Professional Documents

Culture Documents

Tax 267 Feb21 Pyq

Tax 267 Feb21 Pyq

Uploaded by

Kenji HiroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 267 Feb21 Pyq

Tax 267 Feb21 Pyq

Uploaded by

Kenji HiroCopyright:

Available Formats

CONFIDENTIAL 1 AC/FEB 2021/TAX267

UNIVERSITI TEKNOLOGI MARA

FINAL ASSESSMENT

COURSE : TAXATION 1

COURSE CODE : TAX267

EXAMINATION : FEBRUARY 2021

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of:

i) the Question Paper

ii) a four-page Appendix 1

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 8 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/FEB 2021/TAX267

QUESTION 1

A. List TWO (2) types of income which are exempted from tax in Malaysia.

(4 marks)

B. State TWO (2) events that give the rights to taxpayers to make an appeal.

(4 marks)

C. Identify FOUR (4) responsibilities of individual taxpayers.

(4 marks)

D. Dr Dominic Mangga, a Malaysian citizen, is a Dermatology specialist at a Malaysian

private hospital. Under the Experience Enhancement Skills Program, he was

attached to St Vincent's Private Hospital in Sydney, Australia. The following

information relates to him:

Year Details

2016 He left Kuala Lumpur for the first time on 31 December 2016 to

Sydney, Australia.

2017 On 1 April 2017, he came back to Malaysia to attend his son’s

convocation ceremony. He returned to Sydney on 28 April 2017.

On 20 October 2017, he came back to Malaysia to celebrate his

daughter’s birthday and went back to Sydney on 20 December 2017.

2018 On 5 November 2018, he visited his uncle in New Zealand. He

returned to Sydney on 15 November 2018.

2019 Dr Dominic went to Singapore from 2 February 2019 until 10 February

2019 to attend a medical course with his supervisor at St Vincent's

Private Hospital.

He returned to Malaysia after completing 3 years program in Sydney,

Australia on 31 July 2019.

2020 He went back to St Vincent's Private Hospital to attend a seminar on

an updated new screening procedure from 10 February 2020 until 28

February 2020.

Required:

Determine the residence status of Dr Dominic Mangga for the years of assessment

2017 until 2020. Support your answer with relevant sections and reasons.

(8 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2021/TAX267

QUESTION 2

Alisha, aged 42, was appointed as general manager of UMI Takaful Sdn Bhd since 10

February 2012. However, due to Covid-19 pandemic that affected the businesses in

Malaysia, Alisha was terminated from her employment on 30 November 2020. The company

paid her RM140,000 as compensation for the loss of employment and she withdrew

RM250,000 from an unapproved fund whereby 60% of the fund was contributed by her

employer.

Her remuneration and benefits received until 30 November 2020 are as follows:

a. A monthly salary of RM9,000 before deducting EPF at the rate of 11%.

b. A monthly entertainment allowance of RM1,000 but she only spent 50% of the

allowance to entertain the company’s clients.

c. A monthly petrol allowance for official duties of RM500 and parking fees allowance of

RM120.

d. A car costing RM250,000 with a driver were provided by the company since 2014.

e. A fully furnished bungalow with a rental value of RM2,000 (excluding cost of furniture

RM700 per month) was provided until 30 November 2020. Alisha paid RM400 as

monthly rental for the bungalow.

f. Alisha employed a servant and paid salary of RM800 per month. The amount is later

reimbursed by her employer.

g. Alisha obtained a housing loan amounted to RM400,000 on 1 January 2020. The

interest on loan of 3% per annum was subsidised by her employer.

h. In February 2020, she was provided with leave passage to Melbourne, Australia. The

expenses include cost of air fares of RM3,500. The company also paid for her meals

and accommodation amounted to RM5,000.

i. The company paid for her corporate membership of RM200 per month in Regent Golf

Club.

j. The company paid for her dental treatment of RM300.

Required:

Compute the statutory employment income from employment for Alisha for the year of

assessment 2020.

(Total: 14 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/FEB 2021/TAX267

QUESTION 3

Bonda Enterprise owned by Halim is involved in local distribution of mini egg sponge

cupcakes or bahulu cupcakes. The following is the Statement of Profit or Loss for his

business for the year ended 31 December 2020.

