings yet

- This Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityDocument7 pagesThis Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityAnne Marieline BuenaventuraNo ratings yet

- Student Number: 201913610: A. Consolidated Retained EarningsDocument11 pagesStudent Number: 201913610: A. Consolidated Retained Earningsjayjay storageNo ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument4 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- MergerDocument3 pagesMergerJohn BalanquitNo ratings yet

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- P2 Bus Com.O2016Document9 pagesP2 Bus Com.O2016Paulo Miguel100% (2)

- Prelim AE27 First Sem 2324Document4 pagesPrelim AE27 First Sem 2324HotcheeseramyeonNo ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument13 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesNo ratings yet

- Abuscom:: Consolidated Financial Statements at The Date of AcquisitionDocument1 pageAbuscom:: Consolidated Financial Statements at The Date of AcquisitionMarynelle SevillaNo ratings yet

- Final Exam Advance IIDocument4 pagesFinal Exam Advance IIRobin RossNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionMark Joseph OlinoNo ratings yet

- Comprehensive Exercises On Equity InvestmentquestionaireDocument4 pagesComprehensive Exercises On Equity InvestmentquestionaireLilian LagrimasNo ratings yet

- Acivity 1 For Assignment Presenttion FinanciaDocument11 pagesAcivity 1 For Assignment Presenttion FinanciasoleilaineaeifeNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Quiz 1 Inventory and InvestmentsDocument7 pagesQuiz 1 Inventory and InvestmentsMark Lawrence YusiNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Lyceum of Alabang: Partnership AccountingDocument4 pagesLyceum of Alabang: Partnership AccountingJoshua UmaliNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Quiz 2 - Statement of Changes in Equity-CompressedDocument4 pagesQuiz 2 - Statement of Changes in Equity-CompressedJm BalessNo ratings yet

- Toaz - Info Intermediate Accountingdocx PRDocument14 pagesToaz - Info Intermediate Accountingdocx PRGabby OperarioNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Consignment UploadDocument2 pagesConsignment UploadRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Home Office and Branch AccountingDocument4 pagesHome Office and Branch AccountingRafael BarbinNo ratings yet

- 08 Home Office Branch Agency AccountingxxDocument114 pages08 Home Office Branch Agency AccountingxxRafael Barbin100% (1)

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Insurance Contracts UploadDocument2 pagesInsurance Contracts UploadRafael BarbinNo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- DMCIHI - 028 SEC Form 17-A DEC - April 11 PDFDocument249 pagesDMCIHI - 028 SEC Form 17-A DEC - April 11 PDFRafael BarbinNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Organizational ManagementDocument7 pagesOrganizational ManagementMacqueenNo ratings yet

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450No ratings yet

- BAFEDA Circular On USD Exchange RateDocument2 pagesBAFEDA Circular On USD Exchange RateTarek mahmood rahathNo ratings yet

- 2024 CFA Level 3 Analyst Prep Notes, Mock Exam, Item Set Questions, Essay Questions, Video SlidesDocument41 pages2024 CFA Level 3 Analyst Prep Notes, Mock Exam, Item Set Questions, Essay Questions, Video SlidescraigsappletreeNo ratings yet

- Corporate Governance and FinanDocument127 pagesCorporate Governance and FinanLets LearnNo ratings yet

- 12-Article Text-38-1-10-20220701Document12 pages12-Article Text-38-1-10-20220701miftahNo ratings yet

- Jollibee Swot MatrixDocument2 pagesJollibee Swot MatrixAnne MartirezNo ratings yet

- Ekins 2019 Circular Economy What Why How WhereDocument82 pagesEkins 2019 Circular Economy What Why How Wherek mNo ratings yet

- Inv - 2469306Document2 pagesInv - 2469306rajeshNo ratings yet

- Investment Banking AssignmentDocument4 pagesInvestment Banking AssignmentsssssssNo ratings yet

- Module 1 Lesson 3 Week 3Document10 pagesModule 1 Lesson 3 Week 3Rush RushNo ratings yet

- Lecture Note 3 Economic Welfare and Pricing in Competitive and Monopolistic StructuresDocument17 pagesLecture Note 3 Economic Welfare and Pricing in Competitive and Monopolistic Structuresveera reddyNo ratings yet

- Background For International Business and Trade Module 1Document9 pagesBackground For International Business and Trade Module 1Gilbert Ocampo100% (2)

