Professional Documents

Culture Documents

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Uploaded by

Hanna CaraigCopyright:

Available Formats

You might also like

- MAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Document15 pagesMAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Nanananana100% (3)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Stock Inventory List - SampleDocument2 pagesStock Inventory List - SampleBaby Dolle JiaNo ratings yet

- Multiple Choice Questions of Economics: A. Manufacturing SectorDocument203 pagesMultiple Choice Questions of Economics: A. Manufacturing SectorMalik FaysalNo ratings yet

- Module 6 - Worksheet and Financial Statements Part IDocument12 pagesModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- 10 Column WorksheetDocument41 pages10 Column WorksheetRachel Jane TanNo ratings yet

- Barco Projection SystemsDocument15 pagesBarco Projection SystemsSathish Chandramouli100% (1)

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Worksheet PreparationDocument3 pagesWorksheet PreparationJon PangilinanNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Document7 pagesTanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Hanna CaraigNo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Chapter 4. Completing The Accounting CycleDocument3 pagesChapter 4. Completing The Accounting CycleÁlvaro Vacas González de EchávarriNo ratings yet

- CH 4 Work Sheet2Document54 pagesCH 4 Work Sheet2Yasin Arafat ShuvoNo ratings yet

- Principles of Accounting Chapter 6Document3 pagesPrinciples of Accounting Chapter 6“Mysticalfirecracker345”No ratings yet

- Week 1B - Fabm 1 - Completing The Accounting CycleDocument30 pagesWeek 1B - Fabm 1 - Completing The Accounting CycleSheila Marie Ann Magcalas-GaluraNo ratings yet

- Amodia (Accounting Notes - Worksheet)Document3 pagesAmodia (Accounting Notes - Worksheet)CLUVER AEDRIAN AMODIANo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- Acknowledgement: Aditi Vyas (Batch 2019-2024)Document13 pagesAcknowledgement: Aditi Vyas (Batch 2019-2024)Vipul SolankiNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- Basic Accounting With Basic Corporate Accounting (ACCT 101)Document24 pagesBasic Accounting With Basic Corporate Accounting (ACCT 101)Harvy TorreburgerNo ratings yet

- Accounting CycleDocument30 pagesAccounting CycleJenelle RamosNo ratings yet

- The Post of Trial Balance (Bing)Document5 pagesThe Post of Trial Balance (Bing)rezarenonnNo ratings yet

- FABM AJE and Adjusted Trial Balance Service BusinessDocument18 pagesFABM AJE and Adjusted Trial Balance Service BusinessMarchyrella Uoiea Olin Jovenir50% (4)

- Tle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2Document14 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2johnklientantiguaNo ratings yet

- ABM FABM1-Q4-Week-1Document26 pagesABM FABM1-Q4-Week-1Just OkayNo ratings yet

- Year End Closing GLDocument11 pagesYear End Closing GLErshad RajaNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- Step 5 WorksheetDocument8 pagesStep 5 WorksheetBarbie GammadNo ratings yet

- Module 6Document13 pagesModule 6kohi jellyNo ratings yet

- ACCT1002 U3-20150920Document15 pagesACCT1002 U3-20150920SaintNo ratings yet

- Comprehensive Problem Assignment - PDFDocument20 pagesComprehensive Problem Assignment - PDFJunior RobinsonNo ratings yet

- Cfas 3Document10 pagesCfas 3Bea charmillecapiliNo ratings yet

- Safeer AIDocument4 pagesSafeer AIKhuwaja sahabNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- Module 11 ICT 141Document3 pagesModule 11 ICT 141Janice SeterraNo ratings yet

- 2023 PF2 Chapter 1 - Payroll AccountingDocument77 pages2023 PF2 Chapter 1 - Payroll Accountingxiahq163No ratings yet

- Lesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsDocument18 pagesLesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsAra ArinqueNo ratings yet

- University of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Document8 pagesUniversity of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Annie RapanutNo ratings yet

- CH2 Principles of Acc P3Document16 pagesCH2 Principles of Acc P3saed cabdiNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Management PresentationDocument61 pagesManagement Presentationiffat.stu2018No ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- ACCT 1026 Lesson 7Document10 pagesACCT 1026 Lesson 7ChjxksjsgskNo ratings yet

- Adjustments: Steps For Recording Adjusting EntriesDocument2 pagesAdjustments: Steps For Recording Adjusting EntriesYahnsea AlfaroNo ratings yet

