Professional Documents

Culture Documents

I. Introduction To Accounting For Grants and Contracts: A. Overview

I. Introduction To Accounting For Grants and Contracts: A. Overview

Uploaded by

MATIULLAHCopyright:

Available Formats

You might also like

- Ppa LetterDocument1 pagePpa LetterDestiny TobiNo ratings yet

- Let Export Copy: Indian Customs Edi SystemDocument10 pagesLet Export Copy: Indian Customs Edi Systemsaikatpaul22No ratings yet

- VCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Document4 pagesVCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Ruchira ParwandaNo ratings yet

- Department of Agriculture Republic of The Philippines: Da-Cso Application FormDocument7 pagesDepartment of Agriculture Republic of The Philippines: Da-Cso Application FormVerna BeNo ratings yet

- Introduction To Project Finance - A Guide For Contractors and EngineersDocument9 pagesIntroduction To Project Finance - A Guide For Contractors and Engineershazemdiab100% (1)

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONmacroniess khanNo ratings yet

- 13-SOP For Safe Operation Limestone CrusherDocument2 pages13-SOP For Safe Operation Limestone Crushergothic centuary60% (5)

- Aef 2013 Audit Acc ReqDocument9 pagesAef 2013 Audit Acc Reqvikas_ojha54706No ratings yet

- ToR 516Document4 pagesToR 516Rumki SarkarNo ratings yet

- RFP DocumentsDocument10 pagesRFP DocumentsYasir FahadNo ratings yet

- Smart Task 3Document5 pagesSmart Task 3Utkarsh ChaturvediNo ratings yet

- Funding Programme - Long-Term ProjectDocument3 pagesFunding Programme - Long-Term ProjectmarkzwikNo ratings yet

- Master Agreement For Services 4Document11 pagesMaster Agreement For Services 4Tamer SayedNo ratings yet

- Capital Project FundDocument7 pagesCapital Project FundmeseleNo ratings yet

- III. Compensation and Effort Reporting For Grants & ContractsDocument7 pagesIII. Compensation and Effort Reporting For Grants & ContractsMATIULLAHNo ratings yet

- Chapter Four-Part Ii: Accounting For Governmental FundsDocument30 pagesChapter Four-Part Ii: Accounting For Governmental FundsabateNo ratings yet

- 24C00087 - Bid Documents - FMP Sitio Brown Phase IDocument58 pages24C00087 - Bid Documents - FMP Sitio Brown Phase ISamNo ratings yet

- Process of Project Financing: Feasibility StudyDocument23 pagesProcess of Project Financing: Feasibility StudyRohit PadalkarNo ratings yet

- PFDocument16 pagesPFadabotor7No ratings yet

- Chapter Four CPFDocument28 pagesChapter Four CPFtame kibruNo ratings yet

- BID DOCS LEDBillboardDocument30 pagesBID DOCS LEDBillboardNanz11 SerranoNo ratings yet

- PCOA Module 6 - PAS 23 and 24Document8 pagesPCOA Module 6 - PAS 23 and 24Jan JanNo ratings yet

- Report On Funds RaisingDocument28 pagesReport On Funds RaisingNikita MajiNo ratings yet

- Module 2: Financing of ProjectsDocument24 pagesModule 2: Financing of Projectsmy VinayNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Bidding DocumentsDocument62 pagesBidding DocumentskriforbizNo ratings yet

- Bidding-Document-PR No. 2021-10-276Document43 pagesBidding-Document-PR No. 2021-10-276Daniel TuazonNo ratings yet

- Itb Design and Build Six-Storey With Roof Deck Mez Administration Office BuildingDocument89 pagesItb Design and Build Six-Storey With Roof Deck Mez Administration Office BuildingKarl MoralejoNo ratings yet

- Module 3 - Borrowing CostsDocument3 pagesModule 3 - Borrowing CostsLui100% (1)

- Invitation To BidDocument92 pagesInvitation To BidAnita QueNo ratings yet

- Project Finance Documents: Fretutorial Free TutorialDocument7 pagesProject Finance Documents: Fretutorial Free TutorialColin TanNo ratings yet

- Completion of Ten Storey Higher Education Building in Batangas State University Pablo BorbonDocument184 pagesCompletion of Ten Storey Higher Education Building in Batangas State University Pablo BorbonraezenbukalNo ratings yet

- Guidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiDocument6 pagesGuidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiAnush VedhNo ratings yet

- PC 22 - Practice Set 7Document16 pagesPC 22 - Practice Set 7Shadab RashidNo ratings yet

- Bac 20210923001Document189 pagesBac 20210923001Jeremy YabutNo ratings yet

- Projects Analysis and Implementation Assignment-Ii: Group No: 4Document13 pagesProjects Analysis and Implementation Assignment-Ii: Group No: 4Bindu_Shree_4565No ratings yet

- AF210: Financial Accounting: School of Accounting and FinanceDocument11 pagesAF210: Financial Accounting: School of Accounting and FinanceShikhaNo ratings yet

- BIDDING DOCUMENTS 1.5M BaliwananDocument41 pagesBIDDING DOCUMENTS 1.5M BaliwananRubie Anne SaducosNo ratings yet

- PBD - Blinds and CurtainsDocument46 pagesPBD - Blinds and CurtainsM C Dela CrzNo ratings yet

- Bid Docs PB-I-2023-09-009 Construction of Multi-Purpose Building, Carmen Integrated School - TakerDocument37 pagesBid Docs PB-I-2023-09-009 Construction of Multi-Purpose Building, Carmen Integrated School - TakerJustin YuabNo ratings yet

