Professional Documents

Culture Documents

Praktikum Ke-1 Chapter 3: Financial Statement and Ratio Analysis

Praktikum Ke-1 Chapter 3: Financial Statement and Ratio Analysis

Uploaded by

Taram 10030 ratings0% found this document useful (0 votes)

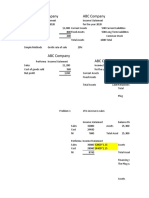

8 views3 pagesThe document provides the financial statements and ratio analysis of PT SEJAHTERA for 2020. It includes:

1) The balance sheet showing assets of Rp. 3 billion including current assets of Rp. 1.4 billion and fixed assets of Rp. 1.6 billion, and liabilities and equity of Rp. 3 billion including current liabilities of Rp. 750 million and total equity of Rp. 1.7 billion.

2) The income statement showing net profit after tax of Rp. 1.2 billion from revenue of Rp. 5 billion, COGS of Rp. 2.2 billion, expenses of Rp. 400 million

Original Description:

Aplikasi komputer

Original Title

PRAKTIKUM KE-1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the financial statements and ratio analysis of PT SEJAHTERA for 2020. It includes:

1) The balance sheet showing assets of Rp. 3 billion including current assets of Rp. 1.4 billion and fixed assets of Rp. 1.6 billion, and liabilities and equity of Rp. 3 billion including current liabilities of Rp. 750 million and total equity of Rp. 1.7 billion.

2) The income statement showing net profit after tax of Rp. 1.2 billion from revenue of Rp. 5 billion, COGS of Rp. 2.2 billion, expenses of Rp. 400 million

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesPraktikum Ke-1 Chapter 3: Financial Statement and Ratio Analysis

Praktikum Ke-1 Chapter 3: Financial Statement and Ratio Analysis

Uploaded by

Taram 1003The document provides the financial statements and ratio analysis of PT SEJAHTERA for 2020. It includes:

1) The balance sheet showing assets of Rp. 3 billion including current assets of Rp. 1.4 billion and fixed assets of Rp. 1.6 billion, and liabilities and equity of Rp. 3 billion including current liabilities of Rp. 750 million and total equity of Rp. 1.7 billion.

2) The income statement showing net profit after tax of Rp. 1.2 billion from revenue of Rp. 5 billion, COGS of Rp. 2.2 billion, expenses of Rp. 400 million

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

PRAKTIKUM KE-1

Chapter 3: Financial Statement and Ratio Analysis

====================================================================

1. Berikut Laporan keuangan PT SEJAHTERA tahun 2020

NERACA

(dalam jutaan Rp.)

ASSET LIABILITIES AND

STOCKHOLDER’S

EQUITY

Cash 400 Account Payable 400

Marketable Securities 300 Notes Payable 150

Account Receivable 300 Accruals 200 +

Inventory 400 + TOTAL CURRENT 750

LIABILITIES

TOTAL CURRENT ASSET 1.400 Long Term Debt 550

Gross Fixed Assets 2.000 Stockholder’s Equity

Acc Depreciation 400 + Preferred Stock 300

Net Fixed Asset 1.600 Common Stock 800

Retained Earning 600 +

TOTAL STOCKHOLDER’S

EQUITY 1.700

TOTAL ASSETS 3.000 TOTAL LIABILITIES AND 3.000

SHE

LAPORAN RUGI /LABA

(dalam jutaan Rp.)

Sales Revenue 5.000

COGS 2.200 +

Gross Profit 2.800

Operating Expenses

SGA Expenses 300

Depreciation Expenses 100 + 400 -

EBIT 2.400

Interest 400 -

Net Profit before Taxt 2.000

Taxt (40%) 800 -

Net profit After taxt 1.200

Preferred Stock Dividend 150

Earning Available for Common Stock Holder’s 1.050

ASUMSI = 1 tahun = 360 hari.

Saham yang beredar = 500.000 lembar

Harga saham di pasar modal = Rp. 6500,- per lembar

Purchase per tahun 75% dari COGS

Dari Data tersebut: Hitunglah ratio-ratio berikut dan analisis secara time series, cross sectional,

overall.