- Importance and Challenges of Smes: A Case of Pakistani Smes: EmailDocument8 pagesImportance and Challenges of Smes: A Case of Pakistani Smes: EmailDr-Aamar Ilyas SahiNo ratings yet

- BK - July Board 2023Document11 pagesBK - July Board 2023akshaydevendra09No ratings yet

- Cultural SymbolsDocument4 pagesCultural SymbolsMark BaquiranNo ratings yet

- Multiway Valves LeafletDocument2 pagesMultiway Valves LeafletOILER GABRIOLA, MARK GREGORY IIINo ratings yet

- Issues in Philippine Fiscal AdministrationDocument8 pagesIssues in Philippine Fiscal AdministrationMIS Informal Settler FamiliesNo ratings yet

- Steel Rates Jan 2023Document5 pagesSteel Rates Jan 2023shakeelt260No ratings yet

- Returns To ScaleDocument50 pagesReturns To ScaleShivani GuptaNo ratings yet

- Indian ManufacturersDocument4 pagesIndian ManufacturersAbhishek TapadiaNo ratings yet

- histretSP 2022Document45 pageshistretSP 2022MarianaNo ratings yet

- World Order 2.0: The Case For Sovereign ObligationDocument11 pagesWorld Order 2.0: The Case For Sovereign ObligationKashif AfridiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Presentation1 ReshmaDocument26 pagesPresentation1 ReshmaJOE NOBLE 2020519No ratings yet

- Artistic Denim Mills LimitedDocument12 pagesArtistic Denim Mills LimitedMubeen AhmadNo ratings yet

- Indonesia Investments: Commodities in Focus: CoffeeDocument7 pagesIndonesia Investments: Commodities in Focus: CoffeeHendra WcsNo ratings yet

- Bahan 4Document9 pagesBahan 4wahyudhyNo ratings yet

- TAO01 FAJAR COPY-dikompresiDocument2 pagesTAO01 FAJAR COPY-dikompresiLELANo ratings yet

- Ielts WritingDocument6 pagesIelts WritingESC18 NBKNo ratings yet

Accounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Accounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Uploaded by

Rafael Barbin0 ratings0% found this document useful (0 votes)

22 views1 pageMamshie Corporation acquired 70% of the outstanding shares of Anakiz Company for P4,200,000 cash on January 2, 2019. The financial statements of both companies on the acquisition date are provided, including book and fair values of assets and liabilities. The problem requires calculating consolidated financial statement amounts from the business combination, and performing the same calculations for various acquisition prices, ownership percentages acquired, and fair values of the non-controlling interest.

Original Description:

Original Title

CONSODOA2020

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMamshie Corporation acquired 70% of the outstanding shares of Anakiz Company for P4,200,000 cash on January 2, 2019. The financial statements of both companies on the acquisition date are provided, including book and fair values of assets and liabilities. The problem requires calculating consolidated financial statement amounts from the business combination, and performing the same calculations for various acquisition prices, ownership percentages acquired, and fair values of the non-controlling interest.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views1 pageAccounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Accounting On Business Combination Acquisition of Stocks - Date of Acquisition Consolidated Financial Statements

Uploaded by

Rafael BarbinMamshie Corporation acquired 70% of the outstanding shares of Anakiz Company for P4,200,000 cash on January 2, 2019. The financial statements of both companies on the acquisition date are provided, including book and fair values of assets and liabilities. The problem requires calculating consolidated financial statement amounts from the business combination, and performing the same calculations for various acquisition prices, ownership percentages acquired, and fair values of the non-controlling interest.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

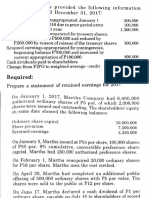

ACCOUNTING ON BUSINESS COMBINATION

ACQUISITION OF STOCKS – DATE OF ACQUISITION

CONSOLIDATED FINANCIAL STATEMENTS

Problem A. On January 2, 2019, MAMSHIE CORPORATION purchased 70% of the outstanding ordinary

shares of ANAKIZ COMPANY for P4,200,000 in cash. The non-controlling interest is measured at fair

value. Statement of financial position of the companies on January 2, 2019 are as follows:

MAMSHIE CORPORATION ANAKIZ COMPANY

Book Value Fair Value Book Value Fair Value

Cash P 600,000 P 600,000 P 600,000 P 600,000

Receivables 1,200,000 1,120,000 900,000 900,000

Inventories 900,000 890,000 780,000 880,000

Land 300,000 320,000 480,000 640,000

Building, net 1,800,000 1,800,000 1,200,000 1,160,000

Long-investment 600,000 600,000 720,000 840,000

Investment in ANAKIZ CO. 4,200,000 4,200,000

TOTAL ASSETS P 9,600,000 P4,680,000

Accounts payable P 1,160,000 P1,000,000 P 300,000 P 300,000

Ordinary shares 2,400,000 1,200,000

Additional paid-in capital 1,240,000 360,000

Retained earnings 4,800,000 2,820,000

TOTAL LIABILITIES & SHE P 9,600,000 P 4,680,000

1. Required: As a result of business combination, compute for the following:

a. Consolidated assets

b. Consolidated liabilities

c. Consolidated shareholder’s equity

d. Non-controlling interest in assets

2. Same requirement for each of the following cases:

Price paid Interest Liabilities of Fair Value of NCI

MAMSHIE

A. P4,800,000 80% P1,760,000 Use relevant share

B. 4,320,000 90% 1,280,000 P 540,000

C. 5,400,000 75% 2,360,000 900,000

D. 3,400,000 80% 360,000 720,000

E. 3,050,000 80% 10,000 955,000

F. 3,500,000 65% 460,000 1,700,000

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Intermediate Accounting 2 AnswersDocument18 pagesIntermediate Accounting 2 AnswersFery AnnNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Week 1 - Partnership Formation and Partnership OperationDocument10 pagesWeek 1 - Partnership Formation and Partnership OperationJanna Mari Frias100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDocument3 pagesAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionClaire CadornaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- EquityDocument4 pagesEquityZairah FranciscoNo ratings yet

- FEU Quiz 2 Conso SY DocxDocument6 pagesFEU Quiz 2 Conso SY DocxBryle EscosaNo ratings yet

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Financial Accounting Q&aDocument4 pagesFinancial Accounting Q&aGlen JavellanaNo ratings yet

- Discussion 1 Second Sem PDFDocument11 pagesDiscussion 1 Second Sem PDFRNo ratings yet

- Quizzer - Buscom 01Document7 pagesQuizzer - Buscom 01khyla Marie NooraNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Acctg 10 - Final ExamDocument6 pagesAcctg 10 - Final ExamNANNo ratings yet

- This Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityDocument7 pagesThis Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityAnne Marieline BuenaventuraNo ratings yet

- Student Number: 201913610: A. Consolidated Retained EarningsDocument11 pagesStudent Number: 201913610: A. Consolidated Retained Earningsjayjay storageNo ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument4 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- MergerDocument3 pagesMergerJohn BalanquitNo ratings yet

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- P2 Bus Com.O2016Document9 pagesP2 Bus Com.O2016Paulo Miguel100% (2)

- Prelim AE27 First Sem 2324Document4 pagesPrelim AE27 First Sem 2324HotcheeseramyeonNo ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument13 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesNo ratings yet

- Abuscom:: Consolidated Financial Statements at The Date of AcquisitionDocument1 pageAbuscom:: Consolidated Financial Statements at The Date of AcquisitionMarynelle SevillaNo ratings yet

- Final Exam Advance IIDocument4 pagesFinal Exam Advance IIRobin RossNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionMark Joseph OlinoNo ratings yet

- Comprehensive Exercises On Equity InvestmentquestionaireDocument4 pagesComprehensive Exercises On Equity InvestmentquestionaireLilian LagrimasNo ratings yet

- Acivity 1 For Assignment Presenttion FinanciaDocument11 pagesAcivity 1 For Assignment Presenttion FinanciasoleilaineaeifeNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Quiz 1 Inventory and InvestmentsDocument7 pagesQuiz 1 Inventory and InvestmentsMark Lawrence YusiNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Lyceum of Alabang: Partnership AccountingDocument4 pagesLyceum of Alabang: Partnership AccountingJoshua UmaliNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Quiz 2 - Statement of Changes in Equity-CompressedDocument4 pagesQuiz 2 - Statement of Changes in Equity-CompressedJm BalessNo ratings yet

- Toaz - Info Intermediate Accountingdocx PRDocument14 pagesToaz - Info Intermediate Accountingdocx PRGabby OperarioNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Consignment UploadDocument2 pagesConsignment UploadRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Home Office and Branch AccountingDocument4 pagesHome Office and Branch AccountingRafael BarbinNo ratings yet