- Bac 20211020001Document181 pagesBac 20211020001Cherry DuldulaoNo ratings yet

- Delay and Disruption Claims March 2014 PDFDocument31 pagesDelay and Disruption Claims March 2014 PDFNuruddin CuevaNo ratings yet

- Procurement Guide: CHP Financing: 1. OverviewDocument9 pagesProcurement Guide: CHP Financing: 1. OverviewCarlos LinaresNo ratings yet

- PBDs - SECURITY SERVICES FOR MEZ and SEZsDocument44 pagesPBDs - SECURITY SERVICES FOR MEZ and SEZsPatrickNo ratings yet

- Bid Docs - 24HG0092Document70 pagesBid Docs - 24HG0092SamNo ratings yet

- 0060 2021 Dayao, Burias Infrastructure Project 07.19 09.16 09.28 9AMDocument35 pages0060 2021 Dayao, Burias Infrastructure Project 07.19 09.16 09.28 9AMJecyl GuelosNo ratings yet

- Itb Proposed Design and Build of Mez Administration Office BuildingDocument38 pagesItb Proposed Design and Build of Mez Administration Office BuildingMarjan CañaNo ratings yet

- Bid Docs-StpDocument57 pagesBid Docs-StpkhuNo ratings yet

- Chapter 2 Summary Financial Statement AnalysisDocument5 pagesChapter 2 Summary Financial Statement AnalysisAzlanNo ratings yet

- Procurement of Projects: InfrastructureDocument47 pagesProcurement of Projects: InfrastructureNicole RodilNo ratings yet

- PBD PR 21-07-0323 Re BidDocument72 pagesPBD PR 21-07-0323 Re BidAayan’s VlogNo ratings yet

- Chapter 5 CPFDocument15 pagesChapter 5 CPFSara NegashNo ratings yet

- Class 6 Notes 04072022Document4 pagesClass 6 Notes 04072022Munyangoga BonaventureNo ratings yet

- Bidding Docs - 24KM0059Document36 pagesBidding Docs - 24KM0059Tine HernaneNo ratings yet

- PFI ManualDocument46 pagesPFI ManualMaggie HartonoNo ratings yet

- BIDDING DOCUMENTS 1M, HatcherymDocument41 pagesBIDDING DOCUMENTS 1M, HatcherymRubie Anne SaducosNo ratings yet

- Accounting For Public Sector Chap 5Document38 pagesAccounting For Public Sector Chap 5fekadegebretsadik478729No ratings yet

- PBD Infrastructure+Projects Office+Fit-Out GLO+110621 PDFDocument67 pagesPBD Infrastructure+Projects Office+Fit-Out GLO+110621 PDFVanessa de VeraNo ratings yet

- Tugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Document3 pagesTugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Fahmi IzzuddinNo ratings yet

- VCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicDocument4 pagesVCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicYaShNo ratings yet

- Bid Docs Multipurpose BC Ez 102021Document154 pagesBid Docs Multipurpose BC Ez 102021Justin YuabNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- 320 Accountancy Eng Lesson5Document23 pages320 Accountancy Eng Lesson5MATIULLAHNo ratings yet

- Accounting Conventions and Standards: Module - 1Document12 pagesAccounting Conventions and Standards: Module - 1MATIULLAHNo ratings yet

- Accounting For Business Transactions: Module - 1Document30 pagesAccounting For Business Transactions: Module - 1MATIULLAHNo ratings yet

- E-Ticket Receipt & Itinerary: 2021 Emirates. All Rights ReservedDocument2 pagesE-Ticket Receipt & Itinerary: 2021 Emirates. All Rights ReservedMATIULLAHNo ratings yet

- Reference Letter For Immigration 01Document1 pageReference Letter For Immigration 01MATIULLAHNo ratings yet

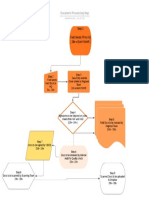

- Document Processing Map: Step 1 Field Sends FR To HQ (28 Each Month)Document1 pageDocument Processing Map: Step 1 Field Sends FR To HQ (28 Each Month)MATIULLAHNo ratings yet

- WAW Audit Findings 113394 & 109111Document2 pagesWAW Audit Findings 113394 & 109111MATIULLAHNo ratings yet

- 2007 Sida-UNDP Evaluation Revised Final Report - 9 August 07Document79 pages2007 Sida-UNDP Evaluation Revised Final Report - 9 August 07MATIULLAHNo ratings yet

- GIZ-Afghanistan: A. Position Applied ForDocument3 pagesGIZ-Afghanistan: A. Position Applied ForMATIULLAHNo ratings yet

- Detailed Project Proposal For: Earnesta Child and Youth Development ProjectDocument11 pagesDetailed Project Proposal For: Earnesta Child and Youth Development ProjectMATIULLAHNo ratings yet

- Asylum Declaration Writing Guide: WWW - Uscis.govDocument14 pagesAsylum Declaration Writing Guide: WWW - Uscis.govMATIULLAHNo ratings yet

- Changes To Non - Exempt Payslips and Check StubsDocument14 pagesChanges To Non - Exempt Payslips and Check StubsMATIULLAHNo ratings yet

- V - Audits and Compliance - FINAL - SEBDocument9 pagesV - Audits and Compliance - FINAL - SEBMATIULLAHNo ratings yet

