Professional Documents

Culture Documents

CH 07

CH 07

Uploaded by

Minh Thu Võ NgọcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 07

CH 07

Uploaded by

Minh Thu Võ NgọcCopyright:

Available Formats

Chapter 7

Risk Assessment and Inherent Risk

Concept Check Questions

C7-1 What are the components of the audit risk model?

The audit risk consists of Audit Risk which is the function of Inherent Risk, Control Risk and

Detection Risk. Auditors use this model to help guide them in maintaining, audit risk, the risk

that the auditor expresses an inappropriate audit opinion when the financial statements are

materially misstated, at an acceptably low level. Risk of material misstatement, which consists

of inherent risk and control risk, resides at the client and the auditor assesses this risk in order to

manage detection risk – the only part of the model which the auditor has control.

C7-2 Using the audit risk model, holding all factors equal, what happens to detection risk if

control risk goes up? Why?

If control risk goes down, detection risk goes up. This means that less assurance is required from

substantive testing, i.e., less detection assurance is required. This happens because the auditor is

relying upon internal control and will do tests of controls to provide some of the assurance

required.

C7-3 What is detection risk? Explain how auditors manage detection risk.

Detection risk the risk that the audit procedures will fail to detect material misstatements.

Auditors manage detection risk by adjusting the nature (type of procedure and quality of

evidence), timing (year-end versus interim) and extent (quantity) of their audit procedures

based upon their assessment of RMM.

C7-4 At what two levels does the auditor assess risk of material misstatement? What level of

RMM is the following condition – management is inexperienced in preparing financial

statements?

The risk of material misstatement exists at two levels: the overall financial statement level and at

the assertion level for classes of transactions, account balances, and presentation and disclosures.

Auditing standards require the auditor to assess the risk of material misstatement at each of these

levels and to plan the audit in response to those assessed risks.

Copyright © 2022 Pearson Canada Inc.

7-1

Instructor’s Solutions Manual for Auditing, Fifteenth Canadian Edition

C7-5 What are inherent risk factors and how do they help in the inherent risk assessment?

Inherent risk factors are characteristics of events or conditions that affect the susceptibility to

misstatement, whether due to fraud or error, of an assertion about a class of transactions,

account balance or disclosure, before the consideration of controls. The characteristics

(complexity, subjectivity, change, uncertainty, susceptibility to management bias and other

fraud risk factors) of these events and conditions will help auditors determine the level of

inherent risk at the financial statement level and the assertion level.

C7-6 What are relevant assertions?

A relevant assertion about a class of transactions, account balances or disclosure is relevant

when it has an identified risk of material misstatement. The determination of a relevant

assertion is made before consideration of internal controls.

C7-7 What are significant risks? Are they the same for all organizations? Why or why not?

A significant risk is an identified and assessed risk of material misstatement that, in the

auditor’s professional judgment, requires special audit consideration. Although audit standards

highlight some examples of significant risks and require auditors to consider two specific risks,

risk of revenue recognition fraud and nonroutine related party transactions, each client’s

circumstances are unique and will vary across organizations and can even change over time (as

the client’s circumstances change).

C7-8 How can general rules of thumb and past experience with the client create judgment

traps for auditors’ risk assessments? Provide an example for inherent risk and control

risk assessments.

General rules and past experience with the client may cause the auditors to not be as reflexive in

their reasoning when assessing materiality or various risks. The judgment traps can be

availability or even anchoring. In the case of past experience, this may cause the auditor not to

adjust the audit approach.

C7-9 How is the overall risk response different than the risk response at the assertion level?

The overall risk response relates to managing the risk at the overall financial statement level. In

audits with high overall financial statement level risk, auditors will assign more experienced

staff and have more careful reviews. The risk response at the assertion level refers to the

development of further audit procedures to address the RMM in relevant assertions. As RMM

increases, the auditor will want to gather more persuasive audit evidence.

C 7-10 Define misappropriation of assets and give two examples.

Misappropriation of assets refers to when employees or management have incentives or financial

pressures to misappropriate assets and circumstances provide opportunities for employees or

management to do so. It could involve embezzlement of cash or theft of inventory.

Copyright © 2022 Pearson Canada Inc.

7-2

Chapter 7: Risk Assessment and Inherent Risk

C7-11 How does brainstorming regarding fraud risk improve auditors’ professional judgment?

