Professional Documents

Culture Documents

Foi12 Ch04 Solutions

Foi12 Ch04 Solutions

Uploaded by

Onin HasanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foi12 Ch04 Solutions

Foi12 Ch04 Solutions

Uploaded by

Onin HasanCopyright:

Available Formats

Solutions to Problems

1. The investor would earn income of $2.25 and a capital gain of $52.50 – $45 =$7.50. The total gain is

$9.75 or 21.7%. $8.25 on a stock that paid $3.75 in income and sold for $67.50. Part of the total

dollar return includes a $4.50 capital gain, which is the difference between the proceeds of the sale

and the original purchase price ($67.50 – $63.00) of the stock.

3. a. Income: $ 2.70

b. Capital gain: $60.00 – $50.00 $10.00

c. Total return:

(1) In dollars: $2.70 $10.00 $12.70

(2) As a percentage of the initial investment: $12.70 0.25 or 25%.

$50.00

5. a. Total return Income Capital gains (or losses) where:

Capital gains (or losses) Ending price – Beginning price

(1) (2) (3) (4) (5)

(1) – (2) (3) (4)

Ending Beginning Capital Current Total

Year Price – Price Gain Income Return

2010 $32.50 $30.00 $2.50 $1.00 $3.50

2011 35.00 32.50 2.50 1.20 3.70

2012 33.00 35.00 –2.00 1.30 –0.70

20130 40.00 33.00 7.00 1.60 8.60

20141 45.00 40.00 5.00 1.75 6.75

b. Of course, there is no correct answer here, but one might forecast using the arithmetic average or

the average one-year holding period return.

$3.50 $3.70 $.70 $8.60 $6.75

i. The arithmetic average: $4.37

5

ii. The average holding period return (HPR):

Ending price Beginning price Current income Total return

HPR

Beginning price Beginning price

(1) (2) (3)

Total Beginning (1) (2)

Year Return* Price HPR

2010 $3.50 $30.00 11.7%

2011 3.70 32.50 11.4

2012 –0.70 35.00 –2.0

2013 8.60 33.00 26.1

2014 6.75 40.00 16.9

*From part a.

Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 4

11.7 11.4 2.0 26.1 16.9

Average HPR 12.8%

5

i. ii.

Based on Based on

Forecasts for: Arithmetic Average Average HPR

2015 $4.37 ($45.00)* 0.128 $5.76

2016 $4.37 ($49.00)** 0.128 $6.27

End of 2010 price gain in original data

For lack of information, we are assuming the 2011 return is $4.00 from capital

gains and $1.76 from income.

c. Students should be made aware of the fact that many other forecasts are possible. Other factors

may be relevant here: Will the pattern of two good years followed by a bad one continue? Do

future prospects seem bright? (We will discuss forecasting returns on specific investments in

later chapters.)

7. a. Using the notation given in the chapter, the risk-free rate of return is:

Rf = r* + IP or 2% +3%

b. The required returns for each investment are calculated as follows:

r1 r * r * IP RPi or RF RPi

rA 2% 3% % 5% 4%

9%

rB 2% 3% 6% 5% 6%

11%

Current income Ending price Beginning price

9. Holding period return (HPR)

Beginning price

$1.00 $1.20 $0 $2.30 $29.00 $30.00 $3.50

HPR X

$30.00 $30.00

11.67%

$0 $0 $0 $2.00 $56.00 $50.00 $8.00

HPR Y

50.00 $50.00

16%

If the investments are held beyond a year, the capital gain (or loss) component would not be realized

and would likely change. Assuming they are of equal risk, Investment Y would be preferred since it

offers the higher return (16.00% for Y versus 11.67% for X).

11. HPR ($50 ($1,000 $950))/$950 $100/$950 10.5%.

13. Using a present value interest factor of 4%:

Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 4

$65 0.962 $62.53

$70 0.925 $64.75

$70 0.889 $62.23

$7,965 0.855 $6,810.08

$6,999.59

15.