- Unaccompanied Asylum Seeking Children Statement of Evidence (SEF)Document43 pagesUnaccompanied Asylum Seeking Children Statement of Evidence (SEF)MATIULLAHNo ratings yet

- Itemized Budget - WAW 972 002 SOMDocument4 pagesItemized Budget - WAW 972 002 SOMMATIULLAHNo ratings yet

- Template Letter To MP-1Document1 pageTemplate Letter To MP-1MATIULLAHNo ratings yet

- SIV Bio DataDocument1 pageSIV Bio DataMATIULLAHNo ratings yet

- IRAP SIV Report 2020Document43 pagesIRAP SIV Report 2020MATIULLAHNo ratings yet

- Request For Quotation The Procurement of Goods or Non-Consulting ServicesDocument42 pagesRequest For Quotation The Procurement of Goods or Non-Consulting Serviceslathasin somxaiyNo ratings yet

- WIN 12-Digit NRIC Number Without Spacing 66628 WIN Passport Number Without Spacing 66628Document9 pagesWIN 12-Digit NRIC Number Without Spacing 66628 WIN Passport Number Without Spacing 66628nitekillerNo ratings yet

- Brown and Green Scrapbook Meditation Healthcare Medical PresentationDocument9 pagesBrown and Green Scrapbook Meditation Healthcare Medical PresentationSiti UmairahNo ratings yet

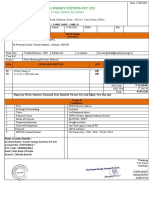

- Ensun-Sundrop PI 17.08.2022Document1 pageEnsun-Sundrop PI 17.08.2022prabhakaranNo ratings yet

- Contract of LeaseDocument1 pageContract of LeaseJules Clyde Fernandez IsaacNo ratings yet

- Bayview Beach Resort PenangDocument2 pagesBayview Beach Resort PenangVeraNo ratings yet

- Lion Air Eticket (JHWEKY) - ShabriDocument2 pagesLion Air Eticket (JHWEKY) - ShabriAmrullah SattarNo ratings yet

- AlyssaDocument3 pagesAlyssaJonathan Val Fernandez PagdilaoNo ratings yet

- Package: Bridges No 2 - 9 Sivok Rangpo New BG Rail Line Project Tender DocumentsDocument6 pagesPackage: Bridges No 2 - 9 Sivok Rangpo New BG Rail Line Project Tender DocumentsKawrw DgedeaNo ratings yet

- PPE - FinalDocument71 pagesPPE - FinalKristen KooNo ratings yet

- Flipkart Labels 01 Apr 2024 09 52Document1 pageFlipkart Labels 01 Apr 2024 09 524frontenterprises.2023No ratings yet

- Jharkhand Ajay InstructorDocument3 pagesJharkhand Ajay InstructorAjay ChauhanNo ratings yet

- MSME CertificateDocument1 pageMSME Certificatearunjoshi12345No ratings yet

- Project Information and Evaluation FormDocument3 pagesProject Information and Evaluation FormRichard LabroNo ratings yet

- Attendance Sheet For Dialysis UnitDocument4 pagesAttendance Sheet For Dialysis UnitgoshidanieltasleemNo ratings yet

- Dwnload Full Accounting Information Systems 10th Edition Gelinas Solutions Manual PDFDocument35 pagesDwnload Full Accounting Information Systems 10th Edition Gelinas Solutions Manual PDFwaymarkbirdlimengh1j100% (17)

- Cockatoo Island SubmissionDocument30 pagesCockatoo Island SubmissionThe Sydney Morning Herald100% (1)

- Bourns v. Carman, 7 Phils. 117 - 1906Document3 pagesBourns v. Carman, 7 Phils. 117 - 1906josephinelogronoNo ratings yet

- Commu BBI LUPONDocument3 pagesCommu BBI LUPONDenielle DelosoNo ratings yet

- Accounting Standard ResumeDocument7 pagesAccounting Standard ResumeIvana YustitiaNo ratings yet

- 27A1100001972546Document2 pages27A1100001972546Meet Communication ServicesNo ratings yet

- Revised Corporation Code 11.16.19Document118 pagesRevised Corporation Code 11.16.19Ed Apalla100% (1)

- LTC Form - DarDocument2 pagesLTC Form - DarFred BagbagenNo ratings yet

- Spa Bir UpdatingDocument1 pageSpa Bir Updatingannette leonardoNo ratings yet

- Argentina: Cash and Treasury ManagementDocument45 pagesArgentina: Cash and Treasury Managementshahid2opuNo ratings yet

I. Introduction To Accounting For Grants and Contracts: A. Overview

I. Introduction To Accounting For Grants and Contracts: A. Overview

Uploaded by

MATIULLAHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I. Introduction To Accounting For Grants and Contracts: A. Overview

I. Introduction To Accounting For Grants and Contracts: A. Overview

Uploaded by

MATIULLAHCopyright:

Available Formats

I.

Introduction to Accounting for Grants and Contracts

A. Overview

Sponsored Programs Accounting (SPA), a unit within the Controller’s Office,

is responsible for the fiscal administration of externally funded projects

including grants, contracts, and cooperative agreements.