- 08 Home Office Branch Agency AccountingxxDocument114 pages08 Home Office Branch Agency AccountingxxRafael Barbin100% (1)

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Insurance Contracts UploadDocument2 pagesInsurance Contracts UploadRafael BarbinNo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- DMCIHI - 028 SEC Form 17-A DEC - April 11 PDFDocument249 pagesDMCIHI - 028 SEC Form 17-A DEC - April 11 PDFRafael BarbinNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Organizational ManagementDocument7 pagesOrganizational ManagementMacqueenNo ratings yet

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450No ratings yet

- BAFEDA Circular On USD Exchange RateDocument2 pagesBAFEDA Circular On USD Exchange RateTarek mahmood rahathNo ratings yet

- 2024 CFA Level 3 Analyst Prep Notes, Mock Exam, Item Set Questions, Essay Questions, Video SlidesDocument41 pages2024 CFA Level 3 Analyst Prep Notes, Mock Exam, Item Set Questions, Essay Questions, Video SlidescraigsappletreeNo ratings yet

- Corporate Governance and FinanDocument127 pagesCorporate Governance and FinanLets LearnNo ratings yet

- 12-Article Text-38-1-10-20220701Document12 pages12-Article Text-38-1-10-20220701miftahNo ratings yet

- Jollibee Swot MatrixDocument2 pagesJollibee Swot MatrixAnne MartirezNo ratings yet

- Ekins 2019 Circular Economy What Why How WhereDocument82 pagesEkins 2019 Circular Economy What Why How Wherek mNo ratings yet

- Inv - 2469306Document2 pagesInv - 2469306rajeshNo ratings yet

- Investment Banking AssignmentDocument4 pagesInvestment Banking AssignmentsssssssNo ratings yet

- Module 1 Lesson 3 Week 3Document10 pagesModule 1 Lesson 3 Week 3Rush RushNo ratings yet

- Lecture Note 3 Economic Welfare and Pricing in Competitive and Monopolistic StructuresDocument17 pagesLecture Note 3 Economic Welfare and Pricing in Competitive and Monopolistic Structuresveera reddyNo ratings yet

- Background For International Business and Trade Module 1Document9 pagesBackground For International Business and Trade Module 1Gilbert Ocampo100% (2)

- Importance and Challenges of Smes: A Case of Pakistani Smes: EmailDocument8 pagesImportance and Challenges of Smes: A Case of Pakistani Smes: EmailDr-Aamar Ilyas SahiNo ratings yet

- BK - July Board 2023Document11 pagesBK - July Board 2023akshaydevendra09No ratings yet

- Cultural SymbolsDocument4 pagesCultural SymbolsMark BaquiranNo ratings yet

- Multiway Valves LeafletDocument2 pagesMultiway Valves LeafletOILER GABRIOLA, MARK GREGORY IIINo ratings yet

- Issues in Philippine Fiscal AdministrationDocument8 pagesIssues in Philippine Fiscal AdministrationMIS Informal Settler FamiliesNo ratings yet

- Steel Rates Jan 2023Document5 pagesSteel Rates Jan 2023shakeelt260No ratings yet

- Returns To ScaleDocument50 pagesReturns To ScaleShivani GuptaNo ratings yet

- Indian ManufacturersDocument4 pagesIndian ManufacturersAbhishek TapadiaNo ratings yet

- histretSP 2022Document45 pageshistretSP 2022MarianaNo ratings yet

- World Order 2.0: The Case For Sovereign ObligationDocument11 pagesWorld Order 2.0: The Case For Sovereign ObligationKashif AfridiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Presentation1 ReshmaDocument26 pagesPresentation1 ReshmaJOE NOBLE 2020519No ratings yet

- Artistic Denim Mills LimitedDocument12 pagesArtistic Denim Mills LimitedMubeen AhmadNo ratings yet

- Indonesia Investments: Commodities in Focus: CoffeeDocument7 pagesIndonesia Investments: Commodities in Focus: CoffeeHendra WcsNo ratings yet

- Bahan 4Document9 pagesBahan 4wahyudhyNo ratings yet

- TAO01 FAJAR COPY-dikompresiDocument2 pagesTAO01 FAJAR COPY-dikompresiLELANo ratings yet

- Ielts WritingDocument6 pagesIelts WritingESC18 NBKNo ratings yet