Bonda Enterprise

Statement of Profit or Loss for the year ended 31 December 2020

Note RM RM

Sales 652,000

Less: Cost of goods sold 1 125,000

Gross Profit 527,000

Add: Other income

Interest income 2 13,400

Rental income 3 10,800 24,200

551,200

Less: Operating expenses

Remuneration 4 283,000

Fees 5 15,200

Entertainment expenses 6 27,200

Donations 7 12,800

Repair and maintenance 8 15,800

Bad debts 9 13,100

Travelling expenses 10 10,700

Water and electricity expenses 11 7,300

Compensation 12 5,600

Depreciation 12,800 (403,500)

Net Profit 147,700

Additional information:

1. Cost of goods sold include:

Goods costing RM1,500 taken by Halim as a wedding gift for his cousin. The market

value of the goods was RM1,800.

2. Interest income were received from:

RM

Fixed deposit account at CIMB bank 4,500

Charges on overdue trade accounts 8,900

13,400

3. Rental income:

Rental income received from a condominium rented out to Halim’s friend.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/FEB 2021/TAX267

4. Remuneration comprise:

Salary Bonus EPF

RM RM RM

Halim 57,000 18,000 22,000

Employees 119,000 22,500 44,500

176,000 40,500 66,500

Included in salary and bonus to employees was RM16,200 paid to shop assistant

who is disabled.

5. Fees comprise:

RM

Accounting service 3,200

Fines paid for exceeding speed limit 1,800

Legal fees for purchase of land 3,500

Legal fees on recovery of trade debts 4,300

Fees for designing business logo 2,400

15,200

6. Entertainment expenses comprise:

RM

Gift vouchers to customers 11,200

Annual dinner for employees 8,100

Lunch with suppliers 2,500

Family Day with staff and their families 5,400

27,200

7. Donations consist of:

RM

Business zakat 4,200

Contribution made to a political party 2,500

Contribution to an approved institution:

(Infrastructure for the poor s 34(6)(h)) 6,100

12,800

8. Repair and maintenance comprise:

RM

Repair of delivery van 4,100

Renovation of business premise 6,800

Installation of new air-conditioner in the premise 2,600

Repainting of Halim’s house 2,300

15,800

9. Bad debts comprise:

RM

Net increase in specific provision 4,100

Net increase in general provision 3,200

Trade bad debts written off 5,800

13,100

10. Travelling expense comprise:

RM

Carriage cost for delivering stock to customers 7,700

Halim’s holiday to Langkawi 3,000

10,700

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/FEB 2021/TAX267

11. 20% of water and electricity expenses for personal use.

12. Compensation paid to dismiss an employee due to wrongful act by him.

13. Capital allowance charged for the year of assessment 2020 amounting to

RM25,000.

Required:

Compute the statutory business income of Bonda Enterprise for the year of assessment

2020. Indicate ‘Nil’ for any item that does not require any adjustment.

(Total: 18 marks)

QUESTION 4

A. Discuss briefly THREE (3) circumstances under which a wife may elect for joint

assessment.

(6 marks)

B. Encik Samad, who is the general manager and the owner of Hijau Segar Enterprise

has the following income for the year 2020:

1. The adjusted income and capital allowance for Hijau Segar Enterprise were

RM81,000 and RM25,000 respectively.

2. Encik Samad received rental income from the following properties:

Terrace Apartment

house

RM RM

Rental income per month 2,000 1,000

Quit rent for the year 2020 1,200 600

Advertisement cost 200 -

Repair and maintenance on 31 July 2020 700 500

The terrace house was occupied by Encik Samad until September 2020 and

effective from 1 October 2020, the house was rented out to a tenant. The

apartment was rented out since January 2019.

3. A royalty of RM65,000 from Muzik Records Sdn Bhd on song compositions.

On 13 March 2020, his wife, Puan Siti (a disabled person), passed away due to

cancer. On 1 July 2020, Encik Samad remarried Puan Athirah, who then left her

position as an engineer of Naim Berhad and become a full time housewife. Below is

the income pertaining to Puan Athirah for the year 2020.

1. She has been working with Naim Bhd since 1 March 2006. Her monthly gross

salary was RM8,800, before deducting EPF of 11%.

2. Upon her resignation, she received RM50,000 as gratuity from Naim Bhd.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/FEB 2021/TAX267

3. Due to her knowledge and expertise, she received invitations from several

cooperative bodies to conduct seminars pertaining to her engineering expertise.

The honorarium derived was RM55,000.

4. She received single tier dividend from Amanah Saham Bumiputera (ASB) of

RM12,000.