Initial Future Calculator

Investment Investment Value Years Solution

A $1,000 $1,200 5 3.71%

B 10,000 20,000 7 10.41

C 400 2,000 20 8.38

D 3,000 4,000 6 4.91

E 5,500 25,000 30 5.18

17. The yield for these investments is the discount rate that results in the stream of income equaling the

initial investment.

The yield or internal rate of return for Investment A can easily be found with any financial calculator:

N=5, PV=-8500, PMT=2500, FV =0, i=14.40%

Most financial calculators can also solve for the internal rate of return of irregular cash flows, but the

routines vary widely from device to another. The yields or internal rates of return for either A or B

can be found quickly using Excel’s internal rate of return formula =irr(range of cells containing cash

flows). Be sure to include the initial investment as a negative cash flow.

End of Year Investment A Investment B

0 (8,500.00) (9,500.00)

1 2,500.00 2,000.00

2 2,500.00 2,500.00

3 2,500.00 3,000.00

4 2,500.00 3,500.00

5 2,500.00 4,000.00

IRR 14.40% 15.36%

Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 4

19. Again this problem is most easily solved using Excel’s internal rate of return formula =irr(range of

cash flows). The yield on this investment falls just short of the required 11%, and the NPV when

discounted at 11% (=npv(.11,range of positive cash flows)-1000) is slightly negative, so the

investment probably should not be accepted.

End of Year Income Stream

$ (1,000)

2014 140

2015 120

2016 100

2017 80

2018 60

2019 40

2020 1,220

IRR/Yield 10.87%

NPV @ 11% –604.56%

21. 2013 – 2006 7 years

Using a financial calculator,

N=7, PV=-1.00, PMT=0,

FV=2.21, i=12.00% ans

Excel =rate(7,0,1.00,2.21)

23. a. Investment A, with returns that vary widely—from 1% to 26%—appears to be more risky than

Investment B, whose returns vary from 8% to 16%.

n

b. s (r r )2

i 1

Standard deviation

CV

Average return

Investment A:

(1) (2) (3) (4)

Return Average (1) – (2) (3)2

Year rI Return, r ri – r (ri – r)2

2006 19% 12% 7% 49%

2007 1 12 –11 121

2008 10 12 –2 4

2009 26 12 14 196

2010 4 12 –8 64

434

Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 4

434

SA 108.5 10.42%

10.42%

CV .87

12.00%

Investment B:

(1) (2) (3) (4)

Year Return Average (1) – (2) (3)2

ri Return, r ri – r (ri – r)2

2006 8% 12% –4% 16%

2007 10 12 –2 4

2008 12 12 0 0

2009 14 12 2 4

2010 16 12 4 16

40

40

SA 10 3.16%

3.16%

CV .26

12.00%

c. Investment A, with a standard deviation of 10.42, is considerably more risky than Investment B,

whose standard deviation is 3.16. This confirms the conclusions reached in Part A.

Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 4

You might also like

- Unit 6 Written Assignment BUS 5110Document5 pagesUnit 6 Written Assignment BUS 5110luiza100% (6)

- Centennial Pharmaceutical Corporation (SPREADSHEET) F-1446XDocument14 pagesCentennial Pharmaceutical Corporation (SPREADSHEET) F-1446XPaco ColínNo ratings yet

- Taewoo Kim Et Al. v. Jump TradingDocument44 pagesTaewoo Kim Et Al. v. Jump TradingCrains Chicago Business100% (1)

- Chapter 7 SolutionsDocument9 pagesChapter 7 SolutionsMuhammad Naeem100% (3)

- PeachTree Securities (B-2) FINALDocument45 pagesPeachTree Securities (B-2) FINALish june100% (1)

- Answer 1Document9 pagesAnswer 1Romeo BullequieNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Stock Valuation TempDocument5 pagesStock Valuation TempANH Nguyen TrucNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- COMM 324 A4 SolutionsDocument6 pagesCOMM 324 A4 SolutionsdorianNo ratings yet

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Document4 pagesSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Ahmed El KhateebNo ratings yet