- Accounting Cycle: BusinessDocument6 pagesAccounting Cycle: BusinessRenu KulkarniNo ratings yet

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1bDocument12 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 1bSheila Marie Ann Magcalas-GaluraNo ratings yet

- Bazele Contabilitatii C4EDocument17 pagesBazele Contabilitatii C4EtamasraduNo ratings yet

- Term 2 Week 3Document42 pagesTerm 2 Week 3bhavik GuptaNo ratings yet

- POA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1Document69 pagesPOA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1muhammad atifNo ratings yet

- Chapter 3 Adjusting The AccountsDocument19 pagesChapter 3 Adjusting The AccountsKabeer Khan100% (1)

- Accounting Worksheet: What Is A Worksheet?Document7 pagesAccounting Worksheet: What Is A Worksheet?ScribdTranslationsNo ratings yet

- Lesson 21Document15 pagesLesson 21Rica Mae ParamNo ratings yet

- Module 5 Completion of The Accounting Process For ServiceDocument14 pagesModule 5 Completion of The Accounting Process For ServiceavimalditaNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument13 pagesPhilippine School of Business Administration: Cpa ReviewLoi GachoNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)ivang95No ratings yet

- Analysis of Trial Balance-: Solution 2Document3 pagesAnalysis of Trial Balance-: Solution 2BUNTY GUPTANo ratings yet

- Tanauan Institute, Inc.: Recording Net SalesDocument9 pagesTanauan Institute, Inc.: Recording Net SalesHanna Caraig0% (1)

- Tanauan Institute, Inc.: Recording Cost of Sales or Cost of Goods SoldDocument10 pagesTanauan Institute, Inc.: Recording Cost of Sales or Cost of Goods SoldHanna CaraigNo ratings yet

- Tanauan Institute, Inc.: PurchasesDocument9 pagesTanauan Institute, Inc.: PurchasesHanna CaraigNo ratings yet

- Lesson 6Document7 pagesLesson 6Hanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Document7 pagesTanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Hanna CaraigNo ratings yet

- Lesson 2Document13 pagesLesson 2Hanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Adjustments For AccrualsDocument7 pagesTanauan Institute, Inc.: Adjustments For AccrualsHanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For The Merchandising Business Part 2Document8 pagesTanauan Institute, Inc.: Completing The Cycle For The Merchandising Business Part 2Hanna Caraig0% (1)

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- Development of An Entry Mode StrategyDocument3 pagesDevelopment of An Entry Mode StrategyRukshi ArawwalaNo ratings yet

- Marketing Management - Unit 1Document12 pagesMarketing Management - Unit 1amritaNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- GE Matrix and 7S FrameworkDocument16 pagesGE Matrix and 7S FrameworkpayalNo ratings yet

- Investment Banking Prep Interview QuestionsDocument8 pagesInvestment Banking Prep Interview QuestionsNeil GriggNo ratings yet

- DrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyDocument1 pageDrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyWilson Perumal & CompanyNo ratings yet

- MARKETING PHILOSOPHIES NewDocument17 pagesMARKETING PHILOSOPHIES Newkapila aroraa100% (5)

- Project Finance Sem 4Document366 pagesProject Finance Sem 4dharaNo ratings yet

- Chapter 8Document15 pagesChapter 8GOD100% (1)

- CB2500 Information Management ChecklistDocument4 pagesCB2500 Information Management Checklistsiu chun chanNo ratings yet

- Eurocash Business Strategy AnalysisDocument6 pagesEurocash Business Strategy AnalysiskshywyNo ratings yet

- 2562 TheoryDocument3 pages2562 Theorymaddy_i5No ratings yet

- Seminar AuditDocument7 pagesSeminar AuditMichael BusuiocNo ratings yet

- Conceptual Framework in AccountingDocument4 pagesConceptual Framework in AccountingKrizchan Deyb De LeonNo ratings yet

- BDocument2 pagesBManu KrishNo ratings yet

- Studying Different Systematic Value Investing Strategies On The Eurozone MarketDocument38 pagesStudying Different Systematic Value Investing Strategies On The Eurozone Marketcaque40No ratings yet

- UPSE Securities Limited v. NSE - CCI OrderDocument5 pagesUPSE Securities Limited v. NSE - CCI OrderBar & BenchNo ratings yet