Additional Information:

a. Encik Samad and Puan Siti were blessed with three children:

Sufian Aged 25 years old, worked as an engineer with TNB and

pursuing his studies in MBA with UiTM on part-time basis

Syaqira Aged 22 years old, studying medicine in England and married

in August 2020

Sofwan Aged 17, waiting for SPM result

b. Encik Samad incurred RM25,000 on medical bills due to Puan Siti’s cancer and

RM5,000 on her wheel chair.

c. Encik Samad also incurred RM3,200 on his father’s medical treatment. In July 2020,

he sent his father to a private nursing home and paid the fees of RM2,500.

d. Encik Samad paid RM450 for a business magazine subscription and RM2,100 for

Internet subscription.

e. Encik Samad paid RM3,000 as zakat to Majlis Agama Islam and RM500 to some

underprivileged families in his residential area.

f. Puan Athirah incurred RM4,000 for her life insurance premium and RM3,500 for

medical insurance premium.

g. Puan Athirah incurred RM2,500 for a mountain bike and RM2,000 on the cycling gear

(helmet, knee and elbow guard).

h. Puan Athirah purchased a new HP laptop of RM6,000. No claim was made since

2016.

i. Puan Athirah donated RM6,000 to Majlis Kanser Negara (MAKNA) and RM3,500 to

Yayasan Pembangunan Ekonomi Islam Malaysia (YaPEIM) (both are approved

under s 44 (6) of Income Tax Act 1967).

j. Puan Athirah also paid RM10,000 as zakat to Majlis Agama Islam.

Required:

Compute the income tax payable for Encik Samad and Puan Athirah for the year of

assessment 2020.

(20 marks)

(Total: 26 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/FEB 2021/TAX267

QUESTION 5

A. Discuss briefly TWO (2) circumstances of non-entitlement of agriculture allowance.

(2 marks)

B. MissAnne Skincare Sdn Bhd is a local cosmetic brand famously known for its effective

skin whitening products. The company made up its account to 31 December annually.

The following information is for the company’s assets for the year ended 31 December

2020.

Car

On 1 March 2018, a new car was bought for the marketing manager under hire

purchase loan amounted to RM150,000. The cash price of the car was RM200,000.

MissAnne Skincare Sdn Bhd paid RM50,000 as deposit and the hire purchase term

was for a period of 60 months. The monthly installment is RM3,000 commencing from

1 April 2018.

Computer

A new desktop computer was purchased on 15 February 2020 at a cost of RM4,500.

MissAnne Skincare Sdn Bhd constructed a factory in January 2018, with the following

costs:

RM

Cost of land 1,200,000

Architect’s fees 45,000

Cost of clearing the land 30,000

Electrical wiring and fitting 55,000

Construction costs 750,000

The factory was completed and used on 1 July 2019. 1/8 of the total floor area was

used as an office while the remaining 7/8 was for manufacturing activities.

Required:

Calculate the capital allowances, industrial allowance, balancing allowances/charges

(if any) that can be claimed by MissAnne Skincare Sdn Bhd for all the relevant years

up to the year of assessment 2020.

(20 marks)

(Total: 22 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- FAR210 - Feb 2023 - SSDocument11 pagesFAR210 - Feb 2023 - SSfarisha aliahNo ratings yet

- CRG660 Past Year AnswersDocument85 pagesCRG660 Past Year AnswersMuhammad Zulhisyam100% (3)

- 2023 Common Test AIS205 SSDocument4 pages2023 Common Test AIS205 SSsyafiah sofianNo ratings yet

- Far460 - Set 1 - Feb 2021 - Suggested SolutionsDocument8 pagesFar460 - Set 1 - Feb 2021 - Suggested SolutionsRuzaikha razaliNo ratings yet

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- Lesson 1 Tax Planning & ManagementDocument35 pagesLesson 1 Tax Planning & ManagementkelvinNo ratings yet

- Far 410 Chapter 1Document47 pagesFar 410 Chapter 1Andi Nabila Anabell100% (1)

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Chapter Two:: Measuring National IncomeDocument42 pagesChapter Two:: Measuring National IncomeArni Ayuni100% (1)

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- L10 - MFRS 137Document72 pagesL10 - MFRS 137andy100% (5)

- Suggested Solution Q15.1Document4 pagesSuggested Solution Q15.1swordshoes100% (1)

- Maf 603 Suggested Solutions Solution 1Document5 pagesMaf 603 Suggested Solutions Solution 1anis izzatiNo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Tax 467 Common Test July 2022 PDFDocument5 pagesTax 467 Common Test July 2022 PDFkhaiNo ratings yet