Objectives:

In this chapter you will learn about:

• the role of SPA in grant/contract administration

• how project numbers for grants and contracts are set up in the general

ledger

• federal circulars A-21, A-110 and A-133

• facilities and administrative costs

• effort reporting

• who is responsible for monitoring expenses on grants and contracts

• how SPA bills a sponsor for expenses

• what cost share accounts are and how they are funded

• faculty summer contracts on sponsored projects

• how deficit account balances are resolved

B. The Role of SPA

1. Fiscal administration of grants and contracts includes: 1) establishing new

project accounts on the general ledger; 2) setting up and monitoring

budgets; 3) reviewing payment requests for subcontractors; 4) resolving

deficit account balances when they occur; 5) preparing progress billings

for grants and contracts; 6) preparing cost share account entries and

monitoring cost share activity; 7) drawing funds for federal grants and

contracts as expenses occur; 8) working with project sponsors to answer

billing questions and other reporting issues; 9) obtaining effort reporting

certification from principal investigators; 10) working with external

auditors who perform the annual federal A-133 audit; and 10) closing out

accounts when a grant/contract is complete.

2. Staff in SPA also act as liaisons with various departments and individuals

within RIT including: 1) Sponsored Research Services (SRS) and

Principal Investigators to ensure compliance with RIT, federal and state

guidelines regarding grant and contract administration; 2) Office of

Financial Aid and Scholarships to monitor activity for aid awarded to

graduate students; and 3) the Human Resources and Payroll Office to

ensure that salary charges to sponsored funded projects are accurate.

Sponsored Programs Accounting and Regulatory Certification 1

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

C. Characteristics of Grants and Contracts

1. Grants and contracts are written agreements received from federal, state or

private agencies or private resource providers.

2. Generally, grants and contracts have the following characteristics:

a. There is a stated time period during which the funds may be spent.

b. The instrument names a Principal Investigator or Project Director

under whose direction the project will be carried out.

c. They carry a number of limiting conditions that are stated in the award

document such as final fiscal reports and project reports (deliverables).

d. A contract differs from a grant in that it has specific commercial value

for the sponsor who defines performance objectives such as detailed

reports and a timetable for meeting objectives. Failure to meet the

terms of the contract agreement may result in penalties for the

recipient (RIT).

3. There are two types of agreements:

a. Cost reimbursement agreements limit reimbursement to actual

costs incurred.

b. Fixed price agreements provide a fixed dollar amount, regardless of

actual expenditures, as long as deliverables are accepted by sponsor.

4. The grant and contract project range on the general ledger is 30000 –

39999 and C0000 – C9999.

a. Federal grants and contracts are assigned to project range 30000 –

32999.

b. State grants and contracts are assigned to project range 33000-35999.

c. Private grants and contracts are assigned to project range 36000-

39999.

e. Cost Share projects for grants and contracts are assigned to the project

range C0000-C9999. The last 4 digits of a cost share project number

matches the last 4 digits of the grant funded project number. For

example, the cost share project for federal project 32500 would be

C2500.

D. Setting Up a New Grant or Contract

1. When SRS receives an award letter from the sponsor, indicating the terms

Key Word: and conditions of the grant/contract, they forward it to SPA. The SPA

representative responsible for the Division or College establishes a new

Sponsor project account in the general ledger.

To determine who the SPA representative is for your division or college, refer

to the Controller’s Office web page: http://finweb.rit.edu/controller/sponsored/

Sponsored Programs Accounting and Regulatory Certification 2

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

a. Special department numbers using the last two digits of the department

account number are reserved for principal investigators. An example

of a federal research grant account number awarded to a PI in

Electrical Engineering (department 63100) is:

01 . 63150 . XXXXX . 15 . 32500 . 00000

Refer to the Accounting Practices, Procedures and Protocols Manual,

Chapter III, Section E for more information about PI department

numbers.

b. If required, SPA sets up a cost share project to track cost share

expenditures and funding.

c. SPA sets up the budgets for the award and the cost share accounts

based upon the information provided to and approved by the sponsor.

d. Each time SPA invoices the sponsor for grant/contract expenditures,

the appropriation (revenue) is credited to the grant/contract account.

An example of a revenue line on a federal award is:

01 . 63150 . 52000 . 00 . 32500 . 00000

e. If a sponsor has assured RIT that funding will be forthcoming, SPA

will assign a project number on a contingency basis upon receiving a

written request from SRS. This allows the PI to expend funds directly

on the contingency account.

Key Words: • SPA will change the designation on the project account when the

official award notice is received.

Cost Share • In the event that the award is not received from the sponsor, the

Dean, Department Head and PI are accountable for funding

Contingency expenditures incurred on the project.

PIM 2. Once the project account is established, SPA and SRS conduct a Project

Initiation Meeting (PIM) which includes the review of fiscal

administration and sponsor requirements of the grant or contract.

E. Compliance with Federal Guidelines & RIT Policies and Procedures

1. There are several government circulars that provide guidelines for RIT to

follow when administering federal grants and contracts

a. OMB Circular A-21 establishes principles for determining costs

applicable to federal grants, contracts, and other sponsored agreements

with education institutions.

b. OMB Circular A-110 provides standards for obtaining consistency and

uniformity among federal agencies in the administration of grants and

other agreements with educational institutions.

Sponsored Programs Accounting and Regulatory Certification 3

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

c. OMB Circular A-133 establishes a uniform system of auditing for

institutions of higher education and other non-profit organizations.

2. The PI is responsible for spending grant and contract funds within the

guidelines of the budget approved by the sponsor.

Key Word:

3. SPA provides guidance and direction to the PI about RIT policies and

Compliance procedures and federal compliance issues with regard to the fiscal

administration of his/her sponsored project.

Refer to the Sponsored Programs Accounting section of the Controller’s

Office web page: http://finweb.rit.edu/controller/sponsored/ for detailed

information about Grant and Contract Post Award Administration.