- Marketing Mix - 4Ps of MarketingDocument5 pagesMarketing Mix - 4Ps of Marketingtom jonesNo ratings yet

- Comparison B/W Branded and Local JewellersDocument21 pagesComparison B/W Branded and Local JewellerscadalalNo ratings yet

- Customer Satisfaction Among EbuyersDocument63 pagesCustomer Satisfaction Among Ebuyerspersonalu65No ratings yet

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- Uniqlo (G5) - 1Document18 pagesUniqlo (G5) - 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Strategic Management Chapter 5-Business Level Strategy: Study Online atDocument2 pagesStrategic Management Chapter 5-Business Level Strategy: Study Online atSodium LightNo ratings yet

- 04 ABC and Coffee Services ACC9811 2021 One Slide Per PageDocument19 pages04 ABC and Coffee Services ACC9811 2021 One Slide Per PageDANNo ratings yet

- Business Plan TemplateDocument14 pagesBusiness Plan TemplateMei HuaNo ratings yet

- Trust FormatDocument40 pagesTrust FormatVictor Jeremiah100% (2)

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Uploaded by

Hanna CaraigOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting Cycle

Uploaded by

Hanna CaraigCopyright:

Available Formats

Tanauan Institute, Inc.

– Senior High School Department

TANAUAN INSTITUTE, INC.

Senior High School Department

Modified Learning Scheme : Workbook

Fundamentals of Accountancy, Business, and Management 2

1st Semester, S.Y. 2020-2021

Subject Teacher: ____________________

Name: ___________________________________ Score: ________________

Section: __________________________________ Date: _________________

Topic Session

Using the Worksheet and Chapter 4

Closing and Reversing Entries –

Finishing the Accounting Cycle

Objectives of the Lesson

At the end of the lesson, the student should be able to:

1. Prepare adjusted balance.

2. Do worksheet preparation.

3. Close the books and make reversing entries.

Values Integration

Perseverance. The attitude that no matter an issue or a problem maybe

one will still continue until he or she succeeds. The lesson that will be

discussed involves analytical thinking which will require the perseverance

of the students in order to learn it.

Discussion

The Worksheet

Accountants often use a worksheet to help transfer data from the adjusted trial balance

to the financial statements. This multi-column document provides an efficient way to

summarize the data for financial statements. It simplifies the adjusting and closing

process. It can also reveal errors. The worksheet is not part of the ledger or the journal,

nor is it a financial statement. It is a summary device used by the accountant for his

convenience.

Subject: Topic: Session: Page | 1

Tanauan Institute, Inc. – Senior High School Department

The accountant generally prepares a worksheet when it is time to adjust the accounts

and prepare financial statements. However, it is possible to prepare financial statements

directly from the adjusted trial balance at the end of the accounting period if the

business has relatively few accounts.

Preparing the Worksheet

In order to clearly illustrate the specifics in worksheet preparation, a sample worksheet

is provided and attached with this lesson.

1. Enter the account balances in the Unadjusted Trial Balance columns and total

the amounts.

Note:

The account titles are written in the worksheet in the same order as they are

written in the trial balance. (We’re just transferring the unadjusted trial balance or

trial balance for short, into the first three columns of the worksheet.)

Debit balances in the trial balance will be written under the debit column of

Unadjusted Trial Balance column in the worksheet while the credit balances in

the trial balance will be written under the credit column of Unadjusted Trial

Balance in the worksheet.

Accounts with zero balances will not be included in the worksheet. (However, the

book advises the opposite which is also correct)

Total debits must equal total credits.

2. Enter the Adjusting Entries in the adjustments columns and total the amounts.

Note:

The amounts of the adjusting accounts are entered in the same row where the

same account title is written, however the amount is written under the

adjustments column instead.

The side where the amounts of the accounts will be put depends on where the

account falls on the adjusting entries.

Total the debit and credit side of the adjustment column. Both sides must be

equal.

3. Compute each account’s adjusted balance by combining the unadjusted trial

balance and the adjustment figures. Enter the adjusted amounts in the Adjusted

Trial Balance columns.

Note:

The adjusted Trial Balance is prepared by combining horizontally, line by line, the

amount of each account in the unadjusted trial balance columns with the

corresponding amounts in the adjustment columns. This procedure is called

cross-footing.