- TVPI, DPI, RVPI - Venture Capital ValuationsDocument21 pagesTVPI, DPI, RVPI - Venture Capital Valuationsharshit.dwivedi320No ratings yet

- Real Estate Excel Functions TutorialDocument14 pagesReal Estate Excel Functions Tutorialajohnson79100% (2)

- 8Document1 page8Magsaysay SouthNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Ch24sol PDFDocument5 pagesCh24sol PDFSandeep MishraNo ratings yet

- Tugas Financial ManagementDocument6 pagesTugas Financial ManagementHananAhmedNo ratings yet

- SDFFDocument10 pagesSDFFNidhi AshokNo ratings yet

- Assignment 5 - Jaime LievanoDocument10 pagesAssignment 5 - Jaime LievanoJaime LievanoNo ratings yet

- Bus 5110 Managerial Acccounting Written Assignment Unit 6Document6 pagesBus 5110 Managerial Acccounting Written Assignment Unit 6rumbidzai chemhereNo ratings yet

- Wealth MGMT - FA ADocument19 pagesWealth MGMT - FA Achinmay manjrekarNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Value Investing ExperimentDocument14 pagesValue Investing ExperimentimbetbmNo ratings yet

- LN01 Smart3075419 13 FI C04 EditedDocument50 pagesLN01 Smart3075419 13 FI C04 EditedAndreas KarathanasopoulosNo ratings yet

- S16 - Scenario Manager - NPV - ClassDocument11 pagesS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHNo ratings yet

- Managerial Accounting Jiambalvo 5th Edition Solutions ManualDocument23 pagesManagerial Accounting Jiambalvo 5th Edition Solutions ManualTammyTylercwjd100% (49)

- FM - Kelompok 4 - 79D - Assignment CH9, CH10Document8 pagesFM - Kelompok 4 - 79D - Assignment CH9, CH10Shavia KusumaNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Introduction To Corporate Finance 4th Edition Booth Solutions ManualDocument28 pagesIntroduction To Corporate Finance 4th Edition Booth Solutions Manualquandiendjv100% (30)

- Macabacus Fundamentals Demo - BlankDocument16 pagesMacabacus Fundamentals Demo - BlankSaleh Raouf100% (1)

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket careNo ratings yet

- Dharmin - Shah - Final - Exam - Section - 71Document11 pagesDharmin - Shah - Final - Exam - Section - 71hani.sharma324No ratings yet

- Test Bank For Business Statistics 3rd Canadian Edition Norean R Sharpe Norean D Sharpe Richard D de Veaux Paul F Velleman David WrightDocument15 pagesTest Bank For Business Statistics 3rd Canadian Edition Norean R Sharpe Norean D Sharpe Richard D de Veaux Paul F Velleman David Wrightdanielsantiagojnwdmbagzr100% (43)

- Total TemplateDocument35 pagesTotal TemplateQuinn CoughlinNo ratings yet

- Chapter 14 SolutionsDocument11 pagesChapter 14 Solutionssalsabilla rpNo ratings yet

- CH 7Document23 pagesCH 7Mohamed MustefaNo ratings yet

- Ebook Business Statistics Canadian 3Rd Edition Sharpe Test Bank Full Chapter PDFDocument31 pagesEbook Business Statistics Canadian 3Rd Edition Sharpe Test Bank Full Chapter PDFhuyenquyen9eemjd100% (14)

- Business Statistics Canadian 3rd Edition Sharpe Test BankDocument16 pagesBusiness Statistics Canadian 3rd Edition Sharpe Test Bankjohnburnettgpbtfdynmi100% (31)

- Suggested End of Chapter Problems and QuestionsDocument4 pagesSuggested End of Chapter Problems and QuestionsThe oneNo ratings yet

- Forcasting Income Statement - Financing FeedbackDocument7 pagesForcasting Income Statement - Financing Feedbackabdulsammad13690No ratings yet

- Solutions To Problems: Coupon Interest Market Price Current YieldDocument4 pagesSolutions To Problems: Coupon Interest Market Price Current YieldAhmed El KhateebNo ratings yet