F. Facilities and Administrative Costs

1. Facilities and Administrative costs (F&A) specifically relate to RIT

central administrative services and general institutional costs such as heat,

light and power, etc.

2. F&A rates are negotiated with the federal government’s department of

Health and Human Services (DHHS).

3. A signed agreement that establishes the allowable rates for reimbursement

is entered into between RIT and the federal government.

4. F&A expenses are part of the approved grant/contract budget and the grant

sponsor will reimburse RIT for F&A expenses incurred on the project.

5. During each month end closing, SPA runs a process in the general ledger

to calculate the F&A costs and charge the expense to each grant/contract

for the period.

a. F&A is assessed on allowable expenses incurred during the period. For

example, if total expenses on federal grant 32500 during a particular

month were $5,000, the F&A expense assessed on project 32500

would be $2,025 (5,000 X 40.5%).

b. F&A expenses are charged to the federal project on object code 90345.

6. While F&A return policies vary, RIT typically shares F&A

reimbursements with the Division or College.

a. SPA returns F&A annually on multi-year awards. The remaining share

of the College or Division’s F&A is returned during the project close-

out process.

Sponsored Programs Accounting and Regulatory Certification 4

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

To obtain information about RIT’s current Facilities and Administrative Cost

Rates, refer to the Controller’s Office web page:

http://finweb.rit.edu/controller/sponsored/rates.html

G. Effort Reporting

1. OMB Circular A-21 states that a statement must be signed verifying that

salaries and wages charged to sponsored agreements as direct charges are

reasonable in relation to the work performed.

2. RIT follows the after-the-fact reporting method. SPA prepares and

distributes Quarterly Monitored Workload Reports (QMWR) for each

federal grant/contract to PI’s for certification.

a. QMWR’s provide details of salary charges to sponsored projects and

any related cost share project for the preceding quarter.

b. The PI (or an individual with direct knowledge of the grant/contract

activity) must sign the QMWR and return it to SPA to be filed in the

grant/contract file.

H. Monitoring Expenditures on Grants and Contracts

1. Department administrators or PI’s are responsible for monitoring expenses

charged to projects including grants, contracts, gifts, special project and

designated fund accounts. Various Oracle reports are available to assist

departments with tracking project revenue and expenses.

Refer to Accounting Practices, Procedures and Protocol Manual, Chapter XI

for information about Oracle FSG and Standard reports.

Refer to Lessons 2, 3 & 4: Requesting and Printing FSG and Standard Reports

in the General Ledger Section of the Oracle Training Manual.

Key Word:

2. In addition, SPA reviews certain transactions such as manual salary

adjustments, foreign travel on federal grants, and payments to

Subcontractor

subcontractors prior to processing to be sure that expenses are allowable

and that there are sufficient funds available.

a. SPA will contact the department administrator or PI if they have a

question about a transaction.

3. SPA monitors grants and contracts to ensure that deficit balances do not

occur. Departments are responsible to fund over expenditures, should they

occur.

a. SPA will work with the PI and department administrator to resolve any

deficit prior to closing the project.

Sponsored Programs Accounting and Regulatory Certification 5

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

I. Invoicing the Sponsor for Grant/Contract Expenses

1. SPA invoices sponsors according to the terms and conditions specified in

the agreement. Typically, sponsors are billed on a monthly or quarterly

basis.

2. After the month end accounting close, SPA prepares invoices for expenses

incurred since the last billing period. When the invoice is mailed to the

sponsor, SPA an entry will be generated through the accounts receivable

system to record the accounts receivable and appropriation (revenue)

earned.

An example of a journal entry to record an accounts receivable and

revenue on a federal grant is:

Debit: Accounts Receivable

01 . 63150 . 04074 . 00 . 32500 . 00000

Credit: Federal Appropriation (Revenue)

01 . 63150 . 52000 . 00 . 32500 . 00000

3. At the conclusion of the grant, the federal appropriation will equal the total

expenses incurred on the project.

J. Cost Share Expenses / Funding

1. Sponsors may require RIT to contribute toward the cost of a sponsored

project. When this occurs, the matching expenses must be accounted for

separately from the funded expenses (e.g., a separate cost share project is

established).

2. Cost share expenses must meet criteria as specified in OMB Circular A-

110 (i.e., verifiable, necessary and reasonable, allowable, etc.) and must be

approved in advance if funded by Institute funds, or the cost share amount

exceeds $50,000 from departmental funds.

3. The most common type of cost share is a PI’s salary.

a. The PI completes an EAF, including the appropriate signatures, to

charge a percentage of his/her annual base salary to a sponsored

project.

b. Through the payroll process, salary expenses are charged directly to

the sponsored project specified on the EAF. Note: fringe benefits

and ITS charges are automatically assessed on the grant based upon

the salary expenses and percentage of effort.

c. Once per quarter, SPA prepares a transfer journal entry to move

funds from the PI’s home department to the grant/contract cost

share project.

Sponsored Programs Accounting and Regulatory Certification 6

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

An example of a cost share transfer from the Electrical Engineering

department operating account to a federal grant is:

Debit: Cost Share Transfer To a Grant or Contract

01 . 63100 . 63030 . 00 . 00000 . 00000

Credit: Cost Share Transfer From an Operating Account

01 . 63150 . 63001 . 00 . C2500 . 00000

K. Summer Contracts

1. According to OMB Circular A-21, faculty are not permitted to earn

additional salary for work performed on a federally sponsored project.