Subject: Topic: Session: Page | 2

Tanauan Institute, Inc. – Senior High School Department

A simple convention to observe when extending amounts from the trial balance

to the adjusted trial balance follows:

o Add when the type of adjustment (debit or credit) is the same as the

unadjusted balance.

o Subtract when the type of adjustment (debit or credit) is different from the

unadjusted trial balance.

This process is followed through all the accounts. The adjusted trial balance

columns are then totalled to check the accuracy of the cross footing.

4. Extend the income and expense amounts to the income statement columns.

Total the statement columns. Extend the asset, liability and owner’s equity

amounts from the adjusted trial balance columns to the balance sheet columns.

Note:

Every account is either a balance sheet account (asset, liability, or owner’s

equity) or an income account (income or expense) statement account.

Income and expense accounts are moved to the income statement columns.

Asset, liability, capital and withdrawal accounts are extended to the balance

sheet columns.

Debits in the adjusted trial balance remain as debits in the statements columns

while credit remains on the credit side.

5. Compute profit or loss as the difference total revenues and total expenses in the

income statement. Enter profit or loss as a balancing amount in the income

statement and in the balance sheet, and compute the final column totals.

Note:

The profit or loss should always be the amount by which the debit and credit

columns for income statement and credit columns for balance sheet differ.

After completion, total debits and total credits in the income statement and

balance sheet columns must be equal.

The profit figure is extended to the credit column of the balance sheet because

profit increases owner’s equity and increases in owner’s equity are recorded as

credits.

Closing Entries

Income, expense and withdrawal accounts are temporary accounts that accumulate

information related to a specific accounting period. These temporary accounts facilitate

income statement preparation. At the end of each year, the balances of these temporary

accounts are transferred to the capital account. Thus, the balance of the owner’s capital

account represents the cumulative net result of income, expense, and withdrawal

transactions. This phase of the cycle is called the closing procedure.

A temporary account is said to be closed when an entry is made such that its balance

becomes zero. Closing simply transfers the balance of one account to another account.

Subject: Topic: Session: Page | 3

Tanauan Institute, Inc. – Senior High School Department

In this case, the balances of the temporary accounts are transferred to the capital

account. A summary account – Income Summary is used to close the income and

expense accounts. The steps in closing the accounts of an entity will be illustrated using

the Auto Sun Repair Shop.

1. Close the income accounts.

Income accounts have credit balances before closing entries are posted. For this

reason, an entry debiting each revenue account in the amount of its balance is needed

to close the account. The credit is made to the income summary account.

The entry to close the income accounts for the Auto Sun Repair Shop is as follows:

Dr. Cr.

Dec. 31 Service Income 42,250

Income Summary 42,250

The dual effect of the entry is to make the balances of the income accounts equal to

zero, and to transfer the balances in total to the credit side of the income summary

account.

2. Close the expense accounts.

Expense accounts have debit balances before the closing entries are posted. For this

reason, a compound entry is needed crediting each expense account for its balance

and debiting the income summary for the total.

Dr. Cr.

Dec. 31 Income Summary 25,250

Salaries Expense 5,600

Supplies Expense 500

Rent Expense 7,000

Insurance Expense 2,000

Gas Expense 1,500

Advertising Expense 1,750

Depreciation Expense – Vehicles 4,500

Depreciation Expense-Equipment 1,000

Interest Expense 1,400

The effect of posting the closing entry is to reduce the expense account balances to

zero and to transfer the total of the account balances to the debit side of the income

summary account.

3. Close the income summary.

After posting the closing entries involving the income and expense account, the balance

of the income summary account will be equal to the profit or loss for the period.

A profit indicated by a credit balance and a loss by a debit balance. The income

summary account, regardless of the nature of its balance, must be closed to the capital

account.

Subject: Topic: Session: Page | 4

Tanauan Institute, Inc. – Senior High School Department

For the Auto Sun Repair Shop, the entry is as follows:

Dr. Cr.

Dec. 31 Income Summary 17,000

Capital 17,000

The effect of posting this closing entry is to close the income summary account balance

and to transfer the balance to the Capital account of the business for the profit.

4. Close the withdrawal account.

The withdrawal account shows the amount by which capital is reduced during the period

by withdrawals of cash or other assets of the business by the owner for personal use.

For this reason, the debit balance of the withdrawal account must be closed to the

capital account as follows.