- Problems With Solutions (BF)Document6 pagesProblems With Solutions (BF)Saadat KhokharNo ratings yet

- FCF Ch10 Excel Master StudentDocument32 pagesFCF Ch10 Excel Master StudentTosa EndrawanNo ratings yet

- LORL Write UpDocument5 pagesLORL Write UpAIGswap100% (1)

- NPV of A Borders - APDocument1 pageNPV of A Borders - APpillai21No ratings yet

- Connection Between Dividends and Stock Values, Equity MarketsDocument57 pagesConnection Between Dividends and Stock Values, Equity MarketsPramod Vasudev0% (1)

- Managerial Economics - Practice 2Document9 pagesManagerial Economics - Practice 2nhidiepnguyet08112004No ratings yet

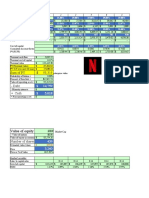

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- Quant Studies Chapter 7Document14 pagesQuant Studies Chapter 7latrattoriamoliseNo ratings yet

- Stock Valuation (Version 1)Document32 pagesStock Valuation (Version 1)محمد حمزه زاہد100% (1)

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- Group2 - Assignment 1Document9 pagesGroup2 - Assignment 1RiturajPaulNo ratings yet

- MacabacusEssentialsDemoComplete 210413 104622Document21 pagesMacabacusEssentialsDemoComplete 210413 104622Pratik PatwaNo ratings yet

- Appendix B. Capital Budgeting TemplateDocument7 pagesAppendix B. Capital Budgeting TemplateAbel AliNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- UMGC Finance HW #4Document9 pagesUMGC Finance HW #4Kimora BrockNo ratings yet

- All Dollar Values in Millions: Operating InformationDocument14 pagesAll Dollar Values in Millions: Operating InformationShubham SharmaNo ratings yet

- Manual Benninga Finacial Modeling PDFDocument82 pagesManual Benninga Finacial Modeling PDFomar100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- 3.1 Methods of Research UsedDocument3 pages3.1 Methods of Research UsedOnin HasanNo ratings yet

- Date Beximco Adjusted Closing PriceDocument31 pagesDate Beximco Adjusted Closing PriceOnin HasanNo ratings yet

- BUS 485 ResearchDocument28 pagesBUS 485 ResearchOnin HasanNo ratings yet

- Submitted By: Valuation, Diversification and Portfolio ConstructionDocument17 pagesSubmitted By: Valuation, Diversification and Portfolio ConstructionOnin HasanNo ratings yet

- Individual Assignment: Name: Md. Rakib Mallick ID: 1921448 Course ID: MGT380Document12 pagesIndividual Assignment: Name: Md. Rakib Mallick ID: 1921448 Course ID: MGT380Onin HasanNo ratings yet

- The Determinants of Working Capital Requirements of Chemical Industry of BangladeshDocument39 pagesThe Determinants of Working Capital Requirements of Chemical Industry of BangladeshOnin HasanNo ratings yet

- BizMaestros 2021 Round 1 CaseDocument12 pagesBizMaestros 2021 Round 1 CaseOnin HasanNo ratings yet

- MD Onin Hasan - ECN202Document12 pagesMD Onin Hasan - ECN202Onin HasanNo ratings yet

- The Similarities and Differences Between Bangladesh and VietnamDocument8 pagesThe Similarities and Differences Between Bangladesh and VietnamOnin HasanNo ratings yet

- (V1.6 Guide) A Thousand Question With PaimonDocument30 pages(V1.6 Guide) A Thousand Question With PaimonOnin HasanNo ratings yet

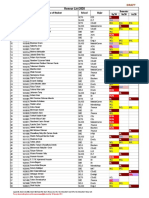

- Honour List 2020: Sp'20 Su'20 Au'20 Semester Major School Name of Student Sl. ID#Document36 pagesHonour List 2020: Sp'20 Su'20 Au'20 Semester Major School Name of Student Sl. ID#Onin HasanNo ratings yet