However, since RIT faculty work on a 9.5-month academic-year contract,

with sponsor approval, they may be entitled to work on their sponsored

project(s) during the summer quarter.

2. According to RIT policy, beginning in fiscal year 2008, faculty may earn

up to a maximum of 26.3% of their prior year’s 9.5 month contract

amount for work performed during the summer.

3. The amount actually paid is based upon the percentage of effort expended

by the individual during the summer quarter (second week in June through

the third week in August) and paid over 6 pay periods (June 15th through

August 31st). A faulty member who expends 100% over the summer

quarter effort may earn 26.3% of his/her prior year academic year salary.

To obtain information about RIT’s current summer salaries, refer to the

Controller’s Office web:

http://finweb.rit.edu/controller/sponsored/summersalaries.html

L. Closing a Project

1. Three months prior to the end of the award period, SPA will send a end

date letter confirming the end date, available balance, and informing the PI

of any actions that may be required during this period.

2. Once all expenses have been processed, SPA will send a final invoice to

the sponsor.

3. Once final payment has been received from the sponsor, SPA will process

an entry to return a portion of the F&A received from the sponsor based

on University’s F&A distribution policy.

Sponsored Programs Accounting and Regulatory Certification 7

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

4. If there is a surplus balance remaining on a fixed price contract, SPA will

return the amount to the PI’s designated project account.

Sponsored Programs Accounting and Regulatory Certification 8

Chapter I: Introduction to Accounting for Grants and Contract

Revised August 2008

You might also like

- Ppa LetterDocument1 pagePpa LetterDestiny TobiNo ratings yet

- Let Export Copy: Indian Customs Edi SystemDocument10 pagesLet Export Copy: Indian Customs Edi Systemsaikatpaul22No ratings yet

- VCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Document4 pagesVCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Ruchira ParwandaNo ratings yet

- Department of Agriculture Republic of The Philippines: Da-Cso Application FormDocument7 pagesDepartment of Agriculture Republic of The Philippines: Da-Cso Application FormVerna BeNo ratings yet

- Introduction To Project Finance - A Guide For Contractors and EngineersDocument9 pagesIntroduction To Project Finance - A Guide For Contractors and Engineershazemdiab100% (1)

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONmacroniess khanNo ratings yet

- 13-SOP For Safe Operation Limestone CrusherDocument2 pages13-SOP For Safe Operation Limestone Crushergothic centuary60% (5)

- Aef 2013 Audit Acc ReqDocument9 pagesAef 2013 Audit Acc Reqvikas_ojha54706No ratings yet

- ToR 516Document4 pagesToR 516Rumki SarkarNo ratings yet

- RFP DocumentsDocument10 pagesRFP DocumentsYasir FahadNo ratings yet

- Smart Task 3Document5 pagesSmart Task 3Utkarsh ChaturvediNo ratings yet

- Funding Programme - Long-Term ProjectDocument3 pagesFunding Programme - Long-Term ProjectmarkzwikNo ratings yet

- Master Agreement For Services 4Document11 pagesMaster Agreement For Services 4Tamer SayedNo ratings yet

- Capital Project FundDocument7 pagesCapital Project FundmeseleNo ratings yet

- III. Compensation and Effort Reporting For Grants & ContractsDocument7 pagesIII. Compensation and Effort Reporting For Grants & ContractsMATIULLAHNo ratings yet

- Chapter Four-Part Ii: Accounting For Governmental FundsDocument30 pagesChapter Four-Part Ii: Accounting For Governmental FundsabateNo ratings yet

- 24C00087 - Bid Documents - FMP Sitio Brown Phase IDocument58 pages24C00087 - Bid Documents - FMP Sitio Brown Phase ISamNo ratings yet

- Process of Project Financing: Feasibility StudyDocument23 pagesProcess of Project Financing: Feasibility StudyRohit PadalkarNo ratings yet

- PFDocument16 pagesPFadabotor7No ratings yet

- Chapter Four CPFDocument28 pagesChapter Four CPFtame kibruNo ratings yet

- BID DOCS LEDBillboardDocument30 pagesBID DOCS LEDBillboardNanz11 SerranoNo ratings yet

- PCOA Module 6 - PAS 23 and 24Document8 pagesPCOA Module 6 - PAS 23 and 24Jan JanNo ratings yet

- Report On Funds RaisingDocument28 pagesReport On Funds RaisingNikita MajiNo ratings yet

- Module 2: Financing of ProjectsDocument24 pagesModule 2: Financing of Projectsmy VinayNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Bidding DocumentsDocument62 pagesBidding DocumentskriforbizNo ratings yet

- Bidding-Document-PR No. 2021-10-276Document43 pagesBidding-Document-PR No. 2021-10-276Daniel TuazonNo ratings yet

- Itb Design and Build Six-Storey With Roof Deck Mez Administration Office BuildingDocument89 pagesItb Design and Build Six-Storey With Roof Deck Mez Administration Office BuildingKarl MoralejoNo ratings yet

- Module 3 - Borrowing CostsDocument3 pagesModule 3 - Borrowing CostsLui100% (1)

- Invitation To BidDocument92 pagesInvitation To BidAnita QueNo ratings yet

- Project Finance Documents: Fretutorial Free TutorialDocument7 pagesProject Finance Documents: Fretutorial Free TutorialColin TanNo ratings yet

- Completion of Ten Storey Higher Education Building in Batangas State University Pablo BorbonDocument184 pagesCompletion of Ten Storey Higher Education Building in Batangas State University Pablo BorbonraezenbukalNo ratings yet

- Guidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiDocument6 pagesGuidelines For Financing To Housing Builders/Developers: State Bank of Pakistan, KarachiAnush VedhNo ratings yet

- PC 22 - Practice Set 7Document16 pagesPC 22 - Practice Set 7Shadab RashidNo ratings yet

- Bac 20210923001Document189 pagesBac 20210923001Jeremy YabutNo ratings yet

- Projects Analysis and Implementation Assignment-Ii: Group No: 4Document13 pagesProjects Analysis and Implementation Assignment-Ii: Group No: 4Bindu_Shree_4565No ratings yet

- AF210: Financial Accounting: School of Accounting and FinanceDocument11 pagesAF210: Financial Accounting: School of Accounting and FinanceShikhaNo ratings yet

- BIDDING DOCUMENTS 1.5M BaliwananDocument41 pagesBIDDING DOCUMENTS 1.5M BaliwananRubie Anne SaducosNo ratings yet

- PBD - Blinds and CurtainsDocument46 pagesPBD - Blinds and CurtainsM C Dela CrzNo ratings yet

- Bid Docs PB-I-2023-09-009 Construction of Multi-Purpose Building, Carmen Integrated School - TakerDocument37 pagesBid Docs PB-I-2023-09-009 Construction of Multi-Purpose Building, Carmen Integrated School - TakerJustin YuabNo ratings yet

- Bac 20211020001Document181 pagesBac 20211020001Cherry DuldulaoNo ratings yet

- Delay and Disruption Claims March 2014 PDFDocument31 pagesDelay and Disruption Claims March 2014 PDFNuruddin CuevaNo ratings yet

- Procurement Guide: CHP Financing: 1. OverviewDocument9 pagesProcurement Guide: CHP Financing: 1. OverviewCarlos LinaresNo ratings yet

- PBDs - SECURITY SERVICES FOR MEZ and SEZsDocument44 pagesPBDs - SECURITY SERVICES FOR MEZ and SEZsPatrickNo ratings yet

- Bid Docs - 24HG0092Document70 pagesBid Docs - 24HG0092SamNo ratings yet

- 0060 2021 Dayao, Burias Infrastructure Project 07.19 09.16 09.28 9AMDocument35 pages0060 2021 Dayao, Burias Infrastructure Project 07.19 09.16 09.28 9AMJecyl GuelosNo ratings yet

- Itb Proposed Design and Build of Mez Administration Office BuildingDocument38 pagesItb Proposed Design and Build of Mez Administration Office BuildingMarjan CañaNo ratings yet

- Bid Docs-StpDocument57 pagesBid Docs-StpkhuNo ratings yet

- Chapter 2 Summary Financial Statement AnalysisDocument5 pagesChapter 2 Summary Financial Statement AnalysisAzlanNo ratings yet

- Procurement of Projects: InfrastructureDocument47 pagesProcurement of Projects: InfrastructureNicole RodilNo ratings yet

- PBD PR 21-07-0323 Re BidDocument72 pagesPBD PR 21-07-0323 Re BidAayan’s VlogNo ratings yet

- Chapter 5 CPFDocument15 pagesChapter 5 CPFSara NegashNo ratings yet

- Class 6 Notes 04072022Document4 pagesClass 6 Notes 04072022Munyangoga BonaventureNo ratings yet

- Bidding Docs - 24KM0059Document36 pagesBidding Docs - 24KM0059Tine HernaneNo ratings yet

- PFI ManualDocument46 pagesPFI ManualMaggie HartonoNo ratings yet

- BIDDING DOCUMENTS 1M, HatcherymDocument41 pagesBIDDING DOCUMENTS 1M, HatcherymRubie Anne SaducosNo ratings yet

- Accounting For Public Sector Chap 5Document38 pagesAccounting For Public Sector Chap 5fekadegebretsadik478729No ratings yet

- PBD Infrastructure+Projects Office+Fit-Out GLO+110621 PDFDocument67 pagesPBD Infrastructure+Projects Office+Fit-Out GLO+110621 PDFVanessa de VeraNo ratings yet

- Tugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Document3 pagesTugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Fahmi IzzuddinNo ratings yet

- VCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicDocument4 pagesVCE Summer Internship Program 2020: Name Email-ID Smart Task No. Project TopicYaShNo ratings yet

- Bid Docs Multipurpose BC Ez 102021Document154 pagesBid Docs Multipurpose BC Ez 102021Justin YuabNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- 320 Accountancy Eng Lesson5Document23 pages320 Accountancy Eng Lesson5MATIULLAHNo ratings yet

- Accounting Conventions and Standards: Module - 1Document12 pagesAccounting Conventions and Standards: Module - 1MATIULLAHNo ratings yet

- Accounting For Business Transactions: Module - 1Document30 pagesAccounting For Business Transactions: Module - 1MATIULLAHNo ratings yet

- E-Ticket Receipt & Itinerary: 2021 Emirates. All Rights ReservedDocument2 pagesE-Ticket Receipt & Itinerary: 2021 Emirates. All Rights ReservedMATIULLAHNo ratings yet

- Reference Letter For Immigration 01Document1 pageReference Letter For Immigration 01MATIULLAHNo ratings yet

- Document Processing Map: Step 1 Field Sends FR To HQ (28 Each Month)Document1 pageDocument Processing Map: Step 1 Field Sends FR To HQ (28 Each Month)MATIULLAHNo ratings yet

- WAW Audit Findings 113394 & 109111Document2 pagesWAW Audit Findings 113394 & 109111MATIULLAHNo ratings yet