- Tax267 Jul2022 QQDocument9 pagesTax267 Jul2022 QQLENNY GRACE JOHNNIENo ratings yet

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- Tax 467 Common Test July 2022 - SS PDFDocument5 pagesTax 467 Common Test July 2022 - SS PDFkhaiNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- FAR Revision Answer Scheme Jul 2017Document8 pagesFAR Revision Answer Scheme Jul 2017Nurul Farahdatul Ashikin RamlanNo ratings yet

- Solution FAR270 NOV 2022Document6 pagesSolution FAR270 NOV 2022Nur Fatin AmirahNo ratings yet

- Tax267 Ss Feb2022Document10 pagesTax267 Ss Feb20228kbnhhkwppNo ratings yet

- Tutorial 3 MFRS 116 QDocument15 pagesTutorial 3 MFRS 116 QN FrzanahNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Ss Jan2023Document6 pagesSs Jan2023AFIQAH NAJWA MOHD TALAHANo ratings yet

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- Far410 Feb2022 Nacab1b 04062023Document15 pagesFar410 Feb2022 Nacab1b 04062023Rabi'atul Addawiyah NoorNo ratings yet

- Ais275 Jan18 Suggested SolutionsDocument7 pagesAis275 Jan18 Suggested SolutionsMUHAMMAD AJMAL HAKIM MOHD MISRONNo ratings yet

- Sample Law446Document3 pagesSample Law446Nor Alia ShafiaNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Group Project 2 - Published Account DEC2019 FAR270 - SSDocument6 pagesGroup Project 2 - Published Account DEC2019 FAR270 - SSHaru BiruNo ratings yet

- Solution DEC 2018Document7 pagesSolution DEC 2018anis izzatiNo ratings yet

- Far160 Pyq July2023Document8 pagesFar160 Pyq July2023nazzyusoffNo ratings yet

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Tax267 July22 QQDocument9 pagesTax267 July22 QQSYAZWINA SUHAILINo ratings yet

- Law 346Document16 pagesLaw 346Hasrul DaudNo ratings yet

- Group Assingment - (Bank Rakyat)Document33 pagesGroup Assingment - (Bank Rakyat)Mishalini VythilingamNo ratings yet

- Ss - Maf551 Feb 22Document7 pagesSs - Maf551 Feb 22izwanNo ratings yet

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- CT MAF251 Q OCT2023 NopasswordDocument3 pagesCT MAF251 Q OCT2023 Nopassword2022890872No ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Acc116 Dec 2022 - Q - Test 1Document6 pagesAcc116 Dec 2022 - Q - Test 12022825274100% (1)

- Ss Jan2022Document6 pagesSs Jan2022AFIQAH NAJWA MOHD TALAHANo ratings yet

- Acc407 Group Assignment (2023)Document15 pagesAcc407 Group Assignment (2023)intisleenrinna100% (2)

- This Study Resource Was: Universiti Teknologi Mara Common Test 1 Answer SchemeDocument4 pagesThis Study Resource Was: Universiti Teknologi Mara Common Test 1 Answer SchemeSyazryna AzlanNo ratings yet

- 3 - MAF603 - Efficient Market HypothesisDocument26 pages3 - MAF603 - Efficient Market HypothesisWan WanNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- GROUP 4 Report MAF682Document18 pagesGROUP 4 Report MAF682Nora ArifahsyaNo ratings yet

- MAF551 - Exercise 1 - Answer Question 4 - Karrimost SDN BHD - Ridzuan Bin Saharun - 2017700141Document3 pagesMAF551 - Exercise 1 - Answer Question 4 - Karrimost SDN BHD - Ridzuan Bin Saharun - 2017700141RIDZUAN SAHARUNNo ratings yet

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Solution FAR270 APRIL 2022Document6 pagesSolution FAR270 APRIL 2022Nur Fatin Amirah100% (1)

- Ent530n - Business Plan Report (Group 4)Document72 pagesEnt530n - Business Plan Report (Group 4)Nur AmirahNo ratings yet

- Solution Dec 2014Document8 pagesSolution Dec 2014anis izzatiNo ratings yet

- BAC1634 - Tutorial 5 & 6 QDocument18 pagesBAC1634 - Tutorial 5 & 6 QLee Hau SenNo ratings yet

- Tax267 February 22 FaDocument13 pagesTax267 February 22 FarumaisyaNo ratings yet