Explain how it helps to mitigate potential judgment traps.

Effective brainstorming is meant to overcome potential biases by being open to various points of

view. Also, since it is performed with the audit team, it enhances consultation and provides less

experienced auditors with views from more experienced auditors.

Copyright © 2022 Pearson Canada Inc.

7-3

You might also like

- Auditing TheoryDocument27 pagesAuditing Theorysharielles /No ratings yet

- Summary of CH 9 Assessing The Risk of Material MisstatementDocument19 pagesSummary of CH 9 Assessing The Risk of Material MisstatementMutia WardaniNo ratings yet

- CH - 9 Assessing The Risk of Material MisstatementDocument14 pagesCH - 9 Assessing The Risk of Material MisstatementOmar C100% (2)

- Chapter 11 A Risk Based Audit Approach - PPT 302925165Document12 pagesChapter 11 A Risk Based Audit Approach - PPT 302925165Clar Aaron Bautista50% (2)

- Advance Baking CompilationDocument44 pagesAdvance Baking CompilationCherry Brutas100% (1)

- SuccessFactors Employee Central Practice QuestionsDocument11 pagesSuccessFactors Employee Central Practice Questionsrekha89757% (7)

- Group 1 Auditing RISK AUDITDocument24 pagesGroup 1 Auditing RISK AUDITFlamive VongNo ratings yet

- Audit ch-5Document55 pagesAudit ch-5fekadegebretsadik478729No ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Chapter 6 Risk Assessment (PART 1)Document9 pagesChapter 6 Risk Assessment (PART 1)Aravinthan INSAF SmartClassNo ratings yet

- Audit Risk & MaterialityDocument23 pagesAudit Risk & MaterialityandreNo ratings yet

- The Risk-Based Audit ModelDocument2 pagesThe Risk-Based Audit ModelJoshel MaeNo ratings yet

- AUD Flashcards Flashcards - QuizletDocument16 pagesAUD Flashcards Flashcards - QuizletDieter LudwigNo ratings yet

- This Study Resource Was: (Select All That Apply.)Document6 pagesThis Study Resource Was: (Select All That Apply.)Jeap JeavNo ratings yet

- Advanced Auditing Chapter FourDocument52 pagesAdvanced Auditing Chapter FourmirogNo ratings yet

- CH 9Document74 pagesCH 9duttasahil19No ratings yet

- Lecture 2 3 Recap Audit ProcessDocument34 pagesLecture 2 3 Recap Audit ProcessSourav MahadiNo ratings yet

- Chapter # 3.2 External Audit Risk ModelDocument10 pagesChapter # 3.2 External Audit Risk ModelMustafa patelNo ratings yet

- Ar 09Document48 pagesAr 09carter PadNo ratings yet

- Aud339 Audit Planning Part 2Document26 pagesAud339 Audit Planning Part 2Nur IzzahNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasYuliana rahayuNo ratings yet

- Auditing II Test BankDocument68 pagesAuditing II Test Bankm992727379No ratings yet

- Chapter 7 NotesDocument7 pagesChapter 7 NotesSavy DhillonNo ratings yet

- Chapter 4 SolutionsDocument13 pagesChapter 4 SolutionsjessicaNo ratings yet

- 4 Audit RiskDocument10 pages4 Audit RiskHussain MustunNo ratings yet

- Risk Assessment and Internal Control - E-NotesDocument55 pagesRisk Assessment and Internal Control - E-NotesManavNo ratings yet

- Tutorial - 3-Answers - For - Selected - Questions PresentationDocument6 pagesTutorial - 3-Answers - For - Selected - Questions Presentationcynthiama7777No ratings yet

- CAF Examination Program Spring 2023Document9 pagesCAF Examination Program Spring 2023Asad ZahidNo ratings yet

- Lecture 3-Risk Materiality-JUNE 2023 Revised 1Document103 pagesLecture 3-Risk Materiality-JUNE 2023 Revised 1Sheany LinNo ratings yet

- AUA3752 Chapter 7 Slides Part 1Document12 pagesAUA3752 Chapter 7 Slides Part 1Turinaua GertzeNo ratings yet

- Lecture 3-Risk Materiality-Jan 2020Document99 pagesLecture 3-Risk Materiality-Jan 2020Ching XueNo ratings yet

- TOPIC 3e - Risk and MaterialityDocument33 pagesTOPIC 3e - Risk and MaterialityLANGITBIRUNo ratings yet