- Activity Income TaxationDocument2 pagesActivity Income TaxationAngie MejaritoNo ratings yet

- Forex MarketDocument33 pagesForex Marketaniket7gNo ratings yet

- CALCULATE Shopping With Interest 3.2 Under 6 WORD DocumentDocument4 pagesCALCULATE Shopping With Interest 3.2 Under 6 WORD Documentawsomepant2327No ratings yet

- Tigo Pesa Ni Zaidi Ya Pesa!: Account StatementDocument5 pagesTigo Pesa Ni Zaidi Ya Pesa!: Account StatementIreneNo ratings yet

- LBS Sample 2 Financial Plan D1Document23 pagesLBS Sample 2 Financial Plan D1LINKED BUSINESS SERVICES LTDNo ratings yet

- TT Norms Pro Specimen 1Document28 pagesTT Norms Pro Specimen 1AmanNo ratings yet

- Flexible Exchange-Rate SystemDocument19 pagesFlexible Exchange-Rate SystemRaj SinghNo ratings yet

- Equity Research and Valuation B Kemp Dolliver-0935015213Document69 pagesEquity Research and Valuation B Kemp Dolliver-0935015213rockkey76No ratings yet

- VC Case Study SaaS Valuation MultiplesDocument17 pagesVC Case Study SaaS Valuation MultiplesJohn SmithNo ratings yet

- Reading 6: The Time Value of MoneyDocument31 pagesReading 6: The Time Value of MoneyAndy Thibault-MilksNo ratings yet

- Bir Ruling Da 427 06Document5 pagesBir Ruling Da 427 06JM Dela PazNo ratings yet

- Business Risk & Financial RiskDocument33 pagesBusiness Risk & Financial RiskdianaNo ratings yet

- Investment Procss of Unicon (Tufail)Document55 pagesInvestment Procss of Unicon (Tufail)Tufail KhanNo ratings yet

- Housing Loan - Mega BankDocument7 pagesHousing Loan - Mega Banksshres4No ratings yet

- Credit Report PDFDocument13 pagesCredit Report PDFMinalNo ratings yet

- Inv617 - Jba2514b - Sovereign Bond Spreads - Nurul Ain Nabila BT Mohd SabriDocument4 pagesInv617 - Jba2514b - Sovereign Bond Spreads - Nurul Ain Nabila BT Mohd SabriAin Nabila000No ratings yet

- ACCT 210-Fall 21-22-Revision Sheet - FinalDocument3 pagesACCT 210-Fall 21-22-Revision Sheet - FinalAndrew PhilipsNo ratings yet

- Kotak Multicap Fund-SIDDocument122 pagesKotak Multicap Fund-SIDsenthilkumarNo ratings yet

- FabmDocument68 pagesFabmAllyzza Jayne Abelido100% (1)

- Assignment #4 (Sep2019) - GDB3023-SolutionDocument3 pagesAssignment #4 (Sep2019) - GDB3023-SolutionDanish Zabidi100% (1)

- Acc 2021 GR 10 T 1 Week 5 DJ Daj Eng v2Document7 pagesAcc 2021 GR 10 T 1 Week 5 DJ Daj Eng v2Linda Dladla100% (1)

- Finch 11713Document166 pagesFinch 11713Ali ReynoldsNo ratings yet

- Indian Capital MarketDocument11 pagesIndian Capital MarketManan KhandelwalNo ratings yet

- Orden de Venta - 372 - 20181123 - 123904Document2 pagesOrden de Venta - 372 - 20181123 - 123904l2oNnYNo ratings yet

- Distribution To ShareholdersDocument47 pagesDistribution To Shareholderszyra liam stylesNo ratings yet

- New Central Bank Act ReviewerDocument10 pagesNew Central Bank Act ReviewernoorlawNo ratings yet

- Wa0020.Document12 pagesWa0020.revathirajakrishnanNo ratings yet

- Interest Formulas: Single PaymentsDocument38 pagesInterest Formulas: Single PaymentsMark DimaunahanNo ratings yet