- Margaret Magee Has Served Both As An Outside Director To: Unlock Answers Here Solutiondone - OnlineDocument1 pageMargaret Magee Has Served Both As An Outside Director To: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Data Guard Configurations: Standby DatabasesDocument3 pagesData Guard Configurations: Standby Databaseschoton123No ratings yet

- Chapter 10 Attitudes and Decision MakingDocument27 pagesChapter 10 Attitudes and Decision Makingwahyu_widodo_14No ratings yet

- The Multi Billion Dollar Industry You Can Make Money From EasilyDocument34 pagesThe Multi Billion Dollar Industry You Can Make Money From EasilyJoshuaNo ratings yet

- IGCSE Economics 1.2 The Factors of ProductionDocument4 pagesIGCSE Economics 1.2 The Factors of Productionyeweiwei0925No ratings yet

- Payment Instruction Form (Pif) : ManilaDocument1 pagePayment Instruction Form (Pif) : ManilaMartir NyeberaNo ratings yet

- PEZA Domestic Market EnterpriseDocument2 pagesPEZA Domestic Market EnterpriseAileen ReyesNo ratings yet

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghNo ratings yet

- Sps Velarde CaseDocument6 pagesSps Velarde CaseJNMGNo ratings yet

- You Cannot Manage Something You Cannot Control, and You Cannot Control Something You Cannot Measure." Peter DruckerDocument53 pagesYou Cannot Manage Something You Cannot Control, and You Cannot Control Something You Cannot Measure." Peter DruckerSahal MirsaalNo ratings yet

- Mulching Guide Benefits of Mulch PDFDocument9 pagesMulching Guide Benefits of Mulch PDFCHP TSTPSNo ratings yet

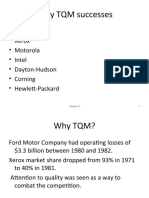

- Early TQM Successes: - Nashua - Xerox - Motorola - Intel - Dayton-Hudson - Corning - Hewlett-PackardDocument31 pagesEarly TQM Successes: - Nashua - Xerox - Motorola - Intel - Dayton-Hudson - Corning - Hewlett-Packardrocks tusharNo ratings yet

- Chapter 5C: The Functions of The Price MechanismDocument3 pagesChapter 5C: The Functions of The Price MechanismAmmaar KIMTI100% (1)

- Institute of Rural Management Anand: Mid Term Examination (Open Book)Document4 pagesInstitute of Rural Management Anand: Mid Term Examination (Open Book)Dharampreet SinghNo ratings yet

- Strategic Management 2nd Edition Rothaermel Solutions ManualDocument25 pagesStrategic Management 2nd Edition Rothaermel Solutions ManualTracySnydereigtc100% (41)

- FULLTEXT01 Smart Denim PDFDocument80 pagesFULLTEXT01 Smart Denim PDFanon_612425549No ratings yet

- Nepal Family TourDocument7 pagesNepal Family TourKarthikeyanVeeNo ratings yet

- Statement 22Document14 pagesStatement 22Saud ShaikhNo ratings yet

- After-Tax Economic Analysis: Engineering EconomyDocument16 pagesAfter-Tax Economic Analysis: Engineering EconomyTUẤN TRẦN MINHNo ratings yet

- Transpo Finals Case DigestDocument3 pagesTranspo Finals Case Digestczabina fatima delicaNo ratings yet

- Chapter 11 Cash Flow Estimation and Risk Analysis PDFDocument80 pagesChapter 11 Cash Flow Estimation and Risk Analysis PDFGelyn Cruz100% (2)

- What Is Stop LossDocument2 pagesWhat Is Stop LossTest TestNo ratings yet

- 144 Daftar P2P Ilegal AprilDocument12 pages144 Daftar P2P Ilegal AprilSumiatiNo ratings yet

- Samsung Management Case Study: April 2020Document18 pagesSamsung Management Case Study: April 2020funwackyfunNo ratings yet

- DENR Citizen Charter 2023 1st EditionDocument259 pagesDENR Citizen Charter 2023 1st EditionBoniel HBNo ratings yet

- Unit 2 Research Project IdentificationDocument4 pagesUnit 2 Research Project Identificationmyron kipropNo ratings yet

- Assignment 1.hasan - CBDocument2 pagesAssignment 1.hasan - CBnoNo ratings yet

- Activity 3 - Accounting EquationDocument7 pagesActivity 3 - Accounting EquationAhmed RazaNo ratings yet

- Tips and Tricks For Building ERP Interfaces in MIIDocument19 pagesTips and Tricks For Building ERP Interfaces in MIInetra14520100% (1)