Dr. Cr.

Dec. 31 Capital 5,000

Withdrawals 5,000

The effect of this closing entry is to close the withdrawal account and to transfer the

balance to the capital account.

Preparation of a Post-Closing Trial Balance

It is possible to commit an error in posting the adjustments and closing entries to the

ledger accounts; thus, it is necessary to test the equality of the accounts by preparing a

new trial balance. This final trial balance is called a post-closing trial balance.

The post-closing trial balance verifies that all the debits equal the credits in the

trial balance.

The trial balance contains only balance sheet items such as assets, liabilities,

and ending capital because all income and expense accounts, as well as the

withdrawal account, have zero balances.

Auto Sun Repair Shop

Post-Closing Trial Balance

Dec. 31, 2016

Cash P182,250

Accounts Receivable 10,000

Supplies 500

Prepaid Rent 14,000

Prepaid Insurance 22,000

Vehicles 300,000

Accumulated Depreciation-Vehicles P 4,500

Equipment 54,000

Accumulated Depreciation-Equipment 1,000

Notes Payable 100,000

Subject: Topic: Session: Page | 5

Tanauan Institute, Inc. – Senior High School Department

Accounts Payable 1,000

Salaries Payable 1,600

Interest Payable 1,400

Unearned Revenues 11,250

Del Mundo, Capital 462,000

P582,750 P582,750

Notice that only the balance sheet accounts have balances because at this point, all the

income statement accounts have been closed.

Reversing Entries

Some entities choose to reverse certain end-of-period adjustments on the first day of

the new period. A reversing entry is a journal entry which is the exact opposite of a

related adjusting entry made at the end of the period. It is basically a bookkeeping

technique made to simplify the recording of regular transactions in the next accounting

period.

Note that reversing entries are optional. Also, the act of reversing a previously recorded

adjusting entry should not lead us to the conclusion that the entries reversed are

unnecessary or inaccurate.

Even when an entity follows the policy of making reversing entries, not all adjusting

entries should be reversed. Generally, a reversing entry should be made for any

adjusting entry that increased an asset or a liability account. Therefore, all accruals are

reversed but only deferrals initially recorded in income statement – income or expense –

accounts are reversed.

The adjustments that can be reversed are as follows: prepaid expenses (expense

method), unearned revenues (income method), accrued expenses and accrued

revenues.

Illustration: To show how reversing entries can be helpful, consider the adjusting entry

made in the records of Auto Sun Repair Shop to accrue salaries expense

Dr. Cr.

Dec. 31 Salaries Expense 1,600

Salaries Payable 1,600

When the employees are paid on the next regular payday, the entry would be:

Dr. Cr.

Jan. 10 Salaries Payable 1,600

Salaries Expense 2,400

Cash 4,000

Subject: Topic: Session: Page | 6

Tanauan Institute, Inc. – Senior High School Department

Note that when the payment is made, without a prior reversing entry, the accountant

must look into the records to find out how much of the P4,000 applies to the current

accounting period and how much was accrued at the beginning of the period.

A reversing entry is an accounting procedure that helps to solve this difficult problem.

As noted above, a reversing entry is exactly what its name implies. It is a reversal of the

adjusting entry made. For example, observe the following sequence of transactions and

their effects on the account – salaries expense.

1. Adjusting Entry

Dec. 31 Salaries Expense 1,600

Salaries Payable 1,600

2. Closing Entry

Dec. 31 Income Summary 5,600

Salaries Expense 5,600

3. Reversing Entry

Dec. 31 Salaries Payable 1,600

Salaries Expense 1,600

4. Payment Entry

Jan. 10 Salaries Expense 4,000

Cash 4,000

These transactions had the following effects on salaries expense:

a. Adjusted salaries expense to accrue P1,600 in the proper accounting period.

b. Closed the P5,600 in total salaries expense for November to income summary.

c. Established a credit balance of P1,600 on Jan. 1 in salaries expense equal to the

expense recognized through the adjusting entry on Dec. 31. The liability account

salaries payable was reduced to a zero balance.

d. Recorded the P4,000 payment of half-month’s salaries with ten workdays in the

usual manner. The reversing entry has the effect of leaving a balance of P2,400

(P4,000 – P1,600) in the salaries expense account. This P2,400 balance

represented the salaries expense for the six workdays in January.