- 2007 Sida-UNDP Evaluation Revised Final Report - 9 August 07Document79 pages2007 Sida-UNDP Evaluation Revised Final Report - 9 August 07MATIULLAHNo ratings yet

- GIZ-Afghanistan: A. Position Applied ForDocument3 pagesGIZ-Afghanistan: A. Position Applied ForMATIULLAHNo ratings yet

- Detailed Project Proposal For: Earnesta Child and Youth Development ProjectDocument11 pagesDetailed Project Proposal For: Earnesta Child and Youth Development ProjectMATIULLAHNo ratings yet

- Asylum Declaration Writing Guide: WWW - Uscis.govDocument14 pagesAsylum Declaration Writing Guide: WWW - Uscis.govMATIULLAHNo ratings yet

- Changes To Non - Exempt Payslips and Check StubsDocument14 pagesChanges To Non - Exempt Payslips and Check StubsMATIULLAHNo ratings yet

- V - Audits and Compliance - FINAL - SEBDocument9 pagesV - Audits and Compliance - FINAL - SEBMATIULLAHNo ratings yet

- Unaccompanied Asylum Seeking Children Statement of Evidence (SEF)Document43 pagesUnaccompanied Asylum Seeking Children Statement of Evidence (SEF)MATIULLAHNo ratings yet

- Itemized Budget - WAW 972 002 SOMDocument4 pagesItemized Budget - WAW 972 002 SOMMATIULLAHNo ratings yet

- Template Letter To MP-1Document1 pageTemplate Letter To MP-1MATIULLAHNo ratings yet

- SIV Bio DataDocument1 pageSIV Bio DataMATIULLAHNo ratings yet

- IRAP SIV Report 2020Document43 pagesIRAP SIV Report 2020MATIULLAHNo ratings yet

- Request For Quotation The Procurement of Goods or Non-Consulting ServicesDocument42 pagesRequest For Quotation The Procurement of Goods or Non-Consulting Serviceslathasin somxaiyNo ratings yet

- WIN 12-Digit NRIC Number Without Spacing 66628 WIN Passport Number Without Spacing 66628Document9 pagesWIN 12-Digit NRIC Number Without Spacing 66628 WIN Passport Number Without Spacing 66628nitekillerNo ratings yet

- Brown and Green Scrapbook Meditation Healthcare Medical PresentationDocument9 pagesBrown and Green Scrapbook Meditation Healthcare Medical PresentationSiti UmairahNo ratings yet

- Ensun-Sundrop PI 17.08.2022Document1 pageEnsun-Sundrop PI 17.08.2022prabhakaranNo ratings yet

- Contract of LeaseDocument1 pageContract of LeaseJules Clyde Fernandez IsaacNo ratings yet

- Bayview Beach Resort PenangDocument2 pagesBayview Beach Resort PenangVeraNo ratings yet

- Lion Air Eticket (JHWEKY) - ShabriDocument2 pagesLion Air Eticket (JHWEKY) - ShabriAmrullah SattarNo ratings yet

- AlyssaDocument3 pagesAlyssaJonathan Val Fernandez PagdilaoNo ratings yet

- Package: Bridges No 2 - 9 Sivok Rangpo New BG Rail Line Project Tender DocumentsDocument6 pagesPackage: Bridges No 2 - 9 Sivok Rangpo New BG Rail Line Project Tender DocumentsKawrw DgedeaNo ratings yet

- PPE - FinalDocument71 pagesPPE - FinalKristen KooNo ratings yet

- Flipkart Labels 01 Apr 2024 09 52Document1 pageFlipkart Labels 01 Apr 2024 09 524frontenterprises.2023No ratings yet

- Jharkhand Ajay InstructorDocument3 pagesJharkhand Ajay InstructorAjay ChauhanNo ratings yet

- MSME CertificateDocument1 pageMSME Certificatearunjoshi12345No ratings yet

- Project Information and Evaluation FormDocument3 pagesProject Information and Evaluation FormRichard LabroNo ratings yet

- Attendance Sheet For Dialysis UnitDocument4 pagesAttendance Sheet For Dialysis UnitgoshidanieltasleemNo ratings yet

- Dwnload Full Accounting Information Systems 10th Edition Gelinas Solutions Manual PDFDocument35 pagesDwnload Full Accounting Information Systems 10th Edition Gelinas Solutions Manual PDFwaymarkbirdlimengh1j100% (17)

- Cockatoo Island SubmissionDocument30 pagesCockatoo Island SubmissionThe Sydney Morning Herald100% (1)

- Bourns v. Carman, 7 Phils. 117 - 1906Document3 pagesBourns v. Carman, 7 Phils. 117 - 1906josephinelogronoNo ratings yet

- Commu BBI LUPONDocument3 pagesCommu BBI LUPONDenielle DelosoNo ratings yet

- Accounting Standard ResumeDocument7 pagesAccounting Standard ResumeIvana YustitiaNo ratings yet

- 27A1100001972546Document2 pages27A1100001972546Meet Communication ServicesNo ratings yet

- Revised Corporation Code 11.16.19Document118 pagesRevised Corporation Code 11.16.19Ed Apalla100% (1)

- LTC Form - DarDocument2 pagesLTC Form - DarFred BagbagenNo ratings yet

- Spa Bir UpdatingDocument1 pageSpa Bir Updatingannette leonardoNo ratings yet

- Argentina: Cash and Treasury ManagementDocument45 pagesArgentina: Cash and Treasury Managementshahid2opuNo ratings yet