- Accountancy (AC1218) : Answer Key - Principles of Auditing CourseDocument15 pagesAccountancy (AC1218) : Answer Key - Principles of Auditing CourseMarijo JuanilloNo ratings yet

- CREDIT Risk Management AT ICICI BANKDocument64 pagesCREDIT Risk Management AT ICICI BANKcity9848835243 cyberNo ratings yet

- Auditing TheoDocument27 pagesAuditing TheoSherri BonquinNo ratings yet

- Tugas Audit Chpter9 Risk PrintDocument11 pagesTugas Audit Chpter9 Risk PrintKazuyano DoniNo ratings yet

- Control RiskDocument19 pagesControl RiskAnonymous HBzUFPliGsNo ratings yet

- Chapter 5Document11 pagesChapter 5fekadegebretsadik478729No ratings yet

- Lecture 4 Risks of Material MisstatementsDocument31 pagesLecture 4 Risks of Material MisstatementsTeng Jun tehNo ratings yet

- 2.1 Chapter 2 - The Fundamental Concepts of AuditDocument21 pages2.1 Chapter 2 - The Fundamental Concepts of AuditĐức Qúach TrọngNo ratings yet

- CH 9 Assessing The Risk of Material MisstatementDocument7 pagesCH 9 Assessing The Risk of Material MisstatementNada An-NaurahNo ratings yet

- Risk Assesment and Internal Control Sa 400Document4 pagesRisk Assesment and Internal Control Sa 400Amit SaxenaNo ratings yet

- Auditing and Assurance - Concepts and Applications - Lecture AidDocument30 pagesAuditing and Assurance - Concepts and Applications - Lecture AidBrithney ButalidNo ratings yet

- Lecture 6-Audit RiksDocument6 pagesLecture 6-Audit Riksakii ramNo ratings yet

- Online Test Series: Jaiib Caiib Mock Test & Study Materias PageDocument83 pagesOnline Test Series: Jaiib Caiib Mock Test & Study Materias PageabhiNo ratings yet

- PBEPIII Inherent Risk PDFDocument5 pagesPBEPIII Inherent Risk PDFkim romanoNo ratings yet

- LS 1.50 Overview of Risk-Based Audit ApproachDocument4 pagesLS 1.50 Overview of Risk-Based Audit ApproachDaren Dame Jodi RentasidaNo ratings yet

- 2 Combined Risk AssesmentDocument15 pages2 Combined Risk AssesmentChaitra Kshathriya MNo ratings yet

- ACCA AA Audit Risk - Technical ArticleDocument5 pagesACCA AA Audit Risk - Technical Articlesaleema ohabNo ratings yet

- Audit RisksDocument4 pagesAudit RisksAliAwaisNo ratings yet

- CH 5Document2 pagesCH 5Scholastica DaniaNo ratings yet

- Caua 3752 - Auditing 1B: Topic and Reference: Auditing NotesDocument42 pagesCaua 3752 - Auditing 1B: Topic and Reference: Auditing NotesMoniqueNo ratings yet

- ACT 141-Module 5 Financial Statement AuditDocument125 pagesACT 141-Module 5 Financial Statement AuditJade Angelie FloresNo ratings yet

- Chapter 3 Risk AssessmentDocument17 pagesChapter 3 Risk AssessmentArizal Zul Lathiif100% (1)

- The Audit Risk ModelDocument7 pagesThe Audit Risk ModelNatya NindyagitayaNo ratings yet

- Arens Auditing16e SM 09Document28 pagesArens Auditing16e SM 09김현중No ratings yet

- Assessing and Responding To Risks in A Financial Statement AuditDocument8 pagesAssessing and Responding To Risks in A Financial Statement AuditGerman ChavezNo ratings yet

- Audit Risk: Risk Assessment Test of Controls Substantive ProceduresDocument17 pagesAudit Risk: Risk Assessment Test of Controls Substantive ProceduresUsama RajaNo ratings yet

- Audit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.Document29 pagesAudit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.nidal_adnanNo ratings yet

- Audit Evidence and Risk AssessmentDocument9 pagesAudit Evidence and Risk AssessmentNAUGHTYNo ratings yet

- Acctg 14 - Midterm Lesson Part3Document21 pagesAcctg 14 - Midterm Lesson Part3NANNo ratings yet