Making the payment entry was simplified by the reversing entry. Reversing entries apply

to all accrued expenses or revenues.

Questions

Subject: Topic: Session: Page | 7

Tanauan Institute, Inc. – Senior High School Department

1. In what ways is the worksheet useful to accountants?

___________________________________________________________

___________________________________________________________

___________________________________________________________

2. After accomplishing the worksheet, the debit and credit columns of the trial

balance, adjustments, adjusted trial balance, income statement and

balance sheet are all in balance. Does it mean that the worksheet is free

from error? Prove your answer.

__________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

3. Why are closing entries made at end of the accounting period?

__________________________________________________________

___________________________________________________________

___________________________________________________________

4. Why income and expense accounts also called temporary accounts are

closed at the end of each accounting period?

___________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

5. What is a reversing entry? Enumerate the four adjustments that can be

reversed at the beginning of the next accounting period.

___________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

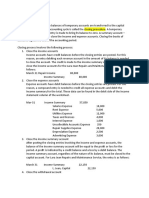

Activity

Worksheet Preparation: Get a piece of columnar pad and complete the

worksheet using the following data.

The May 31, 2016 trial balance of Rose Best Surveying Inc. is presented as follows:

Rose Best Surveying Inc.

Trial Balance

May 31, 2016

Cash P 210,000

Accounts Receivable 930,000

Subject: Topic: Session: Page | 8

Tanauan Institute, Inc. – Senior High School Department

Prepaid Advertising 360,000

Engineering Supplies 270,000

Survey Equipment 1,890,000

Accum. Depreciation – Survey Equip. P 640,000

Accounts Payable 190,000

Unearned Income 120,000

Notes Payable 500,000

Rose, Capital 1,120,000

Rose, Withdrawals 700,000

Service Income 6,510,000

Salaries Expense 3,270,000

Rent Expense 960,000

Insurance Expense 250,000

Utilities Expense 160,000

Miscellaneous Expense 80,000

Totals P 9,080,000 P 9,080,000

The following information pertaining to the year-end adjustments is available:

a. The P360,000 prepaid advertising represents expenditure made on Nov. 1, 2015

for monthly advertising over the next 18 months.

b. A count of the engineering supplies at May 31, 2016 amounted to P90,000.

c. Depreciation on the surveying equipment amounted to P160,000.

d. One-third of the unearned survey revenues has been earned at year-end.

e. At year-end, salaries in the amount of P140,000 have accrued.

f. Interest of P60,000 on the notes payable has accrued at year-end.

Quiz

Complete the accounting cycle for the “Rose Best Surveying Inc.” (the

data can be seen from the activity part after you finish the given activity)

by making closing entries, preparing a post-closing trial balance, and

making reversing entries for the accrued salary and interest expense.

Subject: Topic: Session: Page | 9

Tanauan Institute, Inc. – Senior High School Department

Reflection

As an accounting student what did realize in the lesson?

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

________________________________

References

Book:

Ballada, Win. 2017. Fundamentals of Accountancy Business & Management

1. Manila, Philippines. DomDane Publishers. pp. 197-200.

Subject: Topic: Session: Page | 10

You might also like

- MAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Document15 pagesMAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Nanananana100% (3)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Stock Inventory List - SampleDocument2 pagesStock Inventory List - SampleBaby Dolle JiaNo ratings yet

- Multiple Choice Questions of Economics: A. Manufacturing SectorDocument203 pagesMultiple Choice Questions of Economics: A. Manufacturing SectorMalik FaysalNo ratings yet

- Module 6 - Worksheet and Financial Statements Part IDocument12 pagesModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- 10 Column WorksheetDocument41 pages10 Column WorksheetRachel Jane TanNo ratings yet

- Barco Projection SystemsDocument15 pagesBarco Projection SystemsSathish Chandramouli100% (1)

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Worksheet PreparationDocument3 pagesWorksheet PreparationJon PangilinanNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Document7 pagesTanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Hanna CaraigNo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Chapter 4. Completing The Accounting CycleDocument3 pagesChapter 4. Completing The Accounting CycleÁlvaro Vacas González de EchávarriNo ratings yet

- CH 4 Work Sheet2Document54 pagesCH 4 Work Sheet2Yasin Arafat ShuvoNo ratings yet

- Principles of Accounting Chapter 6Document3 pagesPrinciples of Accounting Chapter 6“Mysticalfirecracker345”No ratings yet