Ratio Industry Actual Actual Time Cross Overall

Average 2019 2020 Series Section

Current ratio 2,10 1,60

Quick ratio 1,68 1,25

Avg Coll Period 40 hari 35 hari

Inventory turn over 7,2 kali 6,7 kali

Avg payment Period 60 hari 57 hari

Total AssetTurn Over 1,25 kali 1,75 kali

Debt Ratio 56% 38%

Debt to Equity Ratio 70% 68%

Time Interest Earned 8 kali 7 kali

SELAMAT MENGERJAKAN

You might also like

- FIn 201 AnswersDocument5 pagesFIn 201 AnswersShahinNo ratings yet

- Midterm Analysis TestDocument33 pagesMidterm Analysis TestDan Andrei BongoNo ratings yet

- Consumer Behaviour MCQ With Answers (2021) : Ad byDocument8 pagesConsumer Behaviour MCQ With Answers (2021) : Ad bysamaya pyp0% (2)

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- Chapter 4Document9 pagesChapter 4Ali ANo ratings yet

- Summative Quiz 2Document3 pagesSummative Quiz 2Sheena Gallentes LeysonNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- Nama: Sony Andika Rizal PratamaDocument3 pagesNama: Sony Andika Rizal PratamaSony AndikaNo ratings yet

- Balance Sheet AnalysisDocument12 pagesBalance Sheet AnalysisAhmed WaqasNo ratings yet

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- 5532 $FDocument1 page5532 $FSarahNo ratings yet

- HE 2 Questions - Updated-1Document6 pagesHE 2 Questions - Updated-1halelz69No ratings yet

- Case 1 New Signal Cable CompanyDocument6 pagesCase 1 New Signal Cable Companymilk teaNo ratings yet

- Wan Aidi Pra Uts Adv. AccDocument10 pagesWan Aidi Pra Uts Adv. AccWan Aidi AbdurrahmanNo ratings yet

- NLKTDocument15 pagesNLKTYến Hoàng HảiNo ratings yet

- Financial ControlDocument6 pagesFinancial ControlAbdul MajidNo ratings yet

- Assets Mar 31, 2022 Entry 1 Entry 2 Non-Current AssetsDocument3 pagesAssets Mar 31, 2022 Entry 1 Entry 2 Non-Current AssetsRishab AgarwalNo ratings yet

- Chapter 4 Problems Evaluating A Firm'S Financial PerformanceDocument22 pagesChapter 4 Problems Evaluating A Firm'S Financial Performancerony_naiduNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- SBA03 FSAnalysisPart32of3Document5 pagesSBA03 FSAnalysisPart32of3Jr PedidaNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Ca5101 Ustamv TaskDocument6 pagesCa5101 Ustamv Taskroseberrylacopia18No ratings yet

- Tugas Kelompok Manajemen Keuangan Semester 3Document5 pagesTugas Kelompok Manajemen Keuangan Semester 3IdaNo ratings yet

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- HD Book 5Document4 pagesHD Book 5humphrey daimonNo ratings yet

- Accounting For Managers Financial Statement Analysis: Shahid IlyasDocument7 pagesAccounting For Managers Financial Statement Analysis: Shahid IlyasAmanda LouiseNo ratings yet

- Chap 1Document14 pagesChap 1Nguyen Thi Diem Quynh (K17 HCM)No ratings yet

- Unit 3Document13 pagesUnit 3hassan19951996hNo ratings yet

- Sb-Frs 7: Statutory Board Financial Reporting StandardDocument11 pagesSb-Frs 7: Statutory Board Financial Reporting StandardLuthfiWaeLaahNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Example: Non Current Assets (NBV) Current AssetsDocument3 pagesExample: Non Current Assets (NBV) Current AssetsMohammad El HajjNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Question Paper - IND AS 103 & IND AS 110Document5 pagesQuestion Paper - IND AS 103 & IND AS 110pratikdubey9586No ratings yet

- FIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4Document4 pagesFIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4the learners club5100% (1)

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- 34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiDocument4 pages34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiKEREN WIJAYANo ratings yet

- 3 AFM - 002 - NEW - Assessing - Organisational - Performance - Using - Ratios - and - Trends - NotesDocument7 pages3 AFM - 002 - NEW - Assessing - Organisational - Performance - Using - Ratios - and - Trends - NotesDerickNo ratings yet

- Chapter 3 Financial Statements, Free Cash FlowDocument2 pagesChapter 3 Financial Statements, Free Cash FlowPik Amornrat SNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- LF BC Corpo Correspondances CorrigéDocument4 pagesLF BC Corpo Correspondances Corrigévive la FranceNo ratings yet

- Financial Statement Analysis Basic ConceptsDocument32 pagesFinancial Statement Analysis Basic ConceptsLester KhanNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- CMA Volume 2 MergedDocument153 pagesCMA Volume 2 MergedShyaambhavi NsNo ratings yet

- Awami Supermarkets LTDDocument16 pagesAwami Supermarkets LTDdeepakjontyNo ratings yet

- Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Document2 pagesLet's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Jerah TorrejosNo ratings yet

- Annual Accounts - Wishlist Ltd.Document4 pagesAnnual Accounts - Wishlist Ltd.shreevarshashankarNo ratings yet

- Topic 6 Test ISBS 3E4Document5 pagesTopic 6 Test ISBS 3E4LynnHanNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Lesson: 39: Give and Take: Collective BargainingDocument32 pagesLesson: 39: Give and Take: Collective Bargainingsarthak1826No ratings yet

- Mergers and AcquisitionsDocument34 pagesMergers and Acquisitionsyash khandol100% (4)

- Information MemorandumDocument199 pagesInformation MemorandumRao PavitraNo ratings yet

- Icici BankDocument2 pagesIcici BankSagar Gowda SNo ratings yet

- Annual Report 1998 PDFDocument171 pagesAnnual Report 1998 PDFHa LinhNo ratings yet

- QUESTIONS For Final EXAM in CONTEMP WORLDDocument2 pagesQUESTIONS For Final EXAM in CONTEMP WORLDPatrick LenguajeNo ratings yet

- Microeconomics Mankiw 9th Edition NotesDocument40 pagesMicroeconomics Mankiw 9th Edition NotesLunaaa LunaaaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Azeem AslamNo ratings yet

- 4.1. Materi Leadership Journey - Pemimpin Membentuk Budaya - HLP#2Document29 pages4.1. Materi Leadership Journey - Pemimpin Membentuk Budaya - HLP#2emyNo ratings yet

- Od 329808896732339100Document5 pagesOd 329808896732339100Rachna GuptaNo ratings yet

- Chapter 5 Job Order Costing.Document6 pagesChapter 5 Job Order Costing.hafiz100% (1)

- MBABANE Report Final Corrected Mark - 2018Document62 pagesMBABANE Report Final Corrected Mark - 2018LindaNo ratings yet

- International and Dutch Standards On Business and Human RightsDocument3 pagesInternational and Dutch Standards On Business and Human RightsjosienkapmaNo ratings yet

- CIPFA Diploma in Contract Management 11 2019Document5 pagesCIPFA Diploma in Contract Management 11 2019kaafiNo ratings yet

- Assignment Final On Banking and InsuranceDocument20 pagesAssignment Final On Banking and InsuranceDawit G. TedlaNo ratings yet

- Importance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNDocument8 pagesImportance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNmehedeeNo ratings yet

- Tata ElxsiDocument10 pagesTata ElxsiRavindra GoyalNo ratings yet

- Case Study On: Prepared by - Manish Motwani Zil ShahDocument17 pagesCase Study On: Prepared by - Manish Motwani Zil Shahmanish14589No ratings yet

- Commercial Bank Management PDFDocument42 pagesCommercial Bank Management PDFaparajita promaNo ratings yet

- Starting A Business Questionnaire - DB - SB - Survey - Economy - Fullname1Document18 pagesStarting A Business Questionnaire - DB - SB - Survey - Economy - Fullname1Atul TirkeyNo ratings yet

- Barila Spa - Ans-1 & Ans-3Document2 pagesBarila Spa - Ans-1 & Ans-3SiddharthNo ratings yet

- 2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleDocument2 pages2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleUdita KaushikNo ratings yet

- Internship Report On Foreign Exchange Business Analysis of Jamuna Bank LimitedDocument84 pagesInternship Report On Foreign Exchange Business Analysis of Jamuna Bank LimitedSufiaun ShaounNo ratings yet

- Personal Finance Canadian 7th Edition Kapoor Solutions ManualDocument25 pagesPersonal Finance Canadian 7th Edition Kapoor Solutions ManualDrAnnaHubbardDVMitaj100% (46)

- Title Ix Merger and Consolidation Merger Consolidation: MOM 24 February 2022Document9 pagesTitle Ix Merger and Consolidation Merger Consolidation: MOM 24 February 2022Yarah MNo ratings yet

- Eclerx Financial ServicesDocument13 pagesEclerx Financial ServicesPrachi GoyalNo ratings yet

- ANANAYO-Case Analysis - Assignment 6Document1 pageANANAYO-Case Analysis - Assignment 6Cherie Soriano AnanayoNo ratings yet

- Anti-Bribery AssignmentDocument11 pagesAnti-Bribery AssignmentDyani Nabyla WidyaputriNo ratings yet

- Web Payslip 332429 202305 PDFDocument3 pagesWeb Payslip 332429 202305 PDFN.SATHYAMOORTHY MoorthyNo ratings yet