- Diffraction GratingDocument9 pagesDiffraction GratingRajaswi BeleNo ratings yet

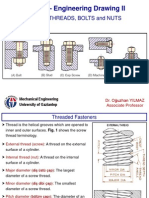

- SCREW THREADS, BOLTS and NUTS PDFDocument10 pagesSCREW THREADS, BOLTS and NUTS PDFhrhgk50% (2)

- Dangase Group - Research FinalDocument59 pagesDangase Group - Research FinalGlenda PapelleroNo ratings yet

- Bend TestDocument38 pagesBend TestAzan Safril100% (1)

- Combiflam Tablets PI - 08072019Document13 pagesCombiflam Tablets PI - 08072019ArunNo ratings yet

- Activity 6Document4 pagesActivity 6Junior SmithNo ratings yet

- Corvid v6 Install InstructionsDocument8 pagesCorvid v6 Install InstructionsНемања ВукашиновићNo ratings yet

- Understanding Financial Accounting Canadian 2nd Edition Burnley Test BankDocument25 pagesUnderstanding Financial Accounting Canadian 2nd Edition Burnley Test BankJamesFowlertmnf100% (28)

- Cayuga Comm. College - New Employees AnnouncedDocument2 pagesCayuga Comm. College - New Employees AnnouncederikvsorensenNo ratings yet

- CNotice LogDocument15 pagesCNotice LogAzertyuioptotoNo ratings yet

- Subaru - CHASSISDocument520 pagesSubaru - CHASSISIS52100% (1)

- Analisis Permasalahan Hukum E-Commerce Dan Pengaturannya Di Indonesia Tansah RahmatullahDocument14 pagesAnalisis Permasalahan Hukum E-Commerce Dan Pengaturannya Di Indonesia Tansah RahmatullahFrans RajagukgukNo ratings yet

- ? - 1000 BTC Bitcoin Challenge Transaction - Private Keys DirectoryDocument9 pages? - 1000 BTC Bitcoin Challenge Transaction - Private Keys DirectorynelsonbmbavoNo ratings yet

- Effects of Handling On Animals Welfare During TranDocument54 pagesEffects of Handling On Animals Welfare During TranNikhilesh WaniNo ratings yet

- Physics PDFDocument276 pagesPhysics PDFBenjamín Medina CarrilloNo ratings yet

- Kubernetes Controllers - The Kubernetes WorkshopDocument70 pagesKubernetes Controllers - The Kubernetes WorkshopOLALEKAN ALEDARENo ratings yet

- Pennisetum PurpureumDocument3 pagesPennisetum PurpureumHildan H GNo ratings yet

- Full Project ReportDocument46 pagesFull Project ReportRakeshNo ratings yet

- Passive VoiceDocument2 pagesPassive Voicenguyen hong phuong63% (19)

- FBS Pre TestDocument4 pagesFBS Pre TestEvelyn Santos100% (1)

- Introductory Entomology: Third Semester Lamjung CampusDocument206 pagesIntroductory Entomology: Third Semester Lamjung Campusnishan khatriNo ratings yet

- Chapter 4 - Braking System 4.1 Brake LinesDocument14 pagesChapter 4 - Braking System 4.1 Brake LinesEmanuel VidalNo ratings yet

- Rex International Holding Limited Preliminary Offer DocumentDocument723 pagesRex International Holding Limited Preliminary Offer DocumentInvest StockNo ratings yet

- BS 2830Document46 pagesBS 2830Mohammed Rizwan AhmedNo ratings yet

- Industrial Arts - Automotive Servicing (Exploratory) : K To 12 Technology and Livelihood EducationDocument7 pagesIndustrial Arts - Automotive Servicing (Exploratory) : K To 12 Technology and Livelihood Educationjayson acunaNo ratings yet

- MODULE 1-RelevantDocument7 pagesMODULE 1-RelevantMerliza JusayanNo ratings yet

- Pyrolysis Oil (69013-21-4) - Final - ESADocument7 pagesPyrolysis Oil (69013-21-4) - Final - ESAKelly LimNo ratings yet

- Evaluation of Antimicrobial and Antioxidant Activity of Crude Methanol Extract and Its Fractions of Mussaenda Philippica LeavesDocument14 pagesEvaluation of Antimicrobial and Antioxidant Activity of Crude Methanol Extract and Its Fractions of Mussaenda Philippica Leavesiaset123No ratings yet