- Week 1B - Fabm 1 - Completing The Accounting CycleDocument30 pagesWeek 1B - Fabm 1 - Completing The Accounting CycleSheila Marie Ann Magcalas-GaluraNo ratings yet

- Amodia (Accounting Notes - Worksheet)Document3 pagesAmodia (Accounting Notes - Worksheet)CLUVER AEDRIAN AMODIANo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- Acknowledgement: Aditi Vyas (Batch 2019-2024)Document13 pagesAcknowledgement: Aditi Vyas (Batch 2019-2024)Vipul SolankiNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- Basic Accounting With Basic Corporate Accounting (ACCT 101)Document24 pagesBasic Accounting With Basic Corporate Accounting (ACCT 101)Harvy TorreburgerNo ratings yet

- Accounting CycleDocument30 pagesAccounting CycleJenelle RamosNo ratings yet

- The Post of Trial Balance (Bing)Document5 pagesThe Post of Trial Balance (Bing)rezarenonnNo ratings yet

- FABM AJE and Adjusted Trial Balance Service BusinessDocument18 pagesFABM AJE and Adjusted Trial Balance Service BusinessMarchyrella Uoiea Olin Jovenir50% (4)

- Tle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2Document14 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2johnklientantiguaNo ratings yet

- ABM FABM1-Q4-Week-1Document26 pagesABM FABM1-Q4-Week-1Just OkayNo ratings yet

- Year End Closing GLDocument11 pagesYear End Closing GLErshad RajaNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- Step 5 WorksheetDocument8 pagesStep 5 WorksheetBarbie GammadNo ratings yet

- Module 6Document13 pagesModule 6kohi jellyNo ratings yet

- ACCT1002 U3-20150920Document15 pagesACCT1002 U3-20150920SaintNo ratings yet

- Comprehensive Problem Assignment - PDFDocument20 pagesComprehensive Problem Assignment - PDFJunior RobinsonNo ratings yet

- Cfas 3Document10 pagesCfas 3Bea charmillecapiliNo ratings yet

- Safeer AIDocument4 pagesSafeer AIKhuwaja sahabNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- Module 11 ICT 141Document3 pagesModule 11 ICT 141Janice SeterraNo ratings yet

- 2023 PF2 Chapter 1 - Payroll AccountingDocument77 pages2023 PF2 Chapter 1 - Payroll Accountingxiahq163No ratings yet

- Lesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsDocument18 pagesLesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsAra ArinqueNo ratings yet

- University of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Document8 pagesUniversity of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Annie RapanutNo ratings yet

- CH2 Principles of Acc P3Document16 pagesCH2 Principles of Acc P3saed cabdiNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Management PresentationDocument61 pagesManagement Presentationiffat.stu2018No ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- ACCT 1026 Lesson 7Document10 pagesACCT 1026 Lesson 7ChjxksjsgskNo ratings yet

- Adjustments: Steps For Recording Adjusting EntriesDocument2 pagesAdjustments: Steps For Recording Adjusting EntriesYahnsea AlfaroNo ratings yet

- Accounting Cycle: BusinessDocument6 pagesAccounting Cycle: BusinessRenu KulkarniNo ratings yet

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1bDocument12 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 1bSheila Marie Ann Magcalas-GaluraNo ratings yet

- Bazele Contabilitatii C4EDocument17 pagesBazele Contabilitatii C4EtamasraduNo ratings yet

- Term 2 Week 3Document42 pagesTerm 2 Week 3bhavik GuptaNo ratings yet

- POA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1Document69 pagesPOA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1muhammad atifNo ratings yet

- Chapter 3 Adjusting The AccountsDocument19 pagesChapter 3 Adjusting The AccountsKabeer Khan100% (1)

- Accounting Worksheet: What Is A Worksheet?Document7 pagesAccounting Worksheet: What Is A Worksheet?ScribdTranslationsNo ratings yet

- Lesson 21Document15 pagesLesson 21Rica Mae ParamNo ratings yet

- Module 5 Completion of The Accounting Process For ServiceDocument14 pagesModule 5 Completion of The Accounting Process For ServiceavimalditaNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument13 pagesPhilippine School of Business Administration: Cpa ReviewLoi GachoNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)ivang95No ratings yet

- Analysis of Trial Balance-: Solution 2Document3 pagesAnalysis of Trial Balance-: Solution 2BUNTY GUPTANo ratings yet

- Tanauan Institute, Inc.: Recording Net SalesDocument9 pagesTanauan Institute, Inc.: Recording Net SalesHanna Caraig0% (1)

- Tanauan Institute, Inc.: Recording Cost of Sales or Cost of Goods SoldDocument10 pagesTanauan Institute, Inc.: Recording Cost of Sales or Cost of Goods SoldHanna CaraigNo ratings yet

- Tanauan Institute, Inc.: PurchasesDocument9 pagesTanauan Institute, Inc.: PurchasesHanna CaraigNo ratings yet

- Lesson 6Document7 pagesLesson 6Hanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Document7 pagesTanauan Institute, Inc.: Completing The Cycle For A Merchandising Business Part 1Hanna CaraigNo ratings yet

- Lesson 2Document13 pagesLesson 2Hanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Adjustments For AccrualsDocument7 pagesTanauan Institute, Inc.: Adjustments For AccrualsHanna CaraigNo ratings yet

- Tanauan Institute, Inc.: Completing The Cycle For The Merchandising Business Part 2Document8 pagesTanauan Institute, Inc.: Completing The Cycle For The Merchandising Business Part 2Hanna Caraig0% (1)

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- Development of An Entry Mode StrategyDocument3 pagesDevelopment of An Entry Mode StrategyRukshi ArawwalaNo ratings yet

- Marketing Management - Unit 1Document12 pagesMarketing Management - Unit 1amritaNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- GE Matrix and 7S FrameworkDocument16 pagesGE Matrix and 7S FrameworkpayalNo ratings yet

- Investment Banking Prep Interview QuestionsDocument8 pagesInvestment Banking Prep Interview QuestionsNeil GriggNo ratings yet

- DrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyDocument1 pageDrinkCo Insight To Action: The Three Facets of An Effective Go-To-Market StrategyWilson Perumal & CompanyNo ratings yet

- MARKETING PHILOSOPHIES NewDocument17 pagesMARKETING PHILOSOPHIES Newkapila aroraa100% (5)

- Project Finance Sem 4Document366 pagesProject Finance Sem 4dharaNo ratings yet

- Chapter 8Document15 pagesChapter 8GOD100% (1)

- CB2500 Information Management ChecklistDocument4 pagesCB2500 Information Management Checklistsiu chun chanNo ratings yet

- Eurocash Business Strategy AnalysisDocument6 pagesEurocash Business Strategy AnalysiskshywyNo ratings yet

- 2562 TheoryDocument3 pages2562 Theorymaddy_i5No ratings yet

- Seminar AuditDocument7 pagesSeminar AuditMichael BusuiocNo ratings yet

- Conceptual Framework in AccountingDocument4 pagesConceptual Framework in AccountingKrizchan Deyb De LeonNo ratings yet

- BDocument2 pagesBManu KrishNo ratings yet

- Studying Different Systematic Value Investing Strategies On The Eurozone MarketDocument38 pagesStudying Different Systematic Value Investing Strategies On The Eurozone Marketcaque40No ratings yet

- UPSE Securities Limited v. NSE - CCI OrderDocument5 pagesUPSE Securities Limited v. NSE - CCI OrderBar & BenchNo ratings yet

- Marketing Mix - 4Ps of MarketingDocument5 pagesMarketing Mix - 4Ps of Marketingtom jonesNo ratings yet

- Comparison B/W Branded and Local JewellersDocument21 pagesComparison B/W Branded and Local JewellerscadalalNo ratings yet

- Customer Satisfaction Among EbuyersDocument63 pagesCustomer Satisfaction Among Ebuyerspersonalu65No ratings yet

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- Uniqlo (G5) - 1Document18 pagesUniqlo (G5) - 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Strategic Management Chapter 5-Business Level Strategy: Study Online atDocument2 pagesStrategic Management Chapter 5-Business Level Strategy: Study Online atSodium LightNo ratings yet

- 04 ABC and Coffee Services ACC9811 2021 One Slide Per PageDocument19 pages04 ABC and Coffee Services ACC9811 2021 One Slide Per PageDANNo ratings yet

- Business Plan TemplateDocument14 pagesBusiness Plan TemplateMei HuaNo ratings yet

- Trust FormatDocument40 pagesTrust FormatVictor Jeremiah100% (2)